DPC Pine Street below Kearney after the great San Francisco earthquake and fire 1906

A Reuters article based one-on-one on Zero Hedge terminology, without proper attribution. Curious. Even nicked the graph.

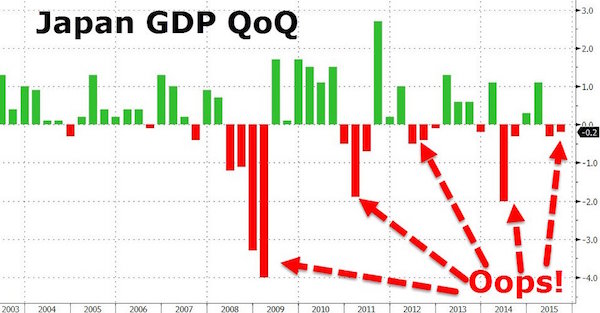

• Japan ‘Quintuple Dip’ Recession Delivers A Fresh Blow To Abenomics (Reuters)

Japan has slid back into recession for the fifth time in seven years amid uncertainty about the state of the global economy, putting policymakers under growing pressure to deploy new stimulus measures to support a fragile recovery. The world’s third-largest economy shrank an annualised 0.8% in July-September, more than a market forecast for a 0.2% contraction, government data showed on Monday. That followed a revised 0.7% contraction in the previous quarter, fulfilling the technical definition of a recession which is two back-to-back quarterly contractions. It is the fifth time Japan has entered recession since 2008, a so-called “quintuple dip”. The Nikkei share average dipped sharply by at the opening of trade on Monday as the poor figures compounded nervousness on markets in the wake of the Paris terror attacks.

But it recovered to just 1% down at lunchtime on the hope that the news would force policymakers to launch another round of stimulus measures. “The headline was weak, but the market is shifting to expectations for more measures,” said Mitsushige Akino at Ichiyoshi Asset Management. The yen rose slightly, reflecting its safe haven status against the euro. But the outlook for the Japanese economy remains weak. Many analysts expect the economy to grow only moderately in the current quarter as companies remain hesitant to use their record profits for wage rises, underscoring the challenges premier Shinzo Abe faces in pulling the country out of stagnation with his “Abenomics” stimulus policies. The dismal reading may affect debate among politicians and policymakers on how much fiscal spending should be earmarked in a supplementary budget that is expected to be compiled this fiscal year.

Make that Japan.

• Asia Pacific Shares Fall Sharply On Paris Attacks, Japanese Recession (Guardian)

Stock markets in Asia Pacific have fallen sharply in the wake of the Paris terror attacks and downbeat economic data. Leading the losers was the Nikkei index in Japan which tumbled nearly 1.3% as official figures showed that the country’s economy had entered recession for the fifth time in seven years. The widely tracked CBOE volatility index or “fear gauge” was at its highest level since 2 October and bourses in Australia, South Korea and Hong Kong all saw substantial falls of more than 1% in early trading. In Europe, futures trade pointed to sharp falls in the main markets with the FTSE100 predicted to be down 40 points or around 0.6% at the open and the Dax in Germany down 1%. The French financial markets were due to open as usual on Monday, with extra security measures taken for staff, stock and derivatives, the Euronext exchange said.

The CAC40 French bourse was set to open 2% lower on Monday. With concerns about how European leaders would respond to the Paris attacks, the euro was sold heavily in Asian trading and fell to a six-month low of $1.071. Global security concerns were better news for some commodities, however, as Brent crude oil was up 1% at $44.92 a barrel after shedding 1% on Friday. US crude was up about 0.54% at $40.96 a barrel. Gold added about 0.5% to stand at $1,091.96 an ounce. “Risk aversion is on the rise and we are seeing broad-based U.S. dollar strength across the board and this may continue until the year end as recent economic data has also disappointed,” said Mitul Kotecha, head of Asian FX and rates strategy at Barclays in Singpore.

World trade is shrinking. Get used to it.

