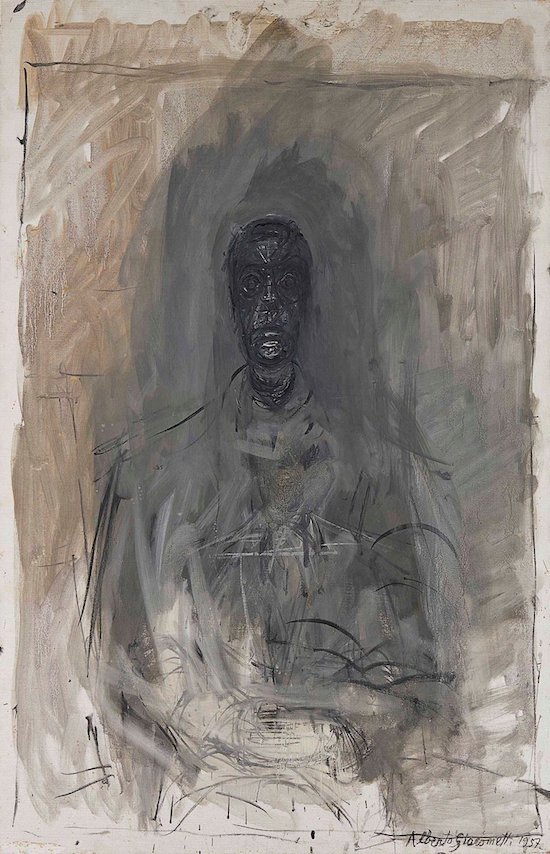

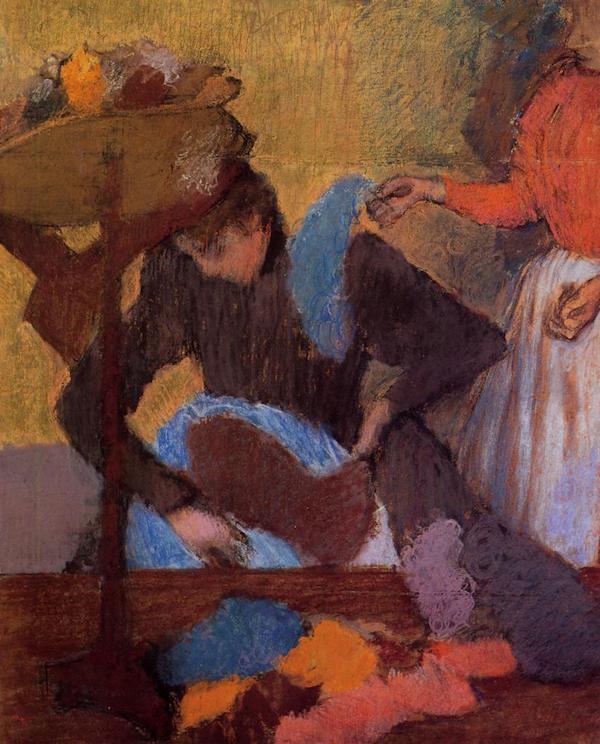

Edgar Degas At the Milliner’s 1905-10

Kanye brings hope.

• Happy New Universe Day (Caitlin Johnstone)

I’m not sure what this is, but it’s definitely different. A bunch of tweets and videos by Mike Cernovich, Scott Adams and Kanye West have been dancing in an unexpected way that has conservatives now talking about a shift in consciousness transforming the way humanity functions in the near future. Liberals and leftists are scoffing at it of course, but it’s definitely a thing, and in my opinion it’s downright fascinating. The MAGA crowd has always impressed me with its ability to energetically and spontaneously unify behind a single theme as a group, like a flock of birds or school of fish changing direction together on a dime. There are certainly worse things they could pour their collaboration into than manifesting a spiritual revolution.

And who the hell am I to say they’re wrong about that? It’s not like we’ve got a choice anyway; either our species will change the way it functions or we’ll wipe ourselves out via nuclear holocaust or climate catastrophe within a few decades, no matter how loudly and smugly we scoff at the guys in MAGA hats. If humanity is going to take a last-ditch, evolve-or-die leap into the unknown and unprecedented, now would surely be the time to do it. If a bunch of right-wingers get it into their heads that humanity is undergoing a spiritual transformation, that certainty could be all it takes to tip us into the shift we all know we need to make anyway.

