Harris & Ewing Second look at Crescent Limited train wreck near Kenilworth, DC August 1933

The global financial system owns our societies, banks, politicians, the whole lot. It therefore owns us too, which includes you, and it’s very counterproductive to deny that. It can do what it wants and what it pleases with impunity. It took the finance wizards surprisingly long to figure that out, but they have. This has enabled them to buy everything and everyone they wanted to buy.

Starting about 40 years ago with the demise of the last slice of gold standard, a tidal wave of debt was unleashed upon western societies, and later on China, that has since taken on proportions the label absurd cannot begin to describe. Yet, as with so many things in life, if and when introduced sufficiently slow and sneaky, people don’t even notice and when they do, they simply see it as a given. “You get used to anything, sooner or later it becomes your life”.

This kind of slow and sneaky scheme gets far more persuasive if the perpetrators manage to convince people that it is actually to their benefit. That the scheme is meant to, for instance, lift them out of a crisis. “It’s very complicated, but lucky you, we know much more about this than you do, and you can trust us, since after all, we’re all in this together, we all want and need growth”. Or else, we have armageddon. Or seven plagues.

So an insane amount of money has been spent, and pledged, on all sorts of sub-schemes – QE – that ostensibly will solve our problems, and theirs. Only, theirs have to be solved first, because if they’re not, it’s still seven plagues for everyone. There is a man in the street “consumer” base consisting of many hundreds of millions of people in the west that can be drawn on to “finance” the rescue schemes. And if that is not enough, there are hundreds of millions more of their children. Who will all be forced to put in their labor to try and survive.

What the perpetrators know, and neither the people nor their children do, is that a recovery is not possible, because as things stand it would have to be built on a pile of debt so large that it makes any recovery impossible. Record stock markets, higher home prices and a tidal wave of good news stories about equal in size to the debt tidal wave, have kept the public in the dark about this painfully simple fact. Meanwhile, not only is the bankrupt financial system being kept alive, it’s made much richer.

What makes this possible is the same thing that makes it possible for us to continue our ‘normal’ lives, and to pretend that it’s normal in the first place, to let debt increase where we don’t immediately notice it. It’s like a bunch of guys with masks coming into your home at night while you’re watching TV, and taking away everything that’s not in your direct range of vision. And then the morning comes.

It’ll be very hard to pry back control over our lives from the cold hands of the rich and ruling class, not in the least because they have incorporated the military-industrial complex into their power sphere while we are stuffing our homes with trinkets and gadgets. But at some point and at some time we will need to realize that the only way we can keep up the appearances that our lives have become, is to take away from our children’s lives and wealth and well-being.

We may not at this point literally eat the flesh of our children, but we do eat their lives. We desire the same TVs and cars and homes our neighbors have, or better and bigger if at all possible, but we refuse to see what prices we pay for those things. Our world today promotes matter over mind, the biggest and ugliest trap that exists for our species. When you think about it, an opposable thumb is very handy, but what good is it if you use it only to produce bling? Are we perhaps not supposed to be smarter than that?

It’s not that hard, it really isn’t. But as long as we keep telling ourselves it’s all awfully hard to understand, we can continue to live in our comfort zones for another day, while Rome is burning. There are plenty species that eat their kids, or leave them behind, or chase them away, but we all (well, not all) pretend we love our children, and many of us would claim we’d give our lives for them. Well, here’s your chance to prove it.

You can either continue to sit in front of your TV, and work your job, and drive to the supermarket, and check your stocks 10 times a day. Or you can put your energy into ensuring that either the system ends, or that you and yours stop depending on it.

Door number 1, you eat your kids’ futures.

Door number 2, you fight for their futures.

That’s all the doors there are. And there’s precious little time left to make your choice.

Happy 4th of July to you and yours.

• Yellen Is Wrong: Bubbles Are Caused By The Fed, Not The Market (Alhambra)

More of the same from Janet Yellen in her latest speech, but her focus on “resilience” caught my attention as it relates to very recent developments. The taper threat experience last year may have been a warning, but it doesn’t seem like it resonated with her or policymakers. The major bond selloff, which led to global ripples of crisis in credit, funding and currencies, was the opposite of flexibility. Perhaps a better definition of the word would be a place to start. But her meaning was a bit different, in that it is clear (from this speech and prior assertions, wrong as they were, about the mid-2000’s housing bubble) she sees bubbles as “market” events in which the central bank’s role is primarily shock absorption. In other words, idiot investors wholly of their own accord create bubbles and it’s the job of the munificent and enlightened Federal Reserve to help ensure that such “market” madness is “contained” without further economic destruction.

At this point, it should be clear that I think efforts to build resilience in the financial system are critical to minimizing the chance of financial instability and the potential damage from it. This focus on resilience differs from much of the public discussion, which often concerns whether some particular asset class is experiencing a “bubble” and whether policymakers should attempt to pop the bubble. Because a resilient financial system can withstand unexpected developments, identification of bubbles is less critical.

The primary example she used is very illuminating in that regard, particularly as it relates to monetary neutrality.

