Grete Stern Bertolt Brecht 1934

Not much longer.

• Bankers, Policy Makers at Davos Revel in ‘Sweet Spot’ Economy (BBG)

The global elites have rediscovered their animal spirits. As the World Economic Forum drew to a close in the Swiss ski resort, the overarching mood of the executives, policy makers and investors was that their economies are in fine shape and that stock markets have every reason to extend their run. “Let’s celebrate what could go right for the moment because we are in a sweet spot,” IMF Managing Director Christine Lagarde said on the closing panel discussion. The Standard & Poor’s 500 Index has gained about a quarter since the start of 2017 and the IMF is forecasting the strongest worldwide economic growth this year since a brief post-recession bounce in 2011. Some 57% of executives polled by PricewaterhouseCoopers saw the economy improving in 2018, about double the number of a year ago.

The rise of cryptocurrencies was evident in the Swiss town both in conference sessions and on the promenade where companies rent shopfronts to promote their wares. “The greatest worry I’ve heard over the past days in Davos is that there is not enough worry,” Mary Callahan Erdoes, JPMorgan asset-management unit CEO, said on the panel. “It’s O.K. to not be worried, to celebrate how we got here.” Erdoes thanked the policy makers on the stage for working “tirelessly” and “giving all of these government jobs such fabulous prestige and something that I know all of us now perhaps aspire to do.” “Wow,” said Bank of England Governor Mark Carney. “This is fantastic.” Such sentiment led delegates to declare that it was the most upbeat Davos gathering since before the financial crisis. Yet the giddiness also gave some investors pause as they warned against turning too exuberant.

Lagarde gets what she wants and then turns against it. Cover all your bases.

• IMF Chief Warns Trump’s Tax Cuts Could Destabilise Global Economy (G.)

Donald Trump’s huge tax cuts are a threat to the stability of the global economy, the managing director of the IMF has warned. Christine Lagarde singled out Trump’s tax reforms as one of three risks that could destabilise the current economic recovery, especially given the boom in stock markets in the past year. “While the US tax reforms certainly will have positive effects in the short term, for the US and other countries around, it might also lead to serious risks,” Lagarde told the World Economic Forum in Davos. “That has an impact on financial vulnerability, particularly given the high asset prices that we see around the world, and the easy financing that it still available,” she added. She was speaking shortly after the US president told Davos that his tax reforms had created “a big, beautiful waterfall” of pay rises for US workers, as American companies passed the tax cut on.

However, the IMF is concerned that cutting taxes will lead to a bigger US budget deficit, and that extra borrowing by the US Treasury will force up long-term American interest rates. As a result, it fears growth could be choked off in the longer term, making the stock market vulnerable to a sudden downward lurch. Lagarde cautioned against people becoming too complacent about the pick-up in global growth reported by the IMF at the start of the WEF’s annual meeting. The IMF raised its forecasts for global expansion to 3.9% this year and in 2019, reporting that all major economies – the US, EU and Japan – are doing better. “I don’t think that we’ve completed the job,” said Lagarde, who fears that the growing economic inequality in many countries is creating “fractures”. “Having growth is good, improving productive is good, but [policymakers should] make sure that the results of that growth are properly allocated,” said the IMF chief, adding that inequality is growing in many advanced economies, and very high in emerging markets.

An emerging market that’s stopped emerging.

• China Set To Lose ‘Emerging Market’ Status As Growth Declines (F.)

China has been considered an emerging market for over 25 years due to its rapid reform process. Generally speaking, emerging markets are defined as developing countries moving toward an open market economy. Unfortunately, if one takes a close look at growth levels and reform factors, China has shed some of the key characteristics of an emerging market, due to a sharp slowdown in the reform process, an increasingly state centered economy, and lower levels of true growth. China is an upper middle income country that enjoyed gangbusters growth through the 1990s and 2000s, but that is now suffering from a major economic slowdown that has no end in sight. One major reason for slowing growth is that market forces have been quashed by a a buildup in the state sector and mounting economic and financial risks that would result in economic collapse if the reform process is restarted.

