John Collier Workmen at emergency office construction job, Washington, DC Dec 1941

“..if BofA has some major and unexpected litigation provision or some “rogue” loss as a result of marking its deeply underwater bond portfolio [..], the drop in the S&P will increase by a whopping 30%, and all due to just one company.”

• As Very “Grim” Earnings Season Unfolds, All Eyes Will Be On Bank of America (ZH)

[..] it isn’t AAPL that everyone will be looking at this quarter – the company that will make or break the Q3 earnings season is not even a tech company at all, but a financial: it’s Bank of America. The reason, as Factset points out, is that thanks to a base effect from a very weak Q3 in 2014, Bank of America is not only projected to be the largest contributor to year-over-year earnings growth for the Financials sector, but it is also projected to be the largest positive contributor to year-over-year earnings for the entire S&P 500! The positive contribution from Bank of America to the earnings for the Financials sector and the S&P 500 index as a whole can mainly be attributed to an easy comparison to a year-ago loss. The mean EPS estimate for Bank of America for Q3 2015 is $0.36, compared to year-ago EPS of -$0.01.

In the year-ago quarter, the company reported a charge for a settlement with the Department of Justice, which reduced EPS by $0.43. Bank of America has only reported a loss in two (Q1 2014 and Q3 2014) of the previous ten quarters. This is how big BofA’s contribution to Q3 earnings season will be: if Bank of America is excluded from the index, the estimated earnings growth rate for the Financials sectors would fall to 0.7% from 8.2%, while the estimated earnings decline for the S&P 500 would increase to -5.9% from -4.5%. In other words, if BofA has some major and unexpected litigation provision or some “rogue” loss as a result of marking its deeply underwater bond portfolio to market as Jefferies did last week pushing its fixed income revenue (not profit) negative, the drop in the S&P will increase by a whopping 30%, and all due to just one company.

Finally, if the market which has been priced to perfection for years finally cracks – and by most accounts it will be on the back of bank earnings which have not been revised lower to reflect a reality in which the long awaited recovery was just pushed back to the 8th half of 2012, and where trading revenues are again set to disappoint – then the recently bearish David Tepper will once again have the final laugh because not only will the new direction in corporate revenues and earnings by confirmed, but a very violent readjustment in the earnings multiple would be imminent. As a reminder, Tepper hinted that the new fair multiple of the S&P 500 would drop from 18x to 16x. Applying a Q3 EPS of 114 and, well, readers can do their own math…

“..foreign euro-denominated bond issuance has dwarfed the borrowing of the domestic non-financial private sector for years..”

• Monetary Stimulus Doesn’t Work The Way You Think It Does, Redux (FT)

Once upon a time people thought central banks could boost business investment by lowering interest rates. Thus America had its Large-Scale Asset Purchase programmes, which, according to the Fed, lowered longer-term Treasury yields. Again, according to the Fed, part of the appeal of these purchases was the impact they would have on investors with fixed income liabilities. Unable to hit their return targets with safer bonds they would be forced to buy riskier instruments, which, in theory, should improve the flow of credit to businesses and households and therefore spending. The plan worked, from a certain point of view. Most of the US government bonds bought by the Fed were sold by foreigners, and for the most part they used their proceeds to buy newly issued dollar-denominated corporate bonds.