Nonetheless, some macroprudential tools can be adjusted in a manner that may further enhance resilience as risks emerge. In addition, macroprudential tools can, in some cases, be targeted at areas of concern. For example, the new Basel III regulatory capital framework includes a countercyclical capital buffer, which may help build additional loss-absorbing capacity within the financial sector during periods of rapid credit creation while also leaning against emerging excesses.

This framework wholly reverses what happened in 2008, but since the FOMC as a whole, with her along for the ride, had absolutely no idea what was taking place at the time this is really not surprising. She sees the Fed as the cleanup crew for the “market’s” mess, essentially the job as it was described anyway a century ago, when in fact the 2008 panic was actually the market finally acting like a true market and exerting some pressure on the central banks to stop the ongoing and heavy inorganic and artificial intrusions. To maintain the idea of market-based mess is to be intentionally obtuse about the nature of interest rate targeting and central bank activism.

• The Yellen “Resilience” Doctrine Is Dangerous Keynesian Blather (Stockman)

Just when you thought that nothing could be worse than bubble blindness of Greenspan and Bernanke—- along comes the Yellen doctrine of “resilience”. Its dangerous Keynesian blather, and far worse than Greenspan’s feigned agnosticism which held that the Fed does not have the capacity to recognize financial bubbles in the making and should therefore mop them up after they burst. The Maestro never did say exactly what caused the massive and destructive dot-com and housing bubbles which occurred on his watch—-except that Chinese factory girls stacked 12-to-a-dorm-room apparently saved way too much RMB. By contrast, Yellen’s primitive Keynesian mind knows exactly what causes financial bubbles. She has now militantly asserted that bubbles are entirely an irrational impulse in the private market and that the price of money and debt has absolutely nothing to do with financial stability.

That’s right, if the Fed could find a way to peg the money market rate at negative 10% to further its self-defined dual mandate of just enough inflation and always more jobs—even then any speculative excesses would presumably be attributable to still another outbreak of the market’s alleged propensity for error, irrationality and greed. Let’s see. If the central bank arranged to cause carry-traders to get paid 8% to borrow short-term money (i.e. on a negative 10% deposit rate) in order to fund the carry on junk bonds, Turkish construction loans and the Russell 2000, do ya think they might get a tad rambunctious? For crying out loud, when it comes to speculation, leverage, maturity transformation and re-hypothecation of financial assets the money market interest rates is “not nothing” as Yellen contends. Its everything!

That’s the heart of the matter and why Keynesian central banking is the most destructive and dangerous doctrine ever invented. In effect, it mandates central bankers to seize control of the single most important price in all of capitalism–the price of “carry” or gambling stakes in the financial markets—-and then asserts that this drastic pre-emption will have no impact on the behavior of speculators, traders and investors. That predicate is so perverse that it puts one in mind of the boy who killed his parents and then threw himself on the mercy of the courts on the grounds that he was an orphan! Keynesian central bankers like Yellen are doing exactly the same thing. Pegging the money market rate at zero for seven years amounts to killing all of the financial market’s inherent stability mechanisms.

The higher and the steeper the surge, the bigger and the deeper the fall.

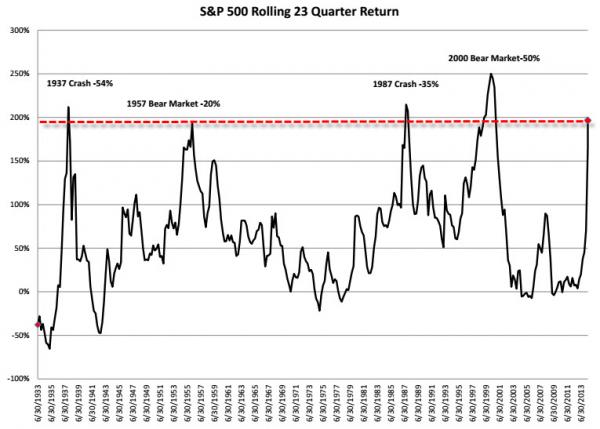

• What Happened The Last 4 Times Stocks Rallied For 23 Quarters? (Zero Hedge)

Does this look sustainable to you? Of course, it’s different this time, right? The S&P 500 is in the 23rd quarter of its recovery – and shows a 196% gain…. the last four moves of similar magnitude ended very badly.

Don’t miss out on the entire article. It reads like a great script for a major Hollywood movie.

• Accusations Fly In Bulgaria’s Murky Bank Run (Reuters)

Just days before the run on Corpbank, the International Monetary Fund had praised the country’s financial sector as “stable and liquid”. A senior IMF official has since said the problems at the two Bulgarian banks did not reflect any underlying problems in the system, which remains well capitalized and liquid. The country’s central bank initially blamed the bank run on media reports about Corpbank’s main owner and leaked news that a central bank deputy governor was under investigation. Central Bank Governor Ivan Iskrov called the leak a deliberate “attack” on the bank. Others suggested alternative reasons. Behind closed doors some government officials blamed the run on a clash between Corpbank’s main owner Tsvetan Vassilev and his political rivals, without saying who they were. Prime Minister Plamen Oresharski publicly blamed a “corporate clash” for the run on Corpbank, without going into specifics.