Under President Xi Jinping, China’s economic policy has shifted toward enhancing the organization and financial sources of state owned enterprises, and away from liberalizing the currency and financial sector. Strides that were made toward internationalizing the RMB and bringing about a more market-based financial system have been reversed. A simultaneous over-reliance on easy credit has created plenty of risks in the financial sector that now prevent officials from even considering making the financial sector more market-based. Slow reform of the service sector and strong state presence in service subsectors like health and education have contributed to declining growth.

When fear is gone, all that’s left is greed. No balance.

• This was 1987. Start Rebalancing – David Rosenberg (ZH)

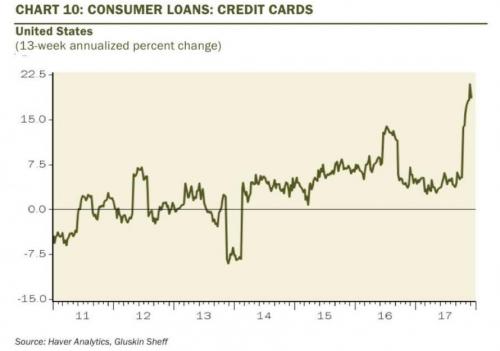

When discussing today’s unexpectedly weak Q4 GDP print, which came in at 2.6%, far below consensus and whisper estimates in the 3%+ range, and certainly both the Atlanta and NY Fed estimates, we pointed out the silver lining: personal spending and final sales, which surged 4.6% Q/Q (vs 2.2% in Q3), although even this number had a major caveat: “as we discussed previously, much of it was the result of a surge in credit card-funded spending while the personal savings rate dropped to levels last seen during the financial crisis.” Indeed, recall the stunning Gluskin Sheff chart we presented a month ago, which showed that 13-week annualized credit card balances in the U.S. had gone “completely vertical” in the last few months of 2017 which we said “should make for some great Christmas.”

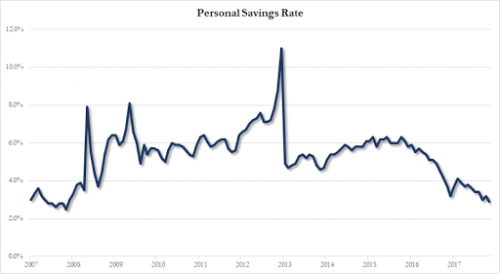

Meanwhile, even more troubling was the ongoing collapse in the US personal savings rate, which last month tumbled to the lowest level since the financial crisis as US consumers drained what little was left of their savings to splurge on holiday purchases.

And while we highlighted and qualified two trends as key contributors to the spending surge in Q4 personal spending, Gluskin Sheff’s David Rosenberg – who is once again firmly in the bearish camp – did one better and quantified the impact. Not one to mince words, the former Merrill chief economist described what is going on as “The Twilight Zone Economy” for the following reason: “how many times in the past have we seen a 2.6% savings rate coincide with a 4.1% jobless rate? How about never…huge ETF flows driving equities higher, but these metrics are screaming ‘late cycle’.” He then proceeded to give “some haunting math” from the GDP number: “The savings rate fell from 3.3% to 2.6%. If it had stayed the same, real PCE would have been 0.8% (annualized) instead of 3.8% and GDP would have been 0.6% instead of 2.6%.”

[..] a more troubling development is that the conditions observed ahead of the Black Monday crash are becoming increasingly apparent. Here is Rosenberg’s stark assessment of where we stand: “Rising bond yields. Full employment. Fed tightening. Trade frictions. Weak dollar. Rising twin deficits, spurred by tax reform. Sound familiar? It should. This was 1987. Start rebalancing.”

More 1987.

