James Karales Selma to Montgomery March Alabama 1965

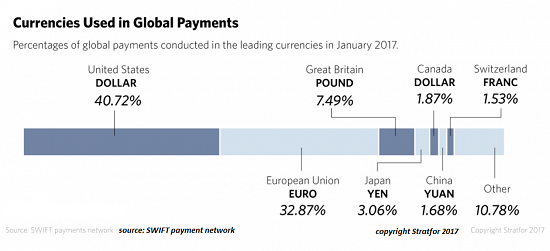

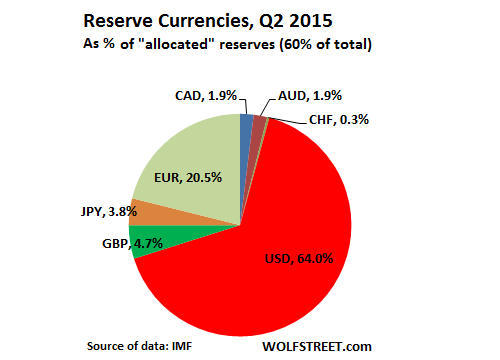

It’s not as if a strong yuan is all that good for China. A stable one might be. But the bottom line remains: nobody wants it.

• Beijing’s Yuan Ambitions Look Dashed (BBG)

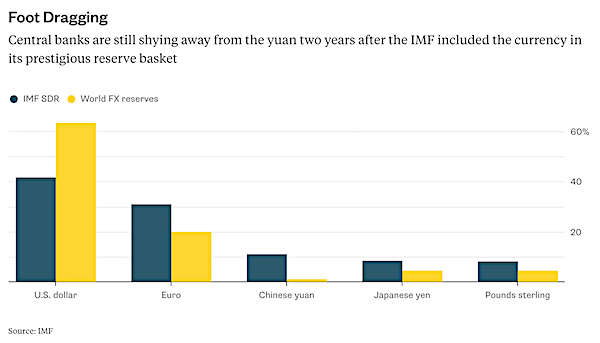

As 2018 gets underway, China seems to be on top again. The yuan has strengthened 6.8% against the dollar over the past 12 months and foreign-exchange reserves are growing. Not so fast.Remember November 2015, when the IMF- with some fanfare – agreed to add the yuan to its prestigious special drawing rights currency basket. Talk then was of the yuan one day becoming one of the world’s reserve currencies, perhaps even rivaling the dollar.Two years on and central banks aren’t buying the notion. Although China’s currency has a weight of more than 10% in the SDR basket, which gives equal importance to a country’s trade status and balance-sheet metrics, just 1.1% of the world’s forex reserves were held in yuan versus 63% in dollars as of the third quarter.

It’s understandable that central banks have been shying away from the euro. German two-year bunds have been offering a negative yield since mid-2014. But why the yuan? China’s short-dated government notes offer among the best interest rates: Part of the explanation is liquidity. According to the Bank of International Settlements, in 2016, the yuan constituted only 4% of the world’s currency trades. The dollar, through pairs with the euro and the yen, accounted for 88% of transactions.

Then there’s the question of time. It could be decades before any currency, yuan or bitcoin, replaces the greenback.But China itself is also to blame. It seems to have abandoned its great yuan ambitions.What happened to the dim sum bond market? The Chinese government, along with policy banks, sold fewer than $3 billion of offshore yuan notes last year, a sharp pullback from 2016 and 2015. And oddly, last October, China sold its first sovereign dollar debenture since 2004 – a move that was widely interpreted as Beijing wishing to develop a vibrant international bond market for its state-owned enterprises. The panda bond market, where foreign companies raise yuan onshore, is also going nowhere. Hungary had a small, 1 billion yuan ($154 million) issue in July, while the Philippines keeps delaying its plans. China has also hit the pause button on the idea of trading oil in yuan.

Curious new problems.

