Esther Bubley Greaseball, mascot at Stevens Airport, Frederick, MD October 1943

Since we can all attest to the fact that our financial banking economic system is bust and busted, we should probably look at ways to repair and cure it. And we don’t want to wait for the system to repair itself from the inside with the aid and abetment of its political stooges, revolving door and otherwise, because that will only lead to everyone else paying through the nose for a system they didn’t break to begin with. If we don’t seize control over this ourselves, it will never be cured, and the guys that went for broke and succeeded will make out like bandits and disappear like thieves into the night, leaving us with enough damage to last for multiple and miserable generations.

That last bit may not be evident to you, because the spin cycle runs at full force and speed, but what you think is the financial system is more volatile and vulnerable than probably ever before, based as it is on central bank handouts exclusively, and can’t take much if any sudden swings. I got three first points together that I think we need to execute, and one is still kind of optional, but there are many more, so let’s have suggestions. Abandoning the use of money altogether is not one I consider to be serious, or one world governments or currencies or debt jubilees.

1) All money must be banned from politics

This is so obvious that maybe that’s precisely the reason it’s ignored. As I said before, if you allow money to enter your political system, money will end up buying the system. That’s where one man one vote becomes one dollar one vote, and that isn’t the spirit of anyone’s constitution. It IS the reality of politics all throughout the western world though. In theory every American has the same weight as Jamie Dimon or the Koch brothers, but in practice that’s just an absurd notion.

Incidentally, just today the US Supreme Court struck down more limits on money that can be handed to politicians, claiming that the limits deny potential donors freedom of speech. And of course that’s just a next step, and of course the Cargenies of the planet have had a much bigger say than your (great-) grandparents for a long time, but how can you call that democratic, and how does it boost free speech that some people can buy a candidate’s time and others cannot? At least have the decency to tell the great unwashed that you changed over into an aristocracy or meritocracy or whatever fancy name you can come up with. Just not democracy.

It may seem like a dead and moot point, but banning money from politics is essential. There are plenty of possible systems under which a state can make a fixed amount of campaign money available for candidates, so there are no practical constraints. More than enough ideological ones, however, judging from Roberts and Scalia cum suis. Total campaign donations in the 2012 elections surpassed $6 billion, and one of Hillary’s 2016 superpacs recently estimated her campaign would cost over $1.7 billion alone. And there’s still people who go vote. Go figure.

2) One country must restructure its entire financial system

Since the global banking system is so interconnected, all it would take to cleanse the system from all the festering debt that still resides within it is for one country to shut all banks on its territory one day and go through their books until there’s not a single stone unturned. People can be allowed – perhaps limited – access to their money while the investigations take place, and foreign banks will have the choice of either participating, with their books opened, or close their branches. Hidden losses will be written down, and banks with too much unpaid debt will be made to default. Bondholders will be the first to absorb losses, and an order created in which other creditors either get paid or not.

It may well be more complicated than I put it now, but just think of the advantages: at the end of the process, the first country to do this will be the only “rich” country to come out with a truly clean bill of financial health. That will attract a lot of investment. It will also attract a lot of anger, but the dirty secrets hiding in the ledgers should shut up a lot of that anger.

3) One country must leave the EU.

This one is optional, but it would help the process along in a big way. I can think of no other reason some countries are still in the EU, other than they have handpicked leaders who happen to have a past in banking. It may be a tough task to go from euro’s to lira or drachmas or escudos, but it will be worth it because the flaws in both the common currency and the bureaucracy that pushes it will be exposed.

I saw Barroso talk the other day about ” … in my ten years as chairman of the European Commission … “, and I was thinking: that unelected beanbag has been in office for ten years, while the leaders and parliaments of European nations’ governments must be (re-)elected every 4 years (or so). To gauge if the people (still) have faith in them, to gauge if broken promises are not held too much against them. The very least Brussels should do is put a maximum term on everybody’s stay, but it’s been a Barroso and Van Rompuy and Rehn and Juncker game of revolving door musical chairs for a very long time now and they’re not going to leave on their own.

It’s like a private enterprise runs the world’s second most populous democracy after India. How is that even possible? And there are European parliamentary elections in May, but they’re not going to leave after that either. At least US senators and congressmen, rich and corrupted as they may be, need to get re-elected.

Once one country leaves the EU and eurozone, more will follow soon after. And that will be the end of a once well-intentioned experiment gone horribly awry. But at least the Greeks and Italians will no longer be held prisoners by the global troika money cabal. They’ll have the freedom to rebuild and go deal with their own domestic corruption issues instead of international ones.

And make no mistake: such upheaval in Europe will have a huge impact in the US. Volatile and vulnerable are the key words.

• ‘Epic’ Debate On High-Frequency Trading (MarketWatch)

Michael Lewis came face-to-face with one of the antagonists of his book on high-frequency debate on Tuesday. The author of the new book “Flash Boys” got into a heated debate on live TV with BATS Global Markets exchange president William O’Brien about the pros and cons of high-frequency trading and whether it ruins the markets for the retail investor. On CNBC on Tuesday, Lewis accused HFTs of “rigging the market” and touted the new exchange IEX making a more even playing field. “I think he is outrageous and part of the problem,” said Lewis pointing to the BATS president. “This is the heart of capitalism right now, the unfairness of the exchanges.”

