Ben Shahn Farmer’s daughter near Mechanicsburg, Ohio Summer 1938

The eurocrisis is over, the US Navy makes fuel from seawater, and America will be energy independent by 2037, according to the EIA. Boy, where do we begin? We’re getting flooded with an increasing amount of sheer nonsense wrapped in sheep’s clothing, and it’s hard to keep up. We not only live in a pretend economy, by now most of what we think we see isn’t really there at all. Indeed, there’s not even a there there anymore. Look, if you believe that the Navy can power its fleet with fuel made from seawater, you should probably know there’s a lot of gold in the oceans as well. Which means that you are potentially very wealthy. All you have to do is dig it out.

On a slightly – but only so – more serious plane, do you guys realize that the folks at the EIA get paid hefty salaries to produce reports like the new one that predicts the US will be energy independent in a mere 23 years? I kid you not. See, I think the US propaganda machine for Ukraine is insane and unworthy, but then you get this on top of all that.

US To Become Oil Independent By 2037 – EIA (RT)

US may stop importing oil by 2037 as abundant domestic crude supplies, including North Dakota’s Bakken field and Texas’s Eagle Ford formation, may push production to the level of consumption, according to the US government. The US Energy Department’s branch that collects and analyzes data – the Energy Information Administration (EIA) says that within 23 years the world’s largest economy may become energy independent …

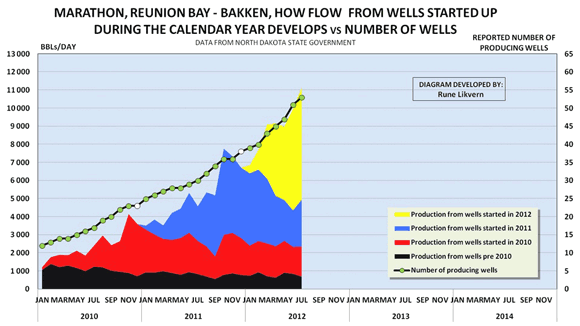

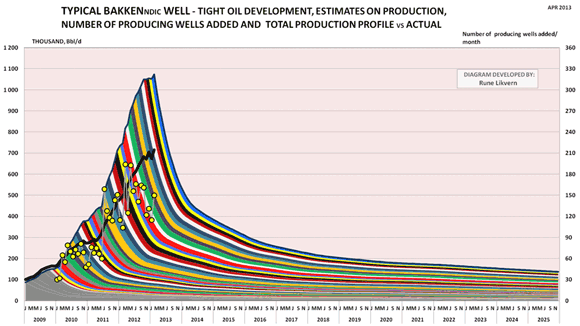

Alright then, once again, there we go. First, Rune Likvern on decline ratio’s in the Bakken Play’s Reunion Bay:

Do note the increase in total well numbers, which sort of mask the decline per well.

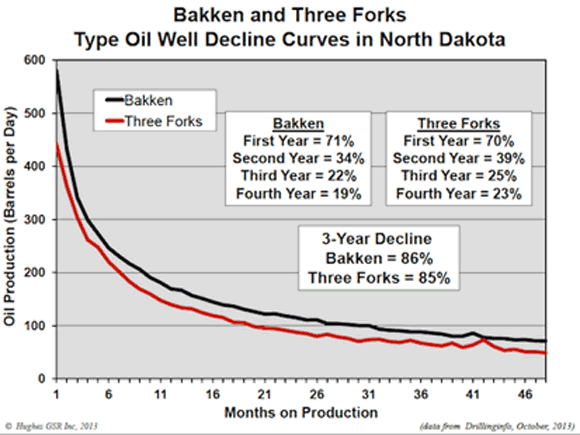

Then, Chris Hughes on the Bakken and Eagle Ford plays:

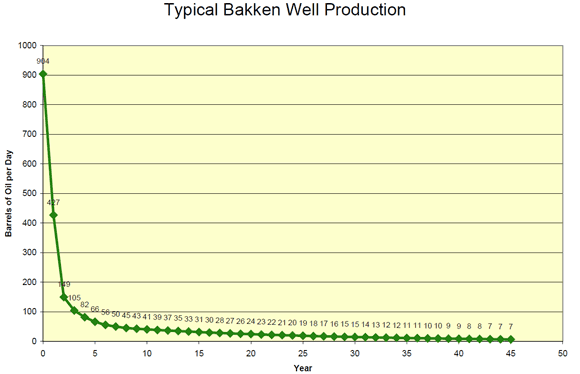

And the North Dakota government on production in a typical Bakken play well:

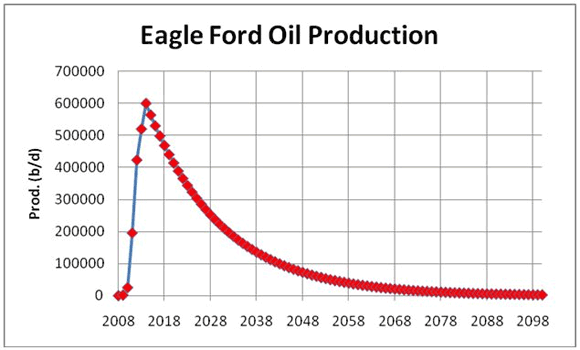

We have Roger Blanchard on total Eagle Ford production:

And Likvern again on accumulated typical Bakken well production:

Are there any further questions on for instance how many wells would have to be drilled to overcome the decline rates? In Bakken’s Reunion Bay (1st graph) the number increased five-fold in 2.5 years. If that rate continued, and there’s little to no reason to assume otherwise, there are some 50,000 wells in that play today. At an average price of $8 million per well, that’s $400 billion.