When the run spread to First Investment Bank, a bigger lender, the government pointed the finger at unnamed people for launching what they called a criminal attack on the country’s financial system. Perpetrators were using phone text messages and the internet to spread malicious rumors about Bulgarian banks, the central bank, finance ministry and interior ministry all said. Much is still unclear. Who was behind the internet rumors and text messages? Why did the government not investigate sooner? How exactly was the feud connected to the run on Corpbank? “The security authorities, the Interior Ministry, are investigating. They have some suspicions and there are some people who have been accused (of the attack on the banks),” finance minister Petar Chobanov told Reuters. “What is true is that there is an investigation into malpractice at Corpbank. But what is the real situation? We are waiting to see what the external auditors will say.”

If all else fails, eat your kids.

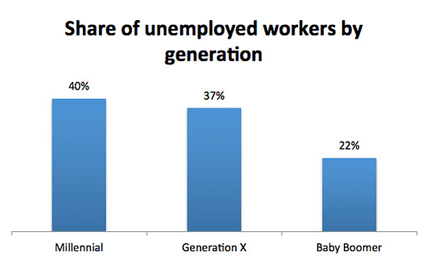

• 40% Of Unemployed Americans Are Millennials (MarketWatch)

The jobs market is improving, according to government data released Thursday, but millennials are still left out in the cold. They’re suffering more than any other age group, new research finds. Some 40% of unemployed workers are millennials, according to an analysis of U.S. Census data by the Georgetown University Center on Education and the Workforce released to MarketWatch, greater than Generation X (37%) and baby boomers (23%). That equates to 4.6 million unemployed millennials — 2 million long-term — 4.2 million unemployed Xers and 2.5 million jobless baby boomers. “I was surprised by how high that number is for millennials,” says Andrew Hanson, research analyst at Georgetown University, who conducted the analysis. “Unemployment is becoming a youth problem.” The U.S. unemployment rate fell to 6.1% in June from 6.3% in May, the government announced Thursday, adding 288,000 jobs. Average hourly earnings rose 2% on the year in June, while consumer price inflation rose 2.1% between May 2013 to May 2014.

But the unemployment rate for 18-29 year olds, including those who have given up looking for work, is 15.2% in June, according to a calculation by Generation Opportunity, a non-profit think-tank based in Arlington, Va. “The headline figure for unemployment doesn’t tell the whole story,” says Dan Schawbel, author of “Promote Yourself: The New Rules for Career Success” and founder of Millennial Branding, a management and consulting firm. Since the recession, the youngest job-hunters are being beaten by the oldest. The number of jobs held by baby boomers rose by 9% from 2007 to 2013, a gain of 1.9 million jobs, while the millennial workforce only snagged 110,000 jobs, up 0.3%, according to new analysis by software firm CareerBuilder and labor market data and software firm Economic Modeling Specialists International. (Generation X jobs fared worse, dropping 2.6 million, or 1%.) [..]

Delayed career starts could impact the earning potential of a generation of Americans. The average worker today doesn’t earn the national median salary until the age of 30; in 1980, workers reached that point in their careers at age 26, Hanson says. One reason: Between 1987 and 2000, 30 million net jobs were added in the U.S., but when many millennials were entering the workforce between 2000 and 2013 only 4 million jobs were added. “Young people are the first to be let go by companies in a recession and the last to be let back in,” he adds. And young men may also fare worse than young women. “With structural changes in the economy, there’s been a gradual decline in blue-collar jobs, which used to give more young men traction at an earlier age,” Hanson says. “Men especially have been failing to beat these entry-level standards in the labor market,” he says.

“While US businesses have on the whole added 1.85 million low-wage jobs over the past six years, they have eliminated 1.83 million medium-wage and high-wage jobs”

• US Jobs Growth Is In Part-Time, Low-Wage Work (WSWS)

The US economy added 288,000 jobs in June, while the unemployment rate fell to 6.1%, according to the latest jobs report issued Thursday by the Labor Department. While the number of new jobs created was higher than in recent months, the new jobs were largely part-time and in low-wage sectors, continuing the trend of replacing better-paid workers laid off during the 2008 crash with lower-paid, more highly exploited employees. A large share of the growth in employed people was, according to the report, attributable to an increase in workers employed part-time for economic reasons, whose numbers grew by 275,000. These workers, “who were working part time because their hours had been cut back or because they were unable to find a full-time job,” hit 7.5 million. The number of people employed full-time actually dropped.

The Obama administration seized on the jobs report to once again proclaim an economic turnaround. “This is one of the strongest reports we’ve seen since the end of the recession,” said Labor Secretary Thomas E. Perez. “There was good job creation in high-wage, mid-wage and low-wage positions. It was broad-based.” In reality, jobs growth was again led by low-wage industries. The retail trade sector added 40,000 jobs, while the leisure and hospitality sector, which pays an average of $13.83 per hour, added 39,000. The health care sector added 34,000 jobs. Relatively higher paying sectors lagged behind. The manufacturing sector added only 16,000 jobs, while construction added only 6,000. As a result, wages have remained stagnant. The average hourly wage for private sector workers increased by just six cents last month, and has increased only 2% over the past 12 months, less than the rate of inflation.