Founder of IEX exchange, Brad Katsuyama, also joined the cast to battle out whether the high-frequency traders beats out the regular investor. “I believe that the markets are rigged and I think you are part of the rigging,” said Katsuyama directly to O’Brien. Katsuyama went on to the explain why traders should price trades more fairly. The exchanges’ view of the market is slower than some of their fastest participants, he said. “Shame on both of you for falsely accusing thousands of people on wrongdoing…to try to build a business on fear, mistrust and accusations,” shot back O’Brien.

• High-Frequency Traders Chase Currencies as Stock Volume Recedes (Bloomberg)

Forget the equity market. For high-frequency traders, the place to be is foreign exchange. Firms using the ultra-fast strategies getting scrutiny thanks to Michael Lewis’s book “Flash Boys” account for more than 35% of spot currency volume in October 2013, up from 9% in October 2008, according to consultant Aite Group LLC. It’s the opposite of equities, where their proportion shrank to 50% in 2012 from 66% four years ago, according to Rosenblatt Securities Inc. As brokers get better at cloaking orders and volume shrinks in stocks, speed trading remains a growth business in the $5.3 trillion foreign-exchange market, where authorities on three continents are examining the manipulation of benchmarks.

While some see them as a sign of transparency, the tactics are catching on just as their role in equities is probed by the New York state attorney general and Federal Bureau of Investigation. “The use of HFT will make trading and regulation in the FX market more complex, and there would also be some questions over the fairness,” Anshuman Jaswal, senior analyst at research firm Celent in Boston, said by e-mail. “Use of HFT also increases liquidity and depth in markets. Both sides of the argument carry some weight, and there is no one right answer.”

The debate surrounding high-frequency trading, a term describing strategies that use lightning-fast computers to eke out profits in securities markets, blew up this week after Lewis published “Flash Boys” and said U.S. equities are rigged. The book makes few references to currency, saying instability HFT creates is bound to spread from equities sooner or later.

About 30% to 35% of transactions on EBS, an electronic trading platform owned by ICAP Plc that facilitates currency deals, are high-frequency driven, the Bank of International Settlements said in a December report. The rise in electronic and algorithmic trading is prompting firms to set up shop close to the servers of electronic platforms, a strategy to reduce transmission time that has long been popular in stocks. High-frequency strategies flourished in American equities as rising computer power and two decades of regulation broke the grip of the New York Stock Exchange and Nasdaq Stock Market and trading spread to more than 50 public and private venues. Now, speed traders are proliferating in foreign exchange.

• Fault Runs Deep in Ultrafast Trading (NYT)

“The United States stock market, the most iconic market in global capitalism, is rigged.” That’s what Michael Lewis told Steve Kroft on the CBS show “60 Minutes” on Sunday evening. It was a clever, if hyperbolic, way for Mr. Lewis to describe the topic of his important new book, “Flash Boys,” a make-your-blood-boil read about the abusive way that high-frequency trading works. Mr. Lewis’s well-crafted narrative highlights a perverse system on Wall Street that has allowed certain professional investors to pay hundreds of millions of dollars a year to locate their computer servers close to stock exchanges so they can make trades milliseconds ahead of everyone else.

In some cases, the superfast investors are able to glean crucial information from the stream of trading data flowing into their systems that allows them to see what stocks other investors are about to buy before they are able to complete their orders. There is only one problem with Mr. Lewis’s tale: He reserves blame for the wrong villains. He points mostly to the hedge funds and investment banks engaged in high-frequency trading. But Mr. Lewis seemingly glosses over the real black hats: the big stock exchanges, which are enabling — and profiting handsomely — from the extra-fast access they are providing to certain investors.

While the big Wall Street banks may have invented high-speed trading, it has gained widespread use because it has been encouraged by stock markets like the New York Stock Exchange, Nasdaq and Bats, an electronic exchange that was a pioneer in this area. These exchanges don’t just passively allow certain investors to connect to their systems. They have created systems and pricing tiers specifically for high-speed trading. They are charging higher rates for faster speeds and more data for select clients. The more you pay, the faster you trade. That is the real problem: The exchanges have a financial incentive to create an uneven playing field.

This is not to suggest that high-frequency hedge funds and banks aren’t complicit; they are. And some may be doing more than simply taking advantage of the rules. Eric T. Schneiderman, New York’s attorney general, recently began an investigation into high-frequency trading. “There are some things here that may be illegal,” he told Bloomberg News. “There are some things that may now be legal that should be illegal or that the markets have to be changed.”

• How Superman III Explains High-Frequency Trading (Bloomberg)

Michael Lewis’ latest book “Flash Boys” explores the world of High Frequency Trading. To understand this complex process, you don’t need to read a whole book, all you need is a copy of the notoriously bad movie Superman III.

• Speed Trading in a Rigged Market (Ritholtz)

On “60 Minutes” last night, author Michael Lewis made a bland assertion: High-frequency traders, he said, working with U.S. stock exchanges and big banks, have rigged the markets in their own favor. The only surprising thing about Lewis’s assertion was that anyone could be even remotely surprised by it. The math on trading is simple: It is a zero-sum game. One trader’s gain is another trader’s loss. Only in the case of HFT, the losers are the investors — by way of their pension funds, retirement accounts and institutional funds. The HFT’s take – the “skim” – comes out of these large institution’s trade executions.

The technology behind HFT may be complex, but the math is that simple. Once the Securities and Exchange Commission allowed stock exchanges to share with traders all of the unexecuted incoming orders, it was hard not to make money by skimming a few cents or fractions of a cent from each trade. Several years ago, the founder of Tradebot, one of the biggest high-frequency firms, had said that the firm had “not had a losing day of trading in four years.” The firm’s average holding period for stocks is 11 seconds.