What, you thought Shell and Exxon left shale alone for no reason? If the deplete/invest trend holds up till the EIA dream date of 2037, we’re talking millions of wells, an utterly ravaged landscape and trillions of dollars of “investment”. You think that’s going to happen? Thing is, because of the depletion rate of shale wells, the investment would have to continue for another 20 years, at the present rate, for shale to just play even. And that’s provided those millions of new wells will be drilled. By whom?

The real question is: Why do US government agencies issue reports like this? What are they seeking to achieve? The entire shale industry has been fully exposed by the likes of Rune Likvern and Chris Hughes for quite a while, so it all looks to be purely a propaganda game, where the mass media convey to their audience whatever it is the government would like them to believe. But that just turns the US into Bizarro world more every step of the way. And whatever that may be, or why it may be happening, it’s certainly not going to solve the problems, energy or finance, of the American people. Who happen to pay those cushy salaries the EIA “scientists” are on the payroll for.

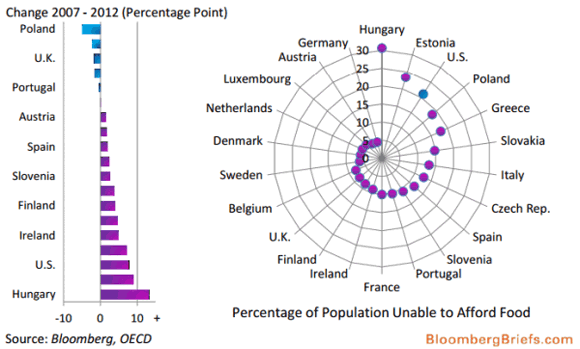

Of course this all plays wonderfully into the whole tale of the US exporting LNG to Europe so it can free from itself from Russian gas dependence. We get it, boys. And that’s at least part of why it’s fed through the media to the Great American Unwashed. More of whom go hungry among OECD nations than in any other country save Hungary and Estonia. Let the eagle soar. So we can shoot it and feed our children.

What is this? Is some foreign desert they have no reason to be in the only place where America’s best and bravest will show what they think they’re made of? Can’t show courage at home anymore? What was that number? I think it was that 8000 US soldiers got killed in action abroad since 9/11, while 100,000 committed suicide. I mean, honestly, people, where do you see this going?

When the recession ended, everyone knows it didn’t.

• Investing In A Pretend Economy (EconomicNoise)

We live in a pretend economy. It is important to recognize this condition, especially if you are an investor. Current market behavior is concerning. Bonds and stocks remain volatile and near record levels. Markets ignore the continuing stagnation in the pretend economy, buoyed apparently by government liquidity injections. To justify investing today in these markets, one must anticipate one or both of the following:

- Economic growth is about to surge.

- Market values can continue to rise from here, potentially further widening the already large gap between valuations and fundamental economics.

No reading of the economic tea leaves suggests a surge in economic growth is coming. Indeed, a critical analysis of the data makes one question whether there has been a recovery at all. Certainly any recovery has to be labeled as abnormal. If economic conditions look like they will continue to be sub-par, then an investor has to believe that it is realistic to expect market valuations to continue to ignore economic conditions. That assumption worked last year when markets rose about 30%. Is it reasonable to expect the divergence to continue for another year? No divergence can continue forever but that doesn’t mean it can’t persist for a while.

The recession ended (according to the National Bureau of Economic Research) in June 2009. Rapid economic expansion normally occurs during the first three or four quarters after a recession ends. The typical recovery period is characterized by three to four quarters of unsustainably high growth rates. That take-off growth never occurred when this recession was declared over. Nevertheless, government went into full propaganda mode and the pretend economy began.

At no time in my recollection has the word “recovering” been used to describe an economy five years after a recession was declared over. Perhaps the term was borrowed from “recovering” alcoholic which I understand is a forever state. Either the government is lying about a recovery or something has radically changed in terms of the economy. Both are likely. The current “recovery” does not conform to other recoveries. After five years, history suggests we may be close to the next recession, not still “recovering” from the previous one. However, history is not economics. It may repeat or rhyme, but it doesn’t rule. [..]

