Dorothea Lange “Gas station road sign near Perry, Georgia” July 1936

There can be no doubt that the biggest story today comes courtesy of the Financial Times. Alan Friedman, whose book ‘Ammazziamo il Gattopardo’ (Let’s Murder the Leopard) is released February 12, details what went on in Italy in 2011 during events that led to both the forced departure of elected prime minister Silvio Berlusconi and the rapid installation of unelected Goldman Sachs alum Mario Monti as PM of a new government.

On November 12, at a meeting with the president, Mr Berlusconi resigned, ending his third stint as prime minister. Within 24 hours – rather than call for fresh elections – Mr Napolitano named Mr Monti, the economics professor and former European commissioner who had never held elected office, as prime minister. The full cabinet was sworn in three days later.

Obviously, as in just about any other democracy, the first option after a PM resigns would have been elections. But all pawns in the game had been in place long before the resignation. What the FT reveals is that Italian President Giorgio Napolitano had been conferring with Monti and others as much as half a year before Berlusconi was ousted, something that gives the process the aura of a conspiracy, not least of all because it’s highly doubtful that Italy’s presidents have such freedom and powers under their constitution. How this is not a coup is hard to see. As is how much longer 89-year old Napolitano can keep his position after this revelation.

What happened in Italy that summer and autumn as policy makers battled the crisis gripping the eurozone is still a subject of intense debate. That the president was planning the replacement of the elected Mr Berlusconi by the unelected technocrat Mr Monti – months ahead of the eventual transfer of power in November – reinforces concerns about Mr Napolitano’s repeated and forceful interventions in politics. His outsized role since the crisis has led many to question whether he stretched his constitutional powers to their limits – or even beyond.

The fact that a conspiracy to oust a government leader involves, or is even led by, a president, albeit one with limited powers, makes it much easier to execute. I could say: imagine what would happen if Obama, or Merkel, or David Cameron were pushed aside by a group of conspirators in their own countries, but the circumstances differ, since the details in respective constitutions differ. Still, it’s a very big deal.

Planning in secret, even as a contingency measure, to appoint a new prime minister when a parliamentary majority is in place may be a prudent and responsible action for a president but it is not an explicit power assigned by the constitution, even if there is a financial crisis under way in half of Europe as was the case in the summer of 2011. Whatever one thinks of Mr Berlusconi, serious constitutional questions are raised by the behind-the-scenes manoeuvring that resulted in the appointment of his successor.

Berlusconi was being shunned by everyone in the world, and certainly in the spring of 2011, after allegations of yet another affair worth yet another girl young enough to be his great-granddaughter, but his party had a majority in parliament, obtained through democratic elections. The involvement of Romani Prodi, yet another ex-Goldman pawn, and a shady character who had once been Italian PM and head of the European Commission, tells us a lot of the upper underworld where such matters are being decided. Berlusconi was set up to fail, and them blackmailed into leaving.

Italy’s crisis intensified throughout the autumn of 2011. All Italians still remember the smirk of scepticism on the faces of Angela Merkel, the German chancellor, and Nicolas Sarkozy, the French president, when they were asked at a press conference in October if they had confidence in Mr Berlusconi’s ability to cut the deficit or reduce the debt, which was then at 120% of gross domestic product. (The latest figure is 133%.)

Subsequently, Monti wasted no time implementing the international Troika’s wishes. Don’t let’s forget that a third Italian former Goldman man, Mario Draghi, had been picked as ECB chairman 1 day (!) before Monti became Italian PM! (It reads like a chess game).

The Monti government acted swiftly to introduce harsh austerity measures, spending cuts, a value added tax rise and new property duties as well as reform of the pensions system. Praise was duly heaped on him by the European Commission, the International Monetary Fund and financial markets.