In fact, a disproportionate number of jobs created during the economic “recovery” pay less than $13 per hour, according to a report issued earlier this year by the National Employment Law Project. While US businesses have on the whole added 1.85 million low-wage jobs over the past six years, they have eliminated 1.83 million medium-wage (paying between $13 and $20 per hour) and high-wage (between $20 and $32) jobs, according to the report. The report found that low-wage industries accounted for just 22% of job losses during the 2008 recession, but 44% of jobs gained since 2008. By contrast, mid-wage jobs accounted for 37% of job losses and just 26% of jobs gained, while high-wage jobs accounted for 41% of job losses but only 30% of new jobs. The number of workers at temporary employment agencies grew by 10,000 last month. The percentage of workers employed by temp agencies has nearly doubled, from 1.3% of all employees in 2009 to 2.1% of all employees last month. [..]

The combination of falling wages and mass unemployment has had a devastating impact on workers’ incomes. The median household income in the US plummeted by 8.3% between 2007 and 2012. Meanwhile, the net worth of America’s billionaires reached $1.2 trillion last year, more than double what it was in 2009. The jobs report came as the cutoff of extended federal jobless benefits for those unemployed for more than 27 weeks entered its seventh month and the number of people whose benefits have been cut off hit more than 3 million. While the Democrats had earlier this year pledged to wage a major campaign to extend long-term jobless benefits, they have now dropped the issue for all practical purposes.

Much more should be revealed in the Qingdao case. But both governments and bankers have vested interests in not doing that.

• Chinese Trader Said to Pledge Metal 3 Times for Loans (Bloomberg)

Decheng Mining pledged the same metals stockpile three times over to obtain more than 2.7 billion yuan ($435 million) of loans in China’s Qingdao port, a person briefed on the matter said, citing preliminary findings of an official investigation. Local authorities are checking metal inventories worth about 1.54 billion yuan including 194,000 tons of alumina, 62,000 tons of aluminum and some copper, the person said, asking not to be identified as he isn’t authorized to speak publicly. Foreign and local banks are examining lending linked to metals at Qingdao amid concern that risks are more widespread in China, where traders use commodities from iron ore to rubber to get funding.

Steps by the Chinese government to rein in credit raised companies’ borrowing costs in recent years and triggered a surge in commodities financing deals that Goldman Sachs Group Inc. estimates to be worth as much as $160 billion. “The whole Qingdao probe will just keep fermenting, inevitably leading to banks increasing their scrutiny of commodities-backed financing activities,” Fu Peng, chief strategist at Galaxy Futures Co., said by phone from Beijing. Bank of China Ltd., Export-Import Bank of China, China Minsheng Banking Corp. and 15 other Chinese banks have lent a total of about 14.8 billion yuan to Chen Jihong, Decheng Mining’s owner, and his companies, the person said.

• Foreign Banks See Exposure to China Port Qingdao Topping $500 Million (WSJ)

Foreign banks at risk in a possible fraud at a Chinese port are tallying up their exposure as they prepare their quarterly earnings reports, with estimates exceeding $500 million. Industry executives believe Chinese banks could be on the hook for more if loans backed by metals stored at the port of Qingdao go bad. Estimates of the losses they could face run into the billions of dollars. Chinese authorities are investigating whether traders fraudulently used the same stockpiles of metals to secure multiple loans. Western banks, meanwhile, have been shut out of warehouses in both Qingdao and Penglai, a second port, also in Shandong province, where concern about fraud has also arisen. Banks are struggling to gauge how much of the metals-backed loans they have made were based on the potentially fraudulent use of collateral and could be at risk of default.

The estimates of exposures cover all of the warehouses at Qingdao port, but so far the probe has focused on Dagang, a smaller unit at the port. The worry for bankers is that the potential fraud may be found to be more widespread at Qingdao, or elsewhere, according to banking executives familiar with the matter. Standard Chartered disclosed a $250 million exposure to Qingdao last week, though Chief Executive Peter Sands told reporters at that time that the amount isn’t “material at this stage,” describing it as “across multiple clients, multiple exposures and multiple facilities.”

Other foreign banks that have exposure to Qingdao are Dutch bank ABN Amro, French banks BNP Paribas and Natixis, South Africa’s Standard Bank, and U.S. bank Citigroup, people familiar with the matter said. Apart from Standard Chartered, lenders including Citigroup and Standard Bank have previously acknowledged potential problems with commodity financing in China but have given no further details. People within banking who are familiar with the matter put the exposure of foreign lenders other than Standard Chartered at around several hundred million dollars, and the total exposure at more than $500 million.

The consequences of bubbles.

• Household Debt Serious Threat To UK Recovery (Guardian)

The Bank of England deputy governor, Sir Jon Cunliffe, has warned that household debt is a key risk to the UK recovery and said the Bank’s new measures to rein in the housing market should be thought of as insurance against a major crash. In a speech at the International Festival for Business in Liverpool, Cunliffe said UK household debt was equal to 135% of household earnings, compared with 110% in 2000 and 165% in the runup to the financial crisis. This is markedly higher than in other European countries, and on a par with the US, he added.

