Francis Bacon Three Studies of Lucian Freud 1969

Same old song: he misses all targets and then vows to do more of the same. Tries to convey a message of recovery but talks about even more QE.

• European Central Bank Sticks To Low Rate Monetary Policy (R.)

The European Central Bank left its ultra-easy monetary policy stance unchanged as expected on Thursday, keeping rates at record lows and even leaving the door open to more asset buys if the outlook worsens. After ECB chief Mario Draghi raised the prospect of policy tightening last month, he signalled that any policy tweaks would come only gradually, setting the scene for a possible discussion in September about a long-awaited tapering of its asset buys. “We need to be persistent and patient because we aren’t there yet, and prudent,” Draghi told his regular news conference after a meeting of ECB policy-makers in Frankfurt. He stressed that the bank’s governing council were unanimous both on the decision to keep its guidance unchanged and to avoid setting a precise date for a discussion of future policy, noting only that it would occur in the autumn.

The prospect of reduced monetary stimulus has kept financial markets edgy, with investors sifting through clues to gauge how big central banks around the globe will unwind unconventional policy that have kept borrowing costs at rock bottom. Euro and government bond yields across the bloc initially slipped after the statement. But as Draghi spoke, eurozone bond yields gained ostensibly on his confirmation of expectations that the taper would be discussed in autumn. The euro firmed more than 3% and German 10-year yields doubled since Draghi’s policy hint. Indeed, the euro’s 11% rise this year will weigh on inflation, compounding the impact of a more than 10% drop in crude oil prices. “As core inflation remains subdued, the ECB will likely prefer to err on the side of caution, that is moving more slowly rather than faster than many observers project,” Holger Schmieding at Berenberg noted.

It’s the only thing they’re good at.

• Bill Gross Is Worried Central Banks Will Lead The World Into Recession (CNBC)

Bond guru Bill Gross is warning about looming interest rate increases and the damage they can do to a debt-laden global economy. In his monthly investor outlook, the Janus Henderson Advisors fund manager said the course of global central banks toward tightening policy could be perilous for the economic recovery. Raising interest rates will increase the cost of short-term debt that corporations and individuals hold. In the U.S. alone, households have $14.9 trillion in debt while businesses owe $13.7 trillion, according to the Federal Reserve. “While governments and the U.S. Treasury can afford the additional expense, levered corporations and individuals in many cases cannot,” Gross said. The Fed is on a course of gradual rate increases, with financial markets expecting it to approve one more rate hike this year.

In addition, other central banks are pulling the reins on bond-buying and other liquidity programs aimed at injecting cash into their respective economies. Gross charged that the adherence of central bankers to hard-and-fast rules that govern when they should tighten policy has “distorted capitalism as we once knew it, with unknown consequences lurking in the shadows of future years.” For instance, he cast doubt on the belief it takes short-term interest rates exceeding longer-term rates — a condition known in economist as an inverted yield curve — to produce a recession. “The reliance on historical models in an era of extraordinary monetary policy should suggest caution,” Gross wrote. “Logically (a concept seemingly foreign to central banks staffs) in a domestic and global economy that is increasingly higher and higher levered, the cost of short-term finance should not have to rise to the level of a 10-year Treasury note to produce recession.”

The EU kicking members out? i’d call that a bluff. But the Union is shaking on its foundations.

• EU Threatens Poland With ‘Nuclear Option’ Over Supreme Court Control (Ind.)

The President of Poland has been urged to veto a bill passed by lawmakers in the country that would give parliament the power to appoint Supreme Court judges. Guy Verhofstadt, the President of the Alliance of Liberals and Democrats for Europe in the European Parliament, has called on President Andrzej Duda to take action and said the European Commission should trigger the EU’s Article 7 if the issue is not resolved. The Article has been often described as a “nuclear option” and can lead to the suspension of a member country’s voting rights. “The European Parliament made it clear earlier this week that these new laws are incompatible with EU Membership and would irredeemably weaken Poland’s future place in the West,” Mr Verhofstadt said. European Council President Donald Tusk, who is also a former Polish prime minister, called for an urgent meeting with President Duda to discuss the “political crisis” in the country.