There has been no real economic recovery. What has occurred is a pretend recovery. The pretend is not limited to this recent cycle. It has been going on for many years. In a sense, what we now have and have had for the last decade or more is a pretend economy. Government interventions have been the driving force in this pretend economy. Government has no incentive to not have a real recovery. It would prefer one, but that is no longer possible as a result of an accumulation of distortions that have built up over decades. A pretend economy is the next best thing. Interventions cover up reality (for awhile) but they also add to the economic distortions and damage.

Dominoes falling.

• China’s Next Bond Default Looms As Polyester Firm Declares Bankruptcy (Bloomberg)

A small manufacturer of polyester yarn based in China’s wealthy Zhejiang province has declared bankruptcy, threatening its ability to meet an interest payment on a high-yield bond due in July. Zhejiang Huatesi Polymer Technical Co Ltd asked a local court for bankruptcy protection in early March, according to an announcement on the website of the Anji County People’s Court.

The firm sold 60 million yuan ($9.7 million) in bonds in a private placement in January 2013 at an interest rate of 11%. The next interest payment is due on July 23, while the bond matures in January next year. A string of credit defaults in recent weeks has highlighted rising credit risks in China, partly fuelled by signs that the economy is slowing down.

Analysts widely expect more defaults on loans, bonds, and shadow bank products this year. Semiconductor, software, and commodities firms are among the most at risk for default, a Reuters analysis of more than 2,600 Chinese companies showed. The Xuzhou Zhongsen default marked the first ever in China’s high-yield bond market, which the securities regulator launched in June 2012 in a bid to offer a new financing channel for small, private firms. Such firms often struggle to access credit in China’s state-dominated financial system.

No bleeping kidding!

• Kerry, Congress Agree: Superpower Status Not What It Was (Bloomberg)

Secretary of State John Kerry and members of the Senate Foreign Relations Committee agreed on one thing yesterday: Being a superpower isn’t what it used to be. At a hearing on the U.S. State Department budget, Republicans and Democrats alike raised concerns about America’s limited ability to cope with global challenges, from Russian aggression in Ukraine to Iran’s nuclear program, China’s assertiveness in the Pacific and Syria’s civil war. While some Republicans blamed the administration for decisions that they say have eroded U.S. influence, Kerry pointed to a “changed world.”

“The United States has power, enormous power,” he said, “but we can’t necessarily always dictate every outcome the way we want, particularly in this world where we have rising economic powers — China, India, Mexico, Korea, Brazil, many other people who are players.” The two-hour Senate hearing was only one place where lawmakers and others challenged President Barack Obama’s foreign policy yesterday. The jousting underscored the U.S. struggle to defend its global interests and allies as technology and the diffusion of economic and military power erode its post-Cold War position as the lone superpower.

Halfway around the world, Chinese Defense Minister General Chang Wanquan told Defense Secretary Chuck Hagel that the U.S. rebalancing to Asia won’t contain China or affect its claims to territory in the region. “With the latest developments in China, it can never be contained,” he said.

How useless can one man get?

• Draghi Hunts for QE Assets in “Dead” Market (Bloomberg)

Mario Draghi’s asset-purchase plan to ward off deflation may be lacking one key element: enough assets to buy. Since the European Central Bank President buoyed investors last week by saying policy makers backed quantitative easing as a way to boost prices if needed, officials including Governing Council member Ewald Nowotny have signaled any purchases may center on asset-backed securities. While that makes sense in an economy funded mostly by bank loans, it’s also a market Draghi once described as “dead.”

The ECB’s focus on ABS for monetary easing risks guiding it toward a policy that might be slow to evolve and far smaller than the $1 trillion ($1.4 trillion) in bond purchases it has already simulated. Draghi has said international regulators must change the rules on ABSs, yet those officials are steering against the easy creation of complex products because of the role they played in the global financial crisis. “A preference for ABSs has been expressed time and again – and in fact it is the first asset class that would make sense for the ECB to buy,” said Marco Valli, chief euro-area economist at UniCredit Global Research in Milan. “The market’s revival is conditional on the regulator changing capital requirements. Until this changes, jump-starting the ABS market is difficult and demand for these securities will remain weak.”

The truth behind the headlines.

• Europe Not Moving Away From Russian Energy (RT)

Europe has no plans to move away from Russian gas, with the major energy projects like South Stream expected to remain in place, according to Reiner Hartmann, Chairman of the Association of European Businesses. The US and EU both have condemned Russian action in Ukraine. The US responded with economic sanctions on banks and individuals thought to be close to Russian President Putin, but Europe’s economy is much more closely integrated with Russia’s, which has kept tough sanctions off the table. “We are very aware of the situation; that we are in a very comfortable position. We are close to Russian gas fields,” Hartmann said on Monday following a meeting at the Association of European Businesses’ office in Moscow.

Business between European clients and Moscow will continue as usual, Hartmann, Managing Director at E.ON Ruhrgas Russia, said. “And during the past 40 years not one cubic meter of gas was not delivered according to contracts.” Ukraine, along with some EU officials, have accused Russia of “gas wars” and of using hydrocarbons as a diplomatic weapon, however, the AEB is able to separate business from politics. “And during the last 40 years Russia also never used gas as a weapon in political issues, etc. And, we believe, this will not be the case in the future,” said Hartmann. [..]