Last week, the Bank’s financial policy committee (FPC) laid out measures to limit risky lending, but stopped short of taking more drastic steps to cool the housing market. The measures – the first limits on the mortgage market in 30 years – include that lenders must check mortgage applicants can cope with a 3 percentage point rise in interest rates – slightly tougher than current affordability checks. From October, there will be a 15% cap on the number of mortgages that banks and building societies can give to people who want to borrow more than 4.5 times their income. Cunliffe, who is in charge of financial stability at the central bank, said: “An outcome in which house prices grow more rapidly relative to income and do so for longer is … quite plausible. It has certainly happened before in the UK. We know the pressure from demand for homes is great and that the supply of new homes is quite weak.”

He concluded: “The stress test of the major UK banks towards the end of the year will assess the resilience of the system to a major crash. The steps taken last week are insurance against the possibility of a sustained boom in the housing market leading a substantial increase and concentration in household debt that could make a crash more likely and more severe.” He said the main risk from the housing market was that house prices would continue to grow strongly and faster than earnings and lead to more household debt: “In short, the risk that more people take on higher debt relative to their income as they have to stretch further to buy homes.”

Sweden’s in a very tight spot. Debt levels are extreme.

• Can Sweden Avert ‘Nordic Japan’ Fate? (CNBC)

Swedish central bank meetings are generally as staid as you’d expect, but they have just got a lot more interesting, as the Nordic country contemplates the specter of Japan-style stagnation. On Thursday, the Riksbank, Sweden’s central bank, cut its main policy rate by 50 basis points to 0.25%, surprising the market, as most economists had forecast a 25 basis points cut to 0.5%. The Swedish krona tumbled to its lowest level against the dollar for close to a year, and its lowest level against the euro for more than three years, following the news. The Riksbank has also signaled very strongly that it will not start cutting interest rates until the end of 2015, later than expected. The meeting is “a lasting negative for the Swedish krona,” according to Citigroup currency strategist Josh O’Byrne.

This may be bad news for Swedish tourists setting off on holiday this summer – but ultimately, good news for their country’s economy, if it encourages exports of Swedish goods. Consumer prices are falling in Sweden, which means the country may be entering a prolonged period of deflation – one of the issues which has dogged the Japanese economy in the past couple of decades. Deflation can cause problems if it means that employment falls and consumers subsequently are not spending, which may lead to a shrinking economy. Sweden also has high levels of household debt in common with Japan. The average indebted Swede owes close to three times their annual income – and the average mortgage borrower 370% of their annual income. Unemployment has remained stubbornly high, at around 8%, since 2011.

Recovery my donkey.

• Eurozone Retail Sales Stall As Households Feel Pain (CNBC)

Retail sales across the 18 countries that share the euro were flat in May, missing expectations as consumers continue to rein in spending amid high unemployment. The European Union’s statistics agency, Eurostat released the figures as members of the European Central Bank’s governing council are gathered in Frankfurt where no new stimulus measures are expected after the bank cut interest rates to record lows last month. Eurostat said the month-on-month volume of sales was stable in May compared to a 0.2% decrease in retail sales in April. The agency said May saw a 0.3% rise for the non-food sector while fuel remained unchanged and sales in food, drinks and tobacco slipped 0.3%. Annually, retail sales are 0.7% higher compared to the same time this year, largely driven by the 1% and 0.8% gains seen in non-food items and fuel respectively.

“It now looks most likely that euro zone retail sales volumes eked out only slight growth in the second quarter, which adds to the impression that the euro zone is finding it hard to build appreciable growth momentum,” said chief U.K. and European economist at IHS Global Insight, Howard Archer. “Flat retail sales in May, coupled with a modest dip in euro zone consumer confidence in June from May’s 79-month high, reinforces suspicion that any improvement in euro zone consumer spending is more likely to be gradual than pronounced over the coming months – especially as there are still significant constraints on consumers in several countries,” said Archer. Euro zone unemployment was stable at 11.6% for the second consecutive month in May, down slightly from the 12% seen a year ago, according to Eurostat data released on Monday.

Someone wake up the French.

• IMF Warns Of Negative Spiral In France As Recession Looms Again (AEP)

France is on the cusp of a fresh recession as services contract sharply and the country braces for yet another round of austerity cuts, with record jobless levels likely to bedevil Francois Hollande’s presidency for years to come. Markit’s PMI services gauge for France fell for the third month to 48.2 in June, pointing to an outright fall in GDP following zero growth in the first quarter. The International Monetary Fund cut its growth forecast this year from 1pc to 0.7pc, warning that there would be no “appreciable decline” in French unemployment until 2016. “Volatile and uneven leading indicators point to the risk of a stalled recovery,” it said. The IMF said public debt should peak at 95pc of GDP next year but a “growth shock” would push it to 103pc by 2016. The Fund warned of a “negative spiral of low growth and falling inflation” that is pushing up real borrowing costs and further choking investment, already dismally weak. Core inflation was 0.3pc in May.