But Mario Draghi never made the situation better for Italians. The artificial pressure on Italian sovereign bonds was released, so it seemed at first like Monti was a blessing, but, as Tyler Durden writes in Meet The Men With The Plan Behind Italy’s Bloodless Coup :

So yes, for anyone still confused – since total debt/GDP has risen by 13% in the past two years, the last thing Italy engaged in was austerity designed to moderate its out of control public spending. What it did engage in, was epic capital misallocation, even greater corruption, and gross incompetence. All of these, however, were conveniently scapegoated on the only well-known traditional fallback.

At this point, we should remind readers of a concurrent story, one involving Italy’s then-member of the ECB executive council, Lorenzo Bini-Smaghi, who revealed in a recent book that at just around this time Berlusconi was realizing that the trap was closing. Bini-Smaghi revealed that Berlusconi had “discussed (threatened?) Italian withdrawal from the euro in private meetings with other EMU governments, presumably with Chancellor Angela Merkel and France’s Nicolas Sarkozy, since he does not negotiate with underlings.”

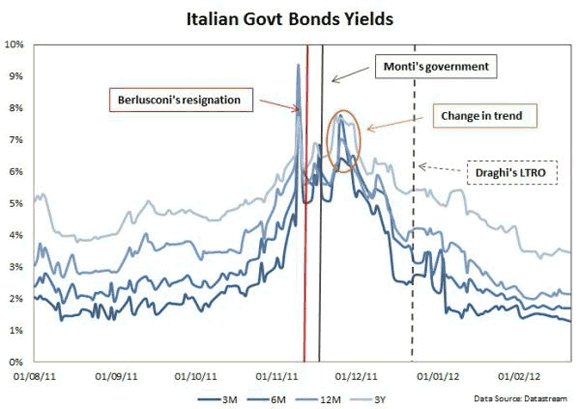

And so the ECB went to task, and under its new boss, yet another Italian, former Goldmanite Mario Draghi, allowed Italian bond yields to crater and take the country, and the Eurozone, and thus the entire developed world, to the edge of collapse. Just so Italy’s president had a pretext to accelerate the demise of Berlusconi and catalyze his replacement with a technocrat crony of the financial establishment. Once again, as a reminder, here is the dynamic of bond yields soaring just as Berlusconi was threatening to end the European dream in which “so much political capital is invested”:

[..] As for the fallout, namely “youth unemployment is at a record high of 41.6 per cent, nationwide joblessness is 12.7 per cent and almost a third of families are near the poverty line. Productivity and competitiveness have dropped sharply in recent years. Mr Monti’s successor, Enrico Letta, another leader championed by Mr Napolitano, is under fire for his handling of the economy”… well, all those are problems of the “99%”. And as everyone knows by know, the 99% is the last thing on the mind of the global ruling class.

Lastly, back to Alan Friedman in the FT:

Perhaps the loudest voice to raise these questions is that of Beppe Grillo, the comedian-turned-politician who garnered 25 per cent of the national vote last year. Mr Napolitano, an 89-year-old former communist, has reacted with anger at Mr Grillo’s incessant accusations of the subversion of democracy. Mr Grillo has frequently called for Mr Napolitano’s impeachment.

But Beppe’s call to impeach the president was thrown out this morning:

Italian parliament dismisses presidential impeachment case

The Italian parliament on Tuesday ruled that there were no grounds to impeach President Giorgio Napolitano for overstepping his constitutional powers. The request from the opposition Five Star Movement (M5S) of Beppe Grillo was dismissed as “manifestly unfounded,” the co-chairman of a special parliamentary committee which examined it, Ignazio La Russa, said.

M5S lawmakers – who took Napolitano to task for sanctioning attempts to speed up constitutional reforms, signing laws that helped former premier Silvio Berlusconi avoid prosecution – were the only ones who supported the drastic action. Berlusconi’s party, Forza Italia, had hinted Monday that it could join it in anger at revelations that, in 2011, Napolitano had prepared Mario Monti’s appointment as prime minister months before Berlusconi’s resigned from the post.