Could something big be in the works? Something which transcends all our little echo chamber walls and ideological boundaries, which comes not from the repetitive thought loops in our minds but from our deep evolutionary drive to survive? I hope so. And call me naive and deluded if you like, but right now I’m seeing plenty of reasons to hope.

Read more …

“Candace seems to have drive, guts, and stamina and there’s no sign that she’s going to shut up. Won’t some Ivy League university please invite her to speak, just to see what happens?”

• Counter-#Resistance? (Jim Kunstler)

Who hit Kanye with that white privilege stick? The rapper / fashion maven / theologian / Kardashian arm candyman sent chills through the Twitterverse when he declared himself, somewhat elliptically, off-the-bus of the Progressive #Resistance movement and an admirer of the Golden One in the Oval Office. This came in his endorsement of YouTube blogger Candace Owen, who happens to not be down with the cause of the national victim lottery. Both Kanye and Candace have apparently crossed some boundary into a Twilight Zone of independent thought. Many probably wonder how they are able to get out of bed in the morning without instructions from Don Lemon.

Speaking as a white cis-hetero mammal, I’m not quite as dazzled by the president, but it’s a relief to see, at last, some small rebellion against the American Stasi who have turned the public arena into a giant holding pen for identity offenders — though it is but one corner of the triad-of-hysteria that also includes the Hate Russia campaign and the crusade against men. This nonsense has been going on long enough, while the country hurtles heedlessly into a long emergency of economic disarray. Next in line after Kanye and Candace, a popular Twitter critter name of Chance the Rapper endorsed Kanye endorsing Candace, more or less, by tweeting “black people don’t have to be Democrats.”

The horror this thought aroused! Slavery, these days, it turns out, has a lot of appeal — maybe not so much for laboring in the canefields under the noonday sun as for serving juleps in the DNC plantation house. It happened that Kanye’s mom was a college professor, Chance’s dad was an aide to Chicago Mayor Daley (Jr.), and later worked in Mr. Obama’s Department of Labor. Candace describes her childhood home in Stamford, CT, as “very poor,” but she rose far-and-fast out of college to become an executive on Wall Street in her twenties. What they seem to have in common is being tainted with bourgeois values, horror again!

[..] I dunno about the perpetually scowling Kanye, with his periodic mood problems and spotlight-stealing antics on stage, or Chance the Rapper’s artificial hood raptures, but Candace makes the argument for the value of a common culture that might bind us together as a nation of individuals, not hostile tribes, starting with a language that everybody can understand. Of course, the whole Kanye / Candace dust-up may be forgotten by the middle of next week, and the country can go back to gaslighting itself into either a new civil war or world war three. Candace seems to have drive, guts, and stamina and there’s no sign that she’s going to shut up. Won’t some Ivy League university please invite her to speak, just to see what happens?

Read more …

Yeah, we’ll have to wait and see. But Kim does what his people want, and more importantly what his father wanted.

• North Korea Says Historic Summit Opens ‘New Era For Peace’ (AFP)

North Korea on Saturday hailed its summit with the South as a “historic meeting” that paved the way for the start of a new era, after the two leaders pledged to pursue denuclearisation and a permanent peace. The official KCNA news agency carried the text of the leaders’ Panmunjom Declaration in full and said the encounter opened the way “for national reconciliation and unity, peace and prosperity”. In the document, North Korean leader Kim Jong Un and the South’s President Moon Jae-in “confirmed the common goal of realising, through complete denuclearisation, a nuclear-free Korean Peninsula”. But the phrase is a diplomatic euphemism open to interpretation on both sides.

