Harris&Ewing National Emergency War Garden Commission display, Wash. DC 1918

Putting a brave face on the desperate hope for higher prices, soon. Or else.

• New US Oil And Gas Well November Permits Tumble Nearly 40% (Reuters)

Plunging oil prices sparked a drop of almost 40% in new well permits issued across the United States in November, in a sudden pause in the growth of the U.S. shale oil and gas boom that started around 2007. Data provided exclusively to Reuters on Tuesday by industry data firm Drilling Info Inc showed 4,520 new well permits were approved last month, down from 7,227 in October. The pullback was a “very quick response” to U.S. crude prices, which settled on Tuesday at $66.88, said Allen Gilmer, chief executive officer of Drilling Info. New permits, which indicate what drilling rigs will be doing 60-90 days in the future, showed steep declines for the first time this year across the top three U.S. onshore fields: the Permian Basin and Eagle Ford in Texas and North Dakota’s Bakken shale. The Permian Basin in West Texas and New Mexico showed a 38% decline in new oil and gas well permits last month, while the Eagle Ford and Bakken permit counts fell 28% and 29%, respectively, the data showed.

That slide came in the same month U.S. crude oil futures fell 17% to $66.17 on Nov. 28 from $80.54 on Oct. 31. Prices are down about 40% since June. U.S. prices fell below $70 a barrel last week after the Organization of Petroleum Exporting Countries agreed to maintain output of 30 million barrels per day. Analysts said the cartel is trying to squeeze U.S. shale oil producers out of the market. Total U.S. production reached an average of 8.9 million barrels per day in October, and is expected to surpass 9 million bpd in December, the highest in decades, according to the U.S. Energy Information Administration. Gilmer said last month’s pullback in permits was more about holding off on drilling good locations in a low-price environment than breaking even on well economics. “I think in this case this was just a quick response, saying ‘there are enough drill sites in the inventory, let’s sit back, take a look and see what happens with prices,'” he said.

Hey, that’s my headline!

• Think Collapsing Oil Is Bullish? Think Again (MarketWatch)

The biggest story of 2014 isn’t the end of quantitative easing. It’s the unrelenting collapse in oil prices, and what that means for stock markets worldwide. The meme out there? Falling oil is bullish. After all, the more oil falls, the more consumers and companies save. I’m sorry, but there are a number of flaws with this argument. First of all, falling oil can be bullish, but collapsing oil tends to historically be very bearish. Many major corrections and bear markets have been preceded by oil in a precipitous fall. Second, people forget that several state budgets actually rely on tax revenue that is derived from oil drilling and exploration activities. If that tax revenue collapses because those companies collapse on that oil decline, what’s the response by those states? Raises taxes on, you guessed it, consumers.

Third, you might want to be careful what you wish for when it comes to falling oil prices. A good amount of many junk-debt indices is made up of energy-sector bonds. Junk-debt spreads have been widening, and should defaults occur in the energy space, that could serve as a butterfly effect for all bonds. The biggest thing that counters the “collapsing oil is bullish” meme is the behavior of defensive sectors of the stock market, which our equity sector ATAC Beta Rotation Fund BROTX, +0.68% has the ability to position all in to based on our proprietary risk trigger. If indeed falling oil were bullish, shouldn’t more cyclical areas of the market rally on that? If falling oil were bullish, shouldn’t U.S. small-cap stocks — which are heavily dependent upon domestic U.S. revenue growth — be substantially outperforming?

And that’s my line! “Why do we insist upon economic growth, if we don’t actually need the products which are additionally produced every year?” Good to see I’m not the only one writing about that.

• Deficit Spending And Money Printing: A German Point Of View (Salzer)

What we experience today is completely contrary to the German (maybe not the U.S.) understanding of the role of the Central Bank. The ECB has now assumed a role not only to protect the value of our common currency against inflation but also to take action as if it is responsible to create economic growth and full employment with instruments like money printing, zero interest rates and unlimited investments in bonds which the free market is rejecting.

We pay a high price for the chimera that we need constant economic growth and that it is a stigma if our GDP-growth is only 1.5% p.a. Can’t we accept that after 50 years of undisturbed peace and continuous prosperity we have reached a certain degree of personal satisfaction where we don’t need a new car every year, another cell-phone, additional furniture, more TV-sets, more laptops etc, etc.

