Russell Lee Columbia Gardens outdoor amusement resort, Butte, Montana 1942

“Credit-rating firms are downgrading more U.S. companies than at any other time since the financial crisis..”

• US Debt Markets Shaken Amid More Corporate Downgrades And Defaults (WSJ)

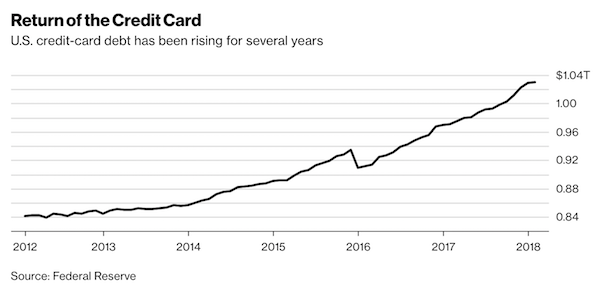

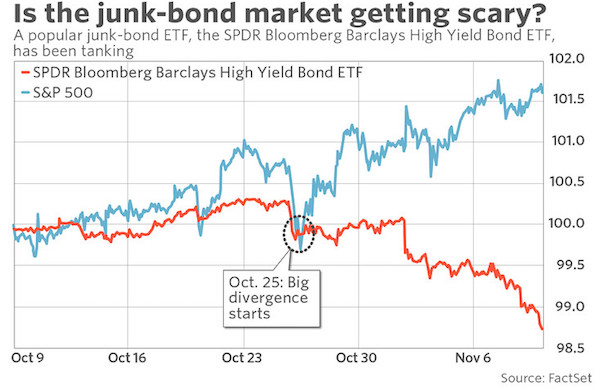

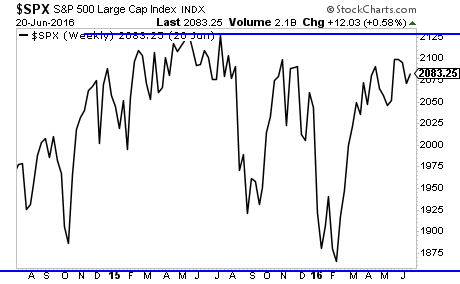

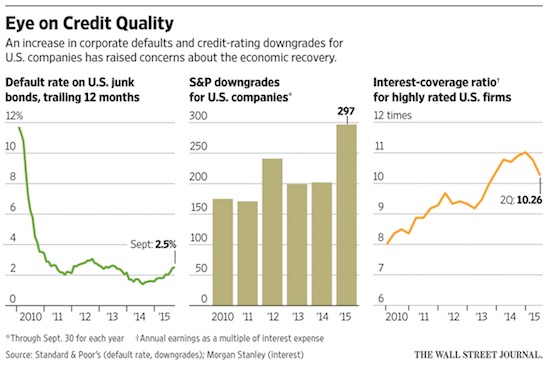

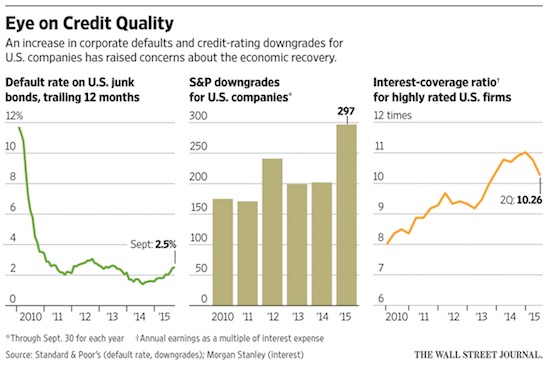

Falling profits and increased borrowing at U.S. companies are rattling debt markets, a sign the six-year-long economic recovery could be under threat. Credit-rating firms are downgrading more U.S. companies than at any other time since the financial crisis, and measures of debt relative to cash flow are rising. Analysts expect profits at large companies to decline for a second straight quarter for the first time since 2009. The market for riskier debt has become snarled, raising fears that companies could have trouble repaying their obligations following several years of record debt issuance, low corporate defaults and persistently low interest rates. Reflecting those concerns, investors are now demanding more yield to own corporate bonds relative to benchmark U.S. Treasury securities.

The softening U.S. corporate fundamentals have been largely overlooked as investors focused on sharp declines in the shares, bonds and currencies of many emerging-markets nations. Many analysts say the health of China remains the largest source of uncertainty in the global economy. But rising downgrades and an increase in U.S. corporate defaults indicate “some cracks on the surface” of the domestic-growth outlook, said Jody Lurie, corporate credit analyst at financial-services firm Janney Montgomery Scott LLC. Many investors closely monitor debt-market trends as an indicator of U.S. economic health. In August and September, Moody’s Investors Service issued 108 credit-rating downgrades for U.S. nonfinancial companies, compared with just 40 upgrades.

That’s the most downgrades in a two-month period since May and June 2009, the tail end of the last U.S. recession. Standard & Poor’s Ratings Services downgraded U.S. companies 297 times in the first nine months of the year, the most downgrades since 2009, compared with just 172 upgrades. Meanwhile, the trailing 12-month default rate on lower-rated U.S. corporate bonds was 2.5% in September, up from 1.4% in July of last year, according to S&P. About a third of the downgrades targeted oil and gas companies or firms in other commodity-linked industries, following a plunge in oil prices in the second half of 2014, said Diane Vazza, head of global fixed-income research at S&P.

Read more …

“S&P 500 financials are expected to show a 3.8% annualized growth in profits [..] As recently as July analysts had been forecasting 9.9% growth..”

• Why US Banks Soon Will Be Singing The Blues (CNBC)

With Wall Street banks about to report on how much money they’ve been making, estimates are moving in the wrong direction. Coming off a quarter in which the industry collectively reported $43 billion in profits, analysts had been hoping a rising rate environment and increasing demand would keep things moving for the $15.1 trillion sector. However, fading hopes for a rate hike in 2015 and other factors are making analysts nervous about just how the quarterly profit reports will shape up. JPMorgan Chase gets things started for the Big Four on Tuesday, with Bank of America and Wells Fargo on tap Wednesday and Citigroup due Thursday. Goldman Sachs reports Thursday as well and PNC will report Wednesday.

As a sector, S&P 500 financials are expected to show a 3.8% annualized growth in profits, according to S&P Capital IQ. While that’s better than the 5.1% decline projected for the entire index, it’s a big comedown from initial projections. Revenue is expected to grow 4.4%. As recently as July analysts had been forecasting 9.9% growth, and a year ago that expectation was a gaudy 27%. So even if results come in better than expected, they likely will remain well below the initially lofty hopes for financials, which were supposed to be 2015’s best-performing sector. Individual companies have seen substantial revisions in recent days.

Analysts have cut MetLife estimates from 88 cents a share to 77 cents, Goldman Sachs from $3.46 to $3.20 and Morgan Stanley from 68 cents to 63 cents, according to FactSet. Earnings expectations have been reduced for 53 of the 88 companies in the S&P 500’s financial sector. The weakness comes as loan growth has held fairly steady thanks to a robust climate in commercial real estate. The sector jumped 9.7% in the third quarter, its best of the year after rising 6.7% in 2014, according to Federal Reserve data. Investment banking also has been fairly solid throughout the year. While global revenue is down 10% year over year, it’s been flat at $28 billion in the U.S., thanks to a record $9.7 billion haul in mergers and acquisition revenue, according to Dealogic.

