NPC People’s Drug Store, 11th & G streets, Washington DC 1920

We’re getting closer.

• NYSE Short Interest Nears Record – And We Know What Happened Last Time (ZH)

In the last two months, NYSE Short Interest has risen 4.5%, back over 18 billion shares near the historical record highs of July 2008 (and up 7 of the last 9 months).

There are two very different perspectives on could take when looking at this data… Either a central bank intervenes, or a massive forced buy-in event occurs, and unleashes the mother of all short squeezes, sending the S&P500 to new all time highs, or .. Just as the record short interest in July 2008 correctly predicted the biggest financial crisis in history and all those shorts covered at a huge profit, so another historic market collapse is just around the corner. The correct answer will be revealed in the coming weeks or months… but we know what happened last time…

Read more …

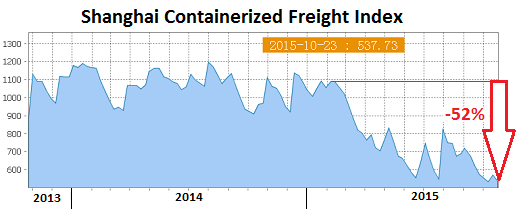

Ask nicely. Prety pretty please. Look, China doesn’t want millions of unemployed workers. They’ll want to smear this out over years.

• EU Chamber Urges China To Cut Excess Production (WSJ)

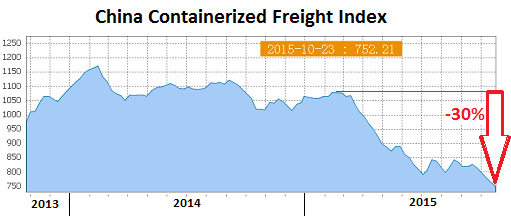

The European Union Chamber of Commerce in China urged Beijing to do more to tackle excess industrial production, saying that failed attempts to do so have created a flood of excess goods that threatens to destabilize the global economy. The call comes as Chinese manufacturers, hit by an economic slowdown, are sending products–from tires and steel to solar panels and chemicals–overseas that they can’t sell at home. The EU Chamber, which represents more than 1,600 members across China, said Monday that excess production is plaguing industrial sectors, such as steel, cement and chemicals, but is also spilling over into the consumer economy, including consumer electronics, pharmaceuticals and even food and apparel.

The usage rate for China’s steel in 2014 dropped to 71% from 80% in 2008, the EU Chamber estimated, based on China’s official data. Production increased to 813 million metric tons from 513 million tons during that time, the industry group said. Representatives from Europe’s steel industry, reeling from competition from cheap Chinese steel, last week took to the streets in Brussels to protest alleged unfair trade practices that they claim will worsen if the EU grants market-economy status to China later this year. Such a move would make it more difficult for Europe to impose steep tariffs on Chinese goods. London-based Caparo initiated bankruptcy proceedings in October for 16 of its 20 steel businesses, which employed 1,700 people. Tata Steel of India blamed overproduction in China when it said in January that it would cut 1,050 jobs from its U.K. operations, adding to cuts announced in October.

In a briefing Monday, the EU Chamber, which released a study on China’s industrial overcapacity, said China must act immediately to restructure its economy and overhaul state-owned companies that are pumping out excess goods. It must reduce negative impacts in China, such as job losses and bad debt, and fend off a crisis that could reverberate globally, the chamber said. Chinese leaders have prioritized party reform and anticorruption, but it is time to shift that focus to the economy, said Jörg Wuttke, president of the European Chamber. “The time spent on economic reforms is way down on the priority list.” said Mr. Wuttke.” We believe they have to act now, not wait.”

Read more …

Are they betting against their own clients yet?

• Biggest Banks’ Commodity Revenue Slid to Lowest in Over a Decade (BBG)

Revenue from commodities at the largest investment banks sank to the weakest in more than a decade last year, laid low by a rout in prices for everything from metals to gas. Income at Goldman Sachs, Morgan Stanley and the 10 other top banks slid by a combined 18% to $4.6 billion, according to analytics firm Coalition. That was the worst performance since the London-based company began tracking the data 11 years ago, and a slump of about two-thirds from the banks’ moneymaking peak in 2008. Revenues are unlikely to return to the heights of $14.1 billion seen at the top of the market, according to George Kuznetsov at Coalition. “The competitive landscape is very different,” Kuznetsov said by phone.

“Financial institutions are now much more regulated. We have significantly less involvement of the banks in the physical commodities market, and banks do not take as much risk as they used to in 2008-09.” The Bloomberg Commodity Index, a measure of investor returns from 22 raw materials, slumped the most in seven years in 2015, led by a plunge in energy and metals. Banks including JPMorgan, Deutsche Bank and Barclays have also been scaling back commodities activity in the past three years amid rising regulatory scrutiny. Even as oil revenues improved last year on increased activity by corporate clients, U.S. curbs on proprietary trading meant banks couldn’t fully take advantage of a 35% plunge in crude by making speculative bets, unlike trading houses and big oil companies.

Last year was one of the best years of all time for trading oil and gas, BP Chief Financial Officer Brian Gilvary said this month. Trafigura’s oil-trading earnings surged to a record last fiscal year. A gauge of industrial-metals prices fell by 24% last year, the most since 2008. Income from energy markets also returned to normal levels after gains in 2014, according to Coalition. “A normalization of the U.S. power and gas markets and weakness in metals and investor products drove the overall decline,” the company said in a report released on Monday. Declining commodities revenues helped bring down the performance for banks’ overall fixed-income divisions, according to Coalition. The analytics company tracks commodities activities including power and gas, oil, metals, coal and agriculture.

Read more …

BHP Billiton looks to be in danger.

