Harris&Ewing Washington snow scenes 1924

If he pulls this off, it’s the biggest thing that’s happened in the US for many decades.

• Trump: US Must End ‘Destructive Cycle of Intervention and Chaos’ (VoA)

U.S. President-elect Donald Trump returned Tuesday to his vision of a non-interventionist foreign policy for the United States, saying as he did during his campaign, that he does not want to have American forces fighting “in areas that we shouldn’t be fighting in.” Speaking during a “thank you” rally for his supporters in Fayetteville, North Carolina, Trump said instead his focus will be on defeating terrorists, including the Islamic State group. “We will stop racing to topple foreign regimes that we know nothing about, that we shouldn’t be involved with,” Trump said. He said the U.S. must end what he called a “destructive cycle of intervention and chaos.” Trump pledged to build up the military, but said the purpose would be to project strength, not aggression. After questioning frequently during his campaign whether NATO and other allies were pulling their weight Trump said Tuesday he wants to strengthen “old friendships” and seek new ones.

At the same rally, Trump formally announced he has chosen retired Marine General James Mattis as his nominee for secretary of defense. “Under his leadership, such an important position, we will rebuild our military and alliances, destroy terrorists, face our enemies head on and make America safe again,” Trump said. Michael O’Hanlon, a senior defense expert at the Brookings Institution, called Mattis “one of the best read, best informed and most experienced generals of his generation.” Mattis has served as the head of U.S. Central Command, which carries out U.S. operations in the Middle East, and the Supreme Allied Commander of NATO forces. The retired general will need a congressional waiver in order to be confirmed as secretary of defense. Mattis would otherwise be ineligible to serve because of a law that requires a seven-year wait for former members of the military to serve in the post. He has been retired for less than four years.

Bold.

• ‘Chances Of Italy Staying In Euro For Next 5 Years Below 30%’ (Ind.)

The political turmoil set off by the Italian referendum result could endanger the euro, a German business group has warned. Ulrich Grillo, the head of the Federation of German Industries, said that the German industry is worried about the consequences of the referendum, which prompted Premier Minister Matteo Renzi to announce his resignation on Monday. “The risks of a new political instability for economic development, the financial markets and the currency union are increasing further,” he said. Douglas McWilliams from the Centre for Economics and Business Researcg (CEBR), a leading economics consultancy, said it estimated the chances of Italy staying in the Euro for the next five years had fallen below 30% following the vote.

“There is no doubt that Italy could stay in the euro if it were prepared to pay the price of virtually zero growth and depressed consumer spending for another five years or so. But that is asking a lot of an increasingly impatient electorate. We think the chances of their sustaining this policy are below 30%,” he said. German’s foreign minister also expressed concerns about the result, which prompted Prime Minister Matteo Renzi to resign. Speaking during a visit to Greece, Frank-Walter Steinmeier said that while the result of the Italian referendum on constitutional reform was “not the end of the world,” it was also “not a positive development in the case of the general crisis in Europe.”

After the laws are changed?

• Italian Interior Minister Sees New Elections In February (R.)

Italy could have an election as early as February, a minister in Prime Minister Matteo Renzi’s outgoing government said on Tuesday, speaking after talking to Renzi. The comments will add to growing support for a quick vote as the only way to avoid protracted political limbo in Italy following Sunday’s “No” vote on Renzi’s constitutional reforms. Renzi announced he would step down after his heavy defeat. President Sergio Mattarella told him to stay on until parliament had approved the 2017 budget, expected later this week. Then, the president said, Renzi could tender his resignation. Before the referendum, most commentators, and financial markets, assumed that even if Renzi lost and resigned, a temporary unelected government would be installed to tide Italy over until the end of parliament’s term in 2018.

But a chorus of comments from party chiefs suggests consensus may be growing for an early vote in spring. “I forecast there will be the will to go to elections in February,” Interior Minister Angelino Alfano, the head of a small centre-right party that is a crucial part of Renzi’s ruling coalition, told Corriere della Sera daily on Tuesday. Significantly, Alfano said he made his forecast after discussing the issue with Renzi. Renzi is still leader of the centre-left Democratic Party (PD), which has the largest number of parliamentarians, so it is unlikely any new government could be formed without his backing.

The 1860s that Mark Carney referred to. Well, or today.

• ‘A Landscape of Exhaustion and Moral Decay’ (G.)