• Quiet US Ports Spark Slowdown Fears (WSJ)

America’s busiest ports are sending a warning about the U.S. economy. For the first time in at least a decade, imports fell in both September and October at each of the three busiest U.S. seaports, according to data from trade researcher Zepol Corp. analyzed by The Wall Street Journal. Combined, imports at the container terminals at the ports of Los Angeles, Long Beach, Calif. and around New York harbor, which handle just over half of the goods entering the country by sea, fell by just over 10% between August and October. The declines came during a stretch from late summer to early fall known in the transportation world as peak shipping season, when cargo volumes typically surge through U.S. ports.

It is a crucial few months for the U.S. economy as well: High import volumes can signal a confident view on the economy among retailers and manufacturers, while fears of a slowdown grow when ports are quiet. Economists are divided as to whether the peak season slump signals a short-term hiccup for the U.S. economy, or marks the start of a sustained period of weakness. Some say the slump is being driven by businesses that have cut back on imports because of a weak economic outlook, which could point to sluggish global growth ahead. Others say it is a side effect of a massive inventory buildup that took place earlier in the year. Despite the weak peak, imports in the first 10 months of the year at the nation’s busiest ports are still up 4% from a year earlier, Zepol data show.

Rather than ordering huge shipments of goods in the late summer and early fall, more businesses are stocking up throughout the year and holding on to inventories for longer. “There was a little bit of overdoing it in the beginning of the year,” said Ethan Harris at Bank of America Merrill Lynch. “Once we adjust to it, I would expect that business picks up again, shipping picks up again, container imports should pick up again.” But the missing peak season has been a major headache for trucking companies, railroads and steamship lines. One large maritime carrier, Singapore’s Neptune Orient Lines, told investors there was “no peak season” in North America as an explanation for a $96 million quarterly loss.

Some of the country’s biggest trucking companies and railroads have recently reported weaker-than-expected earnings. Many have cut the rates they charge customers as demand sagged during what is usually their strongest months. For trucking companies in particular the turnabout has been abrupt, with some companies pivoting from expressing concerns about tight capacity to worries about future profits in the space of a few weeks. Whether it proves a temporary drag or not, the inventory unwind has a long way to go. Nationwide, the seasonally adjusted ratio of inventories to sales at U.S. retailers, wholesalers and manufacturers in September was at 1.38, up from 1.31 in September 2014 and the highest reading for that month since 2001, according to the U.S. Census Bureau.

What central banks produce.

• Debt Market Distortions Go Global as Nothing Makes Sense Anymore (Bloomberg)

Something very strange is happening in the world of fixed income. Across developed markets, the conventional relationship between government debt – long considered the risk-free benchmark – and other assets has been turned upside-down. Nowhere is that more evident than in the U.S., where lending to the government should be far safer than speculating on the direction of interest rates with Wall Street banks. But these days, it’s just the opposite as a growing number of Treasuries yield more than interest-rate swaps. The same phenomenon has emerged in the U.K., while the “swap spread” as it’s known among bond-market types, has shrunk to the smallest on record in Australia.

Part of it simply has to do with the fact that investors are pushing up yields on Treasuries – which guide rates for just about everything – as the Federal Reserve prepares to raise borrowing costs for the first time in a decade. But in many ways, it reflects the unintended consequences of post-crisis rules designed to make the financial system stronger. Those changes have made it cheaper and safer to use derivatives to hedge risk, and more onerous and expensive for bond dealers to make markets in the safest securities. “These kinds of dislocations can be expected to grow over time,” said Aaron Kohli at Bank of Montreal, one of 22 primary dealers that trade directly with the Fed. “The market structure and regulatory structure has evolved in a period with very low volatility. Once you take that away, it’s not clear what the secondary implications of that will be.”