Any professional trader can tell you that his job is to manage risks. It is a statistical certainty that a percentage of trades will be losers. You are establishing a position with an unknown outcome. Sometimes they go your way, other times they go against you. How is it possible that one of the largest high-frequency trading firms executes millions and millions of orders for four years without ever having a down day? The short answer is what they do is not trading — it is skimming. I call it legalized theft. High-frequency trading is a tax on investors, encouraged by the exchanges, allowed by the SEC. It is prima facie proof that something is amiss.

It is interesting to note that the rigging theme is consistent with everyone who looks closely at this subject. My colleague Josh Brown notes that markets haven’t become rigged, they have always been rigged. What is different is the ability of high-frequency traders to see other people’s orders, jump ahead of them, and then sell that exact same stock to them, at a higher price. It is the ultimate market-skimming operation.

The specialist system that pre-dated HFT had its flaws, as we saw in the 1987 stock-market crash. But it also had one crucial redeeming factor: A human being stood ready, willing and able to make a market in a stock when other buyers and sellers disappeared. HFTs, on the other hand, have no such obligation. When things get rough, they unplug their machines. This makes their claims of added liquidity laughable. They are the centerpiece of a flawed system without any socially redeeming qualities. I am looking forward to reading “Flash Boys.” I hope our members of Congress and the folks at the SEC do so too.

• China Burns Speculators as $5.5 Billion Lost on Yuan Bets (Bloomberg)

China is succeeding in making its currency less predictable. Investors are paying the price. Clients of U.S. commercial banks have lost about $2 billion this year on $332 billion of options betting the yuan would appreciate, while Chinese companies lost $3.5 billion on $150 billion wagered on a benchmark forwards contract, according to data compiled by Morgan Stanley and the Depository Trust & Clearing Corp. in Washington. These contracts, when including bearish bets, account for more than a third of global trading in the Chinese currency.

After almost a decade of gains, speculators had come to regard the yuan as a one-way trade, leading to a surge in capital inflows that stands to leave the country vulnerable to a sudden shift in investor sentiment. Policy makers responded by selling the yuan and widening its trading band, encouraging a record 2.4% quarterly decline that was the biggest among Asian currencies. “The depreciation was engineered to burn the fingers of speculators,” said David Loevinger, a former senior coordinator for China affairs at the U.S. Treasury and now a Los Angeles-based analyst at TCW Group Inc., which oversees $132 billion. “The People’s Bank of China wants two-way volatility embedded in the market.”

You know, you got some steel and you use it as collateral for a loan to get more steel (or some other asset). Rinse, repeat and get rich.

• Steel Defaults Seen by S&P as Yuan Ruins Ore Loans (Bloomberg)

The Chinese steel industry’s ability to survive 1 billion yuan ($161 million) of losses per month without more defaults is under threat as a slump in iron ore and the yuan undermines a key source of financing. The currency has weakened 2.5% this year and a measure of exchange-rate swings reached a record, prompting Goldman Sachs Group Inc. to predict funding that uses the steelmaking ingredient as collateral will drop over the next two years due to foreign-exchange hedging costs. Iron ore prices fell 11% in the past five months as cash shortages at closely held mills prompted what Morgan Stanley says is panic selling.

Chinese steelmakers, which account for almost half of the world’s production, can ill afford a funding squeeze as an industry association reported 43% of them made losses in January amid an 8.6% slump in demand from a year earlier. Nanjing Iron & Steel told investors on March 22 its bonds will be delisted, while Caixin magazine reported on March 25 that Shanxi-based Haixin Iron & Steel Group can’t repay loans.

“Private steelmakers will see very significant operational problems and funding issues this year, so we could see another default,” Sangyun Han, a Hong Kong-based credit analyst at Standard & Poor’s Ratings Services, said in a phone interview yesterday. “Higher volatility of the currency is another negative factor in their financing in addition to volatile iron ore prices and weak demand.”

About 40% of the iron ore at China’s ports are part of commodity finance deals, according to Mysteel Research, as cash-starved companies bring in cargo to secure lines of credit. Stockpiles have reached a record 108.45 million metric tons, up 41% in the past year, reflecting both increased use in funding and declining demand from mills. The ore is priced in dollars and usually bought using letters of credit, which means any decline in the yuan causes losses at the time of repayment.

• Ex-President Jiang Urges Beijing To Curb Anti-Corruption Drive (FT)

Jiang Zemin, the former Chinese president, has urged the current leadership to rein in the toughest anti-corruption campaign in decades, which is threatening the interests of some Communist party elders. Mr Jiang, who stepped down as president of China in 2003 but retained control of the military for a further two years, has sent a clear signal in the past month to Xi Jinping, the president, according to three people familiar with the matter. Mr Jiang sent a message saying “the footprint of this anti-corruption campaign cannot get too big” in a warning to Mr Xi not to take on too many of the powerful families or patronage networks at the top of the party hierarchy.

Former President Hu Jintao, who was replaced by Mr Xi a year ago, has also expressed reservations about the anti-corruption drive and warned his successor not to expand it too far, according to one person involved in executing the campaign. President Xi has made tackling corruption and official largesse the centrepiece of his presidency, vowing to tackle powerful “tigers” (high-ranking officials) as well as “flies” at lower levels in the bureaucracy. In the coming weeks, the authorities are expected to reveal public charges against one of the biggest tigers in the Chinese system: Zhou Yongkang, the former head of the domestic security apparatus.