Forza Italia qualified the president’s actions as a “soft coup d’etat,” but in the end, it abstained from the impeachment vote. One the party’s leading lawmakers, Renato Brunetta, said Napolitano still owed the nation some explanations. On his blog, Grillo called Forza Italia deputies “chickens,” and said the president should resign because his and Berlusconi’s parties – the two main opposition groups – had lost their confidence in him. “Today Napolitano is this country’s biggest problem. The sooner he is removed, the sooner can Italy start over again,” the comedian-turned-politician said.

Of course, we can look at this stuff, and smugly say: “What a corrupt country Italy is!”. We might be better advised to check our own backyard, though.

• Meet The Men With The Plan Behind Italy’s Bloodless Coup (Zero Hedge)

The chart below is very familiar to anyone who was observing the hourly turmoil in the European bond market in November of 2011, when Italian bonds crashed, when yields soared to record levels, and every downtick of the Euro could have been its last.

What the chart may not show are the dramatic transformations in Italy’s government that took place just as the Italian bond spread exploded, which saw the resignation of career-politician Silvio Berlusconi literally days after yields soared, and the instatement of Goldman technocrat Mario Monti as Italy’s next Prime Minister.

In fact as some, and certainly this website, had suggested the blow out in Italian yields was merely a grand plan orchestrated to usher in a new Italian government that would, with the support of yet another Goldman alum, the ECB’s then brand new head Mario Draghi, unleash a new era in Italian life, supposedly one of austerity (ignoring that two years after Berlusconi, Italy’s debt to GDP ratio has never been higher), and which would give the impression that Europe is being fixed all the while preserving the broken European monetary system for at least another year or two. In other words a grand conspiracy theory of a pre-planned bloodless coup. That all this would take place under the auspices and with the blessing of Italy’s president Napolitano, only made things worse since Italy is not a parliamentary republic but a parliamentary democracy, where such cloak and dagger arrangements are certainly not permitted under the constitution.

And so, as lately so often happens, courtesy of the narrative by Alan Friedman of what really happened that summer, this too conspiracy theory has just become conspiracy fact. Thanks to the FT’s “Monti’s secret summer“, we learn with painful detail (especially for those of our readers who may be Italian), just how the grand conspiracy to out Berlusconi took shape, and how it was deviously executed with the assistance of none other than the European Central Bank.

• Italy: Monti’s secret summer (FT)

What happened in Italy that summer and autumn as policy makers battled the crisis gripping the eurozone is still a subject of intense debate. That the president was planning the replacement of the elected Mr Berlusconi by the unelected technocrat Mr Monti – months ahead of the eventual transfer of power in November – reinforces concerns about Mr Napolitano’s repeated and forceful interventions in politics. His outsized role since the crisis has led many to question whether he stretched his constitutional powers to their limits – or even beyond. [..]

Planning in secret, even as a contingency measure, to appoint a new prime minister when a parliamentary majority is in place may be a prudent and responsible action for a president but it is not an explicit power assigned by the constitution, even if there is a financial crisis under way in half of Europe as was the case in the summer of 2011. Whatever one thinks of Mr Berlusconi, serious constitutional questions are raised by the behind-the-scenes manoeuvring that resulted in the appointment of his successor.

Perhaps the loudest voice to raise these questions is that of Beppe Grillo, the comedian-turned-politician who garnered 25 per cent of the national vote last year. Mr Napolitano, an 89-year-old former communist, has reacted with anger at Mr Grillo’s incessant accusations of the subversion of democracy. Mr Grillo has frequently called for Mr Napolitano’s impeachment.

And after absorbing what happened in Italy with Napolitano and the Goldman triumvirate, who can still feign surprise at reading this?:

• Goldman Partners 2008 Options Worth About $2.86 Billion Today (Bloomberg)

Goldman Sachs partners exercised options awarded at the end of 2008, benefiting from a doubling in the firm’s stock price since the financial crisis. Sixty-four partners exercised options last month that yielded them $77 million in shares, after covering the cost of the options and some tax withholding, according to a Feb. 7 regulatory filing. Gregory A. Agran, who runs the New York-based firm’s commodities unit, received $7.1 million of stock, while Steve Strongin, 55, head of global investment research, netted $4 million.

