Edgar Degas Landscape with Path Leading to a Copse of Trees 1890-92

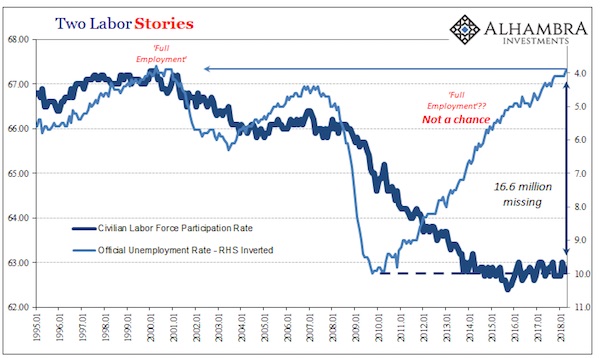

“..at some point it gets pretty hard to hide 16.6 million missing workers..”

• 40% Unemployment Ain’t Awesome (Stockman)

[..] the Awesome Economy narrative gets more threadbare by the month. As Jeff Snider astutely observed in his commentary on today’s report—at some point it gets pretty hard to hide 16.6 million missing workers. What he means is that if the labor force participation rate had not plunged from more than 67.0% to the 62.8% level reported again for April, there would be 16.6 million more persons employed in the US economy today at the ostensible 3.9% unemployment rate.

“Here in the United States, the Bureau of Labor Statistics (BLS) sends us another farce. These payroll Friday’s were always a little overwrought, but in the past four years they have become ridiculous spectacles. It’s not the fault of the BLS (apart from questions about their estimates for 2014), mainly it is the same issue as in Japan. What should be obvious is misinterpreted sometimes intentionally. According to the latest figures, the unemployment rate in the US is now down to 3.9%. The reason it crossed the 4% line in April was perfect. Not in the manner of what a 3.9% unemployment should indicate, rather it was all the wrong things that expose the unemployment rate for what it is – meaningless. The primary reason for its drop was another monthly subtraction from the labor force. Down for a second month in a row, in April by 236k, the HH Survey managed to increase by all of 3k. The result: a perfectly representative decline to 3.9%.”

The Keynesian gummers reject Snider’s point entirely, of course, on the vague theory that retirements and the aging demographics of the US explain away much of the change in the participation rate. As a matter of fact, they don’t. And, besides, the whole BLS employment/unemployment reporting framework and model is essentially a pile of garbage that might have been relevant during the days of your grandfather’s economy, if even then. That is, it is built on the flawed notion that labor inputs can be accurately measured by a unit called a “job” and that an economic trend in motion tends to stay in motion.

To the contrary, in today’s world labor is procured by the hour and by the gig—meaning that the “job” units counted in both the establishment and household surveys are a case of apples, oranges and cumquats. The household survey, for example, would count as equally “employed” a person holding: • a 10-hour per week gig with no benefits; • a worker holding three part-time jobs adding to less than 36 hours per week with some benefits; and • a 50-hour per week manufacturing job (with overtime) providing a cadillac style benefit package.

How about Kondratieff?

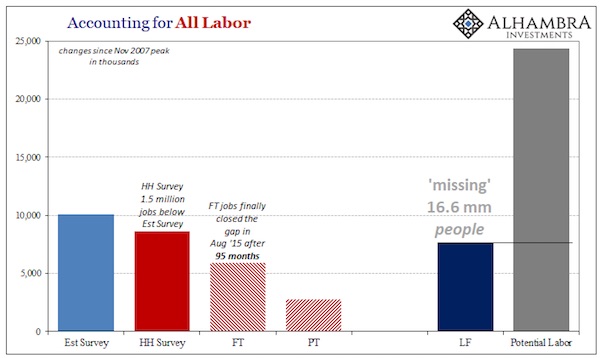

• The Next Recession Is Closer Than You Think (Cook)

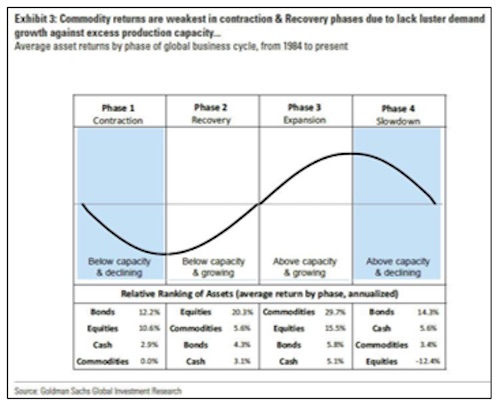

Business cycles run for periods of years, not days, weeks, or months. So business cycle analysis is different from the common definition of market-timing because it is concerned with a much longer time horizon. It is difficult for anyone other than politicians to deny the existence of a business cycle, which includes both an expansion and a recession phase because they are a fact of economic life. A recent Goldman Sachs research piece not only acknowledges the existence of cycles but divides them into four phases and produces recommended asset allocations for each phase, as shown below.

