Wyland Stanley Studebaker motor car in repair shop, San Francisco 1919

There are substantial and profound changes developing in the global economy, and in my view we should all pay attention, because everyone will be greatly affected. Some more than others, but still.

‘Metal markets’, be they gold, silver, copper or iron, exhibit distress and uncertainty, prices are falling, or at least seem to be. Partly, that is because of the apparently still ongoing investigation in the Chinese port of Qingdao, through which a $10 billion ‘currency fraud’ is reported today, ostensibly related to the double/triple borrowing that has been exposed, in which the same iron ore and copper shipments were used as collateral multiple times.

This could soon bring such shipments to the market and add to the oversupply already in place. Combined with ever more evidence of a slowdown in Chinese growth numbers, this doesn’t look good for iron, copper, aluminum.

But the Slow Boat To – or from – China is by no means the only reason metal prices are dropping. The main one is, plain and simple, the US dollar. Gold, for instance, hasn’t changed much at all when compared to a year ago, against the euro. Whereas it’s lost 8-9% against the dollar over the last 2-3 months, about the same percentage as that same euro. The movement is not – so much – in gold, it’s in the dollar.

To claim that this is the market at work makes no sense anymore. Today central banks, for all intents and purposes, are the market. As Tyler Durden makes clear once again for those who still hadn’t clued in:

Bank Of Japan Buys A Record Amount Of Equities In August

Having totally killed the Japanese government bond market, Shinzo Abe has – unlike the much less transparent Federal Reserve, who allegedly use their proxy Citadel – gone full tilt into buying Japanese stocks (via ETFs). In May, we noted the BoJ’s aggressive buying as the Nikkei dropped, and in June we pointed out the BoJ’s plan to buy Nikkei-400 ETFs and so, as Nikkei news reports, it is hardly surprising that the Bank of Japan bought a record JPY 123.6 billion worth of ETFs in August.

The market ‘knows’ that the BoJ tends to buy JPY 10-20 billion ETFs when stock prices fall in the morning. The BoJ now holds 1.5% of the entire Japanese equity market cap (or roughly JPY 480 trillion worth) and is set to surpass Nippon Life as the largest individual holder of Japanese stocks. And, since even record BoJ buying was not enough to do the job, Abe has now placed GPIF reform (i.e. legislating that Japan’s pension fund buys stocks in much greater size) as a primary goal for his administration. The farce is almost complete as the Japanese ponzi teeters on the brink.

Shinzo Abe wants the yen to fall, and he gets his (death)wish, because the Japanese economy and the financial situation of its government are in such bad shape, there’s nowhere else to go for the yen. That doesn’t spell nice things for the Japanese people, who will see prices for imported items (energy!) rise, but for all we know Abe sees that as a way to push up inflation. That’s not going to work, what we will push up instead is hardship. And that plan to force pension funds into stocks is just plain insane, an idea he got from US pension funds which are 50% in stocks – which is just as crazy.

Draghi talks down the euro, says a headline today, but I don’t see it; I wonder why that would be supposed to work now, and not in the preceding years, when it was just as obvious how poorly Europe was doing. Sure, there’s a new ‘threat’ in the AfD (Alternative for Germany), a right wing anti-euro party, but that’s not – for now – enough to cause the euro slide we’re seeing. The movement is not – so much – in the euro, it’s in the dollar.

Why the Fed moves the way it does, the moment it does, in its three pronged combo of fully tapering QE, hiking rates (or at least threatening to) and pushing up the greenback, is not immediately clear, but a few suggestions come to mind, some of which I mentioned earlier this month in The Fed Has A Big Surprise Waiting For You and in What Game Is Being Played With the US Dollar?.

My overall impression is that the Fed has given up on the US economy, in the sense that it realizes – and mind you, this may go back quite a while – that without constant and ongoing life-support, the economy is down for the count. And eternal life-support is not an option, even Keynesian economists understand that. Add to this that the -real – economy was never a Fed priority in the first place, but a side-issue, and it becomes easier to understand why Yellen et al choose to do what they do, and when.

When the full taper is finalized next month, and without rate rises and a higher dollar, the real US economy would start shining through, and what’s more important – for the Fed, Washington and Wall Street -, the big banks would start ‘suffering’ again. Just about all bets are on the same side of the trade today, and that’s bad news for Wall Street banks’ profits.

The higher dollar will bring some temporary relief for Americans, in lower prices at the pump, and for imported products in stores, for example. Higher rates, however, will put a ton and a half of pressure bearing down on everyone who’s in debt, and that’s most Americans. The idea is probably that by the time this becomes obvious and gets noticed, we’re far enough down the line that there’s no going back. Besides, we could be in full-scale war by then. One or two IS attacks in the west would do.

The higher dollar – certainly in combination with higher rates – will also mean a very precarious situation for the US government, which will have to pay a lot more in borrowing costs, but our leadership seems to think that at least in the short term, they can keep that under control. And then after that, the flood. Maybe the US can start borrowing in yuan, like the UK wants to do?

To reiterate: there is no accident or coincidence here, and neither is it the market reacting to anything. That’s not an option in this multiple choice, since there is no market left. It’s all central banks all the way (like the universe made up of turtles). It’s faith hope and charity, and the greatest of these is the Federal Reserve. Is they didn’t want a higher dollar, there would not be one. Ergo: they’re pushing it higher.

The Bank of England will follow in goose lockstep, while the ECB and Bank of Japan can’t. That’s earthquake and tsunami material. The biggest richest guys and galls will do fine wherever they live. The rest, not so much. Wherever they live . At the Automatic Earth, we’ve been telling you to get out of debt for years, and we reiterate that call today with more urgency. Other than that, it’s wait and see how many export-oriented US jobs will be lost to the surging buckaroo. And how a choice few nations in the northern hemisphere will make through the cold days of winter.

Whatever you do, don’t take this lightly. A major move is afoot.