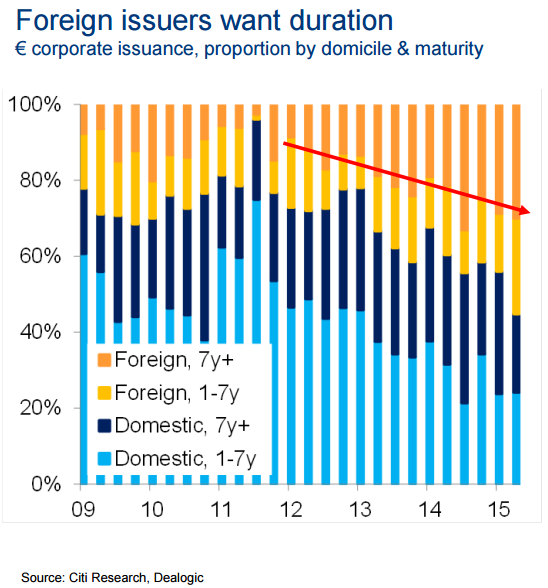

The problem was that these new bonds overwhelmingly funded companies outside the US, often firms based in emerging market countries that wanted to exploit the yield spread between local currency financial assets and dollar liabilities. (This shouldn’t have been too surprising, since researchers have found borrowing costs are irrelevant for investment decisions.) It turns out something similar has happened in Europe. First, consider who has been borrowing since 2012, when Mario Draghi uttered his priestly incantation to narrow credit spreads. It turns out basically all of the euro-denominated bonds issued by the private non-financial sector were issued by companies outside the euro area. The share of euro-denominated corporate issuance has soared from about one fifth of the total to about half. Via a recent presentation by Citi’s Hanz Lorenzen:

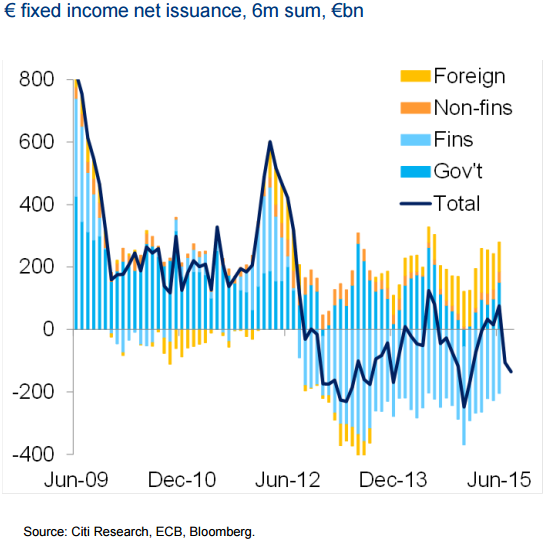

Some of this can probably be explained by the incredible shrinkage of European bank balance sheets, but as the chart below shows, foreign euro-denominated bond issuance has dwarfed the borrowing of the domestic non-financial private sector for years:

We’ve previously noted the eagerness of American firms to borrow in euros — which, counterintuitively, has encouraged European banks to increase their borrowing in dollars. (Unlike the offshore dollar bonds issued by many emerging market companies, Americans and Europeans don’t seem to be borrowing to finance unhedged cash holdings in higher-yielding foreign currency.) [..] we have at least two significant examples of central bank stimulus, ostensibly meant to encourage borrowing and capital expenditure by domestic businesses, instead encouraging foreign firms to borrow from foreign investors using local currency. No wonder people are so hungry for alternatives to the existing monetary transmission mechanism.

Even the Economist wakes up to the perversity of UK housing policies.

• Britain Has One Booming Market That Could Do With A Crash (Economist)

As house prices rise globally, in Britain they are soaring. In the past 20 years they have increased by more than in any other country in the G7; by some measures British property is now the most expensive in the world, save in Monaco. It is particularly dear in the south-east, where about one-quarter of the population lives. According to Rightmove, a property website, at today’s rate of appreciation the average London property will cost £1m ($1.5m) by 2020. The booming market weighs heavily on the rest of the economy. People priced out of the capital take jobs in less productive places or waste time on marathon commutes. Young Britons have piled on mortgage debt—those born in 1981 have one-half more of it than those born in 1961 did at the same age—making them vulnerable to rises in interest rates, which are coming. Some will retire before they pay it off.

Who is to blame? One oft-cited culprit is rich foreign buyers, who are said to see London property as a tax-efficient investment, or even a way to launder ill-gotten gains. Having bought plum properties, they often leave them empty. Transparency International (TI), a pressure group, identified 36,342 London properties held by offshore companies. Polls by YouGov show that the most popular explanation for high prices is “rich people from overseas buying top-end London property”. The argument does not stand up. For one, the number of vacant houses in England has fallen, from 711,000 in 2004 to 610,000 in 2014. And foreign ownership of houses is rare beyond a tiny corner of the capital. TI says that in Westminster one-tenth of all property is owned by firms in tax havens. But outside the centre things look different; the rate is just 1.3% in posh Islington, for instance, and beyond London it is even lower.