Pyongyang has long wanted to see an end to the US military presence and nuclear umbrella over the South, but it invaded its neighbour in 1950 and is the only one of the two Koreas to possess nuclear weapons. Analysts warn that previous displays of inter-Korean affection and pledges by the North ultimately came to naught. For years, Pyongyang insisted it would never give up the “treasured sword” of its nuclear arsenal, which it says it needs to defend itself against a possible US invasion. But it has offered to put it up for negotiation in exchange for security guarantees, according to Seoul – although Kim made no public reference to doing so at Friday’s spectacular summit. In a separate report, KCNA said the two leaders had a “candid and open-hearted exchange of views” on issues including “ensuring peace on the Korean Peninsula and the denuclearisation of the peninsula”.

Read more …

“..Fully 96% of Amazon’s $5.0 billion of LTM operating income was accounted for by its cloud services business..”

• Jumping The Great White Shark Of Bubble Finance (David Stockman)

Wall Street has now truly jumped the shark – the one jockeyed by Jeff Bezos. Last night Amazon reported a whopping 41% plunge in free cash flow for the March 2018 LTM period compared to prior year. Yet it was promptly rewarded by a $50 billion surge in market cap – with $10 billion of that going to the guy riding topside on the Great White Shark of Bubble Finance. That’s right. Amazon’s relatively meager operating free cash flow for the March 2017 LTM period had printed at $9.0 billion, but in the most recent 12 months the number has slithered all the way down to just $5.3 billion. And that’s where the real insanity begins. A year ago Amazon’s market cap towered at $425 billion – meaning that it was being valued at a downright frisky 47X free cash flow.

But fast forward a year and we get $780 billion in the market cap column this morning and 146X for the free cash flow multiple. Folks, a company selling distilled water from the Fountain of Youth can’t be worth 146X free cash flow, but don’t tell the giddy lunatics on Wall Street because they are apparently just getting started. Already at the crack of dawn SunTrust was out with a $1900 price target – meaning an implied market cap of $970 billion and 180X on the free cash flow multiple. At this point, of course, you could say who’s counting and be done with it. But actually it’s worse – and for both Amazon and the US economy.

That’s because Amazon is both the leading edge of the most fantastic ever bubble on Wall Street and also a poster boy for the manner in which Bubble Finance is hammering growth, jobs, incomes and economic vitality on main street. Moreover, soon enough a collapsing Wall Street bubble will bring the already deeply impaired main street economy to its knees. So Amazon is a double-destroyer. [..] Fully 96% of Amazon’s $5.0 billion of LTM operating income was accounted for by its cloud services business (AWS). The e-Commerce juggernaut, by contrast, posted just $188 million of LTM operating income, which amounts to, well, 0.1% of sales on a computational basis. But we’d round that to zero – especially because Amazon’s e-Commerce business was already almost there in the year ago period when its margin on sales came in a tad higher at 0.6%!

Read more …

No kidding.

• Structural Racism At Heart Of British Society, UN Human Rights Panel Says (G.)

The disproportionate number of deaths of black and brown people in incidents with the police shows that structural racism remains rooted in the fabric of British society, a panel of UN human rights experts has said. The panel cited data from the Metropolitan police showing a disproportionate number of minority ethnic people – particularly those of African or Caribbean descent – dying due to excessive use of force by the state. Noting that there had never been a successful prosecution of a police officer for a death in police custody, the panel said: “This points to the lack of accountability and the impunity with which law enforcement and state agencies operate.”

The warning from members of the UN human rights council comes before a 12-day visit to the UK by E Tendayi Achiume, the special rapporteur on racism, beginning on Monday. “The deaths reinforce the experiences of structural racism, over-policing and criminalisation of people of African descent and other minorities in the UK,” they said. “Failure to properly investigate and prosecute such deaths results in a lack of accountability for those individuals and state agencies responsible, as well as in the denial of adequate remedies and reparation for the families of the victims.” The panel pointed particularly to the disproportionate use of stun guns. People from black and minority ethnic backgrounds were three times more likely to be subjected to the use of such weapons by police, they said.

The members added: “People of African descent with psychosocial disabilities and those experiencing severe mental or emotional distress reportedly face multiple forms of discrimination and are particularly affected by excessive use of force.” A report last year by David Lammy, the Labour MP for Tottenham, found racial disparities across the criminal justice system. He has consistently said that young black men feel as though they are living in a police state and that a different standard of policing is applied to black youths, compared with whites.

