NPC Hendrick Motor Co., Carroll Avenue, Takoma Park, Maryland 1928

There’ll be a deluge of data on this coming out where everyone can find their favorite numbers. Everybody happy!

• US Shoppers Spend 3.5% Less Over Holiday Weekend (R.)

Early holiday promotions and a belief that deals will always be available took a toll on consumer spending over the Thanksgiving weekend as shoppers spent an average of 3.5% less than a year ago, the National Retail Federation said on Sunday. The NRF said its survey of 4,330 consumers, conducted on Friday and Saturday by research firm Prosper Insights & Analytics, showed that shoppers spent $289.19 over the four-day weekend through Sunday compared to $299.60 over the same period a year earlier. The survey found that 154 million people made purchases over the four days, up from 151 million a year ago. However, there was a 4.2% rise in consumers who shopped online and a 3.7% drop in shoppers who purchased in a store.

The U.S. holiday shopping season is expanding, and Black Friday is no longer the kickoff for the period it once was, with more retailers starting holiday promotions as early as October and running them until Christmas Eve. NRF Chief Executive Officer Matt Shay said the drop in spending is a direct result of the early promotions and deeper discounts offered throughout the season. “Consumers know they can get good deals throughout the season and these opportunities are not a one-day or one-weekend phenomenon and that has showed up in shopping plans,” he said. Shay said more 23% of consumers this year have not even started shopping for the season, which is up 4% from last year and indicates those sales are yet to come. The NRF stuck to its forecast for retail sales to rise 3.6% this holiday season, on the back of strong jobs and wage growth.

That graph is full-tard baseless and ridiculous.

• Some Of The Biggest UK Banks May Not Clear New Public Stress Tests (BBG)

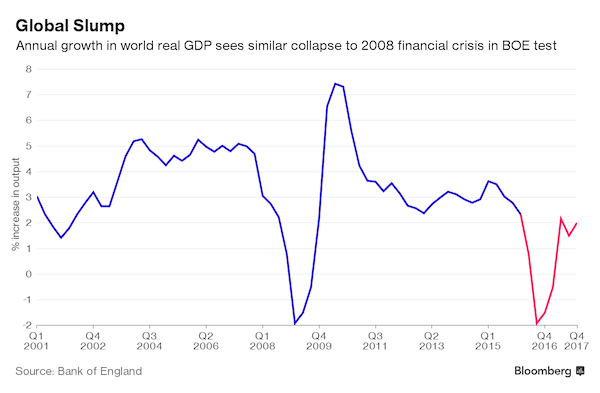

The Bank of England added a new, higher bar to its third round of public stress tests. Some of the U.K.’s biggest banks will scrape through; others may not clear it. The seven major British lenders tested will probably beat the lowest measures of strength required to pass the annual BOE health check when it is released Wednesday, Autonomous Research aid in a note this month. RBS and Barclays risk a “soft fail” of tougher thresholds set for lenders deemed to be integral to the global banking system, they said. HSBC and Standard Chartered’s results may be rattled by a Chinese recession scenario.

Each bank now must top its individual hurdle rate and a new threshold, called the systemic reference point, that takes into account the potential global repercussions if the lender collapses. Firms that fall short of either measure will have to boost their capital ratios, though the BOE will force them to take “less intensive” action if they only miss the SRP. “With bank investing these days, you need to be more cognizant of the economy, the rate environment and crucially of the regulator,” especially if one bank does much worse than its peers in a stress test, said Barrington Pitt Miller at Janus Capital in Denver.

It’s what they’re for.

• China’s Bad Banks Serve Zombies, Not Investors (BBG)

China’s zombie companies can rest easy. It’s a shame the same can’t be said for investors in the nation’s banks.The big five lenders, starting with Agricultural Bank of China, plan to set up bad banks that will convert soured debt to equity. Agricultural Bank, Industrial & Commercial Bank of China, Bank of China, China Construction Bank and Bank of Communications will fork out 10 billion yuan ($1.5 billion) each to establish the asset-management companies, Caixin magazine reported. That banks are forging ahead with debt-to-equity swap plans, albeit via asset-management firms they happen to own, is great news for all those struggling steel and construction companies facing potential closure.

State Council guidelines issued last month indicate that zombie corporations – those ailing state firms plagued by overcapacity – can’t count on bailouts, but it’s difficult to determine which ones are actually destined for the scrapheap.The nation’s top lenders, also all backed by Beijing, are unlikely to want to be seen as responsible for mass unemployment by refusing to rescue companies, no matter how dire their situation. In fact, those companies may have an even better chance of getting capital infusions, considering financial institutions will probably be keen to use their investment-banking units to help monetize equity assets.On the face of it, bank investors might also feel relieved that lenders are farming out bad debt to distinct vehicles.

