William Merritt Chase Back Of A Nude 1888

And who are you going to turn to to protest this? Not your politicians, they’re in on it.

• Banks Earn Record Profits in Q2, Savers Sacrificed: FDIC (WS)

Savers have been shanghaied into doing an enormous job, in small increments, day after day, for nine years: Recapitalizing the collapsed US banking system and making it immensely profitable again, leading to high core-capital ratios, record bonuses, big-fat dividends, and massive share-buybacks. And the FDIC, in its Quarterly Banking Profile released today, shows how. The total number of FDIC-insured commercial banks and savings institutions fell by 271 to 5,787 by the end of the second quarter. Of them, 5,338 were community banks. Most of this shrinkage was due to consolidation. But there were a handful of bank failures: in 2016, five banks failed. So far this year, six banks failed. The remaining banks get a bigger slice of the pie.

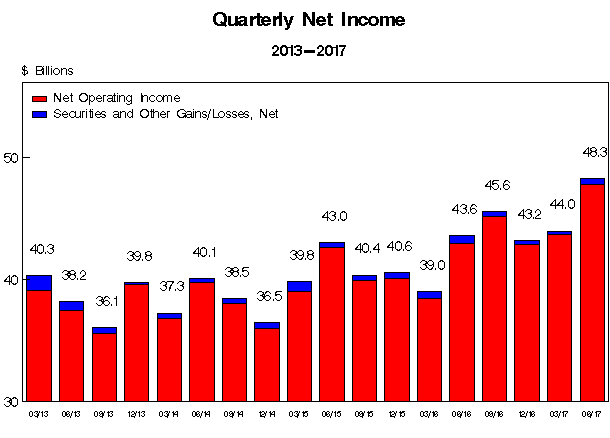

Here’s the good news: Almost everything in the report is good news! That is, unless you’re a saver whose income stream has been confiscated in order to make this good news possible. FDIC-insured banks and savings institutions booked a combined net income of $48.3 billion in the second quarter 2017, a post-crisis high. That’s up by $4.7 billion, or 10.7%, from a year ago (chart via FDIC):

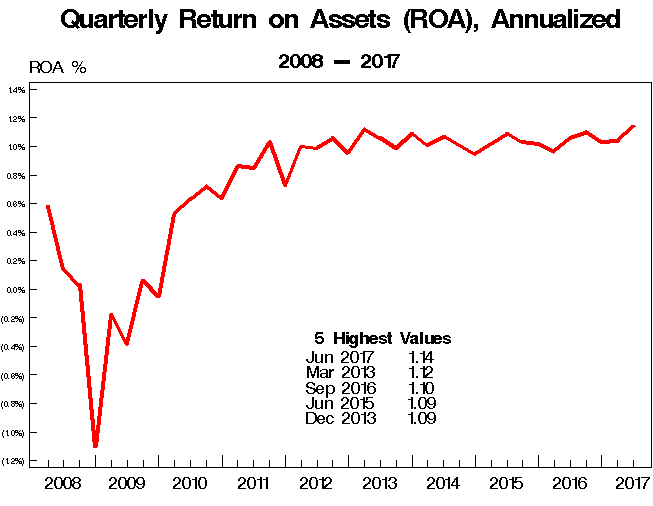

This $4.7-billion increase in earnings was caused by a jump in net interest income of $10.3 billion (9.1%). Net interest income is the difference between a bank’s revenues generated by interest-bearing assets, such as loans, and the costs of its liabilities, mainly deposits but also bonds and the like. Currently banks borrow money from depositors at near zero cost. And it’s a lot of money. At the end of Q2, all commercial banks held $11.2 trillion in domestic deposits. Of that, $9.1 trillion were savings deposits. This is money that banks owe savers. A lot of nearly free money. [..] One of the most important performance metrics for banks is Return On Assets. In Q2, for all FDIC-insured banks combined, the Average ROA reached 1.14%, the highest since Q2 2007. Yes, thank you hallelujah dear savers (chart via FDIC):

Nothing to do with inflation (we know because money velocity is way down), but with trapping people into debt: “Even adjusted for inflation, the median home price in 1940 would only have been $30,600 in 2000 dollars”.

• The Silent Crisis in US Housing Finance (Whalen)

The big picture on housing reflected in the mainstream media is one of caution, as illustrated in The Wall Street Journal. Borodovsky & Ramkumar ask the obvious question: Are US homes overvalued? Short answer: Yes. Send your cards and letters to Janet Yellen c/o the Federal Open Market Committee in Washington. As we’ve discussed in several forums over the past few years, home valuations are one of the clearest indicators of inflation in the US economy. While members of the tenured world of economics somehow rationalize understating or ignoring the fact of double digit increases in home prices along the country’s affluent periphery, sure looks like asset price inflation to us. In fact, since WWII home prices in the US have gone up four times the official inflation rate.

