Marion Post Wolcott “Center of town. Woodstock, Vermont. Snowy night” 1940

More virtual wealth destruction.

• SF Fed Warns US Stock Values Will Be Cut In Half In Next Decade (Zero Hedge)

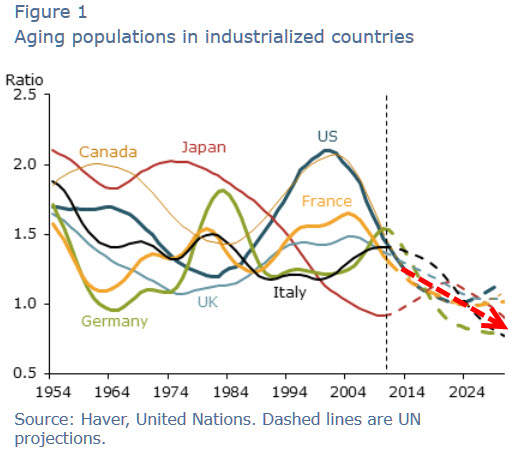

When “the retirement of the baby boomers is expected to severely cut U.S. stock values in the near future,” is the ominous initial sentence from no lesser maintainer-of-the-status-quo than the San Francisco Fed’s research department, one begins to recognize the Federal Reserve’s overall need to hyper-inflate asset prices at whatever cost for fear of the ‘wealth’ destruction looming. As the following study reports, projected declines in stock values – based on the latest demographic and valuation data – have become even more severe. Our current estimate suggests that the P/E ratio of the U.S. equity market could be halved by 2025 relative to its 2013 level. Excerpted from FRBSF’s Global Aging: More Headwinds for U.S. Stocks? (Liu, Spiegel, & Wang)…

Demographic patterns have a strong historical relationship with equity values in the United States (Liu and Spiegel 2011). In particular, the ratio of those people who are the prime age to invest in stocks to those who are the prime age to sell has historically served as a strong predictor of U.S. equity values as measured by price/earnings (P/E) ratios.

Research suggests one reason for this close relationship is a person’s life-cycle pattern of investing. An individual’s financial needs and attitudes toward risk change over the years. As retirement approaches, individuals become less willing to tolerate investment risks, so they begin to sell off stocks. Thus, the aging of the baby boomers and the broader shift of age distribution in the population should have a negative effect on capital markets (Abel 2001). In theory, global demographic changes may further impact U.S. equity values. For example, Krueger and Ludwig (2007) demonstrate that U.S. returns can import the adverse impact of population aging in other countries.

Since the study by Liu and Spiegel (2011), U.S. stock values have increased markedly. Between 2010, which is the end of their sample, and 2013, the S&P 500 Index has increased by 47% and the P/E ratio has increased from around 15 to nearly 17. However, the bearish predictions in Liu and Spiegel (2011), which were based solely on projected aging of the U.S. population, have worsened. Indeed, extending the Liu-Spiegel model’s sample through 2013 suggests that the P/E ratio will decline even more, from about 17 in 2013 to 8.23 in 2025, before recovering to 9.14 in 2030.

Following Liu and Spiegel (2011), we use Bloomberg’s P/E ratio for the United States, which is the ratio of the end-of-year S&P 500 Index levels and the average earnings per share over the previous 12 months. We measure the age distribution using the ratio of “middle-age” people between 40 and 49 years—the group most likely to buy stocks—to those in the “old-age” group from 60 to 69 years—the prime age to sell. We call this measure the M/O ratio.

Incredible that such things are allowed to exist in a supposedly civilized nation.

• Dipping Into Auto Equity Devastates Many US Borrowers (NY Times)

The rusting 1994 Oldsmobile sitting in a driveway just outside St. Louis was an unlikely cash machine. That was until the car’s owner, a 30-year-old hospital lab technician, saw a television commercial describing how to get cash from just such a car, in the form of a short-term loan. The lab technician, Caroline O’Connor, who needed about $1,000 to cover her rent and electricity bills, believed she had found a financial lifeline. “It was a relief,” she said. “I did not have to beg everyone for the money.” Her loan carried an annual interest rate of 171%. More than two years and $992.78 in debt later, her car was repossessed. “These companies put people in a hole that they can’t get out of,” Ms. O’Connor said. The automobile is at the center of the biggest boom in subprime lending since the mortgage crisis. The market for loans to buy used cars is growing rapidly.

And similar to how a red-hot mortgage market once coaxed millions of borrowers into recklessly tapping the equity in their homes, the new boom is also leading people to take out risky lines of credit known as title loans. They are, roughly speaking, the home equity loans of subprime auto. In these loans, which can last as long as two years or as little as a month, borrowers turn over the title of their cars in exchange for cash — typically a%age of the cars’ estimated resale values. “Turn your car title into holiday cash,” TitleMax, a large title lender, declares in a recent television commercial, showing a Christmas stocking overflowing with money. More than 1.1 million households in the United States used auto title loans in 2013, according to a survey by the Federal Deposit Insurance Corporation — the first time the agency has included the loans in its annual survey.