Demand from within Britain exerts a much bigger effect. In the past 20 years the population has grown by 11%, twice the average in the European Union. As in other countries, people are marrying later and divorcing more readily than they did in previous decades, meaning that one in ten Britons now lives alone, boosting the demand for homes. Despite stagnant incomes, buyers have more bite in the housing market. The Bank of England’s base rate of interest has been 0.5% since 2009; in real terms, rates have been below their historical peacetime average since 2004 and in nominal terms they are at their lowest ever. Demand has been stoked by “Help to Buy”, a mortgage-subsidy scheme launched in 2013.

Britons have thus taken on masses of cheap debt. In the 1970s it took the average mortgage-holder eight years to pay off his loan, estimates Neal Hudson of Savills, an estate agent. These days it will take 20 years. Small wonder: the average loan-to-income ratio has jumped from 1.8 in 1981 to 3.2 in 2014. And many are not just buying houses for their own use. Outstanding “buy-to-let” mortgages for landlords are now worth £190 billion, more than 20 times their value at the turn of the century. The National Housing and Planning Advice Unit, a former public body, found that 7% of a total increase in house prices of 150% between 1996 and 2007 was accounted for by increased lending to landlords.

“On 23 July 1973, the EPA accused it of installing defeat devices in cars it wanted to sell in the 1974 model year.”

• Forty Years Of Greenwashing – The Well-Travelled Road Taken By VW (Bloomberg)

Almost as soon as governments began testing vehicle emissions, carmakers found ways to cheat. In the 1970s, some vehicles were found to be rigged with “defeat devices” that turned off the emission systems when the air-conditioning was on. Others had sensors that activated pollution controls only at the temperature regulators used during the tests. “The concept of a defeat device has always been there, because there s such an incentive for the manufacturers to cheat on the emissions tests, said Clarence Ditlow at Washington s Center for Auto Safety. Volkswagen “took it to another level of sophisticated deception we’ve never seen before”.

The scandal now engulfing VW, which has admitted to fitting cars with software designed to give false readings in emissions tests, is unique both for its size and digital complexity. But it’s not the first emissions-cheating case, even for the German giant itself. On 23 July 1973, the EPA accused it of installing defeat devices in cars it wanted to sell in the 1974 model year. VW then admitted it had sold 1973 models with the devices, which consisted of temperature-sensing switches that cut out pollution controls at low temperatures. The EPA suspected that VW had sold 25,000 vehicles with the cheating technology. The US took the company to court for violating the Clean Air Act. It settled with a $120,000 fine without admitting any wrongdoing.

In 1995 General Motors agreed to pay $45m after being accused of circumventing pollution controls on 470,000 Cadillac luxury sedans. The cars 4.9-litre V8 engines were tuned to turn off pollution controls when the air-conditioning ran, the EPA said at the time. The government alleged that the engines, installed for the model years from 1991 to 1995, ended up releasing 100,000 tons of excess carbon monoxide into the atmosphere. GM disagreed, saying it was paying the fine as part of a conciliatory approach inn order to dispose of enforcement cases more quickly. Besides agreeing to cover $25m in recall costs, GM paid an $11m fine and agreed to spend $9m in corporate community service . To help the cause of cleaner air, the Detroit-based carmaker agreed to buy back older, more polluting cars and provide school districts with buses powered by batteries or natural gas.

The EPA says VW has admitted to using defeat devices in the 482,000 cars now under investigation in the US. The agency says the devices sensed when they were being tested on a dynamometer. In these circumstances, the car uses an emission control system that traps nitrogen oxide, a key ingredient in smog. When the car senses it is on the road, it cuts back on the emission control releasing from 10 to 40 times the permissible amount of nitrogen oxide. “It takes a very savvy program to fool the computer and detect the sophisticated test cycle, said Stanley Young, at the California Air Resources Board, which is also investigating VW. “This was clearly well thought-out and took a lot of programming. Engines these days are very complicated”, he added. “So there is a sophisticated and powerful computer inside all cars, and that was where this algorithm, this second routine, was embedded”.

“Our members don’t know if they’re coming or going,” said Luke Bosdet of the AA.”

