Detroit Publishing 12th Street bascule bridge, Chicago 1900

If we can agree for a moment that there is a very real possibility that we will have both much less capital and less energy available to us in the future, what should we do to define our response to this possibility? The obvious answer would seem to be to scale down, and do that as best we can without causing our societies to crumble because of it. We could take comfort in the knowledge that, despite the huge range of inventions and surge in wealth we have developed over the past 150 years, there is no proof whatsoever that we are happier today than our ancestors were in the Paris of 1900 or Chicago of 1950. We could also acknowledge that our present lifestyles are highly destructive to our habitat, so scaling down would seem to be a good idea from that perspective as well.

Still, though many of us are aware of both the potential of less energy availability and the failure of the use of that energy, in combination with our ingenuity, in making us happier and more fulfilled human beings, scaling down is not on the agenda of societies at large. To the contrary, the “successful” people we see as our leaders talk only of more growth, whether or not that’s realistic, let alone desirable, and we pretty blindly follow them in that line of thinking, presumably until it becomes impossible to deny any longer that growth is no longer on the horizon. Since we have a long tradition of seeing any downturn as merely temporary, that realization may take a long time to sink in, which in turn may mean that people need to be dying by the side of the road before we accept it as truth.

A philosophically intriguing debate is why we are so averse to using less energy, and why we perceive less growth as such a bad thing. There are those who point to our fear of dying, which makes us want to stay always a step ahead of death, so to speak. That’s a nice idea, but the use of – more – energy might kill us too. In a recent episode of his remake of the Cosmos TV series, Neil DeGrasseTyson referred to the fact that we live in a very quiet period of earth’s history, after a very long period of severe turbulence, but there’s this “strange” human drive to unleash all manner of greenhouse gases that risks setting off another period of turbulence.

DeGrasseTyson lamented the fact that we have proven in our history that we can be terribly ingenious, so why can we not now? Why are we unable to steer ourselves away from the consequences of ever more energy consumption? An interesting though perhaps challenging answer to that lament is that “the human species may be seen as having evolved in the service of entropy”, as David Price wrote in 1995, that “when the history of life on Earth is seen in perspective, the evolution of Homo sapiens is merely a transient episode that acts to redress the planet’s energy balance.” That turns the question into: can or can we not escape our destiny? Price:

Life on Earth is driven by energy. Autotrophs take it from solar radiation and heterotrophs take it from autotrophs. Energy captured slowly by photosynthesis is stored up, and as denser reservoirs of energy have come into being over the course of Earth’s history, heterotrophs that could use more energy evolved to exploit them, Homo sapiens is such a heterotroph; indeed, the ability to use energy extrasomatically (outside the body) enables human beings to use far more energy than any other heterotroph that has ever evolved. The control of fire and the exploitation of fossil fuels have made it possible for Homo sapiens to release, in a short time, vast amounts of energy that accumulated long before the species appeared.

By using extrasomatic energy to modify more and more of its environment to suit human needs, the human population effectively expanded its resource base so that for long periods it has exceeded contemporary requirements. This allowed an expansion of population similar to that of species introduced into extremely propitious new habitats, such as rabbits in Australia or Japanese beetles in the United States. The world’s present population of over 5.5 billion is sustained and continues to grow through the use of extrasomatic energy.

But the exhaustion of fossil fuels, which supply three quarters of this energy, is not far off, and no other energy source is abundant and cheap enough to take their place. A collapse of the earth’s human population cannot be more than a few years away. If there are survivors, they will not be able to carry on the cultural traditions of civilization, which require abundant, cheap energy. It is unlikely, however, that the species itself can long persist without the energy whose exploitation is so much a part of its modus vivendi.

The human species may be seen as having evolved in the service of entropy, and it cannot be expected to outlast the dense accumulations of energy that have helped define its niche. Human beings like to believe they are in control of their destiny, but when the history of life on Earth is seen in perspective, the evolution of Homo sapiens is merely a transient episode that acts to redress the planet’s energy balance. [..]

The inherent question: can we maintain a form civilization once energy availability diminishes, or will be die fighting each other for what’s left? David Price strongly suggests the latter. In other words: once our numbers start falling, where will they stop? Note Price’s picture of us as a species “introduced” into a habitat that is “extremely propitious”, a notion that is crucial to his idea as to both why we are where we are, and where we’re going.

The cost of energy limited the growth of technology until fossil fuels came into use, a little less than three hundred years ago. Fossil fuels contain so much energy that they provide a remarkable return on investment even when used inefficiently. When coal is burned to drive dynamos, for example, only 35% of its energy ultimately becomes electricity. Nevertheless, an amount of electricity equal to the energy used by a person who works all day, burning up 1,000 calories worth of food, can be bought for less than ten cents.

The abundant, cheap energy provided by fossil fuels has made it possible for humans to exploit a staggering variety of resources, effectively expanding their resource base. In particular, the development of mechanized agriculture has allowed relatively few farmers to work vast tracts of land, producing an abundance of food and making possible a wild growth of population.

All species expand as much as resources allow and predators, parasites, and physical conditions permit. When a species is introduced into a new habitat with abundant resources that accumulated before its arrival, the population expands rapidly until all the resources are used up. In wine making, for example, a population of yeast cells in freshly-pressed grape juice grows exponentially until nutrients are exhausted-or waste products become toxic (Figure 1).

Figure 1. Growth of yeast in a 10% sugar solution (After Dieter, 1962:45). The fall of the curve is slowed by cytolysis, which recycles nutrients from dead cells.

[..] The use of extrasomatic energy, and especially energy from fossil fuels, has made it possible for humans to exploit a wealth of resources that accumulated before they evolved. This has resulted in population growth typical of introduced species (Figure 3).

Figure 3. Growth of worldwide human population (Adapted from Corson, 1990:25).

Note: Price contends that precisely because our population growth is due exclusively to the availability of extrasomatic energy, we are doomed as soon as that availability drops.

[..] For Malthus, the imbalance between the growth of population and means of subsistence might be corrected, from time to time, through natural disasters, but the human species could, in principle, survive indefinitely. Malthus did not know that the universe is governed by the Second Law of Thermodynamics; he did not understand the population dynamics of introduced species; and he did not appreciate that humans, having evolved long after the resource base on which they now rely, are effectively an introduced species on their own planet.

The short tenure of the human species marks a turning point in the history of life on Earth. Before the appearance of Homo sapiens, energy was being sequestered more rapidly than it was being dissipated. Then human beings evolved, with the capacity to dissipate much of the energy that had been sequestered, partially redressing the planet’s energy balance.

The evolution of a species like Homo sapiens may be an integral part of the life process, anywhere in the universe it happens to occur. As life develops, autotrophs expand and make a place for heterotrophs. If organic energy is sequestered in substantial reserves, as geological processes are bound to do, then the appearance of a species that can release it is all but assured. Such a species, evolved in the service of entropy, quickly returns its planet to a lower energy level. In an evolutionary instant, it explodes and is gone.

