Theodor Horydczak U.S. Supreme Court interiors, Washington DC 1931

With The Greek election in full motion, and first results perhaps 12 hours away, It would seem useful, no matter how the Greeks vote, to lay to rest a few misconceptions, and to expose a few ‘conceptions’ that have – largely – remained buried to date.

The first misconception is that the Greeks borrowed like crazy and therefore deserve to be thrown into a pit of suffering and misery. It is simply nonsense, a mere political narrative. Besides, most of what was borrowed went to the utterly corrupt ‘oligarch system’, not to the people in the street. Something the EU was certainly aware of when it accepted Greece as a member. But corrupt regimes can be of great use.

A few days back, in Bunch Of Criminals!, I made the point that the EU, and its members, have no right to do to a fellow member country what they did to Greece – and want to continue doing -.

SYRIZA leader Alexis Tsipras said this week that he will not negotiate with the Troika, but directly with EU officials. And there is a very solid reason for that. In today’s Observer, Helena Smith interviews Greek sociologist Constantine Tsoukalas, who understands what has been happening to his country, and – rightfully – frames it in terms of Naomi Klein’s Shock Doctrine.

What has happened to Greece is what Klein describes was done to South America and – later – Eastern Europe. Disaster capitalism. Bringing entire countries to their knees by enforcing predatory economic policies, and then using the ensuing chaos and smouldering ruins to take full control over their political, economic and social systems. Helena Smith:

Is Greece About To Call Time On Five Punishing Years Of Austerity?

For Professor Constantine Tsoukalas, Greece’s pre-eminent sociologist, there is no question that, come Monday, Europe will have reached a watershed. I first met Tsoukalas in January 2009, in his lofty, book-lined apartment in Kolonaki. For several weeks Athens had been shaken by riots triggered by the police shooting of a teenage boy. The violence was tumultuous and prolonged.

Looking back, it is clear that this was the start of the crisis – a cry for help by a dislocated youth robbed of hope as a result of surging unemployment and enraged by a system that, corrupt and inefficient, favoured the few. Tsoukalas knew that this was “the beginning of something” although he could not tell what. But with great prescience he spoke of the degeneration of politics – both inside and outside Greece – the rise of moral indignation, and the emptiness of a globalised market “that was supposed to put an end to ideology but, in crisis, has instead created this moment of great ideological tension”.

Six years later, following the longest recession on record, he is in little doubt that anger has fuelled the rise of Syriza. On the back of rage over austerity, the leftists have seen their popularity soar from 5% before the crisis to as high as 35% – more than the combined total of New Democracy and left-leaning Pasok, the two parties that have alternated in power since the restoration of democracy in 1974.

The European policy towards Greece, to a large extent, has been determined by the will to experiment with the feasibility of shock therapies,” says Tsoukalas. “It worked, but the reaction is going to be a leftwing government. Europe cannot survive as it is. The rise of fascism … should be sufficient [evidence] to everyone that it has to change.”

If Greece’s rebellion was to occur in a coherent way, Tsoukalas, who is being fielded by Syriza as an honorary candidate, believes it would be only a matter of time before it was replicated in other parts of the continent. “These elections are important because they are a reminder to the people of Europe that there is another way out,” he insists. “That neoliberal orthodoxy is not an immovable problem.”

[..] at 28 Veikou Street, Syriza runs the Solidarity Club – initially set up as a food bank in March 2013 when stories began to surface of malnourished children fainting in schools. In recent months, its staff have focused on providing medicines. “That’s the big problem now because so many are uninsured, without any access to the health system,” says volunteer Panaghiota Mourtidou. “People don’t have the money to go to doctors. If they have a toothache, they get terrified, because how the hell are they going to pay for a visit to the dentist?”

With its Che Guevara posters, Italian Euro-communist flags, chaos of boxes and tins, and makeshift furniture, there is something of a field-camp feeling about Veikou Street. But its army of volunteers are tireless. This, they say, is a battle to be won, a huge victory for the left that Greece will set in motion. “We are conscious that we have managed to unite in a way that the left elsewhere has failed to do,” says Angeliki Kassola, a theatre director. “I’ve met lots of once-strident New Democracy supporters who say they will be voting for us because they are attracted to Syriza’s vision of democracy, justice, dignity – all the things that have been taken from us in the crisis.”