• Two Major Apple Shareholders Push for Study of iPhone Addiction in Children (BBG)

Two big shareholders of Apple are concerned that the entrancing qualities of the iPhone have fostered a public health crisis that could hurt children – and the company as well. In a letter to the smartphone maker dated Jan. 6, activist investor Jana Partners and the California State Teachers’ Retirement System urged Apple to create ways for parents to restrict children’s access to their mobile phones. They also want the company to study the effects of heavy usage on mental health. “There is a growing body of evidence that, for at least some of the most frequent young users, this may be having unintentional negative consequences,” according to the letter from the investors, who combined own about $2 billion in Apple shares. The “growing societal unease” is “at some point is likely to impact even Apple.”

“Addressing this issue now will enhance long-term value for all shareholders,” the letter said. It’s a problem most companies would kill to have: Young people liking a product too much. But as smartphones become ubiquitous, government leaders and Silicon Valley alike have wrestled for ways to limit their inherent intrusiveness. France, for instance, has moved to ban the use of smartphones in its primary and middle schools. Meanwhile, Android co-founder Andy Rubin is seeking to apply artificial intelligence to phones so that they perform relatively routine tasks without needing to be physically handled. Apple already offers some parental controls, such as the Ask to Buy feature, which requires parental approval to buy goods and services. Restrictions can also be placed on access to some apps, content and data usage.

I must admit, another new problem, and one that hadn’t occurred to me yet.

• New Jersey Poised To Bar Drunken Droning (R.)

U.S. drone sales in 2017 topped $1 billion for the first time ever, but don’t raise a glass too quickly if you are in New Jersey, where lawmakers are poised to outlaw drunken droning next week. It is one of a wave of U.S. states moving to bring the unmanned aircrafts’ high-flying fun back to earth. New Jersey’s Assembly is slated to vote on a bill approved by the state Senate to ban inebriated or drugged droning, as well as to outlaw flying unmanned aircraft systems over prisons and in pursuit of wildlife. The vote was set for Thursday but postponed until Monday because of a severe snowstorm that triggered a state of emergency in New Jersey. “It’s basically like flying a blender,” said John Sullivan, 41, of New York, a drone buff and aerial cinematographer.

He said he opposed drunk droning but also fretted about regulatory overreach. “If I had like one drink, I’d be hesitant to even fly it.” A 2015 drone crash on the White House lawn fueled debate in the U.S. Congress over the need for drone regulations. It was a drunken, off-duty employee of the National Geospatial-Intelligence Agency who flew the 2-foot-by-2-foot (60 cm by 60 cm) “quadcopter” from a friend’s apartment balcony and lost control of it over the grounds surrounding the White House, the New York Times reported. [..] “Like any technology, drones have the ability to be used for good, but they also provide new opportunities for bad actors,” said Assemblywoman Annette Quijano of Elizabeth, New Jersey. She backed the bill, which would impose a punishment of up to six months prison and a $1,000 fine for drunk droning.

A big gap: “..bitcoin’s global price average was trading at $16,294 while in South Korean markets, it stood at 25 million won, or $23,467.35..?

• South Korea Inspects Six Banks Over Crypto Currency Services To Clients (R.)

South Korean financial authorities on Monday said they are inspecting six local banks that offer virtual currency accounts to institutions, amid concerns the increasing use of such assets could lead to a surge in crime. The joint inspection by the Financial Services Commission (FSC) and Financial Supervisory Service (FSS) will check if banks are adhering to anti-money laundering rules and using real names for accounts, FSC Chairman Choi Jong-ku told a press conference. [..] Choi said the inspections are intended to provide guidance to banks and are not the result of any suspected wrongdoing. “Virtual currency is currently unable to function as a means of payment and it is being used for illegal purposes like money laundering, scams and fraudulent investor operations,” said Choi. “The side effects have been severe, leading to hacking problems at the institutions that handle cryptocurrency and an unreasonable spike in speculation.”

A Woori Bank spokesperson told Reuters the bank was filling out a checklist for the inspection. The spokesperson said Woori had stopped providing virtual account services last month as the costs of using a real-name transaction system were too prohibitive. [..] Choi said authorities are also looking at ways to reduce risks associated with cryptocurrency trading in the country, which could include shutting down institutions that use such currencies. Last month, the government said it would impose additional measures to regulate speculation in cryptocurrency trading within the country, including a ban on anonymous cryptocurrency accounts and new legislation to allows regulators to close virtual coin exchanges if needed.