• Dollar Hits Four-Year High as Metals Drop on China Fraud (Bloomberg)

The dollar jumped to a four-year high and precious metals retreated on speculation the strengthening U.S. economy is pushing the Federal Reserve closer to raising interest rates. Industrial metals and the yuan declined after China said it uncovered $10 billion of trade fraud, while European stocks rose. The Bloomberg Dollar Spot Index climbed for a fifth day, rising 0.3% by 10:17 a.m. in London, as the euro tumbled to a 22-month low. New Zealand’s dollar led losses against the greenback after the central bank said its strength is unjustified, while silver slumped 0.8% and gold fell to an eight-month low. Copper dropped 0.4% and the yuan reference rate was set at a two-week low. Spain’s bonds rose with Italy’s as the Stoxx Europe 600 Index climbed 0.3%. Standard & Poor’s 500 Index (XU100) futures were little changed.

The U.S. reports durable-goods orders and initial jobless claims numbers today after new-home sales surged in August to the highest level in more than six years. The stronger data are leading traders to bring forward bets on higher U.S. interest rates, buoying the dollar, as monetary policy from the euro area to New Zealand weighs on other currencies. Some banks played roles in fake trade at the port of Qingdao, said Wu Ruilin, deputy head of China’s State Administration of Foreign Exchange. “The theme during the second half of this year is dollar strength,” Yannick Naud, a money manager at Sturgeon Capital Ltd. in London, said in an interview on Bloomberg Television’s “On The Move” with Jonathan Ferro. “The economy is growing very strongly, we have a very good set of results and the central bank will probably be the first, or the second after the Bank of England, to increase interest rates.”

• Iron Ore Falls Below $80 to Lowest Since 2009 on China Concerns (Bloomberg)

Iron ore slumped below $80 a metric ton for the first time in five years on speculation that China’s slowing economic growth will curb demand in the world’s biggest user, exacerbating a global surplus. Ore with 62% content delivered to Qingdao, China, fell 0.5% to $79.69 a dry ton, the lowest level since Sept. 16, 2009, according to data from Metal Bulletin Ltd. The drop followed seven weeks of declines as the steelmaking raw material had the longest run of losses since May. The commodity plunged 41% this year as BHP Billiton Ltd. (BHP) and Rio Tinto Group (RIO) expanded output in a bet that the increase in volumes would more than offset falling prices as higher-cost mines are forced to shut. China’s Finance Minister Lou Jiwei said this week growth in Asia’s largest economy faces downward pressure. China’s economy remained stuck in “low gear” this quarter, with retail and residential real-estate industries struggling, according to the China Beige Book.

“The ramp-up in global supply and downturn in Chinese property sector are driving prices lower,” Paul Bloxham, chief Australia economist at HSBC Holdings Plc, said by e-mail today. “We expect Chinese miners to cut back production, which should keep prices well above the costs of major Australian producers.” Iron ore’s decline came after raw materials dropped to the lowest level in five years yesterday. The Bloomberg Commodities Index (BCOM) retreated 5.1% this year, poised for a fourth year of losses. Global output of seaborne ore will exceed demand by 52 million tons this year and 163 million tons in 2015, according to Goldman Sachs Group Inc. The price will average $102 a ton this year and $80 in 2015, according to the bank. So far this year, it’s averaged about $105.25 in Qingdao. China accounts for about 67% of global seaborne demand.

That’s all?

• China Watchdog Finds $10 Billion in Fake Currency Trade (Bloomberg)

China uncovered almost $10 billion in fraudulent trade nationwide as part of an investigation begun in April last year, including many irregularities in the port of Qingdao, the country’s currency regulator said today. Companies “faked, forged and illegally re-used” documents for exports and imports, Wu Ruilin, a deputy head of the State Administration of Foreign Exchange’s inspection department, said at a briefing in Beijing. The trades have “increased pressure from hot money inflows and provided an illegal channel for criminals to move funds,” Wu said, adding that those involved in such fraud would be severely punished.

“Some companies used the trade channel to bring in hot money,” said Zhou Hao, a Shanghai-based economist at Australia & New Zealand Banking Group Ltd. SAFE’s investigation “will likely further cool down hot money inflows and commodity imports could slow as banks will likely conduct more careful checks on documentation.” Industrial metals fell and the yuan weakened after the announcement. Copper slid as much as 0.5% and all main metals on the London Metal Exchange declined. Chinese banks have about 20 billion yuan ($3.3 billion) of exposure to companies caught up in a loan fraud probe in Qingdao, two government officials told Bloomberg in July. SAFE identified the fake trade invoicing as part of a crackdown on the practice in 24 cities and provinces, Wu said. The news raised speculation that metals supplies may increase as stockpiles tied up in financing deals come back on the market.

• Bank Of Japan Buys A Record Amount Of Equities In August (Zero Hedge)

Having totally killed the Japanese government bond market, Shinzo Abe has – unlike the much less transparent Federal Reserve, who allegedly use their proxy Citadel – gone full tilt into buying Japanese stocks (via ETFs). In May, we noted the BoJ’s aggressive buying as the Nikkei dropped, and in June we pointed out the BoJ’s plan tobuy Nikkei-400 ETFs and so, as Nikkei news reports, it is hardly surprising that the Bank of Japan bought a record JPY 123.6 billion worth of ETFs in August. The market ‘knows’ that the BoJ tends to buy JPY10-20 billion ETFs when stock prices fall in the morning. The BoJ now holds 1.5% of the entire Japanese equity market cap (or roughly JPY 480 trillion worth) and is set to surpass Nippon Life as the largest individual holder of Japanese stocks. And, since even record BoJ buying was not enough to do the job, Abe has now placed GPIF reform (i.e. legislating that Japan’s pension fund buys stocks in much greater size) as a primary goal for his administration. The farce is almost complete as the Japanese ponzi teeters on the brink. Via Nikkei Asia:

The Bank of Japan is growing into its role as a key source of support for the country’s stock market, as it has stepped up purchases of exchange-traded funds to bring its equities portfolio to an estimated 7 trillion yen ($63.6 billion) or so. The central bank bought 123.6 billion yen worth of ETFs in August, the largest monthly tally so far this year. At one point, it snapped up ETFs in six straight sessions amid weak stock prices. The BOJ tends to make 10 billion yen to 20 billion yen worth of purchases when stock prices fall in the morning. The bank has not made any purchases so far in September because the market has been rallying. According to BOJ data, the market value of individual stocks and ETFs that it held as of March 31 came to 6.15 trillion yen. Given its purchases since then and the market rally, the value is estimated to have increased to a whopping 7 trillion yen or so by now.

