DPC Manhattan landmark Flatiron Building under construction 1902

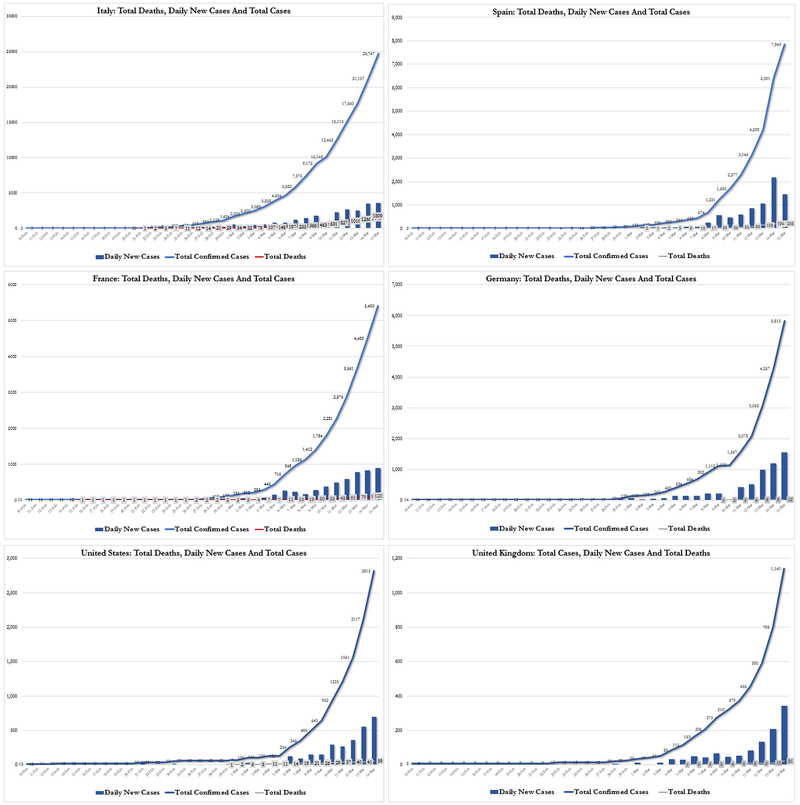

We’re setting regrettable records, and there’s very little reason to think the upward trend in cases and deaths will halt any time soon. Most of Europe is under some form of quarantine, only supermarkets and pharmacies remain open, and the UK and US have no choice but to follow suit -preferably very- soon. A -very- different world.

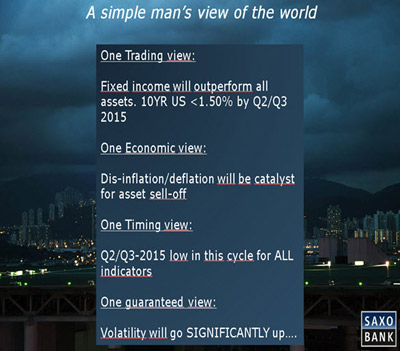

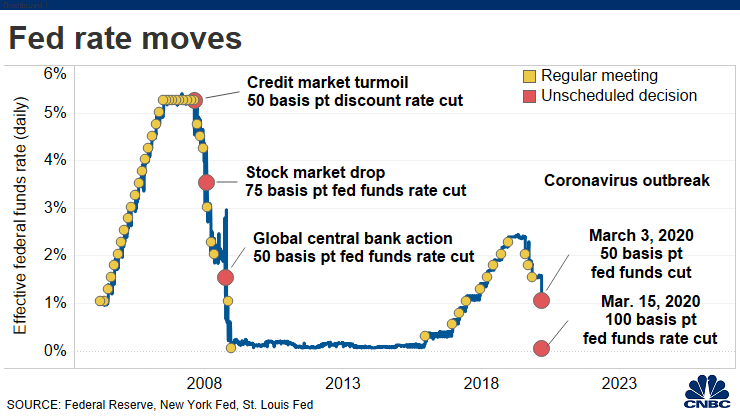

The central banks are so off in their approaches it’s getting harder to see how they will survive in their present shapes. This is not a time to bail out banks, it’s a time to help people. But they refuse that.