• Volkswagen Scandal: The Cost Of A Car Crash Like No Other (Telegraph)

VW represents 12.9pc of the global passenger car market, but its reach is even broader than that. The firm also generated 13pc of earnings per share for the entire DAX index of large-value German stocks, Deutsche Bank figures suggest, and its reputation is tied up with that of Germany’s manufacturing clout. The company also buys 12pc of the world’s semi-conductors, according to UBS, and even if the producers of this technology are not implicated in the scandal their sales could suffer as the market recalibrates. After Toyota’s massive recall in 2009-10, suppliers to Hyundai benefited. “As such, we think a switch to US/Japanese vendors needs to be monitored going forwards,” said the UBS analysts. The worst-case scenario for VW includes an $18bn fine in the United States – or $37,500 for each of the half a million diesel cars it has sold there – along with class actions lawsuits, a criminal investigation and further penalties around the world.

Previous fines in the US for such transgressions have been much smaller. Caterpillar and others were in 1998 handed an $83.4m penalty for defeat devices on industrial diesel engines. General Motors recently agreed to pay $935m for covering up an ignition problem linked to 169 deaths. VW has felt some of this pain already. A sum greater than the possible fine has already been wiped from its market value, angering some shareholders, including Nordea Bank, which said it will retain its 2.2bn kronor stock and debt holdings but has banned its fund managers from buying any more VW stock. Other manufacturers including BMW, Daimler, Jaguar Land Rover and Renault have said they do not use defeat devices, although the listed carmakers have also been caught up in the sell-off of car stocks around the world in the past week. For drivers of diesel cars of all marques, this news is particularly shocking.

“The central point is that from a driver’s point of view, they were told they had to reduce their CO2 and many of them have gone to diesel as a result and as a way to deal with high fuel costs. Now they’ve been told they’ve done the wrong thing. Our members don’t know if they’re coming or going,” said Luke Bosdet of the AA. More than half of European motorists use diesel – compared to less than 3pc in the United States – following tax breaks and other cost benefits designed to reduce Europe’s emissions of carbon dioxide under the Kyoto Protocol agreed in the 1990s. “The move against VW is going to act as a catalyst to speed up the fall in diesel market share in Europe and halt it in the US,” Bernstein told clients. “In fact, regulators will now be much more conservative about what they permit and much tougher real-world tests may prove either too difficult or too expensive for diesel to meet.”

The UK, already struggling to meet European targets on air quality, might now accelerate measures to reduce the use of diesel cars. London, Birmingham and Leeds are forecast to exceed EU air pollution limits until 2030, and local governments are examining levies and even bans on certain disel vehicles to ensure that pollution readings fall. A study by King’s College London published last year found that nearly 9,500 people a year were dying prematurely in London every year as a result of air pollutants including nitrogen oxide. Given the health implications of the scandal, the cost – both financially and in terms of reputation – remains incalculable, but what is clear is that it will be a long time before Volkswagen is able to fulfil its long-held desire to expand further into the lucrative US market, or anywhere else for that matter.

Revolving doors.

• VW Scandal Exposes Cozy Ties Between Industry And Berlin (Reuters)

There are good reasons why Berlin stands by its car companies. The industry employs over 750,000 people in Germany, has been a poster child for German engineering prowess and dwarfs other sectors of the economy. In 2014, the big three carmakers, Volkswagen, Daimler and BMW, hauled in revenues of €413 billion, far bigger than the German federal budget, which stood at just under €300 billion. This has bred a cozy relationship between the industry and politicians. Top auto lobbyist Wissmann is a veteran of Merkel’s Christian Democratic Union (CDU) who, despite their cabinet clash 20 years ago, uses the familiar “Du” with the chancellor.

Daimler’s chief lobbyist is Eckart von Klaeden, a senior CDU politician who worked under Merkel in the chancellery and whose abrupt switch to the Mercedes manufacturer in 2013 prompted an investigation by Berlin prosecutors and new rules on “cooling off” periods. His predecessor at Daimler was Martin Jaeger, now spokesman for Finance Minister Wolfgang Schaeuble. The ties cross party lines. Thomas Steg, a former spokesman under Social Democrat (SPD) chancellor Gerhard Schroeder, heads up government affairs at Volkswagen. Even former foreign minister Joschka Fischer of the environmentalist Greens has done ads for BMW in recent years. The political connections are particularly strong at Volkswagen, whose arcane shareholder structure is laid out in the “Volkswagen Law” which dates back to 1960 and has faced repeated legal challenges at the European level.