Read more …

Me, I predict a giant mess.

• Brexit Failure Looks More Likely Every Day (Ritholtz)

Today, I will violate one of my favorite principles, and hereby make this prediction: No Brexit! In other words, the U.K. will not exit the European Union. By 2023, we will look back at the entire ridiculous affair as if it were a rediscovered lost episode of “Fawlty Towers.” Soon after the referendum in which Brits unwisely voted to leave the EU, I suggested there was a 33% chance that Brexit wouldn’t occur. Now, I raise that to 75%, and with each passing day of incompetence shown by Prime Minister Theresa May’s administration, the probabilities move higher.

With that disclosure out of the way, I’d like to explain the thinking behind this not-so-bold forecast. From the very beginning, I have been a skeptic that a full Brexit would occur. The concept was simply so foolish and self-destructive that the reasonable expectation was cooler heads would prevail. But that was a modest assumption and didn’t anticipate the feckless May government making a bad situation even worse. There seem to be several ways this can, and probably will, fall apart. In order of likelihood (recognizing a combination of any and all of these is possible):

1) Doing nothing

2) Snap parliamentary election leading to a May loss

3) New referendum

4) Ireland/Scotland make it too complicated

5) Europe makes it impossible

Read more …

The EU is ready for a fight.

• Mayday on May Day? Trump Steel Tariff Deadline Looms (R.)

While more than 100 countries take a day off for May Day, U.S. President Donald Trump will spend next Tuesday deciding whether to extend a largely U.S.-China trade standoff into a more global dispute. In a week featuring a Federal Reserve monetary policy meeting, U.S. monthly jobs data and first estimates on euro zone inflation and economic growth, Trump’s decision on metal tariffs may prove to the be biggest market mover. The United States set import tariffs of 25% on steel and 10% on aluminum a month ago, but granted temporary exemptions to the European Union, NAFTA partners Canada and Mexico, as well as Argentina, Brazil, Australia and South Korea. Those exemptions expire on May 1.

Korea secured a permanent exemption for steel within days of agreeing to a revision of its trade pact with the United States. Canada and Mexico may rely on advances in talks on North American Free Trade Agreement (NAFTA) for an extension. Continued exemptions for the other countries, and notably the European Union, remain in doubt. French President Emmanuel Macron and German Chancellor Angela Merkel were meeting Trump in Washington as part of EU lobbying effort in the past week, but German officials played down the chances of a breakthrough before Merkel’s Friday visit. “From today’s point of view, we must reckon that the tariffs will come on May 1,” one official said.

The European Commission, which oversees trade policy for the 28-member bloc, has insisted the United States grant it a permanent exemption without conditions. White House economic adviser Larry Kudlow said on Thursday that Trump wanted concessions on automobiles, for which import duties are higher into Europe than into the United States.

Read more …

The Fed as a cult.

• Donald Trump and the Next Crash (Nomi Prins)

We have entered a landmark moment: no president since Woodrow Wilson (during whose administration the Federal Reserve was established) will have appointed as many board members to the Fed as Donald Trump. His fingerprints will, in other words, not just be on Supreme Court decisions, but no less significantly Fed policy-making for years to come — even though, like that court, it occupies a mandated position of political independence. The president’s latest two nominees to that institution’s Board of Governors exemplify this. He has nominated Richard Clarida, a former Treasury Department official from the days of President George W. Bush who later became a strategic adviser to investment goliath Pimco, to the Fed’s second most important slot, while giving the nod to Michelle Bowman, a Kansas bank commissioner, to represent community banks on that same board.

Like many other entities in Washington, the Fed’s Board of Governors has been operating with less than a full staff. If Clarida is approved, he will join Trump-appointed Fed Chairman Jerome Powell and incoming New York Federal Reserve Bank head John C. Williams — the New York Fed generally exists in a mind meld with Wall Street — as part of the most powerful trio at that institution. Williams served as president of the San Francisco Fed. Under his watch, the third largest U.S. bank, Wells Fargo, created about 3.5 million fake accounts, gave its CEO a whopping raise, and copped to a $1 billion fine for bilking its customers on auto and mortgage insurance contracts.