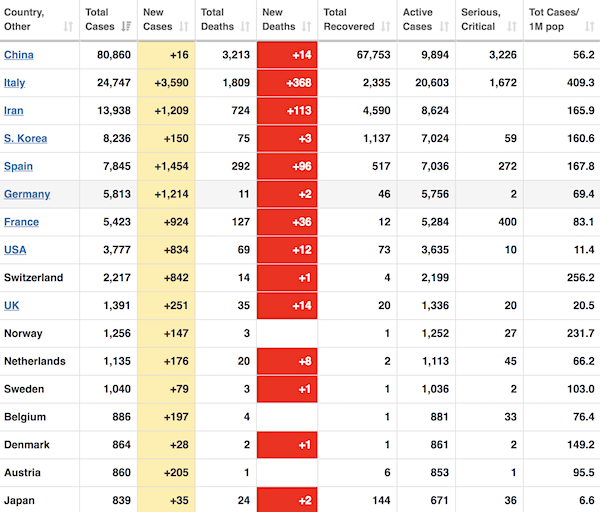

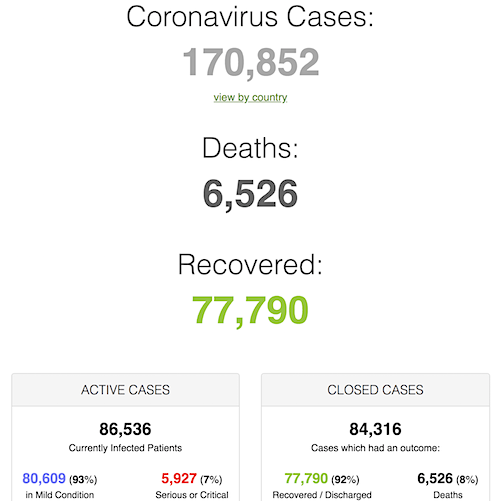

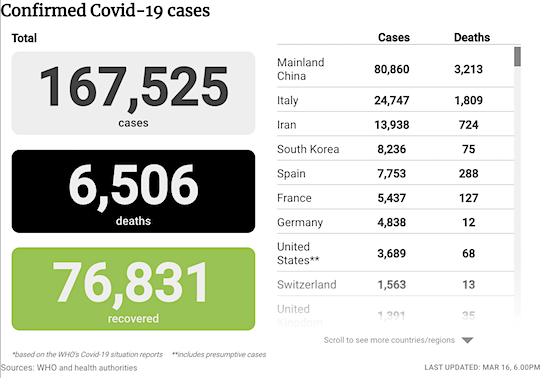

• Cases 170,852 (+ 13,375 from yesterday’s 157,477)

• Deaths 6,526 (+ 681 from yesterday’s 5,845)

These numbers are fit to silence a body. Just look at all the new cases.

From Worldometer yesterday evening (before their day’s close)

While everyone is discussing whether the case mortality rate is 0.1%, 1% or 2%, the rate for known cases just crept back up to 8%. That is much scarier than I see anyone admit.

From Worldometer (NOTE: mortality rate is back up to 8%!)

From SCMP: (Note: the SCMP graph was useful when China was the focal point; they are falling behind now)

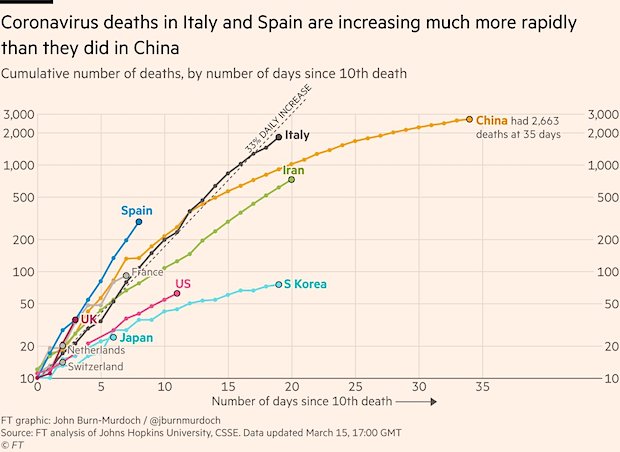

COVID2019.app graph is not avaliable, the site is closed. But this is even better:

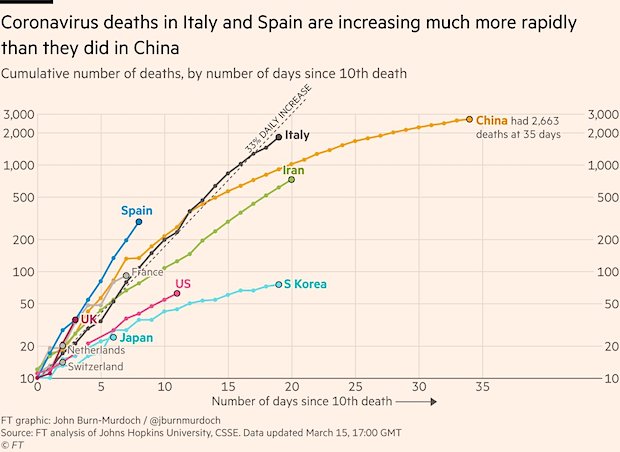

Note: what this graph does not sufficiently reflect is that Switzerland has 10 million people, and China 1,400 million. The graph starts at the 10th death.

The UK cannot hospitalize 7.9 million people, not even spread over a year. Does that cover all of your questions?

• UK Corona Crisis ‘To Last Until Spring 2021, 7.9m To Be Hospitalised’ (G.)

The coronavirus epidemic in the UK will last until next spring and could lead to 7.9 million people being hospitalised, a secret Public Health England (PHE) briefing for senior NHS officials reveals. The document, seen by the Guardian, is the first time health chiefs tackling the virus have admitted that they expect it to circulate for another 12 months and lead to huge extra strain on an already overstretched NHS. It also suggests that health chiefs are braced for as many as 80% of Britons becoming infected with the coronavirus over that time. Prof Chris Whitty, the government’s chief medical adviser, has previously described that figure as the worst-case scenario and suggested that the real number would turn out to be less than that.