Projects already in the works – like the Southern Corridor and the South Stream gas pipelines, won’t be affected by political tension in Ukraine, according to Hartmann. A leaked briefing by European Commission chief Jose Manuel Barroso indicated the EU may try and use the South Stream project as a gambit to negotiate with Russia over Ukraine. South Stream, Gazprom’s $45 billion project that is due to partially open in 2015 and reach full capacity in 2018 and deliver 64 billion cubic meters of gas to Europe, runs through EU countries Bulgaria, Croatia, Greece, Hungary, and soon to be a EU member Serbia. The line connects Russia to Europe via the Black Sea. The route will supply Europe with 15% of its gas needs. The Bulgarian press reported that Barroso said it needed “to be very careful” in its South Stream dealings, hinting that the country must align with EU, and not Russian interests.

• US To Become Oil Independent By 2037 – EIA (RT)

US may stop importing oil by 2037 as abundant domestic crude supplies, including North Dakota’s Bakken field and Texas’s Eagle Ford formation, may push production to the level of consumption, according to the US government. The US Energy Department’s branch that collects and analyzes data – the Energy Information Administration (EIA) says that within 23 years the world’s largest economy may become energy independent, while demand for crude is expected to be modest. “This is the first time the Annual Energy Outlook has projected that net imports’ share of liquid fuels consumption could reach zero,” Bloomberg quotes John Krohn a spokesman for the EIA.

The most optimistic assessment by the EIA assumes that production will increase to about 13 million barrels a day over the next two decades. The projection is based on more favorable assumptions relating to technological improvements and the productivity of wells. Net oil imports have already fallen to about 5 million barrels a day from a peak of almost 13 million barrels in 2006. The shift is mostly due to advances in techniques such as hydraulic fracturing and horizontal drilling into shale rock.

The EIA also calculated a low resource scenario. According to estimates, after the moderate growth of up to 9.1 million barrels a day in 2017 the production of oil may nosedive to 6.6 million barrels a day by 2040. In the worst-case scenario in terms of imports the EIA assessed the net import share of petroleum and other liquids to fall to 25% in 2016 and then again rise up to 32% in 2040.

• The Born Again Jobs Scam: The Ugly Truth Behind “Jobs Friday” (David Stockman)

The mainstream recovery narrative has an astounding “recency bias”. According to all the CNBC talking heads, the 192,000 NFP jobs gain reported on Friday constituted another “strong” report card. Well, let’s see. Approximately 75 months ago (December 2007) at the cyclical peak before the so-called Great Recession, the BLS reported 138.4 million NFP jobs. When the hosanna chorus broke into song last Friday, the reported figure was 137.9 million NFP jobs. By the lights of old-fashioned subtraction, therefore, we are still 500k jobs short—notwithstanding $3.5 trillion of money printing in the interim.

The truth is, all the ballyhooed “new jobs” celebrated on bubblevision month-after-month have actually been “born again” jobs. That is, jobs which were created during the Fed’s 2002-2007 bubble inflation; lost in the aftermath of the September 2008 meltdown; and then “recovered” during the renewed bubble inflation now underway. Stated differently, back when the NFP jobs count first clocked in at 137.9 million in the fall of 2007, the talking heads assured us that we were in a permanent “goldilocks economy” thanks to the brilliant management skills of the Fed. So here we are nearly 7 years later, still a half million jobs short, and the talking heads are gumming once again about the same old illusory “goldilocks”. Who actually pays these people to bloviate!

Setting aside the utterly superficial recency bias, its not hard to see the dire reality lurking in the actual trends. To be precise, 75 months into the post-2000 cycle the US economy had generated 5 million net new jobs—that is, it was way above its prior high water mark. Likewise, 75 months on from the 1990 peak, it had produced 10 million net new jobs. So the fact that we are still in negative jobs territory this far into a recovery cycle is literally off-the-historical-charts. And the fact that we are already in month 57 of this business expansion when the ten expansions since 1950 have averaged only 53 months in duration is even more telling. Notwithstanding Bernanke’s hubristic proclamation of the Great Moderation, the Fed has not abolished recessions—so this time the cyclical clock may run out long before many actual “new jobs” are created.

The US is busy falling into its own knife.

• Housing Pain Could Halt Stocks’ Gain (Marketwatch)

[..] while I’m not too worried about stocks, I do think the housing market may take a hit. And the fallout of negative sentiment could affect other assets and consumer spending as a result. A big narrative of our economic recovery has been a resurgent housing market. As a result, a slowdown or decline could be bad news for investors of all stripes. Here’s what I think investors and homeowners should be watching in the real estate market, and the warning signs worth noting.