Mr Zhou was detained by Communist party investigators late last year along with hundreds of family members and allies throughout the security services, energy industry and political bureaucracy. If he is put on public trial, he will be the most senior Chinese official to face such charges since the founding of the People’s Republic in 1949. Mr Hu and Mr Jiang have been broadly supportive of the anti-corruption drive until now and both accepted Mr Xi’s decision to purge Mr Zhou, even though Mr Zhou was a Jiang ally for many years, according to people familiar with top leadership discussions. But both leaders think the campaign has gone far enough and that further escalation could harm their own interests or those of their respective factions.

• Debt Troubles Within The Great Wall (FT)

Is China different? Or must its borrowing binge, like most others, end in tears? This is now a hotly debated topic. On one side are those who predict a Chinese “Minsky moment” – a point in the credit cycle at which, as Hyman Minsky foretold, panic grips the financial system. On the other side are those who insist that China’s debt mountain poses no threat to the planned growth of the economy: the authorities say it will be above 7% and above 7% it will be. [..]

First, if you take the official statistics at face value, China’s net exports shrank from 8.8% of gross domestic product in 2007 to 2.6% in 2011. This was offset by a jump in the share of investment over the same period, from 42% of GDP – already extremely high – to 48%. There are reasons to doubt reported levels of investment, but it is less reasonable to question its abrupt rise.

Second, linked with the rise in the share of investment was an explosion in credit and debt. According to the International Monetary Fund, by the final quarter of last year total “social financing”, as the Chinese authorities describe it, had reached 200% of GDP, up from only 125% before the crisis. Moreover, much of this increase had been outside traditional banking channels. Instead, there has been explosive growth of what one might call a “shadow banking system with Chinese characteristics”. This does not rely on the complex securitisations or wholesale markets now notorious in the west – but rather on new intermediaries, such as trusts, and innovative instruments such as “wealth-management products”. According to Fitch, the credit rating agency, credit outstanding to the private sector is now as big, relative to GDP, as it was in the US in 2007.

Third, China’s growth rate has slowed from 10% or more in the past decade to about 7% in 2012 and 2013. This is still high. But it is not quite as high. Imagine you were told of an unnamed economy that had soaring investment and credit, but falling growth. A rising proportion of investment activity was being funded by debt, while at the same time returns were falling. You would surely expect an unhappy ending.

• Hong Kong Wins From China Credit Woes as Loans Reach Record (Bloomberg)

Hong Kong’s syndicated loan market enjoyed a record first quarter as Chinese companies shunned local financing in favor of cheaper offshore funds. Lending in the city surged 41% to $20.8 billion in the first three months compared with a year earlier, the busiest start since Bloomberg starting tracking the data in 1999. Volumes in China shrank 45% to $5.8 billion, the worst first quarter in four years. Onshore borrowing costs for the nation’s top-rated companies jumped 30 basis points to 5.89% in March, the biggest monthly rise since November, ChinaBond data show.

Hong Kong is luring Chinese companies as interest rates surge in the world’s second-largest economy amid lending curbs and its first onshore bond default. In the three months through March, borrowers led by Cnooc Ltd. (883) and Dongfeng Motor Group Co. agreed offshore loan margins that averaged 227 basis points more than benchmark rates, down from 254 a year earlier. “The trend for offshore borrowing in Hong Kong is likely to continue this year,” said Pedro Cheung, the head of corporate finance at Bank of China Ltd. (Hong Kong). “China’s onshore borrowing costs have increased and liquidity is relatively tight.”

• Stiglitz: Inequality An Equal Concern for China, U.S. (Caixin)

Your latest book talks about the price of inequality, which is very pertinent to both the United States and China. The Gini coefficient of the two countries is almost the same, surprisingly. What observations would you make of that?

The Gini coefficient is almost the same. The situations are different, and the nature of inequality is different. So for instance, over the last 30 years, China has done a lot to reduce poverty at the bottom, and the people in the middle have done very well. Where the inequality has come is that people at the top have done even better. Also, in the early stages of development, it’s almost always the case that some parts grow faster than others. The coast grows faster than the west, urban areas always grow faster than the rural areas.

So in the early stages of development, it is quite often the case that inequality increases. It’s not an excuse, but it is a description of what often happens. It’s also a warning that one has to take strong policies to try to prevent this from getting worse, policies to try to keep the country together. The distinctive aspect of the U.S. is that it has become the country, among well-developed countries, with the highest level of inequality, whereas China, by any means, does not have the worst inequality amongst the emerging markets. Its increase is a worry, but it’s not the worst. In the U.S., it’s a real worry because it is clearly the worst.

The nature of inequality in the U.S. is that it has all three aspects. The top is getting a larger and larger share. Between 20% and 25% [of wealth] goes to the top 1%. The share of the top 10% has increased three- to fourfold in the last 30 years. The bottom is getting poorer. The fraction of the population in poverty has increased. One out of 40 American children live in poverty, and then the middle is stagnating. The median income in the U.S. today is roughly the same as it was a quarter century ago.

The wealthiest 50 delegates on China’s congress control $15.3 billion, while the 50 richest members of U.S. congress only controls $1.6 billion in total. So does that mean the U.S. Congress represents the people, whereas China’s represents rich capitalism?

I think both countries have to be sensitive to economic inequality getting translated into political inequality, and political inequality creating economic inequality. It’s a vicious circle that one has to worry about undermining our economy and our society. So I think that’s an ailment that is common in both. The title of my book “The Price of Inequality” reflects my judgment that we are paying a high price for this inequality, a high price in economic performance. We could have a faster growing economy, a more dynamic economy with more equality. But we’re also paying a political price. The sense of confidence in our institutions is being undermined. If citizens don’t believe that politicians are making decisions on their behalf, it corrodes trust.