Read more …

Imports down 17.7% in yuan, over 20% in USD. Different numbers reflect the difference between calculations in yuan and in dollars.

• China Imports Slump 20% Amid Falling Commodity Prices, Weak Demand (Guardian)

China’s imports fell heavily in September, official figures said, keeping pressure on policymakers to do more to stave off a sharper economic slowdown. Although exports fell less than expected by 3.7% from the same period last year, the value of imports tumbled more than 20% to register the 11th straight month of falls. Imports plunged 20.4% in September from a year earlier to $145.2bn, customs officials said, due to weak commodity prices and soft domestic demand. These factors will complicate Beijing’s efforts to stave off deflation, one of the headwinds threatening the world’s second biggest economy. Highlighting persistent weakness in demand at home and abroad, China’s combined exports and imports fell 8.1% in the first nine months of the year from the same period in 2014, well below the full-year official target of 6% growth.

“In general, there are no green shoots in this set of data,” said Zhou Hao, senior economist at Commerzbank in Singapore. “The growth of [trade] volume still remains low.” However, monthly figures were much more rosy. Exports to every major market except Taiwan rose from August, as did imports. Julian Evans-Pritchard of Capital Economics said monthly trends showed a steady rise to most major export markets in the US and Europe over the summer. “Basically, exports have been doing better since the second quarter, but that recovery trend has been masked on a year-on-year basis because the second half of 2014 was so strong.” Evans-Pritchard also said that import data had become unreliable given massive swings in prices due to the commodity downturn and a divergence between prices and trading volumes.

“For the major commodities like oil, copper, etc. we’re actually seeing a pretty healthy trend in import volumes.” Import volumes are a leading indicator for exports in China, given a large share of materials and parts re-exported as finished goods. “September’s import figure does not bode well for industrial production and fixed asset investment,” wrote ANZ economists in a research note reacting to the figures. “Overall growth momentum last month remained weak and third quarter GDP growth to be released [on 19 October] will likely have edged down to 6.4%, compared with 7% in the first half.” China posted trade surplus of $60.34bn for the month, the general administration of Customs said on Tuesday, higher than forecasts for $46.8 billion.

Read more …

China has a record surplus. Sounds good. Exports down ‘only’ 1.1% (still curious if you want to grow GDP by 7%). Imports down 17.7%. That will be largely raw materials. So what will they be able to produce for export next year?

• China Trade Data Unsettle Asian Bourses (FT)

Chinese trade data rattled Asian markets as a bigger-than-expected fall in imports offset the cheer afforded by a record mainland trade surplus and slower pace of decline in exports. The Shanghai Composite was down 0.4% and the tech-focused Shenzhen Composite was up 0.3% after data showed China posted its biggest-ever trade surplus, in renminbi terms, of Rmb376.2 in September, up from Rmb368bn in August and comfortably ahead of economists’ expectations of Rmb292.4bn. That was underpinned by exports declining by 1.1% last month from a year earlier, an improvement from August’s 6.1% pace of decline. Economists expected exports to drop by 7.4%.

Imports fell 17.7% in September from a year ago, a bigger-than-forecast drop and larger than August’s 14.3% decline – less than encouraging in the context of China’s goal to shift its growth model from export-driven to consumption-based. Ahead of the trade data release, economists at ANZ said: “China’s exports have likely contracted in September, but its strong trade surplus should ease the pressure of capital outflows.” They reckon economic activity on the mainland remained sluggish in September, leading to their forecast of 6.4% economic growth in the third quarter. China’s official gross domestic product data are due on October 19, and analysts are increasingly bearish, tipping real growth at 6.7%, according to a Bloomberg survey of 25 economists, lower than the official full-year target of “around 7%”. Among other equities benchmarks, Hong Kong’s Hang Seng was down 0.3% and Australia’s S&P/ASX 200 was down 0.9%. Japan’s Nikkei, reopening after a long weekend, was down 0.9%.

Read more …

“As oil starts to move and materials follow, investors will by default feel more positive about China,” he said. “This is a bear market rally.”

• China’s Stock Rally-to-Rout Is About to Repeat (Bloomberg)

In August, Thomas Schroeder correctly predicted a rebound in Chinese stocks wouldn’t last. Now, he says, the benchmark equity gauge will plumb new lows as a bear-market rally fails. The Shanghai Composite Index will climb to 4,100 in the next three months before slumping as much as 41% to 2,400 in early 2016, Schroeder, founder and managing director of Chart Partners, said. The benchmark index added 3.3% to close at 3,287.66 on Monday. Schroeder, a former Asian technical analysis chief at UBS, cited triangle and wedge patterns in making his call. The Shanghai Composite tumbled 29% in the third quarter, the biggest slump among benchmark global gauges, as a stock boom turned to bust amid concern about the slowdown in China’s economy and a crackdown on using borrowed money to buy equities.

The bottoming of oil prices and a rebound in emerging market currencies will help bolster a rally in the nation’s equities in the next two months, which will reverse as the Federal Reserve starts raising interest rates, Schroeder said. “As oil starts to move and materials follow, investors will by default feel more positive about China,” he said. “This is a bear market rally.” Schroeder predicted in August that the Chinese equity rout will worsen, with the Shanghai Composite likely sliding below 3,100 within two months. The measure fell to as low as 2,927.29 on Aug. 26. Technical analysts use past patterns to try to predict future movements. [..] “We haven’t seen a major low for the emerging markets,” said Schroeder, whose Chart Partners Group is a provider of trading strategies linked to technical analysis. “There’s likely to be more pain next year as the U.S. starts lifting rates.”

Read more …

Squeeze.

• KKR Warns About Renewed Commodity, Emerging-Market Rout on China (Bloomberg)

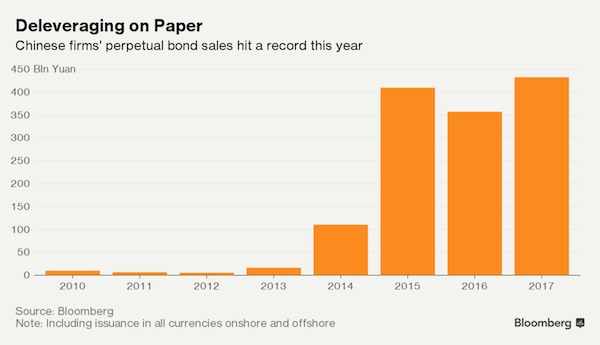

There are few reasons to get excited about the recent rebound in commodities and emerging-market assets, according to KKR which correctly forecast the stock selloff in developing countries five months ago. China will continue to rein in credit growth, reducing the investments in factories and machinery that have been among the key drivers for the commodity boom in recent years, Henry McVey, global head of macro and asset allocation at KKR, one of the world’s largest private equity firms, wrote in a note posted on its website. “Many hard commodity prices are likely to suffer another leg down,” McVey and Frances Lim, who visited Asia recently, said in the note. “We would view any recovery as a bounce, not a sustained re-acceleration in the Chinese economy, as the structural headwinds remain significant.”