Bitcoin and other virtual coins have been extremely popular in South Korea, drawing wide investments from housewives and students. Government officials have expressed concern over frenzied speculation, with South Korea’s central bank chief warning of “irrational exuberance” in trading of virtual currency last month. A South Korean cryptocurrency exchange, Youbit, shut down and filed for bankruptcy in December after it was hacked twice last year, highlighting security and regulatory concerns. South Korea’s virtual currency exchanges have been more vulnerable to hackers as bitcoin trades at higher rates on local exchanges than they do elsewhere. As of 0710 GMT, bitcoin’s global price average was trading at $16,294 while in South Korean markets, it stood at 25 million won, or $23,467.35, according to Coinhills.com.

Bitcoin and Ripple are falling, ether rises.

• Bitcoin Futures Traders Are Quietly Building A Big Short Position (ZH)

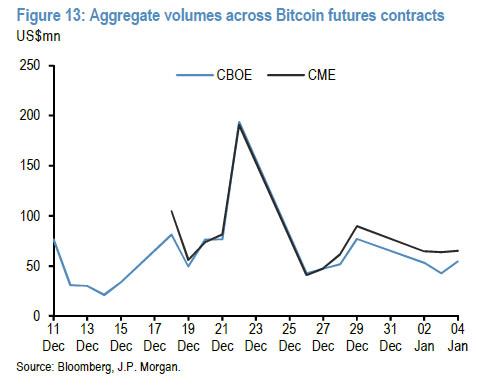

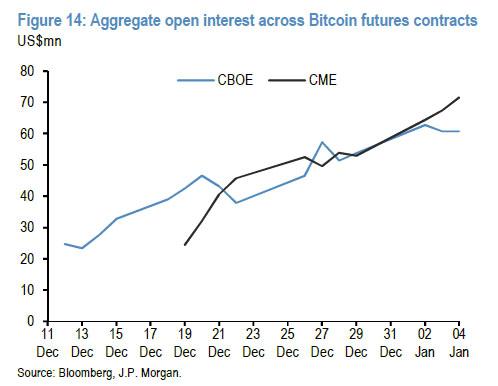

In retrospect, the launch of bitcoin futures one month ago has proven to be a modestly disappointing event: while it helped send the price of bitcoin soaring as traders braced for the institutionalization of bitcoin, the world’s most popular cryptocurrency has stagnated since the beginning of December when first the Cboe then CME started trading bitcoin futures, trading in a range between $12,000 and $17,000. And while bitcoin futures markets volumes have been lower than most had expected, the past 4 weeks have provided enough data to observe how volumes and open interest have evolved.

We discussed previously that Bitcoin futures were off to a slow start in the first week of trading, with volumes of CBOE Bitcoin futures averaging just around $40MM per day, despite intense media hype helping fuel heavy trading when both contracts launched, at least in the first hours of trading. Since then, volumes spike briefly in the following week coinciding with the launch of the CME futures, with volumes of on both exchanges at relatively similar levels. Then, as JPM’s Nikolaos Panagirtzoglou shows, after a spike in volumes to around $200mn on 22 December, which saw sharp swings in underlying Bitcoin prices, volumes have averaged around $50mn and $60mn per day on the CBOE and CME futures, respectively.

One month after their launch, futures trading volumes remain very modest compared to average Bitcoin trading volumes of around $15bn per day since futures contracts were launched according to coinmarketcap.com data. While open interest in both the CBOE and CME contracts has risen steadily, it too remains rather modest at around $60mn and $70mn, respectively. Putting futures volumes in context, on Friday, the combined size of the bitcoin-futures markets at the two exchanges was roughly $150 million, measured in terms of the value of outstanding contracts, while the total value of all bitcoins in existence was around $290 billion.

That’s a big drop.

• Australia Forecasts 20% Iron Ore Price Drop In 2018 (R.)

