davefairtex

Forum Replies Created

-

AuthorPosts

-

davefairtex

Participant> And V. Arnold, did you notice what Picasso could do when he was just 16?

Reminds me of the Tom Lehrer line in the lead-in to “Alma”:

“It’s people like that who make you realize how little you’ve accomplished. It is a sobering thought, for example, that when Mozart was my age he had been dead for two years.”

And for those who imagine a pro-Trump bias, I think rather, its an Anti-CIA-Mockingbird-Echo-Chamber bias.

Anyone remember, for instance, when Liberals were peaceniks, and not intent on beating the war drums against “Russia”? I sure do. But then again, engineers have to have a functioning memory, or else they can’t do their jobs…we remember Operation Northwoods, Tonkin Gulf, Babies in Incubators, WMD in Iraq. All our major wars were con-jobs by … someone.

But I’m sure it’s different this time, with Russia.

Yeah. Ilargi is pro-Trump. Russia is the biggest threat to Western Democracy, ever. Check is in the mail. etc.

davefairtex

ParticipantGold * CNY/USD is not moving sideways, at least not that my mediium-term chart shows. It is showing a smaller trading range than some other things since 2016 – but so is GC * GBP.

Something to watch though.

Attachments:

You must be logged in to view attached files.davefairtex

ParticipantWhy is it I’m not outraged by Alex Jones? I mean, I find him an annoying blowhard – the one time I watched his show was when Binney was on there talking about leaks vs hacks – I really admire Binney, he’s such a patriot – but Alex just couldn’t get himself out of the way for more than about ten seconds.

It is a fascinating thought though, to imagine that he’s such a threat to some people that they feel they have to censor him. I’ve been waiting for someone to come along and establish a “free speech” youtube that doesn’t actually censor people. The more censorship that youtube does, the larger the opening for a “free tube” becomes. And if Alex promotes it, “free tube” gets a deluge of instant users.

Things are getting interesting.

I think the censorship is an own-goal. It just increases the chance for a “free-tube” to be created. And then they will lose all ability to monitor or shadowban or stealthily down-rate or profile, etc.

davefairtex

ParticipantNew Drachma (“ND”) would be backed by everything you can buy with it. For instance, a house in Greece, a business in Greece, Feta Cheese and Greek Wine, there’s all sorts of stuff there that people would want to buy.

Same is true for USD. It is backed by everything you can buy with it, as well as the pressure that debtors have to repay their debts.

As long as Greece allows capital flows into the country, a ND would continue to have value. How much – that’s the question. They should probably put some sort of limit so their whole country isn’t sold off to those very Germans…

The less people can buy with ND, the less value it will have.

davefairtex

Participant@alan –

Pre-pop data is clearly inflationary. Lots of annual credit growth, lots of inflation, the stuff everyone is used to. That’s the old world.

Post pop, the data looks quite different. Some sort of phase-change occurred. That’s today’s world.

I know it doesn’t seem fair that people exclude the past 10 years of data, but that’s because if you mix pre-pop data and post-pop data, you can’t look clearly at directionality that way. And that’s our goal. We want to find out where we are headed post bubble pop.

Averaging pre and post pop together actually ends up hiding information, misleading us as to where we are going.

For example, it similarly hides information if we were to first put someone in a sauna for 4 hours, and then put him in a freezer for 2 hours, average his temperature over the 6 hour period, and then conclude that he is most likely too hot right now because his average temp is hotter than normal.

It compounds the problem if we then go to the next step we predict our victim is likely to die of heat stroke if he stays in that freezer…and then we suggest as a remedy that our victim (currently in the freezer) drink ice water in order to help his clearly above-average temperature.

Make sense?

Data before pop: irrelevant to figuring out where we’re headed.

davefairtex

ParticipantWhy not go to the store and calculate my own personal grocery cost inflation rate from the set of products I buy every week? Well primarily because I don’t assume that I can intuit what the overall monetary pressures are worldwide from just looking at how my own shopping list behaves. Let’s say I buy sugar, and coffee – while Rebecca buys Cocoa and Agave. We will see two very different ‘inflation rates’. Which one is right? And how about the Egyptian’s inflation rate? Or the person from Mexico? Heck, if there is a problem with the cocoa crop, cocoa prices rise. Is that “cocoa inflation” (i.e. more money chasing the same number of goods)? No. That’s just a shortage of cocoa. Like right now, we have a glut of natgas here in the US. Is that deflation? Of course not. Its just overproduction of natgas.

My focus is either nationwide and/or worldwide. Grocery lists aren’t of interest for me because of that. I watch input prices because I’m looking at global macro trends. Not just my own corner of the world.

Now then, for those who claim we have inflation for the past decade – sure, if you choose your starting point as 2003, you can easily make the case that its been an inflationary time. Money supply has also dramatically increased over that period. Heck, go back to 1990. You’ll see even more inflation. That’s what my data shows anyway. Massive credit growth = big inflation numbers.

But I have zero interest in the period prior to the bubble pop. This is because I’m trying to understand how the bubble pop has affected the economy, and especially the answer to the question “what state are we in now.”

From what I can tell, there was a burst of commodity-push inflation (which isn’t monetary inflation) immediately after the 2009 low that lasted through early 2011. And then it stopped cold. Almost all commodities sold off after that peak.

What’s more, if you are seeing your shopping list increase in price since that peak in 2011, you aren’t buying wheat, or corn, or soybeans, cocoa, coffee, sugar, or even gasoline (stockcharts weekly: $WHEAT, $CORN, $SOYB, $DJACC, $COFFEE, $SUGAR, $GASO).

Perhaps you like agave, ahi tuna, wild-caught salmon, or some other stuff that has its own supply & demand curve to it and that is unrelated to monetary matters.

Me, I just look at the input commodity prices for the big agricultural and energy commodities and draw general conclusions from that.

And I have to say, I’m not an avid shadowstats reader. That man over there has been predicting imminent hyperinflation “next year” for the past 6 years. It’s imminent in 2014 too, just FYI, just like it was back in 2008. He had more of a case back then with all that credit growth. Now, unless the Fed drops 10 trillion dollars in the wallets of the actual people of the United States, they most likely won’t get hyperinflation.