The MSCI Emerging Markets Index rose Monday to a two-month high, while commodities are trading around 6% above a 16-year low set in August, on speculation that China will take steps to shore up its faltering economy. The emerging-market stock gauge has still lost about 10% this year, heading for its third annual decline, as lower raw-material prices and the Chinese economic slowdown undermines exports in countries from Brazil to Malaysia. While some “targeted stimulus” in housing and infrastructure in recent months may help stabilize China’s economy, it won’t alter a slowing trajectory because the government needs to reduce debt and production overcapacity, McVey said. KKR,which manages $102 billion in assets, expects growth in China to slow to 6% in 2018, from 6.8% this year, which would be the least since 1990.

McVey, who previously worked as chief investment strategist at Morgan Stanley and a managing director at Fortress Investment, told investors in May to stay away from most of the publicly traded emerging-market companies. He said a buildup in debt and weakening currencies in emerging countries will lead to underperformance in stocks, a call foreshadowing an over 20% decline in the MSCI benchmark gauge over the next four months. McVey said growth in China’s fixed-asset investments, the biggest driver in the country’s rise over the past decade, will decline to as little as 5% a year, from 11% in August, and down from a peak of 34% in 2009.

Read more …

Dead cats bouncing all over the place.

• Pimco’s Bear Case Only Gets Stronger as Emerging Currencies Jump (Bloomberg)

Pacific Investment Management Co. is sticking with its pessimistic outlook on emerging-market currencies, saying the biggest rally in 17 years has only bolstered the case for making bearish wagers. “These currencies look more interesting to be underweight from here than they were a week ago,” Luke Spajic, an emerging markets money manager at Pimco, whose developing-nation currency fund has outperformed 97% of peers during the past five years, said in a phone interview on Monday. Pimco, which oversees $1.52 trillion, said in an Oct. 1 report that it had short positions in currencies such as Malaysia’s ringgit, the Thai baht and the South Korean won. Emerging-market currencies surged last week, recording the biggest rally since 1998 as traders pushed back expectations for when the U.S. Federal Reserve will start raising interest rates.

While Spajic said he doesn’t know how long the rebound will last, he sees a “wave of deflationary pressure” across Asia that will eventually weigh on currencies as exports and economic growth projections decline. Pimco’s concerns echo those of the IMF, which cut its 2015 outlook for the global economic expansion to 3.1% on Oct. 6 from a July forecast of 3.3%. The fund cited a slowdown in emerging markets, saying the following day that high debt levels at banks and other companies have left developing economies susceptible to financial stress and capital outflows.

Read more …

Switzerland does as US does.

• Switzerland to Impose 5% Leverage Ratio on Biggest Banks (Bloomberg)

Switzerland’s finance ministry will require the country’s biggest banks to have capital equal to about 5% of total assets after UBS Group AG and Credit Suisse Group AG sought to win easier terms, according to people briefed on the deliberations. The decision would mimic the U.S. leverage ratio for its biggest banks, which exceeds the 3% minimum set in a global agreement by the Basel Committee on Banking Supervision, according to the people, who asked not to be identified because the talks aren’t public. The Swiss government will also align its calculation of the ratio with the method employed in the U.S., resulting in fewer types of debt counting toward capital, one of the people said. The measure of financial strength has gained importance since the 2008 financial crisis as a means of making big banks less prone to collapse.

A government-appointed expert panel recommended in December that Switzerland follow the lead of the U.S., which in recent years has introduced some of the world’s toughest capital requirements. Zurich-based UBS and Credit Suisse reported Basel III leverage ratios of 3.6% and 3.7% at the end of the second quarter, indicating they would be more than 1%age point short of the new target. “Higher requirements mean that the banks will have fewer funds to return to shareholders,” said Andreas Brun at Zuercher Kantonalbank. “For UBS, whose investment case is based on rising dividend expectations, this is a big issue. For Credit Suisse, whose capital situation is worse, this means a higher dilution because of a bigger requirement of a capital increase.”