When Mark Carney insisted in a speech at Liverpool John Moores University that the conditions through which we are now living are “exactly the same” as those that British citizens endured during the “lost decade” of the 1860s, he was taking a bit of rhetorical licence. The past is never simply the present dressed up in funny clothes, and the analogy between today’s painful realities and those of 150 years ago doesn’t quite hold. And yet, the governor of the Bank of England had a point. When Overend Gurney collapsed in 1866, it undid once and for all the sense that, give or take a few individual misfortunes, capitalism was a moral force that rewarded skill and hard work. Toppling under a mountain of unsecured debt, the joint stock bank dragged down 200 businesses and a broad tranche of private investors with it, from courtiers to grocers.

As with the Northern Rock crisis in 2007, there were queues of panicky investors lining the streets. More profoundly, now came a dawning realisation that bad things could happen to good people. Thanks to the publication of Charles Darwin’s Origin of Species in 1859, the universe increasingly seemed not only godless but, what was perhaps even worse, indifferent to the sufferings of ordinary folk. The shock of 1866 was doubly hard because, for the previous 15 years, Britain had been sailing on a sea of prosperity and confidence. In 1851, the Great Exhibition had showcased the nation’s position as “the workshop of the world”, the great exporter of industrial goods and technological know-how to the four corners of the globe. Business was thriving, the social discontent of the “hungry” 1840s had receded, and this was, to use the coinage of the historian WL Burn, the “age of equipoise”, a serene and sunny upland of prosperity and social cohesion.

Increasingly, though, there were worrying signs that Britain could not hold on to its trading pre-eminence for much longer. Germany and the United States were playing industrial catch-up, and would soon be making everything from saucepans to spanners more cheaply and better than we ever could. What’s more, with global transport systems stretching further as each year passed, Britain’s grain, and even its dairy and meat produce, would soon be supplied from as far away as Australia and Canada. Domestic farming was about to go into a decline from which, some historians suggest, it has never recovered.

Stockman at the head of the Fed would be diffferent…

• Is Janet Yellen Trying To Screw Donald Trump? (Miller)

[..] But will Yellen’s gambit plunge us into a recession is the question. Just because Wall Street is gorging on high returns doesn’t mean the economy is sound. For eight years and running, the Fed has kept interest rates near zero% in an attempt to spark investment and borrowing. Unemployment has gradually shrunk during the Obama years, yet the workforce participation rate remains low by modern standards. Prior to Election Day, two-thirds of Americans were anxious about their economic future. Stock traders are popping the bubbly while middle America drinks the warm beer of worry. If you’re still in the dark as to why Trump stole the Rust Belt from Hillary, you need not look further than that. Fear aside, Trump’s election has been an Advil to the ongoing economic headache felt by most Americans.

Eight years of Obama’s big spending combined with ultra low interest rates has done precious little to shore up their optimism. Retirees on fixed income can’t get a yield on their savings. Millennials earning a salary for the first time in their life have little incentive to put money away. So you might think: Hey, maybe Yellen’s hinting about raising interest rates is a good thing! Sure, it might cause the S&P 500 to dip. But it’s about time Grandma got a return on her CDs. I’m very skeptical. Interest rates most definitely need to rise, but Yellen’s timing is suspicious. Trump, despite his admiration for low borrowing rates (and debt refinancing), has accused Yellen of keeping the lid on interest rates in order to boost Obama’s legacy. He told CNBC in September that rates were “staying at zero because [Yellen’s] obviously political and she’s doing what Obama wants her to do.” In another interview with Reuters, Trump explained with perfect Trumpian simplicity, “They’re keeping rates down because they don’t want everything else to go down.”

Yellen wasn’t happy about the charges. She fired back at a press conference, saying, “We do not discuss politics at our meetings, and we do not take politics into account in our decisions.” Uh huh. And I’m the Archbishop of Canterbury. [..] What the Fed, serving as America’s central bank, does is balance the money supply to reflect market conditions. When the market is roaring, it’s time to cut off the money spigot so as to rein in inflation. When things are sluggish, pouring cash into the economy is supposed to gin up activity. There are all kinds of ins and outs and what-have-yous involved in the process, including convoluted accounting techniques. But long mythologized story short, the tinkers at the Fed are supposed to act on behalf of the economy, and not the elected shysters in Washington. Every macro-econ student learns that faux civics lesson the first week of class.

[..] A few choices off the top of my head: finance writer and all-around mensch Jim Grant, former Director of the Office of Management and Budget David Stockman, commodity guru Jim Rogers, or former congressional representative and arch-Fed-critic Ron Paul.

Brilliant is a big word, but the use of Twitter is interesting.