Using an asset-management company should ensure that the equity resulting from the bad-debt switch doesn’t sit on a bank’s balance sheet. That will help lenders conserve precious capital: Had the equity been on their books, they would have had to apply a risk weighting of 400%, and get special approval from the State Council. Structuring it this way will also allow banks to maintain their much-coveted dividends. But dig a bit deeper and you realize this isn’t a scenario that will necessarily play out well, and not just because equity stakes, even those held at arm’s length, are inherently riskier than loans.For one, how will these asset-management firms be funded long term?

The answer is probably by the banks themselves.According to the State Council, the debt-to-equity swaps can be financed by “social capital,” a catch-all phrase that generally includes high-yielding wealth-management products. Those investment structures come with an implicit guarantee from the banks that issue them, as lenders have found in the past when they’ve had to rescue funds in trouble. It’s ironic that just as authorities have been trying to rein in shadow banking, the debt-to-equity swap plan provides an added reason to gorge.

They even push up the yuan a tad to coincide with the publication of the remarks. All under control.

• PBOC Deputy Governor Talks Up Yuan Strength (CNBC)

Comparing the yuan’s recent moves against the dollar misses the currency’s underlying strength of the against a more appropriately watched basket, People’s Bank of China (PBOC) Deputy Governor Yi Gang said in remarks released on Chinese state-run media at the weekend. In a question-and-answer format interview with Xinhua news agency that was posted on the central bank’s website, Yi said the yuan remained a strong and stable currency in the global monetary system, while noting concerns about a slide against the dollar after Donald Trump’s victory in the Nov. 8 presidential election. The yuan plunged to eight-and-a-half year lows versus the dollar last week.

On Monday, the PBOC set the yuan’s central parity rate against the dollar at 6.9042, stronger than the 6.9168 level set on Friday. “Referencing the yuan against a basket of currencies can better reflect the overall competitiveness of a country’s goods and services,” Yi said. Given that economic structures, cycles and interest rate policies differed in various countries, fixating on a single currency was not suitable and may cause the yen to be “over-managed,” he added. Yi said the yuan’s movements were due to domestic factors in the U.S., as they reflected the rise of the greenback on the back of improvements in the U.S. economy and inflation, alongside expectations of a quickening in the pace of Federal Reserve interest rate hikes.

By now it’s time to wonder how massive the protests will be, and where Modi’s reaction will lead.

• Modi’s Rural Supporters May Not Hang On Much Longer (BBG)

The most ardent supporters of Prime Minister Narendra Modi’s surprise currency withdrawal are those you’d least expect: India’s rural poor, who are suffering the most with the prolonged cash shortages. But the backing of many from India’s villages – based on a belief that Modi’s actions will even out the scale of inequality and reduce corruption – may be short-lived. The jury is still out on the political and economic impact of the decision to target unaccounted cash. And it will be another two months before the government releases inflation, industrial production and growth figures – key areas that may be affected by the prime minister’s shock move on Nov. 8 to ban high-denomination notes, taking out 86% of circulating currency.

Meanwhile, five states, including the most populous state of Uttar Pradesh, will go to elections, leaving the ruling Bharatiya Janata Party vulnerable to a voter backlash if one of its major support bases sees no benefit from the demonetization process. To intensify the campaign against the note ban, several opposition parties called for nationwide protests on Monday, saying the process is a political move dressed up as a fight against corruption. It is not clear whether demonetization will eliminate so-called black money, or who will pay the price if it fails, said Arati Jerath, a New Delhi-based author who has written about Indian politics for about four decades. It will take at least another three weeks to gauge the economic and political impact, she said.

Jerath points to the public reaction to Indira Gandhi’s decision to impose a state of emergency in 1975 as an example of how quickly the tide of public opinion can change. Initially people supported the emergency, welcoming improvements in law and order and the punctuality of government officials. Later they turned against Gandhi when they realized its negative effects, particularity arbitrary abuse of power by bureaucrats, she said. If the Modi government fails to address concerns around cash withdrawals and the situation worsens, there could be food shortages, farmers’ distress, layoffs, rising unemployment and a slowdown of the economy. “At the moment people are patient, they are really giving it a chance, waiting and watching,” said Jerath. “If the situation does not improve by the middle of next month, there will be a backlash against demonetization.”

Yeah. Have them all drive Teslas too, right?

• India’s Modi Calls For Move Towards Cashless Society (R.)

Indian Prime Minister Narendra Modi on Sunday urged the nation’s small traders and daily wage earners to embrace digital payment channels, as a cash crunch following the government’s surprise ban on high-value bank notes drags on. Modi, speaking in his monthly address on national radio, said the government understands that millions have been affected by the ban on 500-rupee and 1000-rupees notes, but defended the action. The government says the bank-note ban announced on Nov. 8 is aimed at cracking down on corruption, people with unaccounted wealth, and counterfeiting of notes.