Read more …

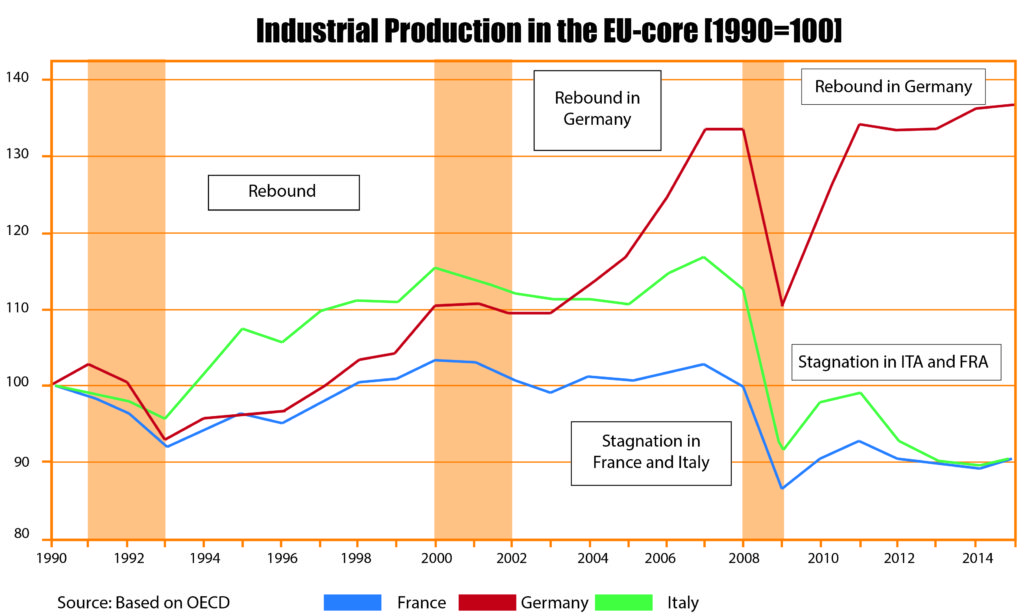

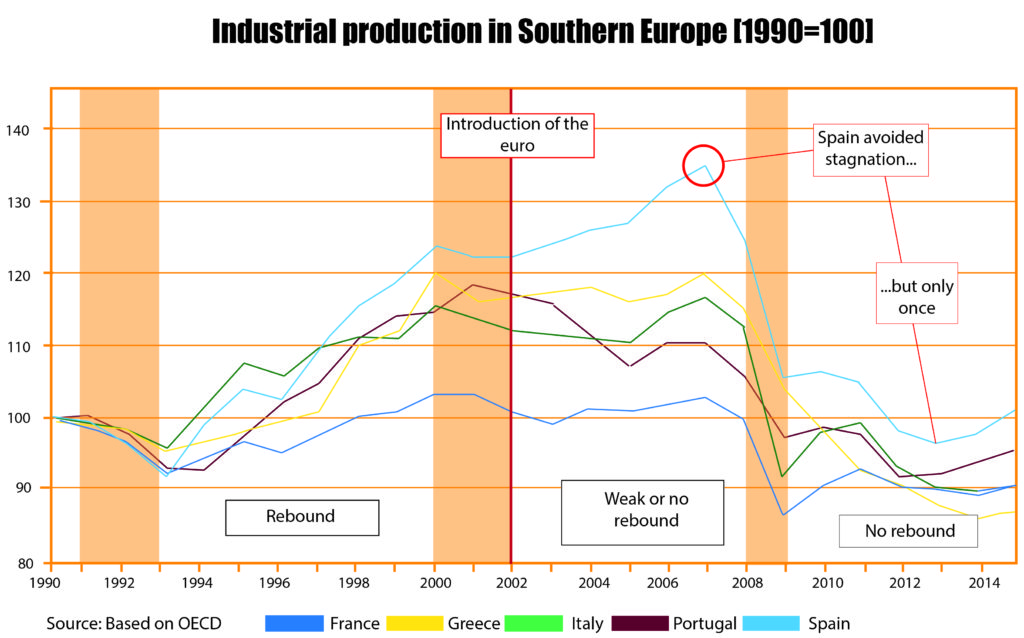

Meanwhile in the EU, banks are still holier than thou.

• Europeans Move To Undercut Global Bank Capital Rules (FT)

Several European countries are taking action to water down new global capital rules for their top financial institutions, causing concern among investors and EU officials. France is set to become the latest country to introduce legislation that would save its leading banks from having to issue tens of billions of euros of new bonds to meet the rules agreed by global regulators a fortnight ago, people familiar with the situation said. Brussels officials are so worried with the divergence in policies that they have started talks with EU countries on a more co-ordinated stance, two EU officials said. Market insiders said that investors were frustrated and that all banks could end up paying more when they issue debt.

The rules on “total loss absorbing capital” (TLAC) agreed on September 25 by the Financial Stability Board are one of the final pieces of a wave of post-crisis regulation designed to ensure there is never a repeat of the bank bailouts of recent times. The rules apply only to the world’s largest banks but have wider reach, according to Laurent Frings, analyst at Aberdeen Asset Management. “The view from investors to a large degree is that local regulators will force domestically important banks to work to the sale rules,” said Mr Frings. In the UK and Switzerland, banks such as UBS, Credit Suisse and Barclays are building up their “loss absorbing capital” by issuing new debt from bank holding companies that can be “bailed in” in a crisis. The banks will have to issue tens of billions of the new bonds to meet their TLAC requirements.

In Germany and Italy, however, legislators are passing laws to make traditional senior debt easier to bail in. This frees their banks of the obligation to issue new debt for TLAC. Several people close to the situation said that France would also propose a solution to help its banks. “Being a European authority we would always argue that it’s a good idea to put in place a European solution, and not try to come up with 19 or 28 solutions on that,” said Elke Koenig, president of the Single Resolution Board, the new EU-wide resolution authority for failing banks. “We’ve clearly given our support to the basic idea [of the German bank law] at the same time saying it would be preferential longer term to have a European solution.”

Read more …

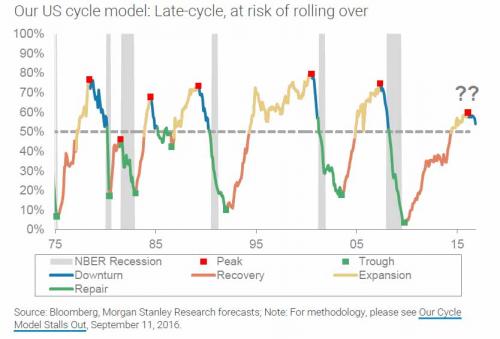

Or the failure to see that this is not a boom-bust cycle?

• The Failure to Learn From Boom-Bust Cycles (WSJ)

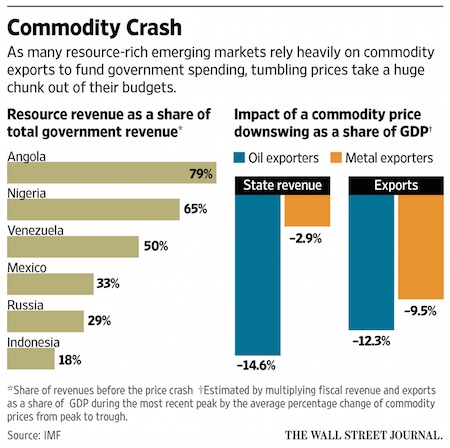

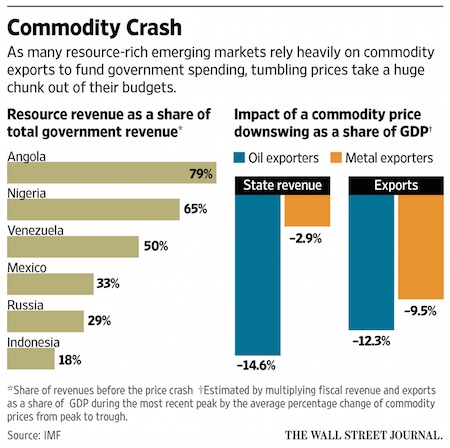

The plunge in commodity prices is thumping oil exporters around the globe. The scale of the beating rests largely on whether governments heeded the lessons from prior boom-bust cycles. Norway and Saudi Arabia built up sizable rainy-day funds and managed their windfalls from high prices conservatively. Now they’ve got considerable buffers against a downturn. Nigeria and Venezuela splurged and made few economic overhauls as prices surged. They’re now suffering as growth skids. The commodity bust is weighing heavily on resource-rich countries that represent 20% of the world’s economic output. The oil-price decline is supporting some of the largest consumers, such as the U.S. and Europe, that are key to keeping the global economy out of recession.

But it is providing less of an overall global boost than predicted just a year ago, while forcing more vulnerable economies to scramble in an uncertain environment. “The oil price drop came as a surprise,” said Angolan finance minister Armando Manuel. “It captured my country in a state in which we were not sufficiently diversified.” The commodity collapse and its effect on emerging economies drew wide attention in Lima, where the world’s finance ministers and central bankers gathered for the IMF’s annual meeting, which ended Sunday, against a backdrop of dimming global growth. The problem isn’t isolated to oil, fueling a much broader slump in major emerging markets from Brazil to South Africa.

Metal prices are in a long-term funk, hitting exporters of iron, copper and similar industrial commodities. Oil exporters are showing what may be in store for other major commodity exporters. Nigeria, which got nearly 65% of its government revenue from crude exports before the price plunge, has seen its projected 2015 growth slashed to less than 4% from more than 6% a year ago, according to the IMF. Kazakhstan’s growth rate has tumbled to 1.5% this year from 6% before the petroleum collapse. In Venezuela, where the state gets half its revenue from oil sales, the economy is shriveling by 10%.

Read more …

That’s the number 1 reason the Fed would love to hike rates.