• Trump’s Air Force One Tweet Was A Brilliant Move (CNBC)

Another day, another provocative tweet from President-elect Donald Trump. This time, he went after Boeing and the cost of the new Air Force One replacement program. But while the target was different, the goal of Trump’s twitter use remains the same: It’s his negotiating tool and, just as importantly, an instant link to public support that no president has ever been able to use before. But why this tweet and comments and why now? As few people knew before now, the Air Force is actually currently in negotiations with Boeing on the final costs of the two new Air Force One jets it hopes to buy and have in service by 2024. The source of Trump’s $4 billion cost figure in his tweet is not so clear, but the last publicly reported estimate was at $3 billion with costs still rising.

Sure, there are a lot of spending programs that cost more that Trump could target. But are there many more that are as easy for all the voters to understand? Air Force One is an iconic jet that we all know exists and almost everyone can picture quickly in their minds. Our social media/short attention span media culture makes this issue absolutely perfect for Trump to single out on Twitter. And it looks like it may have already worked. About two hours after the tweet, Boeing delivered the following statement: “We are currently under contract for $170 million to help determine the capabilities of these complex military aircraft that serves the unique requirements of the President of the United States. We look forward to working with the U.S. Air Force on subsequent phases of the program allowing us to deliver the best planes for the President at the best value for the American taxpayer.”

Yes, that “at the best value” phrase at the end of the statement says it all. Who knows exactly how much the Trump tweet just saved the American taxpayers? But considering that it cost him and us nothing for him to send it, even a few hundred grand looks like a big net windfall. And that’s not the only reason why the use of Twitter remains crucial to Trump. Every President of the United States has had the option to use public opinion to promote his agenda, but none before Trump has had an established and instantaneous link with his supporters like he has with Twitter. In the past, the best a president could do was go on national TV and make a long speech. That’s tortuous compared to the quick bang Trump gets by tweeting directly to his 16 million-plus followers and the tens of millions more who instantly hear about his tweets from the news media.

“..we need more financial chaos (A) To make even more all time “market” highs (C)..”

• The Equation That Explains It All (Mark St.Cyr)

If you were just woken from some form of suspended animation from let’s say 2010 (ancient economic history in today’s terms) then informed of the current state of global political affairs and upheavals, U.S. employment (95+million not,) global currency gyrations, interest rates at not only 0% but some -0%, threats of escalating wars, threats of major confrontational war, GDP of the major global economies not only contracting, but below statistical stagnant, governments, as well as central banks with balance sheets of debt calculated in $TRILLIONS, some in the 10’s of, all financed at near or below 0%, and the Fed is only about a week away from raising rates into the teeth of what can only be called “uncertainty,” and much, much more. (There isn’t enough time, or digital ink to list them all.)

Nobody would be surprised if your first reaction based on your prior acumen (the ancient history of 7 years ago whether it be in stocks, business, or both) would to become immediately concerned that whatever portfolio, or wealth you may have had in the markets, may be worth far less today than when you were first put to sleep. And probably becoming ever smaller as you thought about what you might need to do next in order to preserve any that may be left. That is, till someone explained to you the markets you went to sleep knowing of – are no longer – and the reality of the markets today you could never have dreamed up. Even if they let you sleep another decade or longer. Today, the markets you once knew of are better described as the “markets.”

To clear up any confusion as to how, or why, the “markets” can now be at “never before seen in the history of mankind highs” once again after the resounding “NO” vote in Italy, where the entire E.U. experiment is now seriously undermined, and falling apart in real-time (Brexit first, Italy will surely now vote next, etc., etc,) [here] is the calculation that explains it all. For under the rules of: If A = B and B = C, then A = C, you now have the magical formula to understand with Einstein like surety today’s ‘markets.” If you have any doubt to the soundness of this expression, consider the following: If a financial crisis appears (A) The central banks will intervene (B) If the central banks intervene (B) The “markets” go up (C) Thus, we need more financial chaos (A) To make even more all time “market” highs (C)

“..the decrease reflects Chinese economic downturn, which is just now beginning and will last a long time since China has passed its economic boom period in which many problems were hidden..”