Why do we insist upon economic growth, if we don’t actually need the products which are additionally produced every year? Is it really worth it to increase the already heavy burden of public debt, which our children must service someday, by accepting even more debt in a vain effort to increase public demand? Let’s instead be happy with zero GDP growth, zero inflation and zero growth of public debt! That could be a more rational solution. Why don’t we consider it?

To what extent is North Dakota spinning its numbers? ” .. the state of North Dakota says the average cost per barrel in America’s top oil-producing state is only $42 [..] In McKenzie County, which boasts 72 of the state’s 188 oil rigs, the average production cost is just $30, the state says.”

• OPEC Is Wrong To Think It Can Outlast US On Oil Prices (MarketWatch)

Give Saudi Arabia credit: Whoever sets oil-production policy for the desert kingdom has guts. Unfortunately, the sheiks have made what’s likely to become a sucker’s bet. You know this part already, but the 12-nation Organization of the Petroleum Exporting Countries last week declined to cut production, sending Brent crude oil futures tumbling to their cheapest point since 2009. The Saudis appear to be spoiling for a fight, trying to find out exactly how cheap oil must be to force surging U.S. shale-oil production to seize up like an unlubricated engine. “Naimi declares price war on U.S. shale oil,” a Reuters headline shouted, referring to Saudi Arabia Oil Minister Ali al-Naimi. But there are at least three big problems with this strategy.

One, North American crude isn’t as expensive to produce as it used to be. Two, there’s more than you think in the pipeline to make it even cheaper. And third, OPEC nations, including Saudi Arabia, have squandered their edge in cheap oil supplies on welfare states rulers can’t easily cut back. In 2012, when U.S. shale burst into public consciousness, common wisdom was that it would cost at least $70 to $75 a barrel to produce. As recently as last week, saying U.S. producers could tolerate $60 oil seemed aggressive. But data from the state of North Dakota says the average cost per barrel in America’s top oil-producing state is only $42 — to make a 10% return for rig owners. In McKenzie County, which boasts 72 of the state’s 188 oil rigs, the average production cost is just $30, the state says.

Another 27 rigs are around $29. That’s part of why oil companies aren’t cutting capital spending much — and they say they can keep production rising without spending more, by getting more out of wells they have already drilled. A key example is mega-independent Devon, which produces about 200,000 of the 9 million-plus barrels the U.S. drills each day. Devon wouldn’t give an interview, but said last month that it expects production to rise 20%-25% next year with little growth in capital spending. It has room to work because its pretax cash profit margins have widened by 37% in the first nine months of this year, to almost $30 per barrel of oil equivalent. More than half its 2015 production is protected by hedges if prices stay below $91 a barrel, the company says.

Can the CIA finally take over?

• Oil War Slams Venezuela, Probability of Default Soars to 84% (Wolfstreet)

OPEC member Venezuela has one of the largest oil and natural gas proven reserves in the world. It’s the 12th largest producer in the world. It’s still one of the top suppliers of crude oil to the US. Oil produces 95% of Venezuela’s export earnings. Oil and gas account for 25% of GDP. Oil is Venezuela’s single most important product. Oil is its critical source of foreign currency with which to pay for all manner of imported consumer and industrial products. But the price of oil has plunged 35% since June. Venezuela was already in trouble before the price of oil plunged. The fracking boom in the US and the tar-sands boom in Canada have been replacing Venezuelan imports of crude to the US for years.

The Keystone pipeline, if Congress approves it, will replace costly oil trains to move Canadian tar-sands crude to US refineries, making it even more competitive with Venezuelan crude. Shipments of crude from Venezuela to the US will continue to dwindle. Venezuela’s budget deficit is 16% of GDP, the worst in the world. Inflation is running at a white-hot 63%, also the worst in the world. The economy is heavily subsidized, but now the money for the subsidies is running out. Currency controls have been instituted to shore up the Bolivar. But instead, they’re strangling what is left of the economy. Anti-government protests and riots burst on the scene earlier this year as the exasperated people couldn’t take it any longer. The scarcity of even basic consumer products such as toothpaste and toilet paper has now spread across the spectrum, including medical supplies. Next year, scarcity is going to be even worse.

Venezuelan economist Angel Garcia Banchs worries that “what’s coming to Venezuela is chaos that will probably lead to barbarity and people looting.” It doesn’t help the budget that the government sells its most valuable export commodity at heavily subsidized prices at home, based on a special though iffy deal: the people get cheap energy, and in return, hopefully, they don’t riot, or outright revolt. The hope is that the government gets to stay in power a little longer even as it is going bankrupt. Yet social spending isn’t going to get cut, promised President Nicolas Maduro on state TV on Friday. “If we had to cut anything in our budget, we would cut extravagances, we would cut our own salaries as high officials, but we will never cut one Bolivar of the money that goes to education, food, housing, the missions of our nation,” he said.