However, the briefing makes clear that four in five of the population “are expected” to contract the virus. The document says that: “As many as 80% of the population are expected to be infected with Covid-19 in the next 12 months, and up to 15% (7.9 million people) may require hospitalisation.” [..] “For the public to hear that it could last for 12 months, people are going to be really upset about that and pretty worried about that”, said Paul Hunter, a professor of medicine at the University of East Anglia. “A year is entirely plausible. But that figure isn’t well appreciated or understood,” added Hunter, an expert in epidemiology. “I think it will dip in the summer, towards the end of June, and come back in November, in the way that usual seasonal flu does. I think it will be around forever, but become less severe over time, as immunity builds up,” he added.

[..] The document also discloses that an estimated 500,000 of the 5 million people deemed vital because they work “in essential services and critical infrastructure” will be off sick at any one time during a month-long peak of the epidemic. The 5 million include 1m NHS staff and 1.5 million in social care. However, the briefing raises questions about how Britain would continue to function normally, warning that: “It is estimated that at least 10% of people in the UK will have a cough at any one time during the months of peak Covid-19 activity.”

[..] A senior NHS figure involved in preparing for the growing “surge” in patients whose lives are being put at risk by Covid-19 said an 80% infection rate could lead to more than half a million people dying. If the mortality rate turns out to be the 1% many experts are using as their working assumption then that would mean 531,100 deaths. But if Whitty’s insistence that the rate will be closer to 0.6% proves accurate, then that would involve 318,660 people dying.

Time to make it a national policy. And as I said yesterday, cut down on domestic flights, close down highways, the works. There’s no escaping anyway, and delaying it will kill lots of people.

• NYC & LA Mayors Order Bars, Nightlife, Gyms, & Restaurants To Shut (ZH)

Update (1130ET): Shortly after New York’s mayor de Blasio pulled the plug, Los Angeles mayor Eric Garcetti has ordered the closing of all bars, nightclubs, gyms and entertainment venues from midnight March 16 until March 31. Restaurants will be limited to take-out and delivery. Grocery stores will remain open. “There is no food shortage and grocery stores will remain open. We’re taking these steps to help protect Angelenos, limit the spread of the novel coronavirus, and avoid putting a dangerous strain on our health care system. This will be a tough time, but it is not forever. Angelenos have always risen to meet difficult moments, and we will get through this together.”

Update (1030ET): After announcing earlier that restaurants and venues would be enforced to ensure no more than 50% occupancy, Mayor Bill de Blasio just tweeted that he is ordering all “nightclubs, movie theaters, small theater houses, and concert venues to close”. That leaves restaurants still open, but with max 50% occupancy, as the city encourages residents to order our and stay in instead of venturing anywhere outdoors.

The virus can spread rapidly through the close interactions New Yorkers have in restaurants, bars and places where we sit close together. We have to break that cycle. Tomorrow, I will sign an Executive Order limiting restaurants, bars and cafes to food take-out and delivery.

— Mayor Bill de Blasio (@NYCMayor) March 16, 2020

Update (1630ET): Germany joined the list of European nations reporting new coronavirus figures on Sunday, and like France and Italy, it reported its largest daily spike in new cases, confirming another 1,228 new cases for a new total of 5,813, a roughly 20% increase. It also reported 4 new deaths, bringing its national total to 12. Update (1555ET): France just reported 901 new cases diagnosed on Saturday, bringing the country’s total confirmed cases to ~5,400. The death toll climbed by 29 cases to 120.

Yeah, yeah, let’s pretend Fauci contradicts Trump. Scores well with 50% of the people. Problem is, they have two very different tasks in this. And Trump’s is not to worry Americans. It’s to reassure them, while working to solve issues. If you want to blame Trump for saying things are not so bad, you need a crash course in politics. If you want to blame him for policy failures, you’re right, but you will have to do the same with just about every other world leader as well. They all make such mistakes. How about Italy PM Conte to begin with? A lot more of his people died so far.

• Americans Urged To Scrap Gatherings Of 50 Or More People (G.)

The US Centers for Disease Control (CDC) has recommended that gatherings of 50 people or more be cancelled or postponed for the next eight weeks because of the coronavirus pandemic, as officials across the country continued to curtail freedoms to fight the coronavirus outbreak. The CDC guidance was soon followed by an announcement on Sunday night that several Las Vegas hotels and casinos would suspend operations, and New York City would limit restaurants, bars and cafes to only offer take-out and delivery starting on Tuesday, and nightclubs, movie theaters and other entertainment venues would close.