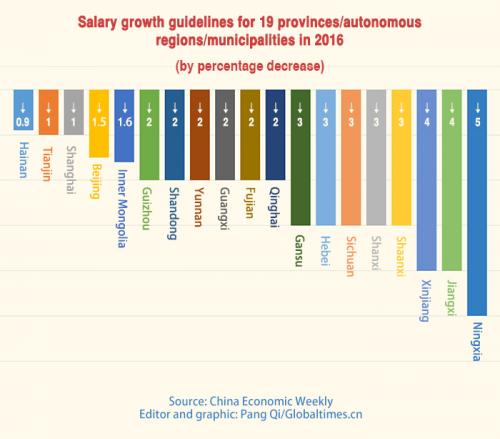

• China Admits “Economic Downturn Just Beginning” (ZH)

In what may be the most direct admission that China’s economy is about to grind to a deflationary halt, today China’s Global Times, a newspaper which is seen as a propaganda companion to the official People’s Daily, revealed data showing this year’s proposed salary guidelines according to which there is a broad wage growth declines in virtually every single province on the mainland, which according to the Chinese publication “confirms the country is experiencing an economic slowdown.” Salary guidelines are issued by local governments as a reference to help firms decide how much they should increase their employees’ salaries. They are based on labor market conditions and economic growth, among other factors.

Global Times notes that compared to 2015 salary guidelines, wages in 2016 have grown at a slower rate in virtually all 19 provinces and regions that have so far published their annual guidelines for firms. Northeast China’s Heilongjiang Province has not released salary guidelines for years as the region has been experiencing a recession and therefore wages are not generally increasing. Seventeen provinces have seen a decrease in salary standards, including North China’s Hebei Province, South China’s Hainan Province, Northwest China’s Xinjiang Uyghur Autonomous Region and East China’s Jiangxi Province. The only increases were seen in Southwest China’s Guizhou Province and Beijing Municipality.

“2016’s guidelines have seen a slowing of salary growth after years of increases, which means that the speed of wage growth has surpassed economic growth since China’s labor contract law was adopted in 2007,” Wang Jiangsong, a professor at the China Institute of Industrial Relations, told the Global Times on Tuesday. Confirming that the only way for Chinese wage growth is down, Wang Jiangsong, a professor at the China Institute of Industrial Relations, told the Global Times that “since China’s labor contract law was adopted in 2007, wage increases have surpassed economic growth.” He said the slowdown reflects China’s economic downturn. It also means that local workers will not be happy.

But more troubling was Wang’s next admission: “the decrease reflects Chinese economic downturn, which is just now beginning and will last a long time since China has passed its economic boom period in which many problems were hidden but now those problems will gradually surface.” In short, declining wage growth, with aggregate 2016 demand driven by the biggest credit impulse and expansion in Chinese history. To all those who truly believe in the global reflation these, we wish you the best of luck.

The shadow banking system gets bigger, not smaller. That should worry Xi to no end.

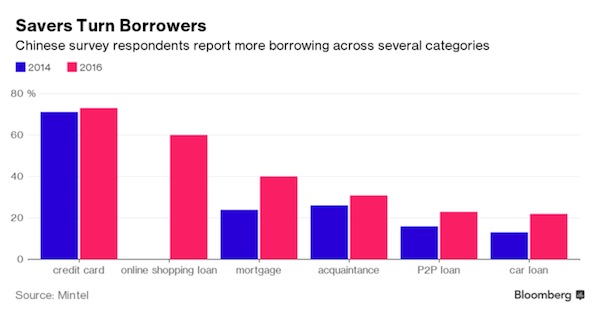

• China’s Big Savers Are Racking Up More Debt (BBG)

China’s savers, who sock away cash like almost no one else in the world, are racking up more debt as borrowing options proliferate. 94% of consumers used a credit or loan in the past year, up from 85% two years ago, according to a survey by market researcher Mintel Group. Peer-to-peer lending via online lenders jumped, while car loans and mortgages nearly doubled, the poll showed. “Huo zai dang xia”, or living in the moment, is the new buzzword. It’s especially prevalent among consumers in their 20s, according to Aaron Guo, a senior analyst for Mintel in Shanghai. “Compared with their parents’ generation, who tend to save more and are sometimes thrifty, youngsters are willing to spend more on products with special features or tailored services,” he said.

That’s a profound shift in attitudes for a nation where saving has long been the bedrock principle of personal financial management and a prerequisite for big milestones like cars, homes and kids. Deposits stand at 59.6 trillion yuan ($8.67 trillion), People’s Bank of China data show. The newfound willingness to borrow from the future to enjoy the present could help support consumption in coming years and nudge the nation’s rebalancing away from old traditional drivers. China’s GDP rose 6.7% in the third quarter from a year earlier on the back of resilient retail sales, which expanded 10.3% in the year to date. The borrowing could be just getting started. China’s household outstanding loans will continue to rise at a rate of 14% for the following five years and exceed 60 trillion yuan by 2021, the Mintel report said.

