Debt Rattle December 1 2024

Home › Forums › The Automatic Earth Forum › Debt Rattle December 1 2024

- This topic has 47 replies, 18 voices, and was last updated 2 months, 3 weeks ago by

D Benton Smith.

-

AuthorPosts

-

December 1, 2024 at 10:54 pm #175760

Dr. D

Participant“Death Toll From Islamist Assault On Aleppo Nears 500 As Iran Says ‘Firmly Supports’ Assad

Israeli media says coordinated offensive is about further weakening the ‘Iran axis’…”ISRAEL is their spokesman? ISRAEL “Coordinated” the attack. …Of all muslim extremists in the area? Including Turkey? Huh.

And not front page news: “ISRAEL AND ALL JIHADISTS ARE ALLIES!!!” The war. Is over.

Huh. So weird. Welp, The Beeb is on, so that’s that I guess.

December 2, 2024 at 12:06 am #175761Oroboros

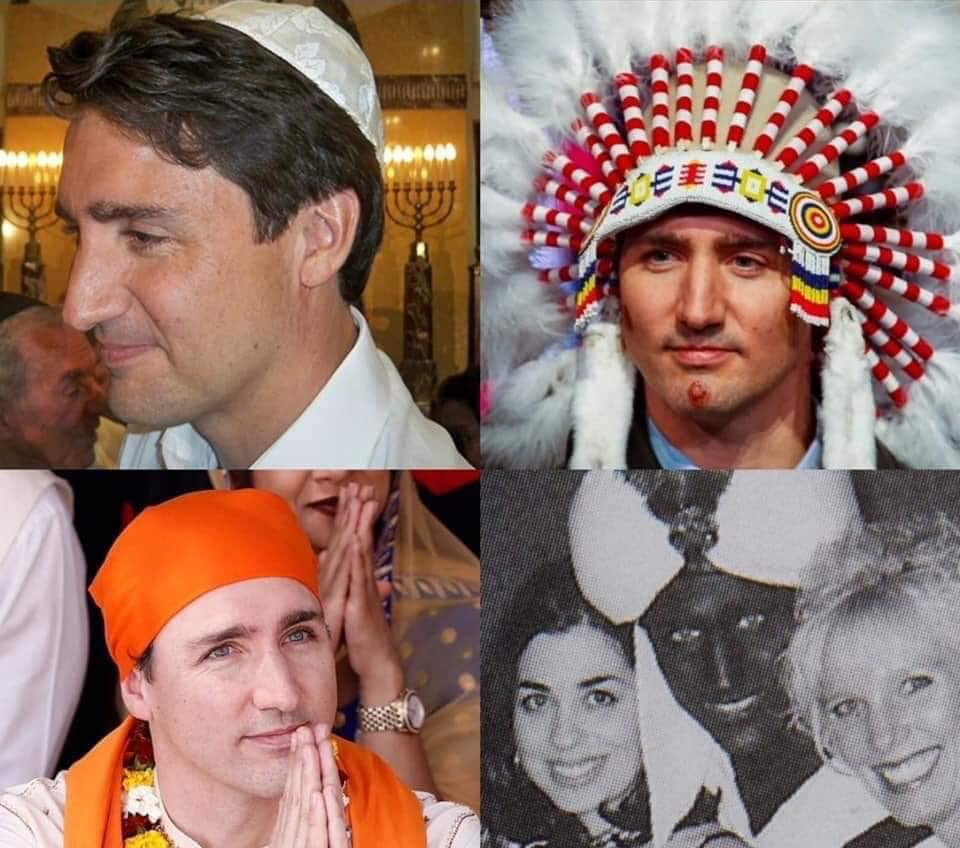

ParticipantMaximum Canazida Cuck

As Alex on the Duran refers to him:

“Big Balls” Turdeau

.

.

.

.

.

.

December 2, 2024 at 1:12 am #175762zerosum

ParticipantCross my heart, hope to die, I’m not going to pardon my son Hunter.

