Lewis Wickes Hine Game of craps. Cincinnati, Ohio 1908

The following is a veritable tour de force by Nicole Foss on the value of gold in a crashing economy, for different people in different circumstances.

Nicole Foss: In light of the rapidly-propagating loss of confidence, and consequent shift to deflation, with falling prices across the board as a result, it is appropriate to review our stance on gold. The yellow metal is often perceived as a panacea – a safe haven guarding against all manner of potential financial disruption. It has long been our stance at the Automatic Earth that this is far too simplistic a position to take. We live in a complex world for which there are no simple one-dimensional solutions. It is important to distinguish between the markets for paper gold and for physical gold, and to understand the risks inherent in gold ownership in order to manage them. As we wrote back in 2009:

Firstly, the goldbugs are right that physical gold is real money (unlike paper gold, which is just another Ponzi scheme). It has held its value for thousands of years and will continue to do so over the long term. However, that does not mean that gold prices cannot fall or that purchasing gold now is the right way for everyone to preserve capital….People’s circumstances are different. Those circumstances determine their freedom of action, both now and in the future.

Bubble Dynamics

It is our view that (paper) gold has been in a bubble which peaked in 2011, along with the rest of the commodity complex. It has been subjected to the same dynamic as other commodities, which have collectively lost touch with their own fundamentals as they have become increasingly over-financialized. Financialization moves the dynamics into the virtual world, while simultaneously subjecting them to perverse incentives. Substantial price movements having at best a tenuous connection with actual supply and demand are the result.

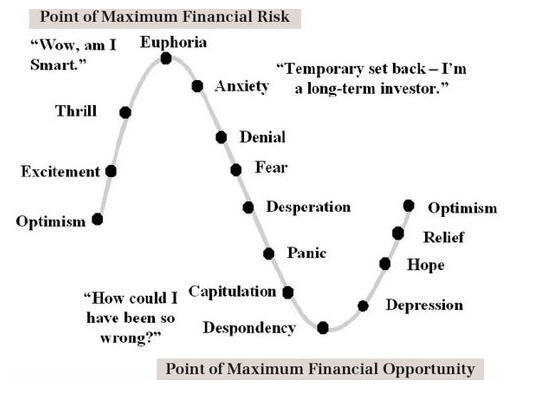

Commodity tops are fear-driven, generally on fear of scarcity. This causes market participants to anticipate ever greater demand and tighter supply, to the point where price is bid up in advance of what the fundamentals would justify. In addition, in bubble times momentum chasing becomes a major factor, with speculators assuming that which rises will continue to do so. Once ever-increasing prices become received wisdom, it no longer matters what one has to pay to buy, because there is a false perception that someone else will always pay more. This is true for a while, until it abruptly is not – until the Greatest Fool has been found. At that point a sharp reversal is on the cards.

Our view of market dynamics as swings of positive feedback in a fractal structure is grounded in human psychology. There are no efficient markets, no rational utility maximization, no equilibrium, no negative feedback, no perfect competition and no perfect information – in short the mainstream model for the functioning of markets bears no resemblance to reality. Prices do not reflect the fundamentals, but the collective state of confidence of market participants engaging in subconscious herding behaviour.

We agree with George Soros that markets are reflexive:

Soros rejected the prevailing idea that “market prices are … passive reflections of the underlying fundamentals”, a dogma he dismissed as market fundamentalism, or that there were stabilizing forces which would automatically drive prices back towards equilibrium. Instead, Soros propounded a theory of “reflexivity”, in which fundamentals shape perceptions and prices, but prices and perceptions also shape fundamentals. Instead of a one-way, linear relationship in which causality flows from fundamentals to prices and perceptions, Soros developed the theory of a loop in which prices, fundamentals and perceptions all act on one another. “I contend that financial markets are always wrong in the sense that they operate with a prevailing bias, but that the bias can actually validate itself by influencing not only market prices but also the fundamentals that market prices are supposed to reflect”.

Later he writes more bluntly: “[The efficient market hypothesis and theory of rational expectations] claims that the markets are always right; my proposition is that markets are almost always wrong but often they can validate themselves”. Beyond a certain point, self-reinforcing feedback loops become unsustainable. But in the meantime positive feedback causes bubbles to inflate further and for longer than anyone could have foreseen at the outset. “Typically, a self-reinforcing process undergoes orderly corrections in the early stages, and, if it survives them, the bias tends to be reinforced, and is less easily shaken. When the process is advanced, corrections become scarcer and the danger of a climactic reversal greater”….

….Crucially, the successful speculator responds to bubbles not by shorting them and waiting for stabilizing forces to drive the market quickly back to some fundamental value, but by identifying them early and riding the wave, hoping to get out before the whole edifice finally comes crashing down. Reading people (other investors, narratives) is as important — if not more important — as understanding the fundamentals of an asset itself. Identifying the next “new new thing” earlier than the rest of the crowd and getting aboard, and then being willing to liquidate before the deluge, is at the heart of the speculator’s success….

….Using the Soros idea of a bubble as a process, rather than simply a frothy end-state, gold has already been a bubble for some time as an ever larger group of investors has climbed aboard, propelling prices higher.

This is of course a perfect description of the Ponzi dynamics upon which bubbles are based, where the winners are those who get in early and out early, leaving everyone else holding an empty bag. This has been a consistent theme at The Automatic Earth. Bubbles are very much a process, one of collectively developing a commitment to a view which transitions from being merely self-reinforcing to becoming firmly entrenched to being publicly indisputable, unless one wishes to be dismissed as insane. Unfortunately, contrarians are typically viewed as insane just at the point where their perspective is the most crucial.

Apart from the fundamental model, we also agree with Soros’ 2010 opinion that gold was forming the “ultimate bubble”:

Soros: In this world, gold is the ultimate bubble because apart from the cost of actually digging it out of the ground it has almost no real fundamentals other than price itself. Investors have been buying it precisely because the price has been going up and is expected to carry on rising. Rising prices have created their own demand. It is the ultimately reflexive investment.

In August 2011, gold had reached the blow-off euphoria stage, with everyone having already bet on further prices rises, and therefore no one left to place the further bets required to take the price higher. In our view this constituted a major top:

August 2011: Of all the commodity bubbles, it is the end of the explosive rise in gold that is set to surprise the largest number of people. Very few expect it to follow silver’s lead, but that is exactly what we are suggesting. Gold has been increasingly considered to be the ultimate safe haven. The certainty has been so great that prices rose by hundreds of dollars an ounce in a blow-off top over a mere two months. The speculative reversal currently underway should be rapid and devastating for the True Believers in gold’s ability to defy gravity eternally.