Having said that, I have to say that Ilargi is in the business of predictions, not me. I just watch the data, and report what I see. I understand the whys of his predictions, like I understand the whys of the hyperinflationists, but there is none – zero – evidence of any hyperinflation in the western world. Even inflation is just barely visible, and that only in the US, and then only because the banks have been able to pretend-away their losses.

If that changes, I’ll be the first to talk about it. But I refuse to be the prisoner of pre-crash thinking. I refuse to continue fighting the last (inflationary) war, especially when all the monetary evidence I see is to the contrary.

As for medicare & social security – if we can’t afford it, we won’t do it. The specifics of how that plays out, I have no idea, but that which can’t be done, won’t be. What’s more, imagining that the only possible outcome to that predicament is hyperinflation is simply displaying a lack of imagination as to alternate possible outcomes.

davefairtex

ParticipantIlargi-

I know food prices shouldn’t be “the metric” for deflation, but I think they are (in aggregate, in terms of overall international price trends) a signpost of sorts. Droughts can confuse things, so can big harvests, so can geopolitics, so its a poor substitute for the more accurate monetary indicators you describe. But because its a signpost everyone understands, I just can’t resist using it.

Those two factors – credit growth, and velocity – are the important indicators. And not just credit growth anywhere. To be useful in fighting deflation, the new money has to be given to someone who will spend it into the economy – a homeowner, a consumer, a business, etc. If its borrowed by a worried company and the cash sits on the balance sheet, it doesn’t help fight deflation.

But right now, velocity is dropping, AND credit is contracting. By anyone who understands how things work, and who really take the time to look at the time series and understand what they mean, the conclusions are undeniable.

The funny thing is, I don’t hear anyone – and really, I mean anyone – talking about declining bank credit in Europe, and to me it’s the smoking gun of why there’s no growth over there.

Spain – its credit contraction is 14% PER YEAR in overall bank loans, and we know all those Spanish banks are lying through their collective teeth about the extent of their bad debt. [There was a good recent article on that] They are just now starting to come clean. And we imagine with this massive credit contraction Spain will somehow magically return growth? Not. Gonna. Happen.

davefairtex

ParticipantRebecca-

I did mention that edible items with international prices have (by and large) gone down since 2011. Wheat: down, Corn: down, Soybeans: flat, Cocoa: down, Cattle: down, Sugar: way down, Coffee: way, way down – as you noticed. Coffee is down 66% from its peak.

They don’t have futures for eggs or Agave, so I can’t comment on those. Likely egg prices are locally determined (i.e. lettuce in Cleveland), and agave – well I’m not sure we should classify that as one of the “things people need to survive.” Although I suppose sugar falls under that heading as well. If the high price of agave disturbs you, you can always switch to sugar. 🙂 I would venture a guess that people on low incomes most likely don’t buy agave.

Your observation about cocoa is valid – cocoa over the past 6 months IS up 20%, but it still remains down 30% from levels that peaked in 2011. It all depends on where you draw your starting point. If it is six months ago, and you just focus on cocoa, then you’re right.

Please, do me a favor. Rather than relying on your shopping list to determine price movement of necessities worldwide, look at global/international price charts for the input commodities. That way you are taking a look at a broader picture, not just stuff that affects you personally, in your local area.

at stockcharts.com:

$DJAAG (corn, soybeans, wheat, sugar, soybean oil, coffee and cotton)

$DJASO (cotton, sugar, coffee index)$CORN, for instance, is almost HALF of what it was back in 2011 (and 2012). You know, back when Mexico was about to have a revolution because of high corn prices. And of course we don’t hear about that anymore. That’s because corn prices have plummeted. But good news never makes headlines.

I get most of my aggregate data from the UN FAO, and the rest from looking up individual futures contracts and indices. My request to you: please, go look at the global price data. Then come back and tell me I’m wrong.

And before you complain that this data is irrelevant or meaningless, the peaks in these charts from FAO correlated pretty closely to the revolutions across the (poor) MENA countries, linking directly back to your point about every nation being 3 meals away from revolution.

That research here:

https://necsi.edu/research/social/foodcrises.htmlHowever, the updated version of those food price charts? Declining from that 2011 peak.

davefairtex

ParticipantRebecca-

If you look at global food prices (taken from prices of futures contracts on everything from wheat, sugar, pork, beef, etc), the picture is one of falling prices since 2011, not rising prices. Overall, commodities have dropped too. Including gold & silver. Of course those are global food prices, so prices of local stuff for which there is no international market may vary.

And since 2012, eurozone bank credit has declined, and right now its declining by 7% per year. “Normal” is growing 5-12% per year (2003-2008), so that’s quite a swing.

These things all point to deflation, at least over the past few years.

Naturally I pick 2011 as my reference point, rather than the trough after the 2008-2009 crash. I could also pick 2008 – top of the bubble – and food prices are down from that point as well.

Again, what we care about for purposes of this discussion is not the price of lettuce in Cleveland, it’s the overall directionality of pressure from the monetary system. Is it inflationary, or deflationary? All my data suggests – deflation.

The recipe is really pretty simple. Willing borrowers create money via the banking system. And so when bank credit declines, when borrowers default, or repay their loans in aggregate, that’s monetary deflation by definition.

There was a small business survey in the US – they asked businesses what was their major concern. Inflation was mentioned by 3% as their top concern. Government rules & regulations: 21%, Taxes 20%, poor sales 19%. That’s anecdotal evidence that seems to confirm what my monetary data is showing me.

Some people get stuck “fighting the last war”; since we’ve had inflation since the Depression, therefore, we must have inflation today, data be damned. And they are convinced that nothing has changed since the 1970s, even though we’ve had a multi-generational debt bubble pop of massive proportions and the credit indicators I watch (especially in the eurozone) supports what Ilargi is saying.

