Pablo Picasso Mandolin and glass of Pernod 1911

Or $8 trillion, depending on who you ask.

• Global Selloff Erased $5 Trillion From Stock And Bond Markets In October (MW)

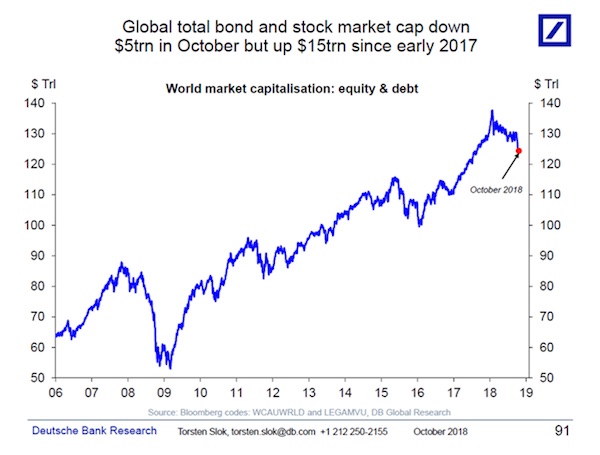

The recent stampede by investors has erased about $5 trillion in value from global stock and bond markets in October alone. But that shouldn’t be severe enough to affect the economy, for now, according to economists at Deutsche Bank. Still, unless the markets regain their footing soon, the pressure for the Federal Reserve to reassess their monetary policy will continue to mount, they said. “Academic studies of the wealth effect find that households and companies don’t react to short-term fluctuations in their wealth but instead react to a moving average of where their wealth levels are,” said Torsten Slok, chief international economist at Deutsche Bank Securities, said in a note to clients.

As the chart below illustrates, global markets shed roughly $5 trillion in market cap just this month, but the total value of equity and debt markets has increased $15 trillion from 2017. “The bottom line is that we need a more significant correction before it will begin to have a meaningful impact on the economic outlook,” he said. The Fed said wages and prices are rising in its 12 districts and overall economic activity expanded at a “modest to moderate” pace, according to the Beige Book released on Wednesday. The report, which compiles anecdotal observations about the economy, by and large suggests that the Fed is likely to stay on course to execute its fourth rate rise of 2018 in December and deliver additional increases next year unless there is a more dramatic unwind in the financial markets.

[..] The sharp selloff this month has prompted at least one market expert to suggest that stocks are in the midst of a sustained downward spiral. “With the S&P 500 only five weeks removed from its all-time high, we’ve not been definitive about labeling this move a new cyclical bear market. But it’s very likely we are experiencing one,” said Doug Ramsey, chief investment officer at Leuthold Group, in a report.

At some point, the word ‘momentum’ will come into play.

• Dow Down 300 Points, S&P 500 1.7% In Another Wild Day On Wall Street (CNBC)

Stocks fell sharply on Friday as investors slogged through another volatile session on Wall Street. The Dow Jones Industrial Average closed 296.24 points lower at 24,688.31 after dropping 539 points at its lows of the day. The Nasdaq Composite dropped 2.1 percent to 7,167.21. At its lows, the tech-heavy Nasdaq had fallen more than 3 percent. The S&P 500 fell 1.7 percent to 2,658.69 and briefly entered into correction territory, trading more than 10 percent below its record high reached in September. The average stock market correction, since WWII, results in a 13 percent drop and lasts for four months if it does not turn into a full-fledged bear market. Larry Benedict, CEO of The Opportunistic Trader, said traders “don’t want to be long heading into the weekend.”

He added, “S&P now down on the year and people are more afraid to be long today than they were when market was 10 percent higher.” Seven of the 11 S&P 500 sectors are down at least 10 percent from their 52-week highs, including energy, materials and financials. Around three quarters of the index’s stocks are also in a correction. “The 19.7 percent correction in 2011 is as close to a bear market as we’ve had in recent years. I don’t think we’ll get close to that, but I think we’re heading for a deeper correction than the one we had in January and early February,” said Sam Stovall, chief investment strategist at CFRA Research. He noted investors are realizing that earnings growth will slow down moving forward, thus they are pricing this in.