Now, in the U.S., the people making the decisions may not be the wealthiest, but they may be making the decisions on behalf of the wealthiest because the wealthiest are paying them. That’s the wealth behind power. In fact, the problem is getting elected in the U.S. is extremely expensive. In the last election, both candidates spent $1billion. Now they didn’t have that billion dollars. They had to raise it, and when you raise it from people, most weren’t doing it as an act of charity but as an investment. And when they make an investment they expect a return.

• Canada’s Getting Richer. Most Canadians Aren’t. (Bloomberg)

Canada’s Conservative government has long made sound economic management the centerpiece of its claim to office. Now, with the country’s outlook showing mixed signals and a federal election coming next year, I’m looking at ways to measure the health of the economy, and what each says about Canada’s. The last installment looked at the state of the labor market, and explained how raw numbers are probably the least useful metric.

But in deciding whether a government has delivered good jobs, people’s ability to find work is only half the story. The other half is how much money they’re making. When the Conservatives took office in 2006, the median family income was $47,600. In 2011, the latest year for which Statistics Canada has released figures, it was $47,700. (Both figures are in 2011 dollars.) In other words, at the end of Stephen Harper’s first six years as prime minister, a household in the middle of the income distribution was pulling in $100 more than it did when he took office.

In fact, 2011 median income was $1,600 lower than at its pre-recession peak in 2008. Things have looked a little better for those at the top of the income distribution. In 2006, adjusted market income for the highest-earning 20% of Canadian families was $104,000; by 2011, that had increased 5%, to $109,200. The change was less sunny for the bottom quintile of families, who saw their adjusted market income fall 6% over the same period, to $8,300 from $8,800.

Another important indicator on income is the share of Canadians earning the minimum wage. In a healthy economy, that share would be steady, or even falling. Instead, the portion of workers getting the adult minimum wage last year was 6.7%, a 50% jump over the level when the Conservatives took office. One could argue that an increase in minimum-wage workers was to be expected during the recession. Indeed, the share started rising in 2009. But four years later, the portion of minimum-wage workers doesn’t seem to be falling back to pre-recession levels.

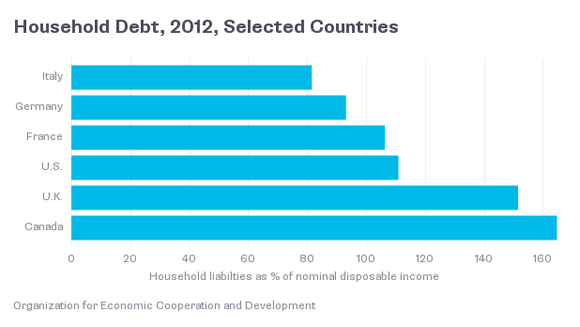

As incomes stagnated, the cost of living rose, pushing households deeper into debt. In 2006, Canadian households had debt equal to 135% of their nominal disposable income, a figure roughly equal to U.S. households and about one-fifth lower than in the U.K. By 2012, household debt had jumped to 165% of disposable income in Canada, while it fell to 111% in the U.S. and 152% in the U.K. In fact, of the countries for which the Organization for Economic Cooperation and Development reports these data for that year, Canada’s household debt levels were the highest for 2012, the latest for which figures are available.

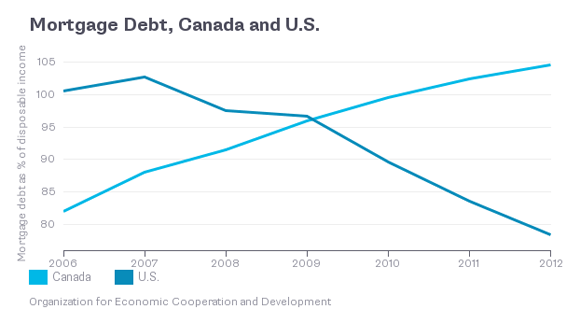

Unsurprisingly, much of that increase came from larger mortgages, as housing costs have rocketed up and Canadians borrow more to pay those costs. Mortgage debt as a share of nominal disposable income rose from 82% in 2006 to 105% in 2012. In effect, Canada switched places with the U.S., where those figures moved in the opposite direction.

The best proof that Europe will slide down into deflation is to be found in the incessant across the board denial by European ‘experts’ and politicians that it will.

• The Eurozone: Sleepwalking Towards Japan (Guardian)

The timing could hardly have been more opportune: just days before its next policy meeting, the European Central Bank (ECB)has been provided with evidence that deflation edges ever closer. The annual inflation rate in March across the 18-nation eurozone dropped to 0.5%, its lowest level in over four years. Five countries are already seeing prices drop year on year. Faced with the same data, the response of the US Federal Reserve or the Bank of England would not be in doubt: policy would be eased. But this is the ECB we are talking about, so the financial markets are in two minds as to what will be decided on Thursday.

Initially, the euro fell on expectations that the ECB would be forced to act. But then the markets had second thoughts, noting that the president of the Bundesbank, Jens Weidmann, had commented at the weekend that the growth picture was improving and that inflation was being driven lower by temporary factors. The suspicion that the ECB will sit on its hands led to the euro rising against the dollar, the pound and the yen. The ECB needs to be extremely careful that it does not sleepwalk its way to disaster. The short-term threat of deflation may well be exaggerated by the timing of Easter in 2013 and 2014. It may also be the case that falling inflation is boosting real consumer incomes by making pay packets go further.