The law effectively shields the company from takeovers and bestows hung influence on Lower Saxony, a state in central Germany that owns a 20 percent stake in VW and has been a stepping stone to national power for countless politicians. Premiers of Lower Saxony who have sat on VW’s board include Schroeder, nicknamed the “Auto Chancellor”, current Vice Chancellor Sigmar Gabriel and former president Christian Wulff. When Schroeder launched his far-reaching reform of the German labor market in 2003, he turned to Peter Hartz, the human resources chief of VW, to steer it. Years later, Hartz was at the center of another major scandal to hit VW, a tale of corruption involving lavish company trips for employee representatives, including visits to prostitutes. He received a suspended sentence and a fine.

The VW scandal has also exposed the toothlessness of Germany’s regulatory regime, opposition parties and industry experts say. The main oversight agency for the car sector, the Federal Motor Transport Authority, falls under the Transport Ministry in Berlin, raising questions about its independence and readiness to police the sector. “The worst of all is that the automobile industry was left to do these tests themselves, there was no control,” Oliver Kirscher, a lawmaker for the Greens said in a debate in the German parliament on Friday. Industry group the VDA rejects the idea that controls were lax and says it has been pressing for reform of the test regime for emissions “intensively and constructively” for years.

What a surprise.

• UK Government Tried To Block Tougher EU Car-Emissions Tests (Guardian)

The British government sought to block EU legislation that would force member states to carry out surprise checks on the emissions of cars, raising fresh questions over ministers’ attitude to air pollution and their conduct in the Volkswagen scandal. A document obtained by the Observer reveals that the Department for Environment, Food and Rural Affairs has been advising British MEPs to vote against legislation that would oblige countries to carry out “routine and non-routine” inspections on vehicles’ “real-world” emissions. The revelation will add to the growing concerns over the government’s commitment to tackling air pollution. It follows the admission last week that the Department for Transport had ignored significant evidence of the fraudulent practices being employed by the car industry when this was sent to it a year ago.

Around 29,000 deaths in the UK are hastened by inhalation of minute particles of oily, unburnt soot emitted by all petrol engines, and an estimated 23,500 by the invisible but toxic gas nitrogen dioxide (NO2) discharged by diesel engines. Volkswagen has been engulfed in a scandal after it emerged that some of its diesel cars had been fitted with devices that could detect when they were being tested, concealing the real level of pollutants being emitted by them when on the road. Now it has emerged that Defra has also been lobbying against part of a proposed EU directive that would force member states to establish national testing regimes to catch out those who tried to conceal the damage they were doing. The proposed legislation – the national emissions ceiling directive – is designed to “ensure that policies and measures are effective in delivering emission reductions under real operating conditions”, according to the European commission.

A Defra briefing document circulated among European parliamentarians in July, and seen by the Observer, says that, while the British government agrees in principle to the need for tough checks to enforce emission limits of NO2, MEPs should vote against the imposition on member states of “market surveillance and environmental inspections” as the legislation is unclear and legally unnecessary. The British government has also been seeking to water down legislation in the directive which seeks to limit the emission of a series of pollutants other than NO2, including methane and ammonia. Officials claim that some of the measures proposed would unnecessarily increase the “administrative burden for industry and government”, according to the briefing paper. The European parliament is due to vote on the proposals at the end of October.

I see a lawsuit in your future.

• Volkswagen Scandal Costs Qatar’s Sovereign Wealth Fund $5 Billion (Telegraph)

The collapse in Volkswagen’s share price as a result of the widening emissions scandal has cost Qatar’s sovereign wealth fund more than £3.3bn, according to calculations seen by The Telegraph. Qatar Holdings – a subsidiary of the Qatar Investment Authority (QIA) – is the third largest shareholder in the German car manufacturer, with a 17pc stake, after Porsche and the German state of Lower Saxony. As a result of VW’s 34pc share price fall last week, more than €20bn (£14.7bn) has been wiped off the value of the car company. In the last week alone Qatar Holdings has seen almost £2.8bn wiped off the value of its portfolio mainly due to losses in Volkswagen following the revelations that it had allegedly cheated US emissions tests for its diesel cars.