Why do we care? If we think there is inflation because we just watch lettuce prices, when in fact its deflation that is the overall problem, we might make the wrong decision about what is to come, and how to protect yourself.

If hyperinflation starts up, it will show up in the data quickly. And I’ll be the first one up on the soapbox talking about it. But until the data supports a hyperinflationary trend – why on earth must we expect that as the logical outcome when the data says otherwise?

November 6, 2013 at 12:09 am in reply to: How Can We Have Record Bad Loans And Record Excess Liquidity At The Same Time? #8957davefairtex

ParticipantLooking at the numbers, all I see are declining money and credit, in the form of eurozone-wide bank loans outstanding. The current deflation rate: 7% year over year.

My guess is that if loans were actually marked to market and/or processed through foreclosure as they should be, the deflation would be dramatically higher.

I’m not sure how people get inflation out of declining money & credit, but there you go. As someone who is strictly data driven, its tough for me to see general monetary inflation anywhere. But believe me, when it appears, I’ll see it. With all due respect to Professor Hyperinflation, the data will tell me.

October 17, 2013 at 8:21 pm in reply to: Nobel Winner Robert Shiller Demolishes UK's Help-To-Buy Scheme #9351davefairtex

Participantgurusid-

Yeah those crazy exponentials.

But my point is that the exponential growth in loan money has stopped since the bubble pop.

So – might it also be true that the housing price appreciation model that depended on said exponential growth in loan money, might stop too?

All right, that’s too scary. Rather than gore that sacred ox (to mix a metaphor), let’s just say that non-growing real estate loan money puts at risk the standard thinking that houses always go up.

We know monetary inflation comes from expanding credit. What must be deduce from contracting credit, then? And given RE credit is contracting, what must we deduce from that?

That housing prices always go up?

Perhaps in cargo-cult land.

October 17, 2013 at 4:20 pm in reply to: Nobel Winner Robert Shiller Demolishes UK's Help-To-Buy Scheme #9345davefairtex

ParticipantI have to say, I am continually surprised by people’s complete unwillingness to look at data. They seemingly prefer to rely on 10, or 30 or 40 year old stories about how something went way back when, and then project that same storyline infinitely into the future.

Cycles. Things move in cycles – and sometimes, supercycles. Likely they do this because of this very phenomenon, where otherwise-intelligent people simply project recent past performance infinitely into the future.

It really is all there in the data. You just have to care to look, with an open mind. Apparently, that last bit runs counter to basic human psychology.

October 17, 2013 at 8:01 am in reply to: Nobel Winner Robert Shiller Demolishes UK's Help-To-Buy Scheme #9344davefairtex

ParticipantProfessor-

Or should I say General, in the sense of, “Generals always tend to fight the last war they were in.”

“I remember the despair in the voices of renters in 1972 in South Silicon Valley, “How can we buy when prices go up faster than we can save?”

A home could be had for around $36k about then. $650K today? A Million and a quarter in 10 years? “

All you have to do is look at one simple FRED timeseries (provided below) and you see the reason for the housing price move since 1972: money loaned into existence by willing borrowers.

You just have to ask yourself a question: do we imagine this chart continues up at its 2000-2008 rate into infinity? If so, then yes by all means, Real Estate will perform just as it did in the 70s and during the 2000 bubble years.

But wait. Currently aggregate RE debt has been declining for the past 5 years. First time in the history of the series. I wonder why that is?

Without the fuel provided by a constant inflow of ever-increasing debt-based money, any boom in housing is doomed to be short-lived. Once the hedge fund money runs out, we get another move down.

October 12, 2013 at 10:15 pm in reply to: Your Pension Is Under Attack From All Sides. Here’s 10. #9328davefairtex

ParticipantHere’s a deflation chart – US total bank loans outstanding.

October 12, 2013 at 8:14 am in reply to: Your Pension Is Under Attack From All Sides. Here’s 10. #9325davefairtex

ParticipantNassim-

Education and medical care are perfect examples of inflation that continue in a deflationary environment because of government support and increasing credit money. You could have added to this list defense products and the Federal Bureaucracy.

The only area of expanding household credit right now is education loans. These loans ensure a constant stream of money to higher education institutions, insulating them from the overall deflation which would force them to cut their administrative fat. (Although more likely, they’d keep the administrators and they’d fire the teachers). CHS at oftwominds has done some excellent writing on this, I encourage you to go read it.

Medicare & medicaid has continued to provide funding for medicine independent of any economic downturn and/or overall deflationary environment. Without all the support from government on the low end, and insurance companies (making the consumer completely price-insensitive) at the higher end, its unlikely hospital administrators would be pulling down $3 million salaries, and we’d see a correction in medicine prices soon enough.

Just a thought: if you really “don’t want to be a part of this anymore,” you might consider not responding! Otherwise a comment which appears to continue the discussion might be seen as some sort of lame attempt to stifle any response while still trying to get in one last shot! 🙂

But I’m sure you weren’t trying to do that!

October 11, 2013 at 8:15 am in reply to: Your Pension Is Under Attack From All Sides. Here’s 10. #9317davefairtex

ParticipantNassim-

I’m fine with doing prices. Food prices overall are down since the peaks in 2008, even in nominal terms.

As for gasoline, if you pick prices from the trough of the recession (mid-2009) that’s cherry picking once again. If you picked it from the top of the bubble in 2008, prices are lower now than they were.

Likewise, picking McDonalds beef prices from 1998 includes the bubble years.

If you look at the UN FAO general food price index (nominal prices) since they peaked in 2008 they’re down. To me, the UN FAO which studies global prices in dozens of different commodities over a decade timeframe is a much more compelling data source than some newspaper in one country quoting the price of eggs over the past year.

https://www.fao.org/worldfoodsituation/foodpricesindex/en/

Again, my point was simple: there has largely been DEFLATION since the bubble pop. Which means, if you are going to argue there’s been INFLATION since the bubble popped, your data sources need to draw a broad selection of price inferences from time period starting at the TOP of the bubble to NOW.

Not from 1998. Not from 2004. Not from the trough in 2009. From the TOP, to NOW.