As it becomes increasingly clear that the Federal Reserve is on track to raise key interest rates in the next 12 to 18 months, the rate on mortgages has been creeping higher too. Mortgage rates were elevated in March, and interest rates are flirting with a monthly average of 4.5% on a 30-year fixed – which, according to Freddie Mac mortgage survey data, would mark the highest levels since July 2011. Consider that a $200,000 loan at a 3.5% rate works out to about $900 per month, while a 4.5% rate is just shy of $1,015 — a difference of $115 monthly for the same home. And for more expensive houses, the difference is even more dramatic.

This additional cost burden could price people into smaller homes or deter them from shopping altogether. And, remember, this recent rate increase has occurred even without a Fed-driven rate hike behind it, so mortgage interest rates could move significantly higher across the coming months. And let’s not even get into what an increase in rates could do to those without fixed mortgages who will see payments adjust up as a result. The bottom line is that higher borrowing costs will undoubtedly cool some of the demand for housing by the time we hit the key house-shopping months of spring and summer 2015.

But wait! What are we going to pay the bonuses with?

• Banks Set to Report Lower Earnings as Debt Trading Slumps (Bloomberg)

Surging stocks, booming initial public offerings and rising employment all pointed to a feast of first-quarter bank profits. Debt markets crashed the party. Fixed-income trading slid 15% in the first three months of 2014, analysts estimate, as the Federal Reserve slowed its bond purchases. Combine that with a drop in mortgage revenue and a $9.5 billion legal settlement, and profit for the nation’s five biggest banks probably fell 14% to $16.5 billion from a year earlier. Only sixth-ranked Morgan Stanley, which relies less on those businesses, is seen bucking the trend.

“There’s been a lot less fixed-income activity than we typically see in the first quarter,” David Konrad, Macquarie Group Ltd.’s head of U.S. bank research, said in a telephone interview. “The environment is more challenging when rates are increasing and liquidity is being pulled from the market and regulation’s coming in.” The slump in bond trading, a business that fueled Wall Street’s rebound after the credit crisis and generates more revenue than equities at most big banks, may erode earnings at firms such as Goldman Sachs Group Inc. Profit there probably fell 23% to $1.73 billion. Morgan Stanley, owner of the world’s biggest brokerage, may be alone among the largest U.S. banks in posting higher earnings as it relies more on equities. Its profit surged 23% to $1.19 billion, according to analysts’ estimates compiled by Bloomberg.

It just ain’t fair!

• US Banks to Face Tougher Leverage Caps Than Competitors (Bloomberg)

The biggest U.S. bank holding companies will need to round up as much as $68 billion more in loss-absorbing capital under supplemental leverage ratio rules adopted by regulators in Washington today. Eight lenders, including JPMorgan Chase and Bank of America, face greater restrictions on borrowing power than their overseas competitors as they meet a demand to hold capital equal to at least 5% of total assets. The rules designed to curtail financial-system risk surpass the 3% minimum set in a global agreement by the Basel Committee on Banking Supervision.

“The leverage ratio serves as a critical backstop to the risk-based capital requirements – particularly for the most systemic banking firms,” Daniel Tarullo, the Federal Reserve governor responsible for financial regulation, said in a statement. The leverage rule, which also affects Citigroup, Wells Fargo, Goldman Sachs, Morgan Stanley, Bank of New York Mellon and State Street, is meant to work alongside risk-based capital standards approved by U.S. regulators last year and a pending rule that would require banks to keep a high level of ready-to-sell assets to weather a crisis.

The rule was approved by the Federal Reserve, Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency. Bankers had argued that the leverage demand – often described by the agencies as a backstop – would become the dominant capital standard, and Tarullo agreed today that it will be the most binding constraint for some banks.

Fed Governor Jeremy Stein said he had “misgivings” about possible “unintended consequences” of the rule. “I do think it is possible to go too far with a simple leverage ratio if it gets raised to the point where it is binding or near-binding rather than being a backstop.” Fed Chair Janet Yellen said regulators should “watch carefully” for such consequences. Most of the banks have said they already or soon will meet the demand for 5% capital at the bank holding company level and 6% at banking units. The holding companies are about $68 billion short, and the banking subsidiaries face a $95 billion shortfall, regulators said.

Look for ugly.

• IMF Cuts Japan Growth Forecast As Abenomics Stalls (AFP)

The International Monetary Fund on Tuesday cut its 2014 growth forecast for Japan and warned that Prime Minister Shinzo Abe must follow through on promised reforms to cement a turnaround in the world’s number-three economy. In its World Economic Outlook, the IMF said it expected Japan’s economy to grow 1.4% this year, down from an earlier 1.7% forecast, before slowing to 1.0% in 2015. The Washington-based Fund has previously been upbeat on Abe’s growth policy blitz — a mixture of big government spending and central bank monetary easing dubbed Abenomics, which is designed to drag the economy out of years of deflation and laggard growth.

The plan’s so-called “third arrow” — reforms that include more flexible labour markets and free-trade deals — have been more talk than action so far, although Tokyo on Monday agreed on a long-awaited trade deal with Australia. The agreement was the first time Japan had negotiated a comprehensive economic partnership agreement or free trade deal with a major economy. But separate negotiations involving the United States, Japan and 10 other nations, known as the Trans-Pacific Partnership, have stalled.