Sentiment is the crucial contrarian indicator:

Ultimately, one has to recognize that the metals are not driven by inflation nor are they driven by deflation. We have clear periods of time in our history where they have acted in the exact opposite manner in which each of the prominent camps would have believed. So, maybe there is another driver of metals which can be relied upon at all times? My answer to that question is that market sentiment is what can be relied upon at all times to point you in the correct direction for the precious metals….One must analyze the market before them irrespective of what other markets may or may not be doing. The main reason is because sentiment is what drives each market, and it varies by market.

The behaviour of central banks is highly indicative of major turning points, given that their actions are lagging indicators of persistent trends, as we have pointed out before:

The Automatic Earth, August 2011: Central banks are buying gold, which some consider to be a major vote of confidence, and therefore bullish for gold prices. However, it is instructive to look at the previous behaviour of central banks in relation to gold prices. When gold hit its low point eleven years ago, after a long and drawn out decline, central bankers were selling, in an atmosphere where gold was dismissed as a mere industrial metal of little interest, or even as a ‘barbarous relic’.

Selling by central banks, which are always one of the last parties to act on developing received wisdom, was actually a very strong contrarian signal that gold was bottoming. They would not have been selling if they had anticipated a major price run up, but central banks are reactive rather than proactive, and often suffer from considerable inertia. As a result they tend to be overtaken by events. Regarding them as omnipotent directors and acting accordingly is therefore very dangerous.

Now we are seeing the opposite scenario. After eleven years of increasingly sharp rises, central banks are finally buying, and they are doing so at a time when the received wisdom is that gold will continue to reach for the sky. Once again, central banks are issuing a strong contrarian signal, this time in the opposite direction. While commentators opine that central banks will hold their gold even if they develop an urgent need for cash, this is highly unlikely. In a deflationary environment, it is cash that is scarce, and cash that everyone, including central bankers, will be chasing.

An urgent need for cash does indeed appear to be precipitating selling, and this rationale is going to become far more powerful in the relatively near future:

Gold is now sitting on a 5-year low after China dumped 5 tonnes of gold into the Shanghai markets on Monday during the first minutes of trading, with a slow, but steady sell-off continuing through the week. IVN has reported on China’s financial crisis since February, and this was not a wholly unexpected move to liquidity.

The psychology has once again shifted. Instead of a barbarous relic, gold is now being referred to as a “pet rock” of questionable value:

Gold is supposed to be a haven amid hard times and soft money. So why, even as Greece has defaulted, the euro has sunk against the dollar, and the Chinese stock market has stumbled, has gold been sitting there like a pet rock? Trading this week below $1,150 an ounce, the yellow metal has fallen more than 39% since it peaked at nearly $1,900 in August 2011. Since June 2014, investors have yanked $3 billion out of funds investing in precious metals, estimates Morningstar, the financial-research firm; total assets at precious-metal funds have shrunk 20% in 12 months. “A lot of investors have become disillusioned with gold,” says Suki Cooper, head of metals research at Barclays in New York. “Safe-haven demand hasn’t been strong enough to lift prices, but has only been strong enough to keep them from falling.”

Many people may have bought gold for the wrong reasons: because of its glittering 18.7% average annual return between 2002 and 2011, because of its purportedly magical inflation-fighting properties, because it is supposed to shine in the darkest of days. But gold’s long-term returns are muted, it isn’t a panacea for inflation, and it does well in response to unexpected crises—but not long-simmering troubles like the Greek situation.

It is not inflation we are facing, and therefore not an inflation hedge that is currently required:

Inflation continues to undershoot the Fed’s goals despite extremely low interest rates and years of massive bond purchases. In fact, the recent collapse in the commodities complex is only lowering inflation and inflation expectations. Everything from coffee, sugar, beans to crude oil is heading south. Industrial metals like copper and aluminum have renewed their tumble in recent days as soft global economic growth hurts demand and supply gluts deepen. All of that is creating an anti-inflationary environment that sucks the air out of the gold market.

Much darker days are coming as we move into a highly deflationary era, driven by an inevitable credit implosion. Such an event will be relatively rapid, as it always has been in the past, given that credit expansion creates virtual wealth in the form of copious ‘financial assets’ with little or no connection to any form of tangible underlying wealth:

Laurens Swinkels, a senior researcher at Norges Bank Investment Management in Oslo, reckons that the total market value of the world’s financial assets at the end of 2014 was about $102.7 trillion. The World Gold Council estimates that the world’s total quantity of gold held for investment was about $1.4 trillion as of late 2014. So, if you held the same proportion of gold as the world’s investors as a whole, you would allocate 1.3% of your investment portfolio to it.

Of course there are many forms of tangible real wealth besides gold, but even if one included all forms of collateral, there remains an extreme crisis of under-collateralization, or an extreme quantity of excess claims to underlying real wealth. That which has no substance can disappear very quickly back into the thin air from where it originated:

In the days of a gold – or more correctly – a gold exchange standard, the collapse of excessive bank credit was always sudden, and vicious in proportion to the previous expansion. Since credit was expanded out of thin air by banks without underlying stocks of gold to cover it, inevitably slumping prices became associated with bank failures, and central banks were set up to insulate commercial banks from this brutal reality. Saving over-extended banks always requires the artificial lowering of interest rates and the expansion of the money quantity to restrain the currency’s purchasing power from rising against declining commodities. Gold therefore remains a store of value for savers because it cannot be devalued in this way by a central bank.

It is not is not, however, always possible to save over-extended banks. It depends on the degree to which they are over-extended and the existence, or lack thereof, of a lender of last resort with sufficiently deep pockets. 2008 was an extremely expensive attempt to disguise an intractable financial predicament while simultaneously making it worse by propping up the credit Ponzi scheme – doubling down on a losing bet. During the bursting of particularly large financial bubbles, the system breakdown is likely to be sufficiently extreme to preclude attempts to expand the money supply for many years, meaning that neither the banking system nor the value of financial assets can be saved. Deflation and economic depression are mutually reinforcing and this will be the dominant dynamic for a prolonged period. Gold, and other forms of tangible assets, will remain stores of value during this period.