Title loans are becoming an increasingly prevalent form of high-cost, short-term credit in subprime finance, as regulators in a number of states crack down on payday loans. For many borrowers, title loans, also sometimes known as motor-vehicle equity lines of credit or title pawns, are having ruinous financial consequences, causing owners to lose their vehicles and plunging them further into debt. A review by The New York Times of more than three dozen loan agreements found that after factoring in various fees, the effective interest rates ranged from nearly 80% to more than 500%. While some loans come with terms of 30 days, many borrowers, unable to pay the full loan and interest payments, say that they are forced to renew the loans at the end of each month, incurring a new round of fees.

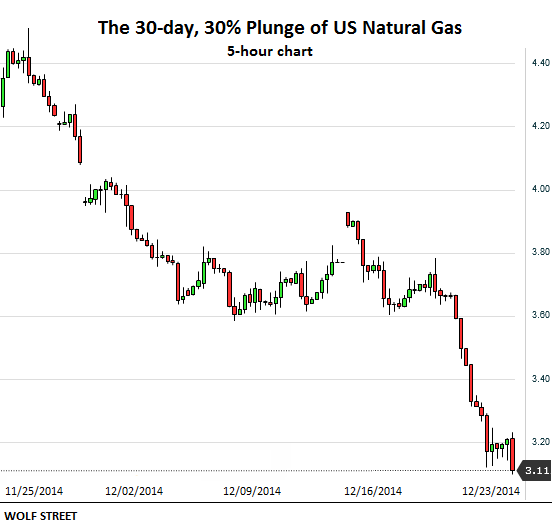

“None of the fancy charts natural gas drillers have shown to investors work at these prices.”

• First Oil, Now US Natural Gas Plunges Off The Chart (WolfStreet)

Friday, natural gas futures plunged 6%. Monday morning, when folks were thinking about the beautiful Santa Rally, NG futures plunged nearly 10% to $3.12 per million Btu, the lowest since January 10, 2013. But the crazy day had just begun. NG bounced off and jumped nearly 4%, only to give up much of it later. Tuesday morning, as I’m finishing this up, NG continues to decline, now at $3.11/mmBtu. Down 30% from a month ago. NG demand peaks when the heating season starts. It’s a bet on the weather. Our gurus forecast warmer than normal temperatures across the country, so prices plunged. Or shorts piled into the pre-holiday session with exaggerated effect to make a quick buck. Here is what this 30-day, 30% plunge looks like (each bar = 5 hours):

Whatever the cause, NG has traded below the cost of production of many wells for years. That lofty $4.40/mmBtu on the left side in the chart above is still below the cost of production for many wells. The price simply fell from bad to terrible. To make the equation work, drillers have shifted from shale formations that produce mostly “dry” natural gas to formations that also produce a lot of liquids, such as oil, natural gasoline, propane, butane, or ethane that were fetching a much higher price. Thus, they’d be immune to the low price of NG. They pitched this strategy to investors to attract ever more money and keep the fracking treadmill going.

Much of this new money was in form of junk debt. Now energy companies account for over 15% of the Barclays U.S. Corporate High-Yield Bond Index – up from less than 5% in 2005. But there is no respite for the American oil patch. The price of oil has plunged 50% since June, the price of propane is down 50% since its recent high in mid-September, and natural gasoline is down 32% since recent high in mid-November. None of the fancy charts natural gas drillers have shown to investors work at these prices.

“.. shadow banking is being tamed ..”

• China Eases Again, Sets Non-Bank Deposit Reserve To Zero (Zero Hedge)

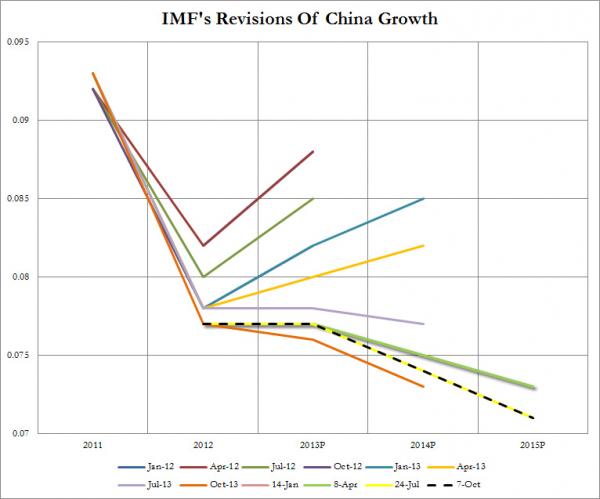

Four years ago, on Christmas Day in 2010, China shocked the world when, unexpectedly, hiked its lending and deposits rates by 0.25% in order to battle inflation – only its second such hike in the prior 3 years. Since then things for the global economy haven’t done exactly as expected, and certainly not for China, which as the following chart of constantly downward-revised IMF growth forecasts, has seen its growth rate tumble from double digits to just hanging on to 7%, and dropping fast.