“Houses weren’t always this expensive,” notes CNBC. “In 1940, the median home value in the U.S. was just $2,938. In 1980, it was $47,200, and by 2000, it had risen to $119,600. Even adjusted for inflation, the median home price in 1940 would only have been $30,600 in 2000 dollars, according to data from the U.S. Census.” Inflation, just to review, is defined as too many dollars chasing too few goods, in this case bona fide investment opportunities. A combination of slow household formation and low levels of new home construction are seen as the proximate cause of the housing price squeeze, but higher prices also limit the level of existing home sales. Many long-time residents of high priced markets like CA and NY cannot move without leaving the community entirely. So they get a home equity line or reverse mortgage, and shelter in place, thereby reducing the stock of available homes.

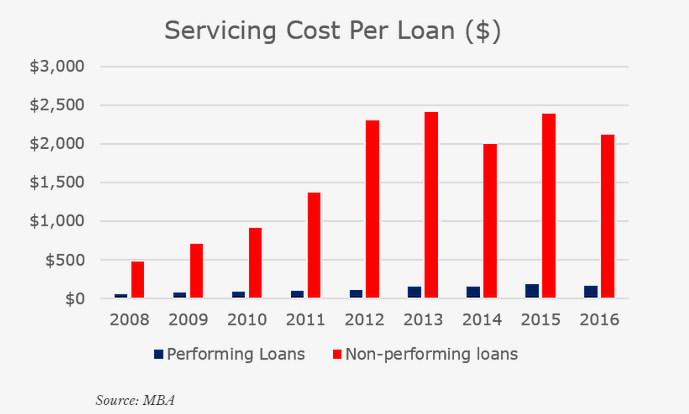

Two key indicators that especially worry us in the world of credit is the falling cost of defaults and the widening gap between asset pricing and cash flow. Credit metrics for bank-owned single-family and multifamily loans are showing very low default rates. More, loss-given default (LGD) remains in negative territory for the latter, suggesting a steady supply of greater fools ready to buy busted multifamily property developments above par value. We can’t wait for the FDIC quarterly data for Q2 2017 to be released next week as we expect these credit metrics to skew even further. Single-family exposures are likewise showing very low default rates and LGDs at 30-year lows, again suggesting a significant asset price bubble in 1-4 family homes. The fact that many of these properties are well under water in terms of what the property could fetch as a rental also seasons our view that we are in the midst of a Fed-induced investment mania.

Nice and interesting, but don’t present it as something new. At best all the scientists et al quoted have only recently found out. And as the Automatic Earth has said forever, don’t say the 2007/8 crisis was caused by energy issues. The financial world didn’t need any help causing it.

• The New Economic Science Of Capitalism’s Slow-Burn Energy Collapse (Ahmed)