Price suggests that the chances for human survival are slim at best. But we’re not gone yet. Which means we have a choice between either burning through all resources as fast as we can, or trying to scale down voluntarily, before we are forced to scale down. “Simply” getting used to using much less energy, and adapting to a life, even if that may not be as simple as it sounds, for a myriad of reasons, in which fossil fuels don’t provide each of us in the West with 200+ “energy slaves”

“Today, the extrasomatic energy used by people around the world is equal to the work of some 280 billion men. It is as if every man, woman, and child in the world had 50 slaves. In a technological society such as the United States, every person has more than 200 such “ghost slaves.” to do our work for us.

The way we have built our communities, our towns and cities, is predicated upon maximizing energy use, even if we’re not always aware of that. Most people, to do something as mundane as grocery shopping, need to drive or be driven. Our homes need huge amounts of energy to be heated and cooled. These things are all as unnecessary as they are fixable. As is the transport of millions of tons of goods from all over the planet that we could just as well produce ourselves. And perhaps most importantly, we all surround ourselves with things we don’t need; even if we discount the poorest people, we’re like 5 billion squirrels on steroids. Because once we have access to all those energy slaves, we don’t want to let go of them, we think they make us happy.

Is there really a solid reason, apart from our religious adherence to the equally religious gospel of growth beyond infinity, that would keep us from taking a step back? Are we capable of recognizing the folly of our ideas, and of choosing a different path? That is not an easy question to answer. We certainly are as individuals, but as a group, as a society, different rules apply. Scaling down would collapse our economies, since they depend on ongoing growth – and energy use -. It would also collapse our political systems, which for better or for worse are integral parts of the organization of our societies. This probably means we’re not going to get anywhere in any scaling down efforts if as individuals we stay where we are, if that is a typical American or British or continental European community. Which in turn means most people may switch a light bulb or get a less inefficient vehicle, but that’ll be it, and they’ll stay put. And help David Price’s predictions along.

It’s entirely possible that there is no way out for us. That we are merely a species that evolved to “redress the planet’s energy balance”, and the best we can lay claim to is that we are “an integral part of the life process”. However, again, we’re not gone yet. But we will be if we keep doing what we do. The pinnacle question is whether we can cross the great divide between what we can do as individuals and what we need to do as societies. Cue Sigmund Freud?!

“Individuals and households don’t sell their assets – like their homes – to pay down debts. They pay debt out of their incomes.”

• Britain Is The Most Indebted Nation On Earth (Ann Pettifor)

There is now a concerted campaign to get the Bank of England to raise interest rates. Among the cheerleaders of this campaign are Chris Giles, chief economics editor of the Financial Times. Giles has gone so far as to suggest that the Bank’s reluctance to raise rates is the result of an “institutionally dovish” approach. Another of the cheerleaders is Allister Heath, editor of City AM. I leave readers to guess whose interests they reflect. Politicians, unsurprisingly, are silent on the issue. Governments have profited from low interest rates, as a recent McKinsey report notes. And while a rise in interest rates would please creditors, financiers and savers, there are just as many if not more British debtors – who are voters – who will be hurt by a rise in debt-servicing costs.

The fact is that, if both public and private debts are added up, Britain ranks as the most indebted nation on Earth. Furthermore, neither the government nor the banks have made concerted efforts to deleverage, restructure or write off that debt since the financial crisis. This is in contrast to the US, where as a result of a brutal deleveraging process – which often involved painful and sometimes fraudulent foreclosures on households – private debt deleveraging has been more significant. UK household and non-financial corporate debt-to-income ratios have fallen since the crisis, but according to the most recent Financial Stability Report from the Bank of England, the ratios remain at historically high levels.

House-price-to-income and house-price-to-rent measures are above historical averages. Borrowers on incomes that are declining in real terms have grown reckless, or – given declining real incomes and insecure work – are desperate. The Bank cites an NMG Consulting survey conducted in September 2013 which shows that households with loan-to-income ratios greater than five account for about a fifth of total UK mortgage debt. At a time of stagnating incomes we should not be relaxed about the impact of rate rises on these households. The traditional rebuttal to these arguments is that UK households own assets that exceed their liabilities. But that won’t wash. Individuals and households don’t sell their assets – like their homes – to pay down debts. They pay debt out of their incomes.

“One in five of the 148,000 borrowers who took out a new mortgage in the first quarter stretched out their loans for a term of over 30 years, compared with just 4.5% of borrowers ten years ago and 11% at the end of 2007. More than 25% of all first time buyers took out loans of 30 years or more in the first quarter.”

• Britons Face Lifetime Of Mortgage Debt (Telegraph)

Britons increasingly face a lifetime of debt if they want to buy their first home or move up the housing ladder, figures show. The proportion of borrowers who took out mortgages for terms of 30 years or more hit a record high in the first three months of the year, according to the Council of Mortgage Lenders (CML). Almost one in five of the 148,000 borrowers who took out a new mortgage in the first quarter stretched out their loans for a term of over 30 years, compared with just 4.5% of borrowers ten years ago and 11% at the end of 2007, before Northern Rock collapsed. More than a quarter of all first time buyers took out loans of 30 years or more in the first quarter, compared with 20% before the crash.

The figures suggest that Britons are taking out loans for longer than the traditional 25 year term in order to lower their monthly payments and cope with surging house prices, which are rising much faster than average earnings. The popularity of longer term loans could also increase in the wake of tough new rules introduced last month which focus on affordability and responsible lending. However, a rise in longer-term loans could potentially leave borrowers vulnerable if prices fall as well as adding tens of thousands of pounds more interest to their mortgage debt.

The popularilty of longer loans was not restricted to new mortgages. The number of households re-mortgaging their homes with a loan that would not be fully repaid within 30 years also remained close to a record high in the first quarter. The CML said 5% of the 78,200 remortgages in the first quarter were for terms over 30 years, compared with just 3% at the height of the boom in 2007. Experts likened the trend to the rise in demand for interest-only mortgages, which at their 2008 peak made up 43% of all new advances. Many borrowers took out these mortgages and banked on the rising value of their home to cover the capital borrowed. However, the 2008 financial crisis and subsequent fall in house prices meant many Britons faced a large shortfall at the end of their loan term.