In some countries, inflation may have continued for local items: India, China, Thailand, etc, because they didn’t have a bubble pop, and their inflation is still going on because borrowing is still happening there. No debt bubble pop = inflation continues.

Hope that makes sense.

October 10, 2013 at 10:43 am in reply to: Your Pension Is Under Attack From All Sides. Here’s 10. #9310davefairtex

ParticipantNassim! Quoting 10-year averages from Shadowstats about 5% average inflation as a response to my claim that for the past FIVE YEARS inflation has been muted seems non-responsive to me.

For this 10-year interval, 5 of those were the last, mad years of the housing bubble. TCMDO went from 34 trillion to 52 trillion over that period (2004-2008). Do we imagine that 18 trillion dollars of credit growth (54%) in just the US economy alone could cause prices to go up? Ya think maybe?

Since 2008, TCMDO has gone from 52 trillion to 57 trillion. That’s a big yawn by comparison. Do you see what I mean? Debt bubble pop = TCMDO doesn’t go up = no monetary inflation.

Just looking at the commodity prices since 2008, one can see that prices are lower now than they were then. Even if you just look at food – the FPO food price index was 140 in 2008, and its at 120 now. That’s a price drop. In anyone’s book, that’s not inflationary.

Again, I encourage you to focus on what is really happening today. 10 year trends that overlap the bubble years don’t paint an accurate picture of today. Credit is growing only very modestly, and only in corporate America where they are actually making good profits.

Follow the growth of credit and you won’t be led astray by these people who have their own credibility on the line for predicting imminent hyperinflation “starting a few months from now” – for the past five years.

Look, if borrowing starts up again I’ll be the first one to sound a warning. I don’t have a prediction I’m making, I just report what’s happening. Right now: no inflation.

I second the bit about velocity too. It certainly isn’t going up. Declining velocity with very slowly increasing credit does not lead to overall monetary inflation.

October 9, 2013 at 1:06 pm in reply to: Your Pension Is Under Attack From All Sides. Here’s 10. #9300davefairtex

ParticipantNassim-

There are lots of scenarios out there. I don’t rate “missiles missing their target” high on the list. Those things can enter a window and blow up inside the building. Whether there are many interesting targets to hit, and whether hitting them would actually advance the cause of peace, that’s another matter. But hitting the target is not a problem I stay up worrying about.

Certainly if the USD suffers a crash, all prices go up. I rate that as less likely than the eurozone having a problem, or Japan having a problem. I think we’re the last ones to tip over and sink. While we may not be what we used to be, we have vastly more natural resources than Japan, and substantially more than Europe. To me, its not so much about “possible scenarios” as it is my judgement as to the likelihood of them happening, and in what order.

Likely – Japan, Europe, then the US. At that point, yeah, the buck could tip over and sink. But only after money fled the Eurozone and Japan first.

This is a “likelihood” thing rather than certainty, and an unexpected military issue might well blow a hole in that scenario, as you say. But for the “regular inflation” scenario, I’m confident I can see that coming by monitoring the various credit metrics. Which right now – point to household deflation (reduction in borrowing), corporate inflation (increase in borrowing), and a reduction in the rate of government borrowing.

October 8, 2013 at 5:21 am in reply to: Your Pension Is Under Attack From All Sides. Here’s 10. #9287davefairtex

ParticipantLosses due to hyperinflation?

I think first we need to see some inflation. Which we aren’t seeing.

Inflation and hyperinflation, over the last 5 years, has been an entirely theoretical concern. It was a REAL concern during the formation of the debt bubble because people were madly borrowing money. Now, since they aren’t borrowing, its entirely hypothetical. I’m going to wait until I see people starting to borrow before worrying about inflation, much less hyperinflation.

And imagining that current social security/medicare promises that will eventually be defaulted upon are actual obligations of the US government – that’s another accounting fiction that will never come true. If you promise your baby a BMW, and then when Baby grows up, you can’t afford to buy one so reneg on your promise, did you have to make car payments on that never-purchased BMW? No, you did not. GAAP deficit is the same thing: worrying about car payments on a promised BMW that you can’t afford, and thus are never going to buy.

If something is so expensive we can’t possibly afford it, the outcome is easy to predict: we won’t do it.

October 2, 2013 at 6:00 pm in reply to: Your Pension Is Under Attack From All Sides. Here’s 10. #9273davefairtex

ParticipantTo me it kind of just boils down to some simple math presented by John Hussman. His methodology (which has data going back 100 years) suggests that at current valuations, the US equity market will return on average 2.3% per year for the next 10 years. (Current dividends on the S&P: 2.3%).

This implies cap gains will be 0. What’s more, we typically have a crash every four years or so. So to get that 2.3% annually, you get to suffer through a 40% drop every 4 years.

10 years from now, if the pension funds manage to survive and avoid selling at the bottoms, they will have expected a 7.5% return and received a 2.3% return. Here’s the math:

Say you have a billion dollars in a fund.

10 years @ 7.5% = 2.06 billion.

10 years @ 2.3% = 1.26 billion.That’s some pretty serious underfunding. And that’s where we will be in 10 years, assuming they stick it out, assuming peak energy doesn’t take the “expected returns” math and turn it significantly more bearish.

davefairtex

ParticipantOk, this is totally off topic, but I just poked around my charts and noticed … deflation in the eurozone continues. Of course, being this is TAE, a chart showing deflation can’t possibly ever be off topic, now can it?

davefairtex

ParticipantProfessor-

You missed my collection of “ifs” that preceded the statement about oil. I’m not claiming that today’s price rises are solely due to oil. I was making a hypothetical statement that said IF such a situation were to arise: IF monetary inflation wasn’t happening and then IF oil prices tripled and then IF the Fed used the skyrocketing CPI as their guide to raising interest rates in an attempt to quell “inflation” it would be severely misguided.

It would be like giving antibiotics to a man with a fever caused by a viral infection. It wouldn’t address the source of the problem, and might even cause harm.