• What Could Possibly Go Wrong? (Lance Roberts)

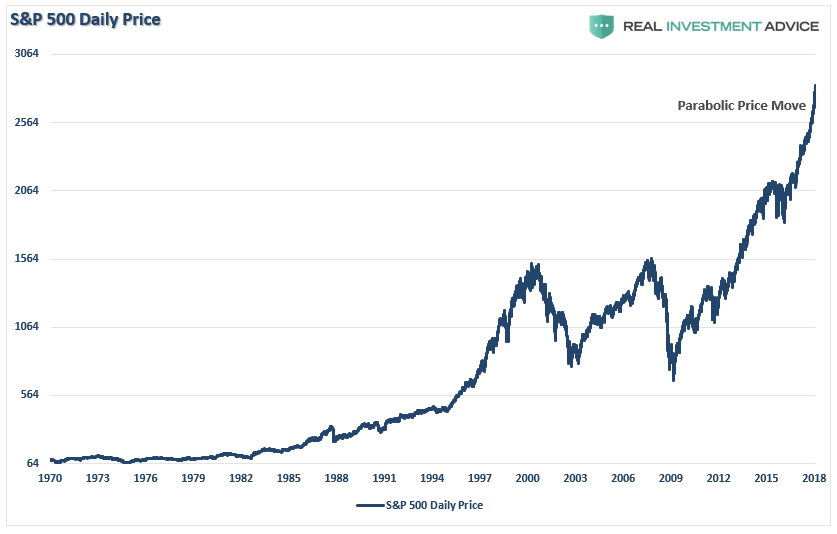

What goes up, eventually comes down. That is just reality. The bull market that began in 2009, has now entered the final stage of “capitulation” as investors throw caution to the wind and charge headlong into the markets with reckless regard for the consequences.