How much of Bezos’s wealth comes directly from cheap and easy money?

• Jeff Bezos Loses $11 Billion In One Day After Amazon Sales Disappoint (F.)

Easy come, easy go: Jeff Bezos’ fortune dropped by $11 billion on Friday, a day after Amazon came out with quarterly results that fell short of the mark. Shares of the e-commerce behemoth fell almost 8% on Friday, swiftly knocking some $70 billion off the company’s market capitalization. The selloff also dragged down the broader market, which has been flirting with correction territory this week. Bezos’ net worth fell in lockstep, dropping by $11 billion to $135.8 billion. That is down from the $160 billion he was worth as of mid-September. Bezos, who owns 16% of Amazon, is still by far the richest man on the planet. He is trailed by Microsoft cofounder Bill Gates, whose fortune clocks in at $94.8 billion.

Amazon, which briefly became the second U.S. company to fetch a $1 trillion valuation in September, shared third quarter results on Thursday that failed to live up to the high expectations that investors and Wall Street have come to adopt. Sales rose by 29% to $56.6 billion in the third quarter. However, that was a far cry from the $73.9 billion that analysts had projected. Amazon also told investors to brace for a slower holiday season. It expects revenue to grow just 10% to 20% in the fourth quarter, reaching $72.5 billion at most. That would make for Amazon’s worst holiday season since 2014. For the last three straight years it has boasted sales increases of more than 20% during the fourth quarter.

Makes sense: “Trump proposed having Medicare base what it pays for some expensive drugs on the average prices in other industrialized countries, such as France and Germany..”

• Trump Adds A Global Pricing Plan To Wide Attack On Drug Prices (Tribble)

President Donald Trump’s new pledge to crack down on “the global freeloading” in prescription drugs had a sense of déjà vu. Five months ago, Trump unveiled a blueprin to address prohibitive drug prices, and his administration has been feverishly rolling out ideas ranging from posting drug prices on television ads to changing the rebates that flow between drugmakers and industry middlemen. Thursday, Trump proposed having Medicare base what it pays for some expensive drugs on the average prices in other industrialized countries, such as France and Germany, where prices are much lower. The proposal is in the early stages of rule-making and awaiting public comments. The U.S., Trump said, will “confront one of the most unfair practices, almost unimaginable that it hasn’t been taken care of long before this.”

The proposal was met with hope and skepticism, with several experts saying they were happy the administration was taking on Medicare Part B’s rising drug prices but questioning its approach. Walid Gellad, director of the Center for Pharmaceutical Policy and Prescribing at the University of Pittsburgh, said in an online post that the administration’s proposed solutions were unclear. And, he said, they would “face insurmountable challenges.” While some industry watchers pointed to the announcement as a political move, Wells Fargo pharmaceutical analyst David Maris said that this is a broader effort by the president and his administration to attack the root causes of high drug prices. “The reality is he could very easily not take this on and do what other administrations have done and let the prices keep rising.”

Defeat. Good.

• Swedish Central Bank Makes U-Turn on Cash as NIRP is Ending (DQ)

Sweden’s Riksbank has become the first central bank in the 21st century to take concrete measures to ensure that cash does not disappear as a means of payment from the financial system. To that end, the Riksbank proposes, in a document published on its website, to make it mandatory for all banks and financial institutions to offer cash services. The pronouncement comes in response to a recent policy suggestion by the Riksbank Committee that only the country’s six major banks should be obligated to continue offering cash services. That prompted a backlash from Sweden’s competition watchdog, which argued that the plan would distort competition as it would affect only a few of the nation’s banks. In response, the Riksbank has opted to apply the rule to “all banks and other credit institutions that offer payment accounts.”