That figure accounts for 1.5% of the entire market value of all Japanese shares, or roughly 480 trillion yen. It also means the BOJ may surpass Nippon Life Insurance, the largest private-sector stock holder with some 7 trillion yen in holdings, as early as this year and emerge as the second-biggest shareholder behind the Government Pension Investment Fund – the national pension fund with 21 trillion yen. The BOJ started outright purchases of shareholdings from banks back in 2002 with the aim of stabilizing the country’s financial system. To prevent stocks from tumbling steeply, it also began buying ETFs in 2010. The bank does not buy individual shares now, but it doubled its annual ETF purchases to 1 trillion yen when it introduced unprecedented levels of monetary easing in April 2013.

It is unusual for a central bank to buy stocks and ETFs, given that their sharp price swings pose the risk of undermining the health of the bank’s assets. High levels of purchases by the BOJ affect stock prices and may hurt asset allocation and development of the financial markets. The timing and technique of selling the BOJ’s shareholdings are also a tricky question. A freeze has been put on sales of individual shares until March 2016, and there is no selling schedule for ETFs. But given that the bank’s holdings are equal to roughly half the 15 trillion yen in net buying by foreigners last year, large-scale selling would be certain to shake the market.

We hope, by now, it is clear what a fraud the entire system has become. Simply put, the BoJ has the firepower (unlimited printing) but not the liquidity (the markets are just not deep enough as was clear in the JGB complex) to keep the dream alive if (and when) investors lose faith in Abenomics. Clearly that’s why Abe needs to get the GPIF on the case…

What a surprise that is.

• Lending to Minorities Declines to a 14-Year Low in US (Bloomberg)

The share of mortgage lending to minority borrowers fell to at least a 14-year low as U.S. regulators struggle to ease credit to blacks and Hispanics shut out of the housing recovery. These borrowers, whose share of the purchase mortgage market has been shrinking since the collapse of subprime lending, continued to lose ground to white borrowers through 2013, according to federal data released this week. Blacks and Hispanics were a smaller portion of borrowers last year than they were in 2000, before the housing bubble.

Minorities, who tend to have less savings and lower credit scores than whites, have been hit hardest by lenders who are giving mortgages only to the strongest borrowers. Fair-lending advocates and civil-rights groups are urging the government to create new loan products and change how creditworthiness is determined to give blacks and Hispanics greater access to one of the best vehicles for building wealth. “These numbers are a wake-up call that the housing market is a major driver of the economy and it can’t be a vibrant market when so many new households are excluded from it,” said Jim Carr, a former Fannie Mae executive who is now a scholar at the Opportunity Agenda, a New York-based organization that works on racial equity issues.

And don’t you forget it.

• The World’s Largest Subprime Debtor: The US Government (Mises.ca)

Do you have a friend who consistently borrows 30% of his income each year, is currently in debt about six times her annual income, and wanted to take advantage of short-term interest rates so that he needs to renegotiate with his banker about once every six years? Well, if Uncle Sam is your friend you do!

Lehman Brothers filed for Chapter 11 bankruptcy protection six years ago this month. The event has become famous as the spark that ignited the global financial crisis. Since that date, millions have lost their jobs and livelihoods, and countless others have seen their futures evaporate before their eyes, sometimes permanently. At the heart of the crisis of 2008 was a common cause acknowledged by almost all commentators. Borrowers now infamously known as “subprime” (or more politely, “non-prime”) were the main reason behind the meltdown. As financial institutions extended loans to those with less than stable means to repay their debts, the foundation of the financial world was destabilized. Six years on and these subprime debtors are largely a relic of the past. That fact notwithstanding, there is a new threat lurking in the global financial arena. This one borrower is far larger than all the previous subprime characters combined, and poses a far more dangerous hazard to the financial stability of nearly all (if not all) of the world’s citizens.

I am speaking, of course, of the United States government. Subprime borrowers are defined by FICO scores which are largely inapplicable to sovereign nations. We can instead look at the type of loans that these borrowers took on to understand how precarious the United States federal government’s finances are. To simplify matters greatly, consider three types of loans that made debt attractive to subprime borrowers. The first was the adjustable rate mortgage. After a short period at a low introductory teaser rate, the interest rate would reset higher. Second was the interest only loan. Borrowers could take out a sum of money and for a period not worry about paying down the principal. An extreme form of the interest only loan is the final type: the negative amortization loan. In this case, not only does the payment not reduce the principal of the loan, it doesn’t even cover all the accrued interest! The effect is that each month that goes by, the borrower slips further in debt as interest deferral is added to the principal to be repaid.

In the wake of the crisis, a lot of commentators focused on two measures of the government’s financial stability. The first was its debt to GDP level, which was added to on a yearly basis by its deficit (also expressed as a%age of GDP). At its nadir in 2010, the federal government ran a budget deficit of nearly 10% of GDP (the highest since World War II). As of today, the federal debt level (ignoring unfunded liabilities such as Social Security or Medicare) amounts to 102% of GDP. While these numbers are indeed high, they really understate the problem. After all, the denominator in both cases is the total income of the whole United States, not just that of the government.

Two pieces on the same anti-euro bet at S&P.