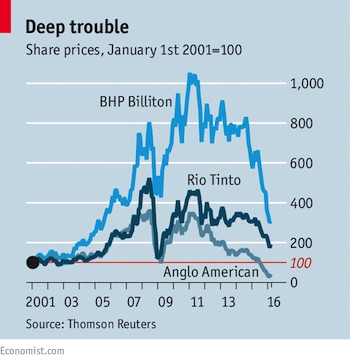

• The Metals Crunch Is Forcing Miners To Reconsider Diversification (Economist)

At the pinnacle of the mining industry sit two Anglo-Australian companies, BHP Billiton and Rio Tinto, which are to iron ore what Saudi Arabia is to oil: the ones who call the shots. Their mines in Pilbara, Western Australia, are vast cash cows; with all-in costs below $30 a tonne, they still generate substantial profits even though prices have slumped from $192 a tonne in 2011 to about $44. They have increased iron-ore production despite slowing demand from China, driving higher-cost producers to the wall—an echo of the Saudis’ strategy in the oil market. But whereas Rio Tinto has doubled down on iron ore, BHP also invested in oil and gas—in which it has nothing like the same heft—at the height of the shale boom. Their differing strategies are a good test of the merits of diversification.

The China-led commodities supercycle encouraged mission creep. Many companies looked for more ways to play the China boom, and rising prices of all raw materials gave them an excuse to cling on to even those projects that were high-cost and low-quality. Now the industry is plagued with debts and oversupply. On February 16th Anglo American, a South African firm that was once the dominant force in mining, said it would sell $3 billion of assets to help pay down debt, eventually exiting the coal and iron-ore businesses that it had spent a fortune developing. That would leave it with a core business of just copper, diamonds and platinum. The day before, Freeport-McMoRan, the world’s largest listed copper producer, was forced to sell a $1 billion stake in an Arizonan copper mine to Sumitomo of Japan, to help cut debts racked up when it expanded into oil and gas.

With Carl Icahn, an American activist investor, agitating for a shake-up, analysts say its energy assets could follow—if there are any buyers. When BHP reports half-yearly results on February 23rd its misadventure in American oil and gas will be of particular concern because it has put the world’s biggest mining firm in the shadow of Rio for the first time. Since BHP merged with Billiton in 2001, its share price has outperformed Rio’s; it made an unsuccessful bid to merge with its rival in 2007. Yet in the past year its shares have done worse. Analysts expect that next week it will cut its annual dividend for the first time since 2001, thereby breaking a promise to raise the dividend year by year. Though Rio ended a similar “progressive dividend” policy this month, it did not cut the 2015 payout.

Read more …

And this is its last desperate call.

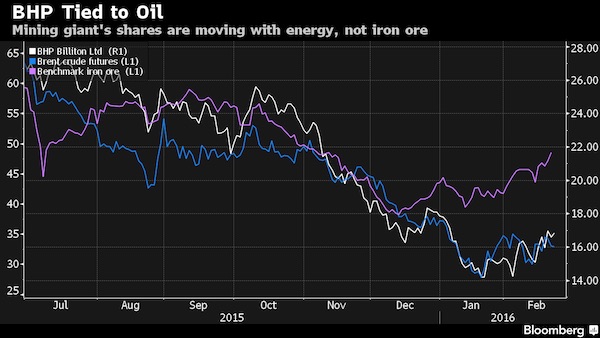

• The World’s Biggest Miner May Be About to Toast Its Oil Drillers (BBG)

BHP Billiton’s shares began tracking oil prices more closely last year as they headed into the worst energy market downturn in a generation. It may not seem like it, but that could be good news for the world’s biggest miner. Unlike its rivals, BHP has a substantial petroleum unit, valued at about $25 billion by UBS. So while iron ore and most base metal prices are forecast to languish over the remainder of the decade as growth in China slows, the Melbourne-based company’s stock stands to benefit from a projected rebound in crude oil. BHP needs an edge. Its Sydney-traded shares sunk last month to the lowest since 2005 and it’s forecast to report a 86% drop in first-half earnings on Tuesday. On top of that, the producer’s ultimate liability for the deadly Samarco dam burst in Brazil late last year remains uncertain and it’s been warned by Standard & Poor’s that it may face a second credit rating downgrade this year.

An oil rebound could deliver a reboot with Schroders saying this month prices may rally almost two-thirds to as high as $50 a barrel in a few months. BHP has flagged it’s on the lookout for petroleum assets, and is likely to study adding more conventional assets, particularly in the Gulf of Mexico, if distressed competitors are forced to sell, according to Aberdeen Asset Management. BHP “follows oil a lot more closely than iron ore these days,” Michelle Lopez, a Sydney-based investment manager at Aberdeen, which holds BHP shares among the $428 billion of assets it manages globally, said by phone. “When you look at the forward curve, iron ore still looks like it’s going to be at these levels if not a bit lower, whereas there are expectations of a correction in the oil price.”