Japan has long been accused of protecting its domestic industries — including the politically powerful agricultural sector — with high trade and other non-tariff barriers, while many of its own exports, including vehicles and electronics, enjoy big sales overseas. Abe has pledged to make changes and grow the long-laggard economy, while battling to contain one of the rich world’s heaviest debt burdens. But “Abenomics still needs to translate into stronger domestic private demand”, the IMF said. “Implementation of the remaining two arrows of Abenomics — structural reform and plans for fiscal consolidation beyond 2015 — is essential to achieve the inflation target and higher sustained growth.”

Lip service.

• IMF Warns Eurozone And ECB On Deflation Threat (RTE)

The International Monetary Fund has identified deflation as the biggest risk to economic recovery in the Euro Area. In its latest World Economic Outlook, the IMF said the Euro Area needs more monetary easing – including unconventional measures, such as quantitative easing – to sustain recovery and reach the ECB’s inflation target of 2%. Last week ECB President Mario Draghi was critical of IMF managing director Christine Lagarde for urging the ECB to effectively print more money to head off the risk of deflation. But today’s IMF publication contains numerous calls for monetary intervention from Frankfurt to deal with deflation.

Overall the IMF said the global recovery is expected to strengthen this year, led by the advanced economies. It said that emerging market and developing economies will only grow modestly this year, adding that a worrying development is a downgrade of growth rates in some of the larger emerging market economies notably Brazil, Russia, South Africa and Turkey. It said the main risk to advanced economies comes mainly from “prospects of low inflation and the possibility of protracted stagnation, especially in the Euro Area and Japan”.

• UK Fails To Notice The Beam In Its Own Eye (RT)

Rather than the exception, corruption is now the norm within the key institutions at the heart of the British establishment. The latest reminder of it is the recent story to dominate British newspapers and the broadcast media involves the UK Culture Secretary and member of Prime Minister David Cameron’s government, Maria Miller, who is the latest in a long line of politicians to become embroiled in scandal over their expenses.

It comes as a reminder that for a country whose political leaders, intelligentsia and media commentators have made a habit of pointing the finger at governments, countries, and political systems around the world, adjudging them to be corrupt and morally deficient, the scale of the hypocrisy in this regard is astounding. In recent years we have witnessed scandals involving the City of London, the main driver of the UK economy, surrounding the greed and recklessness responsible for an economic crisis that has delivered thousands of people into destitution.

Yet at time of writing not one British banker has been prosecuted or faced any legal sanction for the economic chaos that has engulfed the country. Worse, the bonus culture that is prevalent in the City of London, and in corporate boardrooms in general, rather than being curtailed, has remained in place, thus ensuring that an emphasis on short-term profits and personal enrichment continues to take priority over long-term investment and sustainability when it comes to the UK economy. [..]

Corruption within the British political system is now so commonplace that when another example of it is made public, it no longer shocks or surprises. What it does do is re-enforce the view that a sense of entitlement and privilege is so embedded within the British establishment as to make a mockery of words such as integrity and democracy. Making it even worse is that it comes at a time when the most economically vulnerable in Britain are on the receiving end of a vicious assault by the government, seeing their benefits, wages, and conditions cut to the bone on the justification they are no longer affordable because of an economic crisis they weren’t responsible for creating in the first place.

Ha! HAHAHA!

• OPEC Plans to Make Room for Extra Oil From Iran, Iraq, Libya (Bloomberg)

OPEC, which supplies 40 percent of the world’s oil, will accommodate additional output from members Iraq, Iran and Libya, Secretary-General Abdalla El-Badri said, without explaining how it will do so under the group’s ceiling. The Organization of Petroleum Exporting Countries will wait until 2015 to discuss output targets with Iraq, which currently operates outside the production-quota system for each of the group’s other 11 member countries, El-Badri told reporters today in Doha, Qatar.

OPEC foresees gradual increases from Iraq and Iran, while Libya is capable of boosting output by as much as 1 million barrels within a month, he said. “There is no problem for OPEC to absorb any production increment from Iraq and Iran in 2014,” El-Badri said. “When Libya output comes back, we will accommodate it because its production is in our numbers.” OPEC is set to boost output as its second-biggest producer Iraq pumps at a 35-year high and Libya’s government makes progress in talks with rebels who control fields and export terminals in the country’s oil-rich east.

Sanctions on Iran over its nuclear program have constrained the country’s production and sales of crude. OPEC plans to meet on June 11 in Vienna to review its output target, now at 30 million barrels a day. Global demand will increase by 1.1 million barrels a day in 2014, and the group will produce up to 30 million barrels a day for the rest of the year, El-Badri said. “Of course, ministers can change that when they meet,” he said. OPEC pumped 30.3 million barrels a day in March, data compiled by Bloomberg show.

Sail it to the moon, I’d say.