“These places are part of the heart and soul of our city. They are part of what it means to be a New Yorker,” Mayor Bill de Blasio said in a statement on Sunday night. “But our city is facing an unprecedented threat, and we must respond with a wartime mentality.” Moments later, the Washington state governor, Jay Inslee, took a similar step, announcing restaurants and bars would be limited to take-out only until the end of March, and entertainment and recreational facilities such as gyms would also close. Illinois, Ohio, Massachusetts had already taken similar steps. MGM Resorts International, which operates several vast Las Vegas hotels and casinos including Bellagio and Luxor, said it would begin to suspend operations in the city from Monday.

[..] The new advice came as the nation sank deeper into chaos over the crisis. Hours earlier, Donald Trump urged Americans to refrain from panic buying basic supplies, as the administration announced plans to expand testing for the virus and health officials were preparing to release “advanced guidelines” on how to mitigate its spread. During a press briefing at the White House on Sunday evening, Trump again appeared to downplay the threat of the virus. “Relax, we’re doing great,” he said, during short, meandering comments that focused mostly on celebrating a decision by the Federal Reserve to lower interest rates. “It all will pass.”

But the president’s remarks stood in marked contrast to his lead infectious diseases expert, Dr Anthony Fauci, who used the same conference to warn: “The worst is ahead for us”, describing the crisis as reaching a “very, very critical point now”. Earlier in the day, Dr Fauci had declined to rule out a national lockdown of bars and restaurants as he urged more aggressive measures, similar to those in Europe and elsewhere, to contain the virus. “I think Americans should be prepared that they are going to have to hunker down significantly more than we as a country are doing,” said Fauci, a member of the White House task force on combating the spread of coronavirus. He heads the National Institute of Allergy and Infectious Diseases at the National Institutes of Health.

It is time to show the world that nobody stays home and sits on the couch better than the goddamn United States of America

— Pablo S. Torre (@PabloTorre) March 15, 2020

Don’t worry, I know exactly what half the (US) population will say about what I say here. It doesn’t matter. If Trump wants to buy a German medical company that makes a vaccine (and that’s two really big ifs), how can that be portrayed negatively? Well, we’ll say he wants to keep it all to himself. But doesn’t he perhaps want it for the 330 million Americans, those his job description tells him to look after? Cue: this is an anonymous source quoted by a German yellow paper.

“The German government is trying to fight off what it sees as an aggressive takeover bid by the US, the broadsheet Die Welt reports, citing German government circles. The US president had offered the Tübingen-based biopharmaceutical company CureVac “large sums of money” to gain exclusive access to their work, wrote Die Welt. According to an anonymous source quoted in the newspaper, Trump was doing everything to secure a vaccine against the coronavirus for the US, “but for the US only”.”

Along the same line, I see a lot of people combining Trump’s “We have no shortages” with pictures of empty shelves, insinuating he is lying. But those can exist together, and in fact do in many European countries as well as the US. The cause is panic buying. Would these folk like to blame those empty EU shelves on Trump as well? Or are they caused by these countries’ own politicians, many of whom claim to despise Trump? Your call.

Look, Trump makes a lot of mistakes. But saying that things are not that bad is not one of them (literally: “Relax, we’re doing great; It all will pass”). Would you rather he said things are terrible, thereby inviting more panic buying and empty shelves, that you could then blame on him as well? That way you could blame him for two completely opposite things.

• Anger In Germany At Report Trump Seeking Exclusive Coronavirus Vaccine Deal (G.)

German ministers have reacted angrily following reports US president Donald Trump offered a German medical company “large sums of money” for exclusive rights to a Covid-19 vaccine. “Germany is not for sale,” economy minister Peter Altmaier told broadcaster ARD, reacting to a front page report in Welt am Sonntag newspaper headlined “Trump vs Berlin”. The newspaper reported Trump offered $1bn to Tübingen-based biopharmaceutical company CureVac to secure the vaccine “only for the United States”. The German government was reportedly offering its own financial incentives for the vaccine to stay in the country.

The report prompted fury in Berlin. “International co-operation is important now, not national self-interest,” said Erwin Rueddel, a conservative lawmaker on the German parliament’s health committee. Christian Lindner, leader of the liberal FDP party, accused Trump of electioneering, saying: “Obviously Trump will use any means available in an election campaign.” The German health minister, Jens Spahn, said a takeover of CureVac by the Trump administration was “off the table”. CureVac would only develop vaccine “for the whole world”, Spahn said, “not for individual countries”.

[..] At a news conference on Sunday, interior minister Horst Seehofer was asked to confirm the attempts to court the German company. “I can only say that I have heard several times today from government officials today that this is the case, and we will be discussing it in the crisis committee tomorrow,” he said. A US official told AFP on Sunday that the report was “wildly overplayed”. “The US government has spoken with many [more than 25] companies that claim they can help with a vaccine. Most of these companies already received seed funding from US investors.” The official also denied the US was seeking to keep any potential vaccine for itself. “We will continue to talk to any company that claims to be able to help. And any solution found would be shared with the world,” the official said.

That still took a long time.