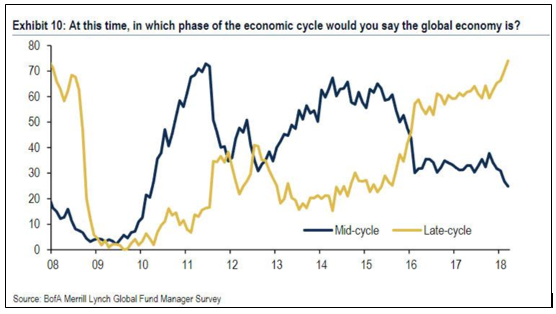

Goldman’s investment recommendation for 2018 is based on the belief that 2018 lies within Phase 3, in which the economy is operating above capacity and growing. More broadly, Goldman’s chart and table show that identifying the Phases is a crucial determinant of investment success. For example, if 2018 truly lies within Phase 4, cash and bonds would outperform commodities and equities. \The Fed appears to agree with Goldman’s analysis of Phase 3, based on its simultaneous campaigns to lift the Fed Funds rate and to reduce the size of its bond holdings that were acquired during its QE experiment. In another admission that business cycles exist, Bank of America/Merrill Lynch (BAML) produces a monthly Fund Manager Survey, in which it asks the largest institutional investment managers a simple question; where are we in the business cycle?

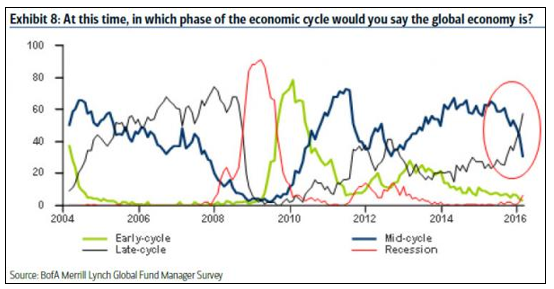

[..] The BAML survey extends further back than 2008, so we can get a better idea of investors’ beliefs leading to the recession of 2008-09, as shown below. During these years, investors were given two other choices to describe the economy; early-cycle or recession. A majority of investors believed the economy was late-cycle beginning in 2005, with a peak in that belief occurring in late 2007 (thin black line), which coincided with a continuous decline in the percentage believing the economy was mid-cycle. During the period 2005-2007, almost no investors believed that the economy was in either in its early-cycle or recession.

China is negotiating.

• US Lays Down A List Of Trade Demands To China (CNBC)

The U.S. stands ready to impose further trade tariffs on Chinese products if Beijing walks away from agreed-upon commitments, according to a reporter at the Wall Street Journal. Trade representatives from the U.S. and China entered a second day of trade discussions on Friday, as the world’s two largest economies sought to find a way to stave off global concerns of a full-blown trade war. The discussions, led by Treasury Secretary Steven Mnuchin and Chinese Vice Premier Liu He, are expected to cover a wide range of U.S. complaints about alleged unfair trade practices in Beijing. A major breakthrough deal to fundamentally change China’s economic stance was widely viewed as highly unlikely.

In a tweet posted Friday, Lingling Wei, a China economics correspondent at the Wall Street Journal, said the U.S asked China to reduce its trade surplus by at least $200 billion by year-end 2020, citing a document issued to the Chinese before the talks. President Donald Trump has often called on China to reduce its bilateral trade deficit by $100 billion a year. The U.S. trade envoy also wanted China not to target U.S. farmers and agricultural products and sought assurances from the Asian giant that it would not retaliate over restrictions on investments from Beijing, Wei said.

The entire British press seems set on ignoring Labour’s win. Which, true enough, isn’t big enough.

• Theresa May Under Pressure To Ditch New Immigration Clampdown (Ind.)