Paper Gold Versus Physical Gold

Gold has not yet retraced it’s steps to an extent which would indicate a full correction of the preceding advance. In paper terms, it has much further to fall, especially as the world moves further into the deflationary spiral which is only just beginning. Gold has already fallen to its cost of production, with up to half of primary producers losing money at the current price, but in a deflationary spiral we can expect a major undershoot in a race to the cost of the lowest price producer. The implication is that prices can fall many hundreds of dollars an ounce more, which is exactly what we expect.

As we said in 2011::

Expect to hear all about the enormous Ponzi scheme in paper gold, and a lot more about plated tungsten masquerading as gold. It doesn’t even matter whether or not that rumour is true. What matters is whether or not people believe it, and how it could feed into a spiral of fear as prices fall….Typically a speculative bubble is followed by the reversal of speculation causing prices to fall, and then by falling demand, which undermines prices further. As the bubble unwinds, people begin to jump on a new bandwagon in the opposite direction, chasing momentum as always. The need to access cash by selling whatever can be sold (rather than what one might like to sell), and the on-going collapse of the effective money supply as credit tightens mercilessly, will also factor into the developing vicious circle.

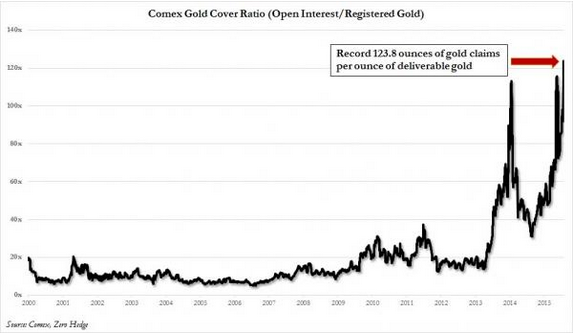

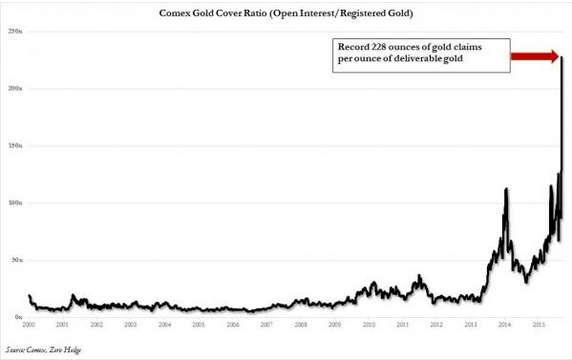

This is the scenario that is now unfolding, particularly in relation to the realization of excess claims to underlying real wealth in the gold market. The paper Ponzi scheme in gold is extreme, with over vastly more paper gold claims than actual gold in existence, and this leverage ratio has greatly increased in recent times, particularly in the last month:

This means that what was already a record dilution factor, with over 200 ounces of paper gold claims for every ounce of deliverable gold, just soared even more, and following today’s [September 9th] 8% drop, there is now a unprecedented 228 ounces of paper claims for every ounce of deliverable “registered” gold.

In fact, this may represent a significant underestimate of the real smoke-and-mirrors problem:

The numerical reports from which fancy graphs and and dry detailed data presentations are created originate from the Too Big To Fail Banks. I’ve said for quite some time that IF the bullion banks who control the Comex and the LBMA are submitting honest data reports for the Comex and LBMA, it would be the only business line in which they do not hide the truth and report fraudulent numbers. What is the probability of that?…

….The obvious conclusion is that the supply deficits in gold and silver are being remedied by hypothecating gold and silver bars from allocated accounts held at bullion banks, including the accounts held in behalf of the gold/silver ETFs, like GLD and SLV. This is why ABN Amro and Rabobank stopped allowing their physical gold account investors to take physical delivery of the gold they thought they have invested in – the gold was not there to deliver. This also occurred in 2013.

Where there is pure paper with nothing to back it up, there is considerable potential for large price movements independent of physical supply and demand:

For investors the present marketplace for gold and silver and other precious metals, has lost any real connection to the regular forces of supply and demand. The issuance of paper gold and silver has allowed a separation from market forces. It has divorced the true monetary values from the quantities of precious metals that are actually in existence. This has vastly inflated the supposed supply, thus putting a downward pressure on price.

The reality is that there is far less physical gold and silver than the supply of the paper equivalence. This situation is allowed to exist because there are many players and speculators in the market that do not actually take possession of their holdings. What they have instead, is pieces of paper that gives an impression of ownership. As long as only a small and manageable number of participants in the futures markets for both gold and silver actually demand delivery of their investment, spot prices can move independently of the real fundamentals.

There is considerable debate as to whether this constitutes active manipulation. Some would argue (in an analogous commodity situation), that dynamics in over-financialized markets move prices as an emergent property, without necessarily having malignant motives or prior outcomes in mind:

The huge drop in oil prices came from the action of traders who had bid up the price of crude in the futures market by momentum trading based on unrealistic assumptions about demand growth. When the price started heading in the opposite direction, traders couldn’t catch a bid on their positions, and the whole market went drastically net short, bidding down the price of the commodity….We can see from this that without the slightest bit of skullduggery, the futures market can greatly affect commodity prices in ways that have nothing to do with supply and demand.

Others suggest that movements in the paper market constitute deliberate manipulation:

An enormous amount of paper gold contracts were dumped into the Comex’s globex electronic trading system during one of the slowest trading periods at any point in time during the trading week (July 19th). A bona fide seller trying to sell a big position at the best possible execution prices would never have dumped a position like this. The only explanation is that someone wanted to drive the price the price of gold lower and make a point of doing so. This particular occurrence in the gold market has been a recurring event over the life of the gold bull market. However, the frequency of the above trading pattern has significantly increased since 2011….There is a definitive correlation between the big spike in gold OTC derivatives and the downward pressure on the price of gold.

Gaming the paper gold market by further inflating the Ponzi scheme can engineer considerable collateral advantages, even as it increases the extent of leverage, and therefore of under-collateralization:

Precious metal prices are determined in the futures market, where paper contracts representing bullion are settled in cash, not in markets where the actual metals are bought and sold. As the Comex is predominantly a cash settlement market, there is little risk in uncovered contracts (an uncovered contract is a promise to deliver gold that the seller of the contract does not possess). This means that it is easy to increase the supply of gold in the futures market where price is established simply by printing uncovered (naked) contracts. Selling naked shorts is a way to artificially increase the supply of bullion in the futures market where price is determined. The supply of paper contracts representing gold increases, but not the supply of physical bullion.