• Germany’s Ukip Threatens To Paralyse Eurozone Rescue Efforts (AEP)

The stunning rise of Germany’s anti-euro party threatens to paralyse efforts to hold the eurozone together and may undermine any quantitative easing by the European Central Bank, Standard & Poor’s has warned. Alternative für Deutschland (AfD) has swept through Germany like a tornado, winning 12.6pc of the vote in Brandenburg and 10.6pc in Thuringia a week ago. The party has broken into three regional assemblies, after gaining its first platform in Strasbourg with seven euro-MPs. The rating agency said AfD’s sudden surge has become a credit headache for the whole eurozone, forcing Chancellor Angela Merkel to take a tougher line in European politics and risking an entirely new phase of the crisis. “Until recently, no openly Eurosceptic party in Germany has been able to galvanise opponents of European ‘bail-outs’. But this comfortable position now appears to have come to an end,” it said. The report warned that AfD has upset the chemistry of German politics, implying even greater resistance to any loosening of EMU fiscal rules.

It raises the political bar yet further for serious QE, and therefore makes the tool less usable. There has long been anger in Germany over the direction of EMU politics, with a near universal feeling that German taxpayers are being milked to prop up southern Europe, but dissidents were until now scattered. “AfD appears to enjoy a disciplined leadership, and is a well-funded party appealing to conservatives more broadly, beyond its europhobe core,” it said. “This shift in the partisan landscape could have implications for euro area policies by diminishing the German government’s room for manoeuvre. We will monitor any signs of Germany hardening its stance.” Mrs Merkel has a threat akin to Ukip on her right flank, and can no longer pivot in the centre ground of German politics. AfD has almost destroyed the centre-Right Free Democrats (FDP), and is also eating into the far-Left of the Linke party. The new movement calls for an “orderly break-up” of monetary union, either by dividing the euro into smaller blocs or by returning to national currencies.

“Germany doesn’t need the euro, and the euro is hurting other countries. A return to the D-mark should not be a taboo,” it says. Club Med states should recover viability through debt restructuring, rather than rely on taxpayer bail-outs that draw out the agony. Unlike Ukip, the movement wants Germany to stay in a “strong EU”. Party leader Bernd Lucke is a professor of economics at Hamburg University. His right-hand man is Hans-Olaf Henkel, former head of Germany’s industry federation. Attempts to discredit the party as a Right-wing fringe group have failed. Prof Lucke had a taste of his new power in the European Parliament this week, questioning the ECB’s Mario Draghi directly on monetary policy. He attacked ECB asset purchases, insisting that there is already enough liquidity in the financial system to head off deflation. Such stimulus merely stokes asset bubbles and does little for the real economy, he argued, adding that the ECB is “saddling up the wrong horse” because it doesn’t have another one in the stable.

S&P said the rise of AfD would not matter for EMU affairs if the eurozone crisis were safely behind us. “This is unlikely to be the case. Eurozone output is still below 2007 levels and in 2014 the weak recovery has come to a near halt in much of the euro area. Public debt burdens continue to rise in all large euro area countries bar Germany,” it said. The report warned that any sign of hardening attitudes in German politics could “diminish the confidence of financial investors in the robustness of multilateral support” for EMU crisis states, leading to a rise in bond spreads. This in turn would shift the focus back on to Club Med debt dynamics, arguably worse than ever.

S&P said a forthcoming judgment by the European Court on the ECB’s backstop plan for Italy and Spain (OMT) might further constrain the EU rescue machinery. Germany’s top court has already ruled that the OMT “manifestly violates” EU treaties and is probably ultra vires, meaning that Bundesbank may not legally take part. The political climate in the eurozone’s two core states is now extraordinary. A D-Mark party is running at 10pc in the latest polls in Germany, while the Front National’s Marine Le Pen is in the lead in France on 26pc with calls for a return to the franc. One more shock would test EMU cohesion to its limits.

• Standard & Poor’s Warns Germany to Trigger the Next Debt Crisis (WolfStreet)

A true debacle happened. Just when we thought the euro was safe, that ECB President Mario Draghi had single-handedly duct-taped the Eurozone back together in the summer of 2012 with his magic words, “whatever it takes.” Markets assumed that they were backed by the ECB’s printing press, and they loved their assumption. Spanish, Italian, even highly dubious Greek debt, some of it with a fresh haircut, soared. And hedge funds and banks gorged on it and loved it. The debt crisis was over! Stocks soared even more. Money was being made. So bank bailouts continued, and the Eurozone recession proved to be a nasty long-term affair, but no problem, everything seemed to be guaranteed by the ECB. Debt-sinner countries, as Germans like to call them, could suddenly borrow for nearly free, and neither deficits nor debts mattered to financial markets.

But now comes ratings agency Standard & Poor’s and douses our illusions, because that’s all they were, with a bucket of ice water. The soaring popularity and electoral successes of Germany’s anti-euro party, Alternative for Germany (AfD), could push Chancellor Angela Merkel and her party, the conservative CDU, to take a harder line against bailouts, hopes of QE, and all manner of other ECB miracles that financial markets had been counting on. And it could spook them. And the nearly free money could suddenly dry up. So S&P warned:

None of this would matter much, if we were to assess that the euro crisis is safely behind us. However, this is unlikely to be the case. Eurozone output is still below 2007 levels, and in 2014 the weak recovery has come to a near halt in much of the euro area. Unemployment remains precariously high and disinflationary pressures have been mounting. Public debt burdens continue to rise in all large euro area countries bar Germany.

Nice try but.