It’s hard to overstate how illogical it is when swap spreads are inverted. That’s because it suggests that governments are less creditworthy than the very financial institutions they bailed out during the credit crisis just seven years ago. And as the Fed prepares to end its near-zero rate policy, those distortions are coming to the fore. The rate on 30-year swaps, which allow investors, companies and traders to exchange fixed interest rates for those that fluctuate with the market, and vice versa, has been lower then comparable yields on Treasuries for years now as pension funds and insurers increasingly hedged their long-term liabilities. But in the past three months, spreads on shorter-dated contracts have also quickly turned negative. Now, five-year swap rates are 0.05 percentage points lower than similar-maturity Treasuries, while those due in three years are also on the verge of flipping.

$4.4 trillion added in dollar denominated debt to non-banks outside US. That’s a lot of bankruptcies.

• China’s Currency Path and the Dollar-Debt Time Bomb (WSJ)

Investors betting that China won’t take another run through the bull’s market shop ought to be careful. Things are looking more settled than in August, when a surprise devaluation by China sent paroxysms through global markets. Stocks in developed countries have mostly recovered, even as investors contend with the likelihood the Federal Reserve will raise rates. One possible reason for the calm is that investors may have reckoned that China, having backed off after witnessing the problems that it unleashed in August, is loath to repeat the experience. Indeed, the value of the yuan has been remarkably stable since the summer’s policy change. But this may have only created a false sense of security among investors. A decision expected later this month from the IMF on whether to include the yuan in its reserve currency basket may have China holding off on any sudden moves.

Once that decision is made, China may feel freer to let the currency fall. If so, it wouldn’t take much to unsettle markets again. This summer’s yuan devaluation was relatively minor, falling by just 3% versus the dollar over three days. Yet it set off fears of a series of competitive devaluations. Other currencies fell against the dollar, and commodity prices came under heavy pressure. One reason that is such a concern: In recent years, there has been a marked increase in dollar-denominated lending outside the U.S., much of it coming through bond issuance rather than banks, and much of it destined for emerging-market borrowers. The Bank for International Settlements estimates that the amount of dollar-denominated credit extended to nonbanks outside the U.S. reached $9.7 trillion in the first quarter this year, from $5.3 trillion at the end of 2007.

For commodity producers straining under dollar debt loads, like Brazil, the pain can be acute. The MSCI Emerging Markets Index, which had already been under pressure this summer, fell by 13% in two weeks after China’s move. It has since gained back much of that lost ground. So what happens next? The “X” factor is Chinese capital flows. Part of the reason China blinked in August is that the move triggered a large outflow of cash. This is inherently destabilizing because it undermines the ability of China’s central bank to keep the financial system liquid. For years, China relied on inflows to boost money supply. When money is flowing out, banks starve for cash.

I said the other day that it’s trnage to include state owned banks in these ‘exercises’.

• China’s Banks Aren’t Feeling the Love (Bloomberg)

China’s biggest banks aren’t happy about being included in international rules that require them to raise extra capital to protect taxpayers in the event of a renewed bout of financial turmoil. It’s hard not to sympathize.China, after all, wasn’t responsible for the global financial crisis. Unlike in the U.S. or Europe, not a single bank collapsed. The country sailed through the upheaval largely unscathed, cushioned by a record $586 billion stimulus plan.Seven years after the collapse of Lehman, the total loss-absorbing capacity, or TLAC, rule is all about the tender loving care of the general public. The idea is that by making banks sell bonds that are explicitly exposed to losses, a lender that fails can be wound down and recapitalized without the government having to resort to taxpayer-funded bailouts.

Here again, China has cause for complaint. The TLAC rule is designed for a world in which systemically important banks, and the bond investors who funded them, could engage in risky behavior without having to bear the consequences. A world of moral hazard, in other words. Creditors of a bank were implicitly relying on the state to back them up and therefore didn’t pay much attention to what the institutions were doing, as Mark Carney, head of the Financial Stability Board, which designed the rule, noted last week. Governments poured hundreds of billions of dollars into banks after the 2008 crisis: Much of that went to rescue bondholders, whose claims were equal to those of depositors.