December 2, 2024 at 1:20 am #175763zerosum

ParticipantMany eyes have been opened to see the hypocrisy of our “leaders” and the lies they tell about “good guys” and bad.

https://www.thecanadafiles.com/articles/trudeaus-good-guys-and-bad-reveal-hypocrisy-of-supporting-us-empire

Trudeau’s ‘good guys’ and bad reveal hypocrisy of supporting US Empire

Written by: Yves EnglerDecember 2, 2024 at 1:56 am #175767my parents said know

ParticipantPardon me, Hunter… Oh, wait. Pardon you!

December 2, 2024 at 2:49 am #175768my parents said know

ParticipantI really can’t get exercised about this. I consider what I think I know about his family. The guy is seriously messed up. His laptop is fair game now- he can do all the talk shows with a five second delay. Heck, the schmuck could run for president in a decade or so, as his reputation gets laundered with endless confessions and fifteen minutes of shame.

…I am ashamed of what I’ve done. I am ashamed of my origins. I am ashamed of who I am…

But I’m much better, now!

I wonder if there are any others who would like to use this method of redemption?December 2, 2024 at 4:00 am #175771Figmund Sreud

ParticipantNote: Article below is originally from behind a pay-wall at: https://www.theglobeandmail.com/investing/investment-ideas/article-there-is-no-reason-to-fear-the-brics-countries-usurping-the-wests/

From my in-Box this p.m.:

Stay invested in America and avoid the BRICS

Since the beginning of the war in Ukraine, there has been much talk about the so-called BRICS countries forming an alternative to the global economic order. Some fear, and some gloat, that the financial hegemony of the Western industrialized countries is coming to an end. They say the importance of the U.S. dollar and to some extent the euro, which have been dominant in international commerce, will be replaced by some alternative championed by the BRICS countries. Many self-described geopolitical and economic experts are certain of this, although they never seem to name exactly what currency will knock the dollar off its pedestal.

But this sentiment of the imminent death of the U.S. dollar is premature. The BRICS are not only poor competition for the West, but they are also, in different and uniquely individual ways, economic accidents waiting to happen. The risk is not that they will usurp the West but that many will become so economically, and eventually, politically chaotic that they will destabilize the entire world.

Investors need to ponder this when evaluating where their portfolios are invested.

The term BRICS was coined in 2001 by Goldman Sachs economist Jim O’Neill, to refer to the grouping of Brazil, Russia, India and China. South Africa was added a few years later. Mr. O’Neill’s thesis was that by 2050, these countries would dominate the world economy. Many economic analysts and investment strategists, including myself, viewed this hypothesis with derision. We felt that making predictions about the world economy a half century in the future was ludicrous, that the U.S. economy was not going anywhere soon and the analysis showed an acute naivete about the BRICS as individual countries.

Shortly after the term was coined, it quickly became a term of contempt. BRICS became associated with large countries with abundant resources that failed chronically to deliver economic prosperity to its citizens. Almost a quarter of a century after the term was created, only China has come close to living up to its potential. Still, despite its size, China remains a middle-income country. It faces numerous challenges and has never developed proper capital markets – a crucial factor in prosperity. Chinese stock markets have done very poorly, especially for an economy that was heralded as the the usurper to the dominant position of the United States.

Arguably, India is the only BRICS country whose outlook appears better than it did in 2001. However, at a GDP per capita of about US$2,500, India remains a poor country. It is growing but has a long way to go. It also continues to have issues with Khalistani separatists and Islamists, both internally and on its borders. I remain cautiously optimistic about India, but its future is with the wealthy industrialized countries of the West and Asia and not the relatively poor BRICS countries. I believe the historic animus between India and China will eventually destroy this nascent alliance aimed at taking down the U.S.-dominated financial system.

Brazil is a non-player. Although it may have had some potential, Brazil elected Luis Inácio Lula da Silva, a far-left anti-Western authoritarian and convicted money-launderer. Kleptocracies do not become rich countries, although rich countries can become kleptocracies. Brazil will be fortunate if it a averts a serious economic crisis in the next few years.

South Africa is no economic giant and never will be in the lifetime of anyone alive today. South Africa has a GDP per capita of about US$2,600. It is a poor country and the income gap between its Black and white citizens is large, and many white people are likely to emigrate in the next few decades. One-fifth to one-quarter of South Africans live in extreme poverty. One-third of the labour force is unemployed.