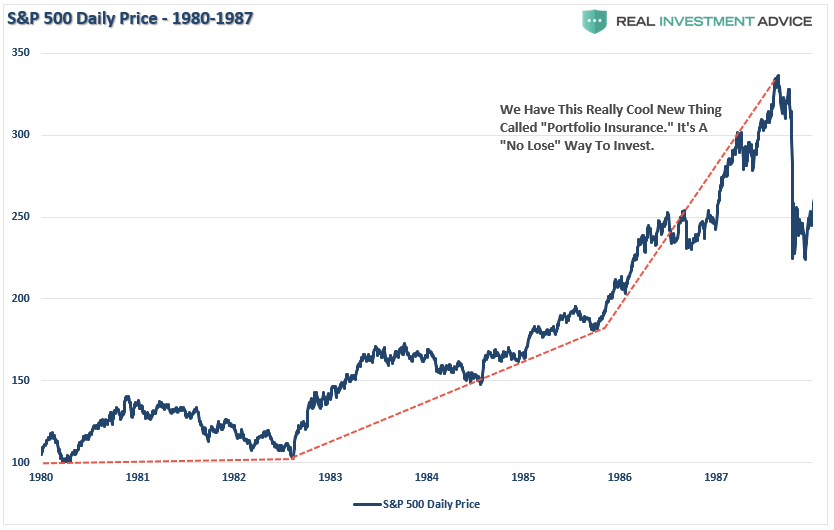

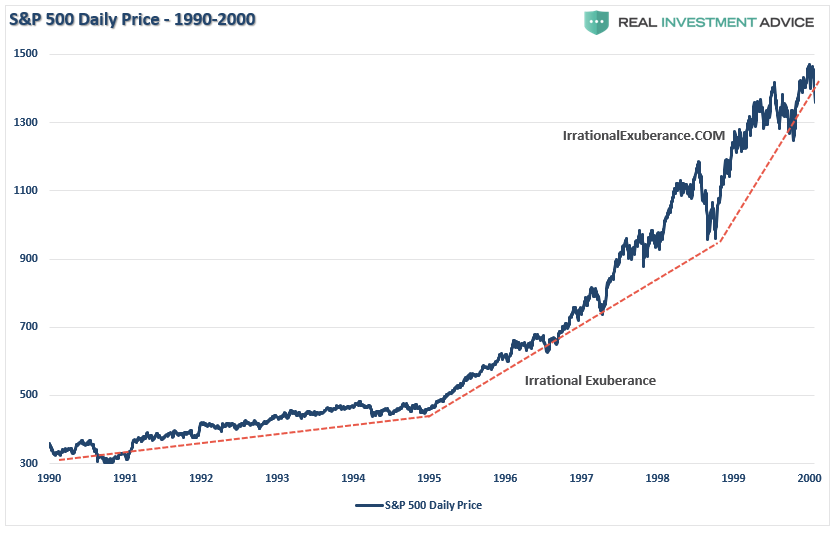

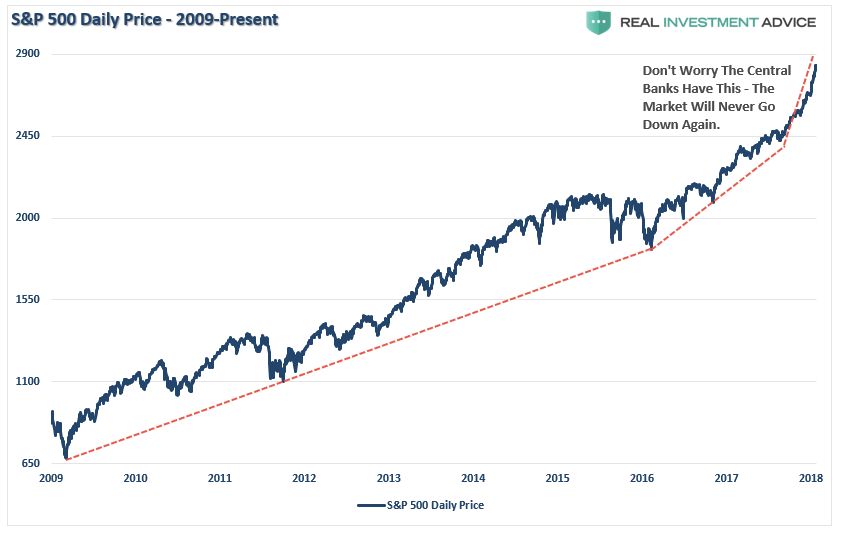

Of course, it isn’t surprising given the massive amounts of liquidity continually injected into the financial markets and global Central Banks have now figured out that continually rising financial markets solve much of the world’s ills. Simply, with enough liquidity, you can cover up bad (credit risks) by guaranteeing holders they will never default. It’s genius. It’s a “no lose” investment scheme. Unfortunately, we have seen this repeatedly in the past. In the 1980’s it was “Portfolio Insurance” – a “no lose” investment program that eventually erupted into the crash of 1987. But not before the market went into a parabolic advance first.

In the 1990’s – it was the dot.com phenomenon which was “obviously” a “no lose” proposition. Even after Alan Greenspan spoke of “irrational exuberance,” two years later the market went parabolic once again.

Then in 2006-2007, banks invented the CDO-squared, a collateralized derivative obligation based on other collateralized derivative obligations. It was a genius way to invest with “no risk” because the real estate market had never crashed in history.

Today, it is once again an absolute “certainty” that markets will rise from here as global Central Banks have it all under control. What possibly could go wrong?

Leverage squared.

• Equity Allocations At Record Highs As Investor Cash Hits All Time Low (ZH)