Mr Tusk described the move as backwards backward and said it went “against European standards and values”. “The European Union is not only money and procedures. It is first and foremost values and high standards of public life. That is why a wave of criticism of the government is rising in Europe and in the whole West,” Mr Tusk said. The bill was passed despite objections from lawyers and opposition politicians after critcisms it undermines democracy and the rule of law. The move would put courts under direct government control and Poland’s human rights ombudsman, Adam Bodnar, told parliament that the legislation, would “deprive citizens of the right to an independent court”. “We are planting an explosive under our judiciary,” he said.

And then Erdogan can send more refugees. Merkel screwed this up years ago.

• Germany Steps Up Economic Pressure On Turkey In Rights Row (R.)

Germany told its citizens on Thursday to exercise caution if travelling to Turkey and threatened measures that could hinder German investment there, in a sign of growing impatience with a NATO ally after the detention of rights activists. The mass-selling daily Bild newspaper, citing government sources, also reported that Berlin was putting arms projects with Ankara on hold. Foreign Minister Sigmar Gabriel highlighted alarm at what Berlin sees as the growing unpredictability of Turkish President Tayyip Erdogan. “Everyone can be affected. The most absurd things are possible,” he said in advice to travellers. Gabriel broke off his holiday to deal with the crisis after Turkey arrested six human rights activists including German national Peter Steudtner on accusations of terrorism, the latest in a series of diplomatic rows.

Germany, Turkey’s chief export partner, called the allegations absurd. “We need our policies towards Turkey to go in a new direction…we can’t continue as we have done,” Gabriel told reporters in unusually direct language touching on sensitive commercial matters including corporate investment guarantees. The Turkish foreign ministry said it would make the “necessary response” to comments it described as one-sided. Foreign Minister Mevlut Cavusoglu later accused Germany of harbouring members of the Kurdistan Workers Party (PKK), which has fought an insurgency in southeast Turkey since 1984, and the network of U.S.-based cleric Fethullah Gulen that Ankara blames for a failed coup last July. “As a country providing shelter to PKK and FETO terrorists in its own territory, statements by Germany are just double standards and unacceptable,” Cavusoglu said on Twitter.

But that’s true for most of the world.

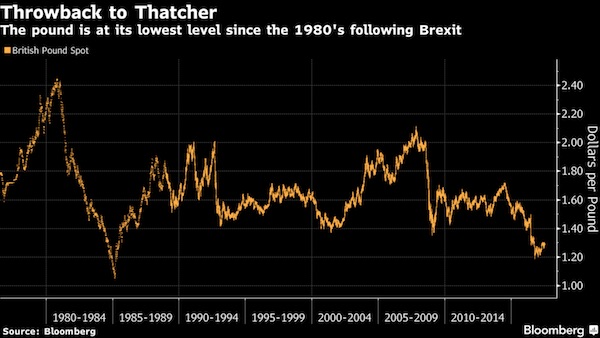

• Britain Hasn’t Been This Risky in 40 Years (BBG)

Britain is having a flashback to the 1970s, and it’s not flared trousers making a comeback. As Parliament breaks for the summer, Prime Minister Theresa May needs to come up with answers to the political drama unfolding at home and threatening her Brexit strategy as investors predict more trouble on the horizon for a country once seen as the stable counterpoint to European turmoil. You would have to go back 40 years to find a time when the country was deemed this politically risky, according to Mark Dowding at London-based BlueBay Asset Management. The ambivalence toward Europe, the political fragility of the government and a population grown weary of making sacrifices are all reminiscent of a time when Britain was tormented over whether to join a forerunner of the European Union and an economic crisis forced it to seek a humiliating bailout.

“Back in the 1970s the U.K. went to the IMF eventually and that’s likely where we will be once more,” warned Dowding. “We seem to have created some self-inflicted wounds here and it looks like we’ll be struggling for some time.” Like Edward Heath in 1974, May took a gamble in calling a snap election only for the Conservatives to lose their majority. Unlike him, she stayed on but with her future the subject of constant speculation and her rival, Labour leader Jeremy Corbyn, waiting in the wings with a promise to loosen the fiscal reins. The latest poll shows that no prime minister since 1977 has been as unpopular as she is a mere month after prevailing in elections. The next big test of her authority will be the Conservative conference in October, where challengers for the leadership might emerge.