Not surprisingly, Wall Street has embraced Trump’s new Fed line-up because its members are so favorably disposed to loosening restrictions on financial institutions of every sort. Initially, the financial markets reflected concern that Chairman Powell might turn out to be a hawk on interest rates, meaning he’d raise them too quickly, but he’s proved to be anything but. As Trump stacks the deck in his favor, count on an economic impact that will be felt for years to come and could leave the world devastated. But rest assured, if the Fed can help Trump keep the stock market buoyant for a while by letting money stay cheap for Wall Street speculation and the dollar competitive for a trade war, it will.

Read more …

And Canada?!

• US Issues New Warning To China On Its Handling Of Intellectual Property (BBG)

The U.S. issued a new warning to China on its handling of intellectual property as President Donald Trump prepares to dispatch senior advisers to the Asian nation to head off a trade dispute. The U.S. Trade Representative’s office kept China on its “priority watch list” of countries whose IP practices require monitoring. China has an “urgent need” to fix a range of IP-related concerns, including trade-secret theft, online piracy, and forced technology transfer, USTR said in its annual report on IP protection and enforcement. Escalating trade tensions between the world’s two-biggest economies have rattled markets and sparked fears of a trade war. Trump has proposed tariffs on as much as $150 billion of Chinese imports on the grounds of alleged IP theft, while Beijing has vowed to retaliate on everything from American soybeans to airplanes.

The annual list, which carries no immediate penalties, is supposed draw attention to the need for nations to address everything from copyright infringement to online piracy. Trump said this week Treasury Secretary Steven Mnuchin and other senior officials will visit China within days, adding that there’s a “very good chance” the two countries can reach a deal. U.S. Trade Representative Robert Lighthizer and White House economic adviser Larry Kudlow will also be part of the delegation. Kudlow said he expects serious negotiations on a range of trade irritants, including technology-related issues, and the U.S. will be looking for specific actions from China. Officials in Beijing in recent weeks have been announcing steps to further open up the economy, such as gradually scrapping foreign ownership caps on local vehicle companies.

The administration added Canada and Colombia to the highest priority watch list for IP challenges, and it dropped Thailand from the regular watch list. Canada is the only Group of Seven country on the monitoring list. The USTR said the country has failed to resolve “key longstanding deficiencies,” including poor border and law enforcement with respect to counterfeit and pirated goods, weak patent protection and pricing for pharmaceuticals, and inadequate copyright protection.

Read more …

It’s the shadow banks that have financed that 6.8% growth they miraculously achieve every single month and year.

• China Is Bolstering Lenders Before A New Assault On Shadow Banking (BBG)

Investors who pushed up Chinese bank shares last week on news of lower reserve requirements may have been celebrating too soon. The subtext to Tuesday’s move is an effort to prepare the banks for a painful new phase in China’s campaign to reduce financial-sector risks, as regulators free up deposit rates and accelerate their crackdown on the nation’s $16 trillion shadow banking sector. “China is gearing up to crack a hard nut with deleveraging and financial reforms, and the central bank is offering some coordinated policies to ensure it will be a smooth transition,” said Xia Le, chief Asia economist at Banco Bilbao Vizcaya Argentaria in Hong Kong.

The People’s Bank of China’s decision to free up more liquidity for banks by slashing reserve ratio requirements, at a time when funding conditions are plentiful, shows the central bank is trying to insulate lenders for the next phase of reform, said Ming Ming, head of fixed-income research at Citic Securities. A key element of that reform process is a plan to give banks greater freedom to set interest rates, flagged by PBOC Governor Yi Gang at the Boao forum earlier this month. That will help banks better compete for deposits from Chinese savers and hasten the shift away from shadow instruments such as wealth management products.

Already, China Construction Bank, Bank of China and other large lenders have started trying to attract funding by rolling out certificates of deposit with sharply higher interest rates. But the move away from off balance sheet WMPs to on-balance sheet deposit funding is likely to be painful. Guosen Securities analyst Wang Jian described interest rate liberalization as like “throwing a bomb at banks” in an April 11 note, saying the need to offer higher deposit rates to attract funds could push them into riskier lending, to real estate for example, in order to protect profits.