Australia on Monday said it expects iron ore prices to average $51.50 a tonne this year, down 20% from 2017, because of rising global supply and moderating demand from top importer China as its steel sector shrinks. The world’s top three mining companies, BHP and Vale rely heavily on iron ore sales for the bulk of their revenue despite efforts to diversify more into other industrial raw materials, such as copper, aluminium and coal. Brazil-based Vale is planning to lift iron ore exports 7% in 2018 to 390 million tonnes. In Australia, Rio Tinto and BHP, along with Fortescue Metals Group aim to add about 170 million tonnes of new capacity over the next several years.

The forecast price decline — from an average of $64.30 a tonne in 2017 — continues into 2019, when the steelmaking raw material will average only $49 a tonne, according to the Department of Industry, Innovation and Science. “The iron ore price is expected to experience some ongoing volatility in early 2018, as the market responds to uncertainty regarding the impact of winter production restrictions on iron ore demand,” the department warned in its latest commodities outlook paper. Iron ore currently sells for about $75 a tonne.

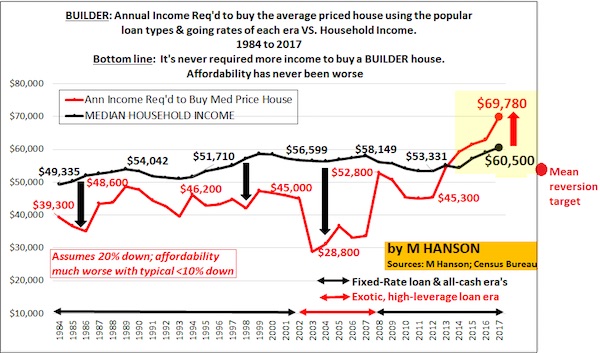

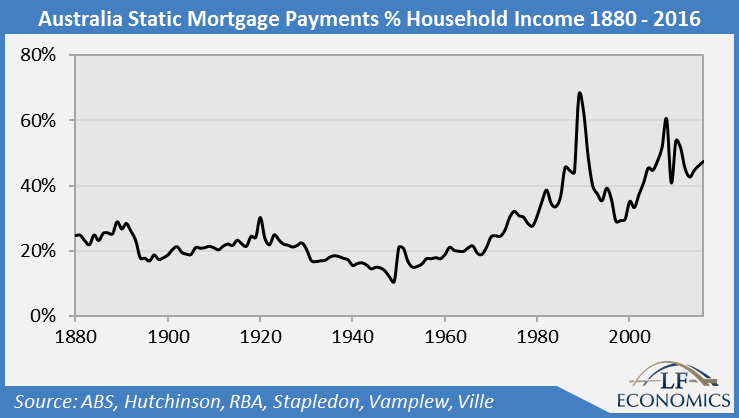

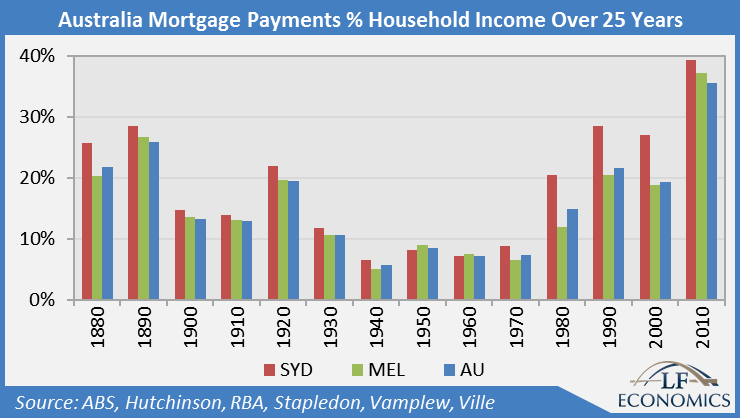

All it needs to do is let prices crash. Does wonders for affordability.