There will be plenty who don’t agree with an analysis like this. Just as there will be plenty who insist that the Greeks brought it all upon themselves. They should take a look at what my friend Steve Keen, presently “Professor of Economics and Head of the School of Economics, Politics and History at Kingston University London”, wrote this week in Forbes Magazine. That should cure a few lost souls of their foolish fantasies. And then they should take their new found insights and ask themselves: wait a minute, what is going on here? Why is Greece being squeezed the way it is? Deep down, you already know, don’t you? Steve:

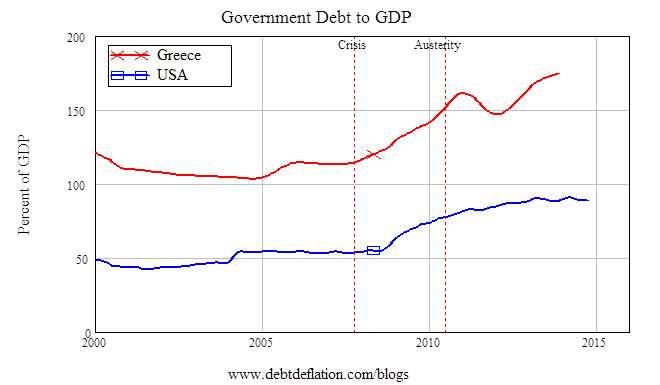

I fully expect most commentators to take a line like that in my title. After all, it’s common knowledge that the Greeks lied about their levels of public debt to appear to qualify for the EU’s entry criteria, which include that aggregate public debt should be below 60% of GDP. Though there’s an argument that Goldman Sachs, many of whose ex-staff are now leading Central Bankers, helped the Greeks make this alleged lie, the responsibility for it will be shafted home to the Greeks, and that in turn will be used to argue that the Greeks deserve to suffer.

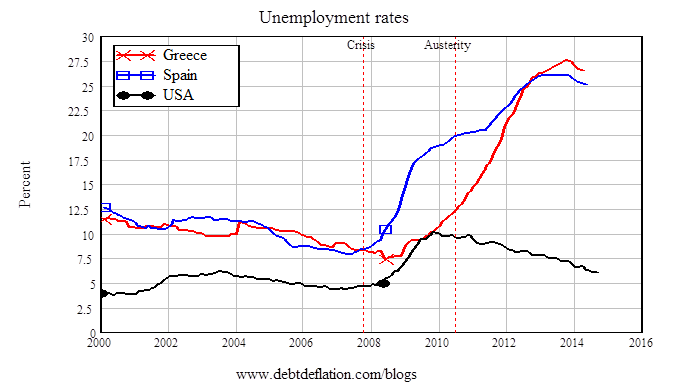

The story, in other words, will be that the Greeks were architects of their own dilemma, and that therefore they should pay for it, rather than making the rest of the world suffer through a write-down of their debts. Emotion will rule the debate rather than logic. So to cast a logical eye over this forthcoming debate, I’m going to consider who is really to blame for the Greek dilemma by considering another country entirely: Spain. Today, Greece and Spain are in very similar situations, with unemployment rates of well over 25%—higher than the worst the USA recorded during the Great Depression (see Figure 1). But unlike Greece, Spain before the crisis was doing everything right, according to the EU.

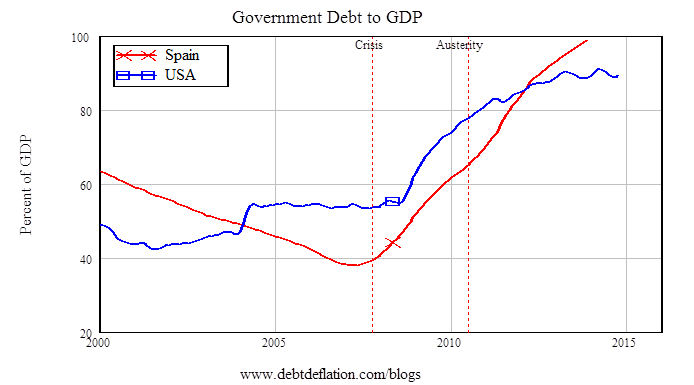

More importantly still, Spain’s government debt when the EU imposed its austerity regime (mid-2010) was still well below America’s, even though both had risen substantially since the crisis. Spain’s government debt ratio was 65% of GDP then, versus 78% for the USA. The whole purpose of the EU’s austerity program was to reduce government debt levels. Reducing government debt was the political topic du jour in America as well from 2010 on, but the various attempts to impose austerity came to naught: instead, after shooting up because of deliberate policy at the time of the crisis America’s budget deficit merely responded to the state of the economy.

Politically paralyzed Washington talked austerity, but never actually imposed it. So who was more successful: the deliberate, policy-driven EU attempt to reduce government debt, or the “muddle through” USA? Figure 2 shows that muddle through was a hands-down winner: the USA’s government debt to GDP ratio has stabilized at 90% of GDP, while Spain’s has sailed past 100%. The USA’s macroeconomic performance has also been far better than Spain’s under the EU’s policy of austerity. Comparing the USA’s unemployment rate to Spain’s has to account for the fact that it was higher before the crisis—at 8.5%, Spain’s unemployment was 1.75 times the USA’s when the crisis began. It is now about 4 times the USA’s.