Qatar Holdings now holds a mixture of ordinary shares and preference shares in VW. Preference shares offer a higher return but have no voting rights in company management. Combined they have lost £3.3bn in Volkswagen so far this year, according to calculations. The Qataris initially bought into the company through a complex deal in 2009 with Porsche, which involved the carmaker transferring most of its VW share options to Qatar Holdings. The problems at VW are not Qatar’s only problems – the fund is sitting on paper losses approaching £7bn as a result of its variety of investments.

“If any vehicle failed to meet emissions targets, a team of engineers from Volkswagen headquarters or luxury brand Audi’s base in Ingolstadt was flown in..”

• Volkswagen Managed Faked US Test Results From Germany (Bloomberg)

Volkswagen executives in Germany controlled the key aspects of emissions tests whose results the carmaker now admits were faked, according to three people familiar with the company’s U.S. operations. The criteria, outcomes and engineering of cars that missed emissions targets were overseen by managers at Volkswagen’s base in Wolfsburg, according to the people who asked not to be identified because they weren’t authorized to speak publicly. Their accounts show the chain of command and those involved in the deception stretched to Volkswagen headquarters. While the company has asked German prosecutors to open an investigation, the executive committee of the supervisory board has backed former CEO Martin Winterkorn’s statement that he knew nothing about the malfeasance.

Emissions testers at the company’s site in Westlake Village, California, evaluated all the cars involved according to criteria sent from Germany and translated into English, and all results were sent back to Germany before being passed to the EPA, one of the people said. If any vehicle failed to meet emissions targets, a team of engineers from Volkswagen headquarters or luxury brand Audi’s base in Ingolstadt was flown in, the person said. After the group had tinkered with the vehicle for about a week, the car would then pass the test. VW had no engineers in the U.S. able to create the mechanism that cheated on the test or who could fix emissions problems, according to two other people. Audi development chief Ulrich Hackenberg and Porsche development head Wolfgang Hatz are among those who will leave the company in the wake of Winterkorn’s resignation two days ago. The two previously ran units at the heart of the affair – Hackenberg, a Winterkorn confidant, was responsible for VW brand development from 2007 to 2013, while Hatz ran the group’s motor development from 2007 to 2011.

Politicians have too much to lose, or so they think.

• While EU Governments Demur, Refugees Find A Welcome On The Web (Guardian)

With one million people expected to seek asylum in Europe this year and governments arguing over how to cope, thousands of volunteers are taking to the Internet to offer refugees shelter free of charge. In France, the Netherlands and other European countries, private individuals are proposing free lodging via Web-based platforms inspired by Airbnb, the home rental venture that has flourished with the rise of smartphones. Some fear private endeavors may complicate government efforts to direct the refugee flow, or simply prove too short-lived as the strains of sharing a home take their toll. “It’s laudable symbolically but it’s not the model favored by the state,” said an official at the interior ministry of France, where arrivals are despatched to accommodation centers or state-paid hotel rooms.

But refugees, many of whom relied heavily on mobile phone maps and communications during their journey to Europe from Syria, Iraq or Africa, will find plenty of offers online. On one Irish website, more than 1,000 people “pledged a bed” for refugees within three hours. In Germany, “Refugees Welcome” offers a matching service to put people with lodgings in touch with refugees. One French venture, Singa, has registered 10,000 offers of free lodgings since it started up in June and now has 10 volunteers working full time to match refugees with hosts. “We’re overwhelmed. We had no idea there would be such an enthusiastic response,” said founder Nathanael Molle. So far, Singa has put 47 refugees in homes around Paris.