Last, we address Russia, the ringleader of this group of ne’er-do-wells. Russia is an interesting study. I believe that Russia is far less powerful and closer to an actual implosion than is generally understood. Total Russian GDP is lower than that of Canada, despite the country having almost four times the population, and that is using what is likely inflated Russian numbers. Russian two-year bonds are at over 20 per cent, although there is not a real market for them. That’s hardly indicative of an economic challenger to the U.S. Almost three years of war and economic sanctions have weakened an already anemic Russian economy.

Russia is facing two issues that will affect its very survival as a country. One is that there is a chronic demographic problem. There is simply a shortage of people between the ages of 15 and 32, as a percentage of the population. Two is that the Russian Federation may see some republics try to break away from the grasp of Moscow. There are already escalating tensions between Chechnya and Dagestan.

Although Russia and China are serious geopolitical adversaries, they are no threat to the Western financial order. Our threats internally dwarf external ones.

For decades, we have been subject to predictions of the imminent demise of the U.S. and the West. All these forecasts have been proven wrong.

Last year, I wrote that there would be a decline in the U.S. dollar, but that it would be gradual. Since that column, I’ve become convinced that the decline is even further away from being realized. The economies of the BRICS countries are looking worse all the time, especially that of Russia. Meanwhile, the U.S./Europe economic growth gap has widened, and that trend will now only intensify with Donald Trump about to bring in America-first policies.

The U.S. is and will continue to be dominant. It has the biggest economy, a wealth of resources, an economically driven and productive population and a cultural belief in hard work, optimism, free enterprise and liberty.

Stay invested in America and avoid the economic basket cases.

Tom Czitron is a former portfolio manager with more than four decades of investment experience, particularly in fixed income and asset mix strategy. He is a former lead manager of Royal Bank of Canada’s main bond fund. Stay invested in America and avoid the BRICS

Since the beginning of the war in Ukraine, there has been much talk about the so-called BRICS countries forming an alternative to the global economic order. Some fear, and some gloat, that the financial hegemony of the Western industrialized countries is coming to an end. They say the importance of the U.S. dollar and to some extent the euro, which have been dominant in international commerce, will be replaced by some alternative championed by the BRICS countries. Many self-described geopolitical and economic experts are certain of this, although they never seem to name exactly what currency will knock the dollar off its pedestal.But this sentiment of the imminent death of the U.S. dollar is premature. The BRICS are not only poor competition for the West, but they are also, in different and uniquely individual ways, economic accidents waiting to happen. The risk is not that they will usurp the West but that many will become so economically, and eventually, politically chaotic that they will destabilize the entire world.

Investors need to ponder this when evaluating where their portfolios are invested.

The term BRICS was coined in 2001 by Goldman Sachs economist Jim O’Neill, to refer to the grouping of Brazil, Russia, India and China. South Africa was added a few years later. Mr. O’Neill’s thesis was that by 2050, these countries would dominate the world economy. Many economic analysts and investment strategists, including myself, viewed this hypothesis with derision. We felt that making predictions about the world economy a half century in the future was ludicrous, that the U.S. economy was not going anywhere soon and the analysis showed an acute naivete about the BRICS as individual countries.

Shortly after the term was coined, it quickly became a term of contempt. BRICS became associated with large countries with abundant resources that failed chronically to deliver economic prosperity to its citizens. Almost a quarter of a century after the term was created, only China has come close to living up to its potential. Still, despite its size, China remains a middle-income country. It faces numerous challenges and has never developed proper capital markets – a crucial factor in prosperity. Chinese stock markets have done very poorly, especially for an economy that was heralded as the the usurper to the dominant position of the United States.

Arguably, India is the only BRICS country whose outlook appears better than it did in 2001. However, at a GDP per capita of about US$2,500, India remains a poor country. It is growing but has a long way to go. It also continues to have issues with Khalistani separatists and Islamists, both internally and on its borders. I remain cautiously optimistic about India, but its future is with the wealthy industrialized countries of the West and Asia and not the relatively poor BRICS countries. I believe the historic animus between India and China will eventually destroy this nascent alliance aimed at taking down the U.S.-dominated financial system.

Brazil is a non-player. Although it may have had some potential, Brazil elected Luis Inácio Lula da Silva, a far-left anti-Western authoritarian and convicted money-launderer. Kleptocracies do not become rich countries, although rich countries can become kleptocracies. Brazil will be fortunate if it a averts a serious economic crisis in the next few years.