• Higher Interest Rates Would Throw Bank Profits a Lifeline (Bloomberg)

Having bailed them out and then helped to repair their balance sheets with record-low interest rates and bond-buying, policy makers may assist the financial industry once more when the U.S. Federal Reserve begins tightening monetary policy. That’s according to two recently published reports by the Bank for International Settlements and McKinsey & Co., both of which have highlighted the downsides of ultra-easy borrowing costs in the past. Based on seven years of data from 109 large international banks in 14 countries, the BIS confirmed a relationship between short-term rates and the slope of the curve for bond yields with bank profitability.

The conclusion drawn by Claudio Borio, the head of the monetary and economic department at the BIS, and colleagues is that the positive impact of being able to earn income by lending money out for higher rates over time is bigger than the hit of defaults and income that doesn’t carry interest. Even better news for the banks is that the effect is strongest when rates are lower and the yield curve isn’t that steep, as is now the case. That provides another reason for the BIS’s economists to again decry the unintended side-effects of accommodative monetary policy. They reckon that between 2011 and 2014, the average bank of those studied lost one year of profits as a result of low rates. “All this suggests that over time, unusually low interest rates and an unusually flat term structure erode bank profitability,” said Borio et al in the report, which was published on Oct. 1.

Return on equity at 500 global lenders was unchanged in 2014 at 9.5%, about the average of the last 35 years, according to the Sept. 30 study by McKinsey. Profit margins also continued a steady decline, dropping by 185 basis points in 2014, in part because of lower rates. It reckons tighter policy would boost return on equity by about 2 %age points. “Many in the industry are waiting for an interest rate rise or some other structural lift to profits,” McKinsey said. There is a sting in the tail. It warned that even if rates do rise, profit margins may still not return to their pre-crisis highs. “Much of the benefit will get competed away, and risk-costs will likely increase, especially in economies where the recovery is still fragile,” McKinsey said.

Read more …

China doesn’t, and won’t, have sufficient growth to execute these plans.

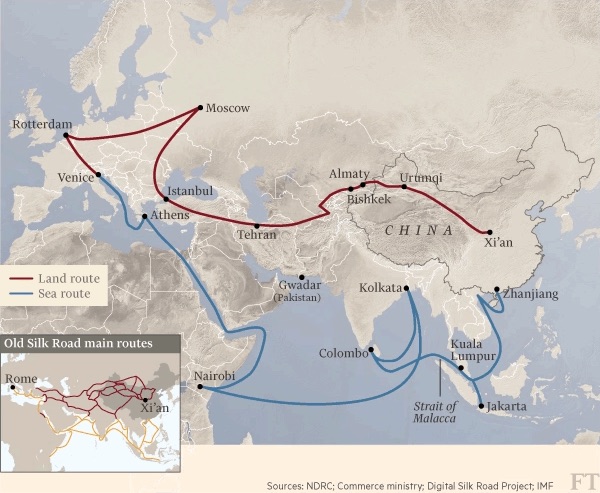

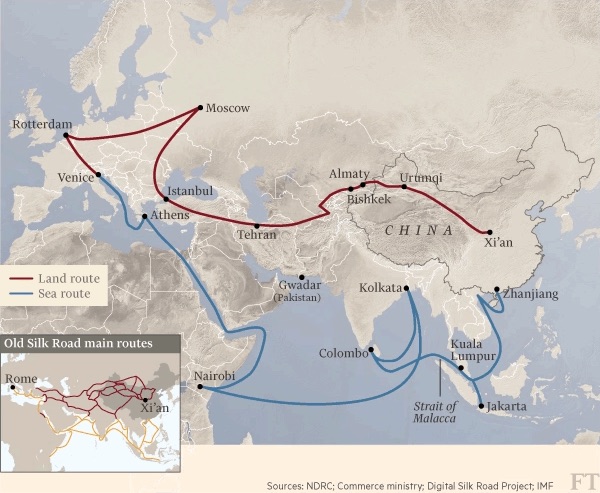

• China’s Great Game: A New Silk Road To A New Empire (FT)

The granaries in all the towns are brimming with reserves, and the coffers are full with treasures and gold, worth trillions, wrote Sima Qian, a Chinese historian living in the 1st century BC. “There is so much money that the ropes used to string coins together rot and break, an innumerable amount. The granaries in the capital overflow and the grain goes bad and cannot be eaten”. He was describing the legendary surpluses of the Han dynasty, an age characterised by the first Chinese expansion to the west and south, and the establishment of trade routes later known as the Silk Road, which stretched from the old capital Xi an as far as ancient Rome.

Fast forward a millennia or two, and the same talk of expansion comes as China’s surpluses grow again. There are no ropes to hold its $4tn in foreign currency reserves -the world’s largest- and in addition to overflowing granaries China has massive surpluses of real estate, cement and steel. After two decades of rapid growth, Beijing is again looking beyond its borders for investment opportunities and trade, and to do that it is reaching back to its former imperial greatness for the familiar Silk Road metaphor. Creating a modern version of the ancient trade route has emerged as China’s signature foreign policy initiative under President Xi Jinping.

“It is one of the few terms that people remember from history classes that does not involve hard power …and it s precisely those positive associations that the Chinese want to emphasise”, says Valerie Hansen, professor of Chinese history at Yale University. If the sum total of China s commitments are taken at face value, the new Silk Road is set to become the largest programme of economic diplomacy since the US-led Marshall Plan for postwar reconstruction in Europe, covering dozens of countries with a total population of over 3bn people. The scale demonstrates huge ambition. But against the backdrop of a faltering economy and the rising strength of its military, the project has taken on huge significance as a way of defining China’s place in the world and its relations -sometimes tense- with its neighbours.

Read more …

Winner of the Fauxbel. Yawn.

• Angus Deaton Showed We’re Helping the Wrong People (Bloomberg)

Presidential candidates from both parties are focusing, as usual, on the middle class. But what’s that? And why, exactly, does it deserve such attention? Princeton’s Angus Deaton, who on Monday was announced as the latest winner of the Nobel Memorial Prize for economics, has offered some intriguing answers. The most important is this: If you care about how people actually experience their lives, you should be concerned about people who earn less than $75,000 per year. Above that amount, Deaton’s evidence suggests that more money may not particularly matter. To understand why, we need to distinguish between two very different measures of human well-being. Researchers have traditionally proceeded by asking people to evaluate their overall life-satisfaction (say, on a scale of 1 to 10).

More recently, researchers have tried to capture people’s actual experiences in a more refined way, for example by asking them about their levels of stress, sadness, happiness and enjoyment during the day (again on a scale of 1 to 10). A key question: Does money buy happiness? Deaton, along with his coauthor Daniel Kahneman (a Nobel Prize winner in 2002), found that in the United States, the answer depends on which question you use. If people are asked about their overall life-satisfaction, money definitely matters. As people’s annual earnings go up, their self-reported life-satisfaction increases as well. But the same is not true for actual experiences. More income is definitely associated with less sadness and more happiness up to $75,000, but above that level people’s experienced happiness is the same regardless of income.