Civil servant Clara de Bort, 40, used to rent a spare room to paying tourists. Now she shares her home for free with Aicha, a woman who fled ethnic conflict and forced marriage in Chad and who has been through 14 different state-funded accommodation centers and hotels since she arrived two years ago. Aicha, 25, recently equipped with a book to help her learn French, hopes for a convivial living arrangement and eventual stability. “What I need now is to speak French properly, get a job and find a HLM (long-term social housing),” said the Arabic-speaker. She asked not to have her family name published. Dutch-based Refugee Hero, whose founders describe it as a “mobile-friendly website with similar functionality to Airbnb”, says 50 refugees have made contact since it started a few days ago.

This could go completely off the rails. Madris threatens with the army. The army itself does too.

• Catalonia Vote Opens With Separatists Tipped To Win (AFP)

Polls opened Sunday in a regional election in Catalonia seen as the most important in Spain’s recent history, with separatists tipped to win. Polling stations opened under cloudy skies in Barcelona, where red- and yellow-striped Catalan flags hung from buildings, AFP reporters saw. More than 5.5 million of Catalonia’s 7.5 million inhabitants were eligible to vote at nearly 2,700 polling stations across the region. A pro-independence alliance led by regional president Artur Mas has vowed to proceed towards a declaration of independence by 2017 if it secures a majority in the regional parliament, even if it manages to do so without a majority of votes. Spain’s central government brands secession illegal and has called for the country to stay united as the eurozone’s fourth-biggest economy recovers from recession.

Madrid says Catalonia would drop out of the European Union and eurozone if it broke away from Spain. “Catalonia decides its future in Europe,” ran Sunday’s front-page headline in the centre-right national daily El Mundo. “The future of Catalonia is at stake,” said Catalan daily La Vanguardia. Centre-left national El Pais declared the ballots “historic” on its front page. Nationalists in Catalonia, which has its own language and cultural traditions, complain that they get less back from Madrid than they pay in taxes. Separatist demands have surged in the recent years of economic crisis. Mas wants Catalonia to follow the example of Scotland and Quebec in Canada by holding a vote on independence – though in both those cases most voters rejected a breakaway. Since Madrid has blocked Mas’s efforts to hold a straight referendum, he has framed Sunday’s election for the regional parliament as an indirect vote on secession.

The end of the conveyor belt?!

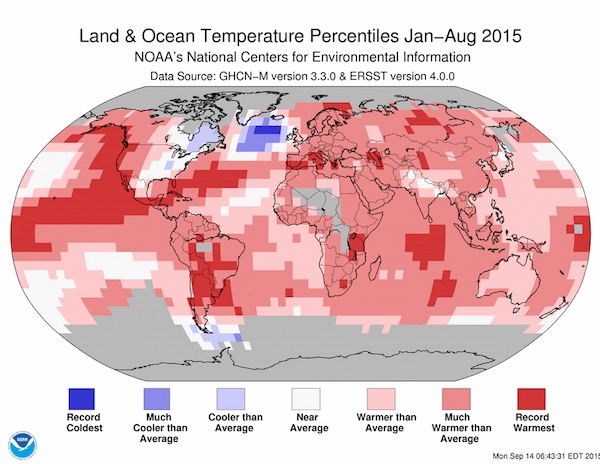

• Scientists Are Worried About A Cold ‘Blob’ In The North Atlantic Ocean (WaPo)

It is, for our home planet, an extremely warm year. Indeed, last week we learned from the National Oceanic and Atmospheric Administration that the first eight months of 2015 were the hottest such stretch yet recorded for the globe’s surface land and oceans, based on temperature records going back to 1880. It’s just the latest evidence that we are, indeed, on course for a record-breaking warm year in 2015. Yet, if you look closely, there’s one part of the planet that is bucking the trend. In the North Atlantic Ocean south of Greenland and Iceland, the ocean surface has seen very cold temperatures for the past eight months: What’s up with that? First of all, it’s no error.

I checked with Deke Arndt, chief of the climate monitoring branch at NOAA’s National Centers for Environmental Information, who confirmed what the map above suggests — some parts of the North Atlantic Ocean saw record cold in the past eight months. As Arndt put it by email: “For the grid boxes in darkest blue, they had their coldest Jan-Aug on record, and in order for a grid box to be “eligible” for that map, it needs at least 80 years of Jan-Aug values on the record.” Those grid boxes encompass the region from “20W to 40W and from 55N to 60N,” Arndt explained. And there’s not much reason to doubt the measurements — the region is very well sampled. “It’s pretty densely populated by buoys, and at least parts of that region are really active shipping lanes, so there’s quite a lot of observations in the area,” Arndt said.