Read more …

What are the little ones going to do?

• World’s Central Banks Just Can’t Quit on Currency Intervention (BBG)

History shows that central banks rarely stem a currency’s long-term decline simply by spending foreign-exchange reserves. Yet not stepping in at all can prove far worse. That’s the argument used by authorities in Brazil, Indonesia and most recently Argentina to explain why it makes sense to shower billions of dollars on what looks like a losing bet. This week alone, Argentina spent about $3 billion, or 5% of its reserves, to bolster the peso after it plunged to a record low. Then, wielding another monetary cudgel, it unexpectedly goosed interest rates. In Buenos Aires, the combination worked – at least for today. The peso ended just a blip or two in the green after sliding 1.8% earlier. It’s still this year’s worst-performing major currency, nosing out Russia’s ruble and the Turkish lira.

“It was a success in the sense that it gave two signals to the market,” said Daniel Chodos, a strategist at Credit Suisse based in the Argentine capital. “One is that it can and will use all available instruments to conduct monetary policy, that is, interest-rate and FX interventions. The second signal is that because of the tool kit it has, it can intervene and cause some pain to markets.” Indonesia is a more cautionary tale. The southeast Asian nation’s central bank drained $6 billion of foreign reserves in February and March partly to stabilize the rupiah, and may have further eroded the $126 billion pile as it stepped up intervention this month. But the moves, coupled with a threat to hike rates, didn’t calm volatility. That led the central bank to say it’s preparing a second line of defense to ensure liquidity.

Brazil’s interventions in the foreign-exchange market, using currency swaps, became so regular between 2013 and 2015 that traders started likening them to “ração diária,” the moment each day set aside to feed your pets.

Read more …

“..for the first time they are going to charge based on factors including affordability, reliability, transparency, renewable energy integration, efficiency..”

• Hawaii Takes Historic First Step Toward Creating ‘Utility of the Future’ (RE)

In what could be the beginning of the new way forward to utilities, on Tuesday, Hawaiian Gov. David Ige signed the Ratepayer Protection Act, a new law that directs utilities in Hawaii to change their business models and fully decouple revenue and capital expenditures. “This is the first jurisdiction that is doing this. It’s a concept that’s been discussed at some length among scholars and experts in the field but no one has actually implemented this so this was definitely a moonshot bill,” said State Sen. Stanley Chang in an interview. “Instead of charging what the market can bear or letting utilities charge on a cost-plus basis to recoup their costs, for the first time they are going to charge based on factors including affordability, reliability, transparency, renewable energy integration, efficiency,” he added.

“That’s a total change to the business model of these utilities.” Today, one of the only ways that utilities all across the world can generate revenue is by rate-basing capital expenditures. What that means in plain English is that the more utilities spend on infrastructure, such as upgrading transmission and distribution equipment (and building new generation plants in some territories), the more money they make because they are allowed to add those capital expenditures to their electric rates plus a healthy margin and recover their costs through ratepayer dollars.

As of July 1, 2020, this model will cease to exist in Hawaii. Under the new law Hawaiian utilities and the public utility commission (PUC) will need to come up with “performance incentives and penalty mechanisms that directly tie an electric utility revenues to that utility’s achievement on performance metrics and break the direct link between allowed revenues and investment levels,” according to the new law.

Read more …

“Contamination of soil, vegetation and water is so widespread in Japan that evacuating all the at-risk populations could collapse the economy..”

• Fukushima is Now Officially Worse Than Chernobyl (CP)

The radiation dispersed into the environment by the three reactor meltdowns at Fukushima-Daiichi in Japan has exceeded that of the April 26, 1986 Chernobyl catastrophe, so we may stop calling it the “second worst” nuclear power disaster in history. Total atmospheric releases from Fukushima are estimated to be between 5.6 and 8.1 times that of Chernobyl, according to the 2013 World Nuclear Industry Status Report. Professor Komei Hosokawa, who wrote the report’s Fukushima section, told London’s Channel 4 News then, “Almost every day new things happen, and there is no sign that they will control the situation in the next few months or years.”