• US Navy Creates Ship Fuel From Seawater (RT)

Researchers working for the United States Navy say they are around a decade away from mastering a procedure that will make high-powered fuel for the military’s fleet of ships out of run-of-the-mill seawater. The US Naval Research Laboratory’s Materials Science and Technology Division have already demonstrated that a new, state-of-the-art conversion method can turn ordinary seawater into a liquid hydrocarbon fuel potent enough to power a small model aircraft. Soon, though, they say the same process will provide the Navy with a way of refueling any of its hundreds of ships at sea without relying on the comparably meager fleet of 15 military oil tankers currently tasked with delivering nearly 600 million gallons of fuel to those vessels on an annual basis.

Scientists say it will be another 10 years before ships will likely be able to successfully convert seawater into super-powerful fuel, but the technology is already being hailed as a game changer and is expected to substantially cut costs for the Pentagon. The process at hand involves extracting carbon dioxide molecules from the ocean water outside of a ship’s hull and using it to produce hydrogen gas, “catalytically converting the CO2 and H2 into jet fuel by a gas-to-liquids process,” according to an article published this week on the Naval Research Laboratory’s website.

“The potential payoff is the ability to produce JP-5 fuel stock at sea reducing the logistics tail on fuel delivery with no environmental burden and increasing the Navy’s energy security and independence,” Dr. Heather Willauer, a research chemist who has worked on the procedure for years, explained to the NRL back in 2012. “With such a process, the Navy could avoid the uncertainties inherent in procuring fuel from foreign sources and/or maintaining long supply lines,” she said.

Everyone buy USD, You know you want to!

• Norway’s Biggest Bank Says Krone Caught in Emerging Market Trade (Bloomberg)

Investing in Norway’s krone is becoming more hazardous as the central bank steers the currency and global trading desks lose their appetite for risk, according to DNB Markets head Ottar Ertzeid. “The Norwegian krone is almost following the emerging markets currencies,” Ertzeid, who heads the investment banking and markets unit at DNB, Norway’s largest bank, said yesterday in an interview in Oslo. “Norges Bank has contributed to this. The last year has been even less liquid than it used to be and some more liquidity could be helpful.”

The krone has plunged 10% against the euro since last year, following central bank steps to halt its gains. Policy makers were blindsided in 2009 as Europe’s debt crisis turned the krone into a haven for investors fleeing the euro. The central bank cut rates in 2011 and 2012. In June last year, it warned it won’t hesitate to ease policy again in an effort to bring inflation back to its 2.5% target. Jon Nicolaisen, who took over as deputy governor at Norges Bank last week, said in an interview there’s no plan to change policy on the krone, and that he doesn’t view it as being significantly riskier than other currencies. “The volatility of the Norwegian krone isn’t particularly scary when you compare it to Australia, New Zealand or Canada — similar economies,” Nicolaisen said. “I don’t see a need to change that policy. If it ain’t broke, don’t fix it.”

• Wikileaks: Internet Governance Body Trying To Stop NSA (RT)

WikiLeaks has published what the anti-secrecy organization says is the penultimate draft agreement expected to be discussed later this month in Brazil at a global internet governance meeting co-hosted by 12 countries including the United States. The 11-page document published on Tuesday by the secret-spilling website is based off of the recommendations submitted by more than 180 international contributors who cared to weigh in with their take on how they think the internet and its infrastructure should be governed ahead of a conference on the matter scheduled to be held in Sao Paulo, Brazil April 23-24.

According to the draft published by WikiLeaks this week and dated April 4, the committee tasked with preparing for the upcoming Global Multistakeholder Meeting on the Future of Internet Governance — or NETmundial — are concerned about the impact that government-sanctioned surveillance is having on the privacy of the planet’s web-connected population and the infrastructure of the internet, as well as the repercussions being brought to light as cyber-weapons continue to be waged between adversarial states around the world as warfare remains a central yet shadowy activity within the digital realm.

Does this include Capitol Hill?

• US Prisons Hold 10 Times More Mentally Ill People Than State Hospitals (RT)

More than 356,000 people with mental illnesses are incarcerated in the United States, as opposed to around 35,000 receiving treatment in state hospitals, a new study found, highlighting the dire state of the nation’s mental health care system. The lead author of the report, conducted by the Treatment Advocacy Center and the National Sheriffs’ Association, said the ten-to-one ratio of patients in prison versus those receiving qualified care is on par with the US mental health system of the 1830s.

“We’ve basically gone back to where we were 170 years ago,” Dr. E. Fuller Torrey, founder of the Treatment Advocacy Center, told Kaiser Health News. “We are doing an abysmal job of treating people with serious mental illnesses in this country. It is both inhumane and shocking the way we have dumped them into the state prisons and the local jails.” The report found 44 states and the District of Columbia have at least one jail that holds more people coping with a mental illness than the largest state psychiatric hospital in the US does.