But China doesn’t work like that. All the biggest and most systemically important banks in China are controlled by the state, so the country isn’t exposed to the kind of moral hazard that laid waste to public finances in the U.S. and Europe. And Chinese taxpayers will ultimately remain on the hook for anything major that goes wrong with those banks, with or without a TLAC rule. The FSB included China’s four biggest lenders on its list of the world’s too-big-to-fail institutions: Industrial & Commercial Bank of China, Bank of China, China Construction Bank and Agricultural Bank of China. They lobbied hard to be excluded, using various reasons in their submissions, including the fact that customer deposits account for a large proportion of total liabilities, making for a lower liquidity risk than for banks whose focus is primarily on wholesale funding.

There are practical as well as philosophical objections. To meet the board’s requirements, Chinese banks may have to sell as much as 4.4 trillion yuan ($690 billion) of securities, according to ICBC’s estimates. That’s going to be a challenge, to put it mildly, in a bond market with a total size of about $5.2 trillion. China’s bond market has been growing, though it remains equal to only about half the size of the country’s $10.4 trillion economy. The U.S. bond market, by contrast, is about one and a half times the size of the economy. What’s worse, the biggest players in China’s bond market are…Chinese banks. Since lenders aren’t allowed to buy each others’ bonds for TLAC purposes (for obvious reasons), that means the effective size of the bond market is even smaller.

China firms want to get back to ther own casino. More gambling going on.

• As China Firms Walk Out On Wall St., Spurned Investors Demand Payback (Reuters)

Chinese firms listed in New York are finding out the hard way that it’s easier to love global investors than leave them. As dozens plan buyouts and a return home in search of higher valuations, companies that were once Wall Street’s darlings for the first time face the wrath of minority shareholders. Asset managers are publicly demanding better premiums, reflecting historical valuations and not 2015’s slide. In deals collectively worth $40 billion, some 33 mainland China companies have unveiled plans this year to be taken private and delisted from the Unites States, according to Thomson Reuters data. But a cottage industry of hedge funds and lawyers is coalescing around those determined not to accept low-ball bids for their assets.

“We want to put as much pressure as possible,” said portfolio manager Lin Yang at FM Capital, a Britain-based hedge fund backed by the Libyan sovereign wealth fund that owns 1.4% of medical firm China Cord Blood. FM Capital is urging a group of mainland China investors to raise a buyout offer, saying the shares are worth 2.5 times the proposed bid. “If no shareholder challenges the offer, it will go through on the cheap,” said Lin. Peaking at a valuation of $615 million in August this year, China Cord Blood’s market capitalization has shrunk to just over $500 million; the bid was made in late April, valuing the target at $512 million.

There’s no deadline for the China Cord Blood buyout offer is and it’s unclear what the outcome will be; the company didn’t respond to email seeking comment. But minority investors have scored notable successes this year: In one case, Chinese investment firm Vast Profit Holdings raised by 34% a March buyout offer that initially valued dating service Jianyuan.com at $178.9 million after pressure from U.S. asset manager Heng Ren Investments and others.

“Global debt has grown some $57 trillion since the collapse of Lehman Brothers in 2008, reaching a back-breaking $199 trillion in 2014..”

• What To Do About Debt (Kazul-Wright)

Over the last few months, a great deal of attention has been devoted to financial-market volatility. But as frightening as the ups and downs of stock prices can be, they are mere froth on the waves compared to the real threat to the global economy: the enormous tsunami of debt bearing down on households, businesses, banks, and governments. If the US Federal Reserve follows through on raising interest rates at the end of this year, as has been suggested, the global economy – and especially emerging markets – could be in serious trouble. Global debt has grown some $57 trillion since the collapse of Lehman Brothers in 2008, reaching a back-breaking $199 trillion in 2014, more than 2.5 times global GDP, according to the McKinsey Global Institute.

Servicing these debts will most likely become increasingly difficult over the coming years, especially if growth continues to stagnate, interest rates begin to rise, export opportunities remain subdued, and the collapse in commodity prices persists. Much of the concern about debt has been focused on the potential for defaults in the eurozone. But heavily indebted companies in emerging markets may be an even greater danger. Corporate debt in the developing world is estimated to have reached more than $18 trillion dollars, with as much as $2 trillion of it in foreign currencies. The risk is that – as in Latin America in the 1980s and Asia in the 1990s – private-sector defaults will infect public-sector balance sheets. That possibility is, if anything, greater today than it has been in the past.