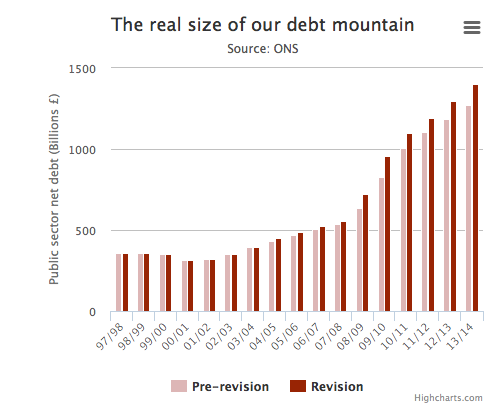

• Just How Big Is Britain’s Debt Mountain? (Telegraph)

The Office for National Statistics (ONS) has changed the way it measures our public finances, throwing fresh light on the precise state of the nation’s coffers. The latest revisions help bring the UK in line with European accounting standards, but they don’t make great reading for the Chancellor. According to the figures, Britain’s debt mountain is £127 billion bigger that we first thought. To provide some context, that’s more than the government’s annual budget for education and housing put together.

In total, the government owes its creditors £1.4 trillion as of this year. Public sector borrowing – the difference between what the government earns in revenues and what it spends and invests – has also jumped. The ONS now thinks borrowing is around £99 billion, £5 billion higher than previously calculated. So what’s changed? The ONS has adopted a different methodology for calculating the public finances. Debt and borrowing are now higher as the new figures include the cost of the bank bailouts carried out in the wake of the credit crunch, as well as the Bank of England’s quantitative easing programme. The new accounting rules also mean that Network Rail has been reclassified as part of central government rather than the private sector. The liabilities associated with Network Rail add £33 billion to the nation’s debt pile. That’s approximately the entire GDP of Uruguay.

Meanwhile the inclusion of the Asset Purchase Facility, the part of the Bank of England that has been purchasing government bonds, adds on a further £42.4 billion to the debt burden. This is more than Britain’s entire defence budget for 2014/15, or roughly six times the market capitalisation of Marks & Spencer’s. In other areas, the ONS no longer treats the government’s auctioning of 4G phone spectrum licences as a one-off windfall. Should we worry? On the question of the accounting changes, the government’s fiscal watchdog, the Office for Budget Responsibility says: “it is important to stress that these are changes to the way public sector finances are measured, not to the underlying activities being measured.”

But they’ll raise rates, Carney said again today.

• Bank of England ‘Won’t Risk Recovery’: Deputy Governor Minouche Shafik (YP)

Businesses must increase productivity, investment and exports to ensure a lasting economic recovery, according to the new deputy governor of the Bank of England. In her first interview since taking on the role, Minouche Shafik discussed the risks to the rebounding UK economy, the need for more growth-orientated policies in Europe and when to start unwinding the Bank’s £375bn quantitative easing scheme. She said the economy has been growing faster than many had expected at 3.2%. Ms Shafik told The Yorkshire Post: “The recovery is encouraging. The real question is how can we make this recovery sustainable. “We don’t want to take risks with this recovery. It’s been a long recession and I think that’s going to be the biggest challenge going forward.”

On the question of when to increase interest rates, she said she would be closely watching the relationship between wage growth and productivity. She said there are mixed signals about the strength of that growth. “If wage increases are expected but productivity is performing well we can wait for longer; if those wage increases are not accompanied by productivity increases then I think we will have to move more quickly on rates because inflationary pressures will build up. “I think that’s the key choice that we face,” said Ms Shafik, who has so far attended two meetings of the Monetary Policy Committee.

Buy stocks in a shrinking economy. Great idea.

• Brace For China Markets’ Biggest Opening In Years (NY Times)

O’Connor, the $5.6 billion hedge fund owned by UBS, has been expanding its presence in Asia. It has hired traders from UBS’s proprietary trading desk to work in its Hong Kong and Singapore offices. In August, it hired John Yu, a former analyst at SAC Capital Advisors. It is not alone. Bankers, brokerage firms and hedge funds have all been quietly expanding their Asian operations to take advantage of one event: the biggest opening into China in years. China plans to connect the Shanghai stock exchange to its counterpart in Hong Kong over the next month as part of an initiative announced by Premier Li Keqiang this year to open China’s markets to foreign investors who have been largely shut out. The move will allow foreign investors to trade the shares of companies listed on the Shanghai stock exchange directly for the first time, and Chinese investors to buy shares in companies listed in Hong Kong.

The potential rewards of an open market between the mainland and Hong Kong are enormous for investors. Currently, the only way for foreign investors to trade Chinese stocks is indirectly through a limited quota program that allows a trickle of foreign money into the country. “This is the single most important development in China’s intention to internationalize this market,” one senior Western banker in Asia said of the planned reform, speaking on the condition he not be named because he was not authorized to speak publicly on the matter. The program, called the Shanghai-Hong Kong Connect, will create the second-largest equity market in the world in terms of the market value of the combined listed companies, said Dawn Fitzpatrick, the chief investment officer of O’Connor. “It is also going to create a much more efficient way for the global marketplace to value many Chinese companies, and this attribute alone makes the market more attractive,” she added.

Infighting?

• Speculation Resurfaces on China Central Bank Governor (Bloomberg)

Speculation about the retirement of China central bank Governor Zhou Xiaochuan, a champion of shifting the world’s second-largest economy to greater reliance on markets, is resurfacing, focusing attention on potential successors. With Zhou, 66, past the typical retirement age for senior officials and a Communist Party leadership meeting looming next month, social media chatter on his possible exit escalated. The Wall Street Journal said yesterday party boss Xi Jinping is considering replacing Zhou, citing unidentified officials. The China Times this month published an opinion piece on prospects for ex-securities regulator Guo Shuqing taking the job. Six of 13 economists in a Bloomberg News survey this month cited Guo, 58, as the most likely successor when Zhou does leave. Five predicted it would be People’s Bank of China Deputy Governor Yi Gang, 56. The government, which controls the PBOC, hasn’t publicly signaled its intention and rounds of speculation in 2007 and 2012 that Zhou would be replaced failed to pan out.