TEXT

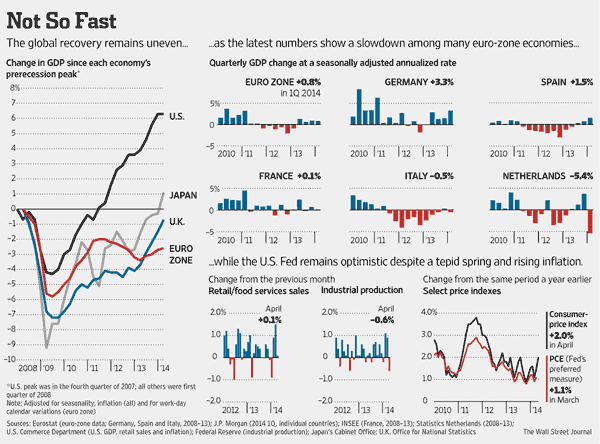

• Global Growth Worries Climb (WSJ)

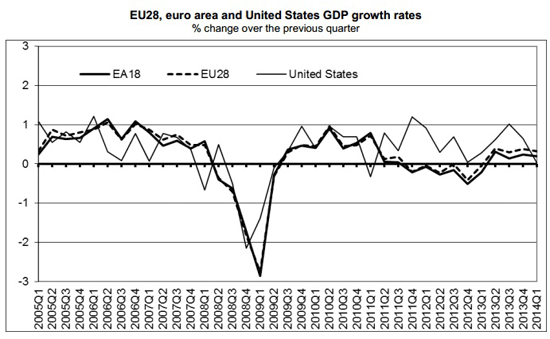

Five years after the financial crisis ended, soft growth in Europe, a stop-and-start U.S. recovery and waning momentum in China have policy makers groping for what to do next. A spate of worrying economic data Thursday shook stock and bond markets. Economic activity in the 18-country euro zone expanded at a weak annual rate of 0.8% during the first quarter, data released Thursday showed. Excluding Germany, which grew at a robust 3.3% pace, the rest of the euro-area economy contracted slightly during the quarter.

European Central Bank officials are now moving toward enacting additional low interest-rate policies to prevent the region from sliding into a lengthy period of economic stagnation, while the U.S. Federal Reserve guardedly tries to wind down a bond-buying program meant to revitalize economic growth. Meantime, Chinese authorities are trying to prod banks to lend more to first-time home buyers shut out of their real-estate market. U.S. officials privately say they expect Chinese officials to act to boost their economy and support banks if growth slows severely, though Chinese officials say they will avoid major stimulus if it undermines economic overhauls or deepens credit woes. Underscoring the sense of angst, stock prices dropped sharply Thursday in Europe and the U.S. The Dow Jones Industrial Average fell 167.16 points, or 1.01%, to 16446.81.

Yields on bonds issued in big developed markets continued to fall Thursday. Yields on German bunds with 10-year maturities sank to 1.307%, their lowest level in a year, while yields on 10-year U.S. Treasury notes fell to 2.498%, the lowest level in six months. “It will take a long time before we see a real recovery,” said Andrea Illy, Chairman and chief executive of Italian coffee maker Illy Caffè. “I’m really skeptical on how and if we can grow, and I hear the same feelings among entrepreneurs and consumers in Italy.” New U.S. data released Thursday showed the mixed economic backdrop that Fed officials confront as they scale back a bond-buying program aimed at lowering long-term interest rates, and consider how much longer to keep short-term rates near zero.

U.S. industrial output slumped in April, according to a Fed report, and a survey showed sentiment of U.S. home builders slipped. Many Fed officials believe U.S. growth is rebounding in the second quarter after slumping in the first period largely because of bad weather. Hiring has been robust of late. Still, some officials see the first half of the year shaping up as a disappointment. “My guess is that we will see some pickup as we get into the second half of the year, but the longer we go without getting the 3% growth that many people had in their forecasts, the more concerned you have to be that there are other things going on that we hadn’t fully appreciated,” Eric Rosengren, president of the Federal Reserve Bank of Boston, said in an interview Thursday. Mr. Rosengren is in the camp of Fed officials who have supported aggressive responses to slow growth and low inflation.

TEXT

• The “Recovery” Fizzle Is Global (Alhambra)

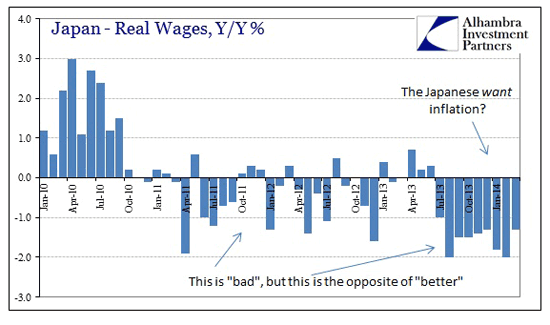

The surge in Japanese GDP in the first quarter has given back some cautious optimism that eroded significantly in the fourth quarter of last year. The increase in activity was not unexpected, only the degree to which it reached. Given the household spending data from earlier, this result was foreshadowed. And I think that the analysis of spending applies equally to GDP – that the greater-than-expected figure foreshadows not a robust future, but a bleaker one. If a changing tax rate forces consumers to consume at such a high level, that would suggest that household expectations are not overly rosy further on. If the economy were truly set to recover, the tax rate would not have pulled forward so much demand. It really is telling that the shopping spree to save some tax money was so engrossing and comprehensive.

That aside, it is not next quarter that will be the most important, but the one thereafter. Everyone knows next quarter will show a contraction, especially the artificial boost provided by residential construction. So it will take a few quarters before we know for sure just how much activity was displaced by such a change (smoothing out this volatility). Again, I would think that if consumers were optimistic they would have taken it much more in stride, rather than gone crazy over it. Some actual wage growth would have made a difference in that respect. Europe is in a similar predicament to a varying degree. It too looks for a rebound but all we have seen so far is positive GDP numbers. As in Japan, a plus sign is not the end of the analysis. In the wider context, GDP has only rebounded to the slightest amount – and even then only because Germany has failed to suffer the same fate as its fellow continentals.

The chart above, taken directly from Eurostat’s GDP release, actually overstates the degree to which the economy is moving. The recent nosedive in the official inflation figures is actually “helping” here in the narrow statistical sense. In nominal terms, GDP has barely grown in the past few years, even if you view the latest move as a completed cycle.

TEXT

• Real Estate Bailouts Begin In Six Chinese Cities (Simon Black)

According to the Chinese financial publication Securities Daily, emergency real estate rescue packages have been launched in large cities such as Wuxi, Nanning, Hangzhou, Tianjin, Tongling and Zhengzhou in the last month alone. “Zhengzhou created a mortgage guarantee policy to win back banks’ confidence” according to the story. Further, “if a borrower does not fulfill the loan repayment obligations as agreed in the contract, the guarantee institutions will have to repay the housing loans…” What a surprise– a government guarantee. The market is imploding and defaults are going through the roof. Property vacancy rates in Zhengzhou are an astounding 23%. So the government is putting taxpayers on the hook. The article goes on: “A legislative affairs official of Zhengzhou revealed to the media that this was the first time for Zhengzhou to carry out such individual housing loans guarantee policy.”

In other words, the government is panicking. Home sales in China fell last month by 18%, in no small part due to tightening credit conditions. Developers have tried to pick up the slack and liquidate inventory by offering no money down deals… their own desperation tactic. But it’s not working. Over the May 1-3 holiday weekend, new home sales across China’s 54 largest cities were 47% lower than last year. The national government in China has all but capitulated, and they’ve turned the reins over to local governments to ‘fix’ the problem. This has been a long time in the making.