Increasingly open financial markets allow foreign banks and asset managers to dump debts rapidly, often for reasons that have little to do with economic fundamentals. When accompanied by currency depreciation, the results can be brutal – as Ukraine is learning the hard way. In such cases, private losses inevitably become a costly public concern, with market jitters rapidly spreading across borders as governments bail out creditors in order to prevent economic collapse. It is important to note that indebted governments are both more and less vulnerable than private debtors. Sovereign borrowers cannot seek the protection of bankruptcy laws to delay and restructure payments; at the same time, their creditors cannot seize non-commercial public assets in compensation for unpaid debts. When a government is unable to pay, the only solution is direct negotiations. But the existing system of debt restructuring is inefficient, fragmented, and unfair.

“Greek banks have been weighed down by a mountain of bad loans with lenders claiming that many are the result of strategic defaulters..”

• Greece Misses Bailout Deadline As Talks With Creditors Drag On (Guardian)

The deadline to dispense further rescue loans to debt stricken Greece was extended by eurozone countries once again on Sunday amid continuing deadlock between Athens and its creditors. With negotiations still bogged down over failure to agree on a new foreclosure law – legislation the leftist-led government says would push austerity-hit Greeks over the edge – lenders postponed a critical Eurogroup Working Group until Tuesday. The meeting, a final assessment of the reform progress Athens has made since it signed up to a third bailout in July, is crucial to unlocking €2bn in rescue loans and €10bn for the recapitalisation of Greek banks. Finance ministers gathered in Brussels last week had insisted talks should be concluded by Monday, to trigger the release of the next instalment of the €86bn euro bailout programme.

But announcing the delay, Jeroen Dijsselbloem who chairs the Eurogroup of euro area finance ministers, also heaped praise on Greece saying headway had been made. “I welcome that good progress has been made between the Greek authorities and the institutions in the discussions on the measures included in the first set of milestones,” the Dutch politician said in a statement Sunday. “Agreement has been reached on many issues.” The Eurogroup Working Group sets the tone for decisions taken by finance ministers representing EU member states in the single currency. Talks were meant to have been completed by mid-October but have repeatedly stalled on the issue of how much protection local home-owners should be given in the event of defaulting on mortgages. Greek banks have been weighed down by a mountain of bad loans with lenders claiming that many are the result of strategic defaulters deliberately failing to keep up with payments.

“From next year EU “bail-in” rules take effect. Then the Italian government will no longer simply be able to bail out banks but will have to make bondholders and depositors pay up first.”

• It Is Hard To See How Italy Can Stay In The Eurozone (Münchau)

Yoram Gutgeld last week made one of the most astonishing economic statements I have heard in a long time. The adviser to PM Matteo Renzi said in an interview that Italy’s economy was immune to global developments for the next 12 to 24 months because of the tax cuts and reforms of the present administration. The idea that a G7 club of rich nations is immune to the global economy is ludicrous. This is the 21st century. Granted, Mr Gutgeld may have spoken as the prime minister’s spin-doctor. That is part of his job. But what worries me is that the Italian government is not ready for when the impact of the slowdown in China and emerging markets hits Europe. Friday’s preliminary figures for eurozone GDP show that the slowdown has started. Italy’s quarter-on-quarter growth rates have been falling: from 0.4% in the first quarter to 0.3% in the second to 0.2% in the third.

Italy’s ability to sustain a healthy rate of growth is critical — for the country’s political stability, for its young people with no hope of finding work, for debt sustainability and in particular for its future in the eurozone. The euro has brought Italy nothing but stagnation. Real GDP is now at the same level as at the start of 2000, a year after the euro was launched. GDP today is 9% below the pre-crisis level in early 2008. If Italy fails to bounce back strongly from this recession, it is hard to see how it can stay in the eurozone. At some point it might well be in the country’s undisputed economic self-interest to leave and devalue. So when we ask whether the economic recovery is sustainable, we are not having a technical dialogue about economics. We are talking about Italy’s future in Europe.