As we have documented on a number of occasions, the prices of bullion are being systematically driven down by the sudden appearance and sale during thinly traded times of day and night of uncovered future contracts representing massive amounts of bullion. In the space of a few minutes or less massive amounts of gold and silver shorts are dumped into the Comex market, dramatically increasing the supply of paper claims to bullion. If purchasers of these shorts stood for delivery, the Comex would fail. Comex bullion futures are used for speculation and by hedge funds to manage the risk/return characteristics of metrics like the Sharpe Ratio. The hedge funds are concerned with indexing the price of gold and silver and not with the rate of return performance of their bullion contracts.

A rational speculator faced with strong demand for bullion and constrained supply would not short the market. Moreover, no rational actor who wished to unwind a large gold position would dump the entirety of his position on the market all at once. What then explains the massive naked shorts that are hurled into the market during thinly traded times? The bullion banks are the primary market-makers in bullion futures. They are also clearing members of the Comex, which gives them access to data such as the positions of the hedge funds and the prices at which stop-loss orders are triggered. They time their sales of uncovered shorts to trigger stop-loss sales and then cover their short sales by purchasing contracts at the price that they have forced down, pocketing the profits from the manipulation.

As always, this is at the expense of smaller investors:

According to the Zero Hedge piece, the equivalent of 17 tons of gold was sold on the New York Comex in two bursts in one morning. Think how crazy that is. A seller trying to optimize profits would not make huge sales like this in a short period of time. The size of the sale itself causes the price to drop. Someone (person or entity) owning that much gold would know such things. So, one has to wonder why someone would work against its own interests like that.

The only answer I can come up with is that the sellers had already accumulated huge short positions in derivatives that they wanted to push into the money. The bottom line effect was that someone who wanted a lot of real gold got it, and the seller probably made a bundle on the other side of trade by shorting in the paper market. Two deep-pocketed entities came out happy. Rank and file gold investors were left licking their wounds.

Some regard gold’s rather more ambivalent recent image as evidence that powerful parties are attempting to undermine gold’s monetary legitimacy, presumably in order to drive the price down and purchase it in quantity at a much lower price:

The bullion banks’ attack on gold is being augmented with a spate of stories in the financial media denying any usefulness of gold. On July 17 the Wall Street Journal declared that honesty about gold requires recognition that gold is nothing but a pet rock. Other commentators declare gold to be in a bear market despite the strong demand for physical metal and supply constraints, and some influential party is determined that gold not be regarded as money.

Why a sudden spate of claims that gold is not money? Gold is considered a part of the United States’ official monetary reserves, which is also the case for central banks and the IMF. The IMF accepts gold as repayment for credit extended. The US Treasury’s Office of the Comptroller of the Currency classifies gold as a currency, as can be seen in the OCC’s latest quarterly report on bank derivatives activities in which the OCC places gold futures in the foreign exchange derivatives classification.

The manipulation of the gold price by injecting large quantities of freshly printed uncovered contracts into the Comex market is an empirical fact. The sudden debunking of gold in the financial press is circumstantial evidence that a full-scale attack on gold’s function as a systemic warning signal is underway.

While it is possible that gold’s recent bad press could be an attempt to talk the price down for nefarious purposes, it is not necessary to invoke conspiracy. Just as gold sentiment was extremely bearish at it’s price nadir in 2000, and then rose to fever pitch as the price increased to nearly $1900/ounce, one would expect sentiment to have gone off the boil with prices down substantially over the last four years. Price and sentiment move in tandem in a self-reinforcing feedback loop. Considering the huge extent of excess claims to underlying physical gold, and therefore the approaching destruction of virtual wealth as the paper gold pyramid implodes, both price and sentiment would appear to have much further to go to the downside. At the point where gold sentiment is the diametric opposite of its peak in 2011, price will be bottoming, but a great deal of upheaval will be unfolding at that point, and paper gold will likely be essentially worthless:

If the owners of this paper gold begin to want a conversion to physical gold, panic will ensue and the entire market in precious metals will collapse. The ratio between paper gold and physical gold is now at a record low of 0.08%. This situation has now become a Ponzi scheme, where the majority of investors will be wiped out, when the next crisis unfolds. It is no longer a matter of if, but when this happens.

Apart from the machinations in the paper gold, and silver, markets, physical precious metals are increasingly in demand, and for a considerable premium over the spot price as supplies tighten. The divergence between paper prices and physical prices will continue to widen, with a major discontinuity expected in the future at the point where extent of the paper Ponzi scheme is finally recognized:

Public demand for physical bars and coins of gold and silver are soaring, since the middle of June. At the same time demand for paper gold and silver has leveled off and is actually falling during this period. As a result, government and private mints are struggling to maintain sufficient supplies of precious metals, for the orders they receive. Some have even been forced to temporarily halt sales. Interest in buying physical gold and especially silver, is at the highest level since the financial meltdown of 2008.

Premiums are already being given, above the spot price for both raw gold and silver, at a number of private mints. Some major national depots in the United States are running empty and more investors than ever, are seeking physical delivery of their investment from Comex (Commodity Exchange) warehouses, which are rapidly becoming depleted as well….

…For the first time, knowledge of the thin inventory of gold and silver held in exchange vaults that back the enormous volumes of paper being traded on a daily basis, is beginning to seep out. For those who are shorting these metals, they are counting on being able to settle accounts in cash or to make a withdrawal from a vault. If too many investors start wanting delivery of gold and silver, the whole present corrupt system will rapidly unravel….

….The United States Mint in July ran out of silver the same day the price of the metal dropped to the lowest level in 2015. The same month the US Mint had sold 170,000 ounces of gold. This was the highest rate since April of 2013 and the fifth highest rate on record. Yet, it was occurring as gold was dipping to the lowest price in five years. The Perth Mint in Australia is also struggling to keep up with demand, as interest surges with new customers in Asia, Europe and the United States. The problem for the mint is the amount of unrefined gold delivered, is not meeting the present physical demand.

In Europe numerous dealers had their inventories emptied, as investors decided given the financial crisis in Greece, that owning gold and silver would be a hedge against any further instability. The UK (United Kingdom) Royal Mint for example, saw demand from Greek customers alone, double earlier this summer. In the United States the amount of Comex registered gold dropped to 359,519 ounces or just over 10 tons, by the beginning of this month. It has never been lower. Meanwhile, the paper gold demand for these remaining stocks, is at a whopping 43.5 million ounces.