According to data from the US Geological Survey and China’s National Bureau of Statistics that was compiled by the Financial Times, in just two years (2011 and 2012), China produced more cement than the United States produced in the entire 20th century. Much of this development came from centrally planned monster infrastructure projects– bridges to nowhere, zombie train stations, and infamous ghost cities. So much excess inventory has built up, a major slowdown was inevitable. This is a huge issue for China given that housing sales comprised nearly 12% of GDP last year. Even President Xi Jinping recently stated that his nation must adapt to a ‘new normal’ of slower economic growth. And like the butterfly that flaps its wings, a slowdown in China has substantial effects on the rest of the world.

“Growth in China’s economy dipped to an 18-month low in the first quarter and may be on track this year for its weakest showing in more than two decades. ”

• China Firms Slow Payments, File Lawsuits, As Unpaid Debt Weighs (Reuters)

As China’s economy continues to cool, companies are waiting longer and finding it harder to get paid for goods and services they’ve already sold, leading to record amounts of receivables – and potential write-offs – on corporate balance sheets. At Longyuan Construction Group Co, an east China builder of high-rise offices, apartments and highways, receivables last year inched up 4.9% to 4.1 billion yuan ($657.3 million), while on average collection times extended to 95.2 days, compared with 76.3 days for 2011. Slow collection of money owed is causing Longyuan to delay its own payments to steel and cement suppliers, Zhang Li, the company’s board secretary, told Reuters, in a ripple effect that is being repeated across the economy. “If you don’t pay me and I pay others, aren’t I just a sucker?” said Zhang. “I’m not that stupid.”

Growth in China’s economy dipped to an 18-month low in the first quarter and may be on track this year for its weakest showing in more than two decades. Beijing policymakers are moving to put the world’s second largest economy on a more sustainable footing less driven by exports and investment, however tightening credit and a faltering real estate market have raised concerns about a sharper-than-anticipated slowdown. A Thomson Reuters survey of data on China’s more than 2,300 stock market-listed firms illustrates the impact on corporate payments, with company receivables – the accounting term for money owed by customers – on average reaching $160.49 million at the end of last year, more than double the $65.9 million average at the end of 2009.

Over the same period, the median collection time for billings crawled up from 71.4 days to 90.42 days. It was the first time China’s market-listed firms averaged more than 90 days in a decade. “It’s a pretty loud warning bell,” said Paul Gillis, an accounting professor at Peking University’s Guanghua School of Management. “Companies cannot pay-off their receivables in a slowing business cycle. Some of these receivable may not get paid, which means you’ll see a lot of write-offs in the future.” [..] As a downturn in the property market gathered pace late last year, more than four years after Beijing began introducing a series of cooling measures designed to head off an asset bubble, payments to builders and materials suppliers slowed.

Unpaid bills among construction companies, cement makers and related firms are now creating interlocking, triangular debt that stretches across broader parts of the economy. China West Construction Co, a small Sichuan-based manufacturer of concrete products distributed mainly in China’s northwest, reported net cash flow from operations last year turned negative by 41.76 million yuan, driven by a 23.2% jump in accounts receivables, which reached 3 billion yuan. The firm also wrote-off 226.37 million yuan in bad debt, a 23.51% rise from a year earlier. In a statement, the company attributed its problems to a slowing economy along with real estate controls, forcing construction companies to reduce their payments and use notes in lieu of cash. Those include acceptance bills, which guarantee payments only at a future date.

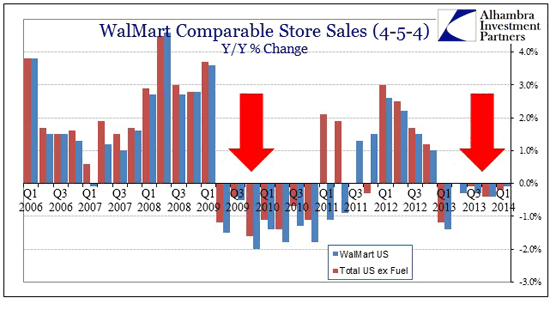

WalMart is on a losing path. Who’s next?

• The Canary In The Greeter’s Aisle: No “Escape Velocity” At Wal-Mart (Alhambra)

Bill Simon, speaking of the latest disappointing figures, basically reiterated almost exactly what he said almost exactly one year prior: A number of severe winter storms negatively impacted us during the quarter. A solid start to spring and a strong Easter drove positive comps in the back half of the quarter. That is the same kind of rhetoric that is being used by corporate chiefs and economists everywhere. It was bad when it snowed, but got better once it warmed. How did that work out last year? The “back half” extrapolation was just as fallacious as it is now, but it sounds meekly plausible as if data backs up such optimism.

In the end, however, to take a page from Inigo Montoya, it doesn’t mean what they think it means. In other words, if winter were a valid explanation for weak results, as in delaying consumer spending, the snap back in the “back half” should be both “regular” sales and an added bonus of all those delayed sales finally taking place. The net across the weather beaten “front half” and warm and friendly “back half” should be positive growth. Instead, for two years running, the back half is only enough to keep sales overall from being a total disaster. That’s not quite what the weather explanation is designed to convey. The broader picture shows very well the state of US consumers, particularly how it relates to cycles. Perhaps that provides a better, more complete and consistent (and logical) explanation for what we see out of the largest retailer.

Whatever happened to all the grand ideals?

• More American Cities Become Extremely Cruel To The Homeless (M. Snyder)

Have you ever given food to a homeless person? Well, if you do it again in the future it might be a criminal act depending on where you live. Right now, there are dozens of major U.S. cities that have already passed laws against feeding the homeless. As you will read about below, in some areas of the country you can actually be fined hundreds of dollars for just trying to give food to a hungry person. I know that sounds absolutely insane, but this is what America is turning into. Communities all over the country are attempting to “clean up the streets” by making it virtually illegal to either be homeless or to help those that are homeless. Instead of spending more money on programs to assist the homeless, local governments are bulldozing tent cities and giving homeless people one way bus tickets out of town. We are treating some of the most vulnerable members of our society like human garbage, and it is a national disgrace.

What does it say about our country when we can’t even give a warm sandwich to a desperately hungry person that is sleeping on the streets? A retired couple down in Florida named Debbie and Chico Jimenez wanted to do something positive for their community during their retirement years, so they started feeding the homeless in Daytona Beach. But recently the police decided to crack down on their feeding program and slapped everyone involved with a $373 fine…

For the past year, the Jimenezes have set up shop every Wednesday on Manatee Island in Daytona Beach, Fla., where they feed hot dogs, chicken, pasta salad and other BBQ staples to about 100 homeless people, WFTV reported. Handing out meals is just one aspect of the ministry the two founded, Spreading the Word Without Saying a Word, to help people living in poverty. But on Wednesday, the Jimenezes said that without warning, they and four other volunteers were accosted by police, fined and told that they could be thrown in jail if they continue their program, according to NBC News. Each of the six was fined $373 and were given 10 days to either pay up or go to court. “We’re going to court,” Debbie Jimenez, 52, a former auto parts store manager, told NBC News. “The police don’t like it. But how can we turn our backs on the hungry? We can’t.”