• More Coronavirus Cases Outside Of Mainland China Than Inside (CNN)

There have now been more cases of the novel coronavirus outside of mainland China than inside, according to numbers from the World Health Organization and from public health agencies tracked by CNN. While China, the early epicenter of the outbreak, has still had more confirmed cases than any other country – more than 80,000 – a number of other countries have surged in recent days, including Italy with more than 24,000 cases, Iran with almost 14,000 and Spain with more than 7,000. On February 26, the World Health Organization reported for the first time that the majority of new cases per day had come from outside of China. This trend has continued as newly confirmed cases in China have dwindled in recent days, while other countries have discovered thousands of new infections – including the United States, which has now reported more than 3,000 cases.

It’s starting. 100 million frail forms at Europe’s door soon?

• Scientists Worry About Coronavirus Spread In Africa (ScienceMag)

Late on Sunday evening, South African President Cyril Ramaphosa, in a televised address to the nation, declared that COVID-19, the respiratory disease spreading globally, had become a “national disaster.” [..] “Never before in the history of our democracy have we been confronted by such a severe situation,” Ramaphosa said before announcing a raft of measures to curb the virus’ spread, including school closures, travel restrictions, and bans on large gatherings. So far, the official numbers seemed to suggest that sub-Saharan Africa, home to more than 1 billion people, had been lucky. The interactive map of reported COVID-19 cases run by Johns Hopkins University shows big red blobs almost everywhere—except sub-Saharan Africa.

But now the numbers are rising quickly. South Africa, which had its first case 10 days ago, now has 61. According to Ramaphosa, the virus has begun spreading inside the country. And just yesterday, Rwanda, Equatorial Guinea, and Namibia all reported their first cases, bringing the number of affected countries to 23. Some scientists believe COVID-19 is circulating silently in other countries as well. “My concern is that we have this ticking time bomb,” says Bruce Bassett, a data scientist at the University of Cape Town who has been tracking COVID-19 data since January. And while Africa’s handling of the pandemic has received scant global attention so far, experts worry the virus may ravage countries with weak health systems and a population disproportionately affected by HIV, tuberculosis (TB) and other infectious diseases. “Social distancing” will be hard to do in the continent’s overcrowded cities and slums.

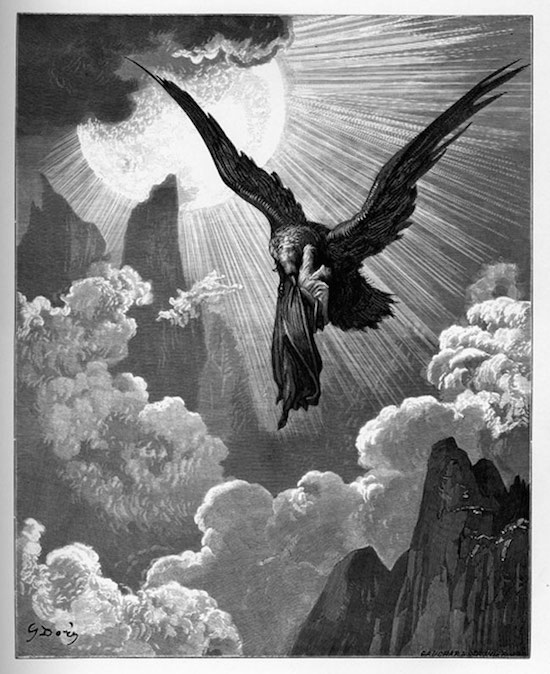

“And Darkness and Decay and the Red Death held illimitable dominion over all..”

• The American Mask of Death (Lauria)

The U.S. is unlike the rest of the industrialized world, which, since the end of the Second World War, has had some kind of nationalized health insurance covering all citizens, regardless of their ability to pay. Many of the partisans who helped defeat the Nazis were socialists who demanded something in return from their governments after the war. Many British soldiers were Labour voters. They threw out war leader Winston Churchill in the 1945 election and the National Health Service was begun in 1948. Though Harry Truman around the same time floated the idea of socialized medicine in the U.S., and the 1965 Medicare Act was to eventually cover all Americans, the greed of medical business interests has always won. It leaves millions of potentially infected Americans unable to be tested or treated. And that endangers even those in their high towers who “might bid defiance to contagion.”

The Mask of the Red Death by FlamiatheDemon (Deviant Art- flamiathedemon.deviantart.com)

“And now was acknowledged the presence of the Red Death. He had come like a thief in the night. And one by one dropped the revellers in the blood-bedewed halls of their revel, and died each in the despairing posture of his fall. And the life of the ebony clock went out with that of the last of the gay. And the flames of the tripods expired. And Darkness and Decay and the Red Death held illimitable dominion over all.”

When the oligarchs’ economic system crashed in 2008 from over-speculation, the U.S. government did the unimaginable. It nationalized industries to save them. It used socialism to rescue capitalism. But it was temporary. Once the economy had sufficiently recovered, the U.S. returned to its market fundamentalism. If the coronavirus crisis approaches the numbers recent studies point to—as many as 240 million Americans infected and one million dead—expect serious consideration to a single-payer system sweeping through Congress and signed into law. But once the virus is contained expect your premiums to rise again. Just like the nationalizations in the 2008 financial crisis, a temporary national health insurance would only be enacted to save the oligarchs from the Red Death.