But growth is weak, banks are reducing their lending, credit is contracting, and the ECB is reducing the size of its balance sheet. To cap it all, the euro has been strengthening at a time when a key export market – China – has been slowing. Sure, in the best of all worlds, the eurozone recovery will continue to strengthen. But the risk of growth losing momentum – as it did in the UK in 2011 and 2012, before the announcement of the Funding for Lending scheme – is real. The eurozone is one mild recession away from being the new Japan. Hence the need for policy action. Starting this week.

• François Hollande’s Deficit Plea Sets Up Clash With Brussels (FT)

A demand by France for more leeway in imposing Berlin-backed austerity policies has reignited a fight at the core of the eurozone over how to promote growth in countries struggling to pull out of recession. Paris traded blows with Brussels on Tuesday over the issue after President François Hollande made clear after appointing a new prime minister that he wanted a delay in meeting targets for the budget deficit to allow room for his new growth plan. Arnaud Montebourg, the outspoken leftwing industry minister who is set to occupy a prominent role in the new government, condemned the European Commission for its “austerity and dogma” and for being “totally useless on the question of growth”.

Like Mr Hollande, Matteo Renzi, the new Italian prime minister, has repeatedly suggested he should be allowed to flout the budget deficit limit if it presents a credible reform effort. But the European Commission, charged with enforcing the eurozone’s tough new fiscal rules, signalled it would not look favourably on French requests not to be held to its already delayed target of reducing its budget deficit to 3% of national income by 2015. Berlin, backed by the Finnish government, in February issued a stinging rebuke of the Commission’s 2013 decision to give Paris and Madrid two additional years to get under the 3% deficit ceiling. It accused Brussels of using “a somewhat arbitrary approach” to granting leniency.

A confidential paper, distributed to all EU finance ministries and obtained by the Financial Times, made clear that Germany believed France and Spain had failed all criteria required to be granted budget flexibility. Olli Rehn, the EU economic commissioner in charge of evaluating eurozone budgets, has publicly warned Mr Renzi’s government that Brussels will have no choice but to cite Italy formally if it breaches the 3% limit. Reacting to Mr Hollande on Tuesday he noted that Paris’ deadline “has already been extended twice in recent years”. Speaking at a meeting of EU finance ministers in Athens, he added: “What is important now is France make the necessary structural effort. I believe it is essential France acts decisively.”

• Italy Turned Into A Launch Pad For The US Empire (RT)

Italy is in fact a limited sovereignty country. “Italy appears in many respects to be a colony,” says the Italian philosopher, Gianni Vattimo, former European MP. “On one hand it is a Vatican colony, on the other it is an American colony, an American State even, without the power to elect the president. We are a limited sovereignty country indeed. We are a kind of Batista’s Cuba with military bases instead of brothels.”

Well, the bases are obviously not simply an old gift from the Cold War, they are the claws and antennas of the Empire. Calling the US an empire is not some kind of hippie 1968 revolt jargon. If you have any doubts, read the US 2012 Defense Strategic Guidance. You will see that it speaks of US military power expanding globally exactly as empires have always done in history. This is said to be in the national interest (a word that only the US can use) and, more superficially, i.e. ideologically, in the “common interest.”

Obviously they never speak of aggression but always about facing global threats. To quote the DSG at its most ideological level ironically resounds as a modern global philosophy “à la Habermas”: “Across the globe we will seek to be the security partner of choice, pursuing new partnerships with a growing number of nations — including those in Africa and Latin America — whose interests and viewpoints are merging into a common vision of freedom, stability, and prosperity.”

To achieve this, the US has more than 1,000 bases around the world, plus 4,000 at home. Pressed by Congress, the Pentagon said that this network in 2012 had a cost of $22 billion, but in reality no one is really capable of fathoming the depths of the US military annual balance sheet. A recent calculation by David Vine, assistant professor of anthropology at American University, in Washington, DC, guess that the real cost is around $170 billion. In Vine’s definition, US bases are the “Launch Pad” for the Pentagon’s unending war program.

• Cyprus Wants to Seize Assets to Tame Bad Debt (Bloomberg)

Cypriot lawmakers must make it easier for banks to seize property when borrowers default to tackle the issue of bad loans, the country’s most pressing issue, central bank governor Panicos Demetriades said. Borrowers who intentionally fail to repay loans need to be reined in, Demetriades said in an interview yesterday in Athens. A possible political fight may delay planned legislation to tackle the Mediterranean nation’s stock of bad debt, he said. The law is required under the country’s 10 billion-euro ($13.8 billion) international rescue put together a year ago.

“There’s a lot of strategic default happening,” Demetriades said. “Borrowers need to know that there’s a consequence when you don’t pay. It’s still the case that the banks are not able to basically carry out any repossessions in any meaningful timeframe. That’s the top priority now, to address NPLs,” or non-performing loans.

A holdup in addressing bad debt could, as happened in Greece, hamper Cyprus’s plan to recover from a financial crisis that came close to forcing the country out of the euro. Demetriades, who also sits on the European Central Bank’s Governing Council, steps down on April 10 after resigning in the wake of a long-running feud with Cypriot President Nicos Anastasiades. Demetriades declined to comment on the circumstances of his resignation. Demetriades will be succeeded by Chrystalla Georghadji, the country’s auditor general.