Don’t the police down in Daytona Beach have something better to do with their time? Sadly, more than 50 major cities have passed laws against feeding the homeless at this point. It appears that “cleaning up the streets” has become a big point of emphasis all over the nation. And what the city of Camden, New Jersey just did is even worse than what happened in Daytona Beach. Camden just bulldozed an entire tent city and dumped all of the belongings of the homeless people living there into the trash…

Hazmat teams showed up at the camps in the early morning to search for syringes. A drug-sniffing dog followed a police officer around the area. And bulldozers tossed trash and discarded belongings into dumpsters before razing the premises. Over the past few weeks, flyers had warned people in the tent cities that this was going to happen. Yet it still seemed surreal to many of them that their communities were about to be demolished for good.

But for most of the people that were living in that tent city, there is no place else for them to go. The homeless shelters in the area are at max capacity, and so many of them will end up sleeping in the streets without any shelter at all…

Aaron Howe, the “mayor” of a tent city that had 12 tents the night before eviction day, said he had called every shelter in town and not a single place had room for him and his girlfriend. “There’s no available spots, and the city is saying if we pitch a tent somewhere else they’re gonna rip it down,” he said. “It’s not gonna look good when there’s a bunch of homeless on the streets.”

Extend and pretend.

• Belgium Now Third Largest Foreign Holder Of US Treasuries (CNBC)

Global asset markets were jolted Thursday as investors fled for “safe havens” including U.S bonds, sending the yield on the 10-year U.S. Treasury below the psychological 2.50% level. But while weak growth data, deflation fears and dovish central bankers might be the main reasons behind this move, it appears strong buying from a small European country could be accentuating this move lower. Investors see U.S. Treasurys as a port in any market storm. As demand for the assets rises, so does its price, which sends its borrowing costs, or yield, in the opposite direction. The sub -2.5% level seen on Thursday was the lowest seen since last October. U.S. Treasury International Capital data released on Thursday showed that Treasury purchases in Brussels have surged higher, making Belgium the third largest foreign holder of U.S. government debt after China and Japan.

Belgian holdings have doubled over the last year and stood at $381.4 billion in March, up to $40.2 billion from the month before. Two-thirds of the $60 billion increase in foreign Treasury holdings in March were from the northern European nation, according to the data. Some fixed income experts have told CNBC that the logical conclusion would be to believe that Russian investors, worried about having their assets frozen due to tensions over Ukraine, are now using clearing houses in Brussels rather than buying directly. However, a decline of $25.8 billion in Russian Treasury holdings in March to $100.4 billion can’t fully explain this reason. “Belgium (yes Belgium),” BTIG Chief Global Equity Strategist Dan Greenhaus said in a research note late on Thursday. “Russia has reduced its holdings by $50 billion in the last five months, yes, but that isn’t enough to offset Belgium’s $215 billion increase since fall 2013.”

Analysts point to a “technical change” that could stem from an increase in activity at Brussels-based company Euroclear. Euroclear is a major European financial house that specializes in the settlement of securities transactions. A spokesperson for Euroclear said that the company wasn’t able to comment due to its confidentiality agreement with its clients. The company holds €24.2 trillion ($33.3 trillion) of its customers’ money, sees 2.5 trillion euros flow through its doors every day, has clients in around 100 countries and sees itself as a big player in the Belgium market and on the international stage.

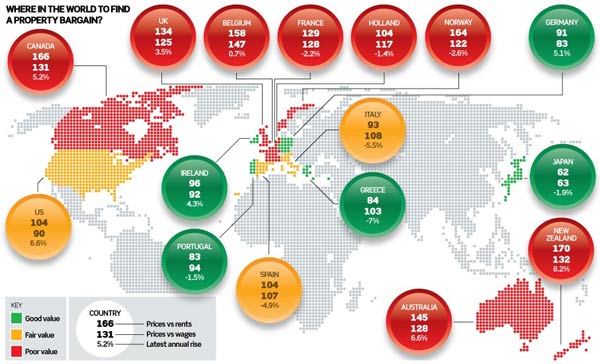

• OECD: The World’s Cheapest And Most Expensive Property Markets (Telegraph)

The OECD research is based on two different measures of valuation. It compares prices with typical wages and then plots the ratio against the long-term average. At 100, it would be in line with that average. At 150, it is 50% above the average. A comparison with wages indicates what buyers can afford but the OECD also captures how prices look against rents. This measurement is akin to valuing homes as if they were businesses – not dissimilar to the price to earnings ratio used to value shares. A figure of 84, the number for Greece, suggests prices are 16% below the long-term average on this measure. We have created a colour-coded map to capture these differences and give a rough indicator of whether it is worth buying (green), worth avoiding (red) or in between (orange).

The OECD’s assessment of house prices today: “House prices and housing investment are now rising in over half of the OECD economies. In Europe, strong house price growth is continuing in Germany (based on data from the big cities) and Switzerland, and has also resumed in the United Kingdom, even though UK prices are already above longer-term norms relative to rents and incomes. Markets remain softer in other parts of the euro area, reflecting weak income growth and tighter financing conditions. “Recent data, however, suggest that the long declines in real house prices in Ireland and the Netherlands may now have started to bottom out.

“In the United States, housing developments are mixed. Prices continue to rise, but new home sales, starts and builders’ confidence have turned down, in part due to adverse weather conditions in the first quarter of 2014, but also because of a moderation in mortgage purchase applications since long-term mortgage rates rose last summer. Existing home sales have also declined, although much of this appears to reflect a welcome drop in the level of distressed sales. Looking ahead, given the likelihood of continued solid income growth, further easing of credit standards and pent-up demand after a period of subdued household formation rates, the housing market recovery should continue through this year and next. “In Japan, real house prices are continuing to edge down, but land prices have now begun to stabilise and housing investment has been very buoyant, although this has now faded given the temporary boost provided by the demand for sales contracts to be finalised ahead of the consumption tax increase in April.”

• Swiss To Vote In Referendum On World’s Highest Minimum Wage (Guardian)

Switzerland will put a proposal for the world’s highest minimum wage to a national referendum on Sunday. The proposal is for a 22 Swiss francs (£14.70) an hour and if voted through it would put a salary floor under the average 35-hour week of more than £27,000. Ministers have fought the proposal, made by the SGB union and supported by the Socialist and Green parties, saying it will put smaller firms out of business. While Switzerland is renowned as a home for hedge fund managers, a secretive banking sector and one of the highest per capita incomes in the world, more than 20% of its GDP comes from an increasingly beleaguered manufacturing sector.