Read more …

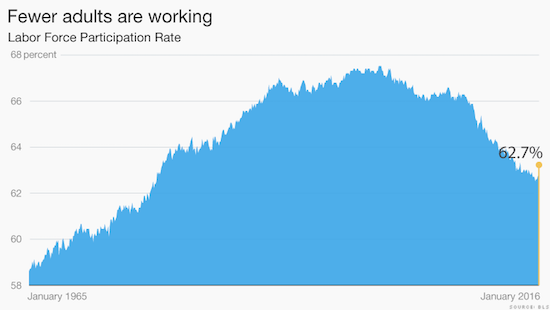

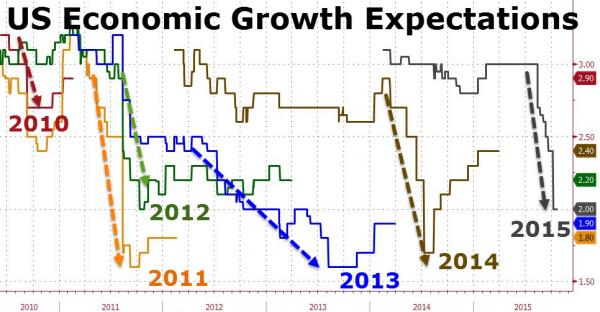

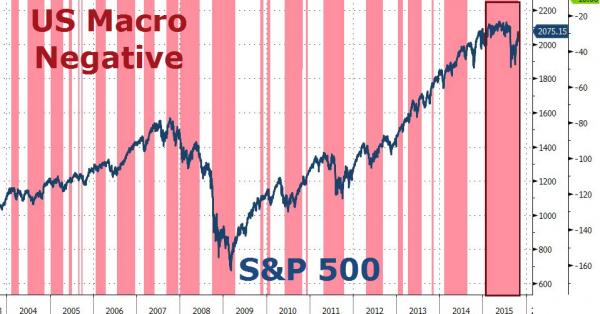

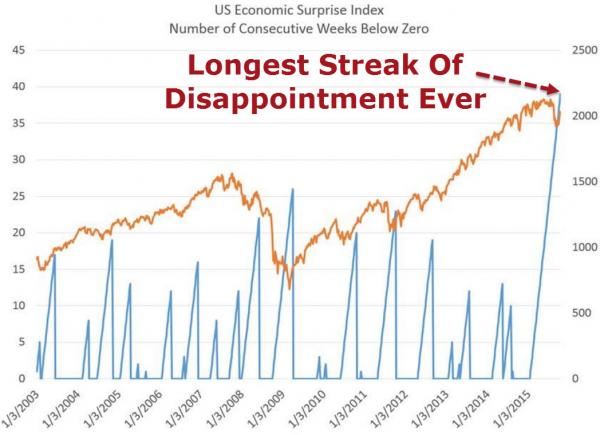

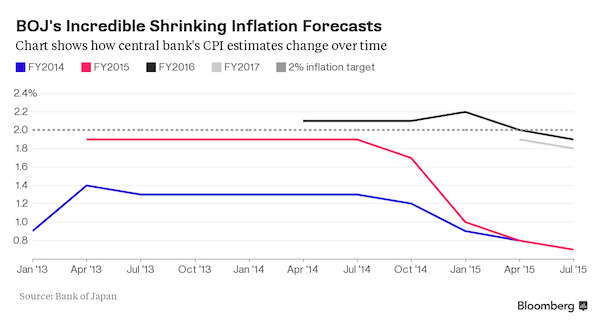

Some people are still talking about a recovery. Get real.

• New Market Storm Could Catch Eurozone Unprepared (Reuters)

Distracted by an unresolved migration crisis and negotiations on keeping Britain in the EU, euro zone leaders could be caught unprepared by a new storm on financial markets. Global market turmoil since the start of the year has helped set warning lights flashing in euro zone sovereign bond markets. In early February, the premium that investors charge to hold Portuguese, Spanish and Italian government debt rather than German bonds hit some of the highest levels since the euro zone crisis that peaked in 2011-2012. European bank shares have been badly hit by concerns over their high stock of non-performing loans, new regulatory burdens and a squeeze on profits due to sub-zero official interest rates. New EU banking regulations that force shareholders and bondholders to take first losses if a bank needs rescuing are further spooking the market, notably in Italy.

All this comes at a time when public resistance to further austerity measures has surged all over southern Europe, producing unstable results at the ballot box. Furthermore, the storm clouds are gathering above a tenuous and slow euro zone economic recovery – growth is officially forecast to reach 1.9% this year versus around 1.6% in 2015. Southern periphery countries all face budget problems that are fuelling political tension with Brussels. Inflation is also refusing to perk up despite the ECB’s bond-buying programme and negative interest rates, making it harder for heavily indebted euro zone countries to pay down debt. Yet euro zone governments transfixed by differences over sharing out refugees, managing Europe’s porous borders and accommodating British demands for concessions on EU membership terms have a huge amount on their hands already. One French government adviser said the EU had never faced such an accumulation of crises in the last 50 years.

Read more …

Yeah, sure: “We’re still looking for some confirmations for the economic growth outlook.”

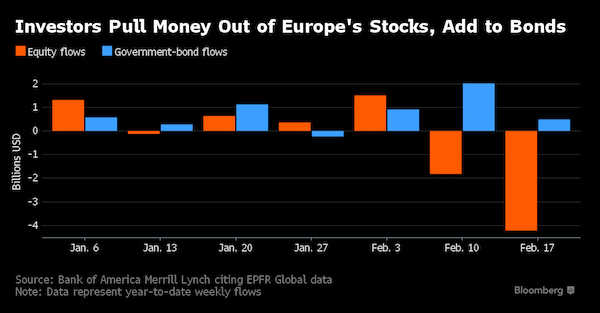

• Traders Would Rather Get Nothing in Bonds Than Buy Europe Stocks (BBG)

The cash reward for owning European stocks is about seven times larger than for bonds. Investors are ditching the equities anyway. Even with the Euro Stoxx 50 Index posting its biggest weekly rally since October, managers pulled $4.2 billion from European stock funds in the period ended Feb. 17, the most in more than a year, according to a Bank of America note citing EPFR Global. The withdrawals are coming even as corporate dividends exceed yields on fixed-income assets by the most ever. Investors who leaped into stocks during a similar bond-stock valuation gap just four months ago aren’t eager to do it again: an autumn equity rally quickly evaporated come December.