Fast forward to last night, when in another Christmas surprise, China once again decided to adjust the cost of money, only this time instead of hiking it eased, and in an effort to shore up the world’s second-largest economy, China Business News reported that: PBOC WAIVES RESERVE REQUIREMENT FOR NON-BANK DEPOSIT. As WSJ adds, at a meeting with big financial institutions on Wednesday, the People’s Bank of China told participants that they will soon be able to add deposits from nonbank financial institutions to their calculations of their loan-to-deposit ratios, according to the executives. The move would add considerably to the banks’ deposits and allow them to lend more. Why is this a major development? Because as we reported over a month ago, “China’s Shadow Banking Grinds To A Halt As Bad Debt Surges Most In A Decade” in which we explained:

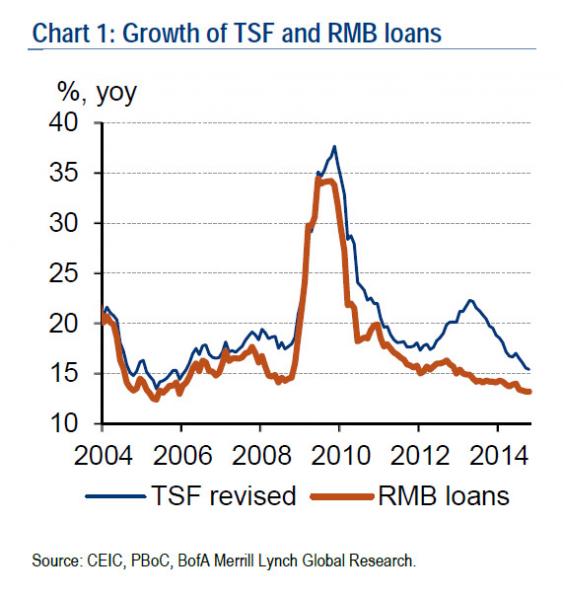

As the following chart shows the main reason for China’s relentless slowdown in its growth pace, which only two years ago was expected to rebound back into the double digits soon (at least according to the IMF), is the ongoing contraction in credit formation, which rising at 13.2% for new loans and 15.4% for TSF outstanding, was the lowest credit expansion recorded in China also since 2005.

So what is the main culprit for the contraction in China’s all important credit formation? In two words: shadow banking. As Bank of America summarizes “shadow banking is being tamed” because “the changing structure of TSF suggests that Beijing’s efforts in controlling some types of shadow banking have made some achievements. Two major drivers for the steep decline of TSF from Sept to Oct were the falling of non-discounted bills (down RMB241bn) and falling trust loans (down RMB22bn). By contrast, new corporate bonds were at RMB242bn, a sharp rise from RMB151bn in Sept.”

Tad optimistic?!

• Russia Says Ruble Crisis Over As Reserves Dive, Inflation Climbs (Reuters)

Russia said on Thursday its currency crisis was over even though its forex reserves have plunged and annual inflation has climbed above 10%, adding to the problems facing the government as it fights its worst economic crisis since 1998. The ruble plunged to all-time lows last week on heavy falls in the price of oil, the backbone of the Russian economy, and Western sanctions over the Ukraine crisis that made it near impossible for Russian firms to borrow on Western markets. But it has since rebounded sharply after authorities took steps to halt its slide and bring down inflation, which after years of stability threatens President Vladimir Putin’s reputation for ensuring the country’s prosperity. Those measures included a hike in interest rates to 17% from 10.5%, curbs on grain exports and informal capital controls.

“The key rate was raised in order to stabilise the situation on the currency market. … That period has already, in our opinion, passed. The ruble is now strengthening,” Finance Minister Anton Siluanov told the upper house of parliament on Thursday. He added that interest rates would be lowered if the situation remained stable. Standard & Poor’s said this week it could downgrade Russia to junk as soon as January due to a rapid deterioration in “monetary flexibility”. Keen to avert a downgrade, Russia said it had started talks with ratings agencies to explain the government’s actions. Siluanov said the budget deficit next year would be “significantly more” than the 0.6% of gross domestic product originally planned. The ruble slumped to 80 per dollar in mid-December from an average of 30-35 in the first half of 2014. It has strengthened in the last few days to trade as strong as 52 per dollar on Thursday, in part thanks to government pressure on exporters to sell hard currency.

“Sometimes this is done without violence when the Alpha simply knows he is no longer top dog and he moves on. Often times it ends is horrible violence.”