Tokyo Electric Power Co. has estimated that about 900 peta-becquerels have spewed from Fukushima, and the updated 2016 TORCH Report estimates that Chernobyl dispersed 110 peta-becquerels.[1](A Becquerel is one atomic disintegration per second. The “peta-becquerel” is a quadrillion, or a thousand trillion Becquerels.) Chernobyl’s reactor No. 4 in Ukraine suffered several explosions, blew apart and burned for 40 days, sending clouds of radioactive materials high into the atmosphere, and spreading fallout across the whole of the Northern Hemisphere — depositing cesium-137 in Minnesota’s milk.[2]

The likelihood of similar or worse reactor disasters was estimated by James Asselstine of the Nuclear Regulatory Commission (NRC), who testified to Congress in 1986: “We can expect to see a core meltdown accident within the next 20 years, and it … could result in off-site releases of radiation … as large as or larger than the releases … at Chernobyl.[3] Fukushima-Daiichi came 25 years later. Contamination of soil, vegetation and water is so widespread in Japan that evacuating all the at-risk populations could collapse the economy, much as Chernobyl did to the former Soviet Union. For this reason, the Japanese government standard for decontaminating soil there is far less stringent than the standard used in Ukraine after Chernobyl.

Read more …

75% of insects are gone in France and Germany and they make this only about the bees?

• EU Votes To Ban Bee-Killing Pesticides (AFP)

European Union countries voted on Friday in favour of a near-total ban on neonicotinoid insecticides which are blamed for an alarming collapse in bee populations. The move comes after the European food safety agency said in February that most uses of the chemicals posed a risk to bees, prompting environmentalists to push the 28-nation EU to immediately outlaw them. Bees help pollinate 90% of the world’s major crops, but in recent years have been dying off from “colony collapse disorder,” a mysterious scourge blamed on mites, pesticides, virus, fungus, or a combination of these factors.

Campaigners dressed in black and yellow bee suits rallied outside the headquarters of the European Commission in Brussels ahead of the vote for a ban on three key pesticide chemicals. EU Environment Commissioner Vytenis Andriukaitis said he was “happy that member states voted in favour of our proposal” to restrict the chemicals and tweeted a picture of the activists.

Read more …

Time for a very large and thorough study into plastics in humans.

• The Hills Are Alive With The Signs Of Plastic (G.)

Microplastic pollution contaminates soil across Switzerland, even in remote mountains, new research reveals. The scientists said the problem could be worse in other nations with poorer waste management and that research was urgently needed to see if microplastics get into food. In the first major study of microplastics in soil, the researchers analysed soil samples from 29 river flood plains in nature reserves across Switzerland. They found microplastics, fragments under 5mm in size, in 90% of the soils. The scientists believe the particles are carried across the country by the wind. Research on microplastic pollution to date has largely concentrated on the oceans, in which it is found across the globe, including the Arctic. The particles have been shown to harm marine life and can absorb toxins from the water.

Record levels of microplastics were revealed in rivers by research released in March and last year tap water around the world was found to contain plastic fibres. Other studies have found microplastics in bottled water, which prompted the World Health Organization to launch a review, as well as in beer, honey and salt. However, almost no research has yet been done on whether the particles end up being widely consumed by people and whether they are harmful. Michael Scheurer and Moritz Bigalke at the Geographical Institute of the University of Bern, conducted the new research, which is published in the journal Environmental Science and Technology. “These findings are alarming,” Scheurer said. “For example, new studies indicate that microplastics in the soil can be harmful to and even kill earthworms in the soil.”

Microplastics were found even in remote mountain regions that can only be reached by foot. “We were really surprised,” said Bigalke. “All the areas were in national parks. We thought we might find one or two plastic particles, but we found a lot.” [..] One of the very few studies into microplastics in food examined backyard chickens in Mexico. The researchers found 57 particles per gramme in the gizzards of the chickens. “Chicken gizzard is a specialty in the Mexican kitchen and the intake of the present plastics form a strong risk for human health,” the scientists said.

Read more …