A Bank of America fund-manager survey this month showed cash allocations rose to a 14-year high and expectations for global growth are the worst since 2011. If anything, the valuation discrepancy between stocks and bonds is likely to get wider, said Simon Wiersma of ING. “The gap between bond and dividend yields will continue expanding,” said Wiersma, an investment manager in Amsterdam. “Investors fear economic growth figures. We’re still looking for some confirmations for the economic growth outlook.” Dividend estimates for sectors like energy and utilities may still be too high for 2016, Wiersma says. Electricite de France and Centrica lowered their payouts last week, and Germany’s RWE suspended its for the first time in at least half a century.

Traders are betting on cuts at oil producer Repsol, which offers Spain’s highest dividend yield. With President Mario Draghi signaling in January that more ECB stimulus may be on its way, traders have been flocking to the debt market. The average yield for securities on the Bloomberg Eurozone Sovereign Bond Index fell to about 0.6%, and more than $2.2 trillion – or one-third of the bonds – offer negative yields. Shorter-maturity debt for nations including Germany, France, Spain and Belgium have touched record, sub-zero levels this month.

Read more …

And Germany makes sure to transfer that blow to the rest of the eurozone.

• German Economy Takes a Blow From Weakening Global Demand (BBG)

The German economy took a hit this month from weak global demand, with a manufacturing gauge dropping to a 15-month low. Markit Economics said its factory Purchasing Managers Index fell to 50.2, barely above the key 50 level, from 52.3 in January. A services gauge improved slightly, but a composite measure declined to the lowest since July. “The German economy appears to be in the midst of a slowdown,” said Oliver Kolodseike, an economist at Markit. Manufacturing is “near stagnation,” he said. While Germany weathered global headwinds through 2015, maintaining its pace of expansion in the fourth quarter, business confidence has weakened recently.

China’s slowdown is weighing on exports while the equity selloff this year threatens a fragile recovery in the euro area, the country’s largest trading partner. The OECD cut its global growth forecast last week and said both Germany and the euro region will expand less this year than previously estimated. Markit said the slowdown in German output led to increased caution on hiring, with the rate of job creation at the weakest in almost a year. France’s composite Purchasing Managers Index slipped to 49.8 from 50.2 in January. In the 19-nation euro area, both the factory and services measures probably declined this month, according to surveys of economists. Markit will publish those numbers at 9 a.m. London time.

Read more …

Germany’s surpluses keep on bleeding its neighbors dry. That is the problem.

• Germany Isn’t Investing the Way It Used to and That’s a Problem (BBG)

All the pieces appear to be in place for a surge in corporate investment in Germany – except one critical element. While low borrowing costs, robust domestic consumption and capacity strains mean companies should be itching to spend, the confidence to do so is lacking. Market turmoil, signs of a weaker global demand and Germany’s own aging population are giving bosses plenty of reason to hold back, leaving capital spending as a share of output clinging stubbornly to a five-year low. That matters both for Germany, where the IMF says more capital spending is needed to ensure future growth, and the 19-nation euro area. The strength of the region’s largest economy could be key to whether the currency bloc’s fragile recovery can be sustained.

“Every year since 2013, most pundits including ourselves have been predicting that this is going to be the year that investment really picks up in earnest,” said Timo Klein, an economist at IHS Global Insight in Frankfurt. “But every year something unfolds that clouds the picture, from Ukraine to China, and investment is postponed again. The long-term consequence of this is a reduction in growth potential.” A report on Tuesday will shed more light on the role of investment in Germany’s economic expansion in the fourth quarter. Preliminary data showed gross domestic product rose 0.3%, matching the pace of the previous three months, with government and consumer spending leading the way.

While that’s unspectacular, France and Italy fared worse. The euro zone’s second and third-largest economies cooled, with the latter barely growing, increasing the burden on Germany to be the region’s engine. Yet investment as a share of German GDP fell to less than 20% last year from about 23% at the turn of the century, a Bundesbank study in January showed. Private investment slid to 11.5% from 13.4%, according to Eurostat. In its February bulletin, the Bundesbank said investment should increase because of an “above-average level of capacity utilization.” However, it also said a “key prerequisite” is that external demand picks up.

Read more …

One safe bet.

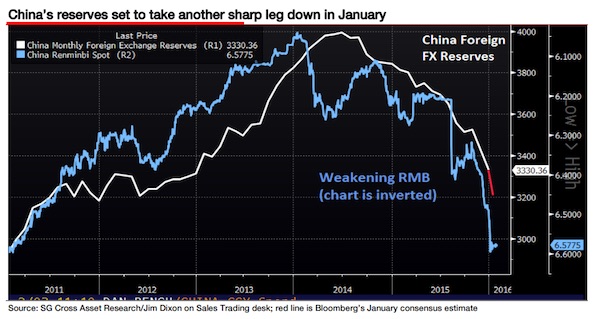

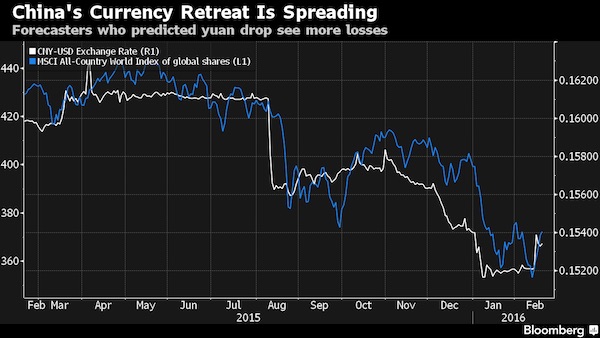

• China Yuan Bears Predict More Trouble Ahead (BBG)

Before China’s devaluation in August roiled global markets and spurred some of the hedge fund industry’s biggest names to bet against the yuan, a small cohort of researchers saw the whole thing coming. Now, some of those same forecasters are warning that there’s more turmoil in store – and it’s not just China they’re worried about. Asianomics’s Jim Walker, who predicted the yuan’s four-year advance would end a month before the currency peaked in January 2014, is forecasting a U.S. recession and says 10-year Treasury yields will plunge to all-time lows. Raoul Pal, publisher of the Global Macro Investor report and a yuan bear since 2012, says European bank shares will tumble by half. John Mauldin of Millennium Wave Advisors, who has argued since 2011 that the Chinese currency should weaken, sees the risk of heightened geopolitical instability in the Middle East as lower crude prices strain the budgets of oil-rich countries.