Gold’s physical movements are somewhat obscure, but it appears that significant parties are already seeking physical delivery:

Back in April, the publication said that JPMorgan Chase, which has the largest private gold vault in the world, showed a 20% drop in “eligible” gold in its vault in one day. That day was April 5, just five days before the two-day $210 plunge in gold prices. (Eligible gold is gold stored that is not registered to a specific owner, but is available to be either registered or traded.)…Comex-registered gold remained relatively flat in the following days. JPMorgan’s vault is one of the Comex vaults, so the data suggest that the gold was not reclassified from “eligible” to “registered” but actually left the building.

Where did it go? China? India? Russia? We will probably never know. We do know that while the price of paper gold (ETFs, funds, stocks, futures) plunged, demand for the actual metal soared, with buyers paying significant premiums to the spot price.

It is no surprise to see ‘cashing out’ of a Ponzi scheme before a crash that is obviously coming, and this this case ‘cashing out’ means claiming physical possession before a flood of claims collapses the paper gold market. It will, however, be interesting to see what transpires when that crash occurs. Physical gold must be stored somewhere, and the security of storage is also suspect, especially in times of upheaval were storage companies involved in many different aspects of the financial system may fail. As account holders at MF Global discovered in 2011, holders of financial derivatives enjoy super-priority in bankruptcy. Customer segregated accounts had been fraudulently pledged as collateral for derivative bets in Europe that went against the company. Despite the fraud involved, the customer accounts, including those holding physical gold, were removed by the owners of the derivative rights.

Thus even those who take physical possession early may lose later to paper claims by those higher up the ‘financial food chain’ if they store their wealth within the system and are therefore dependent on the solvency of middle-men. Warehouse receipts for gold will be worthless if the warehouse has been emptied, and possession will be nine tenths of the law. This is already happening:

By the time auditors and lawyers got access to Bullion Direct’s 14th-floor offices six weeks ago, there were only a handful of gold and silver coins in an office safe. A second vault it had recently rented held only slightly more. An estimated $30 million in cash, metal bullion and valuable coins, meanwhile, had vanished. The cumulative weight of the unaccounted for metal is the equivalent of dozens of standard-sized gold bullion bars and hundreds of silver ones. Also missing are an estimated 1,400 ounces of platinum and palladium.

What is clear is that the news has devastated those who believed the company was safekeeping the futures they’d bet on the rounds and bricks of gold and silver. Some lost hundreds of thousands of dollars’ worth of the precious metal with little apparent prospect of regaining it. Jesse Moore, an attorney representing several creditors, predicted that investors can hope to recover 2 or 3 percent of their money, at best….Philosophically, the disappearance of their precious metal has left many Bullion Direct customers, who turned to gold as a safe port in a turbulent financial world, with a crisis of confidence. Attracted to an investment specifically because of its detachment from a government and financial system they didn’t believe in, now that their treasure has disappeared they find themselves wondering what, really, is permanent.

Similarly, safety deposit boxes may well not be secure. They would not be accessible in a systemic banking crisis, and are too obvious a location for the storage of valuables. Following a bank holiday, or a raid by authorities looking for what they believe are ill-gotten gains, as they did in 2008, there may be nothing left to recover:

More than 300 officers and staff were involved in simultaneous raids at three depots in London’s Park Lane, Hampstead and Edgware. Officers have secured the concrete and steel vaults and will take several weeks to remove each box, using angle grinders, to a secret location where they will be prized open with diamond-tipped drills. It is believed that a top tier of criminal masterminds may have rented out “the majority” of the boxes. The safe-keeping company – Safe Deposit Centres Ltd – has been operating for more than 20 years.

Metropolitan Police Assistant Commissioner John Yates said: “Each box will be treated as a crime scene in its own right.” Members of the public who have innocently and legally stored their valuables were “inevitably” going to get swept up in the disruption, it was predicted.

In short, if you do not own metals in physical form, you do not own them at all, and ownership is only as secure as the storage method chosen:

To those who have some gold ETF certificates in a brokerage account, which by law are the possession by DTCC’s Cede & Co. – a bank owned institution – we wish the best of luck to anyone hoping to preserve or even recover any of the invested wealth in such instruments.

Confiscation?

In times of extreme financial crisis, states are highly likely to seek to control the money supply. As previously noted, gold has been considered money for thousands of years, whether or not a gold standard is in force. Financial crisis will involve the loss of monetary equivalence for credit instruments representing promises which will obviously not be kept, leaving relatively few forms of wealth still accepted as having value. Cash, particularly US dollars and a few other favoured currencies, will hold value for the period of deleveraging, but only precious metals will likely retain value in the longer term. The desire to control the supply is going to be powerful, as it was in the United States during the Great Depression of the 1930s, when gold was subject to confiscation.

The Emergency Banking Act of 1933 amended the Trading With the Enemy act of 1917, which had granted the President power to investigate, regulate, or prohibit any transactions in foreign exchange, export or earmarkings of gold or silver coin or bullion or currency by any person within the United States, and to prevent the hoarding of gold by Americans. The provisions of the earlier Act, referring to wars and enemies were extended in 1933 in order to encompass “any other period of national emergency declared by the President”, specifically the protection of a currency on a gold standard at the time.

Emergencies allow for legislation to be rushed through with little scrutiny:

A key piece of legislation in this story is the Emergency Banking Act of 1933, which Congress passed on March 9 without having read it and after only the most trivial debate. House Minority Leader Bertrand H. Snell (R-NY) generously conceded that it was “entirely out of the ordinary” to pass legislation that “is not even in print at the time it is offered.” He urged his colleagues to pass it all the same: “The house is burning down, and the President of the United States says this is the way to put out the fire. And to me at this time there is only one answer to this question, and that is to give the President what he demands and says is necessary to meet the situation.”

Executive Order 6102 under the 1933 Act criminalized the possession of monetary gold by any individual, partnership, association or corporation, requiring that gold be exchanged for paper currency. In accordance with the eminent domain clause of the 5th Amendment, market value compensation was paid at $20.67 per ounce.