There are three reasons why I am sceptical. The first is evident in last Friday’s GDP data. Italy is not exceptional. The second reason is the lack of restructuring of Italian banks. The stock of non-performing loans as a percentage of all loans is about 10%, which is close to the peak level in the current cycle. Many of the small and medium-sized banks are in effect insolvent. The clean-up of the banking system — following the 2008 crisis and the two subsequent recessions — has yet to happen. If it does, it will take place in a much tougher regulatory environment. From next year EU “bail-in” rules take effect. Then the Italian government will no longer simply be able to bail out banks but will have to make bondholders and depositors pay up first.

Can we be sure the rotten banks will continue to sustain the recovery in this environment? My third concern is Mr Renzi’s fiscal policy choices. His priority has been to ensure that these create more winners than losers. This is exactly what Silvio Berlusconi did when prime minister. And it should come as no surprise that Mr Renzi ends up with similar policies. Instead of reforming the public administration or the judiciary, he has opted for a cut in the housing tax. This will win votes but will not deliver the change to the economy. We have been here before.

As I wrote last week, it’s the convergence of refugees and a depressed economy that will define Europe going forward.

• Europe’s Youths Yearn to Move as Prosperity Proves Elusive (Bloomberg)

An unprecedented number of migrants from Asia, Africa and the Middle East have headed for Europe this year in their quest for safety and prosperity. Yet for almost a quarter of its youths, the continent is no wonderland. On average, 23% of Europeans aged between 18 and 24 years old are contemplating moving to another country to escape the financial situation at home, according to a report by Intrum Justitia, Europe’s biggest debt collector. “What our survey shows is that many young people in several parts of Europe are considering moving to other countries and that is sad since it indicates that many young people lack hope for their economic future,” Erik Forsberg, Intrum Justitia’s acting CEO, said in the report. Still, the refugees who are escaping violent conflicts and coming to Europe “is another, much more acute problem,” he said.

What’s perhaps no coincidence, some of the highest percentages in the survey involve countries that have been the least welcoming of refugees. Hungary, which built a razor-wire fence along its southern border to keep them out, topped the survey with 60% of its young people considering a move. Poland and Slovakia, both unhappy with redistributing refugees across the EU, followed with 41% and 40%, respectively. The percentage of those considering a move abroad was also well above 30% in Italy, Portugal and Greece, according to the company’s European Consumer Payment Report, which surveyed 22,400 people in 21 countries. Those numbers correlate closely with national youth unemployment rates.

They underscore the quandary facing many EU nations – particularly those still grappling with the fallout from Europe’s debt crisis – when it comes to dealing with the hundreds of thousands of asylum seekers arriving from Syria and other war zones in the Middle East. Some of their governments tend to justify their reluctance to welcome refugees by arguing that they already have enough to cope with trying to provide for their own citizens. At about 21%, the average unemployment rate for Europeans under age 25 is double the overall jobless rate for the 28-member bloc. While 67% of those surveyed said they had “a reasonable chance of substantially improving their economic situation in life,” 17% see no prospect of a better life. One in five of those polled expect their children to be worse off financially.

“We all know that time is running out to return hope to the millions of refugees..”

• Merkel Warns Against Drawing Innocent Refugees Into Terror Fight (Bloomberg)

German Chancellor Angela Merkel pushed back against critics of her open-door policy on refugees, saying those fleeing war zones shouldn’t have to bear the blame for the terrorist attacks in Paris. Merkel’s comments during a Group of 20 summit in the Turkish coastal resort of Antalya Sunday were a rebuff to domestic opponents who cited the slaughter in the French capital as evidence that the chancellor must reverse her stance and turn people away. A statement by the Greek authorities that raised the possibility one of the assailants may have entered Europe posing as a refugee raised the pressure on Merkel still further. She hit back in her only public comments on the first day of the two-day summit of world leaders that’s taking place in the shadow of the Paris attacks.