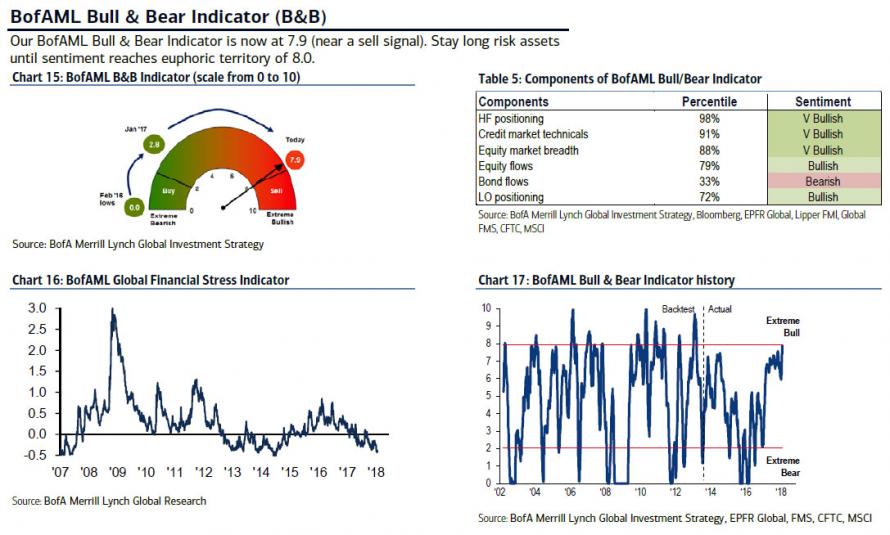

While Bank of America may or may not be right in its forecast that as a result of the market meltup, buying panic and sheer euphoria to get into stocks, which just pushed the bank’s proprietary “Bull and Bear” indicator to a level which on 11 out of 11 prior occasions always presaged a ~12% selloff…

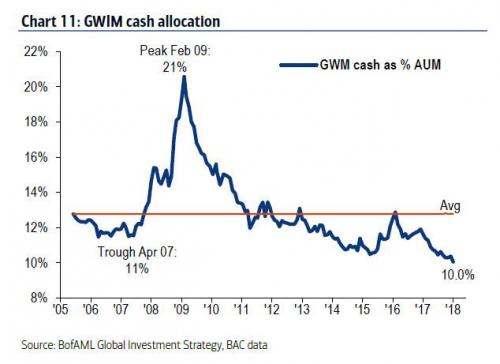

… a market correction or worse is imminent, one thing that is indisputable is the funding status of the Private Clients served by BofA’s Global Wealth and Investment Management (GWIM) team. What it shows is that investor cash allocation has just dropped to a record low of just 10%…

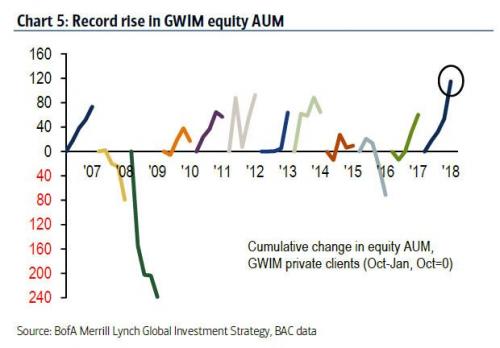

… while investor equity exposure is rising at fastest pace in 10 years.

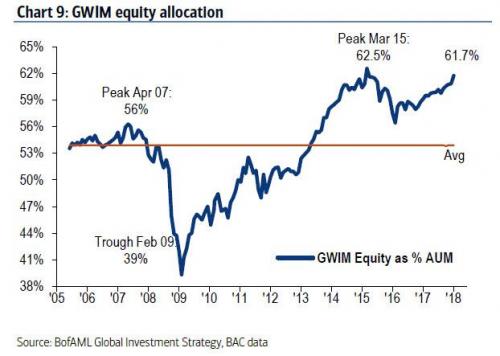

… and total equity allocations are back to record highs.

In other words: ‘bear capitulation’ as everyone is now long stocks in what BofA called a “non-stop euphoric cabaret.” When will this stop, or reverse? According to BofA, keep an eye on the dollar, which as long as it keeps sliding is supporting of risk assets, however the risk is once it bounces, to wit, the “US dollar key catalyst; note US-Europe FX spat sparked ’87 crash” and “higher US$ “pain trade” = risk-off coming weeks”

Even if cryptos don’t have a security issue, they certainly appear to have one.