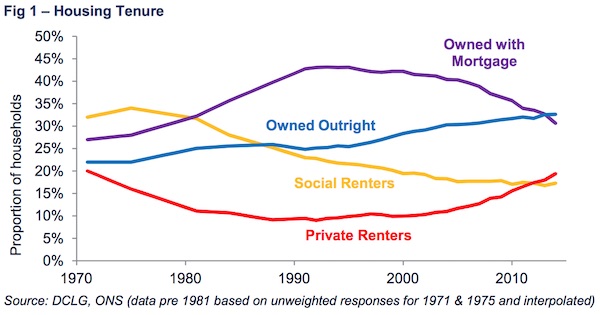

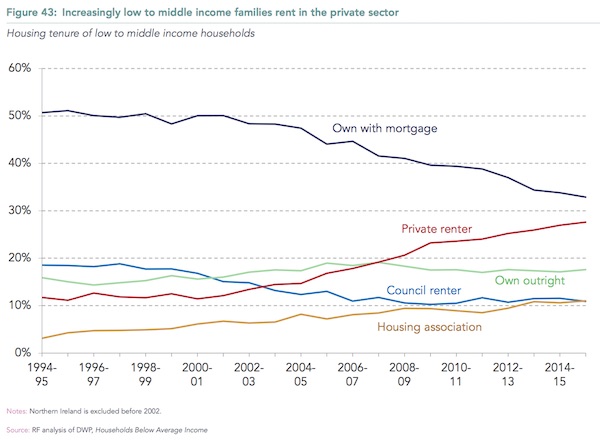

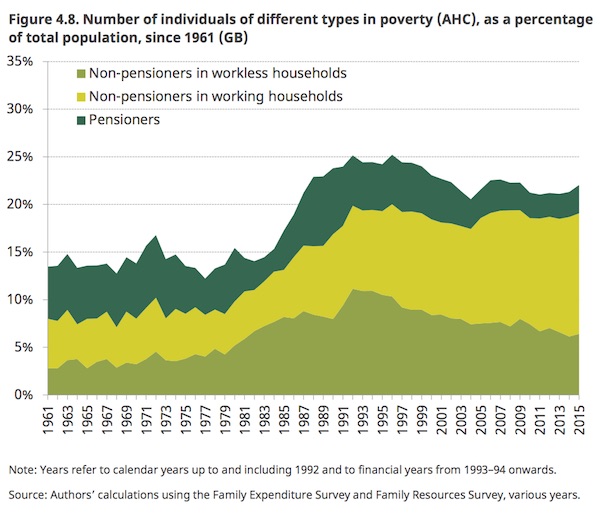

• Australia Government Can’t Supply Its Way To Housing Affordability (SMH)

Sydney and Melbourne are entering a housing downturn. While the government has hoped record high levels of property development would have an impact, research shows supply is not behind the price falls. Housing economists say the market slowdown is not due to additional home building but a drop in demand, in part thanks to the banking regulator making it more difficult for some to get a loan. In fact, the effect of new supply on property prices has been very limited despite state governments largely pinning hopes on a surging home building industry to rein in affordability. In a recent Australian National University paper Regional housing supply and demand in Australia academics Ben Phillips and Cukkoo Joseph found supply levels from 2001 to 2017 were larger than necessary to cover demand requirements, with thousands of excess homes in Sydney, but prices boomed over the time period.

This flies in the face of conventional economic wisdom, with the law of supply and demand dictating that the more of something you make, the cheaper it should be. There are many reasons why housing doesn’t respond to increases in supply in the way the market for coal, apples or t-shirts might be expected to react. When economists are making models they usually assume they are calculating the impacts on a “normal” good. One of the assumptions often made when modelling supply and demand for these goods is that what is produced is all homogenous, that is they are more or less the same. Typically, someone will pay the same amount for one item as they will for another that is identical.

Housing is not in this category. Even in the most sterile of apartment blocks, there will be many different design features, flaws, views and aspects that differ in each unit. The impact of new supply on the property market is limited by whether the type of property being built caters to existing demand. For instance, new apartments on the outskirts of greater Sydney or Melbourne may not appeal to the same market bidding up the price of mansions with water views.

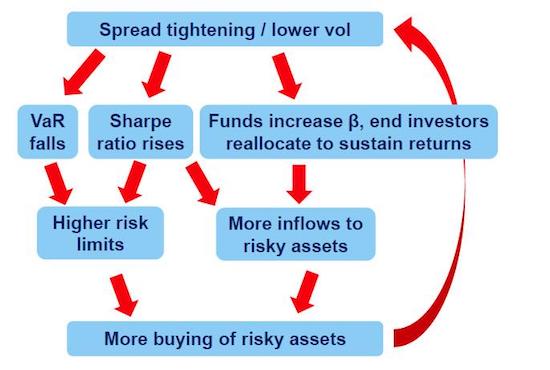

It’s just like Minsky: stability begets instability.