• Reuters Objectively Sees Russia’s Options as Losing or Losing Badly (Beversdorf)

Clearly Russia’s future has very little to do with the Western world and so they have no motive to start wars with the West. There is nothing to gain by doing so. However, they have every motive to defend themselves against Western aggression. And so if you see Russian aggression with the West it can only be defensive in nature. Nations (other than North Korea) do not act in a way that is to the detriment of its political class. Because warring with the West presents no possible upside but significant downside for Russia and her leaders, they will actually be willing to do everything in their power to prevent such a scenario. However, as we discussed above, the Western Alliance has only one option to secure its global control and that is to contain China and the only way to contain China is via Russian energy.

Thus, the Western Alliance has every reason to war with Russia. Behaviour (for rational minds) is always logical and so we can use logic to come to the truth about behaviour by looking at the logical results of actions. If an action seems to be detrimental to a particular subject nation’s political class, then the action would be illogical and thus will not be taken. If an action is the only course of survival for a nation, or more pertinently its political class, then you can be damn certain that action will be taken. Looking at the Russian conflict then from a logical context, it really becomes not up for debate that the Western Alliance must be the aggressor.

But so ok, we are doing what we need to in order to secure our dominance and perhaps there are working class folks that may agree with such a policy. Sounds simple enough according to John Lloyd. As he lays out, the two options for Putin and Russia are to either lose or lose badly. But when John pulls his head out his ass or decides to speak with some integrity rather than selling himself out as a politician’s town crier he will admit that things won’t be so simple. China’s future growth is dependent on Russian energy, and so on Russia itself. As such, China will never allow the Western Alliance to crush Russia as China understands the end objective is not a containment of Russia but China itself.

I made the point in the previous article that China will not only step in economically, which we’ve already seen by example with the signed energy deals and now explicitly stating they will back the Russian economy but, if comes to it, China will be prepared to step in militarily, they have no choice. That is a very scary WWIII proposition and one might wonder why in the hell are we headed in that direction? It is obviously not something citizens of any involved countries would want. Again the reason goes back to that very natural process of Alpha selection. It requires a final fight of the Alpha dog, the one in which he loses his reign of power to a new more impressive Alpha dog. Sometimes this is done without violence when the Alpha simply knows he is no longer top dog and he moves on. Often times it ends is horrible violence.

A major shift. Japan’s model has been held up by savers investing in sovereign bonds.

• Japan No A Longer Nation Of Savers, For First Time Ever (MarketWatch)

Japan, long held up as a model of thrift and a “nation of savers,” is no longer saving, according to data cited Friday in the Nikkei Asian Review. For the fiscal year that ended in March, Japan’s household savings rate dropped to negative 1.3%, according to Cabinet Office statistics released Thursday. The result represented “the first time the ratio entered negative territory since the government started compiling comparable data in fiscal 1955,” the Nikkei reported. Part of the drop was likely due to a spending binge ahead of the nationwide consumption-tax hike on April 1, but the report also cited a broad drawdown of savings by Japan’s elderly.

The figure has special significance for Japan, as much of the government’s huge debt is funded by the nation’s own savers. “If fewer people buy government bonds, it would feed latent upward pressures for long-term interest rates,” the report quoted Goldman Sachs Japan’s Masahiro Nishikawa as saying. On the other hand, any threat to low interest rates seemed distant Friday, with several reports noting that the yield on the benchmark 10-year Japanese government bond TMBMKJP-10Y, -3.96% had hit its lowest level in history the previous day, amid extended ultra-easy policy from the central bank.

“The savings rate in the year through March was minus 1.3%, the first negative reading in data back to 1955 ..”

• Japan’s Savings Rate Turns Negative, Wages Fall in Abe Challenge (Bloomberg)

Japanese drew down savings for the first time on record while wages adjusted for inflation dropped the most in almost five years, highlighting challenges for Prime Minister Shinzo Abe as he tries to revive the world’s third-largest economy. The savings rate in the year through March was minus 1.3%, the first negative reading in data back to 1955, the Cabinet Office said. Real earnings fell 4.3% in November from a year earlier, a 17th straight decline and the steepest tumble since December 2009, the labor ministry said today. A higher sales tax combined with the central bank’s record easing are driving up living costs, squeezing household budgets and damping consumption. Abe’s task is to convince companies to agree to higher wages in next spring’s labor talks to sustain a recovery.

“Households are suffering from a decline in real income,” said Hiromichi Shirakawa, an economist at Credit Suisse. Abe is trying to generate a virtuous cycle in the economy, where higher incomes fuel consumer spending, which in turn prompts companies to boost investment and wages. Last week he secured a pledge from business leaders to do their best to boost pay next year. The government will aim for wages to increase faster than inflation next year, Economy Minister Akira Amari said last week. BOJ Governor Haruhiko Kuroda said yesterday he’d watch the spring wage talks “with strong interest.” The savings rate, which the Cabinet Office calculates by dividing savings by the sum of disposable income and pension payments, peaked at 23.1% in fiscal 1975.