— Alex M. Adams (@AlexMAdams2) March 16, 2020

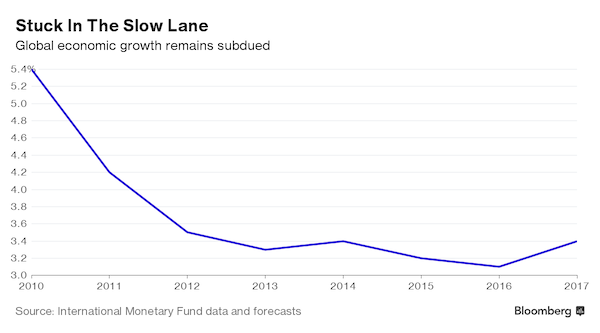

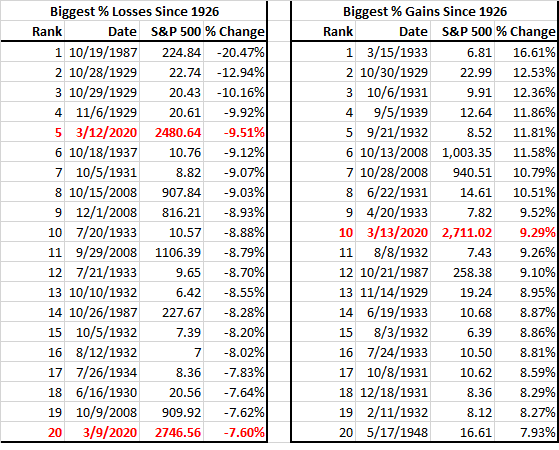

Can the US fall 5% without breaking?

• Goldman Sachs Predicts A 5% Contraction In The US Economy In Q2 (CNBC)

Goldman Sachs on Sunday downgraded its outlook for the economy in the first two quarters of 2020 as the coronavirus zaps all growth from the U.S. Jan Hatzius, Goldman’s chief economist, lowered his first-quarter GDP growth forecast to zero from 0.7%. The economist also sees a 5% contraction in the second quarter, followed by a sharp snapback for the remainder of the year. “We expect US economic activity to contract sharply in the remainder of March and throughout April as virus fears lead consumers and businesses to continue to cut back on spending such as travel, entertainment, and restaurant meals,” Hatzius said in a note to clients Sunday. [..] The rapid spread of the virus has sent stocks tumbling into a bear market, with both the Dow Jones and S&P 500 now trading more than 20% below their record highs set just last month.

“Even with monetary and fiscal policy turning sharply further toward stimulus … these shutdowns and rising public anxiety about the virus are likely to lead to a sharp deterioration in economic activity in the rest of March and throughout April,” Hatzius said. In addition to the consumer spending hit, Goldman also noted the growing likelihood of “significant supply chain disruptions” as the outbreak sends business activity to a standstill. Hatzius believes that U.S. economic growth should pick up in the second half of 2020. He expects GDP growth of 3% in the third quarter and a 4% expansion in the final three months of the year. Factoring in his new estimates, for 2020 he sees the economy growing 0.4%, compared with a prior growth estimate of 1.2%.

Save people not banks. Didn’t we say that 10 years ago as well?

• Fed Cuts Rates To Zero, Launches Massive $700 Billion QE (CNBC)

The Federal Reserve, saying “the coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States,” cut interest rates to essentially zero on Sunday and launched a massive $700 billion quantitative easing program to shelter the economy from the effects of the virus. The new fed funds rate, used as a benchmark both for short-term lending for financial institutions and as a peg to many consumer rates, will now be targeted at 0% to 0.25% down from a previous target range of 1% to 1.25%. Facing highly disrupted financial markets, the Fed also slashed the rate of emergency lending at the discount window for banks by 125 basis points to 0.25%, and lengthened the term of loans to 90 days.

Despite the aggressive move, the market’s initial response was negative. Dow futures pointed to a decline of some 1,000 points at the Wall Street open Monday morning. The discount window “plays an important role in supporting the liquidity and stability of the banking system and the effective implementation of monetary policy … [and] supports the smooth flow of credit to households and businesses,” a separate Fed note said. The discount window is part of the Fed’s function as the “lender of last resort” to the banking industry. Institutions can use the window for liquidity needs, though some are reluctant to do as it can indicate they are experiencing financial issues and thus sends a bad message.

The Fed also cut reserve requirements for thousands of banks to zero. In addition, in a global coordinated move by centrals banks, the Fed said the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank took action to enhance dollar liquidity around the world through existing dollar swap arrangements.

The Fed is choking on its own policies.

• The End of the Central Bank [Put]? (Jim Bianco)

The past week has seen unprecedented market movements and action taken by central banks. We have also seen unprecedented action by governments. Given the events that took place in 2008, this is saying a lot.