“For the biggest speculators and financiers in the world, oil was a money substitute, a hedge against the massive money printing campaigns of the Fed, the BoJ, and the ECB.”

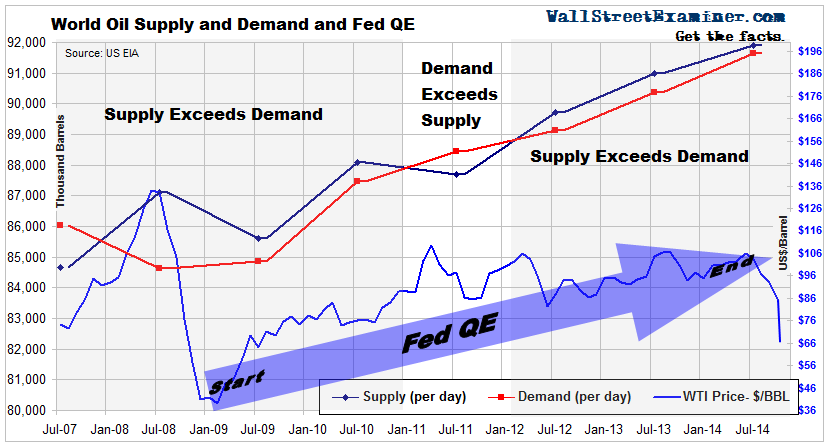

• Why Oil Is Finally Declining, Which May Lead to Disaster (Lee Adler)

The price of oil has finally started to obey the law. What law is that? The Law of Supply and Demand. Thanks to the US fracking boom that has done this (see chart) to US production, the supply of oil worldwide has outstripped demand since 2012. So why haven’t prices fallen before this summer? And are falling oil prices now a good thing? Or not? While US production was exploding, other countries had level or declining production. Meanwhile consumption was falling in developed nations, but the developing world more than made up for that. Worldwide consumption has been steadily increasing since 2009. However, because of the US fracking boom, with the exception of 2011 supply has exceeded demand. Prices should have been declining since 2012, right? After the oil price bubble peaked in 2008, the price of oil did crash when demand dropped. That drop in demand created a huge oversupply just as the US fracking boom was in its infancy.

Then the Fed and its cohort central banks started printing money helter skelter in 2009. The results showed up not only in world stock markets but in commodities as well, particularly oil. The price of oil rose in spite of the fact that world oil production continued to outstrip demand. For the biggest speculators and financiers in the world, oil was a money substitute, a hedge against the massive money printing campaigns of the Fed, the BoJ, and the ECB. It worked for a while, and the oil market even helped in 2011 when supply fell below consumption for a year. But then the US production increase again overran world wide consumption.

Prices don’t have to sink further to cause mayhem, they only need to stay where they are now.

• The Financialization of Oil (CH Smith)

Like home mortgages, oil has been viewed as a “safe” asset. The financialization of the oil sector has followed a slightly different script but the results are the same: A weak foundation of collateral is supporting a mountain of leveraged, high-risk debt and derivatives. Oil in the ground has been treated as collateral for trillions of dollars in junk bonds, loans and derivatives of all this new debt. The 35% decline in the price of oil has reduced the underlying collateral supporting all this debt by 35%. Loans that were deemed low-risk when oil was $100/barrel are no longer low-risk with oil below $70/barrel (dead-cat bounces notwithstanding). Financialization is always based on the presumption that risk can be cancelled out by hedging bets made with counterparties.

This sounds appealing, but as I have noted many times, risk cannot be disappeared, it can only be masked or transferred to others. Relying on counterparties to pay out cannot make risk vanish; it only masks the risk of default by transferring the risk to counterparties, who then transfer it to still other counterparties, and so on. This illusory vanishing act hasn’t made risk disappear: rather, it has set up a line of dominoes waiting for one domino to topple. This one domino will proceed to take down the entire line of financial dominoes. The 35% drop in the price of oil is the first domino. All the supposedly safe, low-risk loans and bets placed on oil, made with the supreme confidence that oil would continue to trade in a band around $100/barrel, are now revealed as high-risk. [..]