As Japan’s population ages, its growing ranks of elderly are tapping their savings, according to the Cabinet Office. Consumers also ran down savings to make purchases ahead of a sales tax-increase in April, the first since 1997. The shrinking workforce is intensifying a labor shortage that Kuroda has said will prompt an increasing number of companies to boost pay to secure workers. Today’s data showed there were 1.12 jobs available for every person seeking a position, the most since 1992. The jobless rate, at 3.5%, remained at lows unseen since 1997.

Kuroda makes things worse, fast.

• Japan Struggles to Escape Recession as Production Drops (Bloomberg)

Japan’s inflation slowed for a fourth month in November, and industrial production and retail sales unexpectedly dropped, pointing to further weakness in an economy Prime Minister Shinzo Abe is trying to revive from recession. Output fell 0.6% in November from a month earlier, the trade ministry said today, against a median estimate of a 0.8% increase in a Bloomberg News survey of economists. Retail sales slid 0.3%, while consumer prices excluding fresh food rose 2.7% from a year earlier. Real wages fell the most since 2009. With little sign of a rebound in domestic demand, the world’s third-largest economy may rely on exports to avert a third straight quarterly contraction in the final three months of the year.

Today’s reports add pressure on Abe, whose government tomorrow will unveil a stimulus package, and who pledged growth-inducing structural changes after winning re-election this month. “Companies have to see a recovery in domestic consumption before boosting production,” said Minoru Nogimori, an economist at Nomura Holdings Inc., noting any rebound in the economy in the fourth quarter “will be far from strong.” With oil prices weighing on inflation, the BOJ is likely to boost stimulus again, probably around October, he said. [..] Stripped of the effect of April’s sales-tax increase, core consumer prices – the Bank of Japan’s key measure – rose 0.7%, moving further away from the BOJ’s 2% goal. Tumbling oil prices could push Japan’s inflation as low as 0.5% by the middle of next year, according to economists.

BOJ Governor Haruhiko Kuroda said yesterday that over the longer term, cheaper oil will support the economy and spur consumer prices. Energy prices dropped 1.2% from a month earlier, according to today’s data. The price of Dubai crude oil – a benchmark for Middle East supply to Asia – has lost about a half of its value in the past year. Japan’s gasoline prices declined the most in almost six years last week. “Japan, a commodity-importing country, gains a large advantage from the decline in crude oil prices,” Kuroda said in a speech to business leaders yesterday in Tokyo. The decline “will lead to an increase in underlying prices from a somewhat longer-term perspective,” he said.

“Today, the only right way forward is for the troika to allow Greece to repay its official creditors in, say, 100 years.”

• Greece to the Eurozone’s Rescue (Bruegel)

The European Commissioner for Economic and Financial Affairs, Pierre Moscovici’s unnecessary—and unseemly—visit to Athens served to spotlight Europe’s corrosive politics. Mr. Moscovici chose to all but endorse Antonio Samaras, the beleaguered Greek Prime Minister, who promises to play by the European Union’s dysfunctional rules. And the Commissioner described as “suicidal” the positions held by the opposition party Syrzia, which may well lead the next government and correctly deems the EU’s rules to be intolerant. His boss, European Commission President Jean-Claude Juncker, weighed in by expressing his preference for Greece to be led by “known” faces. Greece should not have been a member of the eurozone. But after the German Chancellor Helmut Kohl ensured Italy’s inclusion in May 1998, Spain and Portugal were waived in. So, the inevitable Greek entry came in 2002.

By then, any vestige of economic good sense in the euro’s construction had been abandoned in the name of peace and friendship, a cause that Moscovici and Juncker presumably seek to promote. From October 2009, when Greek authorities acknowledged that they had lied about their fiscal accounts, to May 2010, the claim was that the problem would go away without external help. When eventually the troika—the European Commission, the European Central Bank, and the International Monetary Fund—put together a large bailout fund, the manifestly untenable claim was that Greece would repay its private creditors in full. In July 2011, the repayment terms on the troika’s debt were eased, but it was too little too late. Large losses were eventually imposed on private Greek creditors but not before harsh austerity caused an extraordinary slump in growth and lasting misery.

Pretty much every time there was a choice between the right and wrong decision, the wrong one was taken. Today, the only right way forward is for the troika to allow Greece to repay its official creditors in, say, 100 years. This will effectively mean debt forgiveness but the cosmetics may help German leaders tell their citizens that they will be repaid. But, of course, the system fights back all rational thinking. Ireland and Portugal will yelp that they also deserve more relief on their troika borrowings. More fundamentally, the forgiveness will directly contravene the Lisbon Treaty’s no-bailout provision, which prevents one member state from paying another’s debts. That would call into question the constitutionality of the European Stability Mechanism, which was approved by the European Court of Justice on the basis that the loans from the facility would be repaid with an “appropriate margin.”

“There is a school of thought that holds that commitment, not achievement, gives a policy credibility.”