Eurasia Group Managing Director Mujtaba Rahman said that “even though May will survive through to the party conference it’s unclear whether she survives on the other side of that.” The fallout from the Brexit vote, May’s tenuous position and a heightened security alert have created a level of turmoil rarely seen since the so-called lost decade when widespread labor unrest and political instability played out against a backdrop of terrorist attacks by Irish republicans.

Don’t know how far the analogy really goes, but a great headline.

• Concorde Was The Flying Brexit (G.)

The idea that we now live in an age of ‘post-truth’ implies that once-upon-a-time politics was guided by objective reality. Clearly, this is nonsense. We shouldn’t mistake a period in which the media and political establishment offered more coherent stories for a time when politics was truthful. In the recent past, politics could be astonishingly dishonest, especially when it came to supporting national machines. Concorde, the fastest lame duck ever built, was a flying Brexit. The political establishment privately despaired about its costs, whilst knowingly pretending that the project would improve Britain’s place in the world. Few politicians actually believed in the Concorde project. It was accepted inside Whitehall that the scheme would be an economic disaster.

After Harold Wilson came to power in 1964, the Anglo-French supersonic airliner only survived because the government was concerned that unilaterally cancelling the project would lead the French to sue them for more than it would cost to continue to develop the machine. Edward Heath, the Conservative prime minister, also wanted to cancel Concorde. Heath even personally stopped Prince Phillip flying it on the grounds that it would be quite embarrassing for the government to scrap the aeroplane soon after it had been treated to a royal pilot. Concorde only continued because Heath wanted to enter the European Economic Community. Annoying the French was to be avoided. Once Britain was in the Community, the unions kept Concorde afloat.

The second Wilson administration, a minority government, could not risk killing off Concorde for fear that the resulting the outcry in the labour movement would endanger their fragile political position. What, then, did politicians say about Concorde? Well, Concorde was not only going to bring supersonic speed to civil air travel, but also ensure that Britain could capture a crucial new export market and create a world-beating aviation industry in the coming supersonic revolution. In this bright future, Britain’s technology would be bought across the world. Most of the politicians who made these arguments knew better.

Brexit under Labour. How much worse could it be?

• Why The Moaning? If Anything Can Halt Capitalism’s Fat Cats, It’s Brexit (G.)

Jeremy Corbyn is not the first leader of the Labour party to have form as a Eurosceptic. Hugh Gaitskell was so fearful of the drive for European political union that he warned about Britain ending a thousand years of history as an independent state. Clement Attlee was no big fan of what was then called the common market either. But this was all a long time ago. Under a succession of leaders starting with Neil Kinnock, Labour warmed to Europe. In the 1980s, with Thatcherism rampant at home, the party saw Brussels as providing protection from free-market zealotry. In the 1990s, under Tony Blair, the feeling was that globalisation had made the nation state redundant. Even so, a small number of Labour MPs remained unreconciled. They pointed out that Labour’s love affair with Europe began just as Europe’s economic performance started to deteriorate.

They opposed the Maastricht treaty that paved the way for the single currency on the grounds that it would create an undemocratic central bank with deflationary tendencies. Corbyn was one member of this band. John McDonnell, now the shadow chancellor, was another. Unlike the majority of their parliamentary colleagues and most trade union leaders, they never bought the idea that being a progressive meant being positive about Europe. They saw nothing especially progressive about mass unemployment, the impact of the common agricultural policy on the developing world, the Transatlantic Trade and Investment Partnership, or the bias towards austerity ingrained in the stability and growth pact. Rather, they saw neoliberalism being hardwired into the European project. As indeed it was.

None of this really mattered until Corbyn became Labour leader two years ago. But since 2015 the maverick outsiders have become the maverick insiders. What’s more, the shambolic state of the Conservatives means that Corbyn and McDonnell could soon be neighbours in Downing Street and responsible for Brexit. Parliamentary arithmetic and the determination of the Tories to avoid another election at all costs makes this unlikely, but these are strange and unpredictable times. What Corbyn and McDonnell think about Europe now counts in a way that it didn’t before.

“Clearly you need to remember that asset price movements go in two directions..”