The failure of one counterparty will topple the entire line of counterparty dominoes. The first domino in the oil sector has fallen, and the long line of financialized dominoes is starting to topple. Everyone who bought a supposedly low-risk bond, loan or derivative based on oil in the ground is about to discover the low risk was illusory. All those who hedged the risk with a counterparty bet are about to discover that a counterparty failure ten dominoes down the line has destroyed their hedge, and the loss is theirs to absorb. All the analysts chortling over the “equivalent of a tax break” for consumers are about to be buried by an avalanche of defaults and crushing losses

Putin is still very popular in Russia. Western media will tell you that’s because of domestic propaganda, but they themselves engage in anti-Putin propaganda over here.

• Oil, the Ruble and Putin Are All Headed for 63. A Russian Joke (Bloomberg)

Heard the one about Vladimir Putin, the oil price and the ruble’s value against the dollar? They will all hit 63 next year. That’s the joke doing the rounds of the Kremlin as the Russian government digs in to weather international sanctions over the conflict in Ukraine. According to at least five people close to Putin, pressure from the U.S. and Europe is galvanizing Russians to withstand a siege on their economy. The black humor is part of an image of defiance not seen since the Cold War. As the economy enters its first recession in more than five years, the ruble depreciates to records and money exits the country, Putin’s supporters are closing ranks and say he’s sure to run for another six-year term in 2018. “We are becoming poorer, our savings vanish, prices grow, however we see an opposite effect to the one that is wanted by people who wish to see Putin knocked down,” said Olga Kryshtanovskaya, a sociologist studying the elite at the Russian Academy of Sciences. The jokes just underline their determination to stand till the end, she said.

Putin celebrates his 63rd birthday on Oct. 7. The price of Brent crude sank to a five-year low of $67.53 a barrel this week. The ruble has dropped to near 55 to the dollar from as strong as 34 less than six months ago, meaning it needs to lose another 13% to complete the joke. A friend of Putin who spoke on condition of anonymity said sanctions won’t work because the U.S. and European Union don’t understand the Russian mentality. The country endured the Leningrad siege for more than two years during World War II and will survive this too, he said. “The West is wrong in its understanding of the motivation Putin and his inner circle have,” said Evgeniy Minchenko, head of the International Institute of Political Expertise in Moscow. “They think Putin is a businessman, that money is the most important thing for him and that by pressing him and his allies financially they will break them.”

Not much so far.

• What Low Oil Prices Mean For The Environment (Reuters)

Are low oil prices good or bad for the environment? From one perspective, they’re bad: lower oil prices mean lower gas prices, which in turn encourage people to drive rather than use more environmentally friendly means of transportation. But in the case of U.S. shale oil, lower prices are good for Mother Earth, if only temporarily. Oil prices have been falling steadily since June, and given OPEC’s recent decision not to curb production, it seems they’ll remain low for a while. As Myles Udland pointed out in Business Insider last week, a lot of shale projects have break-even prices beneath the $80-per-barrel price level, but producers become less and less incentivized to start new projects as prices fall. [..] shale drilling permits fell 15% across 12 major shale formations in October, a sign that shale producers are willing to slow their rapid expansion until they can get more bang for their buck. It comes down to opportunity cost.

As Harold Hamm, an early shale pioneer who has lost $10 billion since August (let that sink in), told Bloomberg, “Nobody’s going to go out there and drill areas, exploration areas and other areas, at a loss. They’ll pull back and won’t drill it until the price recovers. That’s the way it ought to be.” Many see OPEC’s refusal to curb output as a multi-billion-dollar game of chicken with U.S. shale producers, whose booming production can be credited with the recent fall in world oil prices. Early evidence shows that it may be working—for now; fuelfix.com reported yesterday that Texas shale permits were down 50% in November. Ultimately, the case can be made that low oil prices are bad for the environment, as they encourage more oil use now, which makes investments in alternative energy less urgent. And the shale isn’t going anywhere–it’s just waiting there patiently for prices to become sufficient for new extraction projects.

“Stay away from U.K. assets into the 7 May elections ..”

• French Bank Tells Investors To Dump UK Assets (CNBC)

French bank Société Générale has told investors to steer clear of U.K. assets and sell sterling, because “zero” reform and political deadlock pose key risks to the country’s economy. “Stay away from U.K. assets into the 7 May elections,” the SocGen global asset strategy team, led by Alain Bokobza, said in the bank’s 2015 outlook. “In the U.K., 2015 will be marked by the General Election, triggering some volatility and pushing the risk premium on the FTSE 100 higher as the debate on the European Union exit gains momentum.” As such, Bokobza recommended: “Minimal exposure to U.K. assets as political deadlock and delayed tightening by the Bank of England should lead to a weakening of sterling.”