In terms of stress, another important indicator of people’s well-being, it’s a lot worse to earn $20,000 than $60,000 – but above $60,000, stress levels are not reduced by more money. What’s going on here? Deaton and Kahneman don’t exactly know, but they speculate that above a certain threshold, increases in income do not much affect people’s ability to engage in activities that matter most – which include spending time with friends, enjoying good health and taking time off from work. They also suggest that beyond that threshold, more money might have some negative effects, such as a reduced ability to enjoy small pleasures. But below the $75,000 threshold, many of life’s misfortunes have a much bigger negative impact. For the poor, getting divorced, having asthma, and being alone have far more severe effects. Even the benefits of the weekend turn out to be lower.

Read more …

Let’s see how much banks have buried away in shale loans.

• US Annual Oil Output to Drop for First Time Since 2008 (WSJ)

U.S. oil output will decline in 2016 for the first time in eight years as producers slash spending, OPEC said Monday, while the producer group continues pumping at high levels. In its closely watched monthly oil market report, OPEC slashed its U.S. oil production forecast by 280,000 barrels a day next year, to 13.538 million barrels a day, a number that includes natural gas liquids. That would be about 60,000 barrels a day less than in 2015, the first decline since 2008. The finding is consistent with what the U.S. Energy Information Administration said last week, predicting that U.S. crude production would average about 8.9 million barrels a day in 2016, down from 9.2 million barrels a day in 2015.

OPEC said lower oil prices were forcing U.S. oil producers to cut spending and causing their wells to deplete faster than expected. OPEC producers continued to pump at high rates, the report said, with Saudi Arabia at 10.226 million barrels a day—slightly down from last month—and Iraq producing a near-record 4.143 million barrels a day. Overall the producer group was pumping 31.571 million barrels a day, the highest reported level since April 2012. The increasing levels of OPEC production—and the forecast declines in the U.S.–are part of a new order for the world’s petroleum industry since crude prices collapsed from over $100 a barrel last year to less than $50 this year.

Read more …

“We see kind of a lot of volatility over the next four or five years..”

• Oil Sands Boom Dries Up in Alberta, Taking Thousands of Jobs With it (NY Times)

FORT McMURRAY, Alberta — At a camp for oil workers here, a collection of 16 three-story buildings that once housed 2,000 workers sits empty. A parking lot at a neighboring camp is now dotted with abandoned cars. With oil prices falling precipitously, capital-intensive projects rooted in the heavy crude mined from Alberta’s oil sands are losing money, contributing to the loss of about 35,000 energy industry jobs across the province. Yet Alberta Highway 63, the major artery connecting Northern Alberta’s oil sands with the rest of the country, still buzzes with traffic. Tractor-trailers hauling loads that resemble rolling petrochemical plants parade past fleets of buses used to shuttle workers.

Most vehicles carry “buggy whips” — bright orange pennants attached to tall spring-loaded wands — to help prevent them from being run over by the 1.6-million-pound dump trucks used in the oil sands mines. Despite a severe economic downturn in a region whose growth once seemed limitless, many energy companies have too much invested in the oil sands to slow down or turn off the taps. In addition to the continued operation of existing plants, construction persists on projects that began before the price fell, largely because billions of dollars have already been spent on them. Oil sands projects are based on 40-year investment time frames, so their owners are being forced to wait out slumps.

“It really is tough right now,” said Greg Stringham, the vice president for markets and oil sands at the Canadian Association of Petroleum Producers, a trade group that generally speaks for the industry in Alberta. “We see kind of a lot of volatility over the next four or five years.” After an extraordinary boom that attracted many of the world’s largest energy companies and about $200 billion worth of investments to oil sands development over the last 15 years, the industry is in a state of financial stasis, and navigating the decline has proved challenging. Pipeline plans that would create new export markets, including Keystone XL, have been hampered by environmental concerns and political opposition.

The hazy outlook is creating turmoil in a province and a country that has become dependent on the energy business. Canada is now dealing with the economic fallout, having slipped into a mild recession earlier this year. And Alberta, which relies most heavily on oil royalties, now expects to post a deficit of 6 billion Canadian dollars, or about $4.5 billion. The political landscape has also shifted. Last spring, a left-of-center government ended four decades of Conservative rule in Alberta. Federally, polls suggest that the Conservative party — which championed Keystone XL and repeatedly resisted calls for stricter greenhouse gas emission controls in the oil sands — is struggling to get re-elected in October.

Read more …

Merkel will find it harder to impose her will.

• German Brand Dealt ‘Hammer Blow’ By VW Scandal And Weakening Economy (Telegraph)

The VW emissions scandal has dealt a “hammer blow” not just to Volkswagen’s reputation but potentially to the entire German national brand, according to a consultancy that calculates brand worth. The revelations that as many as 11 million diesel vehicles have been fitted with software designed to deceive emissions testers has damaged the German repuation of efficiency and reliability, said the report from Brand Finance. As a result, the value of the ‘Made in Germany’ brand has fallen 4pc – or $191bn – to $4.2 trn this year. The report added the scandal threatens to undo decades of accumulated goodwill and cast doubt over the efficiency and reliability of German industry.

However, the authors said Germany has attracted worldwide admiration for its sympathetic stance to migrants escaping Syria and other war-torn countries, which is boosting the country’s positive image. Not only has the county benefited from goodwill perceptions, but the migrants will also boost the economy, said the report. The country’s birth rate has been flagging and the influx of generally young people and families will boost Germany’s labour force, encouraging investment in Europe’s largest economy. Germany’s birth rate has collapsed to the lowest level in the world. A study by the World Economy Institute in Hamburg earlier this year said the country’s workforce will start plunging at a faster rate than Japan’s by the early 2020s due to the declining birth rate, seriously threatening the long-term viability of Europe’s leading economy.

Data last week showed German exports suffered their worst month since the global recession, as global demand slowed. Exports in Europe’s largest economy collapsed by 5.2pc in August – their largest drop since January 2009, according to figures from the country’s Federal Statistics Office. Overall the US remains the world’s most valuable national brand, having benefited from a large, wealthy market wanting to “buy American”. The country is worth $19.7 trn, when combining its strength as a brand with GDP data. Fast-growing superpower China, which has previously threatened to knock the US off the top spot, has instead been rocked by the recent stock market turbulence and slowing economic growth. Its brand worth slipped 1pc to $6.3 trn, when compared to the previous year. The UK comes in at fourth place, worth $3bn, a rise of 6pc from last year.

Read more …

Diesel is dead for luxury cars. French carmakers will be hit very hard, if only because Paris MUST scrap its huge diesel subsidies.

• Emissions Test Changes Could Make Diesels ‘Unaffordable’ (BBC)

Making European emissions tests more stringent could make some diesel vehicles “effectively unaffordable”, a trade body has warned. The European Commission is trying to get vehicle makers to agree to bigger cuts in emissions from diesel engines. The pressure comes in the wake of the Volkswagen emissions scandal. The European Automobile Manufacturers’ Association (ACEA) said car companies needed enough time to implement changes to emissions testing. Diesel vehicles have been encouraged in many European markets because they can produce less carbon dioxide – a major greenhouse gas – than those with petrol engines.