Merkel called for a swift investigation into the motives behind the terrorist carnage to “find out who the perpetrators were, who’s behind them and what connections there were.” “We owe it to the victims and their relatives, but also for the sake of our own security,” Merkel told reporters. “And we owe it to all the innocent refugees who are fleeing from war and terrorism.” Merkel said she’d discuss efforts to resolve the Syrian conflict with Russian President Vladimir Putin late Sunday, then again in a one-on-one meeting with U.S. President Barack Obama on Monday, as she steps up her international diplomacy aimed at stemming the flow of refugees to Europe.

In Germany, some among her political allies stoked further tension over the projected arrival of some one million refugees this year alone. Friday night’s attack in Paris “changes everything,” Markus Soeder, a member of the Bavarian state government, said in a Twitter post. Merkel said that G-20 leaders, who will release a statement Monday on fighting the terrorist threat, were sending a “decisive signal” that all forms of terrorism will be defeated. A key element is resolving the war in Syria peacefully and as soon as possible, she said. “We all know that time is running out to return hope to the millions of refugees,” Merkel said. “It’s also completely clear – and that’s borne out by the discussions here – that we have to tackle the root cause of where the refugees are coming from.”

Oops, too late there, Angela. Or: what a few planted passports will get you.

• US States To Turn Away Syrian Refugees (CNBC)

Two U.S. states have said they will not allow the resettlement of Syrian refugees following the terrorist attacks in Paris that killed 129 people on Friday. Alabama Governor Robert Bentley said in a statement Sunday that he would oppose any attempt to relocate Syrian refugees to Alabama through the U.S. Refugee Admissions Program. “The acts of terror committed over the weekend are a tragic reminder to the world that evil exists and takes the form of terrorists who seek to destroy the basic freedoms we will always fight to preserve,” he said in a statement issued Sunday. “I will not place Alabamians at even the slightest, possible risk of an attack on our people.”

There have been no Syrian refugees relocated in Alabama to date, Bentley said, but added that the Alabama Law Enforcement Agency is working with the Federal Bureau of Investigation, Department of Homeland Security and federal intelligence partners to monitor any possible threats. The statement added that law enforcement presence had been increased at big events in Alabama to further insure the safety of citizens. It added that there had been no credible intelligence of any terrorist threats in the state. The news came at the same time as the local media in Detroit reported Michigan state would look to take similar action.

Governor Rick Snyder’s office released a statement Sunday saying it would not be accept any Syrian refugees until the U.S. Department of Homeland Security fully reviewed its procedures, according to the Detroit Free Press. “Michigan is a welcoming state and we are proud of our rich history of immigration,” Snyder said in the statement, according to the news publication. “But our first priority is protecting the safety of our residents.” Kristine Van Noord, a refugee program manager for Bethany Christian Services in Michigan, told a local radio station in October that the organization settled 27 Syrian refugees in the last fiscal year and was expecting the number for next year to be “much, much higher.” President Barack Obama has previously stated that his administration would accept at least 10,000 displaced Syrians over the next year.

Vale and BHP Billiton. It will take years, too, to conclude any court case against them.

• Brazil Mining Flood Could Devastate Environment For Years (Reuters)

The collapse of two dams at a Brazilian mine has cut off drinking water for quarter of a million people and saturated waterways downstream with dense orange sediment that could wreck the ecosystem for years to come. Nine people were killed, 19 are still listed as missing and 500 people were displaced from their homes when the dams burst at an iron ore mine in southeastern Brazil on Nov. 5. The sheer volume of water disgorged by the dams and laden with mineral waste across nearly 500 km is staggering: 60 million cubic meters, the equivalent of 25,000 Olympic swimming pools or the volume carried by about 187 oil tankers.