In December 2008, Goldman Sachs granted 36 million options in an effort to give top performers an incentive to stay after the bank reduced pay costs by almost half during the financial crisis. That grant was more than five times the number of options the firm awarded in the three previous years.

The options show that Wall Street employees received substantial awards even after the largest U.S. banks accepted government support amid the worst credit crisis since the Great Depression. They also echo regulators’ desire to have bonuses tie employee incentives to the long-term performance of the bank, as partners have had to wait more than five years to reap the gains. The options vested over three years ended in January 2012, and shares gained through such awards couldn’t be sold until this year.

More than 34.1 million options were still outstanding at the end of 2012. The contracts would be collectively worth about $2.86 billion today if none had been exercised, according to data compiled by Bloomberg. Banks typically book the cost of stock awards when they vest.

Brave attempt, but can anyone lift even a sliver of the veil behind which Washington and Wall Street do their deals?

• JPMorgan’s $13 Billion DOJ Settlement Goes To Court (Bloomberg)

JPMorgan’s $13 billion fraud settlement with the U.S. government should be blocked until a court is able to review it, a Wall Street watchdog group founded by an Atlanta hedge fund manager said. Better Markets Inc. is seeking judicial scrutiny of the accord because it’s the largest settlement “with a single entity in the 237-year history of the U.S.,” according to a complaint filed today in Washington federal court. “No one has any ability to determine if the $13 billion agreement is fair” or “if it is a sweetheart deal,” the group said in the filing.

The accord, announced in November, settled allegations that the biggest U.S. lender by assets misled investors and the public when it sold bonds backed by faulty residential mortgages. U.S. and state officials blamed JPMorgan’s actions for helping to cause the credit crisis, and said the agreement didn’t shield JPMorgan or its employees from possible charges. The Justice Department “acted as investigator, prosecutor, judge, juror, sentencer and collector,” Dennis Kelleher, chief executive officer of Better Markets, said at a press conference in Washington. The agreement was “mostly designed to conceal, not reveal.”

Better Markets describes itself as “a nonprofit, nonpartisan organization that promotes the public interest in financial reform.” It was founded by Michael Masters, founder and managing member of Atlanta-based Masters Capital Management. The group expects that its standing to bring the complaint will be challenged, Kelleher said. “It will be hotly contested but I believe we have a solid foundation to prove and demonstrate concrete and demonstrable harm that give us ample standing to assert both the constitutional claims and the statutory claims,” Kelleher said.

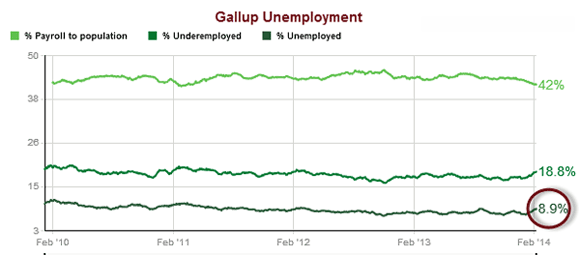

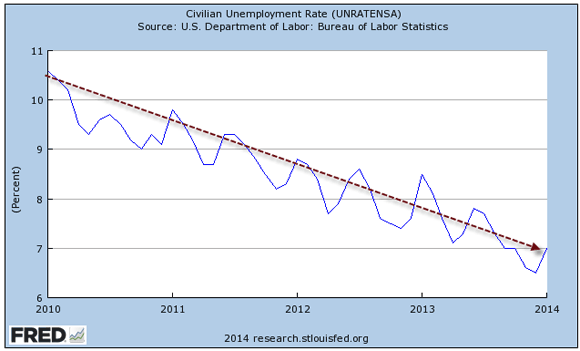

Curious. After, as I noted, Tyler Durden yesterday posted About Those 2.9 Million Jobs Lost In January… , Mish arrives at pretty much that exact same number, but through an entirely different calculation. Where Durden evoked seasonal adjustments and birth/death models the BLS uses, Mish compares the BLS numbers to those from Gallup. The difference, once again, is 2.9 million jobs.