We’ll save detailing what happened for another time. Instead, we’ll focus on what it means and what to focus on next. Two titanic forces are at play. First, the economy is at a real risk of collapsing. This is not hyperbole. Goldman Sachs has already revised its Q2 GDP forecast to -5%.

We fear this might look optimistic in a few weeks. Yes, this virus-driven economic collapse is temporary, one or two quarters, but the risk is very real that long-lasting damage is being done that will hamper the economy for years. The other titanic force is world central banks and governments going “all in” to keep markets from falling further. They have effectively done everything they can. This better work. This better stimulate risk markets to hold last week’s low. If risk markets continue to fall, effectively there is nothing left that central banks can do. They can always invent more programs, but they already fired their most potent weapons.

Many will argue that the Fed should buy corporate bonds and/or equities, but this requires Congress amending the Federal Reserve Act. Considering Congress has still not passed virus relief, this will not happen fast enough and is not advisable as it could make things worse. Simply put, if this does not work, the central bank “put” no longer works. So stop devising new ways to exercise it and move on to other actions. So that leaves one tool left should risk markets continue to fall through last week’s low – close financial markets before they collapse.

The S&P 500 has already declined more than 25% in just 16 days. We have never seen this big a decline this fast. Should stock prices fall to new lows and corporate bond prices decline accordingly, it risks chaos in financial markets. Margin calls will force involuntary liquidation. The inability to properly price illiquid securities like high yield bonds and emerging market securities may prompt funds to halt redemptions. People’s money may be trapped. Covenants will be triggered, forcing unwanted restructurings or change of control. Pension fund minimum funding requirements are at risk of being violated.

Not done yet.

• Fed Disaster: S&P Futures Crash, Halted Limit Down; Gold, Treasuries Soar (ZH)

The Fed may have a very big problem on its hands. After firing the biggest emergency “shock and awe” bazooka in Fed history, one which was meant to restore not just partial but full normalcy to asset and funding markets, Emini futures are not only not higher, but tumbling by the -5% limit down at the start of futures trading on Sunday evening… … with Dow futures down over 1,000, and also limit down… … the VIX surging 14%…. … perhaps because the Fed has not only tipped its hand that something is very wrong by failing to wait just an additional three days until the March 18 FOMC, but that it can do nothing more to fix the underlying problem, while gold is surging over 3% following today’s dollar devastation (if only until risk parity funds resume their wholesale liquidation at some point this evening when we expect gold to tumble again)…

… as US Treasury futures soar (which will also likely be puked shortly once macro funds are hit again on their basis trades), as it now appears that the Fed’s emergency rate cut to 0% coupled with a $700BN QE is seen as not enough by a market which is now openly freaking out that the Fed is out of ammo and has not done enough. In short, with the ES plunging limit down, this has been an absolutely catastrophic response to the Fed’s bazooka; expect negative interest rates across the curve momentarily… oh and Trump demanding Powell’s resignation in the next 48 hours.

The Fed has thrown a kitchen sink of policy measures that should in theory weaken the US dollar. Problem is the global backdrop due to Covid-19 isn't conducive to putting money to work in other countries/FX. Fed making US risky assets relatively more attractive may support $USD pic.twitter.com/zqBLJ3e1dA

— Viraj Patel (@VPatelFX) March 15, 2020

Jamie Dimon loves you long time. Nationalize the suckers. Divvy up the spoils and start anew.

• America’s Biggest Banks Suspend Buybacks In Effort To Support Economy (F.)

America’s largest and most important lenders are temporarily suspending their stock buybacks so they can help pump money into an economy battered by the coronavirus pandemic. The move means that Wall Street is prioritizing supporting the U.S. economy with its cash, instead of using it to engineer stock prices higher after a sharp market drop. Eight of the biggest banks in America said on Sunday evening they will be suspending their stock buybacks for the remainder of the first quarter, ending on March 30, and the second quarter, so as to use the spare cash to lend to individuals and businesses in need of credit. Banks suspending their buybacks are JPMorgan, Bank of America, Citigroup, Wells Fargo, Goldman Sachs, Morgan Stanley, Bank of New York Mellon and State Street.

The coordinated move, among firms who’ve recently bought back a collective tens of billions of dollars in stock annually, underscores Wall Street’s vital role in helping to pull the American economy though what economists increasingly forecast will be a deep recession. “The COVID-19 pandemic is an unprecedented challenge for the world and the global economy and the largest U.S. banks have an unquestioned ability and commitment to supporting our customers, clients and the nation,” said the Financial Services Forum, an advocacy group for banks, on behalf of the eight lenders. “The decision on buybacks is consistent with our collective objective to use our significant capital and liquidity to provide maximum support to individuals, small businesses, and the broader economy through lending and other important services,” it added