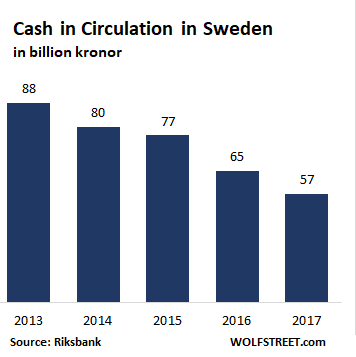

[..] For years, the government and the Riksbank have been pushing for a “cashless society.” The Riksbank has over 1,000 articles posted on its website on the “cashless society“. The emphasis worked: between 2013 and 2017, the amount of cash in circulation dropped by 35%, earning Sweden a reputation as the world’s “most cashless nation”:

Many of Sweden’s bank branches had stopped handling cash altogether. Now, they will have to begin doing so all over again. Many of them are not happy about it. Nor indeed are Sweden’s competition and financial watchdogs, which both oppose the proposal, arguing that access to cash should be the sole responsibility of the state and not private banks. “To secure access to cash is a collective good that the state should reasonably be responsible for,” the Swedish Financial Supervisory Authority said. It’s an opinion that’s shared by ATM provider Bankomat, which argued that it should be the state’s responsibility to ensure that citizens have access to cash since the handing of notes and coins is such an important — and expensive — part of a country’s infrastructure. Bankomat is jointly owned by the five largest banks in Sweden.

To be continued. Forever.

• FBI Reviews Tesla Model 3 Production Numbers As Part Of Criminal Probe (CNBC)

The FBI is reviewing Tesla’s Model 3 production numbers as part of an ongoing criminal probe into whether the company misled investors, according to a Wall Street Journal report published Friday. Federal agents are reviewing Tesla’s stated Model 3 numbers dating back to early 2017, the Journal reports, citing unnamed sources. Tesla had previously said it provided documents to the Department of Justice regarding CEO Elon Musk’s controversial take-private tweet — a blunder that ultimately cost Tesla and Musk a combined $40 million in fraud settlement fees. Now Tesla says it also provided information to the Department of Justice regarding Musk’s public statements regarding production numbers of its Model 3 sedan.

Tesla says the company has not received “a subpoena, a request for testimony, or any other formal process,” but the Journal reported Friday that former Tesla employees have received subpoenas and requests for testimony. Tesla struggled to ramp up Model 3 production as promised, plagued by factory issues and reports of unfit working conditions. Musk set lofty goals and insisted on sticking to them, according to countless media reports. Federal agents are probing whether the company knowingly made public statements of impossible production goals, the Journal reported.

Godspeed.

• Varoufakis, Bernie Sanders To Launch Progressives International Movement (RT)

Former Greek Finance Minister Yanis Varoufakis said he and US Senator Bernie Sanders will in a month formally launch a left-wing counterpart to the nationalist movement being forged by Steve Bannon. A Sanders-Varoufakis team-up was suggested in an recent op-ed by the Greek economist published by the Guardian. The formal creation of Progressives International is to happen in Sanders’ home state of Vemont on November 30, Varoufakis announced during a press conference in Rome on Friday. Varoufakis, who led tough negotiation with European lenders in 2015 before resigning after Athens agreed to EU’s austerity terms, says the world today is facing a crisis of leadership similar to what Europe saw in the 1930s.

With the establishment failing the common people, populist nationalist forces are rising to power, offering quick and simple solutions to problems like social inequality, loss of jobs to countries with cheaper labor and mass migration. Steven Bannon, the former strategist for the Donald Trump 2016 campaign, is currently trying to unite such right-wing forces in various nations into a global movement. For Varoufakis figures like Bannon, Italian Interior Minister Matteo Salvini, Hungarian President Viktor Orban and others pose a threat similar to the fascist movements of the 1930s, according to his Guardian op-ed. He and potential allies like Sanders or UK’s Labour leader Jeremy Corbyn can offer an alternative way out of the crisis, he believes.

But if they are to succeed in a struggle for power against both the globalist establishment and the nationalists, they need to unite across borders. “The financiers are internationalists. The fascists, the nationalists, the racists – like Trump, Bannon, [German Interior Minister Horst] Seehofer, Salvini — they are internationalists,” Varoufakis told BuzzFeed News. “They bind together. The only people who are failing are progressives.”

Could be part of a solution.