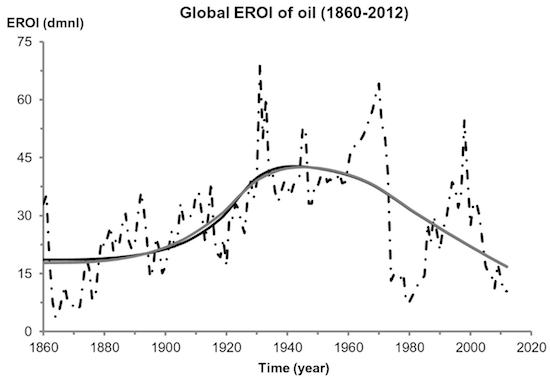

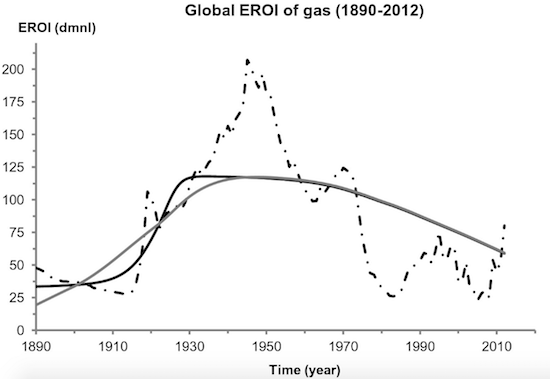

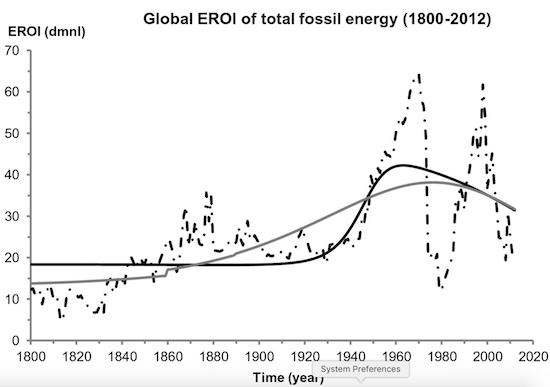

Recent studies suggest that the EROI of fossil fuels has steadily declined since the early 20th century, meaning that as we’re depleting our higher quality resources, we’re using more and more energy just to get new energy out. This means that the costs of energy production are increasing while the quality of the energy we’re producing is declining. But unlike previous studies, the authors of the new paper [..] have removed any uncertainty that might have remained about the matter. Court and Fizaine find that the EROI values of global oil and gas production reached their maximum peaks in the 1930s and 40s. Global oil production hit peak EROI at 50:1; while global gas production hit peak EROI at 150:1. Since then, the EROI values of oil and gas-the overall energy we’re able to extract from these resources for every unit of energy we put in- is inexorably declining.

Even coal, the only fossil fuel resource whose EROI has not yet maxed out, is forecast to undergo an EROI peak sometime between 2020 and 2045. This means that while coal might still have signficant production potential in some parts of the world, rising costs of production are making it increasingly uneconomical. Axiom: Aggregating this data together reveals that the world’s fossil fuels overall experienced their maximum cumulative EROI of approximately 44:1 in the early 1960s.

Since then, the total value of energy we’re able to extract from the world’s fossil fuel resource base has undergone a protracted, continuous and irreversible decline. At this rate of decline, by 2100, we are projected to extract the same value of EROI from fossil fuels as we were in the 1800s. Several other studies suggest that this ongoing decline in the overall value of the energy extracted from global fossil fuels has played a fundamental role in the slowdown of global economic growth in recent years. In this sense, the 2008 financial crash did not represent a singular event, but rather one key event in an unfolding process. [..] Going back to the new EROI analysis by French economists, Victor Court and Florian Fizaine, the EROI of oil is forecast to reduce to 15:1 by 2018. It will continue to decline to around 10:1 by 2035. They broadly forecast the same pattern for gas and coal: Overall, their data suggests that the EROI of all fossil fuels will hit 15:1 by 2060, and decline further to 10:1 by 2080.

Whole new resources wars lie ahead.

• Switch to Renewables Won’t End the Geopolitics of Energy (BBG)

Yes, there are many reasons to be enthusiastic about a shift toward renewables. Unfortunately, an escape from energy geopolitics is not likely to be among them. [..] Among the most interesting of possible trends we highlight is the idea that a more renewable-heavy future will likely bring with it new forms of the “resource curse” – the phenomenon that political and economic development in many resource-wealthy countries seems stymied when compared to resource-poor ones. In many resource-rich nations, economic growth is actually slower and political institutions are more likely to be repressive and nondemocratic. In the world of fossil fuels, this curse has generally applied to big producers of oil and gas.

In a world heavier on renewables, the curse will probably not be so relevant for producers of power; solar, wind and geothermal energy are more likely to be generated and consumed within the borders of a country than to become profitable exports and generators of huge windfall cash flows. Rather, we may see this curse surface in countries rich in the materials required to produce the components that make renewable energy possible. Many of these resources are rare-earth metals and other commodities deep underground. For example, indium and cobalt – neither is technically a rare-earth metal, but they are still relatively hard to come by – are essential for making solar panels and batteries.

China provides approximately half of the indium consumed globally today, whereas the Democratic Republic of the Congo is the source of more than half the world’s cobalt. The big producers of lithium, another material essential for the production of batteries, are Argentina, Australia, Chile and China. Yet Bolivia’s large untapped reserves of lithium could catapult it into this league in the future. Tellurium is not a rare-earth mineral, but it is another key component of solar panels. The U.S. has imported most of this material from Canada, but relies to some extent on Belgium, China and the Philippines. By some estimates, China supplies as much as 95% of all the rare-earth elements in the global market. Given Beijing’s dominant position, the world should expect repeats of the 2010 episode when China halted the sale of rare earths to Japan – where they are vital for the production of solar panels and batteries – in the wake of a maritime dispute.

Whatever anyone thinks of this, do note that one political freely body voting itself the powers of another is scary.

• No U.S.-Russia Cyber Unit Without Trump Notifying Congress (R.)