• Is George Osborne A Closet Keynesian? (Project Syndicate)

There is a growing apprehension among Britain’s financial pundits that chancellor George Osborne is not nearly as determined to cut public spending as he pretends to be. He sets himself deadlines to balance the books, but when the date arrives, with the books still unbalanced, he simply sets another. Consider some fiscal arithmetic. When Osborne became chancellor in 2010, the budget deficit – spending minus revenue – was £153bn, or 10.2% of GDP. He promised that by 2015 the deficit would stand at only £37bn, or 2.1% of GDP – equivalent to balancing current spending and revenue. Instead, the deficit for 2014-2015 is expected to be £97bn. The conclusion of Osborne’s balancing act has been postponed until the 2019-2020 budget. Osborne talks about the need to cut spending, but his actions say otherwise.

Though he vowed to reduce spending by more than £100bn by now, he has cut less than half of that, simply extending his five-year rolling programme of cuts for another few years. As a result, Osborne, the poster child for British austerity, is starting to look like a closet Keynesian. There is a school of thought that holds that commitment, not achievement, gives a policy credibility. For example, the Bank of England is committed to achieve 2% inflation “in the medium term”. Annual inflation has not been 2% at any time in the last six years, but it is possible that the BoE’s commitment has had some effect in lowering interest rates. Osborne’s defenders might make the same argument for his fiscal policy. A credible policy of fiscal consolidation, they might say, will have the same exhilarating effect on confidence as fiscal consolidation itself.

Economists call this the “signalling effect”. If you announce that you intend to balance the books over five years and pencil in a lot of spending cuts, consumers, relieved of their fears of future tax increases, will start spending more freely. This will cause national income to rise, and, with luck, the budget deficit will start shrinking, more or less according to plan, without requiring any, or much, retrenchment. In its emphasis on the importance of the signal, economics enters postmodernist territory. The signal – in this case the promise to balance the books – creates the reality. People start behaving as though the books were balanced, ignoring the fact that they are not. When one believes the narrative, one acts in ways that make it come true.

Can the west screw this up too?

• Ukraine Peace Talks Focus on Prisoner Swap Before New Year Break (Bloomberg)

Envoys to Ukraine peace talks are discussing an exchange of prisoners before the New Year, according to a separatist leader, as Russia criticized the country for having “NATO ambitions.” The talks may continue for about two days and no agreements have been reached yet, Alexander Zakharchenko, leader of the self-proclaimed Donetsk People’s Republic, told the pro-Russian rebels’ news website. Ukraine, Russia and the Organization for Security and Cooperation in Europe sent representatives to Minsk, Belarus, yesterday to hold the first of two planned rounds of talks. The participants, including separatist negotiators, left the venue without commenting to reporters.

“The main task at the moment is to stop the violence,” Alexei Panin, deputy director of the Center for Political Information, a Moscow-based research group, said by phone. A two-week truce has tempered the bloodshed in a conflict that has killed more than 4,700 people since April in fighting between government forces and separatists in Ukraine’s eastern Donetsk and Luhansk regions. The talks cleared the last objections to a swap of 150 prisoners for 225, Zakharchenko said. Ukraine’s Security Service reiterated commitment to an “all-for-all” exchange, RIA Novosti reported.

The insanity continues.

• Ukraine’s Anti-Corruption Agency Could Be Led By US Citizen (TASS)

A former US federal prosecutor Bohdan Vitvitsky, who has Ukrainian roots, could be appointed as the director of Ukraine’s newly-created Anti-Corruption Bureau, local media reported on Friday. Officials from the Ukrainian presidential administration are currently in talks with Vitvitsky, who has not yet made a final decision saying that he “still has no guarantees that the position is independent.” Another candidate for the top post is former Georgian President Mikheil Saakashvili, the reports say. The candidacy has been proposed by a member of a tender commission, Yury Butusov. The ex-Georgian leader, who is now on the run and has recently failed to receive a US working visa, has not yet taken a decision, saying that he is waiting for “a more specific proposal.” Saakashvili will have to take Ukraine’s citizenship and in line with an anti-corruption law to settle the issues over closing criminal cases against him in his home country, including on abuse of power.

In October, Ukrainian President Petro Poroshenko signed a package of anti-corruption laws, including on creating the National Anti-Corruption Bureau in Ukraine. The agency will be charged with exposing, preventing and investigating corruption cases in the country. Poroshenko also suggested that a foreigner could lead the newly-created agency. Foreigners have been already appointed as ministers in the Ukrainian government. President Poroshenko earlier signed a law on granting Ukrainian citizenship to US national Natalya Yaresko, Lithuanian Aivaras Abromavichus and Georgian Alexander Kvitashvili, who head the country’s finance, health and economic development ministries, respectively. Ukraine’s Opposition Bloc and Yulia Tymoshenko’s Batkivshchyna party are against the work of foreigners in the Ukrainian government, saying that Kiev wants to absolve itself of the responsibility for what is happening in the country.

“What right have you to be merry? What reason have you to be merry? You’re poor enough.” To this Fred replies, “What right have you to be dismal? What reason have you to be morose? You’re rich enough.”