“So I think it’s pretty robust analysis.” Thus, the record seems to be a meaningful one — and there is a much larger surrounding area that, although not absolutely the coldest it has been on record, is also unusually cold. At this point, it’s time to ask what the heck is going on here. And while there may not yet be any scientific consensus on the matter, at least some scientists suspect that the cooling seen in these maps is no fluke but, rather, part of a process that has been long feared by climate researchers — the slowing of Atlantic Ocean circulation. In March, several top climate scientists, including Stefan Rahmstorf of the Potsdam Institute for Climate Impact Research and Michael Mann of Penn State, published a paper in Nature Climate Change suggesting that the gigantic ocean current known as the Atlantic Meridional Overturning Circulation, or AMOC, is weakening.

It’s sometimes confused with the “Gulf Stream,” but, in fact, that’s just a southern branch of it. The current is driven by differences in the temperature and salinity of ocean water (for a more thorough explanation, see here). In essence, cold salty water in the North Atlantic sinks because it is more dense, and warmer water from farther south moves northward to take its place, carrying tremendous heat energy along the way. But a large injection of cold, fresh water can, theoretically, mess it all up — preventing the sinking that would otherwise occur and, thus, weakening the circulation.

Our destiny.

• Humans Have Caused Untold Damage To The Planet (Gaia Vince)

We live in epoch-making times. Literally. The changes humans have made in recent decades have been on such a scale that they have altered our world beyond anything it has experienced in its 4.5bn-year history. Our planet is crossing a geological boundary and we humans are the change-makers. Millions of years from now, a stripe in the accumulated layers of rock on Earth’s surface will reveal our human fingerprint, just as we can see evidence of dinosaurs in rocks of the Jurassic, or the explosion of life that marks the Cambrian or the glacial retreat scars of the Holocene. Our influence will show up as a mass of species going extinct, changes in the chemistry of the oceans, the loss of forests and the growth of deserts, the retreat of glaciers and the sinking of islands.

Geologists of the far future will note in the fossil records the extinctions of wild animals and the abundance of domesticates, the chemical fingerprint of materials such as aluminium drinks cans and plastic carrier bags, and the footprint of projects such as the Syncrude mine in the Athabasca oil sands of north-west Canada, which moves 30bn tonnes of earth each year – twice the amount of sediment that flows down all the rivers in the world in that time. Geologists are calling this new epoch the Anthropocene, recognising that humanity has become a geophysical force on a par with the earth-shattering asteroids and planet-cloaking volcanoes that defined past eras. Earth is now a human planet. We decide whether a forest stands or is razed, whether pandas survive or become extinct, how and where a river flows, even the temperature of the atmosphere.

We are now the most numerous big animal on Earth, and the next in line are the animals we have created through breeding to feed and serve us. 40% of the planet’s land surface is used to grow our food. Three-quarters of the world’s fresh water is controlled by us. It is an extraordinary time. In the tropics, coral reefs are disappearing, ice is melting at the poles, and the oceans are emptying of fish because of us. Entire islands are vanishing under rising seas, just as naked new land appears in the Arctic. During my career as a science journalist, it has become my business to take special interest in reports on how the biosphere was changing. There was no shortage of research.

Study after study came my way, describing changes in butterfly migrations, glacier melt rate, ocean nitrogen levels, wildfire frequency … all united by a common theme: the impact of humans. Scientists I spoke to described the many and varied ways humans were affecting the natural world. Climate scientists tracking global warming told of deadly droughts, heatwaves and metres of sea-level rise. Conservation biologists were describing biodiversity collapse to the extent of a mass extinction; marine biologists were talking of “islands of plastic garbage” in the oceans; space scientists were holding conferences on what to do about all the junk up there threatening our satellites; ecologists were describing deforestation of the last intact rainforests; agro-economists were warning about deserts spreading across the last fertile soils.