• Japanese Cryptocurrency Exchange Loses $535 Million To Hackers (CNBC)

Hackers stole several hundred million dollars’ worth of a lesser-known cryptocurrency from a major Japanese exchange Friday. Coincheck said that around 523 million of the exchange’s NEM coins were sent to another account around 3 a.m. local time (1 p.m. ET Thursday), according to a Google translate of a Japanese transcript of the Friday press conference from Logmi. The exchange has about 6% of yen-bitcoin trading, ranking fourth by market share on CryptoCompare. The stolen NEM coins were worth about 58 billion yen at the time of detection, or roughly $534.8 million, according to the exchange. Coincheck subsequently restricted withdrawals of all currencies, including yen, and trading of cryptocurrencies other than bitcoin. Bloomberg first reported the hack. A CNBC email sent to Coincheck’s listed address bounced back.

Cryptocurrency NEM, which intends to help businesses handle data digitally, briefly fell more than 20% Friday before recovering to trade about 10% lower near 85 cents, according to CoinMarketCap. Most other major digital currencies, including bitcoin, traded little changed on the day. Coincheck management said in the press conference that it held the NEM coins in a “hot” wallet, referring to a method of storage that is linked to the internet. In contrast, leading U.S. exchange Coinbase says on its website that 98% of its digital currency holdings are offline, or in “cold” storage. The Japanese exchange said it did not appear that hackers had stolen other digital currencies.

There will never be a global consensus. Just a lot of poorly understood laws.

• How Bitcoin Regulation Will Happen, And What It Will Mean (Ind.)

Bitcoin has been surging and falling in recent weeks. And it seems mostly to come down to one thing: regulation. The lack of regulation is, for now, a large part of bitcoin and other cryptocurrencies’ intrigue: they seem to allow people to avoid the traditional restrictions in place in money and other assets. But they’re also part of their bad reputation, with the same anonymity and decentralisation allowing them to be used for crime. Many governments have suggested they could introduce such rules. But it’s still not clear what they’d look like, or how they’d arrive; here’s an attempt to predict what might be to come in that most unpredictable of markets. In recent weeks, bitcoin has plunged after the threat of regulation in South Korea.

But it was part of a much broader trend – countries around the world have already introduced new rules, and those that haven’t are talking about it. The price has mostly levelled out in recent weeks, after regulation brought volatility and a slowly sliding price. But there might be more disruption coming, as countries look towards regulation, worried about the activity and behaviour that bitcoin could be enabling. That was obvious as world leaders arrived in Davos and were asked their opinion. The event could be a preview of far more wide-ranging controls that could be introduced in March, when the G20 governments’ financial and economic leaders meet in Argentina – a number of the countries attending have specifically said they will focus on fixing regulation of cryptocurrencies at that meeting.

They include France and Germany, which are said to be working together on bitcoin regulation. Many other countries have called for the international community to work together to bring regulation to bitcoin. Davos has been a platform for various world leaders to give their opinion on bitcoin. And they all seem to agree on one thing. “My number-one focus on cryptocurrencies, whether that be digital currencies or bitcoin or other things, is that we want to make sure that they’re not used for illicit activities,” said Steven Mnuchin, Donald Trump’s most senior financial policymaker, told the World Economic Forum in Davos, Switzerland. “We encourage fintech and we encourage innovation, but we want to make sure all of our financial markets are safe,” Mnuchin said. “We want to make sure that the rest of the world – and many of the (Group of) 20 countries are already starting on this – have the same regulations.”

Airplane makers wars are set to intensify.

• Bombardier Gets Surprise Win After U.S. Rebuffs Boeing Trade Case (BBG)

Bombardier can start shipping C Series jets to Delta Air Lines after a surprise ruling by a U.S. trade panel that said the proposed imports won’t hurt American industry. U.S. companies and workers aren’t being harmed by sales of 100- to-150-seat aircraft from Canada, the International Trade Commission said Friday. The tribunal’s unanimous vote blocks a Commerce Department decision last month to impose duties of almost 300%. Friday’s vote deals a blow to Boeing, which said Bombardier sold the C Series in the U.S. at less than fair value while benefiting from government subsidies. The ruling also opens the door for Montreal-based Bombardier to woo new American customers while potentially easing U.S. trade tensions with Canada and the U.K., where the company builds wings for the aircraft. “I’m shocked,” said Chris Murray, an analyst in Toronto. “This clears the way for the jets being to delivered to Delta,” Murray said. “It also removes any concerns about potential future orders in the U.S.”