President Dilma Rousseff compared the damage to the 2010 oil spill by BP in the Gulf of Mexico and Environment Minister Izabella Teixeira called it an “environmental catastrophe.” Scientists say the sediment, which may contain chemicals used by the mine to reduce iron ore impurities, could alter the course of streams as they harden, reduce oxygen levels in the water and diminish the fertility of riverbanks and farmland where floodwater passed. Samarco Mineração, a joint venture between mining giants Vale and BHP Billiton and owner of the mine, has repeatedly said the mud is not toxic. But biologists and environmental experts disagree. Local authorities have ordered families rescued from the flood to wash thoroughly and dispose of clothes that came in contact with the mud.

“It’s already clear wildlife is being killed by this mud,” said Klemens Laschesfki, professor of geosciences at the Federal University of Minas Gerais. “To say the mud is not a health risk is overly simplistic.” As the heavy mud hardens, Laschesfki says, it will make farming difficult. And so much silt will settle along the bottom of the Rio Doce and the tributaries that carried the mud there that the very course of watershed could change. “Many regions will never be the same,” he says.

Theo’s a good friend of ours from Melbourne.

• An Alternative Long Shot (Theo Kitchener)

This article is an attempt to chart what might happen in terms of climate change, both in terms of science, and particularly the potential politics, if we see a serious financial collapse followed by further contraction due to peaking energy and resources. Despite this being quite a likely scenario, there is barely anything written on the topic. Peak oilers, often end up thinking that we don’t need to worry about climate change because peak energy will take care of it for us. I think this view is strongly mistaken. While it is true that peak energy leads to less emissions than would otherwise be possible, we still end up in the zone of highly likely runaway climate change, and there will still be much that needs doing on an activist front in order to minimise our risk.

On the other hand, climate change activists are often blind to the possibility of financial collapse or even peak energy collapse. Accordingly, I think their strategies are based on business as usual continuing, which I don’t think is realistic. Climate change activists tend to already know that their hopes to create a mass movement that will convince governments to act, and act enough, are likely to fail, but it’s a long shot worth fighting for if the current context is all you have to go on. What I’m offering below is simply an alternative long shot, one I think is more likely to succeed, considering it is based more on the short term interests of the population rather than long term interests, which are harder to get people active on.

Below is a brief analysis of what financial collapse means for the climate, followed by an analysis of potential political scenarios, and particular detail on what I see as the most likely strategies to create a safe climate. These include a decentralised movement to reduce greenhouse gas concentrations, emphasising a shift to permaculture and appropriate technology, the continuation of the anti-emissions movement, a mass movement mobilising to take what’s left of our industrial capacity out of the hands of elites, and put it into good use drawing down carbon, remediating the planet and providing for our needs. This scenario could definitely be seen as an unlikely long shot; however, considering the situation we find ourselves in, a long shot is much better than no shot.

That tangled web again..

• Snow Decline, Water Shortage To Hit 2 Billion Living in N. Hemisphere (Reuters)

Large swathes of the northern hemisphere, home to some 2 billion people, could suffer increasing water shortages due to shrinking snowpacks, researchers said on Thursday. Data shows reduced snowpacks – the seasonal accumulation of snow – will likely imperil water supplies by 2060 in regions from California’s farmlands to war-torn areas of the Middle East, according to a team of scientists in the United States and Europe. In total, nearly a hundred water basins dependent on snow across the northern hemisphere run the chance of decline. “Water managers in a lot of places may need to prepare for a world where the snow reservoir no longer exists,” said Justin Mankin, the study’s lead author and a researcher at Columbia University’s Earth Institute in New York, in a statement.

Basins in northern and central California, the Ebro-Duero basin in Portugal, Spain and southern France and the Shatt al-Arab basin affecting much of the Middle East including Iraq and Syria count among those most sensitive to changes, the study shows. In these areas, global warming is disrupting snow accumulation, which acts as a seasonal source of water when it melts, the researchers said. Still, across most of North America, northern Europe, Russia, China and southeast Asia, rainfall is projected to continue meeting demand, according to the study published in the online journal Environmental Research Letters. Earlier this year, amid a devastating drought in California, U.S. authorities reported that a dry, mild winter had left the country’s Western mountain snowpack at record low levels.

Home › Forums › Debt Rattle November 16 2015