The economic relapse is a political disaster for Mr Hollande, already the least popular leader in modern times with a poll rating of 23pc, and reeling from a crushing defeat by the far-Right Front National in European elections. The country is being left behind by Spain and others as they reap the first rewards from supply-side reforms, although the France’s Socialists grumble that they are merely under-cutting France with deflationary wage cuts in a 1930s-style race to the bottom that ultimately benefits nobody. Mr Hollande is paying the price for a failed strategy in his first two years in office when he clung to the old model and relied on tax rises rather than spending cuts to cover austerity packages. The state sector has risen to 57pc of GDP, suffocating the private economy. Yet the country is also caught in a vicious circle as it tries to meet EMU deficit rules, forced to push through successive austerity packages without offsetting monetary stimulus or a weaker currency. The IMF said France’s exchange rate is over-valued by 5-10pc.

The effect of austerity has been to erode the tax base, leaving the budget deficit stuck at over 4pc of GDP. France has gained remarkably little from fiscal tightening equal to 5pc of GDP over the last three years. Undeterred, it is now pushing through extra cuts of €50bn by 2017 under the new premier Manuel Valls, dubbed the “economic Clemenceau” for his willingness to endure casualties stoically. The biggest hit will come next year, raising the risk that economy will once again to fail to achieve escape velocity. There is unlikely to be a quick rescue from the European Central Bank. Mario Draghi, the ECB’s president, offered no further clues yesterday on whether the bank would launch quantitative easing to revive credit and to build a safety buffer against deflation. Mr Draghi said the ECB’s next rounds of cheap loans for banks (TLTROs) could inject €1 trillion into the system, and signalled that borrowers would not be treated too harshly if they used the money to play the “carry trade” by investing in government bonds rather lending to the real economy.

Time for legal action, and lots of it.

• GM Received First Switch Complaints 17 Years Ago (Reuters)

General Motors car owners have been complaining to dealers about defective ignition switches since 1997, years before the automaker launched the Chevrolet Cobalt and other small cars with faulty switches linked to at least 13 deaths. GM this week expanded its recall of cars with switch issues by more than 8 million, but it did not indicate when it first learned of problems in cars including the 1997 Chevrolet Malibu and the 2000 Chevrolet Impala. A Reuters review of a consumer complaints database maintained by U.S. safety regulators showed that GM dealers were told of switch-related defects almost as soon as the Malibu was put on the market, and that many could not fix the defects. Early issues included keys that either stuck in the ignition or could be pulled out while the vehicle was running, as well as ignition switches that failed to start the engine or apparently caused the engine to stall. In later years, some owners said their cars stalled while on the highway and one quoted a dealer as saying changing the switch could solve the problem.

In one of the earliest complaints filed with the National Highway Traffic Safety Administration, a New Jersey woman in April 1997 said she had been “stranded seven times” when her new 1997 Malibu could not be started, while the key remained stuck in the ignition and could not be turned. The ignition was replaced twice by her dealer, but the problem was not resolved. “I cannot comprehend how three different… ignition cylinders can all be defective,” she wrote. A GM spokesman said he could not say what was known about the Impala issue nearly two decades ago and that GM had decided to make the recent recall after the most exhaustive safety review in company history. GM advised dealers about ignition issues on both cars in 2001, sending so-called service bulletins, which generally describe customer issues and potential solutions.

Or should it be the other way around?

• Will Japan’s Democracy Survive Abe? (Bloomberg)

For the third time since taking office in December 2012 Abe did exactly what all too many of his 126 million people oppose. Earlier, he rushed into law a controversial secrecy bill that could send reporters and whisteblowers to jail on varied and ambiguous grounds, and he pushed to restart reactors shut on safety grounds after the March 2011 Fukushima disaster. Given a mandate to end deflation, Abe’s biggest moves to date involve flexing geopolitical muscles, not building economic ones. “He has ignored popular will and made a mockery of constitutional and democratic principles on all three fronts,” says Jeff Kingston, head of Asia studies at the Tokyo campus of Temple University. “The alleged success of Abenomics has stoked his popularity and given him an opportunity to overturn Japan’s postwar order.”

Banri Kaieda, head of the opposition Democratic Party of Japan, bemoans Abe’s “authoritarian tendencies” that have nothing to do with raising living standards or restoring growth. In an April speech in Washington, Kaieda warned that the “Abe administration could move beyond the realm of healthy nationalism and become a destabilizing factor in East Asia.” China would argue that Abe crossed that line with his December 2013 visit to Tokyo’s Yasukuni Shrine, where 14 class-A war criminals are interred. But this latest move to enable Japan to deploy troops overseas, ostensibly to defend its allies, is sending shockwaves through the region, particular victims of Tokyo’s World War II militarism, China and South Korea. Japan has every right to defend itself. It’s been a good global citizen since 1945 and deserves a permanent seat on the U.N. Security Council. If its people support a change in the pacifist Article 9 of the postwar constitution, then so be it.

But Abe should hold a national referendum on the issue, and lawmakers in his Liberal Democratic Party shouldn’t give him carte blanche to pretend Japanese law allows what it forbids. “It’s an awful precedent, of course,” says Colin Jones, a legal scholar at Doshisha Law School in Kyoto. “If the cabinet can reinterpret this part of the constitution why not others?” Adds Kingston: “Abe is like a thief in the night sneaking in the backdoor to steal the heart and soul of Japan’s constitution and that’s why he has provoked such a strong backlash and anger — because Article 9 is a touchstone of national identity.” Japanese housewife Naomi Takusu even nominated Article 9 for a Nobel Peace Prize. It will be fascinating to see if the Nobel committee calls Abe’s bluff come October.