While all three forecasters see scope for further declines in the yuan, they’re also emphasizing risks outside the Chinese economy as the outlook for world growth dims and commodities trade near the lowest levels in more than 15 years. Their bearish stance has gained traction in global markets this year, with share prices from New York to Riyadh and Sydney sliding as investors shifted into gold and sovereign bonds. “There’s a storm of troubles coming,” Pal, a former hedge-fund manager at GLG Partners whose clients now include pension plans and sovereign wealth funds, said in a phone interview from the Cayman Islands. “The risk of a very bad outcome in 2016 and 2017 remains the highest probability.”

Read more …

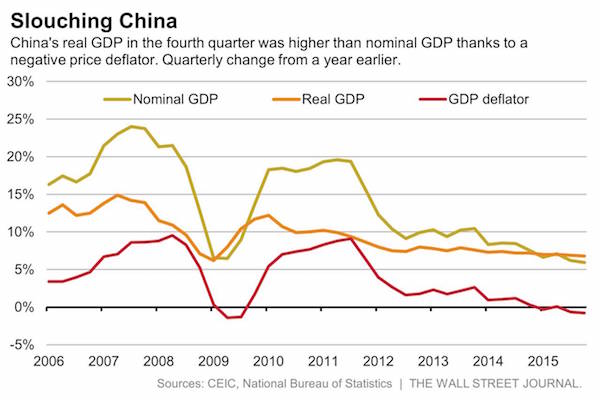

“What we are witnessing is the resetting of the largest macro imbalance the world has ever seen..”

• Kyle Bass, A Sharpshooting Short-Seller (FT)

I’ve been to Beijing twice, I don’t care to go back,” Kyle Bass says. “I’m OK with that.” The subprime-shorting, sniper rifle-shooting, spearfishing hedge fund manager from Dallas, Texas, does not fear the ire of the Chinese authorities. He has a decade-long record of putting his mouth where his money is, and if his latest apocalyptic call — that the Communist government does not have the resources to prevent a banking crisis and a vicious currency devaluation — puts him at the centre of the angriest debate in financial markets, well, that is just fine by him. “Anyone who is invested in China, whether you are a pension fund or sovereign wealth fund or a large US or European institution — you better be thinking about this, and not with the reverence that people give to China,” he says.

“Everyone has this embedded belief that China can pull off the ‘triple lindy’ every time they want to do it,” says the former springboard diver, “but our view is they are going to have to have a reset.” Mr Bass is hardly the only hedge fund manager betting on a renminbi devaluation; when Beijing wanted to send a shot across speculators bows last month, it was George Soros who was singled out on the front of the People’s Daily, a government mouthpiece. Yet, thanks to a 12-page dissection of China’s banks, shadow banks and central bank reserves sent to investors in his $1.7bn hedge fund Hayman Capital last week, it is Mr Bass who has given the most strident, forensic and colourful voice to those who suspect China will be forced to revalue the currency sharply lower. “What we are witnessing is the resetting of the largest macro imbalance the world has ever seen,” he wrote.

Banking system losses could be four times as big as those on subprime mortgages in the US during the financial crisis, and the central bank does not have the reserves to plug the hole and defend its currency. “China’s back is completely up against the wall today” and the country is “on the precipice of a large devaluation”. Economists and Beijing have challenged the alarming analysis; Zhou Xiaochuan, the People’s Bank of China governor, gave a rare interview to insist capital outflows were evidence of economic rebalancing rather than capital flight. This is all of a piece with previous declarations by Mr Bass. Since the Great Recession he has predicted sovereign debt crises in Ireland, Greece, Portugal, Spain, the UK, Switzerland and France.

He has compared the Japanese economy to a “Ponzi scheme”. Armageddon does not always come — he admits he was wrong on Switzerland and the UK; and Japan is notably still standing, though a devaluation of the yen meant his bet eventually made money overall there. Hayman’s returns since the financial crisis have been modest by the standards of the greatest hedge fund investors and 2015 was, by his own admission, one of his worst. But enough of Mr Bass’s predictions have come true to justify taking him seriously. One manager of a fund of hedge funds says investing with Mr Bass is like funding a “think-tank” on how to navigate the global economy.

Read more …

Creative bankruptcies.

• As US Shale Sinks, Pipeline Fight Sends Woes Downstream (Reuters)

Within weeks, two low-profile legal disputes may determine whether an unprecedented wave of bankruptcies expected to hit U.S. oil and gas producers this year will imperil the $500 billion pipeline sector as well. In the two court fights, U.S. energy producers are trying to use Chapter 11 bankruptcy protection to shed long-term contracts with the pipeline operators that gather and process shale gas before it is delivered to consumer markets. The attempts to shed the contracts by Sabine Oil & Gas and Quicksilver Resources are viewed by executives and lawyers as a litmus test for deals worth billions of dollars annually for the so-called midstream sector. Pipeline operators have argued the contracts are secure, but restructuring experts say that if the two producers manage to tear up or renegotiate their deals, others will follow.