“I want to tell my small merchant brothers and sisters, this is the chance for you to enter the digital world,” Modi said speaking in Hindi, urging them to use mobile banking applications and credit-card swipe machines. “It’s correct that a 100% cashless society is not possible. But why don’t we make a beginning for a less-cash society in India?,” Modi said. “We can gradually move from a less-cash society to a cashless society.” More than 90% of consumer purchases in India are transacted in cash, Credit Suisse estimates. While a smartphone boom and falling mobile data prices have led to a surge in digital payments in recent years, the base still remains low. Modi urged technology-savvy young people to spare some time teaching others how to use digital payment platforms.

Pushing plastic. A new global sport.

• Greek Banks Call For Taxing Cash Withdrawals (Kath.)

Banks are proposing that the government take a series of measures to combat tax evasion, which are centered around reducing the use of cash in favor of increasing online transactions. The proposal that stands out concerns the taxing of cash withdrawals. As bank executives say, cash is easily channeled to the so-called shadow economy, so imposing a tax on withdrawals would drastically reduce transactions in cash and therefore the illegal economy as well.

Lenders are also asking for the compulsory use of cards or other online means for all transactions concerning professions where there are strong indications of tax evasion or cash is used as the main means of payment. Credit and debit cards as well as the new technologies that allow for contactless transactions, such as cell phone apps, should be possible to use even for the smallest transactions, from the purchase of a newspaper to buying a bus ticket, banks argue. The illegal economy in Greece is estimated at some €40 billion every year, with state coffers losing out on tax revenues of around €15 billion per annum.

Pitting real bad policy vs really really bad.

• Trump Faces Dilemma As US Oil Reels From Record Biofuels Targets (R.)

The Obama administration signed its final plan for renewable fuel use in the United States last week, leaving an oil industry reeling from the most aggressive biofuel targets yet as President-elect Donald Trump takes over. The Renewable Fuel Standard (RFS) program, signed into law by President George W. Bush, is one of the country’s most controversial energy policies. It requires energy firms to blend ethanol and biodiesel into gasoline and diesel. The policy was designed to cut greenhouse gas emissions, reduce U.S. reliance on oil imports and boost rural economies that provide the crops for biofuels. It has pitted two of Trump’s support bases against each other: Big Oil and Big Corn.

The farming sector has lobbied hard for the maximum biofuel volumes laid out in the law to be blended into gasoline motor fuels, while the oil industry argues that the program creates additional costs. Balancing oil and farm interests is likely to prove a challenge for Trump, who has promised to curtail regulations on the oil industry but is already being reminded by biofuels advocates of the importance of the program to the American Midwest, where he received strong support from voters on Nov. 8. Oil groups are renewing their calls to change or repeal the program following Wednesday’s announcement, when the Environmental Protection Agency (EPA) set record mandates for renewable fuels – for the first time hitting levels targeted by Congress nearly a decade ago.

The EPA plan is “completely detached from market realities and confirms once again that Congress must take immediate action to remedy this broken program,” said Chet Thompson, President of the American Fuel and Petrochemical Manufacturers, in a statement. It is unclear what Trump’s plans for the program will be and his transition team did not respond to Reuters’ requests for comment. Both camps are expecting an administration receptive to their demands, though both have expressed concern and uncertainty over Trump’s plans for the program, according to experts, industry and political sources.

Pump baby pump.

• Oil Trades Near $46 Amid Skepticism OPEC to Reach Output Deal (BBG)

Oil halted declines near $46 amid skepticism over OPEC’s ability to reach an agreement to cut output and as representatives prepare to meet Monday amid last-minute negotiations over the deal the group aims to formalize Wednesday. Futures were little changed in New York after earlier falling as much as 2% and dropping 4% on Friday. Saudi Arabia for the first time on Sunday suggested OPEC doesn’t necessarily need to curb output and pulled out of a scheduled meeting with non-member producers, including Russia. OPEC will hold an internal meeting in Vienna Monday to resolve its differences, and as part of the final push to reach an agreement, oil ministers from Algeria and Venezuela are heading to Moscow to get the group’s biggest rival on board.

OPEC is heading into the final stretch before its November 30 meeting to adopt a deal first floated in September to collectively reduce output. Saudi Arabia, the group’s de facto leader, is seeking to reverse the pump-at-will policy it supported in 2014 and is now pushing members to agree how they will individually shoulder the first production cuts in eight years. Saudi oil minister Khalid Al-Falih said the oil market will recover in 2017 even without cuts. “The market is currently quite pressured by the uncertainties raised from various reports, including Saudi Arabia pulling out of Monday’s talks with non-OPEC nations,” Seo Sang-young at Kiwoom Securities said by phone. “It’s also highly suspicious whether OPEC will keep its promises even if it achieves an accord because the members are constantly raising production.”