• Rising Volatility Begets Rising Volatility (Peters)

To sell implied volatility at current 50yr lows, investors must imagine tomorrow will be virtually identical to today. They must imagine that bond yields won’t rise despite every major central bank eager to hike interest rates and exit QE. They must imagine that economies at or near full employment will not create inflation; that GDP will neither accelerate nor decelerate; that governments will tolerate historic levels of income inequality despite citizens voting for the opposite; that strongly rising global debts will be supported by structurally decelerating global growth. And volatility sellers must imagine that nine years into a bull market, amplified by a proliferation of complex volatility-selling strategies and passive ETFs with liquidity mismatches, that we will dodge a destabilizing shock to market infrastructure.

I can imagine a few of those things happening, but neither sustainably nor simultaneously. It is much easier to imagine a tomorrow that looks different from today. Also consider that investment banks and asset managers have always devised creative strategies to make money once asset valuations exceed reasonable levels. These perpetual prosperity machines typically combine leverage and alchemy, transforming real risk into perceived safety. Examples abound. But in this cycle, a proliferation of cleverly disguised volatility-selling strategies has dominated. Zero interest rates and quantitative easing left yield-starved investors with few ways to achieve their target returns. Wall Street’s engineers developed many wonderful solutions to this problem. Their magnificence is matched only by the amount of negative convexity now lurking in investment portfolios.

As volatility has declined, investors have had to sell even more of it to sustain sufficient profits. This selling reinforces the trend lower, which produces an illusion that legacy volatility shorts are less risky today than yesterday. Lower volatility thus begets lower volatility. And this also ensures that quantitative models reduce overall portfolio risk estimates, which allows (and in many cases forces) investors to buy more assets at prevailing prices. This in turn reduces volatility, reflexively. Naturally, the reverse is also true. Rising volatility begets rising volatility. And given the unprecedented volatility-selling in this cycle, this market is exposed to a historic reversal somewhere along the path to policy normalization. Which has now begun.

aka the everything bubble.

• The Artificial Liquidity Bubble (Henrich)

8 years after the financial crisis we remain in an environment that is entirely dependent on artificial liquidity, be it via central bank liquidity driven low rates and/or QE or now US fiscal stimulus in the form of tax cuts. And while a reduction in central bank stimulus is anticipated for 2018 the $1.5 trillion US tax cut is the next active artificial boost to hit markets. You can view it perhaps this way: When the US ended QE3 Europe and Japan took over the stimulus baton, and now that Europe is reducing stimulus the US again is taking the lead, this time with fiscal stimulus. It is a bizarre dance that excels in one aspect in particular: It never ends. Consider: German unemployment is at all time lows, and European PMIs are at their highest in over 7 years.