Bombardier goes from one lawsuit to another. Should have stuck to making skidoos.

• Canada Illegally Subsidized Bombardier: Embraer (R.)

Brazilian planemaker Embraer said on Friday that the U.S. Department of Commerce has shown that the Canadian government “heavily and illegally subsidized” Bombardier and its C Series aircraft, allowing the company to survive and distorting the aviation industry. The statement came just after Bombardier won an unexpected trade victory against U.S. planemaker Boeing when a U.S. agency rejected imposing hefty duties on sales of Bombardier’s new CSeries jet to American carriers.

Oh well, there’s plenty homeless people.

• More Than Half Of New-Build Luxury London Flats Fail To Sell (G.)

Developers have 420 towers in pipeline despite up to 15,000 high-end flats still on the market. More than half of the 1,900 ultra-luxury apartments built in London last year failed to sell, raising fears that the capital will be left with dozens of “posh ghost towers”. The swanky flats, complete with private gyms, swimming pools and cinema rooms, are lying empty as hundreds of thousands of would-be first-time buyers struggle to find an affordable home. The total number of unsold luxury new-build homes, which are rarely advertised at less than £1m, has now hit a record high of 3,000 units, as the rich overseas investors they were built for turn their backs on the UK due to Brexit uncertainty and the hike in stamp duty on second homes.

Builders started work last year on 1,900 apartments priced at more than £1,500 per sq ft, but only 900 have sold, according to property data experts Molior London. A typical high-end three-bedroom apartment consists of around 2,000 sq ft, which works out at a sale price of £3m. There are an extra 14,000 unsold apartments on the market for between £1,000-£1,500 per sq ft. The average price per sq ft across the UK is £211. Molior says it would take at least three years to sell the glut of ultra-luxury flats if sales continue at their current rate and if no further new-builds are started. However, ambitious property developers have a further 420 residential towers (each at least 20 storeys high) in the pipeline, says New London Architecture and GL Hearn. Henry Pryor, a property buying agent, says the London luxury new-build market is “already overstuffed but we’re just building more of them”.

Building more is the worst of all options. See above. But it’s alos the only option that lets the illusion last a bit longer.

• Building More Homes Will Not Solve Britain’s Housing Crisis (Pettifor)

Everyone – from the government, to housing charities, to housebuilders – has bought into the conventional wisdom that the dysfunction that racks our housing market is a matter of demand and supply. We’re not building enough houses, so house prices have been sent rocketing, taking home-ownership out of reach for growing numbers of young people. But in reality, our housing problems are not a simple feature of supply and demand. Rather, our housing market has a bitcoin problem. What has bitcoin mania got in common with house prices, especially in the capital? For starters, both are speculative bubbles. Vast sums of money have been poured into finite supplies of bitcoins and London property. Both have consequently exploded in value, albeit over different time periods.

And so both have become financialised assets that deliver capital gains far in excess of people’s ability to earn income from work, or from investment in the real economy. And as with bitcoin, so with London property: speculators are convinced that prices will continue to rise for ever. It’s speculation in the property market that is fuelling stratospheric house price rises, not shortage of supply. When the “fuel” of private capital, mortgage credit and cash from the bank of mum and dad is supplemented by government subsidies and tax breaks, house prices rise. Moreover, wealthy global and non-resident buyers have funnelled more than £100bn into London property over recent years, making the problem even worse.