That could add a new element of risk for already hard-hit investors in midstream companies, which have plowed up to $30 billion a year into infrastructure to serve the U.S. fracking boom. “It’s a hellacious problem,” said Hugh Ray, a bankruptcy lawyer with McKool Smith in Houston. “It will end with even more bankruptcies.” A judge on New York’s influential bankruptcy court said on Feb. 2 she was inclined to allow Houston-based Sabine to end its pipeline contract, which guaranteed it would ship a minimum volume of gas through a system built by a Cheniere Energy subsidiary until 2024. Sabine’s lawyers argued they could save $35 million by ending the Cheniere contract, and then save millions more by building an entirely new system. Fort Worth, Texas-based Quicksilver’s request to shed a contract with another midstream operator, Crestwood Equity Partners, is set for Feb. 26.

[..] So far, relatively few oil and gas producers have entered bankruptcy, and most were smaller firms. But with oil prices down 70% since mid-2014 and natural gas prices in a prolonged slump, up to a third of them are at risk of bankruptcy this year, consultancy Deloitte said in a Feb. 16 report. Midstream operators have been considered relatively secure as investors and analysts focus on risks to the hundreds of billions of dollars in equity and debt of firms most directly exposed to commodity prices. That’s because firms such as Enterprise Products, Kinder Morgan and Plains All American relied upon multi-year contracts – the kind targeted in the two bankruptcies – that guarantee pipeline operators fixed fees to transport minimum volumes of oil or gas.

Now, with U.S. oil output shrinking and gas production stalling, many of the cash-strapped producers entering bankruptcy will be seeking to rid themselves of pricey agreements, particularly those with so-called minimum volume commitments that require paying for space even if it is not used. “They will be probably among the first things thrown out,” said Michael Grande, director for U.S. midstream energy and infrastructure at Moody’s.

Read more …

Volatility writ large.

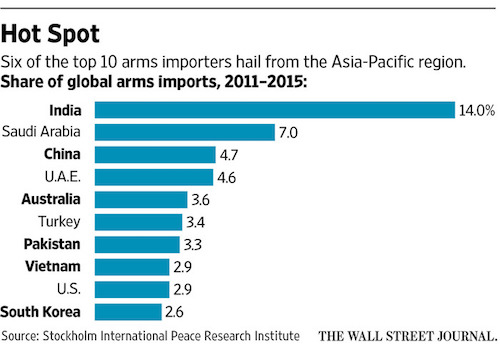

• Chinese Military Ambitions Fuel Asian Arms Race Amid Slowdown (WSJ)

The rapid rise in Chinese military spending and a greater assertiveness in its territorial claims is fueling an arms race in the Asia-Pacific region even though many of the countries involved have been hit by an economic slowdown, new research reports suggest. Of the 10 biggest importers of defense equipment in the past five years, six countries were in the Asia-Pacific region, the Stockholm International Peace Research Institute, or SIPRI, said in an annual report on arms transfers. India was the largest buyer of foreign equipment, with China in third position after Saudi Arabia, the think tank said. Although a country’s spending power is often tied to its economic strength, buyers in the Asia-Pacific region aren’t slashing military budgets even as their economies have come under strain from falling commodity prices and lower growth in China.

“The slight moderation in economic activity had little effect on regional military spending in 2015,” the International Institute for Strategic Studies, or IISS, said in a new report. China, Japan, South Korea, and Indonesia last year were among the countries to announce plans for higher military spending, the IISS said. Lower economic output has driven up Asian military spending as a percentage of GDP to 1.48%, the London-based research organization said, its highest level since at least 2010. China leads the way, accounting for 41% of the region’s military spending, well ahead of No. 2 India at 13.5% and Japan with 11.5%.

Read more …

William K. Black: always a pleasure.

• Krugman and the Gang of 4 Need to Apologize (Bill Black)

If you depend for your news on the New York Times you have been subjected to a drumbeat of article attacking Bernie Sanders – and the conclusion of everyone “serious” that his economics are daft. In particular, you would “know” that four prior Chairs of the President’s Council of Economic Advisers (CEA) (the Gang of 4) have signed an open letter to Bernie that delivered a death blow to his proposals. Further, you would know that anyone who dared to disagree with these four illustrious economists was so deranged that he or she was acting like a Republican in denial of global climate change. The open letter set its sights on a far less famous economist, Gerald Friedman, of U. Mass at Amherst. It unleashed a personalized dismissal of his competence and integrity.

Four of the Nation’s top economists against one non-famous economists – at a school that studies heterodox economics. That sounds like a fight that the referee should stop in the first round before Friedman is pummeled to death. But why did Paul Krugman need to “tag in” to try to save the Gang of 4 from being routed? Krugman proclaimed that the Gang of 4 had crushed Friedman in a TKO. Tellingly, Krugman claimed that anyone who disagreed with the Gang of 4 must be beyond the pale (like Friedman and Bernie). Indeed, Krugman was so eager to fend off any analysis of the Group of 4’s attacks that he competed with himself rhetorically as to what inner circle of Hell any supporter of Friedman should be consigned. In the 10:44 a.m. variant, Krugman dismissed Bernie as “not ready for prime time” and decreed that it was illegitimate to critique the Gang of 4’s critique.

In Sanders’s case, I don’t think it’s ideology as much as being not ready for prime time — and also of not being willing to face up to the reality that the kind of drastic changes he’s proposing, no matter how desirable, would produce a lot of losers as well as winners. And if your response to these concerns is that they’re all corrupt, all looking for jobs with Hillary, you are very much part of the problem.