Only a month was given for compliance, and the penalty for non-compliance was $10,000 and up to ten years imprisonment. Only jewellery and a few rare collectable coins were exempted. Since currency had previously be convertible into gold on demand, those who surrendered their gold would not initially have thought the surrender permanent, but this reality dawned shortly, especially after the Gold Reserve Act of 1934 altered the conversion price by fiat to $35 per ounce, engineering a devaluation of the gold-based dollar. The Act also made gold clauses in private contracts unenforceable, forcing payment in paper currency instead, without reference to an equivalent value of gold, despite the fact that such contracts had been deliberately constructed to guard against the risk of a currency devaluation:

On June 5, 1933, at the behest of the president, Congress took the next step, passing a joint resolution making it illegal to “require payment in gold or a particular kind of coin or currency, or in an amount in money of the United States measured thereby.” Any provision in a private or public contract promising payment in gold was thereby nullified. Payment could be made in whatever the government declared to be legal tender, and gold could not be used even as a yardstick for determining how much paper money would be owed.

After 1934, only foreign governments and central banks were allowed to convert dollars into gold, and only until 1971. Gold ownership remained off-limits to ordinary people until 1975, but the restriction could be circumvented by those with the means to do so through off-shoring:

Many Americans dutifully turned in their meager holdings. But not everyone. Many simply ignored the order, assumed the risks and stashed them away knowing that gold was more valuable than the paper given in exchange. Keeping it literally meant the difference between living or dying for some. There are not significant historical legal records of US citizens being fined or imprisoned for failing to comply. This was the bottom of the depression and average citizens did not have large quantities of gold. Many were jobless, bankrupt and barely surviving; selling pencils and apples on the street corners as so often depicted in the old black and white newsreels from that era.

But wealthy businessmen, bankers and society elites did own considerable gold. They obviously did not turn in their gold. How do we know? Most of the US mint made gold coins that were in circulation at the time ($2.50, $5.00, $10.00 and $20.00 denominations, but mostly the 10 and 20 dollar coins) were simply shipped off in bags by the thousands to European banks (primarily in Switzerland and Great Britain) for anonymous safekeeping, far away from the reach of US authorities. They simply sat there in darkness and dust buried at the bottom of bank vaults. When gold ownership was again legalized for US citizens in 1975, tons of the coins appeared back on the US market.

In the depths of the Depression, President Roosevelt was attempting to decrease unemployment, raise wages and increase the money supply, but these goals were complicated by the country’s adherence to the gold standard. Gold confiscation allowed for greater concentration of wealth in the hands of the government in order to fund the programmes of the New Deal:

The forced call-in was done not as a punitive measure against gold owners but as a way to enrich the government at the expense of the entire US population, whose purchasing power would be reduced in the future by both inflation and the subsequent devaluation. The government’s new-found wealth supported New Deal programs such as Social Security (1937)….The motivation of the government for a call-in must be to gain some value, not to merely to deprive, discourage or punish investors. In 1933 the purpose was to enable the government to expand the money supply to overcome deflation and to fund the vast social programs of the New Deal, something impossible to do when the country was on the gold standard and the public held significant quantities of gold.

Ironically, the devaluation created an incentive for foreigners to export their gold to the United States, even as many wealthy Americans were preserving their holdings by sending them in the other direction. In combination with domestic confiscation, foreign inflows resulted in a substantial increase in the supply of gold in the hands of the US Treasury:

Even in 1900 the U.S. only held 602 tonnes of gold in reserve. This was 61 tonnes less than Russia and only 57 tonnes more than France. Over the next 20 years countries’ reserves grew as the amount of gold in the market increased and as normal trading occurred. However, in the 1930s there was a sudden shift up in reserves in the U.S. From 1930 to 1940, treasury holdings had tripled, mostly due to foreign investing….The Bank of France also saw over 200 tonnes of gold get transferred to New York following the raising of prices in America.

This in turn allowed for a major expansion of the money supply during the Depression:

The Gold Reserve Act, an act of monetary policy, drastically increased the growth rate of the Gross National Product (GNP) from 1933 to 1941. Between 1933 and 1937 the GNP in the United States grew at an average rate of over 8 percent. This growth in real output is due primarily to a growth in the money supply M1, which grew at an average rate of 10 percent per year between 1933 and 1937. Previously held beliefs about the recovery from the Great Depression held that the growth was due to fiscal policy and the United States’ participation in World War II. “Friedman and Schwartz stated that the ‘rapid rate [of growth of the money stock] in three successive years from June 1933 to June 1936… was a consequence of the gold inflow produced by the revaluation of gold plus the flight of capital to the United States’”. Treasury holdings of gold in the US tripled from 6,358 in 1930 to 8,998 in 1935 (after the Act) then to 19,543 metric tonnes of fine gold by 1940.

The largest inflow of gold during this period was in direct response to the revaluation of gold. An increase in M1, which is a result of an inflow of gold, would also lower real interest rates, thus stimulating the purchases of durable consumer goods by reducing the opportunity cost of spending. If the Gold Reserve Act had not been enacted, and money supply would have followed its historical trend, then real GNP would have been approximately 25 percent lower in 1937 and 50 percent lower in 1942.

For the following forty years, the US government was able to build enormous gold reserves:

Not only did the government remove the incentive for ordinary citizens to hold gold by establishing price and criminal controls over possession, it also changed the rules in the middle of the game allowing it to build up a massive gold hoard of over 8000 tons today which is maintained at Fort Knox, and is, to the best of our knowledge, unauditable by any mere mortal. Critically, it made the US government the sole source and monopoly agent of gold purchases, using reserve fiat currency it could print with impunity, beginning in 1933 and continuing through 1974 when the limitation on gold ownership was repealed after President Gerald Ford signed a bill legalizing private ownership of gold coins, bars and certificates by an act of Congress codified in Pub.L. 93-373, which went into effect December 31, 1974. In summary, the US government, which is now the largest official holder of physical gold in the world, had 40 years of uncontested zero cost gold accumulation.

The gold confiscation of the Depression years has been described as “grabbing private wealth, and using it to try and reboot the system”. At the time, this was motivated by a combination of the gold standard and the holding of gold reserves by a significant fraction of the population:

It is important to realize that the motivation for confiscating gold which existed for FDR in 1933 has largely disappeared. Back then the U.S. was still on the gold standard (the U.K. had been forced off 18 months earlier). So seizing private gold and then devaluing the currency was in fact a 1930s version of quantitative easing. Saving our banks from their stupidity still means swelling the money supply, and hurting cautious savers by devaluing their wealth.

While gold is still hoarded by governments (and increasingly by fast-growing emerging economies), it is only tenuously tied to our currency system as the “foundation” of sovereign reserves. Gold also makes a disappointing asset to grab, especially in the rich but troubled West. Because few people own it compared for instance to real estate (a sitting duck for local government levies and the new talk of “wealth taxes”) or readily-captured financial assets such as pension pots (already so enticing to distressed governments in Argentina, Hungary and Portugal).