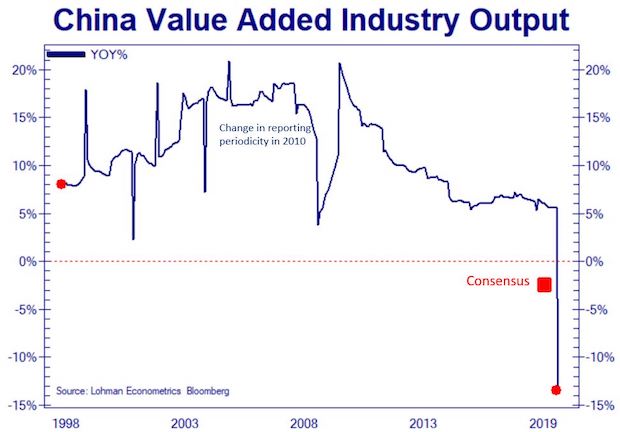

CHINA BREAKING NEWS:

• Jan-Feb Fixed Investment: -25.5% vs -2% estimate

• Jan-Feb Retail Sales: -20.5% vs -4%

• Jan-Feb Industrial Production: -13.5% vs -3% estimate

“#China is able to achieve 6% GDP growth in 2020 despite #COVID19, as the impact is temporary and China has uniquely high savings to help cushion shocks by black swan events”

Liang Hong, chief economist of China International Capital Corp

• China’s Industrial Output, Retail Sales Plummet (MW)

China’s economic activity contracted sharply across the board in the first two months of the year amid Beijing’s aggressive measures to contain the coronavirus epidemic. Industrial output declined 13.5% in the January-February period from a year earlier, compared with December’s 6.9% increase, the National Bureau of Statistics said Monday. The result was worse than the 3.0% drop expected by economists polled by The Wall Street Journal. China typically combines economic data for the first two months to reduce distortions from the Lunar New Year holiday.

Fixed-asset investment, a gauge of construction activity, slid 24.5% during the period, reversing growth of 5.4% in 2019. Economists expected fixed-asset investment to fall 1.0%. Retail sales tumbled 20.5% in the first two months of the year–typically a boom season for consumption–compared with growth of 8.0% in December. Economists expected retail sales to fall 5%. Meanwhile, China’s urban unemployment rate rose to 5.7% in February from 5.2% in December, official data showed. To contain the spread of the coronavirus, Beijing in January locked down cities hit most by the epidemic, ordered an extended shutdown of factories and businesses and advised residents to stay home.

Somehow I could see this succeed. In 2021.

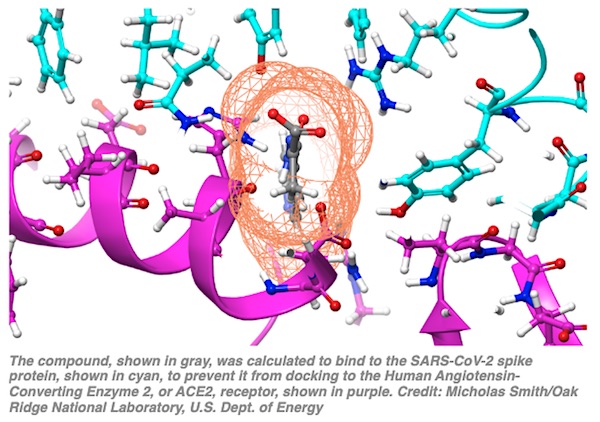

• World’s Most Powerful Supercomputer Tasked With Finding COVID19 Cure (ZH)

Researchers at the Department of Energy’s Oak Ridge National Laboratory have used the world’s most powerful supercomputer to identify 77 drug compounds that could lead to scientific breakthroughs to combat Covid-19. The supercomputer, dubbed Summit, has been tasked to run complex computation across existing databases of drug compounds to see which combinations could thwart Covid-19 from infecting cells. Summit has been able to “simulate 8,000 compounds in a matter of days to model which could impact that infection process by binding to the virus’s spike, and have identified 77 small-molecule compounds, such as medications and natural compounds, that have shown the potential to impair COVID-19’s ability to dock with and infect host cells,” read an IBM press release, whose technology is present in Summit.

“Summit was needed to rapidly get the simulation results we needed. It took us a day or two whereas it would have taken months on a normal computer,” said Jeremy Smith, Governor’s Chair at the University of Tennessee, director of the UT/ORNL Center for Molecular Biophysics, and principal researcher in the study. “Our results don’t mean that we have found a cure or treatment for COVID-19. We are very hopeful, though, that our computational findings will both inform future studies and provide a framework that experimentalists will use to further investigate these compounds. Only then will we know whether any of them exhibit the characteristics needed to mitigate this virus.” Smith’s team is expected to pass on the findings to others in the scientific community, who will then begin to experiment on Summit’s 77 compounds to see which one is the most effective against Covid-19.

Things to do while staying home: feed a mini donkey, watch the remarkably enticing marble racing.

Stay at home as much as possible. Listen to the experts, ignore the morons (foreheads). We will get through this together. pic.twitter.com/FRg41QehuB

— Arnold (@Schwarzenegger) March 16, 2020

https://twitter.com/i/status/1239196410857340933

If you read us, please support us. Help the Automatic Earth survive.