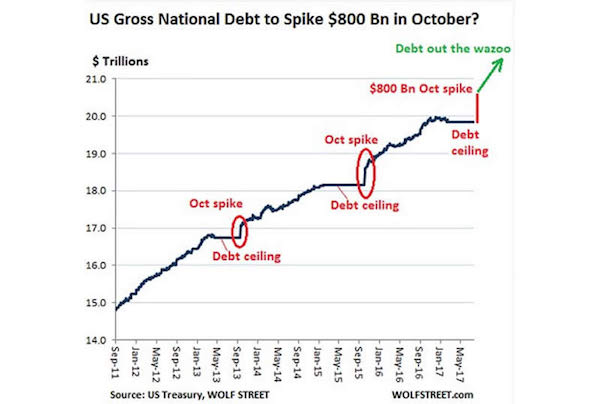

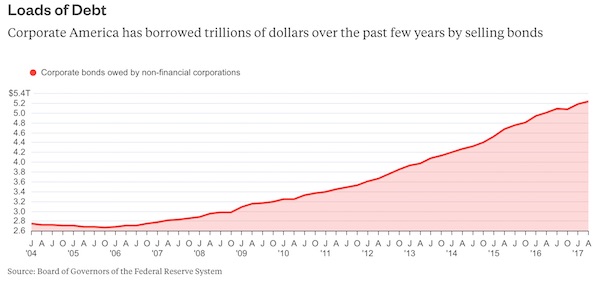

Is the ECB raising rates from record lows? Nope. Has QE ended? Nope. QE continues to run at $30B Euro a month and rates remain in full panic mode. Not what one would’ve expected 8 years ago following a return to full employment. Stimulus programs & interventions used to be methods of crisis management now they have become permanent fixtures in global economies. Why? Because this is what it takes. And they will continue. Japanese Prime Minister Shinzo Abe has just instructed central bank chief Kuroda to keep printing as he decides whether to keep him in his job. Wink wink. Normalizing rates? Reducing balance sheets back to pre-crisis levels? Letting markets run on their own without intervention? Call it the big central banking lie. It will never happen. It can’t. Global debt is now exceeding $233 Trillion.

[..] the math of higher rates doesn’t work and will eventual break the camel’s back. Low rates are an absolute must requirement to keep the construct afloat. It is no accident that Morgan Stanley wealth management has decided to pull out of junk bonds. They are warning of US tax cuts accelerating market excesses bringing about a coming recession. And make no mistake, a recession will come as we are very late in the cycle.

Count me out.

• Wikileaks Publishes Michael Wolff’s Entire Sold Out Trump Book As A PDF (ZH)

Considering that Wikileaks made its name by leaking confidential and/or hard to find documents and information, and also considering the reversal in the Trump administration vis-a-vis Julian Assange, whom it first lauded only to threaten with incarceration in recent months, it is perhaps not surprising that moments ago the official Wikileaks twitter account published Michael Wolff’s controversial – and largely sold out – book, “Fire and Fury” in pdf format.

New Trump book “Fire and Fury” by Michael Wolff. Full PDF: https://t.co/sf7vj4IYAx

— WikiLeaks (@wikileaks) January 7, 2018

Since, somewhat ironically, WikiLeaks picked a google drive to host the leaked pdf, it will unlikely remain available for an extended period, as it would mean substantial lost revenue for book published Henry Holt and Company. So for those who wish to read what all the hoople is about – for free – they are advised to do so sooner rather than later.

View from the west only. How do you dress for a flight like that?

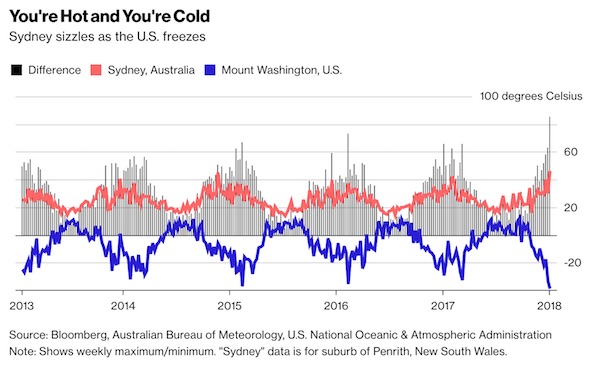

• US Freezes While Sydney Sizzles: World’s Temperature Extremes Span 85ºC (BBG)

Temperature extremes across the globe spanned more than 85 degrees Celsius at the weekend as Sydney melted and parts of the U.S. froze. Western Sydney touched 47.3 degrees Celsius (117 degrees Fahrenheit) on Sunday afternoon local time, the city’s hottest day since 1939. Weekend temperatures at Mount Washington Observatory in New Hampshire plummeted to minus 36 degrees Fahrenheit (minus 38 degrees Celsius). Roads melted, firefighters battled wildfires across New South Wales state and Sydney residents retreated to air-conditioned shopping malls as temperatures surged. English cricket captain Joe Root was hospitalized with severe dehydration after battling Australia in the cauldron of the Sydney Cricket Ground. At the same time, freezing fog and snow buffeted Mount Washington, tying the observatory for the second-coldest place on Earth.