So simply on the data, the prima facie case is that all of Spain’s problems—and by inference, most of Greece’s—are due to austerity, rather than Spain’s (or Greece’s) own failings. On the data alone, the EU should “Cry Uncle”, concede Greece’s point, stop imposing austerity, and talk debt-writeoffs—especially since the Greeks can argue that at least part of its excessive public debt ratio is due to the failure of the EU’s austerity policies to reduce it.

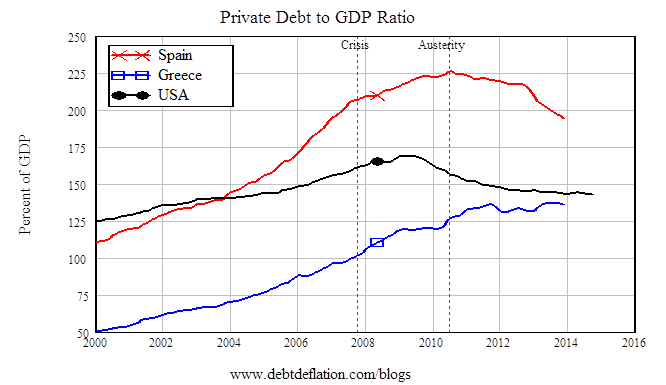

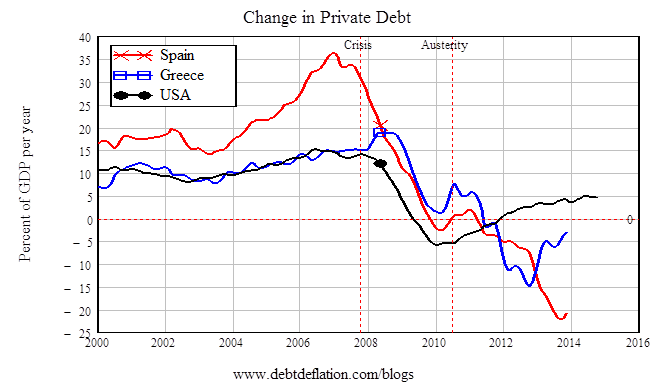

But I know that data isn’t enough to sway the public opinion—let alone the bureaucrats in Brussels. So we need to know the why: why did austerity in Europe fail to reduce the government debt ratio, while muddle-through has stabilized it in the USA? Here I return to my hobby-horse: the key factor that I consider and mainstream economists ignore—the level and rate of change of private debt. The first clue this gives us is that the EU’s pre-crisis poster-boy, Spain, had the greatest growth in private debt of the three—far exceeding the USA’s. Its peak debt level was also much higher—225% of GDP in mid-2010 versus 170% of GDP for the USA in 2009 (see Figure 4).

The second clue comes from the change in debt data: the factor that Greece and Spain have in common is that the private sector is reducing its debt level drastically—in Spain’s case by over 20% per year. The USA, on the other hand, ended its private sector deleveraging way back in 2012. Today, Americans are increasing their private debt levels at a rate of about 5% of GDP per year—well below the peak levels prior to the crisis, but roughly in line with the rate of growth of nominal GDP.

The third clue? I’ll leave that for my next post—this one is long enough already. But the conclusion is that Greece’s crisis is the EU’s fault, and the EU should “pay” via the debt write-offs that Syriza wants – and then some.

Austerity is something that doesn’t work, but it does fit in great with the will to experiment with the feasibility of shock therapies. Austerity, in the way it’s been applied to Greece, is a tool to gain greater power over people and their social structures. It is economic warfare, plain and simple. That is to say, the EU has become a ‘union’ where the people in weaker member states can be strangled, and ‘economically conquered’, with impunity.

If you live in a EU country, and you don’t like that these things are carried out in your name, this is the time to make your discontent known. Because now you know. Don’t let the Greeks fight this battle on their own. I don’t care what you say, but you’re not innocent if you let it happen. If they lose, it’ll be on your conscience.

Oh, and if they win, heed Helena Smith’s words: “if Greece’s rebellion was to occur in a coherent way, [..] it would be only a matter of time before it was replicated in other parts of the continent.” But don’t think ‘they’ will let it happen peacefully. They’ll organize huge social unrest, inject violence, and then try to use it to clamp down on the population and reinforce their grip on power. This won’t remain confined to Greece.

Home › Forums › Is This The Day Europe Gets Its Future Back?

Tagged: jubilee, Paul Grignon, unrepayable debt