“There will eventually be a rumor that’s right – Zhou will retire at some point,” David Loevinger, former U.S. Treasury Department senior coordinator for China affairs and now a Los Angeles-based analyst at TCW Group Inc., said in an e-mail. “I’ve met Guo several times. He’s an accomplished economist, banker and regulator with a good understanding of the international financial system.” The PBOC, along with the rest of the nation’s policy making community, is grappling with a slowdown in growth and efforts to follow through on a pledge to give markets a “decisive” role in the economy. Zhou, at 11 years the longest-serving PBOC chief on record, has advocated freeing up controls on interest rates and reducing intervention in the exchange rate. “If Guo were to replace him, I wouldn’t expect much change in Chinese policy,” said Nicholas Lardy, author of the book “Markets Over Mao” and a senior fellow at the Peterson Institute for International Economics in Washington. “Guo Shuqing has very similar strong reformist credentials as Governor Zhou.”

Altogether now.

• Is Shorting The Euro The New One-Way Bet? (CNBC)

The euro’s drop to its lowest against the U.S. dollar in over a year may be just the beginning, with some analysts expecting the common currency to fall to levels not seen since 2003. “The euro is vulnerable to a serious hit,” analysts at Barclays said in a note Wednesday. “We now expect a large, multi-year downtrend in the euro, following a substantial deterioration in the euro area’s economic outlook and the ECB’s (European Central Bank) aggressive response to that deterioration.” The euro slipped as low as $1.2764 in early Asian trade Thursday, touching its lowest level since July 2013, after ECB President Mario Draghi said monetary policy will remain loose for as long as it takes to bring the euro zone’s inflation rate up to the central bank’s 2% target.

On Monday, Draghi told the European parliament the central bank may use unconventional tools to spur inflation and growth, which could include quantitative easing, or buying credit and sovereign bonds. Draghi reiterated those views in an interview published Thursday by Lithuanian business daily Verslo Zinios, and noted he expects modest economic growth in the second half of this year after it stalled in the second quarter Also weighing on the common currency, fresh data from the region’s economic powerhouse Germany showed business sentiment fell in September to its lowest level since April of last year.

Barclays cut its 12-month forecast for the euro to $1.10 from $1.25, with much of the depreciation expected within six months. Others are equally bearish. “The main drivers of euro trends point to significant weakness,” Societe Generale said in a note earlier this week. “Draghi will succeed in weakening the euro now because in the coming months the contrast between euro area and U.S. economic performance will translate into monetary policy divergence as the ECB remains accommodative but the Federal Reserve first stops buying assets and then raises rates from mid-2015 onwards.”

Well, that sounds realistic …

• Rapid Growth At Top Of Agenda For Emerging Market Businesses (CNBC)

Emerging economies look to corporations to keep their economies expanding at their rapid rates, according to a survey. One in three (34%) of the public and 30% of business leaders in emerging economies said helping to strengthen the economy was the most important responsibility for a company, according to the CNBC/Burson-Marsteller Corporate Perception Index. Job creation was the second most important responsibility for corporations. In developed markets however, the trend was flipped with job creation seen as the number one role of corporations, followed by helping the economy more generally. Emerging market countries are known for their rapid economic growth, which has appealed to investors over recent years. China is obsessed with its growth rate and the government continues to push for a 7.5% target. This focus on rapid growth is behind the results of the survey, according to economists.

“Growth is key and it is all about growth,” Benoit Anne, head of global emerging market strategy at Societe Generale, told CNBC by phone. “In emerging markets unemployment seems to be less of a concern because the informal economy is large and premium is attached to growth considerations.” 37% of the general public in developed countries, which includes Spain, France and the U.K., said creating jobs was the most important role for an organization, while 31% of business executives thought this was the case. The euro zone economy has been struggling since the 2008 crisis and even Germany, the bloc’s largest economy contracted in the second quarter. Unemployment in the 18 country zone stands at 11.5%, and in Spain at 24.5%. This, combined with increasing perception of income inequality, has driven the results of the survey, analysts said.

Power.

• What Does The US Gain From Paying For Europe’s Security? (RT)

Despite the fact that Europe is a very rich continent – the EU’s total GDP is higher than the US – Americans are bankrolling its security. The only way to explain the background to this conundrum is in fairytale style. When detailed in analytical text it’s even more baffling, and I don’t want to confuse everyone. Once upon a time in a land far away there were two families, the Europas and the Amerigos, who were closely related. The Europa’s fought bloody wars for millennia, mainly due to disputes between kings and queens they declared fealty to, and a few centuries ago, the Amerigos moved out of the home region. After that, the Europas continued to – constantly – argue and the Amerigos became extremely rich in their new homeland. Then, about 70 years ago, the Europas had the mother, father and cousin of all internal rows and much of the family was annihilated in a mass fratricide, but the Amerigos and their other cousins, the Sovetskys, came to save them.

While the Europas became largely poor as a result of the conflict, the Amerigos and the Sovetskys were bolstered and decided they both wanted to be top dog. They then ‘fought’ a cold war for 45 years. The Amerigos worshipped free markets, but the Sovetskys believed in socialism. The Europas were divided by the ‘isms’ – capital and social. Most of the family members on the west side of town supported the Amerigos but the east end of things fancied the Sovetskys ideas. Eventually, the Sovetskys system of communism proved inadequate and their power dissipated so the Europas began to unite again. But something had changed. A half century of peace and stability meant that the western Europas were now as wealthy as the Amerigos but the eastern branch were not; in fact, many on the east side of town were sickeningly poor after their system had collapsed.

The western Europas had become used to the Amerigos looking after security needs, but most of them were no longer afraid of the Sovetskys, who had now embraced the free market ideology and were called the Rus. They’d changed their names after half the family had splintered into smaller groups. However, many of the eastern Europas were still extremely afraid of the Rus and they pressured the Amerigos into also paying for their security. The Amerigos had promised the Rus after the Sovetsky split that they wouldn’t interfere with former family members – but this promise was broken. Now the eastern Europas too had their safety bankrolled by the Amerigos. However, they didn’t run off and join their cousins, instead they re-united with the western branch of the Europa family.