Presented as a one-off.

• Australia’s Economy Shrinks 0.5%, Most in Eight Years (BBG)

While Australia’s economy shrunk last quarter, it’s probably more of a red flag than a precursor to recession. One of only four quarterly contractions in the past 25 years, the so-called ‘lucky country’ is unlikely to suffer a second consecutive slump — just as in those prior periods. But it’s a wake-up call for lawmakers that recent political timidity and gridlock is unsustainable, as is reliance on monetary policy to support growth with a 1.5% interest rate that may not even fall further. A growing chorus of high-profile economists and international institutions are calling on Australia to follow U.K. and U.S. plans to use infrastructure stimulus, particularly with global borrowing costs so low. But the government has made clear its priority is returning the budget to balance as it seeks to protect a prized AAA credit rating.

Wednesday’s report showed:

• GDP fell 0.5% from previous quarter, when it gained a revised 0.6%

• Decline was driven by slump in construction and government spending

• Result was worst since depths of global financial crisis at the end of 2008 and well below economists’ estimates of a 0.1% drop

• The economy grew 1.8% from a year earlier, compared with a forecast 2.2% gain

• Australian dollar fell almost half a U.S. cent on the data

Nice put-down of a wanker of a man.“He pulled ponytails instead of grabbing pussies.” Does New Zealand have any competent people in politics?

• John Key Was Known As The Smiling Assassin. And People Still Liked Him (G.)

John Key’s legacy will not be defined by great policy achievements; it’s his success as the model of a neoliberal leader – a poster boy for trickle-down economics – that he will be remembered for. Key presided over increasing and gross social inequality with all the glibness of the banker who was known as the “smiling assassin” in his Merrill Lynch days. And people still liked him. In this regard, Key was like a Tony Blair of the South Seas: a certain level of personal charisma and a socially inclusive façade allowed both Key and Blair to sell the nasty side of neoliberalism. Compared with the likes of Donald Trump in the United States and Tony Abbott in Australia, Key was socially moderate in ways that many thought – and hoped – Malcolm Turnbull would have been before he capitulated to the far right of his party on refugees, marriage equality and climate change.

Key was more inclusive, and less divisive. He pulled ponytails instead of grabbing pussies. Key supported marriage equality in New Zealand and, as far as race is concerned, Key’s National party entered into a coalition government with the Maori party not once, but twice. Like Blair, Key had the Teflon gene. Despite ignoring public preferences not to privatise state-owned enterprises (2-1 against in a referendum), increasing the GST during the global financial crisis, and more or less ignoring New Zealand’s chronic child poverty because he blames the victims, none of it stuck. What did stick with Key was his reputation as a smart-money guy who was also likeable, self-effacing and wouldn’t look out of place having a beer with regular folks. Never mind the hundreds of thousands of children living under the poverty line in New Zealand – a country of 4 million – and him brushing off the recommendations of the government panel charged with improving their lot; Key was seen as a good guy and a safe pair of hands.

It’s time for the international press, including Bloomberg, to stop dithering around the topic and tell Brussels to stop this disgrace.

• Europe’s Still Dithering Over Greece (BBG)

This week, the European Union’s finance ministers granted some new debt relief to Greece. The new “short-term” measures are better than nothing – but they’re less than a convincing solution to a problem that has dragged on far too long. The deal, sketched out and agreed to in principle earlier this year, should help the Greek government convince voters to keep accepting much-needed domestic reform. That’s good. It isn’t enough, though, to put the country’s debts and budget plans on a sustainable footing. That’s why the International Monetary Fund, whose support will be necessary to achieve that larger goal, isn’t yet on board. After years of muddling through, the issue still isn’t resolved. In the approach to the latest talks, French Finance Minister Michel Sapin acknowledged that “Greece has made huge efforts. This is the first Greek government in a long time that has implemented its commitments.”

He said it was vital that Europe respond by recognizing its obligation to help ease the country’s debt burden, both as a reward and to encourage further improvements in the business climate. All true. Greece can’t be accused of doing nothing to help itself. The banking system has stabilized after three bouts of recapitalization, and deposits are returning, albeit slowly. The economy is growing modestly. The country posted a primary budget surplus for the first 10 months of this year. State asset sales are proceeding slowly but surely. These efforts justify extending the repayment schedule and swapping some floating-rate debt to fixed payments at the current low rates, as announced. But the expected reduction in Greece’s debts relative to its economic output by 20 percentage points through 2060 is far too timid – while the idea that Greece can achieve an annual primary budget surplus of 3.5% of output throughout the coming decade is a fantasy.