Theresa May is under mounting pressure to ditch a fresh immigration clampdown dubbed “the next Windrush”, ahead of a crucial Commons vote next week. Thirty-four organisations have joined forces to urge the prime minister not to repeat the blunders that sparked the scandal by preventing other immigrants from proving their right to be in the UK. Under planned new data laws, people will be denied access to the personal information the government holds about them if releasing it would “undermine immigration control”. Leading lawyers have warned that withholding potentially vital proof would lead to people being wrongly deported, detained or denied health treatment – in a mirror image of the treatment of the Windrush generation.

On Wednesday, Labour and the Liberal Democrats will join forces to try to throw out the exemption, arguing it is the “first test” of Ms May’s promise to learn the lessons of the Windrush debacle. Now, the joint letter – seen by The Independent – brings together human rights campaigners, trade unions, migrant support groups and law firms to warn it will “foster fear within minority communities”. Unless halted, the plan will make it “near-impossible” to prevent the “disposing of information that could help people prove their right to reside in the UK – as it did with the Windrush landing cards”, they say. People would also avoid using essential public services “for fear that their medical or school records will be secretly passed to the Home Office”.

The lenders don’t own the loans anymore, they’ve been packaged and sold.

• 150,000 UK ‘Mortgage Prisoners’ Need Help To Escape Expensive Deals (Ind.)

Tens of thousands of people are “mortgage prisoners”, trapped on expensive deals and not allowed to switch, the financial regulator has said. The Financial Conduct Authority urged for more innovation to help around 150,000 people who signed up for deals before interest rates plummeted after the financial crisis. They have since been switched to more expensive “reversion rates” once their previous deal expired and are unable to switch because they do not meet stricter affordability rules which have been brought in. Christopher Woolard, director of strategy and competition at the FCA, said: “For many, the market is working well, with high levels of consumer engagement. “However, we believe that things could work better with more innovative tools to help consumers.

“There are also a number of long-standing borrowers that have kept up-to-date with their mortgage repayments but are unable to get a new mortgage deal; we want to explore ways that we, and the industry, can help them.” The FCA said it will consider seeking an industry-wide agreement to approve applications from those who are affected and are up-to-date with payments. However, this will only help 30,000 people who are with authorised mortgage lenders. The remaining 120,000 are with firms who are not authorised to lend, often because the lender has sold on a batch of mortgages. These firms are outside the FCA’s remit, which is set by parliament, meaning new legislation would be required to enable the regulator take action.

“..large twin budget and current account deficits, a heavy dollar debt burden, entrenched high inflation and an overvalued currency..”

• Argentina Hikes Interest Rates To 40% Amid Inflation Crisis (Ind.)

Argentina has jacked up its interest rates to 40 per cent in a drastic attempt to keep a lid on domestic inflation and stabilise its currency. The Latin American country’s central bank announced the hike on Friday, the third in seven days, saying it would keep using the tools at its disposal to get inflation back down to it 15 per cent target. Inflation in the country is currently running at 25.4 per cent, despite the investor-friendly economic reforms of President Mauricio Macri. Argentina is one of several emerging market economies that have suffered from currency pressure in recent weeks as the US dollar has strengthened and foreign capital has been withdrawn.

“Investors are moving out of [emerging markets], frontier [economies], and other risky assets and so countries like Argentina remain at heightened risk,” said Win Thin of Brown Brothers Harriman. The value of the Argentinian peso has declined from 18.6 against the greenback in January to 23 this week. President Macri succeeded the Peronist Cristina Fernandez de Kirchner in 2015 and has been seeking to reverse her policies of protectionism and high government spending. “This crisis looks set to continue unless the government steps in to reassure investors that it will take more aggressive steps to fix Argentina’s economic vulnerabilities,” said Edward Glossop of Capital Economics.

“Risks to the peso have been brewing for a while – large twin budget and current account deficits, a heavy dollar debt burden, entrenched high inflation and an overvalued currency. The real surprise is how quickly and suddenly things seem to be escalating.”

“It’s unlikely you’re going to persuade me the special prosecutor has power to do anything he or she wants. ..”

• Judge In Manafort Case Rebukes Mueller For Exceeding Authority (G.)

A federal judge has rebuked the special counsel investigating alleged collusion between Trump aides and Russia, for overstepping his bounds in a criminal case against the president’s former campaign manager. Robert Mueller last year brought tax and bank fraud charges against Paul Manafort, the first indictment in the Russia investigation. Manafort maintains his innocence. On Friday TS Ellis, a judge in the eastern district of Virginia, suggested that Mueller’s real motivation for pursuing Manafort was to compel him to “sing” against Trump. “You don’t really care about Mr Manafort’s bank fraud,” the judge, reportedly losing his temper, challenged lawyers from the office of special counsel.