South Africa is no economic giant and never will be in the lifetime of anyone alive today. South Africa has a GDP per capita of about US$2,600. It is a poor country and the income gap between its Black and white citizens is large, and many white people are likely to emigrate in the next few decades. One-fifth to one-quarter of South Africans live in extreme poverty. One-third of the labour force is unemployed.

Last, we address Russia, the ringleader of this group of ne’er-do-wells. Russia is an interesting study. I believe that Russia is far less powerful and closer to an actual implosion than is generally understood. Total Russian GDP is lower than that of Canada, despite the country having almost four times the population, and that is using what is likely inflated Russian numbers. Russian two-year bonds are at over 20 per cent, although there is not a real market for them. That’s hardly indicative of an economic challenger to the U.S. Almost three years of war and economic sanctions have weakened an already anemic Russian economy.

Russia is facing two issues that will affect its very survival as a country. One is that there is a chronic demographic problem. There is simply a shortage of people between the ages of 15 and 32, as a percentage of the population. Two is that the Russian Federation may see some republics try to break away from the grasp of Moscow. There are already escalating tensions between Chechnya and Dagestan.

Although Russia and China are serious geopolitical adversaries, they are no threat to the Western financial order. Our threats internally dwarf external ones.

For decades, we have been subject to predictions of the imminent demise of the U.S. and the West. All these forecasts have been proven wrong.

Last year, I wrote that there would be a decline in the U.S. dollar, but that it would be gradual. Since that column, I’ve become convinced that the decline is even further away from being realized. The economies of the BRICS countries are looking worse all the time, especially that of Russia. Meanwhile, the U.S./Europe economic growth gap has widened, and that trend will now only intensify with Donald Trump about to bring in America-first policies.

The U.S. is and will continue to be dominant. It has the biggest economy, a wealth of resources, an economically driven and productive population and a cultural belief in hard work, optimism, free enterprise and liberty.

Stay invested in America and avoid the economic basket cases.

Tom Czitron is a former portfolio manager with more than four decades of investment experience, particularly in fixed income and asset mix strategy. He is a former lead manager of Royal Bank of Canada’s main bond fund.

December 2, 2024 at 5:52 pm #175820D Benton Smith

ParticipantTrump wants to preserve (or “return to” might be a better choice of verb) the Good Ol’ Boy American Empire. This intent is more than mere nostalgia or personal greed. It is a matter of raw survival.

Given that the alternative seems to be that of having no nation state called America (at all) then I’m all for it, and especially that part of the campaign which ANIHILATES the ultra-creeps, perverts, anti-human Satan worshippers who had taken over the reins in recent decades and have been so manically intent on subjecting the gen pop of normal human beings to a terminal bout of torture-murder.

But he ain’t no choir boy, and his Zionist links, (which are myriad) are of grave grave concern.

Meanwhile, it’s slightly reassuring that him and his crew think that the Dollar can be resurrected as The world’s Reserve Currency. Fine. We all need our comfort blanket and one delusion is pretty much as good as another in such circumstances. Just be careful not to actually believe such a delusional fantasy is possible. The Dollar will survive, but NOT as the world’s Reserve Currency.

Ironically, the BASIC reason (and its a very good reason indeed) that the Dollar will survive as a legitimately useful currency, is that the Dollar’s adversaries WANT it to. They don’t want the Dollar reduced to zero. That event would collapse the market that BRICS wants to sell its products to. (One can’t sell very profitably to destitute paupers, now can one?) They just want it to stop being the means by which the United States Empire was being used by total psychopaths to print-for-free the vast amount of purely counterfeit freebie “Dollars” which were then used to subjugate the rest of the planet.

In other words, the world is intent on removing the “magic checkbook” that the West has been using to bribe crooks, hire goons, crush competition and bankroll revolutions in other people’s countries.

The best that Trump can hope for (and I wish him sell in that regard) is to negotiate and cut deals well enough that we can still do business now that the “Magic Checkbook” (and the EVIL that dollar hegemony was used for) is going away.

-

AuthorPosts

- You must be logged in to reply to this topic.

Sorry, the comment form is closed at this time.