Suppositions galore.

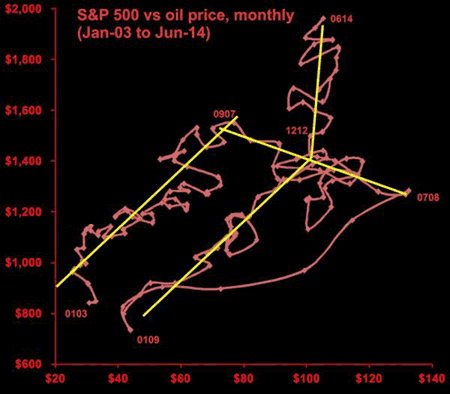

• The Changing Correlation Between The S&P 500 And Oil (World Complex)

Today we investigate the relationship between oil and the broad US market, using the S&P 500 index as a proxy. A common thought is that the two functions are inversely correlated, with the US market in danger whenever oil rises too high. The relationship has been a complex one over the past 11 years, but the correlation is positive most of the time. In particular, we see from 2003 until late 2007, both oil and the market rose in tandem. The only time the two records show an inverse correlation was during the windup to the financial crisis–from late 2007 to July 2008. The collapse in both market index and oil price through the second half of 2008 shows up quite clearly. The two prices rise in tandem from early 2009 to the end of 2012.

It doesn’t seem logical that the S&P should be positively correlated to oil prices – so it is more likely that both records are correlated to the same thing – inflation. But what to make of the last 18 months, in which we see an almost vertical rise in the stock market without an increase in the oil price? Is an American renaissance in the works, powered by increased American oil production? Or is it due to the much rumoured mass purchase of securities by financial institutions, powered by monetary creation? Is it being done to prevent another period of negative correlation, which might foretell another economic crisis? Stay tuned . . .

Peculiar article.

• All Snowden Files To Be Published In July? (RT)

All of the National Security Agency files accessed by former contractor Edward Snowden could be published in the month of July if vaguely worded predictions tweeted this week from the digital library site Cryptome prove to be correct. A series of micro-messages published by the website — a portal for sharing sensitive documents that predates WikiLeaks by a decade — suggest further Snowden leaks may be on the way. “During July all Snowden docs released” reads an excerpt from one Cryptome tweet sent on Monday this week. “July is when war begins unless headed off by Snowden full release of crippling intel. After war begins not a chance of release,” reads another tweet sent from Cryptome on Monday this week. “Only way war can be avoided. Warmongerers [sic] are on a rampage. So, yes, citizens holding Snowden docs will do the right thing,” insists another.

Follow-up tweets from the organization have been equally vague, however, and a report published by a journalist at Vocativ on Tuesday does little to disclose what information, if any, will be published in the coming weeks. Other dispatches this week from Cryptome direct followers to watch for two upcoming conferences planned for this month: the biannual Hackers On Planet Earth (HOPE) event in New York City starting July 18, and the Aspen Institute’s yearly Security Forum the following weekend, which will feature appearances from the likes of former NSA directors Keith Alexander and Michael Hayden. Daniel Ellsberg, the former United States Department of Defense staffer attributed with leaking the so-called “Pentagon Papers” during the Vietnam War, may have a role in the possible Cryptome release. Ellsberg is scheduled to deliver a keynote address at HOPE, and Cryptome tweeted that those wanting more information on the release of Snowden docs should stayed tuned to that event for his speech and another from a yet-to-be-announced special guest.

As the tweets continued through Monday, Vocativ journalist Eric Markowitz approached Cryptome founder John Young for further details. Ahead of that article’s publication, however, Cryptome published the email exchange between Young and the reporter, the contents of which provide little more except for vaguely worded predictions that could be deciphered to conclude that Mr. Ellsberg may or may not discuss unpublished Snowden documents at HOPE later this month. “July is a summitry of anti-spy and pro-spy events, HOPE and Aspen Security Forum. Both sides will be pushing their interests, with dramatic revelations by newsmaking and news breaking speakers,” Young wrote to the reporter. “At Aspen there is a star-studded list of top military and spy officials, defense industry and main stream media parading the need to combat the Snowdens and the WikiLeakers who do not understand the necessity of a luxurious and wasteful natsec and spy warmongering.”

Our ancestors were smarter than we are.

• Scientists Rewrite Human Evolution Timeline (ANI)

Scientists have synthesized a new theory that the traits that have allowed humans to adapt and thrive in a variety of varying climate conditions evolved in Africa gradually and at separate times. Many traits unique to humans were long thought to have originated in the genus Homo between 2.4 and 1.8 million years ago in Africa and it was earlier believed that large brain, long legs, the ability to craft tools and prolonged maturation periods have evolved together at the start of the Homo lineage as African grasslands expanded and Earth’s climate became cooler and drier. However, the new analysis suggested that these traits did not arise as a single package but several key ingredients once thought to define Homo evolved in earlier Australopithecus ancestors between 3 and 4 million years ago, while others emerged significantly later.