The risk of such a confiscation occurring again in modern times is complicated. The rationale for doing so has changed, since the gold standard is no longer operative. So some regard the risk as remote:

To assess the likelihood of confiscation today, we need to look at what the government could gain by calling in privately held gold. My view is that the Federal government has little to gain by calling in gold today and that therefore the likelihood of confiscation is remote. Because the size and cost of the federal government has expanded so much since the 1930’s, and because the quantities of gold currently held by Americans are too small to fund the huge federal budget for more than a few weeks, the government has little to gain by a call-in today. Furthermore, doing so would send the dollar tumbling toward worthlessness, which would be a disaster when so many dollar-denominated bonds are held as central bank reserves by creditor nations like China. So, while confiscation is certainly possible, we consider it unlikely….Investors who are concerned about confiscation today are often assiduous about keeping their purchases from any one dealer small and their holdings secret. Some avoid keeping their gold in a bank safe-deposit box, and some keep their gold in a non-bank vault outside the country.

Others point out that the mechanisms for a modern confiscation still exist:

On March 9, 1933, the statute was amended to declare (as it remains today) that “during time of war or during any other period of national emergency declared by the President,” the President may regulate or prohibit (under such rules and regulations as the President may prescribe) the hoarding of gold bullion.

Other jurisdictions besides the USA also have confiscation mechanisms on the books, albeit presently in suspension. These could quickly be revived if it were thought expedient:

In Australia, part IV of the Banking Act 1959 allows the Commonwealth government to seize private citizens’ gold in return for paper money where the Governor-General “is satisfied that it is expedient so to do, for the protection of the currency or of the public credit of the Commonwealth.” On January 30, 1976, this part’s operation was “suspended”.

Targeting other more prevalent forms of private wealth may well be a more significant risk at this point. Indeed it is already happening in our current era, for instance with the hijacking of pension funds. Expect significant attacks on real estate holdings as well, since this form of wealth is a ‘sitting duck’ to which punitive property taxation can be applied. Unlike the 1930s, however, confiscation of private wealth by the government will not be able to fund a recovery along the lines of the New Deal. The ocean of bad debt is simply too large this time for any amount of confiscated wealth to fill the gap.

Storing gold outside of one’s home country, in order to avoid whatever confiscation risk may exist today, is a consistent theme, exactly as it was in the 1930s:

People can also own gold in ways which make it inaccessible to government decree. In our opinion, a good way to own gold is directly (i.e. not through a trust), in allocated physical form, and offshore, in a place with a strong tradition for protecting international investors’ property. This makes it a tough target for confiscation by your government, and one that would upset other countries for little reward. BullionVault stores gold in four separate jurisdictions, all of which have a reasonable (if imperfect) tradition of defending private property rights: London, New York, Zurich and Singapore. There are clear potential benefits to diversifying physical property across international jurisdictions.

Even with the reduced focus on the monetary role of gold in recent times, it is not at all difficult to imagine desperate governments seeking to concentrate ownership in their own hands. This would not be a simple matter, but it would be extremely naive to presume that the attempt would not be made. Ultimately, consolidation of central control over money is the goal, and that requires preventing capital preservation by the public:

Since gold acts as a stand-alone asset that is not another’s liability, it functioned as an effective store of value prior to 1933 for those who either converted a portion of their capital to gold bullion or withdrew their savings from the banking system in the form of gold coins before the crisis struck. Those who did not have gold as part of their savings plan found themselves at the mercy of events when the stock market crashed and the banks closed their doors (many of which had already been bankrupted)….

….That, by the way, is the primary reason governments tend to restrict gold ownership when confronted with widespread bank runs and failing financial markets. Governments seize gold not because they need the money; they seize it to cut off the escape route and force capital flows back into banks and financial markets. As an aside, that is precisely the reason why governments have an interest in controlling the price of gold. Former Fed chairman Paul Volcker, it has been copiously reported, once said, “Gold is my enemy. I’m always watching what it is doing.”…Gold, in the end, is not just competition for the dollar; it is competition for bank deposits, stocks and bonds most particularly during times of economic stress — and that is the source of enduring interest among policy-makers.

As Alan Greenspan wrote in 1966, gold represents economic freedom. It is economic independence – the ability to opt out of the system – which is inimical to the Ponzi dynamics upon which the system is based. Ponzi schemes require continued buy-in, therefore buy-in becomes less and less optional over time, as the potential lack of it becomes an ever greater threat to an increasingly tenuous credit expansion. Credit expansion actively requires that there be no safe store of value, and therefore no true independence:

In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone decided, for example, to convert all his bank deposits to silver or copper or any other good, and thereafter declined to accept checks as payment for goods, bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights.

Greenspan’s focus is on government spending and the welfare state, but this is far too narrow a focus. Public spending and debt is much less of an issue than private credit expansion and debt. The bulk of the Ponzi scheme requiring continued buy-in is based in the private sector, in derivatives and shadow banking. This is the heart of the credit expansion that governments are required by their Big Capital paymasters to protect. Regulations preventing independence and opting-out result from pervasive regulatory capture. The system creates artificial scarcity and rationing on price, forcing the population to obtain the essentials of its own existence through ever greater amounts of borrowing, and in doing so pay its dues to the system as it keeps the credit expansion going. The end comes when the debt overhang is so large that it can no longer be serviced, even by all the income streams of the productive economy which credit expansion has so thoroughly parasitized. The supply of willing borrowers and lenders dries up, and the game is over.

It is not simply deficit spending which amounts to a confiscation of wealth, but the global credit Ponzi scheme which has generated a vast excess of claims to underlying real wealth. As we have pointed out many times before at the Automatic Earth, those excess claims will be invalidated in the coming financial crisis. People will be trying to protect and fulfil their claims, but larger entities will be trying to prevent them from doing so. Under such circumstances, an attempt at gold confiscation, even in the absence of a gold standard, seems to be a very real threat.

Putting Gold Ownership in Perspective

Gold ownership is not a panacea, nor a guarantee of security. It could even represent a threat to personal security. Confiscation is a distinct possibility during a substantial economic contraction. At least gold, unlike real estate, is, for the time being, capable of being transferred to another jurisdiction for remote storage. The risk, of course, is whether or not it might be possible to reclaim it from another location at some point in the future, given that the degree of upheaval is likely to be larger this time than in the 1930s, and that possession is nine tenths of the law.