Wanna bet?

• Fillon Would Beat Le Pen in Both Rounds of Election – Polls (BBG)

Francois Fillon, the former prime minister who won the French Republican presidential nomination Sunday, would beat National Front leader Marine Le Pen in both rounds of a presidential election, two polls showed. In a scenario where incumbent Francois Hollande is running along with former Economy Minister Emmanuel Macron, Fillon would win the first round with 32% of the vote against 22% for Le Pen and 8% for Hollande, according to a poll by Odoxa for France 2 television. In the run-off two weeks later, he would defeat Le Pen 71% to 20%. A Harris Interactive poll showed Fillon winning the first round with 26% support compared with 24% for Le Pen and 9% for either Hollande or Manuel Valls as leader of the Socialists. The same survey showed him winning against Le Pen in the second round 67% to 33%.

“What needs to be considered… is what is good for the country.” Translation: what is good for the incumbent class.

• Renzi Faces Pressure To Stay In Office As Italy Referendum Defeat Looms (R.)

When a handful of European leaders met Barack Obama in Berlin this month to say their goodbyes, Italian Prime Minister Matteo Renzi informed the group that he may well lose power before the U.S. president. While Obama leaves office on Jan. 20, Renzi has promised to resign if he does not win a Dec. 4 referendum on constitutional reform, opening the way for renewed political instability in the eurozone’s third largest economy. “I have no desire to hang around if I lose,” Renzi told the gathering, according to a diplomatic source who was at the low-key Nov. 18 meeting. Opinion polls now predict Renzi’s defeat, in what would be the third big anti-establishment revolt by voters this year in a major Western country, following Brexit and the U.S. election of Donald Trump.

Pressure is mounting on Renzi to drop his threat and instead agree to remain in power to deal with the fallout from a ‘No’ vote, including the risk of a fullblown banking crisis. Obama himself said in October that Renzi should “hang around for a while no matter what” and a number of businessmen and senior government officials contacted by Reuters said they feared the worst if the prime minister abandoned his post. “My personal opinion is that Renzi should stay,” Industry Minister Carlo Calenda said in an interview on Friday. “What needs to be considered… is what is good for the country.” The Italian president could appeal to Renzi’s sense of responsibility and ask him to seek a new mandate from parliament. His response might depend on the size of any defeat, with one advisor saying the 41-year-old premier could quit politics altogether if he suffers a huge snub next Sunday.

Is it really that hard to throw out Soros?

• Recount: Losers Who Won’t Lose (Mehta)

President-elect Trump won 306 electoral votes versus Hillary Clinton’s 232 (24% less electoral votes). Similar to 2000, the surrendering party then reversed course and put the nation through a recount, just for the sake of it. What are the odds that such an exercise here would yield successful for Ms. Clinton? Based on statistical randomness of re-assessing voter intent, the chance of Hillary emerging as the victor is far less than 10%. Anything can happen, but these lean odds do not rise to the level of putting our peaceful democracy into the hands of a temptuous recount scheme every time a stung party loses (let alone misleadingly blame it on something else from Russia’s Putin, to sexism, to “in hindsight the popular vote would be reasonable”, to FBI Director Comey).

All Americans should instead focus on how the 6 states that flipped this election, were all economically ignored and all flipped to Donald Trump. The only viable path for a Hillary Clinton victory at this stage is to astoundingly uncover a wide-spread (across three states) fraud. And that’s equally unlikely, since the basis for the voting aberrations occurred in less populated counties and anyway the three states employ three different voting mechanisms, so the fraud would have had to somehow occur through different transmission vehicles (paper voting, and electronic voting) and we would require a speedy judicial resolution for states such as Pennsylvania that sidestepped back-up recordings from their direct voting equipment.

We should note the following statistical facts about the electoral vote in the three recount states:

10 votes, Wisconsin (Trump leads by 0.9 %age points)

20 votes, Pennsylvania (Trump leads by 1.1 %age points)

16 votes, Michigan (Trump leads by 0.2 %age points)Given that Mr. Trump won by 74 electoral votes, Ms. Clinton would need to flip all three states noted above, in order to liquidate this deficit (i.e., >74/2 = >37 votes). The leads described above however, among 4.4 million voters from these three states, is highly statistically significant on a state-level (and certainly when all three states are combined). It would be remarkably unlikely that we would arbitrarily second-guess every one of these millions of voters’ intents and, convert any (certainly let alone all) of these three states.