• Correcting Scrooge’s Economics (Mises Inst.)

As Charles Dickens himself admits, Ebenezer Scrooge is a thoroughly peaceful man, guilty of no true crime, who has robbed no one. Therefore, we must conclude that his wealth is a sign of his ability to please at least some people, and as Michael Levin notes: “Dickens doesn’t mention Scrooge’s satisfied customers, but there must have been plenty of them for Scrooge to have gotten so rich.” But as he is a person with bad manners and a disagreeable personality, many have conflated Scrooge’s personality traits with his business practices, although the two are unrelated phenomena. As a miser and businessman, Scrooge provides numerous valuable services to the community including, as Walter Block has shown, driving down prices and making liquidity available to those who, unlike the wrongly maligned misers, have been either unwilling or unable to save in comparable amounts.

His business prowess notwithstanding, however, a closer look at Scrooge’s economics suggests some significant blind spots in several areas. Scrooge, as displayed in many of his comments and observations, misunderstands some key economics concepts. Indeed, Scrooge’s ignorance in these areas may contribute to his bad habit of assuming that others are taking advantage of him, or are too foolish or lazy to attain what Scrooge has. As Carl Menger demonstrated long ago, value is subjective and different persons value goods differently depending on the person’s goals in life. Does the person want to raise a family? Perhaps he wishes to be an independent scholar who devotes all his time to reading and research. Perhaps he wishes to be a hermit who prays most of the day. Money prices reflect these goals, and a hermit will value a video game console differently from a gamer. But of course not everything can be calculated in terms of money prices. A like or dislike of Christmas, for example, cannot be calculated this way.

Scrooge, who is apparently not a Christmas enthusiast, greatly values money, and likes to have plenty of it handy. But why? If we accept the analysis of Scrooge’s former fiancée, (a fairly reliable source on that period in his life) she suggests that Scrooge “fear[s] the world too much” and that all his other hopes “have merged into the hope of being beyond the chance of its sordid reproach.” So here we see the real root of Scrooge’s fondness of money. In Human Action, Ludwig von Mises explained that human action stems from a desire to “remove unease” about one’s present situation. With Scrooge we see (if his fiancée is to be believed) that the thought of being destitute is a source of constant unease for him. Thus, he desires to build as much wealth as possible in the hope of being beyond the possibility of poverty.

As Scrooge’s primary goals is poverty avoidance, this colors how he views all economic action. His peers tend to not recognize this in him, either dismissing his as simply “odious,” as Mrs. Cratchit does, or as unhappy. In fact, as Levin demonstrates, Scrooge appears rather content with his situation at this point, although, unfortunately — just as Scrooge’s colleagues and family members do not appreciate his ranking of values — Scrooge does not seem to appreciate that others might value money for different reasons. This is demonstrated in an early exchange with Scrooge’s nephew. When wished a merry Christmas by his nephew Fred, Scrooge retorts “What right have you to be merry? What reason have you to be merry? You’re poor enough.” To this Fred replies, “What right have you to be dismal? What reason have you to be morose? You’re rich enough.”

“.. political and business interests responded to the peak by redefining what counts as crude oil, pouring just about any flammable liquid they could find into the world’s fuel tank ..”

• Waiting for the Sunrise (John Michael Greer)

… the coming of 2015 marks a full decade since production of conventional petroleum worldwide hit its all-time peak and began to decline. Those who were around in the early days of the peak oil scene, as I was, will doubtless recall how often and eagerly the more optimistic members of that scene insisted that once the peak arrived, political and business interests everywhere would be forced to come to terms with the end of the age of cheap abundant energy. Once that harsh but necessary awakening took place, they argued, the transition to sustainable societies capable of living within the Earth’s annual budget of sunlight would finally get under way.

Of course that’s not what happened. Instead, political and business interests responded to the peak by redefining what counts as crude oil, pouring just about any flammable liquid they could find into the world’s fuel tank—ethanol, vegetable oil, natural gas liquids, “dilbit” (diluted bitumen) from tar sands, you name it—while scraping the bottom of the barrel for petroleum via hydrofracturing, ultradeep offshore wells, and other extreme extraction methods. All of those require much higher inputs of fossil fuel energy per barrel produced than conventional crude does, so that a growing fraction of the world’s fossil fuel supply has had to be burned just to produce more fossil fuel. Did any whisper of this far from minor difficulty find its way into the cheery charts of “all liquids” and the extravagantly rose-colored projections of future production?