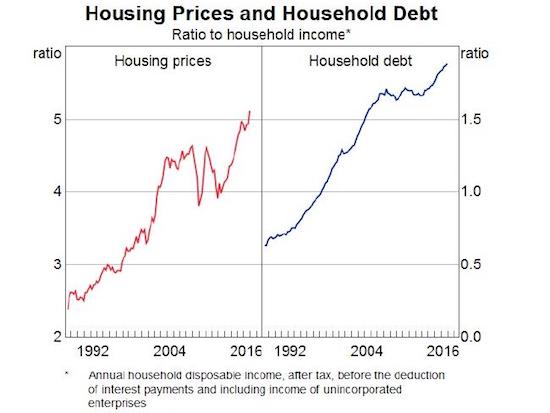

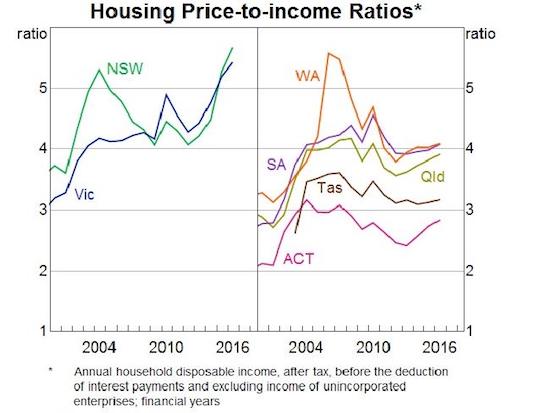

• Australia Prime Minister Quietly Issues Warning On House Prices (NCA)

The Prime Minister has issued a quiet warning to Australians investing in housing that they cannot continue to assume house prices will only go up. “Clearly you need to remember that asset price movements go in two directions,” Prime Minister Malcolm Turnbull said after a speech to an economics conference this week. In particular, this is relevant to housing. “It has been a pretty good one-way bet for a long time — but it is going to be important for people to be prudent.” Mr Turnbull made the comments alongside an observation that interest rates have risen for many borrowers. Interest rates are a big factor in the housing market. The lower the interest rate, the more you can borrow from the bank and the more you can pay for a house. Australians have borrowed a lot, and for now the risks of borrowing have been well managed, Mr Turnbull said.

But that could change. “High levels of indebtedness that are incurred with low levels of interest rates always pose a risk when you have the prospect of an increase in rates. Particularly if it has all been built on an assumption of rising asset prices.” Interest rates have been at record lows until banks recently tweaked up rates on certain investor loans. Higher interest rates across the whole housing market could be next. Financial market pricing hints that official interest rates are more likely to go up than down when the RBA next makes a move, perhaps in 2018. Mr Turnbull made his comments at the Economic and Social Outlook Conference, presented by the Melbourne Institute and The Australian. At the conference, which was thronging with people who watch the Australian economy with laser focus, Mr Turnbull was far from the only speaker worried about Australian house prices and debt.

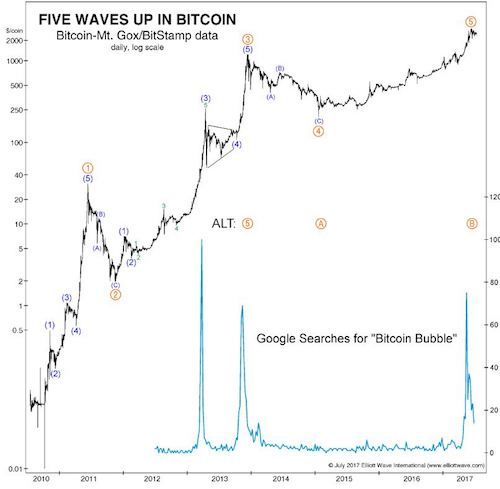

“Crypto tech is like the internet in 1999: It was poised to take over the world, but the NASDAQ still fell almost 90% during the dot-com bust of 2000-2002.”