This warning comes despite the U.K.’s robust economic growth compared with the euro zone. U.K. GDP grew by 0.7% in the third quarter on the previous quarter, while the euro zone and France grew by just 0.2% and 0.3% respectively over the same period. But the French banking group insisted that U.K. assets remained risky, and had continually underperformed. “We have been underweight on U.K. assets in the last quarters, with little reason for regret. In particular, U.K. equities are underperforming all developed markets, and a lower GBP/USD is one of our strategic calls (with a 1.50 target),” the bank’s asset strategy team said. “So far there has been zero structural reform and no improvement in twin deficits or exports despite a significant devaluation of the currency. Also, the spillover effects of weak euro zone fundamentals have been underestimated. We are concerned, and therefore seek to protect our asset allocation.”

The perils of having just one main client.

• Australia Headed Into Perfect Storm In 2015 (CNBC)

Australia’s economy will undergo a crucial stress test in 2015, faced with a triple whammy from the lagged impact of plunging commodity prices, sharp declines in mining investment and renewed fiscal tightening, says Goldman Sachs. “The challenges are now widely known…but these challenges still lie mainly ahead for Australia rather than behind,” Tim Toohey, chief economist, Australia at Goldman Sachs wrote in a note on Wednesday. On top of the these headwinds, the economy also needs to contend with tighter financial conditions and lower levels of housing investment, said Toohey, factors that had previously helped to offset the slump in the mining sector. The bank expects GDP growth to average just 2.0% next year, down from an estimated 2.9% in 2014, as the economy continues to search for new growth drivers.

The decline in mining investment will continue to be a major drag on the economy, leaving commodity exports and consumption to pick up the slack, the bank said. Australia’s third quarter GDP data published on Wednesday pointed to a sluggish domestic economy, suggesting rebalancing away from mining-driven growth is taking longer than hoped. The economy expanded 2.7% on year in the three months to September, undershooting expectations for growth of 3.1%, as construction spending fell while sliding export prices hit incomes. “This GDP result concurs broadly with the perceived wisdom on the Australian economy, albeit with perhaps a little more domestic weakness than expected, said David de Garis, director and senior economist at National Australia Bank.

A perfect example of why seeing deflation only as falling prices is so completely useless and dumbing. If you refuse to look a WHY prices fall, you never learn a thing, and you will always be behind. Apart from the fact that the idea of Greece and Spain doing well can easily be refuted by 1000 other data sources, looking at one day or week or month tells you nothing. You need to look at consumer spending over at least the past few years. That would also show more respect for the 25% of the working population, and 50% of youth, who are unemployed in both countries.

• If Deflation Is So Terrible, Why Are Spain, Greece Growing? (MarketWatch)

Prices are starting to fall across the European continent. Mass unemployment, and a grinding recession are forcing companies with too much capacity to charge less for their products. Company profits will soon be collapsing, while government debt ratios threaten to spiral out of control. The threat of deflation is so worrying, the European Central Bank is expected to throw everything in its armory to prevent it, and to get prices rising again. It may even move towards full-blown quantitative easing as early as Thursday. But here’s a puzzle. The two countries with the worst deflation in Europe are Greece and Spain. And two of the countries with the best growth? Funnily enough, that also happens to be Greece and Spain. So if deflation is so terrible, how come those two are recovering fastest?

The answer is that deflation is not nearly as bad as it sometimes made out to be by mainstream economists. The real problem is debt. But if that is true, perhaps the eurozone would be better off trying to fix its debt crisis than campaigning to raise prices — especially as it probably won’t have much success with that anyway. There is no question that the eurozone is sliding inexorably towards deflation. Only last week, we learned that the inflation rate across the zone ratcheted down to 0.3% last month, from 0.4% a month earlier, and a significantly lower figure than the market expected. It has been going steadily down for some time. Consumer inflation has not hit the ECB’s target level of 2% since the start of 2013. It has been falling steadily since it peaked at 3% in late 2011

It would be rash to expect that to change any time soon. The oil price has collapsed, and other commodity prices are coming down as well. That will all feed into the inflation rate. Retail sales are still weak, and unemployment is still rising. People who have lost their job don’t spend money — and companies don’t hike prices when the shops are empty.

Super Mario to the rescue.