Did, for example, any of the official agencies tasked with tracking fossil fuel production consider subtracting an estimate for barrels of oil equivalent used in extraction from the production figures, so that we would have at least a rough idea of the world’s net petroleum production? Surely you jest. The need to redirect an appreciable fraction of the world’s fossil fuel supply into fossil fuel production, in turn, had significant economic costs. Those were shown by the simultaneous presence of prolonged economic dysfunction and sky-high oil prices: a combination, please note, that last appeared during the energy crises of the 1970s, and should have served as a warning sign that something similar was afoot. Instead of paying attention, political and business interests around the world treated the abrupt fraying of the economy as a puzzling anomaly to be drowned in a vat of cheap credit—when, that is, they didn’t treat it as a public relations problem that could be solved by proclaiming a recovery that didn’t happen to exist.

Economic imbalances accordingly spun out of control; paper wealth flowed away from those who actually produce goods and service into the hands of those who manipulate fiscal abstractions; the global economy was whipsawed by convulsive fiscal crisis in 2009 and 2009, and shows every sign of plunging into a comparable round of turmoil right now.

Another story on the theme, after yesterday’s long one.

• World War I’s Christmas Truce, 100 Years Ago (Klein)

Five months into World War I, the Christmas spirit took hold in the most unlikely of places—the bloody Western Front. In a series of spontaneous ceasefires, soldiers laid down their arms to sing carols, exchange gifts and even play soccer with the enemy. On the centennial of the Christmas Truce of 1914, look back at the sudden outbreak of peace that brought a brief moment of cheer to a grim war. Charles Brewer never expected to be spending Christmas Eve nearly knee-deep in the mud of northern France. Stationed on the front lines, the 19-year-old British lieutenant with the Bedfordshire Regiment of the 2nd Battalion shivered in a trench with his fellow soldiers. After Great Britain entered World War I in August 1914, many of them had expected that they would make quick work of the enemy and be home in time for Christmas.

Nearly five months and 1 million lives later, however, the Great War had bogged down in intractable trench warfare with no end in sight. Although disappointed to be far from home on Christmas Eve, Brewer at least took solace in the fact that the perpetual rain, which made moving through the trenches as much of a slog as the war itself, had finally abated on the moonlit night. All was jarringly quiet on the Western Front when a British sentry suddenly spied a glistening light on the German parapet, less than 100 yards away. Warned that it might be a trap, Brewer slowly raised his head over the soaked sandbags protecting his position and through the maze of barbed wire saw a sparkling Christmas tree.

As the lieutenant gazed down the line of the German trenches, a whole string of small conifers glimmered like beads on a necklace. Brewer then noticed the rising of a faint sound that he had never before heard on the battlefield – a Christmas carol. The German words to “Stille Nacht” were not familiar, but the tune—“Silent Night”—certainly was. When the German soldiers finished singing, their foes broke out in cheers. Used to returning fire, the British now replied in song with the English version of the carol.

Better be careful.

• CDC Reports Potential Ebola Exposure In Atlanta Lab (WaPo)

Researchers studying Ebola in a highly secure laboratory mistakenly allowed potentially lethal samples of the virus to be handled in a much less secure laboratory at the Centers for Disease Control and Prevention in Atlanta, agency officials said Wednesday. One technician in the second laboratory may have been exposed to the virus and about a dozen other people have been assessed after entering the facility unaware that potentially hazardous samples of Ebola had been handled there. The technician has no symptoms of illness and is being monitored for 21 days. Agency officials said it is unlikely that any of the others who entered the lab face potential exposure. Some entered the lab after it had been decontaminated.

Officials said there is no possible exposure outside the secure laboratory at CDC and no exposure or risk to the public. “At this time, we know of only the one potential exposure,” CDC Director Tom Frieden said in a telephone interview. The mistake took place Monday afternoon. It was discovered by laboratory scientists Tuesday and within an hour reported to agency leaders. The error, which is under internal investigation, was reported to Secretary of Health and Human Services Sylvia Mathews Burwell and to a program that has oversight over pathogens such as Ebola and anthrax.

Nothing has been solved.

• Sierra Leone Declares Three-Day Lockdown In North To Contain Ebola (BBC)

Sierra Leone has declared lockdown of at least three days in the north of the country to try to contain the Ebola epidemic. Shops, markets and non-Ebola related travel services will be shut down, officials said. Sierra Leone has already banned many public Christmas celebrations. More than 7,500 people have died from the outbreak in West Africa so far, the Word Health Organization (WHO) says, with Sierra Leone the worst hit. Sierra Leone has the highest number of Ebola cases in West Africa, with more than 9,000 cases and more than 2,400 deaths since the start of the outbreak. The other countries at the centre of the outbreak are Liberia and Guinea.

Alie Kamara, resident minister for the Northern Region, told AFP news agency that most public gatherings would be cancelled. “Muslims and Christians are not allowed to hold services in mosques and churches throughout the lockdown except for Christians on Christmas Day”, he said. No unauthorised vehicles would be allowed to operate “except those officially assigned to Ebola-related assignments” he added. The lockdown would operate for at least three days but this could be extended if deemed necessary, officials said. Sierra Leone has been in a state of emergency since July. The outbreak began a year ago in the West African country of Guinea, but only gained international attention in early 2014.