So, rather counterintuitively, building more houses is not the right prescription. House prices won’t fall until the tide of cash flowing into the market abates, for example by tightening mortgage credit, or shrinking the pool of buy-to-let investors. That may already be starting to happen as real incomes continue to fall, the Bank of England toughens up buy-to-let mortgages, and stamp duty rises are phased in for second properties. Despite this, the government pretends the real cause of unaffordable housing is a shortage of new builds. It uses this argument to provide cover for further taxpayer-funded subsidies and tax breaks that benefit its property-owning core voters, its close allies in the construction industry and property market, and its supporters in the City of London.

Germany crony Holland wants to pay less toward Brexit because its economy is hit harder than others. It also wants the entire EU budget cut. Juncker wants to raise that budget and buy more Europe. This could blow up. Expect more heavy handedness from Brussels.

• Brexit Saddles EU With A Huge Budget Problem (CNBC)

Brexit is leaving the EU with a big problem on its hands and a “very tough” negotiation ahead, European Commission Vice-President Jyrki Katainen told CNBC on Friday. The U.K. has been one of the main contributors to the European budget, but once it has left the bloc there will be a gap in the EU budget that will have to be worked out somehow, Katainen said. “It is certainly a problem and we have to address it,” he said at the World Economic Forum (WEF) in Davos, Switzerland. “If I should bet something, we need to adjust the budget to a certain extent but also we need fresh money from member states. We also have to look at how money is spent, how we could get more out of less.”

But many EU members do not want to pay more to compensate for the U.K.’s decision to leave the union. Denmark, for example, made it clear last year that it would not step up its financial commitment because of Brexit. Katainen told CNBC that one solution could be using more financial instruments, including equity investments, to finance European projects rather than direct financial contributions. “This is what we are planning or exploring at the moment… it’s going to be a very though negotiation,” he said.

The current EU budget is planned out until 2020. The European Commission is due to come up with proposals on the future of the budget in May. During a speech in September, EC President Jean-Claude Juncker said: “An important element will be the budgetary plans the commission will present in May 2018. Here again, we have a choice — either we pursue the European Union’s ambitions in the strict framework of the existing budget, or we increase the European Union’s budgetary capacity so that it might better reach its ambitions. I am for the second option.”

Yeah, the ones they previously promised to take but never did.

• Deal With France ‘Could Bring Hundreds More Child Refugees To UK’ (G.)

Charities working to bring unaccompanied refugee children to safety are optimistic that agreements signed by Theresa May and Emmanuel Macron could lead to hundreds more receiving permission to travel legally to the UK. Details emerging from last week’s summit show that officials agreed to extend an eligibility deadline so that children fleeing conflict and arriving in Europe before last Friday could be considered under the Dubs amendment, the scheme launched in 2016 under which the government agreed to offer a safe and legal route to refugee children travelling alone. Previously, refugee children had to have arrived in Europe before March 2016 to be considered for acceptance under the scheme. This deadline meant large numbers of vulnerable young people who had arrived in France, Germany and Italy more recently were not eligible.

Lord Dubs, the Labour peer who forced the government to commit to helping more young refugees in January 2016, welcomed the development. “We hope dozens more will be transferred, but it is crucial that they get a move on. In France they are sleeping under the trees in very bleak conditions.” Although the May-Macron agreement focused on France, concerns are growing for the large number of unaccompanied refugee children in Greece where there are currently 3,150 refugee children, travelling without families, and only 1,109 spaces in shelters, according to the charity Safe Passage, which has campaigned to bring more young refugees to the UK. The charity hopes that a further 250 could be brought to safety under the Dubs scheme. The government has committed to accommodating 480 refugee children under the scheme, but has so far only transferred about 220.

Campaigners hope the announcement could reduce the number of young refugees killed on roads outside Calais, after a spike in deaths in recent weeks among asylum seekers attempting to climb on to lorries in order to travel illegally to the UK. The UK government also agreed to speed up the time it spends considering applications from young refugees for transfer to the UK, committing to providing an answer in 10 days, and to transferring them within 15 days after that. George Gabriel, at Safe Passage, said: “For those who are awaiting family reunion, these changes will mean that there is a much lower incentive to make a dangerous journey to reunite with a loved one.”