• Gallup vs. BLS Unemployment Differs by Nearly 3 Million Workers (Mish)

Inquiring minds note a huge discrepancy between Gallup measured unemployment and BLS reported unemployment. Please consider the Gallup Daily: U.S. Employment report.

Gallup Unemployment Rate Not Seasonally Adjusted

Gallup says “Because results are not seasonally adjusted, they are not directly comparable to numbers reported by the U.S. Bureau of Labor Statistics, which are based on workers 16 and older. Margin of error is ±1 percentage point.”

However, the BLS maintains both seasonally-adjusted data and non-adjusted data. Gallup data is comparable (or at least should be) to BLS unadjusted data.

BLS Unemployment Rate Not Seasonally Adjusted

Unemployment Rate Comparison

BLS: 7.0%

Gallup: 8.9%The non-seasonally adjusted Civilian Labor Force is 154.381 million. Thus, the 1.9 percentage point difference in the unemployment rate equates to about 2.93 million employees.

Something is wrong with at least one of the above data series.

A ‘permanent scar’ on wages. That is the pattern throughout the entire western world. And make no mistake: “permanent” here means “is never coming back”. Ever. Let that sink in.

• Financial crisis has left ‘permanent scar’ on UK wages (Telegraph)

The financial crisis has left a “large permanent scar” on UK wages, with some salaries not expected to recover to pre-crisis levels until 2022, according to the Resolution Foundation. The think-tank said the 2008 recession had caused an “unparalleled collapse in real wages” and any hope of closing the gap between current wage levels to where they would have been without the crisis was all but lost.

According to the Resolution Foundation, by 2019 – more than ten years after the crisis began – median incomes will still be 3.5%below their pre-crisis peak. It said typical household incomes would remain anaemic for years, with median full time earnings for men not recovering to 2008 levels until 2022.

“Despite the strengthening recovery it looks like we’re set for several years of very weak income growth. It’s increasingly clear that the long downturn has permanently changed the course of living standards, with effects continuing to play out,” said James Plunkett, director of policy at the Resolution Foundation. “As things stand, the recovery rests on consumer spending. And that spending rests on a diminishing savings rate, not income growth. With so many households already struggling with their debts – even with rates still low—a savings-led recovery is not a happy prospect.”

Because of its proximity to Russia, as well as its approaches to the EU, Ukraine ticks off a lot of the boxes to make it a dangerous place for many of us.

• Worse than Greece: Fitch says Ukraine’s default risk high (RT)

The worsening political and economic circumstances in Ukraine has prompted the Fitch Ratings agency to downgrade Ukrainian debt from B to a pre–default level CCC. This is lower than Greece, and Fitch warns of future financial instability. “Intensification of political and economic stress is such that default on government debt becomes probable,” Fitch said in an e-mail.

On the brink of default, the Ukrainian economy has taken a further beating as protests drag on in the capital Kiev. Foreign debt is $140 billion, nearly 80% of the country’s gross domestic product. “There are emerging signs of stress in the banking system. Demand for foreign currency cash has risen, potentially leading to further steep exchange rate depreciation. These developments pose liquidity and asset quality risks, given the large amounts of foreign currency debt on private sector balance sheets,” the note said.

The Ukrainian Central Bank is tapping into the country’s reserves to pay off the country’s fast-accumulating debt. Foreign reserves shrank 12.8% to $17.8 billion in January, the lowest since 2006, according data published by the central bank. Overall in 2013, international reserves dropped 16.8 percent, losing a total of $4.1 billion.