The implicit message is that four famous economists had to be correct, therefore anyone who disagreed with them must be a conspiracy theorist who is “very much part of the problem.” Paul doesn’t explain what “the problem” is, but he sure makes it sound awful. Logically, “the problem” has to be progressives supporting Bernie. Two hours later, Paul decided that his poisoned pen had not been toxic enough, he now denounced Sanders as a traitor to the progressives who was on his way “to making Donald Trump president.” To point out the problems in the Gang of 4’s attack on Friedman was to treat them “as right-wing enemies.”

Why was Krugman so fervid in its efforts to smear Friedman and prevent any critique of the Gang of 4’s smear that he revised his article within two hours and amped up his rhetoric to a shrill cry of pain? Well, the second piece admits that Gang of 4’s smear of Friedman “didn’t get into specifics” and that progressives were already rising in disgust at Paul’s arrogance and eagerness to sign onto a smear that claimed “rigor” but actually “didn’t get into specifics” while denouncing a scholar. Paul, falsely, portrayed Friedman as a Bernie supporter. Like Krugman, Friedman is actually a Hillary supporter.

Read more …

Greece is a cash country. For one thing, there are still capital controls. People cannot get more than $420 a week or so out of their ATM. That is very limiting in many ways.

• Greek Attempt To Force Use Of Electronic Money Instead Of Cash Fails (ZH)

While the “developed world” is only now starting its aggressive push to slowly at first, then very fast ban the use of physical cash as the key gating factor to the global adoption of NIRP (by first eliminating high-denomination bills because they “aid terrorism and spread criminality”) one country has long been doing everything in its power to ween its population away from tax-evasive cash as a medium of payment, and into digital transactions: Greece. The problem, however, is that it has failed. According to Kathimerini, “Greek businesses are not ready for the expansion of plastic money through the compulsory use of credit and debit cards for everyday transactions.” Unlike in the rest of the world where “the stick” approach will likely to be used, in Greece the government has been more gentle by adopting a “carrot” strategy (for now) when it comes to migrating from cash to digital.

The government has told taxpayers that they will have to spend up to a certain amount of their incomes via bank and card transactions in order to qualify for an annual tax-free exemption. This appears to not be a sufficient incentive however, as a large proportion of stores still don’t have the card terminals, or PoS (Points of Sale), required for card payments, while plastic is accepted by very few doctors, plumbers, electricians, lawyers and others who tend to account for the lion’s share of tax evasion recorded in the country. Almost as if the local population realizes that what the government is trying to do is to limit at first, then ultimately ban all cash transactions in the twice recently defaulted nation as well. It also realizes that an annual tax-free exemption means still paying taxes; taxes which could be avoided if one only transacted with cash.

For the government this is bad news, as the lack of tracking of every transaction means that the local population will pay far less taxes: a recent study by the Foundation for Economic and Industrial Research (IOBE) showed that increasing the use of cards for everyday transactions could increase state revenues by anything between 700 million and 1.6 billion euros per year, and that the market’s poor preparation means that the tax burden has been passed on to lawful taxpayers. As a reminder, in Greece, the term “lawful taxpayers” is not quite the same as in most other countries. What is more surprising is that according to data seen by Kathimerini, PoS terminals in Greece amount to just 220,000, and that despite the fact these were effectively forced on enterprises with the imposition of the capital controls, an estimated half of all businesses do not have card terminals. Almost as if the Greeks would rather maintain capital controls than be forced into a digital currency by their Brussels overlords.

Read more …

Some things are just plain weird. They invest $150 million in Espirito Santo in July -when everyone already knew something was fishy, but that’s not even the gist-, and then lose it all one month later?! That’s not fish I’m smelling, it’s a rat.

• New Zealand Super Fund’s $200 Million Loss (NZ Herald)

Almost $200 million of taxpayer money invested through the Kiwi Superannuation Fund has been lost after a Portuguese bank where the money was invested, supposedly as a “risk free” loan, collapsed. The Super Fund, set up with public money to cover partly the retirement costs of baby boomers, has revealed it had been caught up in last year’s collapse of Banco Espirito Santo (BES) and a US$150m (NZ$198m) investment made in July had been completely wiped out. The investment was a contribution to a Goldman Sachs-organised loan to the Portuguese bank, but only weeks after the money was injected it imploded, with president and founder Ricardo Salgado arrested as part of a criminal investigation into tax evasion.

After disclosing billions of Euros in losses, and facing a run on funds by depositors, the bank collapsed in a heap and was broken up in August. Goldman Sachs, described by Rolling Stone as “the great vampire squid” for their sharp business practices in the run-up to the global financial crisis, today said it would “pursue all appropriate legal remedies without delay” in an attempt to recover the loans to BES. The company also announced that, alongside the Super Fund, they were suing the Central Bank of Portugal over their loans being excluded from the bailout of BES. Despite this legal action, Super Fund chief executive Adrian Orr conceded today the entire investment had been written off as a “conservative” precaution. Finance Minister Bill English, the minister responsible for the Super Fund declined to comment on the spectacular loss, but Green Party MP Russel Norman said Mr English should be demanding answers.

“They have to give some sort of explanation as to why they gambled US$150m in this case, and why it’s come unstuck,” he said. The episode also illustrated what the NZSF should try to avoid, Mr Norman said. “For a fund operating on behalf of the NZ taxpayer, taking these high-risk investments is probably not appropriate,” he said. Mr Orr denied the investment was high-risk and said the NZSF had been covered in the event of BES defaulting. “It was risk-free with insurance,” he said. However, an unusual retrospective rule change in Portugal had resulted in the insurance being voided. Orr added the Super Fund had withdrawn lending to banks in Portugal until the result was overturned. The Fund said the loss amounted to only 0.7% of the firm’s total pool of $27b in assets.