The discussion about whether or not the UK has a real estate bubble won’t be resolved until it blows up in Britain’s faces. Fear of a bubble? Hey, if 18% per year is not a bubble, what is?

• Fears Of Bubble As London House Prices Rise 18% (Guardian)

House prices in London have increased by almost a fifth over the past 12 months, and are now 20% above their pre-crisis peak, according to the latest data from the country’s biggest building society. In news that will fuel concerns of a price bubble in the capital, Nationwide building society said the average price of a London home had increased by 18% over the year and by 5.3% in the past three months alone, and at £362,699 was now more than twice the figure for the rest of the UK.

“The gap between house prices in London and the rest of the UK is the widest it’s ever been, both in cash and percentage terms,” said Nationwide’s chief economist, Robert Gardner. “Overall, the southern regions have been outperforming for some time, with the result that house prices in London, the outer metropolitan and outer south-east have now surpassed their pre-crisis peaks,” he said.

• Russia To Construct Gas Pipeline To Crimea (RT)

Russian gas exporter Gazprom will build a pipeline to supply gas to energy-strapped Crimea, according to the Russian Ministry of Energy. “Without gas in Crimea there is no possibility for new production, therefore the likelihood of the project is 90%,” a senior official at the Ministry of Energy told Vedomosti on Tuesday. Since the project is in its early stages, the cost is highly speculative, and ranges from $200 million to $1 billion, depending on the route of the pipeline. The more expensive option is a 10 billion cubic meter capacity pipeline that would run between Russia’s southern Krasnodar region to Sevastopol.

The more economic option would start in Anapa, another city in the Krasnodar region on the northern coast of the Black Sea, adding an extra section to the existing South Stream project. However, the project would take at least two years, according to Michael Korchyomkin, director at European Gas Analysis. The most important thing that needs to be studied before construction kicks off is Crimea’s own resource potential, as Vedomosti cites its source in one of the project institutes. “First we are considering Crimea’s shelf,” Interfax quoted Sergey Donskoy, Crimea’s Natural Resources Minister, on Monday. Data is still being collected, Donskoy added.

In 2013, the Crimea peninsula consumed 650 million cubic meters of gas, according to Crimea’s Deputy Energy Minister Vadim Zhdanov. In the summer Crimea’s demand is about 2 million cubic meters per day and in the winter roughly 10 million cubic meters. On Tuesday, Gazprom announced new gas prices for Ukraine; $385.5 per 1,000 cubic meters, an increase from the discounted $268.50 per 1,000 cubic meters the country enjoyed in the first quarter of 2014. As part of the Russian Federation, Crimea will likely not have to pay this price, but a fraction, as Russia caps domestic natural gas prices, and they are usually a quarter of what is charged to European and CIS clients.

• In The US, Democracy Is Now A Sham (ClubOrlov)

The founding principle for this new form of government which emerged in the 18th century, was that the Common Man was the ultimate source of power. Citizen legislators would enact the laws and shape the nation’s destiny. But instead, our republic is now strong-armed by professional politicians. The two dominant concerns of these careerists are to STAY in power and to do the bidding of those who ENABLE them to stay in power. Anyone who doubts this statement might try explaining why campaign finance reform and term limits are perennially “off the table.” Actually, that is an understatement – they aren’t even in the building.

It is bad enough that the President, Congress and the Courts serve the interests of a minority that is so tiny that it is almost microscopic. What is even worse, is WHO that elite constituency is. It is exclusively THE BIGS: Big banks, Big corporations, Big agriculture, Big energy, Big pharmaceuticals, Big health care, Big high tech and the BIGGEST of them all – the military-industrial complex.

The “Vox Populi” – voice of the people is now as quaint and outmoded as telephone booths on street-corners. Even when there is a massive outpouring of disapproval for a policy – such as the enormous public outcry against Iraq Invasion 2 – the will of the people is disregarded. Instead, the “leaders” kiss the sterns of their financial backers. Ten million irate citizens cannot offset a single Halliburton.

But not only has genuine democracy vaporized, its putrid carcass is used against the ordinary person for whom it was initially conceived. Our demagogues give stirring speeches applauding our inalienable rights and the freedoms that our constitution protects. But at the same time, they barely whimper when a whistle blower reveals that the surveillance grid that is monitoring our behavior is beyond the wildest imaginings of Orwell or Huxley. And when the head of the Department of Omnipresent Surveillance admits that he lied to Congress, he is not prosecuted for perjury. Amazingly, he doesn’t even lose his job.

When the President signs the NDAA act which allows for “indefinite detention” of citizens without formal charges or without the right to a lawyer, it should be utterly clear that the boot of Soft-Core Tyranny is now on our neck. And that unchecked and almost unnoticed power continues to grow at an obscene pace.

• NSA Performed Warrantless Searches On Americans’ Calls And Emails (Guardian)

US intelligence chiefs have confirmed that the National Security Agency has used a “back door” in surveillance law to perform warrantless searches on Americans’ communications. The NSA’s collection programs are ostensibly targeted at foreigners, but in August the Guardian revealed a secret rule change allowing NSA analysts to search for Americans’ details within the databases. Now, in a letter to Senator Ron Wyden, an Oregon Democrat on the intelligence committee, the director of national intelligence, James Clapper, has confirmed for the first time the use of this legal authority to search for data related to “US persons”.

“There have been queries, using US person identifiers, of communications lawfully acquired to obtain foreign intelligence targeting non-US persons reasonably believed to be located outside the United States,” Clapper wrote in the letter, which has been obtained by the Guardian. “These queries were performed pursuant to minimization procedures approved by the Fisa court and consistent with the statute and the fourth amendment.”