• Bitcoin Bubble Dwarfs Tulip Mania From 400 Years Ago – Prechter Jr (CNBC)

Just as many on Wall Street are warming up to bitcoin, one of the lone financial analysts who forecast a surge when the digital currency was just six cents now has an extremely negative view. “A bearish trifecta — the Elliott wave pattern, optimistic psychology and even fundamentals in the form of blockchain bottlenecks — will lead to the collapse of today’s crypto-mania,” analyst Elliott Prechter wrote in the July 13 edition of The Elliott Wave Theorist newsletter. “The price activity and manic sentiment that led to present prices have dwarfed even the Tulip mania of nearly 400 years ago,” he said. “The success of Bitcoin has spawned 800-plus clones (alt-coins) and counting, most of which are high-tech, pump-and-dump schemes.” “Nevertheless, investors have eagerly bid them up,” Prechter added.

He’s the son of the famed technical analyst Robert Prechter, who popularized the Elliott Wave by using it to forecast the stock market crash of 1987 and has published a newsletter since 1979. However, debate over the accuracy of the Elliott Wave has grown after Robert Prechter called the end of the 1990s bull market five years before it actually ended. The principle is a sophisticated form of technical analysis widely followed by traders that analyzes cycles of sentiment in an attempt to predict market performance — five waves typically signals a coming downturn. Regarding bitcoin, “under the Elliott Wave model, what we’re seeing, we’re making a final fifth wave from six cents,” the younger Prechter told CNBC in a phone interview Thursday.

“It does not imply it will go to zero. It does not imply it will go to six cents. I do think it will happen to the clones [newly formed digital currencies].” In September 2010, Elliott Prechter wrote in The Elliott Wave Theorist about bitcoin when it traded at 6 cents. Very few in the financial world seriously considered the digital currency at the time. “It proved to be the buying opportunity not just of a lifetime, but so far of all time,” Prechter said. Bitcoin hit a record of $3,025 in June, 50,000 times its price in 2010. The digital currency traded near $2,652 Thursday, more than twice where it started the year. [..] To be sure, Prechter told CNBC that a mania “can be both a mania and a revolution at the same time.”

Like many digital currency enthusiasts, he sees significant potential in the cryptocurrencies for automating the banking and legal industries. “The distant future of crypto is bright,” Prechter said in the report. “Crypto tech is like the internet in 1999: It was poised to take over the world, but the NASDAQ still fell almost 90% during the dot-com bust of 2000-2002.” But bitcoin may not be part of that future. “It’s too soon to know if Bitcoin is Facebook or MySpace,” Prechter said.

The Tesla Tulip.

• Elon Musk: I Got ‘Approval’ For New York-DC Hyperloop. Officials Deny (G.)

Elon Musk does not have government approval to build a Hyperloop tunnel from New York City to Washington DC. The Tesla executive took to Twitter this morning to tantalize his legion of fans and the tech press with the “news” that he had “just received verbal govt approval for The Boring Company to build an underground NY-Phil-Balt-DC Hyperloop. NY-DC in 29 mins … City center to city center in each case, with up to a dozen or more entry/exit elevators in each city.” Lest any billionaires need to brush up on civics 101: the US system of government does not operate on “verbal government approvals”. Musk walked back his claim about 90 minutes later, tweeting: “Still a lot of work needed to receive formal approval, but am optimistic that will occur rapidly”. A lot of work is needed to receive formal approval, indeed.

Musk was received with typical credulity by the tech press, and considerable consternation by various government agencies. Several spokespeople who answered the phones at relevant city, state and federal government bodies laughed upon hearing of the claim that an interstate transit project with a significant street-level footprint in four of the east coast’s largest cities could be approved verbally. “Who gave him permission to do that?” asked a spokesman with the Maryland department of transportation. “Elon Musk has had no contact with Philadelphia officials on this matter,” said Mike Dunn, the city spokesman. “We do not know what he means when he says he received ‘verbal government approval’. There are numerous hurdles for this unproven ‘hyperloop’ technology before it can become reality.”

A spokesperson for the state of Pennsylvania confirmed that neither the governor nor the state’s department of transportation had been contacted by Musk or his company. Ben Sarle, a spokesman for the New York City mayor’s office, said in an email: “Nobody in City Hall, or any of our city agencies, has heard from Mr Musk or any representatives of his company.”

Makes you ponder what voice people have left in their own societies.