Today, monetary inflation exists, but is relatively mild, especially compared to historical values. I can show you data that backs this up, if you are interested.

And your statement that an original silver quarter minted in 1963 still buys a gallon of gas AND that somehow proves that monetary inflation is happening today is just silly and unworthy of your usual level of insight. I will grant you that monetary inflation caused the devaluation from 1963-2008. That’s easy to see in the data. But then it stopped because our debt bubble popped. In the US, monetary inflation/debasement is debt driven, pure and simple. No debt increase = no monetary inflation.

And now oil’s price moves are due primarily to production expense (that marginal barrel cost) and other Peak Cheap Oil issues as well as perceptions of political risk in the ME.

And your statement that “nothing backs the dollar” is simply silly as well. Its a popular thing to say in the goldbug community and its often repeated, but that’s not the same as it being correct. The dollar is backed by all the assets that exist in the US that are in private hands. As long as a foreigner, armed with an FRN, can use it to buy stuff in the US that people might want, the dollar has solid backing. Once that is no longer true, then yes, the dollar will become completely unbacked. And that’s when it is time to panic.

davefairtex

Participantpipefit –

So just to be clear, you acknowledge that we don’t have hyperinflation now, regardless of the trillion in printed money annually (most of which camps out in Excess Reserves anyway).

And you understand that 10 year rates rising 100 basis points (from 1.6% to 2.6%) aren’t indicators of hyperinflation, and you also realize that rates rising from 1.6% to 2.6% don’t actually cause hyperinflation.

Furthermore, you understand clearly that we can avoid hyperinflation later if we simply default on our unaffordable promises prior to having to make good on them.

And for my part I understand that if we don’t default on our unaffordable promises, and if we simply print vast sums of money to make good on them (maybe even 7 trillion per year) at some point down the road, then that is when we’ll get hyperinflation. And that point might well be 10 years from now.

Does that pretty well sum it up?

One more thing. Price increases are not the same as monetary inflation. You appear to be conflating them in your posts. We might have an environment where we have higher oil prices, but monetary deflation. Talk about a killer outcome.

If overall money and credit decline, that’s monetary deflation. If at the same time the middle east decides to stop pumping oil and prices triple, the price of oil goes up (and so do all related products), but that is NOT monetary inflation. In this example, less money exists at the same time oil prices rise – but those price increases are not due to monetary inflation.

That’s why CPI is not a valid indicator of monetary inflation. The CPI measures the cost of living, but it doesn’t address the underlying reasons

WHY the cost is rising. And if we were to put our Fed hats on, and raise short term interest rates in order to stifle “inflation” at a time when price increases are solely based on oil shortages rather than an increasing money supply – it would just be lunacy.davefairtex

Participantpipefit –

Rising rates do not cause monetary inflation – that is, rising rates don’t result in more money being created. Its the opposite. Thought experiment: are you more likely, or less likely, to borrow money if rates move from 4% to 8%, assuming your wages remain stable? Answer: less likely, since that money is more expensive, while your ability to pay does not rise. Less money created through lending = less inflation. That’s why when Volker raised rates to 20% it killed inflation. Nobody borrowing = inflation crushed.

Now then, you may be suggesting that rising rates are an indication of inflation. That I’d be more likely to agree with. The higher rates don’t cause inflation, but they might be reflecting increasing inflation expectations. Kind of like a fever doesn’t cause a viral infection – its just a symptom.

These days, however, I think rising rates are simply an artifact of an unwinding carry trade that ends up with foreign central banks selling their treasury holdings, thus causing the long rates to rise. That, and a rising equity market means money flees bonds for stocks. Lastly, it also could be front-running expectation of Fed tapering. Perhaps more importantly, nobody could actually call a 10 year rate of 2.6% as actually indicating inflation. Take a gander sometime at historical 10 year rates and you’ll see what I mean. [For some reason I can’t insert it inline; it’s in the attached PNG]

Anyone seeing actual hyperinflation right now is not looking at a broad cross-section of data. My sense: its an exercise in wishful thinking. “My models suggest hyperinflation must be occurring, therefore, I’ll select data that backs up my storyline.” Also known as the Texas Sharpshooter Fallacy.

https://en.wikipedia.org/wiki/Texas_sharpshooter_fallacy

A GAAP deficit won’t cause hyperinflation any more than me writing you a check for a billion dollars will end up injecting a billion dollars into the economy.

Another way of putting that: Wimpy’s promise (GAAP deficit) to buy you a hamburger Tuesday does not actually create an increase in demand for hamburgers today (hyperinflation). For that, we have to wait until Tuesday rolls around and even then, Wimpy must make good on his promise. Its the “making good” that causes inflation, rather than the promise.

davefairtex

ParticipantCapitalism self-destructs when growth runs out? Why is it we say that again?

I get that our current monetary system will self-destruct when growth runs out, but our current monetary system isn’t a required part of capitalism.

Society will always have capital. It will always need to be allocated. Currently we have crony capitalism and its doing it poorly, various flavors of cartel capitalism, dictator-state-ism, colonialism and marxism give it a try. Growth or no growth, the problem of capital allocation will remain. It does seem that decentralizing the process is useful, as is a system that rewards proper allocation and punishes capital misallocation, regardless of whether or not we have growth in the total capital available to the system as a whole.

I think modern systems suffer partly from issues driven by inherently sociopathic structures, combined with sociopathic individuals (possibly not an accident – maybe the latter constructed the former) resulting in some unpleasant outcomes. Better structures, better people – perhaps better outcomes?

Perhaps increased enlightenment is a requirement to construct a better world.