• Mexico Offers Caravan Migrants Temporary Work Permits, Housing (BBC)

Mexico has offered temporary work permits to migrants who register for asylum, as a big caravan of Central American migrants makes its way through the country toward the US. The plan also envisages temporary ID cards, medical care and schooling. But to qualify, migrants must remain in Mexico’s southern Chiapas and Oaxaca states. The US has warned that about 800 troops may be sent to the US-Mexico border to stop the migrant caravan. “I am bringing out the military for this National Emergency,” US President Donald Trump said earlier this week. “They [migrants] will be stopped!” The president also threatened cutting aid to Guatemala, El Salvador and Honduras. The caravan set off from Honduras several weeks ago.

The scheme, announced by President Peña Nieto, covers Central Americans who have officially asked for a refugee status in Mexico or are planning to do so in the nearest future. It is called Estas en Tu Casa (“This is Your Home” in Spanish). “Today, Mexico extends you its hand,” President Nieto said. But he added: “This plan is only for those who comply with Mexican laws, and it’s a first step towards a permanent solution for those who are granted refugee status in Mexico.” The plan envisages: • Temporary ID cards and work permits • Medical care • Schooling for migrants’ children • Housing in local hostels. But President Nieto failed to explain what would happen to the migrants if they chose to carry on regardless.

But they confuse climate crisis and species extiction. Not the same thing at all.

• Hundreds Ready To Go To Jail Over Climate Crisis (G.)

A new group of “concerned citizens” is planning a campaign of mass civil disobedience starting next month and promises it has hundreds of people – from teenagers to pensioners – ready to get arrested in an effort to draw attention to the unfolding climate emergency. The group, called Extinction Rebellion, is today backed by almost 100 senior academics from across the UK, including the former archbishop of Canterbury Rowan Williams. In a letter published in the Guardian they say the failure of politicians to tackle climate breakdown and the growing extinction crisis means “the ‘social contract’ has been broken … [and] it is therefore not only our right, but our moral duty to bypass the government’s inaction and flagrant dereliction of duty, and to rebel to defend life itself.”

Those behind Extinction Rebellion say almost 500 people have signed up to be arrested and that they plan to bring large sections of London to a standstill next month in a campaign of peaceful mass civil disobedience – culminating with a sit-in protest in Parliament Square on 17 November. Roger Hallam, one of the founders of the campaign, said it was calling on the government to reduce carbon emissions to zero by 2025 and establish a “citizens assembly” to devise an emergency plan of action similar to that seen during the second world war. On top of the specific demands, Hallam said he hoped the campaign of “respectful disruption” would change the debate around climate breakdown and signal to those in power that the present course of action will lead to disaster.

“The planet is in ecological crisis – we are in the midst of the sixth mass extinction event this planet has experienced,” he said. “Children alive today in the UK will face the terrible consequences of inaction, from floods to wildfires, extreme weather to crop failures and the inevitable breakdown of society. We have a duty to act.”

Make America Great Again MUST start with American nature, with protecting species. Major flaw.

• US Withdrawal Of Gillnet Protections For Whales, Turtles Ruled Illegal (R.)

The Trump administration unlawfully withdrew a plan to limit the number of whales, turtles and other marine creatures permitted to be inadvertently killed or harmed by drift gillnets used to catch swordfish off California, a federal judge has ruled. The decision requires U.S. fisheries managers to take steps to implement the plan, which calls for placing numerical limits on the “bycatch” of bottlenose dolphins, four whale species and four sea turtle species snared in swordfish gillnets. As currently written, the regulation in question also would mandate suspension of swordfish gillnet operations altogether off Southern California if any one of the bycatch limits were exceeded.

The Pacific Fishery Management Council endorsed the plan in 2015, and it was formally proposed for implementation by the U.S. Commerce Department’s National Marine Fisheries Service the following year. The rule was expected to gain final approval but was abruptly withdrawn instead in June 2017 under President Donald Trump, whose Commerce Department determined the cost to the commercial fishing industry outweighed conservation benefits. The environmental group Oceana sued, accusing the Commerce Department of violating U.S. fisheries laws and the federal Administrative Procedures Act. Oceana also asked the courts to order the agency to put the bycatch limits into effect.

U.S. District Judge R. Gary Klausner declined to force the National Marine Fisheries Service to immediately implement the restrictions in a decision handed down Wednesday in Los Angeles. But he sided with environmentalists in finding the agency’s reversal exceeded its authority and was “arbitrary, capricious or an abuse of its discretion.”