The trade body said diesel was an important part of meeting future CO2 targets and it was important for the Commission to let manufacturers plan and implement necessary changes. The VW scandal, in which saw the German car maker admit rigging emissions tests, has put significant pressure on diesel vehicle manufacturers. Diesel engines emit higher levels of nitrogen oxide and dioxide (NOx) that are harmful to human health. European government officials have set out plans to introduce real-world measurements of NOx emissions rather than rely on laboratory tests. The new testing regime is due to start early next year, with the results coming into effect in 2017.

However, talks between officials in Brussels last week to discuss the plans are reported to have stalled. The ACEA said it would continue “to stress the need for a timeline and testing conditions that take into account the technical and economic realities of today’s markets”. The trade body added: “Without realistic timeframes and conditions, some diesel models could effectively become unaffordable, forcing manufacturers to withdraw them from sale.” Such a move would hit both consumers and jobs in the automotive sector, it said.

Read more …

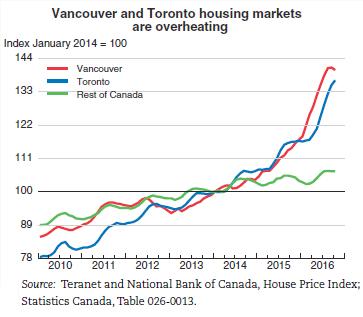

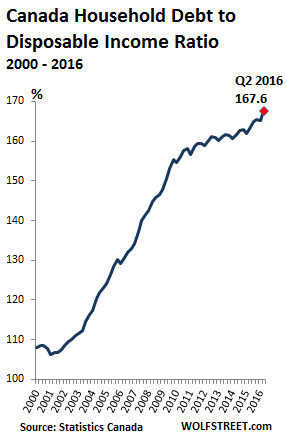

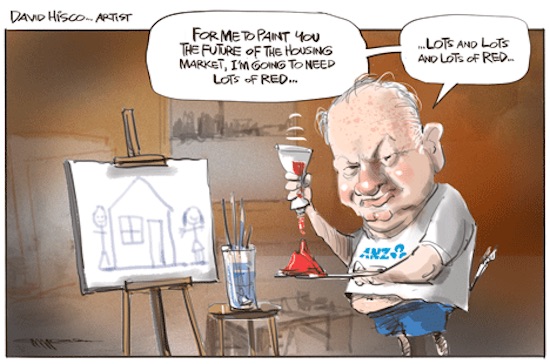

They’ve denied the bubble for so long now, why not do it a while longer?

• Home Flipping Frenzy in Sydney Sparks Warnings on Housing Risks (Bloomberg)

Sydney home prices soared 44% in the three years ended September, enticing speculators who’ve been partly inspired by home renovation shows on how to spruce up and sell homes for quick profits. The frenzy surrounding Sydney’s property boom, reminiscent of the exuberance in U.S. real estate before the 2008 financial crisis, has prompted regulators and Goldman Sachs to warn the market is overheated, while Bank of America Merrill Lynch on Monday said it expects prices to fall. Since September 2013, more than 1,500 houses and 800 apartments have been resold in less than a year in Sydney, for about 20% more on average, according to online property listing firm Domain Group. That compares with about about 530 houses and almost 400 apartments in the previous two years.

People need to be careful because “house prices aren’t going to continue to rise much more quickly than income; debt levels can’t keep rising faster than income,” Reserve Bank of Australia Deputy Governor Philip Lowe said at a conference in Sydney Tuesday. “Ideally, we’ll now go through a period of quite modest house price growth. I think that would de-risk household balance sheets a little and would probably be good for the economy.” Rushing to buy and sell homes is underscoring a build-up of mortgage risks as households take on record debt, lured by home-loan costs at the lowest in five decades. The housing debt to income ratio touched a record high of 132.8% in the three months ended June 30 up from 119.4% three years earlier, according to government data.

Read more …

That is the ultimate danger.

• TTIP Deal Would Remove People’s Rights To Access Basic Human Needs (Ind.)

People’s access to basic rights such as water and energy could be at the mercy of multinational corporations, according to a new report into two controversial EU free trade deals. The report claims that the agreements could allow all public services to be locked into commercial deals that would place profit above the rights of individuals to access basic services – regardless of any possible consequences for welfare. According to the report, Public Services Under Attack, such deals would be “effectively irreversible.” They would allow multinational corporations to sue governments that try to regulate the cost of public services if it could be proved companies’ profits would be harmed.

The two trade agreements, the CETA (Comprehensive Economic and Trade Agreement) with Canada and the TTIP (Transatlantic Trade and Investment Partnership) with the US, are currently being negotiated. In their current state, it is claimed, all public services including health, education and energy could be at risk of privatisation. Under current WTO agreements, access to water is regarded as a basic human right. The new trade agreements would effectively undermine this, according to John Hilary, the executive director of War on Want, one of the campaign groups behind the report . He claims that in a worst-case scenario, if individuals were unable to pay their water bill, they would be denied access to it.

“Suddenly, instead of water being considered a human right, it would be treated as a commodity and people could be cut off if they can’t afford it,” Mr Hilary told The Independent. Previously, the UK Government has insisted that public services such as education and the NHS would be protected from such action. In November last year, the UK Government published a document on the deal, Separating Myth from Fact, in which it states: “TTIP will not change the way that the NHS, or other public services, is run. “The European Commission is following our approach that it must always be for the UK to decide for itself whether or not to open up our public services to competition.”

But Mr Hilary believes the public should be sceptical of such assurances. He said: “There is no truth in the government’s claim that public services are safe in TTIP. “Corporate lobbyists have made sure that key services such as health, education, post, rail and water are to be opened up to the private sector, and treaties such as TTIP will lock in that privatisation for ever. “As a result of the lobbying by these special interest groups in the services sector, it’s quite clear that public services are in the frame and any claim to the contrary is bogus.”

Read more …

Children are stil drowning, Angela. That should be your priority, not borders or camps.

• Merkel Seeks Turkey’s Aid on Borders to Stem Refugee Flow to EU

German Chancellor Angela Merkel said Turkey needs to help stem the flow of Syrian refugees to Europe, setting the tone for her talks with Turkish leaders this week. “It’s necessary to look not just at the European dimension, but also to talk with Turkey about sensible border controls,” Merkel said Monday in a speech to party members in Stade near Hamburg. “We have to start getting more involved internationally. That’s why I will go to Turkey on Sunday.” With a record 800,000 or more refugees and migrants expected to arrive in Germany this year, Merkel is under pressure to offer solutions to an increasingly skeptical public as her approval ratings decline and she says Germany can’t stop the stream on its own. “We don’t know how many there will be,” she said.

In her speech to members of her Christian Democratic Union, Merkel said for the first time that her government is considering screening at Germany’s borders. This way, “we could possibly decide immediately” which people are economic migrants who wouldn’t qualify to stay in Germany as asylum seekers, Merkel said. While saying that all 28 European Union countries need to help stem the continent’s biggest refugee crisis since World War II, Merkel singled out Turkey as part of the solution. After EU leaders discuss the crisis at a summit in Brussels on Thursday, Merkel plans to travel to Ankara on Oct. 18 for talks with Turkish President Recep Tayyip Erdogan and Prime Minister Ahmet Davutoglu, her first official trip to Turkey since February 2013.