• Eurozone Business Activity Slumps To 16-Month Low (CNBC)

Business activity in the euro zone fell to a 16-month low in November, according to data released on Wednesday, confirming fears that the region’s economy is faltering. Final euro zone composite Purchasing Manager’s Index (PMI) data from Markit came in at 51.1 in November, below flash estimates of 51.4 released last month. It marks a fall from October’s final reading of 52.1. The composite reading measures both manufacturing and services activity, with the 50-point mark separating contraction from expansion. The figures could put more pressure on the ECB to increase stimulus measures ahead of its next monetary policy announcement on Thursday. There is growing pressure on the bank to start buying government bonds, although Germany has opposed the move to date.

The euro zone data was preceded by disappointing services PMI figures for Germany and France, the euro zone’s largest and second-largest economies respectively. The slowdown across the 18-country region reflected weakness in new order inflows, as new business fell for the first time since July last year. Job creation also remained near-stagnant, Markit said. Chris Williamson, chief economist at Markit, said there were “worrying signs” of economic performance deteriorating in the euro zone’s core countries, which, if sustained, “could drive the region back into recession.” “France remains the biggest concern, suffering an ongoing decline in business activity, but growth has also slowed to the weakest for one-and-a-half years in Germany,” he added.

“ECB easing is necessary for us, we are closely related with the euro zone and ECB easing should, in the long run, generate more demand in the euro zone, which is helpful for us ..”

• Non-Eurozone Czech Central Banker: We Need ECB Easing Too (CNBC)

As the European Central Bank’s (ECB) next policy meeting looms, the governor of the Czech central bank has insisted that further euro zone easing will have “necessary” knock-on benefits for the Czech Republic. The ECB is expected to leave monetary policy unchanged on Thursday, although there are growing calls for the bank to launch a full-blown quantitative easing package. ECB President Mario Draghi is likely to wait until the new year before deciding on sovereign bond-buying measures – a move that Czech National Bank (CNB) Governor Miroslav Singer said he supported. “It (further easing) is helpful for us. ECB easing is necessary for us, we are closely related with the euro zone and ECB easing should, in the long run, generate more demand in the euro zone, which is helpful for us,” Singer told CNBC.

Speaking from the CNB in Prague, Singer said that easing could take some time to filter through to some weaker parts of the euro zone, but added that a weaker euro would help “shield” the Czech Republic’s economy by giving some of the region’s biggest countries a boost. The Czech Republic is a member of the European Union, but doesn’t yet use the euro. Its currency is called the Czech koruna. The euro has weakened against the dollar and other currencies since the summer, falling to a two-year low against the greenback last month after Draghi hinted that the bank was prepared to undertake more stimulus. Singer added that a weaker euro had helped boost countries like Germany, which price their exports in euros. A weaker euro makes euro zone exports cheaper in the global market.

Barry shares my worries.

• The Gold Fairy Tale Fails Again (Barry Ritholtz)

Yesterday, oil rallied 4.3% and gold gained 3.6% as commodities had an up day after a long and painful fall. The fascinating aspect of the trading wasn’t the $45 pop in gold, nor the even greater%age rally in oil, but the accompanying narrative. (As of this writing, each has giving up about half of those gains). When it comes to speculating, especially in precious metals, it is all about storytelling. Over the years, I have tried to remind investors of the dangers of the narrative form (See this, this and this). Following a storyline is a recipe for losing money. Why? The spoken word emerged eons ago and narration was a convenient way to pass along information from person to person, generation to generation. Your DNA is coded to love a good yarn of heroes and villains and conflicts to resolve, preferably in a way that is both exciting and memorable. However, your genetic makeup wasn’t created with the risks and rewards of capital markets in mind. When it comes to being suckers for storytelling, I have been especially critical of the gold bugs.

Since 2011, the gold narrative has been a money loser, the secular bull market for the metal clearly over. However, gold often provides a plethora of teachable moments. I want to point out several recent gold narratives that have been dangerous to investors. One of my favorite narratives involves the SPDR Gold Shares, an exchange-traded fund. The history of this ETF is a fascinating tale, well told by Liam Pleven and Carolyn Cui of the Wall Street Journal. Since its peak in September 2011, GLD has declined 37%. As we discussed almost a year ago, the most popular gold narrative was that the Federal Reserve’s program of quantitative easing would lead to the collapse of the dollar and hyperinflation. “The problem with all of this was that even as the narrative was failing, the storytellers never changed their tale. The dollar hit three-year highs, despite QE. Inflation was nowhere to be found,” I wrote at the time.