As states have drastically cut funding for mental health services in the last several years, the number of available beds in psychiatric hospitals has plunged to the lowest level since 1850. Thus, many of these patients are shuffled into the prison system simply because there is nowhere else for them to go. The US prison population has steadily increased as mental health funding has decreased, the National Alliance on Mental Illness has found. Prisoners with mental health issues are often put in solitary confinement for long periods of time, stay incarcerated longer than other prisoners, and are disproportionately abused, beaten, and raped by other inmates, the new report noted. Without treatment, the condition of ill inmates often worsens.

• Cars Become Biggest Driver of Greenhouse-Gas Increases (Bloomberg)

The greatest emerging threat to the global climate may rest in the side pocket of your trousers – or wherever you keep the car keys. Emissions from transportation may rise at the fastest rate of all major sources through 2050, the United Nations will say in a report due April 13. Heat-trapping gases from vehicles may surge 71% from 2010 levels, mainly from emerging economies, according to a leaked draft of the most comprehensive UN study to date on the causes of climate change.

Rising incomes in nations like China, India and Brazil have produced explosive demand for cars and for consumer goods that must be delivered by highway, rail, ship or air. The new pollution, measured in millions of tons of greenhouse gases, may exceed all of the savings achieved through initiatives like subsidies for public transport and fuel efficiency. Cutting back on transportation gases “will be challenging, since the continuing growth in passenger and freight activity could outweigh all mitigation measures unless transport emissions can be strongly decoupled from GDP growth,” the report’s authors wrote.

In China, gross domestic product will jump to $10,661 per capita this year from $3,614 a decade earlier, according to estimates by the International Monetary Fund. That vaulted it to rank 92 worldwide by that measure, from 114 in 2004. The countries that jumped even more in ranking were Timor-Leste, up 43 levels, followed by Azerbaijan, Belarus and Turkmenistan. The warning in the 2,061-page report forms the third part of the UN’s study into global warming. Hundreds of scientists and government officials are meeting through at least April 11 in Berlin to finalize the wording of a smaller document summarizing their findings. It will guide UN envoys as they try to devise a plan to fight climate change and stop temperatures from rising to dangerous levels.

Exxon speaks truth to power=energy=money. And time is money, so …..

• Exxon Mobil Dismisses Low Carbon Future, Puts Faith In Oil Markets (Guardian)

When an international group of 77 institutional investors with more than $3trillion in assets asked the world’s 45 largest fossil fuel companies to assess the risks that climate change poses to their business, they were aware they were asking a tough, complex question. Knowing this, investors launched the Carbon Asset Risk Initiative to spur fossil fuel companies to assess the risks climate change poses to their business based on two scenarios: a business-as-usual scenario under which the world’s fossil fuel use continues to grow, warming the earth to levels society may not be able to adapt to; and a low-carbon scenario where governments achieve their stated goal of limiting the average temperature rise to below 2C.

Many of the 45 companies that received this request are responding – among those, Exxon Mobil, the world’s largest publicly traded energy company, which agreed to publish a report after investors agreed to withdraw a pair of related shareholder resolutions. This agreement was considered by many to be groundbreaking. And if the company had in fact provided the information requested by investors, the report itself would have been. While the report is a positive step, providing investors with useful information about the company’s views on managing climate risk, it mostly sidesteps investors’ concerns by dismissing a low carbon scenario as “highly unlikely” and glossing over the climate change implications of the company’s own Outlook for Energy.

According to the report, Exxon Mobil does expect increasing government action to curb emissions, but not to the level required to limit global warming to below 2C, which the company claims would be unaffordable. In fact, the report says the emissions projections in the company’s Outlook for Energy are comparable to the Intergovernmental Panel on Climate Change scenario that projects a temperature rise well above the international two degree goal. The company focuses on the costs of action and largely ignores the costs of inaction, suggesting that policymakers should balance mitigation, adaptation, and other social priorities.

Yeah, we’re a great species.

• Gulf Oil Spill “Not Over”: Dolphins, Turtles Dying in Record Numbers (NatGeo)

Four years after the biggest oil spill in U.S. history, several species of wildlife in the Gulf of Mexico are still struggling to recover, according to a new report released today. In particular, bottlenose dolphins and sea turtles are dying in record numbers, and the evidence is stronger than ever that their demise is connected to the spill, according to Doug Inkley, senior scientist for the National Wildlife Federation, which issued the report.

The Deepwater Horizon oil rig exploded on April 20, 2010, killing 11 people and spewing more than 200 million gallons (750 million liters) of oil into the Gulf of Mexico. Since then, various government agencies and nonprofits, including the National Wildlife Federation, have been studying the region’s wildlife to track the impacts of the oil.

The report, a compilation of published science since the spill, reveals that “the Gulf oil spill is far from over,” Inkley said. “The oil is not gone: There is oil on the bottom of the Gulf, oil is washing up on the beaches, and oil is still on the marshes,” he said. “I am not surprised by this. In Prince William Sound, 25 years after the wreck of Exxon Valdez, there are still some species that have not fully recovered.”

Home › Forums › Debt Rattle Apr 9 2014: The Great Unwashed American Energy Independence