This is a critique of the theory of Freegold (F-theory), which is part of an ongoing series entitled, Freegold: Perspectives and Critiques (FPC).

One very important thing to note about FOFOA right off the bat is that he is NOT a “hard money” advocate, i.e. someone who believes currencies should be backed by a hard commodity (typically gold). He makes this clear repeatedly throughout his writing, as did Another and FOA, because F-theory is supposed to represent progress in the monetary structures of human civilization. That means going beyond the national/international systems of gold-backed money that existed for centuries, as well as the global system of pure credit-money that has practically existed for the better part of the last century.

Here is an excerpt from FOA and FOFOA on this issue from the latter’s article, Gold is Money – Part I:

FOA: Owning wealth aside from official money units is nothing new. Building up one’s storehouse of a wealth of things is the way societies have advanced their kind from the beginning. What is new is that this is the first time we have used a non wealth fiat for so long without destroying it through price inflation. Again, a process of using an unbacked fiat to function as money and building up real assets on the side. Almost as if two forms of wealth were circulating next to each other; one in the concept of money and the other in the concept of real wealth.

This trend is intact today and I doubt mankind will ever pull back from fiat use again. Fiat used solely in the function of a money concept that I will explain in a moment.

Understanding all of this money evolution, in its correct context, is vital to grasping gold’s eventual place in the world. A place where it once proudly stood long ago.

All of this transition is killing off our Gold Bug dream of official governments declaring gold to be money again and reinstitution some arbitrary gold price. Most of the death, on that hand, is in the form of leveraged bets on gold’s price as the evolution of gold from official money to a wealth holding bleeds away any credible currency pricing of gold’s value in the short run.

To understand gold we must understand money in its purest form; apart from its manmade convoluted function of being something you save.

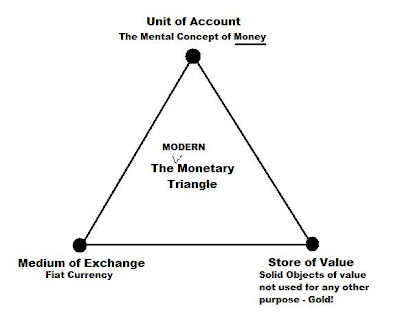

FOFOA: he human concept of money is changing whether we like it or not. It is being torn apart. Gold, as a wealth reserve and wealth asset, will exist and trade parallel to the world of fiat, the world of credit and debt. Producers and savers will finally have the option to switch tracks so to speak. To get on a parallel track that avoids the inevitable collision with the debt-hungry collective their savings have always faced.

And as we pass through this phase transition, as gold switches from the transactional track to the wealth-reserve track, it will take on a whole new meaning… and a whole new value! The non-dollar part of the world already knows this. This is why they are buying gold now!

As you can see, this commentary is so far more of an explanation of an insightful concept expressed by Freegold advocates than a critique of F-theory itself. I am in complete agreement with the writers above that the conflation of transactional currencies (credits) and “money” used for savings is (partially) responsible for creating the extremely unbalanced, unstable economic system we have today, and that, ideally, the two functions should be separated into two different types of money, whose roles should always remain separate. It just makes good sense!

Where the critique comes in, though, is when the Ideal is transformed into the natural result of monetary evolution in human society, and is predicted to occur with near certainty as a part of F-theory. One could think of the synthesis between hard money and soft money in a Freegold system as a monetary Utopia, in which producers (savers) and consumers (debtors) will exist in a harmonic stasis that could theoretically last forever. Compare this to a description of Hegelian philosophy in theory and in practice:

…all successive historical systems are only transitory stages in the endless course of development of human society from the lower to the higher. Each stage is necessary, and therefore justified for the time and conditions to which it owes its origin. But in the face of new, higher conditions which gradually develop in its own womb, it loses vitality and justification. It must give way to a higher stage which will also in its turn decay and perish.

…

Mankind, which, in the person of Hegel, has reached the point of working out the absolute idea, must also in practice have gotten so far that it can carry out this absolute idea in reality. Hence the practical political demands of the absolute idea on contemporaries may not be stretched too far. And so we find at the conclusion of the Philosophy of Right that the absolute idea is to be realized in that monarchy based on social estates which Frederick William III so persistently but vainly promised to his subjects, that is, in a limited, moderate, indirect rule of the possessing classes suited to the petty-bourgeois German conditions of that time…

Do you notice a similarity between what Hegel did and what A/FOA/FOFOA have done? They have taken a very well thought-out philosophy of the Ideal and forced it to become an actual economic/political denouement that human civilization will occupy. After all, what good is a philosophy if it does not have very practical implications and/or predictions for human society? As Frederick William III proved, though, the material manifestation of the Ideal does not always reflect the Utopian conditions envisioned, and, most of the time, it doesn’t even come close! F-theory predicts the manifestation of a monetary Ideal throughout all of global human society, and that fact alone should leave us very skeptical of its predictions.

(more critiques of F-theory are to come later, and, fear not, most of them will not be nearly as philosophical as this one!)

DISCLAIMER: I am not an EXPERT on the writings of Another, his friend (FOA) or HIS friend (FOFOA), or on the theory of Freegold. Just like I am not an expert on the writings of any other economic theorist out there or their theories in general. There are a lot of economic works that I have not had the pleasure to read and a lot of ideas I have not considered in-depth, including those contained within the body of work that comprises F-theory. None of my descriptions of F-theory should automatically be taken as 100% accurate, and I welcome any and all challenges to my representations.

Home › Forums › FPC: The Hard Money – Soft Money Synthesis