This is why we are raising funds for Greece (see top of this page). So the poor can have a little bit better Christmas. And a little better prospect for the new year. To counter the devastation unleashed by the EU.

• Christmas Spirit Lacking In Greek Bailout Wrangles (R.)

Greece thanked creditors for modest debt relief on St. Nicholas Day in Brussels but did not hide disappointment it won’t get the Christmas gift it wants – a pass on the latest phase of its bailout programme. Athens has been hoping fellow euro zone governments will approve a second review of its third bailout, granted in August last year, before year’s end. A government spokesman said on Tuesday it did not yet rule that out. But others, not least German Finance Minister Wolfgang Schaeuble, made clear that is highly unlikely after a Eurogroup meeting on Monday that revealed differences over how well Greece has done in meeting reform commitments. That left Greece and its allies among its EU partners annoyed at stalemate.

Athens wants to clear the review in order to be able to take advantage of selling bonds to the ECB’s quantitative easing scheme. “We could have got this done by the end of the year but the Germans are not moving,” one EU source said. “Greece has done a lot … We haven’t been so strict in other programmes.” A senior EU official involved in Monday’s talks described them as “useless” in terms of furthering agreement, according to another EU source. Ministers were at odds too on budget targets to set Greece after the bailout regime ends in 2018 – conditions important in persuading the IMF to join in lending. [..] The Eurogroup did agree to a series of short-term adjustments to the structure of Greek debt that will smooth out humps in repayments and should reduce its costs in the long run.

Government spokesman Dimitris Tzanakopoulos called that a “significant success”. But he said Athens still wanted Schaeuble and the IMF to scale back demands for more belt-tightening. “They must stop insisting on continuing a policy of extreme austerity which has been proven destructive for society and also economically ineffective,” he said. Schaeuble made clear he will not be swayed by pleas to forgo economic reforms which, he insisted, were for Greece’s own good.

Note the effects of chemicals on populations.

• Polar Bear Numbers To Plunge A Third As Sea Ice Melts (AFP)

Polar bear numbers could drop a third by mid-century, according to the first systematic assessment, released on Wednesday, of how dwindling Arctic sea ice affects the world’s largest bear. There is a 70% chance that the global polar bear population – estimated at 26,000 – will decline by more than 30% over the next 35 years, a period corresponding to three generations, the study found. Other assessments have reached similar conclusions, notably a recent review by the International Union for the Conservation of Nature (IUCN), which tracks endangered species on its Red List. The IUCN classified the sea-faring polar bear – a.k.a. Ursus maritimus – as “vulnerable”, or at high risk of extinction in the wild.

But the new study, published in the Royal Society’s Biology Letters, is the most comprehensive to date, combining 35 years of satellite data on Arctic sea ice with all known shifts in 19 distinct polar bears groupings scattered across four ecological zones in the Arctic. [..] Researchers led by Eric Regehr of the US Fish and Wildlife Service in Anchorage, Alaska projected three population scenarios out to mid-century, and all of them were bad news for the snow-white carnivores. The first assumed a proportional decline in sea ice and polar bears. Despite year-to-year fluctuations, long-term trends are unmistakable: the ten lowest Arctic ice extents over the satellite record have all occurred since 2007.

The record low of 3.41 million square kilometres (1.32 million square miles) in 2012 was 44% below the 1981-2010 average. This week, the US National Snow and Ice Data Center reported that sea ice extent in October and November was the lowest ever registered for both months. [..] Unfortunately, polar bears face other threats besides a habitat radically altered by the release of heat-trapping greenhouse gases. In the 1980s and 1990s, females and pups were found to have accumulated high levels of toxic PCPs in their tissue and organs. The manmade chemicals – used for decades and banned in many countries in the late 1970s – worked their way up through the food chain, becoming more concentrated along the way.

But a new study, published last week in the Royal Society’s Proceedings B, suggested that declines in some polar bear populations stemmed from contaminated males rendered sterile by the chemicals. “PCB concentrations in the Arctic have levelled off,” said lead author Viola Pavlova, a scientist at the Institute of Hydrobiology in the Czech Republic. “Unfortunately, many other manmade chemicals that are also endocrine disruptors occur in the Arctic and could act similarly,” she told AFP.

Home › Forums › Debt Rattle December 7 2016