Blame Putin.

• Ukraine Is Broke – And Winter Is Coming… (RT)

How broke is Ukraine? On a scale of one to 10, I’d venture 10 and a half. What the well-meaning idiots from abroad haven’t talked about is how dependent Kiev’s economy is on Russia. In 2013, more than 60% of their exports went to post-Soviet countries. Meanwhile, export levels have, officially, fallen by a gigantic 19% already this year (and the real figure is probably much worse). Also, what little high-end manufacturing Ukraine had was almost entirely beholden to the Russian military-industrial complex. An example is Antonov, the famed aircraft maker, which recently had to write off $150 million when it couldn’t deliver an order to the Russian Air Force. Antonov’s planes can’t compete in western markets, so without the Russian market the company is finished. Good news for Komsomolsk-on-Amur (the home of Sukhoi) in Russia’s Far East, but a tragedy for the 12,000 employees of Antonov, near Kiev.

I’m not sure how Roshen Chocolates is doing, but with a $1.3 billion fortune, its owner, oligarch Willy Wonka, or President Petro Poroshenko as he’s better known, won’t be going hungry. He’s one of the lucky ones. Industrial production has fallen off a cliff in Ukraine, down over 20% already this year and retail sales aren’t far off, at about 19%. Foreign currency reserves have collapsed by around 25%, even with emergency IMF funding. Yet, that’s not even close to the largest concern. This would be the currency, the hryvna, which crumbled by 11% against the dollar last Friday alone. A year ago, the rate was around 8.1, it’s now a startling 13.5. Great news for those paid in greenbacks, but 99% of locals are remunerated in hryvnas. Inflation is north of 14% and is set to increase dramatically in the short-term as the currency is geared in only one direction. Winter is coming, and anyone who has been in Kiev in January can tell you how shivery that gets. It’s a special variety of biting cold and it takes more than North Face – for the few can afford it – to survive the onslaught.

Ukraine imports 80% of its natural gas – and most of that comes from Russia. A real problem here is that Kiev currently owes Gazprom, Russia’s state gas giant, $4.5 billion. In fact, Ukraine’s single most profitable export service (worth $3 billion annually) is transit fees for Gazprom’s access to other European markets. This is what is known as a “double bind.” I didn’t mention the IMF loans yet. They are not “aid” – and they must be repaid. The latest guarantee was around $20 million and there have been suggestions that a sizeable portion has been looted by kleptocrat insiders already. The IMF’s Articles of Agreement forbid it to make loans to countries that clearly cannot pay. Unless the agency is willing to tear up its rule book – thus making Greeks the happiest people alive – it’s clear that emergency funding from that source is also about to grind to a halt.

Good Parry piece.

• The High Cost of Bad Journalism on Ukraine (Robert Parry)

To blame this crisis on Putin simply ignores the facts and defies logic. To presume that Putin instigated the ouster of Yanukovych in some convoluted scheme to seize territory requires you to believe that Putin got the EU to make its reckless association offer, organized the mass protests at the Maidan, convinced neo-Nazis from western Ukraine to throw firebombs at police, and manipulated Gershman, Nuland and McCain to coordinate with the coup-makers – all while appearing to support Yanukovych’s idea for new elections within Ukraine’s constitutional structure. Though such a crazy conspiracy theory would make people in tinfoil hats blush, this certainty is at the heart of what every “smart” person in Official Washington believes. If you dared to suggest that Putin was actually distracted by the Sochi Olympics last February, was caught off guard by the events in Ukraine, and reacted to a Western-inspired crisis on his border (including his acceptance of Crimea’s request to be readmitted to Russia), you would be immediately dismissed as “a stooge of Moscow.”

Such is how mindless “group think” works in Washington. All the people who matter jump on the bandwagon and smirk at anyone who questions how wise it is to be rolling downhill in some disastrous direction. But the pols and pundits who appear on U.S. television spouting the conventional wisdom are always the winners in this scenario. They get to look tough, standing up to villains like Yanukovych and Putin and siding with the saintly Maidan protesters. The neo-Nazi brown shirts are whited out of the picture and any Ukrainian who objected to the U.S.-backed coup regime finds a black hat firmly glued on his or her head. For the neocons, there are both financial and ideological benefits. By shattering the fragile alliance that had evolved between Putin and Obama over Syria and Iran, the neocons seized greater control over U.S. policies in the Middle East and revived the prospects for violent “regime change.”

But not going to happen.

• Russia Calls For International Probe Into Ukraine Mass Burial Sites (RT)

Russia is calling for an international investigation into the discovery of burial sites with signs of execution at locations where the Ukraine National Guard forces were stationed two days earlier. The head of Russia’s presidential human rights council, Mikhail Fedotov, has called on the authorities to do everything to “ensure an independent international probe” and “let international human rights activists and journalists” gain access to the site in Eastern Ukraine’s embattled Donetsk region. The crime, Fedotov noted, shouldn’t “remain without consequences.” He didn’t exclude the discovery of other burial sites, reminding that mass killings are “the reality of the modern-day war” and that such crimes were committed in the wars in the former Yugoslavia. The burial sites near the Kommunar mine, 60 kilometers from Donetsk, were first discovered on Tuesday by self-defense forces. Four bodies have been exhumed, including those of three women. Their hands were tied, at least one of the bodies was decapitated, self-defense fighters said.

Two bodies were found Monday, and two others Tuesday. Self-defense forces believe there might be other burials in the area. “They are from Kommunar, which has just been freed [by DNR/DPR forces]. The people told me that the women had been missing and here we found four bodies. And I don’t know how many more people we might find,” a self-defense fighter, nicknamed Angel, told RT. “The peaceful Ukrainian army came here and “liberated” them but I can’t understand what the Army freed them from. These women died horribly,” his comrade, Alabai, added. Self-defense forces said that near the mine – which was abandoned by the Ukrainian forces a few days ago – there are other burial sites which will also be examined.