More recently, the narrative has shifted. Switzerland was going to save gold based on a ballot proposal stipulating that the Swiss National Bank hold at least 20% of its 520-billion-franc ($538 billion) balance sheet in gold, repatriate overseas gold holdings and never sell bullion in the future. This was going to be the driver of the next leg up in gold. Except for the small fact that the “Save Our Swiss Gold” proposal was voted down, 77% to 23%, by the electorate. Why anyone believed this fairy tale in the first place is beyond me. Surveys of voters suggested that the ballot proposal was likely to fail. And yet there’s muddled thinking about gold among the bears too. Short sellers loaded up on bets that gold would plummet, a mistake in its own right since the outcome was all but foretold. When the collapse failed to materialize as the ballot initiative lost, the shorts had to cover their errant bets, sending spot prices higher (temporarily it seems).

Why do these narratives all tend to fail? For the most part, they reflect information that is already in prices. Markets are far from perfectly efficient (they are kinda- sorta-eventually-almost efficient). But they are more efficient than many seem to assume. What’s that you say? Consumers in China and India are big buyers of gold? You mean, the way they always have been? Indeed, most of the recent narratives contain information that is already reflected in prices. Yesterday, I read a breaking news article that said India’s decision to lift gold import restrictions would have a big, positive impact on prices. The problem with that narrative is that India eased import limits in May – and it moved gold prices higher by all of 0.5%.

The Germans don’t like what NATO is up to.

• Stop Talking about NATO Membership for Ukraine (Spiegel)

Just to be sure there is no misunderstanding: Vladimir Putin bears primarily responsibility for the new Cold War between the West and Russia. These days, you have to make that clear before criticizing Western policies so as not to be shoved into the pro-Putin camp. When NATO foreign ministers meet in Brussels today, the question of Ukraine’s possible future membership in the alliance is not on the agenda. It will, however, overshadow the meeting — and that is the fault of two politicians. During an interview with German public broadcaster ZDF on Sunday night, Ukrainian President Petro Poroshenko said he would like to hold a referendum on NATO membership at some point in the future. And new NATO General Secretary Jens Stoltenberg apparently had nothing better to do than to offer Poroshenko his verbal support and to reiterate the right of every sovereign nation in Europe to apply for NATO membership.

As if that weren’t enough, Stoltenberg added in comments directed at Moscow that “no third country outside NATO can veto” its enlargement. In the current tense environment, open speculation about possible Ukrainian membership in NATO is akin to playing with fire. German Chancellor Angela Merkel proposed the former Norwegian prime minister as NATO chief because he is considered to be a far more level-headed politician than predecessor Anders Fogh Rasmussen. But since he took the helm, differences between the two have been difficult to identify. Hawkish statements made by NATO’s top military commander, Philip Breedlove, haven’t done much to ease the situation either. Why is it even necessary for NATO officers to comment so frequently about Ukraine? Since the outbreak of the crisis, the alliance has expressed the opinion that the conflict cannot be resolved through military means. If that’s true, then wouldn’t it be better if Stoltenberg, Breedlove and company kept quiet?

“David Cameron has been just as generous with our money: as he cuts essential services for the poor, he has almost doubled the public subsidy for English grouse moors, and frozen the price of shotgun licences, at a public cost of £17m a year.”

• We Are Starting To Learn Who Owns Britain (Monbiot)

Bring out the violins. The land reform programme announced last week by the Scottish government is the end of civilised life on Earth, if you believe the corporate press. In a country where 432 people own half the private rural land, all change is Stalinism. The Telegraph has published a string of dire warnings – insisting, for example, that deer stalking and grouse shooting could come to an end if business rates are introduced for sporting estates. Moved to tears yet? Yes, sporting estates – where the richest people in Britain, or oil sheikhs and oligarchs from elsewhere, shoot grouse and stags – are exempt from business rates, a present from John Major’s government in 1994. David Cameron has been just as generous with our money: as he cuts essential services for the poor, he has almost doubled the public subsidy for English grouse moors, and frozen the price of shotgun licences, at a public cost of £17m a year.