A recent opinion poll by gfs.bern found that 64% of voters were against the proposal, but in a recent referendum voters unexpectedly forced the parliament to draw up plans to curb EU immigration. Cristina Gaggini, director of the Geneva office of the Swiss business association, Economiesuisse, told the BBC: “I think it’s an own goal, for workers as well as for small companies in Switzerland.” She added: “Studies show that a minimum wage can lead to much more unemployment and poverty than it helps people. And for very small companies it would be very problematic to afford such a high salary.”

No. 1.

• Canada Trims Russia Sanctions To Protect Business Interests (Reuters)

Canada broke with the United States and did not impose sanctions on two key allies of Russian President Vladimir Putin because the pair had Canadian business interests, according to sources familiar with the matter. The revelation puts into question the government’s tough line on Russia over the crisis in Ukraine. Prime Minister Stephen Harper recently compared Putin’s actions to those of Adolf Hitler in the run-up to World War Two. Canada, home to 1.2 million people of Ukrainian descent, has imposed sanctions on more than 80 Russian and Ukrainian officials and businesses, compared to about 60 by the United States.

But unlike the United States, Canada has not moved against Sergei Chemezov, who heads state-owned industrial and defense conglomerate Rostec, and Igor Sechin, CEO of oil giant Rosneft . Both men, who are close to Putin, have business ties to Canada. Rosneft owns some 30% of a Canadian oil field, while Rostec has an aircraft assembly joint venture lined up with Bombardier Inc. The venture is vital to the Canadian plane and train maker, as the fate of a roughly $3.4 billion aircraft sale deal is tied to it. Asked about the decision not to go after either Sechin or Chemezov, a Canadian government source familiar with Ottawa’s sanctions strategy told Reuters: “Our goal is to sanction Russia, it is not to go out of our way to sanction or penalize Canadian companies.”

The comments appear to contrast with the official government approach. Harper, referring to the Ukraine crisis, said in March that “we will not shape our foreign policy to commercial interests” and officials say that stance is still valid. Indeed, the Conservative government on Wednesday called on business executives not to attend events in Russia, like the St. Petersburg International Economic Forum this month and the World Petroleum Congress in Moscow in June. “We will continue to apply pressure to Russia, we will continue to impose sanctions along with our allies, but we will also look out for Canada’s broader interests,” the government source said.

• US Bee Die-Off Continues, Extends Beyond Winter (BSun)

The mysterious die-off of honey bees continues, as beekepers across the nation lost more than one in three of their colonies since last spring, researchers reported Thursday. The losses in Maryland were even more extreme, where nearly half were lost, according to the state’s chief apiary inspector. The national survey of beekeepers found that they lost one in five honey bee colonies over the winter, fewer than the winter before. But they reported seeing substantial die-off in summer as well, pushing their year-round losses to more than a third.

The annual survey, led by a University of Maryland entomologist, is part of an effort to get to the bottom of high death rates that commercial beekeepers have experienced for nearly a decade. The losses impose high costs on beekeepers and could lead to shortages of some crops that depend on honey bees for pollination, experts say. While many beekeepers and some researchers have linked the die-off to pesticide exposures, the team that did the survey say no single culprit is responsible for all the honey bee deaths. But Dennis vanEngelsdorp, the UM assistant professor of entomology who led the survey team, said mortality was much lower among beekeepers who treated their hives to control a common but lethal parasite, the varroa mite.

Researchers surveyed nearly 7,200 beekeepers, who collectively manage about a fifth of the nation’s 2.6 million commercial honey bee colonies. It was conducted for the Bee Informed Partnership, a joint effort of the Apiary Inspectors of America and the U.S. Department of Agriculture. In Maryland, Jerry Fischer, chief apiary inspector with the Maryland Department of Agriculture, said the state’s beekeepers have been losing about a third of their colonies annually for several years. The rate increased in the past year to nearly 50%, he said, which he blamed on an unusually cold winter.

Insane.

• US Halts Yucca Mountain Fee After 30 Years, $43 Billion Collected (RT)

The US Department of Energy will no longer collect a small electricity fee from the bills of nuclear energy customers which was originally intended to fund the construction and operation of a nuclear waste dump that was never built. The charge, which will no longer be collected past Friday, was first instituted in 1983 with the aim of constructing a facility capable of disposing of what is now almost 70,000 metric tons of highly radioactive spent fuel. The waste is spread throughout nuclear reactors across the US. The government collected $750 million from the charge each year, totaling $43 billion. It remains to be seen what Washington plans to do with that money.

“From the very infancy of the commercial nuclear power industry, the federal government has always stated that it would take responsibility for the (disposal) of high-level nuclear waste, and that hasn’t always happened,” Michigan Public Service Commissioner Greg White told KDVR-TV in Colorado. “The waste all sits at the plant sites where it was generated, despite the collection of some $40 billion.” Vast amounts of decaying waste are expensive to store, terrible for the environment, and constitute a major risk to public health. Nuclear and utility industries have for years complained that the Energy Department has collected the money while doing nothing to ease the disposal process, eventually filing suit to stop the fees from being collected.

Last year, an appeals court determined that the government had no intention to actually build the dump and that it could not accurately estimate the cost of such a plan. It then ordered the Energy Department to suspend the collection of the fee, though it took nearly six months for the government to carry out the legal order, according to the Los Angeles Times. “The federal courts have gotten fed up with what the Department of Energy is doing,” said Jay Silberg, the industry’s lead attorney in the case against the charges. “We want something in exchange for our money.” It’s unlikely that customers will notice they are paying a fraction of a cent less on their bill from now on. An estimated $31 billion of the $43 billion that was collected sits in a trust fund that will accrue interest, likely until a plan for a dump is actually developed.

The initial $12 billion taken from that $43 billion sum was spent trying to develop a waste facility in Yucca Mountain, Nevada, although the project was stopped before any meaningful progress was made. “I don’t see how it is a terrific win for anybody,” said Marta Adams, the chief deputy attorney general in Nevada who fought to stop the Yucca Mountain dump. “It relieves consumers of this charge but it doesn’t get rid of the waste.” The Energy Department said this week that, despite the delays, lawmakers still hope to find a solution that works for all those concerned. “When this administration took office, the timeline for opening Yucca Mountain had already been pushed back by two decades, stalled by public protest and legal opposition with no end in sight,” the Department of Energy said in a statement.

Quite a thing to say. Nice timing too.

• Bernanke: “No Return To Normal Fed Funds Rate In My Lifetime” (Reuters)

In a series of quarter-million-dollar dinners with wealthy private investors, Ben Bernanke has been clearer than he ever was as chairman of the Federal Reserve on his expectations that easy-money policies and below-normal interest rates are here for a long time to come, according to some of those in attendance. Bernanke, who retired from the U.S. central bank in January, has predicted the Fed will only very slowly move to raise rates, and probably do so later than many forecast because the labor market still has a lot more room to recover from the financial crisis and recession.