Richard Potts, Smithsonian paleoanthropologist, has developed a new climate framework for East African human evolution that depicts most of the era from 2.5 million to 1.5 million years ago as a time of strong climate instability and shifting intensity of annual wet and dry seasons. Susan Anton, professor of anthropology at New York University, said that they could tell the species apart based on differences in the shape of their skulls, especially their face and jaws, but not on the basis of size and the differences in their skulls suggest early Homo divvied up the environment, each utilizing a slightly different strategy to survive. Leslie Aiello, president of the Wenner-Gren Foundation for Anthropological Research, said that the data suggested that species of early Homo were more flexible in their dietary choices than other species, while the team also concluded that this flexibility likely enhanced the ability of human ancestors to successfully adapt to unstable environments and disperse from Africa.

• Great Barrier Reef’s Coral Faces Ravaging By Expected El Niño (Guardian)

The Great Barrier Reef is set to be ravaged by the expected El Niño weather phenomenon and scientists warn that similar warming events have significantly impacted upon the reef’s coral. Research by the University of Queensland studied large Porites coral colonies, a type of coral considered more resistant than others to changes in the environment. By analysing and dating coral samples, researchers found there was a significant correlation between mass coral mortality events and spikes in sea surface temperature over the past 150 years. This finding raises “serious concern” for the wellbeing of the Great Barrier Reef, the scientists said, because of the long-term threat of climate change and, more immediately, the arrival of El Niño. El Niño is a climate phenomenon, occurring every few years, when water in the western part of the Pacific Ocean becomes exceptionally warm. It has different impacts in different parts of the world but in Australia it is associated with warmer temperatures and increased risk of droughts.

The chances of El Niño hitting this year has been measured at 90%; scientists are concerned it could cause widespread damage to the reef, which is already weakened because of pollution, cyclones and a plague of coral-eating starfish. It has suffered a number of coral bleaches, notably in 1997 and 1998, after an El Niño. Bleaching is where the coral loses life and colour and turns white and brittle. Professor Jian-xin Zhao, who led the University of Queensland project, said there has been a rise in Porites coral deaths in recent decades. “The 1997-98 bleaching followed a strong El Niño event on top of a decline in water quality and a long-term global warming trend, which seems to have pushed the most robust corals past their tolerance limit,” he said. “Considering that a similar El Niño event is predicted to occur this coming summer, we have grave concerns for the reef.”

• Oklahoma Earthquakes Linked To Fracking Wastewater Wells (Guardian)

Scientists have, for the first time, linked hundreds of earthquakes across a broad swath of Oklahoma to a handful of wastewater wells used by the fracking industry. The research, published in the journal Science on Thursday, said about one-fifth of the quakes that helped turn Oklahoma into the earthquake capital of America were caused by just four wells. Oklahoma has had about 240 magnitude 3.0 or higher earthquakes just since the start of the year. The state now has twice the number of 3.0 earthquakes as California. Before 2008, when the oil and gas boom got underway, the state averaged about one a year. The researchers from Cornell University and other institutions traced a large number of earthquakes through 2012 to just four wells, south-east of Oklahoma city.

Those wells were pumped with significantly higher volumes of fracking wastewater and chemicals than the thousands of other disposal wells in the state. The findings were the first to show such waste wells can trigger earthquakes up to 40kms away from the injection site. They are bound to further deepen the controversy surrounding fracking, which has vastly expanded America’s oil and natural gas production, but with rising consequences for health, safety and the environment. Another Cornell-led team this week found that 40% of the fracked wells in north-eastern Pennsylvania were at risk of leaking methane into groundwater and air. The researchers said faulty cement casings could be responsible.

• Canada’s Big, Ugly Environmental Problem (Pacific Standard)

Since Stephen Harper’s election as prime minister in 2006, and especially since his Conservative Party won a parliamentary majority in 2011, Canada’s once-celebrated record of environmental science research and climate change policy has been swiftly and thoroughly turned on its head. Dramatic funding cuts, censorship, and other acts of what many environmental scientists, activists, and journalists are calling thinly veiled sabotage have plagued the once emblematically green country. Over 2,300 government scientists have lost their jobs; groundbreaking research projects such as the Experimental Lakes Area (ELA) and Polar Environment Atmospheric Research Lab (PEARL) have been ended or handed over to third-party management; and seven of 11 Department of Fisheries libraries were shuttered late last year, much of their valuable research and archival material allegedly thrown away or burned.

In perhaps the biggest blow to environmental sovereignty, the 2012 omnibus budget bill C-38 repealed and amended 70 laws, nearly 20 of them concerning environmental regulation and protection, and easing the path for the energy industry. Government scientists—whose research is funded with public money—have been effectively banned from speaking with the press when their findings have differed in any way from Canada’s official policies or positions. Revenue Canada was given $8 million specifically in order to audit a number of environmental organizations, looking for violations of Canada’s tax code, which allow a maximum of 10% of a registered charity’s budget to be spent on political activities; of the nearly 900 audited, only one was found to be exceeding limits on political activity.

Home › Forums › Debt Rattle 4th of July 2014: If All Else Fails, You Eat Your Kids