Read more …

“Christchurch, home to 366,000 people, who are still shaken daily by thousands of aftershocks..” (Nicole and I were there at the first anniversary)

• Long Way To Go: 5th Anniversary of the Christchurch Earthquake (G.)

It was as the clock struck 12.51pm that the last of the 185 names were read out. Then, the 1,000 people who had gathered in the city’s botanic gardens to mark the anniversary of the 2011 Christchurch earthquake fell silent for a minute to remember the moment, five years ago, that the 6.3-magnitude quake struck. Earlier, posies of flowers had been laid in road cones and taped to the safety fences that still litter the city centre half a decade after the disaster turned it largely to rubble.Once the memorial ceremony had finished, talk turned – as it usually does – to the rebuilding of this once-rich, agricultural hub – and what the new Christchurch will look like when it finally rises from the ashes. “There is still some way to go until Christchurch is truly reborn,” said the governor-general, Jerry Mateparae.

His is a sentiment widely shared in Christchurch, home to 366,000 people, who are still shaken daily by thousands of aftershocks – including a significant 5.9 rumble on Valentines day this year and a 5.0-magnitude quake that hit in nearby Blenheim on the anniversary itself. Despite years of clean-up and a recent boom in construction, Christchurch is still in a state of flux, with hundreds of people waiting for insurance payouts and widespread concern about the pace of the rebuild, especially in the heart of the city. The health of Christchurch residents has also fared poorly since the quake. Suicide and domestic violent rates have risen sharply – as has illegal drug use and the spread of sexually transmitted diseases.

Mental health problems are a persistent concern – particularly widespread are incidences of depression, anxiety and post traumatic stress disorder. Waiting lists for state-funded counselling in Christchurch are long, and last week it was reported the government would significantly cut funding to community mental health providers – from $1.6m in 2015 to $200,000 this year. Yet in tandem with the trauma of the quake’s aftermath has come a remarkable flourishing of the creative arts in the garden city. Rachael Welfare, operations director for Gap Filler, a charitable organisation filling the “gaps” of Christchurch with pop-up creative projects, said: “Before the quake, people thought of Christchurch as quite conservative, but now the opportunities have given people a blank canvas, if nothing else, and people are very open-minded about what the spaces could be.”

Read more …

Who told them to do this and say damn the Geneva conventions?

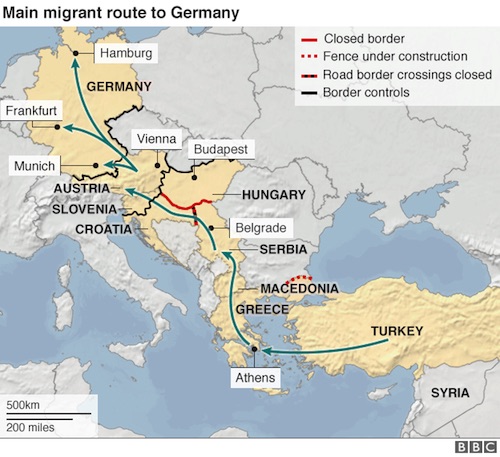

• Macedonia, Serbia Close Borders To Afghan Refugees (AP)

Former Yugoslav Republic of Macedonia (FYROM) closed its border to Afghan migrants early Sunday, Greek police said, slowing the admission of refugees to a trickle and leaving a growing bottleneck of people stuck at their shared border. A FYROM police spokeswoman denied there was any new prohibition regarding Afghans, blaming the problem on Serbia, the next nation along the Balkans migration route into Western Europe. By early afternoon, about 1,000 migrants were waiting at the Greek border camp in Idomeni – and at a gas station only 17 kilometers (11 miles) away, 80 buses with 4,000 more migrants were waiting to take them to the border. Greek police said FYROM refused to let Afghans through because Serbia made the same decision and officials feared the migrants would get stuck in FYROM.

“The authorities of the Former Yugoslav Republic of Macedonia informed us that, beginning at dawn Sunday, they no longer accept Afghan refugees because the same problem exists at their border with Serbia,” Petros Tanos, spokesman for Greek police’s Central Macedonia division, told The Associated Press. Despite the reports, about 500 migrants of all nationalities made the trek on foot from the gas station to the border Sunday. “I can no longer wait,” said 17-year-old Ali Nowroz, one of the trekkers from the Afghan city of Jaghori Zeba. “We have spent three nights in the cold, we are hungry. They told me that the borders have been closed to us. However, when I started from Afghanistan I knew borders were open for us. I am going to the Idomeni border crossing to find out and ask why they have closed it.”

Read more …

Every single day. Numbers are rising as borders are closing. Greece can’t be far away from becoming a failed state

• Shadowing The Hellenic Coast Guard’s Refugee Rescues (CCTV)

As Europe tries to deal with the biggest refugee crisis since World War II, improving weather means the pace of migrants and refugees reaching Greece from Turkey will pick up again. On Feb 15., over 4,500 people were rescued across the Aegean Sea in Greece. Since last year, the Hellenic Coast Guard has rescued almost 150,000. CCTV’s Filio Kontrafouri went on patrol with the Hellenic Coast Guard off the Greek island of Lesvos and witnessed what happens after those dinghies, usually loaded with women and children, enter the Greek waters. “For us, all these people are like they are condemned to death,” said Sub-lieutenant Kyriakos Papadopoulos of the Hellenic Coast Guard. “You’ll see when we get to that boat, about which some other colleagues in the area have informed us, even with everyone on board, there is panic. People could move from one side to the other, these boats are not suitable for travel at sea, their life jackets are not suitable and at any moment their life is in danger.”

Read more …