“You really care about getting information Mr Manafort can give you that would reflect on Mr Trump and lead to his prosecution or impeachment.” The comments, at a tense court hearing in Alexandria, were a boost for Manafort’s lawyers who contend that the charges against him are outside Mueller’s mandate to investigate Russian interference in the 2016 election. Ellis added: “I don’t see what relationship this indictment has with anything the special counsel is authorised to investigate. “We don’t want anyone in this country with unfettered power. It’s unlikely you’re going to persuade me the special prosecutor has power to do anything he or she wants. The American people feel pretty strongly that no one has unfettered power.”

[..] Ellis withheld ruling on dismissal of the indictment. He asked the special counsel’s office to share privately with him a copy of deputy attorney general Rod Rosentein’s August 2017 memo elaborating on the scope of Mueller’s Russia investigation. The current version has been heavily redacted, he said. Leaving the White House on his way to Texas on Friday, Trump claimed he would welcome an interview with Mueller. “So I would love to speak,” he told reporters. “I would love to go. Nothing I want to do more, because we did nothing wrong. We ran a great campaign. We won easily.” But he added: “I have to find that we’re going to be treated fairly, because everybody sees it now, and it is a pure witch-hunt. Right now, it’s a pure witch-hunt.”

The FBI is far from squeaky clean.

• The Horsefly Cometh (Jim Kunstler)

You can see where this Mueller thing is going: to the moment when the Golden Golem of Greatness finally swats down the political horsefly that has orbited his glittering brainpan for a whole year, and says, “There! It’s done.”

It suggests that Civil War Two will end up looking a whole lot more like the French Revolution than Civil War One. The latter unfurled as a solemn tragedy; the former as a Coen Brothers style opéra bouffe bloodbath. Having executed the presidential swat to said orbiting horsefly, Trump will try to turn his attention to the affairs of the nation, only to find that it is insolvent and teetering on the most destructive workout of bad debt the world has ever seen. And then his enemies will really go to work. In the process, they’ll probably wreck the institutional infrastructure needed to run a republic in constitutional democracy mode.

They got a good start in politicizing the upper ranks of the FBI, a fatal miscalculation based on the certainty of a Hillary win, which would have enabled the various schemers in the J. Edgar Hoover building to just fade back into the procedural woodwork of the agency and get on with life. Instead, their shenanigans were exposed and so far one key player, Deputy Director Andrew McCabe, was hung out to dry by a committee of his fellow agency execs for lying about his official conduct. Long about now, you kind of wonder: is that where it ends for him? Seems like everybody else (and his uncle) is getting indicted for lying to the FBI. How about Mr. McCabe, since that is exactly why his colleagues at the FBI fired him?

Perhaps further resolution of this murky situation awaits Inspector General Michael Horowitz’s forthcoming report, which the media seems to have forgotten about lately. An awful lot of the mischief at the FBI and its parent agency, the Department of Justice, is already on the public record, for instance the conflicting statements of Andrew McCabe and his former boss James Comey concerning who illegally leaked what to the press. On the face of it, it looks pretty bad when at least one of these Big Fish at the top of a supposedly incorruptible agency is lying. There are at least a dozen other Big Fish in there who still have some serious ‘splainin’ to do, and why not in the grand jury setting?

There goes the OPCWs credibility.

• Chemical Weapons Watchdog Backtracks On ‘100g Of Novichok’ Claim (Ind. )

The international chemical weapons watchdog has backtracked on a suggestion that as much as 100 grams of nerve agent may have been used in the poisoning of former Russian spy Sergei Skripal and his daughter Yulia. Ahmet Uzumcu, director general of the Organisation for the Prohibition of Chemical Weapons (OPCW), had said the relatively large quantities of novichok used suggested it had been created as a weapon rather than for research purposes. But a new OPCW statement said the organisation was not able to “estimate or determine the amount of the nerve agent that was used” in the incident. Mr Uzumcu had said samples collected suggested the nerve agent used to poison the Skripals was of “high purity”.

He said: “For research activities or protection you would need, for instance, five to 10 grams or so, but even in Salisbury it looks like they may have used more than that. “Without knowing the exact quantity, I am told it may be 50, 100 grams or so, which goes beyond research activities for protection. “It’s not affected by weather conditions. That explains, actually, that they were able to identify it after a considerable time lapse.” It came as Czech President Milos Zeman said his country had produced small quantities of novichok. Britain has argued the use of Novichok – which was developed by the former Soviet Union in the 1980s – meant there was no “plausible alternative” explanation other than the Russian state was behind the attack.