Just some thoughts. The rest of it all made sense.

davefairtex

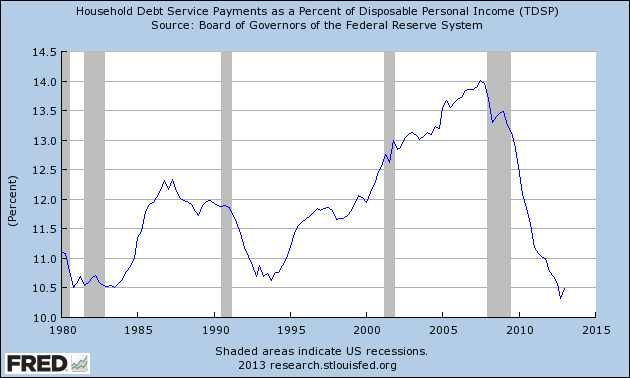

ParticipantQE causes bubbles in the bond market, and the money doesn’t make it out to the economy, but the lowered rates do help reduce the effective payment burden for those in debt – at least it did until rates went up two months ago.

Here’s a chart of that: this is the TDSP timeseries from FRED, which shows the percentage of disposable personal income devoted to mortgage payments. It has dropped to levels last seen back in the mid 90s. Timeseries is only updated quarterly though, so its a bit out of date.

The debt remains (no Jubilee, certainly) but the payment burden is far lower. Basically, you’re still a debt-slave, just the chains you are wearing aren’t quite as heavy.

davefairtex

ParticipantMy suggestions:

Overall, I’d suggest you hang on and do your best to enjoy yourself until the logic of events forces you out. And there is no need to encourage your superiors to make this decision for you – which is the sense I have that you are doing now. 🙂

* rather than focusing on the work to find meaning, focus on people and interactions. people are the same everywhere; perhaps you can find inspiration in that.

* perhaps there’s a lateral move you can make to an area that’s more hospitable.

* in the meantime, spend your vacation time and spare time doing things that you find interesting.

* focus your salary on debt paydown.

* each day, express gratitude that you have a well-paying job. thank the taxpayers sincerely every morning, and do your best to provide them good value however you can – working within the organization. If your only daily meaningful contribution is contributing to a positive atmosphere, that’s ok. and that’s healthier for you too.

* you can watch others go up the chain, but you are not required to do so. perhaps – have compassion for them because they have been sucked in by the societal programming while you are undergoing the process to break free.Of course, once you’re debt free, you have a lot more freedom of action. You won’t need the same income to retain the same standard of living. In the meantime, you could make changes that involve getting rid of stuff that has an interest payment on it. Likely you’re already doing that.

I think debt freedom is safest and at the same time, the most revolutionary act we can individually execute. You cannot be prosecuted for it, not even chastised, but if we all did it, we’d bring down the system.

Just my two cents.

davefairtex

ParticipantI’m in relatively complete agreement with everything Ilargi is saying. Bernanke would be happy to help main street if he could – but he works for the banks, and so that is who gets the love.

For a good chunk of the move up it has been about improving earnings driving equity market prices higher. However at this moment, with companies disappointing on earnings and top-line sales numbers dropping, it seems clear that QE and the promise of more to come is responsible for continued upward movement, and as Ilargi suggests sucking volatility out along the way. The VIX (the “volatility index”) is currently down around 12, values common during the period 2004-2006.

John Hussman thinks this equity market behavior is primarily a faith-based self fulfilling prophecy trade; his thesis being, people think QE causes stock prices to rise, therefore, they rise because people buy because QE is happening. Converse is also true; the absence of QE or these days, even TALK about QE slowing down is enough to cause the market to drop.

The day will come when the promise of the current level of QE is no longer able to encourage the faithful to bid up equity prices. Once this occurs, it is likely that the jig will be up, and we will see a brisk correction no matter what Bernanke says. I have no idea what will trigger this; perhaps its a economic shock that happens in spite of Fed bond buying, due to currency market moves or interest rate moves, etc. Perhaps the end of the current housing mini-bubble. There are lots of candidates.

As for when this happens, who can say? We can only watch market prices and let them tell us. Hussman also suggests that during conditions like this, which he calls overvalued, overbought and overbullish, topping can be a long multi-month process with each rally back up to the peak increasing the complacency for the longs (and frustration for the shorts).

John’s article here

davefairtex

ParticipantIlargi –

To generalize your statement even further, I’d say that any organization – because it is comprised of people – is inherently political. Politics seems to happen as soon as you have more than 2 people in one place.

And so even though churches start from a spiritual basis, because they are earthly organizations comprised of people, they instantly start morphing into political organizations.

After enough time, you get Borgia Popes and the Spanish Inquisition.

davefairtex

ParticipantProfessor –

I too was a bit surprised at what happened to the 10 year – one expects a run to the longer duration bonds when deflation hits, but the link between the 10 year bond and the emerging market currencies is tough to deny. Just look at the data and you’ll see what I mean.

Check out:

* TLT

* Ruble, Mexican Peso, Thai Baht, Indian Rupee, Brazil RealCurrency moves aren’t in lock step, but they’re close. Thai Baht which I follow relatively closely moved from 28.7 to 31.2 – a 9% move in less than two months.

Thailand also showed up on the “sellers of US treasury bonds” report at that same time.

TLT also dove at that same time.

For quite some time people have been selling the buck, and the yen, and buying emerging market investments. To slow the appreciation of their currencies, the emerging markets central banks have been selling their currency and buying US treasury bonds. Just last year Brazil was muttering about currency wars and imposing all sorts of hot money inflow restrictions.

Taken all together, exporting nations own 5.8 trillion in foreign currency reserves, perhaps 60% of that are US Treasury bonds. If money flees from these nations back to the US unwinding that short dollar-long emerging markets trade, those central banks will need to sell some portion of those treasury bonds in order to stabilize their currency.

In that instance, we could see (perhaps) a neutral-to-positive dollar, and a really hammered treasury bond.

Well, its what we saw over the past few months anyway. I agree, chart shows TLT may be a decent buy right now. Macro potential for trouble is there, however, if investors decide emerging markets need to be sold further.

I don’t think we’re at the point where we have a Fall of Saigon helicopter scene in Washington. In fact, we’re likely to see the opposite. Buck is still the safe haven. That’s what the charts show, at least. Things fail starting from the periphery and only then moving towards the core. Europe and Japan are next on the list; until they go, the US will be fine.