But this is small change. Let’s talk about the real money. The Westminster government claims to champion an entrepreneurial society of wealth creators and hardworking families, but the real rewards and incentives are for rent. The power and majesty of the state protects the patrimonial class. A looped and windowed democratic cloak barely covers the corrupt old body of the nation. Here peaceful protesters can still be arrested under the 1361 Justices of the Peace Act. Here the Royal Mines Act 1424 gives the crown the right to all the gold and silver in Scotland. Here the Remembrancer of the City of London sits behind the Speaker’s chair in the House of Commons to protect the entitlements of a corporation that pre-dates the Norman conquest. This is an essentially feudal nation.

It’s no coincidence that the two most regressive forms of taxation in the UK – council tax banding and the payment of farm subsidies – both favour major owners of property. The capping of council tax bands ensures that the owners of £100m flats in London pay less than the owners of £200,000 houses in Blackburn. Farm subsidies, which remain limitless as a result of the Westminster government’s lobbying, ensure that every household in Britain hands £245 a year to the richest people in the land. The single farm payment system, under which landowners are paid by the hectare, is a reinstatement of a medieval levy called feudal aid, a tax the vassals had to pay to their lords.

Sounds good, tastes good too.

• Mediterranean Diet Keeps People ‘Genetically Young’ (BBC)

Following a Mediterranean diet might be a recipe for a long life because it appears to keep people genetically younger, say US researchers. Its mix of vegetables, olive oil, fresh fish and fruits may stop our DNA code from scrambling as we age, according to a study in the British Medical Journal. Nurses who adhered to the diet had fewer signs of ageing in their cells. The researchers from Boston followed the health of nearly 5,000 nurses over more than a decade. The Mediterranean diet has been repeatedly linked to health gains, such as cutting the risk of heart disease. Although it’s not clear exactly what makes it so good, its key components – an abundance of fresh fruit and vegetables as well as poultry and fish, rather than lots of red meat, butter and animal fats – all have well documented beneficial effects on the body. Foods rich in vitamins appear to provide a buffer against stress and damage of tissues and cells. And it appears from this latest study that a Mediterranean diet helps protect our DNA.

The researchers looked at tiny structures called telomeres that safeguard the ends of our chromosomes, which store our DNA code. These protective caps prevent the loss of genetic information during cell division. As we age and our cells divide, our telomeres get shorter – their structural integrity weakens, which can tell cells to stop dividing and die. Experts believe telomere length offers a window on cellular ageing. Shorter telomeres have been linked with a broad range of age-related diseases, including heart disease, and a variety of cancers. In the study, nurses who largely stuck to eating a Mediterranean diet had longer, healthier telomeres. No individual dietary component shone out as best, which the researchers say highlights the importance of having a well-rounded diet.

But then this does not help. Especially for the poor in southern Europe.

• Olive Oil Prices Soar After Bad Harvest (Guardian)

Take it easy with the salad dressing: the price of Italian olive oil has more than doubled in the past year to its highest level in a decade as the impact of drought and a fruit fly infestation has hit production. The price of extra virgin oil from Spain, the world’s biggest producer, is also up 15% year-on-year after olive trees across the Mediterranean suffered from drought and extreme heat in May and June, their peak blooming period when moisture is vital to develop a good crop. Analysts began warning that prices would rise this summer, but the cost of Italian extra virgin olive oil soared by nearly a quarter in November compared with October as the poor state of the harvest became clear, according to market analysts Mintec. Loraine Hudson at Mintec said demand could outstrip supply over the next year as Italian production would be down 35% and global production down 19% to 2.5m tonnes at a time when global consumption is rising.

“It would take off on its own, and re-design itself at an ever increasing rate ..”

• Stephen Hawking Warns Artificial Intelligence Could End Mankind (BBC)

Prof Stephen Hawking, one of Britain’s pre-eminent scientists, has said that efforts to create thinking machines pose a threat to our very existence. He told the BBC:”The development of full artificial intelligence could spell the end of the human race.” His warning came in response to a question about a revamp of the technology he uses to communicate, which involves a basic form of AI. But others are less gloomy about AI’s prospects. The theoretical physicist, who has the motor neurone disease amyotrophic lateral sclerosis (ALS), is using a new system developed by Intel to speak.

Machine learning experts from the British company Swiftkey were also involved in its creation. Their technology, already employed as a smartphone keyboard app, learns how the professor thinks and suggests the words he might want to use next. Prof Hawking says the primitive forms of artificial intelligence developed so far have already proved very useful, but he fears the consequences of creating something that can match or surpass humans. “It would take off on its own, and re-design itself at an ever increasing rate,” he said. “Humans, who are limited by slow biological evolution, couldn’t compete, and would be superseded.”

Home › Forums › Debt Rattle December 3 2014