The accounts of the discussions come from attendees as well as those who heard second-hand what was said at the dinners, where hedge fund managers and others willing to foot the roughly $250,000 bill for each event asked the former Fed chairman questions in a free-flowing round-table fashion over recent weeks. Bernanke has no constraints on expressing his views in public or private, providing he does not talk about confidential Fed matters. He declined to comment on any of his remarks at the private events. The demand for Bernanke’s time shows that many of Wall Street’s highest-profile brokers and investors see him as holding rare insight on how the Fed will react in the months and years ahead – and are prepared to pay big bucks to get private access to those views.

At least one guest left a New York restaurant with the impression Bernanke, 60, does not expect the federal funds rate, the Fed’s main benchmark interest rate, to rise back to its long-term average of around 4% in Bernanke’s lifetime, one source who had spoken to the guest said. [..] Another dinner guest was moved when Bernanke said the Fed aims to hit its 2% inflation target at all times, and that it is not necessarily a ceiling. “Shocking when he said this,” the guest scribbled in his notes. “Is that really true?” he scribbled at another point, according to the notes reviewed by Reuters.

No kidding.

• UK Housing Market Biggest Risk To Financial Stability: BOE’s Carney (Reuters)

Bank of England Governor Mark Carney gave his strongest warning to date about the risks of a housing bubble and said policymakers were looking at new measures to control mortgage lending. The British housing market has “deep, deep” structural problems, among them insufficient construction of new homes, Carney said in an interview with Sky News television broadcast on Sunday. “When we look at domestic risk the biggest risk to financial stability, and therefore to the durability of the expansion, those risks center in the housing market and that’s why we are focused on that,” he said. British house prices rose about 10% in the 12 months to April but Carney has previously stressed that the BoE will seek to take measures to exert more control over mortgage lending before it resorts to raising interest rates, which could hurt the economic recovery.

Carney said on Sunday that the Bank would check lending procedures “so people can get mortgages if they can afford them but they won’t if they can’t”. He said the Bank was looking at the possibility of recommending that banks do more to limit the size of mortgages based on the incomes of borrowers, a potentially controversial move by the BoE that could be felt by many would-be homeowners. “The level of higher loan-to-income mortgages, ones above four and a half, five times loan-to-income, potentially could store up bigger problems for the future and we need to be careful,” he said. “We need to be calibrated, we need to be proportionate, if we were to suggest some adjustments to the amount of these types of mortgages that banks should underwrite.”

All you need to do to get your gas is to make sure Ukraine doesn’t get it first.

• Gazprom Head Soothes Europe Over Gas Supply Via Ukraine (Reuters)

Russia’s Gazprom assured European customers it would continue to supply their gas, after its threat to halt supplies to transit nation Ukraine next month over non-payment. Any shortfall would be the fault of Ukraine, chief executive Alexei Miller told Russian television. Moscow blamed theft by Ukraine for a disruption to exports in a previous dispute. Russia has warned that it will not supply Ukraine with gas in June unless Kiev pays in advance $1.66 billion by June 2, raising fears that gas piped to Europe through Ukraine could be affected.

“Gazprom will simply supply Ukraine as much as gas as it will have bought, and to the Russian border with Ukraine we will send as much gas as Europe should get and Ukraine should transit,” Miller said in an interview on Rossiya-24 television. “It would be our Ukrainian partners’ responsibility for a so-called unauthorised off-take. But Gazprom from its part will do everything to ensure that European customers have no problems,” Miller told the news show Vesti. Gazprom said on Friday that exports to Europe via Ukraine remained stable, as they have so far during mounting tensions between Moscow and Kiev – and Russia and the West – since the removal of a Moscow-friendly Ukrainian president in February.

We’ll see a lot of this. The costs are infinite.

• Utilities Want German Taxpayers to Pay For Decommissioning Nuke Plants (Spiegel)

After the Chernobyl disaster in 1986 and the Fukushima catastrophe in 2011, it is no longer possible to claim that atomic power is a safe and fully controllable technology. And no legitimate solution has been found for the problem of storing or eliminating nuclear waste. Now, on top of all that, come the full economic disclosures. The government subsidized nuclear power at the time of its introduction, just as it now lends a state hand in the development of wind and solar energy. Depending on which estimate you go by, somewhere between €17 and €80 billion in taxpayer money has been funneled into nuclear energy.

Once the reactors began successfully producing electricity, the profits landed in the coffers of the energy utility companies and their shareholders. Now that the end is approaching for the technology in Germany, the state is expected to assume the risks again. So far, German Economics and Energy Minister Sigmar Gabriel of the center-left Social Democrats (SPD) has dodged official talks on the issue. A few weeks ago, he cancelled a meeting with the heads of E.on and RWE at an industry event at the last minute. The reason given at the time was that Gabriel wants to first wrap up reforms to Germany’s Renewable Energy Act (EEG), the core of the country’s transition from nuclear power to renewables.

Its possible Gabriel won’t be able to postpone discussion of the controversial issue for long, because what at first glance might look like a crude attempt by the utility companies to cheaply rid themselves of their radioactive legacies is actually more complicated. It could, in fact, be in the government’s interest to take up the companies’ offer to negotiate. It’s not just E.on, RWE, EnBW and Vattenfall who have lots at stake over the nuclear issue — the government in Berlin also faces considerable risks. The energy producers are asking for about €15 billion in compensation from the government in several lawsuits.

Because the Merkel government decided on a swift exit from nuclear power after the Fukushima disaster, E.on and RWE are bringing their complaints to the German Constitutional Court. At issue is whether the government’s decision represented an illegal invasion of the companies’ property rights. The sector is expecting the first verdicts in early 2015. The outcome, legal experts say, is hard to predict. Vattenfall is also asking an arbitration court in Washington for about €3 billion in compensation for the early closure of the Krümmel and Brunsbüttel nuclear reactors. The Energy Charter Treaty allows a foreign company like Vattenfall to turn to American courts, and the German government needs to abide by the verdict, even if it is decided in Washington.

What a grand idea. The only remaining source of wealth.

• Investors Covet 215 US Companies’ Pension Cash (USA Today)

Big companies like automaker Ford, aircraft builder Boeing and beverage king Coca-Cola are planning to cut the cash they put into employees’ pensions this year. Investors are hoping to get their hands on the money instead. Thanks to the rising stock market and higher interest rates, companies aim to cut contributions to their employee pension plans by 28% or $16 billion this year to $40 billion, says research firm International Strategy & Investment, based on estimates provided by the 345 companies in the S&P 500 that still have pension plans. These expected 2014 pension contribution cuts come after the companies already reduced their pension contributions 27% in 2013 to $56 billion, the lowest contribution since 2008, ISI says. That’s all money investors hope will be coming their way in the form of dividend hikes or stock buybacks.

Power games.