You heard it here first. 🙂

davefairtex

ParticipantProfessor –

I know the goldbug storyline is that currencies are being devalued simultaneously, but if you really look at the magnitude of the printing operation, its quite small compared to the amount of money floating around out there. And if you add in the deflation that’s hidden on the banks’ balance sheets, why, it certainly explains why after 5 years of QE, we’re farther from hyperinflation that ever.

I believe that any hard-headed analysis from an independent thinker will reveal this. That’s what my analysis has shown me, and I care more about truth than about salving my ego in front of my nervous goldbug flock.

Now of course if the Fed really prints – 10-20 trillion – then that’s another matter entirely. But it has to be serious money to move the needle, not this penny-ante stuff most of which ends up parked in Excess Reserves anyway.

The 10-year makes me nervous. If the emerging markets start to get really sick, hot money will flee, and all the emerging market central banks will sell their trillions in US treasury bonds to prevent their currencies from rapid depreciation, and this will cause the 10-year to get pounded like it did in May/June. To me, May/June was a warning shot across the bows.

Outcome: dollar up, emerging market currencies down, US treasury down. Safe haven: < 1 year treasury bonds. Who knows, we might even get negative yields like they have in Switzerland.

davefairtex

ParticipantGO –

The constant cry of the Goldbug is the unfairness of the leveraged market, the manipulation, the Deux Ex Machina that messes up the whole one-way trade in gold.

I believe reality is something different.

For 11 years, leveraged longs pushed up the price of gold. For the past two years, some of them pulled out because hyperinflation, long promised once QE started, just hasn’t happened. Now you complain about the shorts and how evil they all are but its really just the lack of buying the hyperinflation story thats responsible.

Again – I didn’t hear ANYONE complain about the leveraged longs and how they moved the price on the way up. Do you imagine it was just the virtuous buying of physical gold that pushed prices from $250 to $1900?

If you just look at the $CCI (overall commodity price index) over the past two years, perhaps you will understand why leveraged longs have bailed out. During inflationary times, $CCI rises. But since 2011, what has happened? Exactly the opposite.

Or is the entire commodity complex, the prices of all commodities everywhere, under the wicked thumb of the evil speculators?

Conjuring modern-day demons to explain market reactions that don’t adhere to your storyline smacks of Cargo Cult analysis techniques. Might it be possible these techniques are flawed?

I think gold has quite possibly bottomed. It will move up again when the leveraged longs return. But judging from how things are going today, the whole hyperinflation storyline seems busted, so you might want to float a new one if gold is going to get off the ground again.

davefairtex

ParticipantProfessor –

I’m not seeing any “shunning of the buck overseas” – perhaps you could point out in the following chart this shunning of which you speak. USDX bottomed in mid 2008 at 71 and is now at the higher end of its recent trading range at 83.

In fact, in recent months there has been a marked flight of money out of emerging markets and into USD. There are apparently a vast number of USD short positions that are being unwound…and this has caused interest rates to jump, as longer term US treasury bonds are likely being unloaded by emerging market central banks to try and stem the drop in their currencies.

davefairtex

ParticipantThe 2 trillion in excess reserves are in no danger of manifesting magically into 20 trillion in loans. Steve Keen wrote an article – its a bit technical, but not over the top – that at least to me convincingly showed that the 1:10 ratio of reserves to loans and indeed the whole theory of reserves driving lending was just wrong.

Here are two paras which give you a clue as to where Steve Keen is going:

The most recent proof of this is in an excellent discussion paper from Federal Reserve economists Carpenter and Demiralp, entitled “Money, Reserves, and the Transmission of Monetary Policy: Does the Money Multiplier Exist?”. The first clue that it doesn’t exist is given by their abstract, which notes that, “before the financial crisis, reserve balances were roughly $20 billion”. If the textbook model were correct, the total stock of money in the USA would be $200 billion, versus the multi-trillion dollar level of even a narrow definition of the money stock. As the authors note, this makes a mockery of the textbook “Money Multiplier” model:

M2 averaged about $7.25 trillion in 2007 … bank loans for 2007 were about $6.25 trillion… if we consider the fact that reserve balances held at the Federal Reserve were about $15 billion and required reserves were about $43 billion, the tight link drawn in the textbook transmission mechanism from reserves to money and bank lending seems all the more tenuous.

So don’t be scared of the 2 trillion in excess reserves. Without borrowers, they aren’t going anywhere. On the other hand, if the banks found enough willing borrowers, 2 trillion in reserves would not be an effective limit on lending either.

davefairtex

ParticipantJack –

Since perhaps Feb 2013 gold has been in a downtrend. Trying to pick the bottom on the way down is tough – one might even say a fool’s game. Even though the price was good at that moment, the downside momentum hadn’t even slowed down. Today, on the other hand, momentum seems like it might have reversed. At least, the odds are better now than they were 3 weeks ago.

It is possible that gold has made a tradable bottom in the past two weeks. We will know more if/when it hits 1310. If the dollar continues down, it might easily rally substantially more. There are a large number of gold shorts out there that will start to cover, and the big banks are now net long, so its to their advantage to see the price rise.

The overall sentiment in gold is horrible enough – I mean really horrible, not-this-bad-in-5-years-horrible – that we might see a substantial rally off these levels.

A lot depends on how excited people are to own the buck.

davefairtex

Participant“doubtless they will try and confiscate it once more…”

And the French built the Maginot Line in order to stop a certain German invasion that – went around it.

Might want to avoid Fighting the Last War. My guess is they’ll get grabby where the stored value is, and these days, that’s not gold, it’s pensions & retirement funds.

Just judging from current trends, its not hyperinflation we have to fear, its the all-seeing Eye of NSA. Imagine that married to a government hungry for tax money to keep itself in power and pensions, and I don’t see hyperinflation, I see financial repression, fleeing capital, defaults on social promises, pension funds containing real cash exchanged for future promises, and ever more burdened tax donkeys.

Just change a few keywords in the NSA Machine, and all those guys communicating with their tax havens suddenly have all their data turned over to the IRS.

Nowhere to run, nowhere to hide.