If stored remotely, its usefulness in the meantime would be very limited. If concealed locally under a confiscation scenario, rather than held in a foreign ‘secure facility’, it may still be extremely difficult and dangerous to exchange for anything of more immediate value, such as cash, or essential supplies. Even with the best forethought, gold ownership is no guarantee of wealth preservation in a major depression. Depressions are not times when much of anything can be guaranteed.

Gold represents an extremely concentrated source of value, and it is not always advisable to own that which others are very highly motivated to obtain for themselves. Being too close to a highly concentrated source of value is comparable to being too close to the centre of power. If everyone wants what you have, having it creates substantial risks in its own right, and creates a need to manage those additional risks. Where risk management would become too complex or expensive, taking the risk in the first place may not be the best course of action. Other lower risk strategies, with better risk management potential, may be preferable.

The advisability of owning gold would depend very much on one’s own personal circumstances. There are many things one would wish to secure first, before pondering gold as an option. Cash will temporarily be king in a deflationary scenario, where a systemic banking crisis is increasingly likely. As we have seen in Cyprus, for instance, a country can be forced to revert to a cash-only economy very rapidly, meaning that access to cash would be critical for obtaining supplies not already in storage. Supplies cannot normally be purchased directly with gold, and if cash is exceptionally scarce, the cash price for distressed gold sales would not be high.

While all fiat currencies are destined to die eventually, and competitive devaluation currency wars have indeed already begun, cash will nevertheless be necessary during the period of deleveraging, and is likely to see its purchasing power rise substantially in relation to goods and services domestically. The falling prices characteristic of deflationary times, as prices follow a contracting money supply to the downside, amount to bull market in cash, for those lucky enough to have some. However, as the vast majority of the money supply is credit rather than physical cash, and ephemeral credit is going to disappear under such circumstances, little cash will remain, and relatively few will have any unless they have secured it in advance.

Following the destruction of much of the money supply with the evaporation of credit, those with very scarce cash would be less an less likely to want to part with it as the value of access to liquidity rises. What little actual cash remains is likely to be hoarded, so that very little cash circulates.

In other words, the velocity of money is going to fall much further than it already has. Obtaining cash will become very difficult, even as the need for it becomes acute. Supplies could be exchanged for gold, but under a scenario where such a thing might be necessary, distressed gold exchange would not result in as many supplies as one might think. Cash on hand will be more important in the initial stages of a financial crisis than gold, as it is cash that confers freedom of action, including the freedom to seize opportunities presented.

The argument relating to cash does have caveats however, in that where currency re-issue is a substantial risk in the short term, holding much of such a currency makes much less sense. This is clearly the case in the European Union, where the single currency is already under threat and national currencies are arguably likely to be revived within the foreseeable future.

Another higher priority than gold ownership would be the elimination of debt. Debt repayments create a structural dependence on cash flow at a time when cash will likely be very difficult to come by. Eliminating debt will remove this requirement for cash and secure important assets, such as homes, from the potential for foreclosure. A debt servicing requirement at a time when debt servicing is becoming increasingly difficult (due to high unemployment, falling salaries, rising taxation and pay-as-you-go services), would be a factor in forcing distressed gold sales at much lower prices than one would get today. In addition, the burden of debt will rise as the increasing perception of risk creates a move towards much higher interest rates. This will compound the potential for distressed gold sales.

Obtaining critical supplies and control over the essentials of one’s own existence would also be a higher priority than gold ownership. Securing access to food, water, energy and other essentials would confer relative peace of mind, and also reduce the need for cash going forward. Ultimately, one cannot eat gold. Also, while prices fall in a deflation, volatile currency inter-relationships are going to affect the price of imported goods, meaning that not all prices will necessarily fall, where imported goods are denominated in weak currencies. Imports could rise in price, or cease to be available at all as the evaporation of credit undermines international trade, hence certain imported goods should be obtained as a matter of priority.

In addition, a good strategy could be the establishment of a business dealing in essential goods and services, with local supply chains and local distribution networks. Returns will typically be low in comparison to the returns one might be used to from financial speculation, but the risks will also be much lower, and will be far more manageable with a certain amount of forethought. Deploying a certain amount of capital in the real economy today in order to set up such ventures could secure a vital source of income in the future, as well as providing a means of maintaining essential social stability in uncertain times. This would be a far better use of resources than purchasing a hoard of gold. Business risks during a liquidity crunch would be very large, so a substantial operating cushion would probably be required, however.

For ordinary people, having cash on hand, getting out of debt and securing access to essential supplies is likely to push them to, or beyond, their financial limits. They may need to pool resources with family or friends in order to be able to accomplish these goals, or make hard choices between them. Gold ownership makes little sense unless these hurdles have already been crossed. It represents an insurance policy for those who can afford to own it, but such insurance is a luxury that will not be available to all.

Those who can afford the luxury of insurance are likely to be those who have all higher priority issues already addressed and who can afford to sit on their gold for perhaps twenty years without relying on the value it represents in the meantime. In other words, the benefit of gold ownership would accrue to those who would not need to make distressed sales over the next few years when gold prices would be very depressed – those who are wealthy enough not to have to make hard choices between competing basic priorities.

For those who can afford to hold gold for the long term, and who are lucky enough to have found a secure and trustworthy storage mechanism in the meantime, gold will hold its value in terms of goods. One can buy approximately the same number of loaves of bread for an ounce of gold as one could have done during the Roman Empire. At that time an ounce of gold would have bought a good toga, and now it would buy a good suit.

It represents a long term store of value for those who are both wealthy enough to own it, and lucky enough to keep it, but this will be a very small minority. For most people, wealth will be measured not in terms of gold, but in terms of far more prosaic, but far more essential commodities and skills. For most people, wealth will not be measured in terms of having something inert to bury in a hole in the ground, or to send abroad for someone else to bury in an armoured hole in the ground.

The real value of gold will always be difficult to establish, as that relative value will always depend on prevailing circumstances, and so many of those circumstances will be subject to rapid change in the coming era of extreme volatility:

And you will put lightning in a bottle before you figure out what gold is really worth. With greenhorns in gold starting to figure all this out, the price has gotten tarnished. It is time to call owning gold what it is: an act of faith….Own gold if you feel you must, but admit honestly that you are relying on hope and imagination. Because gold, unlike stocks, bonds, real estate and other financial assets, generates no income, valuing it is all but impossible. It’s intrinsically worthless or intrinsically priceless. You can build a financial model to value it, but every input is going to be your imagination.