• To Save Rural Iowa, We Must Oppose Monsanto-Bayer Merger (Dmr)

Iowa farmers face a crisis. Crop prices have fallen by more than 50 percent since 2013, with no end in sight. At the same time, farmers hold more debt and possess fewer capital reserves to fall back on. In fact, farmers’ debt levels are almost as high as they were prior to the farm crisis of the mid-1980s. Meanwhile, a wave of mergers among the world’s agricultural giants is upending the markets for seeds, fertilizers and pesticides. If approved, the proposed merger would result in just two companies — Monsanto-Bayer and Dow-DuPont — controlling about three-quarters of the U.S. corn seed market. The power that these corporations would hold in the seed market is unprecedented.

Farmers are already being squeezed. The price of corn seed has more than doubled in the past 10 years — from $51 per acre in 2006 to $102 in 2015 — as a result of similar consolidation, including Monsanto’s purchases of DeKalb and Cargill’s international seed business. If the Monsanto-Bayer merger is permitted, this problem will only intensify, further limiting farmers’ choices and making the products they need even more expensive. The merger does not just strengthen Monsanto’s control over the corn seed industry. It also helps the company grow its dominance in other areas, like fertilizers, pesticides, and precision farming technology. Monsanto’s goal is to bundle all of these products together, sort of like how a cable company bundles internet, phone and television.

And just like with most cable companies, the service will be overpriced and shoddy because it will leave farmers with no other option. Yet this mega-merger is moving forward with barely a murmur of concern from our elected officials in Washington. Not a single senator raised this matter at confirmation hearings for Secretary of Agriculture Sonny Perdue. Even worse, the nominee to lead the Department of Justice’s Antitrust Division is a former lobbyist who asserted in a recent interview that “a monopoly is perfectly legal.” It is not surprising that Monsanto and Bayer alone spent $120 million in the last decade on lobbying elected officials at the federal level.

And while stopping the Monsanto-Bayer merger would be a good first step, we need to go even further to prevent these giants from bullying Iowa farmers. Monsanto and other agricultural giants like it are just too big. A century ago, President Teddy Roosevelt broke up the trusts and monopolies of his time because he understood that the deck was stacked against consumers, farmers and small businesses. We need to take a cue from Roosevelt and break up Monsanto and other Big Ag corporations like it.

Easy solution, and high time: put a bounty on the heads of these idiots. Organize it halfway decently and you’ll get a lot of donations.

• Son of Cecil The Lion Killed By Trophy Hunter (G.)

A son of Cecil the lion has been killed by trophy hunters in Zimbabwe, meeting the same fate as his father whose death in 2015 caused a global outcry. Xanda was six years old and had fathered a number of cubs himself. He was shot on 7 July just outside the Hwange National Park, not far from where Cecil died, but news of the death only became public on Thursday. The trophy hunt was organised by Zimbabwean private hunter Richard Cooke but his clients, who may have paid tens of thousands of dollars, have not been revealed. Xanda was wearing a GPS tracking collar, fitted by scientists led by Andrew Loveridge at Oxford University, who have studied the Hwange lions for many years.

“Xanda was one of these gorgeous Kalahari lions, with a big mane, big body, beautiful condition – a very, very lovely animal,” Loveridge told the Guardian. “Personally, I think it is sad that anyone wants to shoot a lion, but there are people who will pay money to do that.” “I put the collar on Xanda last October and spent a bit of time following him around,” he said. “You have handled them so you feel a personal engagement with the animal.” But Loveridge does not condemn trophy hunting outright: “Trophy hunting protects an area about the size of France and Spain combined in Africa. So if you throw trophy hunting out, what happens to all that habitat?” Xanda was the pride male in a group with two adult lionesses and cubs which roamed near the boundary of the national park.

“He was shot 2km from the park boundary, which is a hop and a skip for a lion,” Loveridge said. The scientists want a 5km no-hunting zone around the park. “It is something we have suggested for years,” he said. “But there is a lot of resistance because a lot of the hunting happens right on the boundary, because that is where the animals are. The photo-tourism operators in Hwange are very keen to have that discussion. They are annoyed that this has happened.” Xanda’s death poses no immediate danger to the 550-strong lion population in Hwange national park, which spreads over 15,000 square kilometres, Loveridge said: “The lion population is pretty healthy, but it would probably be better if it didn’t happen,” said Loveridge.