OSCE monitors have already visited and inspected the burial site. According to the OSCE report published Wednesday, some of the victims buried not far from Donetsk were killed a month ago. Near an entrance to the village the organization’s staff saw “a hill of earth, resembling a grave” and a sign with the initials of five people and a date of death – August 27, 2014. This was one of the three unidentified burial sites discovered by OSCE monitors. Prosecutors in the Donetsk People’s Republic have started an investigation. Russian Foreign Ministry’s envoy for human rights, Konstantin Dolgov, said on Twitter that the Ukrainian army was to blame for the killings. “The finding of mass burial sites in Donetsk area is yet another trace of the Ukrainian forces’ and radical nationalists’ humanitarian crime,” Dolgov said. “This beastly crime targeting civilians attracts our attention even more to the necessity of investigating humanitarian crimes in Ukraine under international control,” he added.

Not just the US, I’d venture.

• How the US Screwed Up in the Fight Against Ebola (BW)

It was a small victory in a grim, relentless, and runaway catastrophe. In July, Kent Brantly and Nancy Writebol, both American medical workers in Liberia, became stricken with Ebola hemorrhagic fever after treating dozens suffering from the disease, which has a mortality rate of between 50% and 90%. They were rushed doses of an experimental cocktail of Ebola antibodies called ZMapp, flown home via a Gulfstream III on separate flights on Aug. 2 and 5, and isolated inside a special tent called an “aeromedical biological containment system.” The U.S. State Department and the Centers for Disease Control and Prevention (CDC) coordinated the flights, operated by Phoenix Air, a private transport company based in Georgia. Cared for in a special ward at Emory University in Atlanta, they recovered within the month and later met with President Obama. It appeared a win for the White House.

Mapp Biopharmaceutical, the San Diego company that developed ZMapp, is also in a way a White House project. It’s supported exclusively through federal grants and contracts that go back to 2005. The antibody mixture hadn’t yet passed its first phase of human clinical trials, but after the two Americans were infected with Ebola, the Food and Drug Administration granted emergency access to ZMapp. It’s impossible to say whether ZMapp was vital to the Americans’ survival. There were a limited number of doses available. Mapp ran out after having given doses to the two Americans, a Spanish priest, and doctors in two West African countries, although it declined to say how many. And that raised a fair question: Why hadn’t the promising treatment gone through human clinical trials sooner, and why were there so few doses on hand?

Since appearing in Guinea in December, Ebola has spread to five West African countries and infected 5,864 people, of which 2,811 have died, according to the World Health Organization’s Sept. 22 report. This number is widely considered an underestimate. The CDC’s worst-case model assumes that cases are “significantly under-reported” by a factor of 2.5. With that correction, the CDC predicts 21,000 total cases in Liberia and Sierra Leone alone by Sept. 30. A confluence of factors has made it the biggest Ebola outbreak yet. For starters, West Africa has never seen Ebola before; previous outbreaks have mainly surfaced in the Democratic Republic of the Congo in Central Africa. The initial symptoms of Ebola—fever, vomiting, muscle aches—are also similar to, and were mistaken for, other diseases endemic to the region, such as malaria.

Then, when officials and international workers swept into villages covered head to toe and took away patients for isolation, some family members became convinced that their relatives were dying because of what happened to them in the hospitals. They avoided medical care and lied to doctors about their travel histories. Medical staff at local hospitals became scared and quit their jobs. Aid workers trying to set up isolation units or trace infected people’s contacts were attacked by angry villagers. With these countries short on resources, staff, medical equipment, and basic understanding of the disease, Ebola took hold and spread.

Ambrose is the epitomy of techno-happy. And he proves once more than actual knowledge has nothing to do with it.

• Technology Revolution In Nuclear Power Could Slash Costs Below Coal (AEP)

The cost of conventional nuclear power has spiralled to levels that can no longer be justified. All the reactors being built across the world are variants of mid-20th century technology, inherently dirty and dangerous, requiring exorbitant safety controls. This is a failure of wit and will. Scientists in Britain, France, Canada, the US, China and Japan have already designed better reactors based on molten salt technology that promise to slash costs by half or more, and may even undercut coal. They are much safer, and consume nuclear waste rather than creating more. What stands in the way is a fortress of vested interests. The World Nuclear Industry Status Report for 2014 found that 49 of the 66 reactors under construction – mostly in Asia – are plagued with delays, and are blowing through their budgets.

Average costs have risen from $1,000 per kilowatt hour to around $8,000/kW over the past decade for new nuclear, which is why Britain could not persuade anybody to build its two reactors at Hinkley Point without fat subsidies and a “strike price” for electricity that is double current levels. All five new reactors in the US are behind schedule. Finland’s giant EPR reactor at Olkiluoto has been delayed again. It will not be up and running until 2018, nine years late. It was supposed to cost €3.2bn. Analysts now think it will be €8.5bn. It is the same story with France’s Flamanville reactor. We have reached the end of the road for pressurised water reactors of any kind, whatever new features they boast. The business is not viable – even leaving aside the clean-up costs – and it makes little sense to persist in building them. A report by UBS said the latest reactors will be obsolete by within 10 to 20 years, yet Britain is locking in prices until 2060.

The Alvin Weinberg Foundation in London is tracking seven proposals across the world for molten salt reactors (MSRs) rather than relying on solid uranium fuel. Unlike conventional reactors, these operate at atmospheric pressure. They do not need vast reinforced domes. There is no risk of blowing off the top. The reactors are more efficient. They burn up 30 times as much of the nuclear fuel and can run off spent fuel. The molten salt is inert so that even if there is a leak, it cools and solidifies. The fission process stops automatically in an accident. There can be no chain-reaction, and therefore no possible disaster along the lines of Chernobyl or Fukushima. That at least is the claim.

Home › Forums › Debt Rattle Sep 25 2014: It’s The Dollar, Stupid!