However Mr Zeman’s comments were seized on by President Vladimir Putin’s spokesman Dmitry Peskov, who said they were a “clear illustration of the groundless stance the British authorities have taken”.

And they want you to believe the economy is growing.

• Greek Unpaid Taxes Build Up Again As Taxpayers Are Unable To Pay (K.)

Concerns are growing in the Finance Ministry as expired debts to the tax authorities grew at an unexpectedly high rate in March – a month with no major obligations. Unpaid taxes came to 776 million euros in March, taking total new arrears to the state in the first quarter of the year to 3.55 billion euros. According to figures released on Friday by the tax administration, the sum of old and new debts to the state amounted to 101.6 billion euros at end-March. Out of the 3.55 billion created in Q1, 3.3 billion euros was in the form of unpaid taxes. Ministry officials argue that the increase in tax debts is due to the fact that many taxpayers missed the deadlines for them to pay installments as part of debt settlement programs concerning the revelation of previously undeclared incomes.

Other reasons cited are that taxpayers have failed to pay fines, as well as many individuals and enterprises having exhausted all means for paying taxes. If this situation continues in the following months, the hole in budget revenues will grow considerably, given that the submission process for income tax statements has just begun and the first tranche is payable by end-July. The state’s response to this phenomenon is confiscations, which in March alone numbered 21,275. This takes the sum of taxpayers who have suffered confiscations to 1,109,971, while the total number of Greeks owing to the state has risen to 3,907,847.

“..agricultural products, including seeds, cannot be patented in India..”

• Monsanto Appeals To India Supreme Court Over GMO Cotton Patents (R.)

Monsanto has appealed to the Supreme Court against a ruling by the Delhi High Court which decreed last month that the world’s biggest seed maker cannot claim patents on its genetically modified or GM cotton seeds, a company spokesman said on Friday. The Delhi High Court on April concurred with Indian seed company Nuziveedu Seeds Ltd (NSL), which argued that the Patent Act does not allow Monsanto any patent cover for its genetically modified cotton seeds. Monsanto has appealed to the Supreme Court, said a Monsanto India spokesman. “In the Supreme Court, we’ll maintain our stand that agricultural products, including seeds, cannot be patented in India,” said Narne Murali Krishna, a company secretary for NSL.

“The judgement of the Delhi High Court has already vindicated our stand.” New Delhi approved Monsanto’s GM cotton seed trait, the only lab-altered crop allowed in India, in 2003 and an upgraded variety in 2006, helping transform the country into the world’s top producer and second-largest exporter of the fibre. Monsanto’s GM cotton seed technology went on to dominate 90 percent of India’s cotton acreage. But for the past few years Monsanto has been at loggerheads with NSL, drawing in the Indian and US governments, Reuters revealed last year.

Gorilla’s, bonobos, dwarf chimpanzees, Congo peacocks and forest elephants…

• Congo To Drill For Oil In Parks Home To Endangered Mountain Gorilla (Ind.)

The Democratic Republic of Congo is planning to reclassify two protected national parks to allow oil exploration. Documents seen by The Independent show the government wants to redraw the boundaries of the Salonga and Virunga national parks, which are home to critically endangered species such as mountain gorillas, to remove protected status from certain areas. Both parks are UNESCO World Heritage sites, a status which in theory should protect them from oil exploration and other extractive activities. In a letter, Congo’s oil minister Aime Ngoi Muken invited the environment minister and the minister for scientific research to a special commission meeting to discuss the plans on 27 April.

Minutes and notes of the meeting give more details about the areas in which the Congolese government wants to allow exploration. In another series of letters seen by NGO Global Witness, Congo’s oil minister Ngoi Muken argued for the need to open up the protected sites for oil exploration and set out the legal procedures to do so. Global Witness said the plans would be a violation of the UNESCO World Heritage Convention to which the Democratic Republic of Congo is a signatory. The Virunga park is one of the most biologically diverse areas on the planet and is home to about a quarter of the world’s remaining mountain gorillas. According to UNESCO, the Salonga park is Africa’s largest tropical rainforest, home to many endangered species such as bonobos, dwarf chimpanzees, Congo peacocks and forest elephants.