The legal authority to perform the searches, revealed in top-secret NSA documents provided to the Guardian by Edward Snowden, was denounced by Wyden as a “backdoor search loophole.” Many of the NSA’s most controversial programs collect information under the law affected by the so-called loophole. These include Prism, which allows the agency to collect data from Google, Apple, Facebook, Yahoo and other tech companies, and the agency’s Upstream program – a huge network of internet cable taps.

Confirmation that the NSA has searched for Americans’ communications in its phone call and email databases complicates President Barack Obama’s initial defenses of the broad surveillance in June. “When it comes to telephone calls, nobody is listening to your telephone calls. That’s not what this program’s about,” Obama said. “As was indicated, what the intelligence community is doing is looking at phone numbers and durations of calls. They are not looking at people’s names, and they’re not looking at content.”

Detroit is a textbook example of what happens when there are multiple claims to to the same shrinking slices underlying wealth. This is our future.

• Detroit Pension Fight Heats Up After Deeper Cuts (DFP)

Retirees and pension board representatives fighting big benefits cuts in Detroit’s bankruptcy pushed back Tuesday after the city said it would pursue a comprehensive change in the management of the city’s two pension funds. Increasingly angry retirees launched counterefforts to fight cuts to the pension benefits of thousands of current and retired city workers, holding their largest protest yet outside federal court. Pension fund representatives, meanwhile, chastised emergency manager Kevyn Orr’s team for announcing a shake-up in the structure and management of the pension funds even as both sides are in confidential mediation talks.

The pension funds also released a joint statement, calling Orr’s proposal for replacement of the pension boards “tantamount to a takeover.” “This is when we are supposed to be in good-faith negotiations and court-ordered mediation,” the statement said. “The plan as proposed is best described as completely unrealistic for the operation of these important pension funds for first responders and city workers who dedicated their careers to the City of Detroit. Indeed, such radical and irresponsible concepts could very well derail mediation and ensure protracted litigation.”

Meanwhile, the official committee of Detroit retirees, representing pensioners in the city’s bankruptcy case, served subpoenas on the Detroit Institute of Arts, seeking extensive records and documentation about the museum, its artworks, financing and a broad array of tax returns and appraisals. The retiree committee also served a subpoena on New York-based auction house Christie’s for documents related to its city-commissioned appraisal of the DIA’s artworks last year.

The subpoenas by the retiree committee appeared aimed at pressuring the city for a fuller accounting of the museum’s overall worth in an attempt to potentially force the issue of selling DIA assets to satisfy the city’s liabilities — a gambit that one legal expert said could prove risky. The move mirrored a similar subpoena served on the DIA by bond insurer Syncora, one of Detroit’s largest creditors, which is fighting for a sale of the museum’s art because the insurer is on the hook for about $620 million in Detroit debt.

• Chicago Mayor Seeks to Repair Badly Underfunded Pension Plan (NYT)

Contending with one of the most poorly funded pension systems among the nation’s major cities, Mayor Rahm Emanuel’s administration has begun an urgent push to require some city workers to pay more for their retirement benefits and to raise property taxes for Chicagoans. The effort is meant as a crucial step toward repairing a pension system at risk of insolvency and so troubled that Moody’s Investors Service last month downgraded Chicago’s credit rating, saying pension liabilities “threaten the city’s fiscal solvency absent major revenue and other budgetary adjustments adopted in the near term and sustained for years to come.”

Laurence Msall, president of the Civic Federation, a nonpartisan research group that has regularly warned about the city’s fiscal problems, said, “We think this is a reasonable plan that balances shared sacrifices among employees, city government and Chicago taxpayers.” Mr. Msall said the changes would put two of the city’s pension funds — representing more than 56,000 city workers and retirees — on a course to be 90% funded in 40 years, although he said it would be preferable if they were completely funded sooner.

Yet the proposal by Mr. Emanuel, a Democrat who faces re-election next year, is complicated by a seeming split among union forces in this Democratically controlled state. The city said the proposal grew out of talks with labor unions, but at least one union has already publicly expressed vehement opposition, particularly given a state constitutional protection of pensions. The city now finds itself aligned with the state, which late last year passed a long-debated overhaul of pensions for state workers, as test cases for how Democrats, who have often steered clear of pensions because of their traditional ties to labor, will manage the politically and financially sensitive terrain.

The mayor’s proposals are subject to legislative approval, and as early as this week his aides are expected to press lawmakers to back them. But even if the legislature approves Mr. Emanuel’s idea, it will be only a partial solution. Remaining unanswered will be issues about retirement funding for teachers, police officers and firefighters, as well as a looming requirement that the city increase its contribution to some workers’ pension funds by almost $600 million next year.

Mr. Emanuel’s proposal would require more than half the city’s workers and retirees — those with ties to the municipal pension fund and the laborers’ pension fund — to contribute more toward their pensions over a period of years. By 2019, for instance, employees would contribute about 11% of their salaries to pensions, compared to about 8.5% now. In addition, cost-of-living increases would no longer rise at a 3% rate, compounded each year, but would typically rise more slowly, and such increases would be skipped in certain years. Some of the details are similar to changes lawmakers agreed to last year for state workers.

Home › Forums › Debt Rattle Apr 2 2014: 3 First Steps To Cleanse The Economic System

Tagged: Admiralty Law - Coup - US eliminated Common Law Grand Juries by Corporate Contract Law - Unlawful - Natural Rights are Forever