The central bank is intervening on behalf of the hryvnia, which has fallen significantly as President Viktor Yanukovich and the opposition fail to strike an agreement, and protesters continue to clash in Kiev after 3-months of unrest. Limits on foreign-currency purchases have been set in order to protect the hryvnia, which has spiraled into freefall, rising above 9.0 against the dollar for the first time since February 2009. At 16:30 MST Monday it was trading 8.4350 against the dollar. If the situation continues to unravel, more capital controls could be introduced to limit the amount of foreign currency bought, or even moved outside Ukraine. This is the action Cyprus took when it faced default in March 2013.

Look, either Iceland’s people can be held responsible for the debts of its banks, or they can not. And still we need to see another court case over this? Maybe those Brits and Dutchies should have left their money in their own economies, instead of being stupid enough to chase another 0.5% in interest somewhere else and still expect to be fully compensated for their stupidity?

• British and Dutch Demand $8.7 Billion from Iceland’s Collapsed Icesave (IBTimes)

British and Dutch authorities have filed a £5.3bn claim in court in a bid to return cash to depositors whose money was held in the now defunct Icesave fund. Landsbanki, which ran the Icesave account, was one of three Icelandic lenders, along with Kaupthuing Bank and Glitnir Bank, which collapsed in 2008 and eventually cost the government at least £52bn (€62bn, $87bn) – more than six and a half times its annual GDP. Foreigners had used Icesave to take advantage of higher rates of interest offered through internet-based accounts. [..]

Iceland’s supreme court ruled in October of 2011 that savers should rank ahead of bondholders in the government’s plans to repay the billions lost in the collapse. In January last year, Iceland was cleared by a European court for failing to pay the British and Dutch governments costs associated with rescuing Icesave customers.

The European Free Trade Association ruled that Iceland did not break depositor protection laws when it refused to cover the billions lost to 350,000 British and Dutch holders of so-called Icesave accounts. Iceland’s government had argued it was not liable to pay compensation for foreign savers and instead made arrangements for Landsbanki administrators to repay the lost deposits over time.

Orlov. Always good for a fine tale. Though he shirks too close for my comfort here to the idea that energy brought about the financial crisis. That’s just not smart enough, and that is a shame, since he has so much to say that is.

• How To Time Collapses (Dmitry Orlov)

There are a number of ways of expropriating wealth, generally proceeding from various kinds of stealth taxation measures, to more overt measures, to outright expropriation. Taking the US as the example (since I am most familiar with it) the expropriation cascade is proceeding as follows:

1. Central bank policy of zeroing out of interest rates on savings combined with massive money-printing. This forces money into speculative markets (stocks, real estate, etc.) creating huge financial bubbles; when these bubbles pop, savings are said to be destroyed, but in reality that money has already been spent by the government or used to fill the private coffers of those closely associated with the government.

2. Government policy of canceling retirements or short-changing retirees. Another federal expropriation scheme is via guaranteed student loans …

3. Ever more onerous reporting requirements for financial transactions, especially for those who try to leave the country and expatriate their savings.

These are the measures that are already in place. Looking at what’s been tried before, here and elsewhere, we can see what other measures are in the works. Among them:

1. So-called “bail-ins” where insolvent financial institutions are rescued by confiscating depositor funds.

2. Limits on bank withdrawals. You might still “have” money in the bank, but that’s the only place you can “have” it. The semantics of the verb “to have” can be quite tricky, you see…

3. Ever-increasing taxes on property resulting in property confiscation. It works like this: government prints money and hands it out to its friends; its friends use it to temporarily bid up property values; property taxes go up to a point where the property owners can’t pay them; owners lose their properties. A staggering 63% of real estate purchases in Florida last December were cash purchases.

4. Various kinds of sudden, new, super-complex regulations, noncompliance with which results in very large fines. In turn, nonpayment of these fines results in forfeiture of assets.