That all sounds pretty deflationary to me.

davefairtex

ParticipantWhy is gold going down?

My simple-minded view: the story that “money printing will inevitably lead to hyperinflation” started in 2009, gathered steam, peaking in 2011. Now, with no inflation in sight (never mind hyperinflation), the story appears busted. Gold owners (mostly the “paper” kind) have capitulated, first slowly, then en masse.

If gold is to bounce back, its quite likely that the goldbugs will have to come up with a better story than “QE will lead inevitably to hyperinflation.”

Deflation in the eurozone and threatened deflation in China has just added emphasis to gold’s move down.

This is my best guess anyway.

davefairtex

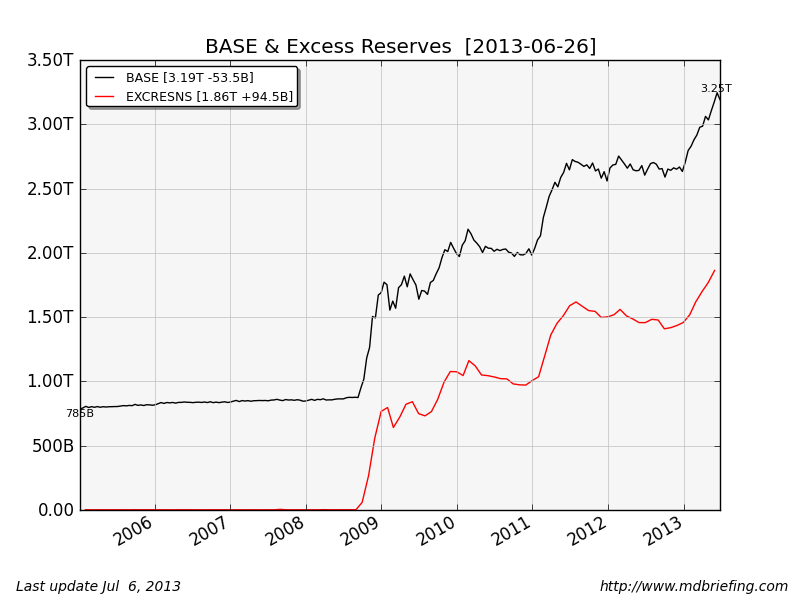

ParticipantSo BASE includes EXCRESNS – Excess reserves deposited at the Fed.

This is essentially cash deposited at the Fed in excess of the reserve requirements. Why do banks deposit anything at the Fed if they don’t have to? The Fed currently pays 0.25%. Currently, a one-year treasury bill pays 0.14%, and short-term bank repos pay about 0.09%. In other words, the Fed is giving Banks a good deal, so guess what – the banks take it.

People aren’t borrowing – enough anyway – so the banks need to make money in order to pay their depositors that 0.01% they get from their savings account. So, banks take deposits, pay 0.01%, and get 0.25% from the Fed. It won’t make them rich, but its better than nothing, that’s for sure.

Anyone – how much does your money market fund pay you? How much does your savings account pay you? If you could get 0.25% for ultimately safe deposits, would you take it? I sure would. The Fed is the bank that will never go under!

The Fed started paying for excess reserves in October 2008. Short term treasury bond yields plummeted at that moment as money fled to safe havens, and it was at that moment that excess reserves category took off.

To me EXCRESNS is the place where a big chunk of QE money goes to…well if not die, then sleep. If the Fed decided to stop paying 0.25%, the excess reserves would flee from there into somewhere else that provided yield. Perhaps the 1 year treasury yield would fall even further.

QE does construct a bubble in the bond market, by propping up bond prices, and then most of the cash goes to park at the Fed, back where it started from.

davefairtex

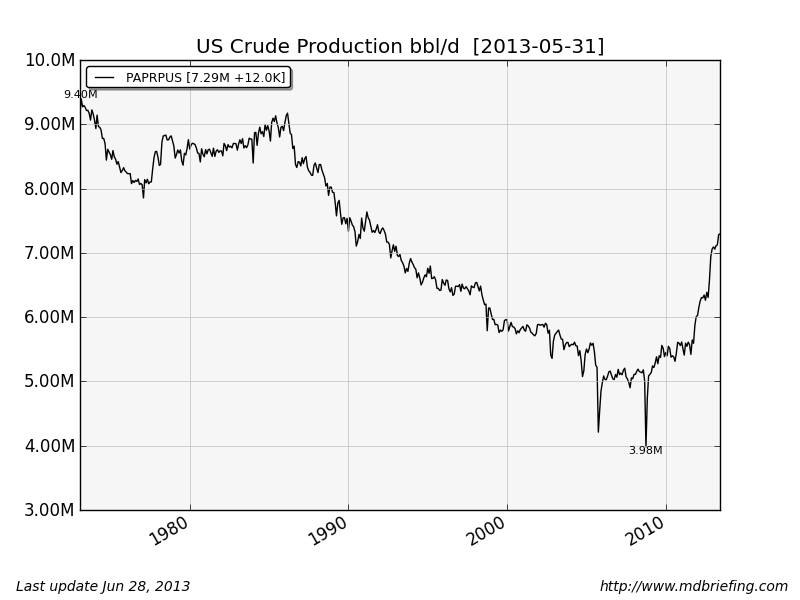

ParticipantUS Crude Oil production in barrels per day:

Pretty clearly US crude production is doing well, and the trajectory is still going up. However, this takes a large number of wells to make it happen. I don’t have charts on the number of wells – I’ve seen them, and the sheer number of wells this takes is pretty astonishing. I recall calculating something like 100 bbl/day as the average rate per well (vs something around 1800 bbls/day per well from Prudhoe Bay – and the lifespan of that field was measured in decades), and given the brisk decline rates of the shale oil, once drilling stops, my guess is the curve won’t look like this for very long.

davefairtex

ParticipantViscount –

One could just as easily say that any action that has an element of uncertainty to it is gambling. Opening a restaurant, hoping that it will be successful. Paying for your child’s education, hoping they will graduate.

Tomato, tomahto.

-

AuthorPosts