• German Official Mulls Breaking Up Google (AP)

A senior German official has warned that Google may have such a dominant market position that a breakup of the company “must be seriously considered.” Such a move – which would be difficult to enforce because Google is based in the United States – could be a last resort for countries seeking to prevent the Internet search giant from systematically crowding out competitors, said Sigmar Gabriel, who is Germany’s economy minister and vice chancellor. “A breakup, of the kind that has been carried out for electricity and gas grids, must be seriously considered here,” Gabriel wrote in an op-ed published Friday by German daily Frankfurter Allgemeine Zeitung. “But it can only be a last resort. That’s why we are focusing on anti-trust style regulation of Internet platforms.”

Google has for years faced criticism over its dominant position in Europe, where no serious local rival has emerged to challenge its search business. But Gabriel’s comments reflect a new sense of urgency among European governments and businesses that the continent’s home-grown Internet industry risks being smothered by American rivals. On Thursday, some 400 companies—including major German and French publishers—announced they were submitting a new anti-trust complaint against Google. The grouping, calling itself Open Internet Project, alleges that Google promotes its own products in search results at the expense of rivals.

Alternatively, we could just act normal.

• Inequality Insurance Could Be Solution To Future Disaster (Shiller)

Thomas Piketty’s impressive and much-discussed book Capital in the Twenty-First Century has brought considerable attention to the problem of rising economic inequality. But it is not strong on solutions. As Piketty admits, his proposal – a progressive global tax on capital (or wealth) – “would require a very high and no doubt unrealistic level of international cooperation”. We should not be focusing on quick solutions. The really important concern for policymakers everywhere is to prevent disasters – that is, the outlier events that matter the most. And, because inequality tends to change slowly, any disaster probably lies decades in the future.

That disaster – a return to levels of inequality not seen since the late 19th to early 20th century – is amply described in Piketty’s book. In this scenario, a tiny minority becomes super-rich – not, for the most part, because they are smarter or work harder than everyone else, but because fundamental economic forces capriciously redistribute incomes. In The New Financial Order: Risk in the 21st Century, I proposed “inequality insurance” as a way to avert disaster. Despite the similarity of their titles, my book is very different from Piketty’s. Mine openly advocates innovative scientific finance and insurance, both private and public, to reduce inequality, by quantitatively managing all of the risks that contribute to it. And I am more optimistic about my plan to prevent disastrous inequality than Piketty is about his.

Inequality insurance would require governments to establish very long-term plans to make income tax rates automatically higher for high-income people in the future if inequality worsens significantly, with no change in taxes otherwise. I called it inequality insurance because, like any insurance policy, it addresses risks beforehand. Just as one must buy fire insurance before, not after, one’s house burns down, we have to deal with the risk of inequality before it becomes much worse and creates a powerful new class of entitled rich people who use their power to consolidate their gains.

I thought he was an economist.

• Ken Rogoff Calls For European Union Army (Telegraph)

The European Union must pull closer together and establish a strong military presence, so it can act as a “moral anchor” to the United States, the economist Kenneth Rogoff has warned. Speaking ahead of next week’s European elections, Mr Rogoff, a former chief economist of the International Monetary Fund, said the EU should strive to become more “like a single country”. Closer integration would help Europe survive another financial disaster, such as a dramatic slowdown of the Chinese economy, but would also help to keep the existing super powers in check. “For the sake of the world we need Europe to integrate, to counterbalance the United States, to be able to step in in geopolitical terms,” he told The Telegraph. “You can’t just depend on the US to do everything, especially as China rises, as Russia rises.”

He also argued that the EU needed its own military capability, adding: “The events in the Ukraine are kind of frightening from that point of view.” Earlier this year, Mr Rogoff described the establishment of the euro as a “giant historic mistake”, arguing that the EU should have waited until it forged closer political and cultural ties. However, he now believes that the experiment is too hard to unravel. He added: “It would be a very good investment of German taxpayers’ money to write down debt in the periphery countries. There are a lot of ways to do it. You can be very opaque about it. The taxpayers don’t ever need to know it happened.

Wait till this week’s elections.

• Thousands Across Europe Protest EU Policies (RT)

Thousands of activists took to the streets of Germany and Spain on Saturday to protest the EU’s policies as the union prepares for parliamentary elections at the end of May. In Germany, the EU’s powerhouse, people participated in a day of anti-Brussels protests in Hamburg and the capital Berlin. A rally in Berlin broke out into clashes between protesters and police. Around 1,000 people marched through the city’s center to voice their anger against EU policies as part of the so-called ‘Blockupy’ movement. Participants also called for equal rights for refugees, including freedom of movement and residency. Police arrested at least four protesters during the rally.

Blockupy protesters also pelted Berlin’s Haus der Deutschen Wirtschaft (House of the German Economy) with eggs filled with colored paint on Saturday, protesting against the European Union’s “crisis management” policies, capitalism, and social injustice. The German city of Hamburg also had its own Blockupy rally. The march turned violent when anti-EU protesters started throwing projectiles at police. Authorities responded by firing water cannons. Several people were injured in the clashes. The protesters intentionally chose to march through Hamburg’s famous HafenCity and towards Elbe Philharmonic Hall, as they believe the affluent areas convey the city’s “most visible symbol ostentatious elite culture, corruption and waste in Hamburg.” The rallies are part of a larger Blockupy campaign movement which is focused against the European Central Bank (ECB) and will last from May 15-24.

Spain, one of the worst hit countries by the economic recession, was also hit with a day of protests. On Saturday, people demonstrated on the streets of Madrid to mark the anniversary of the movement against the government’s repressive economic policies, RT’s Matt Trezza reported from the Spanish capital. About 1,000 people rallied at Puerta del Sol square, protesting austerity measures and new laws restricting a woman’s right to abortion and the right to protest.The demonstration was organized by Spain’s grassroots movement ‘Los Indignados’ (The Indignant Ones), otherwise known as the 15M Movement, which originated in Madrid’s Puerta del Sol on May 15, 2011 in response to surging youth unemployment, political corruption, and austerity measures.

The German wall crumbles?!

• German FM Calls For ‘Cooperation Instead Confrontation’ With Russia (RT)

German Foreign Minister Frank-Walter Steinmeier has called for restraint in imposing new sanctions on Russia, as politicians, businesses and the general public in Germany grow ever more skeptical of putting more pressure on Moscow. Steinmeier defended the already imposed sanctions against Russia, but said that he still preferred “cooperation instead of confrontation” with Moscow, according to a Saturday interview with Thüringische Landeszeitung. “We must avoid falling into an automatic [sanctions] mode, which leads only to a dead end and leaves no more policy options,” Steinmeier said.

The comment was made the same day Ukraine’s acting Foreign Minister Andriy Deshchytsia appealed for toughening sanctions, including imposing “preventive” ones, against Russia in an interview to another German newspaper, Die Welt. The idea of slapping Moscow with any further restrictions appears to be lacking popular support in Germany. That was felt earlier this week in Berlin when Chancellor Angela Merkel, attending her party’s campaign event, was booed by a rally of protesters holding signs, which read ‘Europe is strong only with Russia’ or ‘Stop the Nazis in Ukraine.’

Home › Forums › Debt Rattle May 18 2014: How To Redress The Planet’s Energy Balance