In Turkey, control over the border with EU member Greece “was given up at some point” because Turkey felt overwhelmed and its economy “isn’t doing so well anymore,” leaving Greece and the EU’s border patrol mission to deal with the refugee flow, Merkel said. “Naturally, we need to talk to Turkey about that.”

Read more …

And the ideas won’t fly anyway. Next. Bring in the German navy?!

• Athens Rules Out Joint Sea Patrols With Turkey (Kath.)

Diplomatic sources in Athens Monday ruled out the prospect of Greek and Turkish naval forces conducting joint patrols in the eastern Aegean in a bid to curb a dramatic influx of migrants and refugees. Speaking to Kathimerini, the same sources from the Greek Foreign Ministry stated that no official European documents raise the issue of joint sea patrols – which was first reported in the German press ahead of the draft action plan signed last week between the European Union and Turkey on the support of refugees and migration management.

According to the plan, Turkey will “strengthen the interception capacity of the Turkish Coast Guard, notably by upgrading its surveillance equipment, increasing its patrolling activity and search and rescue capacity, and stepping up its cooperation with the Hellenic Coast Guard.” In an interview with Germany’s Bild newspaper published Monday, Chancellor Angela Merkel heralded closer cooperation between Greece, Turkey and EU border agency Frontex. “In the Aegean Sea, between Greece and Turkey, both NATO members, traffickers do whatever they want,” she told the paper. Diplomatic circles in Athens suggest that Ankara is tempted to use the refugee crisis as a tool for prompting additional EU aid, concessions on the issue of EU visas, or the creation of a buffer zone behind the Syrian border.

Read more …

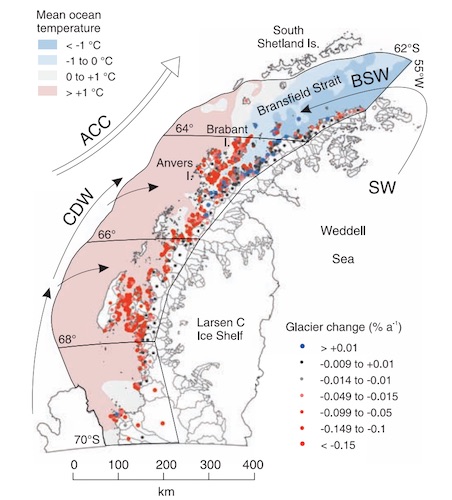

Acidification.

• Marine Food Chains At Risk Of Collapse (Guardian)

The food chains of the world’s oceans are at risk of collapse due to the release of greenhouse gases, overfishing and localised pollution, a stark new analysis shows. A study of 632 published experiments of the world’s oceans, from tropical to arctic waters, spanning coral reefs and the open seas, found that climate change is whittling away the diversity and abundance of marine species. The paper, published in the Proceedings of the National Academy of Sciences, found there was “limited scope” for animals to deal with warming waters and acidification, with very few species escaping the negative impact of increasing carbon dioxide dissolution in the oceans. The world’s oceans absorb about a third of all the carbon dioxide emitted by the burning of fossil fuels.

The ocean has warmed by about 1C since pre-industrial times, and the water increased to be 30% more acidic. The acidification of the ocean, where the pH of water drops as it absorbs carbon dioxide, will make it hard for creatures such as coral, oysters and mussels to form the shells and structures that sustain them. Meanwhile, warming waters are changing the behaviour and habitat range of fish. The overarching analysis of these changes, led by the University of Adelaide, found that the amount of plankton will increase with warming water but this abundance of food will not translate to improved results higher up the food chain.

“There is more food for small herbivores, such as fish, sea snails and shrimps, but because the warming has driven up metabolism rates the growth rate of these animals is decreasing,” said associate professor Ivan Nagelkerken of Adelaide University. “As there is less prey available, that means fewer opportunities for carnivores. There’s a cascading effect up the food chain. “Overall, we found there’s a decrease in species diversity and abundance irrespective of what ecosystem we are looking at. These are broad scale impacts, made worse when you combine the effect of warming with acidification. “We are seeing an increase in hypoxia, which decreases the oxygen content in water, and also added stressors such as overfishing and direct pollution. These added pressures are taking away the opportunity for species to adapt to climate change.”

Read more …

Run away.

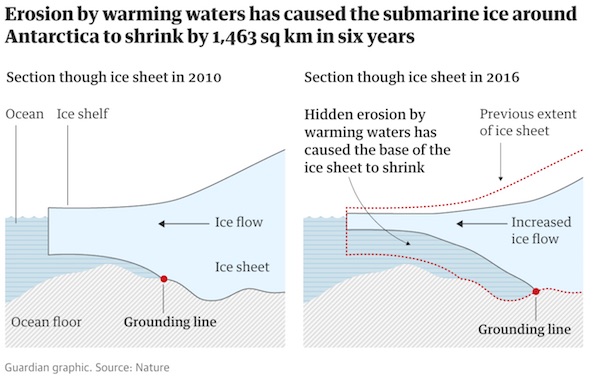

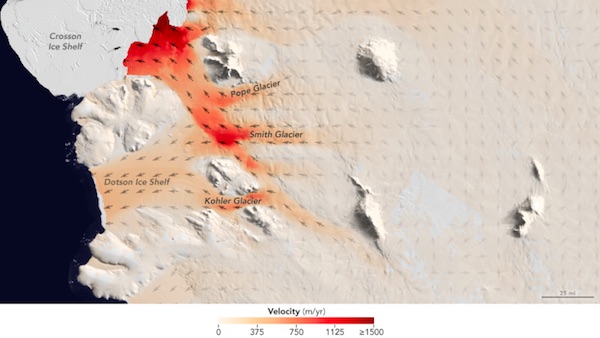

• Antarctic Ice Melts So Fast Whole Continent May Be At Risk By 2100 (Guardian)

Antarctic ice is melting so fast that the stability of the whole continent could be at risk by 2100, scientists have warned. Widespread collapse of Antarctic ice shelves – floating extensions of land ice projecting into the sea – could pave the way for dramatic rises in sea level. The new research predicts a doubling of surface melting of the ice shelves by 2050. By the end of the century, the melting rate could surpass the point associated with ice shelf collapse, it is claimed. If that happened a natural barrier to the flow of ice from glaciers and land-covering ice sheets into the oceans would be removed. Lead scientist, Dr Luke Trusel, Woods Hole Oceanographic Institution in Massachusetts, US, said: “Our results illustrate just how rapidly melting in Antarctica can intensify in a warming climate.”

“This has already occurred in places like the Antarctic Peninsula where we’ve observed warming and abrupt ice shelf collapses in the last few decades. “Our model projections show that similar levels of melt may occur across coastal Antarctica near the end of this century, raising concerns about future ice shelf stability.” The study, published in the journal Nature Geoscience, was based on satellite observations of ice surface melting and climate simulations up to the year 2100. It showed that if greenhouse gas emissions continued at their present rate, the Antarctic ice shelves would be in danger of collapse by the century’s end..

Read more …