5. Gold confiscation, which happened once in the US already, so there is a precedent for it.

Jim Quinn rattles off all stupidities evident in public economic policy, deliberate or not.

• The Broken Limb & Burst Pipe Fallacies (Jim Quinn)

The Keynesian fallacy of increased economic activity being beneficial is annihilated by the fact homeowners and business owners are left in the same condition as they were prior to the storms, while the money spent to achieve the same property condition was not spent on other goods and services that would have truly expanded the economy.

The fallacious government engineered GDP calculation will portray destruction as an economic boost. Keynesian worshiping economists and government bureaucrats observe this tragedy as only between two parties, the consumer who is forced to repair their property and is denied the pleasure of spending their money on something more enjoyable and the tree service company who experiences a positive impact to their business. They exclude the appliance store, restaurant, or hotel that did not receive the money spent on repairing the property.

It is this third unseen party who is left out of the equation. It is this third party that shows the absurdity of believing destruction leads to profit and economic advancement. The national economic output is not increased, but highly educated government drones and Wall Street captured economists will point to GDP and disseminate the fallacy.

Elizabeth Kolbert published her new book, “The Sixth Extinction: An Unnatural History.” See here for book review by Al Gore: Without A Trace (NYTimes)

• Chasing the Biggest Story on Earth: ‘The Sixth Extinction’ (NYTimes)

Elizabeth Kolbert: I wrote a book almost 10 years ago on climate change, and I was looking for the next project. And my thought was, “Climate change is a huge story — there can’t be a bigger one.” As I looked for a new book, what I kept bumping into was the reality that climate change was actually part of an even bigger phenomenon: the many ways humans are changing the planet.

It’s not something we’re doing because our species is greedy or evil. It’s happening because humans are human. Many of the qualities that made us successful — we are smart, creative, mobile, cooperative — can be destructive to the natural world.

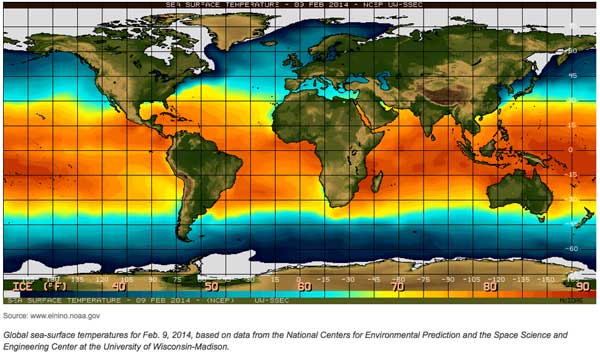

New El Nino prediction tools look to provide us with earlier warning tools. They point to rising temperatures later this year. With a 76% probability.

• If Ocean Heat Pump Switches on, Expect to Feel It (Bloomberg)

Scientists are chipping away at a question that has dominated public climate change discussions in the U.S. the last few years: Where’s the heat? Despite unchecked carbon pollution, warming felt on the Earth’s surface has slowed since 1998. Clues keep pointing to the Pacific Ocean, and a new paper in Proceedings of the National Academy of Sciences (PNAS) predicts that the temperatures will rise again toward the end of this year.

More specifically, the authors predict the return later this year of El Nino, the tendency of the Pacific Ocean to vent more heat than normal into the atmosphere, often with dramatic effects on weather in North America. The last powerful warming phase of what scientists call the El Nino-Southern Oscillation (ENSO) was 1998, the hottest year on record. Since then, natural climate variability has been disguising the manmade warming.

“This might lead to an end of the present ‘hiatus,'” Armin Bunde of the Institute for Theoretical Physics in Giessen, Germany, said in an email. He qualified the prediction, saying that the tool can’t predict the strength of an El Nino, only that it’s coming. “We can only predict that in 2014 there will be an El Nino event with 76% likelihood,” he said.

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › Debt Rattle Feb 11 2014: Coups and Constitutions