U.S. President Donald Trump would be required to notify U.S. lawmakers before creating a joint U.S.-Russia cyber security unit – an idea that has drawn criticism across the political spectrum – under legislation advancing in Congress. The proposal, if it became law, would be the latest in a series of maneuvers by Congress that either limit the president’s authority on Russia matters or rebuke his desire to warm relations with Moscow. A provision contained within the annual Intelligence Authorization Act and passed by the U.S. Senate Intelligence Committee 14-1 would require the Trump administration to provide Congress with a report describing what intelligence would be shared with Russia, any counterintelligence concerns and how those concerns would be addressed.

The bill, which grants congressional approval for clandestine operations carried out by the CIA and other U.S. intelligence agencies, passed the Senate Intelligence Committee in July, but its text was only recently made public because it involves sensitive intelligence operations. Trump last month said on Twitter that he and Russian President Vladimir Putin had discussed establishing “an impenetrable Cyber Security unit” to address issues like the risk of cyber meddling in elections. Trump quickly backpedaled on the idea, which was criticized by Democrats, senior Republicans and the National Security Agency director. [..] Trump wants to improve relations with Russia, a desire that has been hamstrung by the conclusions of U.S. intelligence agencies that Russia interfered in the 2016 presidential election to help Republican Trump against Democrat Hillary Clinton.

U.S. congressional panels and a special counsel are investigating the interference and possible collusion between Russia and members of Trump’s campaign. Moscow has denied any meddling and Trump has denied any collusion. Previously, Congress tied the president’s hands on Russia by passing a bill that Trump cannot ease the sanctions against Russia unless he seeks congressional approval. In August, the Senate blocked Trump from being able to make recess appointments while lawmakers were on break, fearing the president would fire Attorney General Jeff Sessions over his handling of the Russian probe. Lawmakers have also introduced legislation to stop Trump from having the ability to fire Robert Mueller, the special counsel appointed to determine whether there was collusion between Trump’s 2016 presidential campaign and Moscow.

Amen.

• The Imperial Collapse Clock Ticks Closer to Midnight (Krieger)

If you haven’t watched Trump’s Afghanistan speech by now you really should. It’s not good enough to read anyone else’s summary, you need to hear it for yourselves. It’s only 25 minutes long. As I started listening, I sensed myself getting angry. It was the same empty, bullshit propaganda I’ve been hearing from U.S. Presidents my entire life. This broken record of disingenuousness has become simply unbearable, and even worse, I know it’s going to work on millions upon millions of Americans. We refuse to think for ourselves, and we refuse to admit the obvious. There will be hell to pay for this ignorance and denial. [..] towards the end of the speech, Trump says the following:

“In every generation we have faced down evil, and we have always prevailed. We prevailed because we know who we are and what we are fighting for.”

Unfortunately, here’s the cold hard truth: We have no idea who we are, and we have no idea what we are fighting for. We’ve become the very evil he claims to be fighting against as the nation morphed into a pernicious, destructive, and immoral empire. This is the heart of the problem — we are constantly lying to ourselves. Of course, we’ll never set things on the right track if we can’t diagnose the disease in the first place. We’ve torched our national treasure and goodwill by running around the world trying to push everybody around, and simultaneously institutionalized a corrupt and predatory neo-feudal society at home. We’ve ignored our own people in a foolish and self-destructive quest to maintain and grow empire and the results will not be pretty.

Good story. The world is not black and white, there are simply people who don’t want to see color.

• The Confederate General Who Was Erased (Dailey)

A native Virginian, a railroad magnate, a slaveholder, and an ardent secessionist, Mahone served in the Confederate army throughout the war. He was one of the Army of Northern Virginia’s most able commanders, distinguishing himself particularly in the summer of 1864 at the Battle of the Crater outside Petersburg. After the war, Robert E. Lee recalled that, when contemplating a successor, he thought that Mahone “had developed the highest qualities for organization and command.” General William Mahone has not been forgotten entirely. Rather, he has been selectively remembered. There is a Mahone Monument, for example, erected by the Daughters of the Confederacy, at the Crater Battlefield in Petersburg, and Civil War scholars have treated Mahone’s military career with respect.

There is an able biography. The problems posed by William Mahone for many Virginians in the past — and what makes it worthwhile for us to think about him in the present — lie in his postwar career. Senator William Mahone was one of the most maligned political leaders in post-Civil War America. He was also one of the most capable. Compared to the Roman traitor Cataline (by Virginia Democrats), to Moses (by African American congressman John Mercer Langston), and to Napoleon (by himself), Mahone organized and led the most successful interracial political alliance in the post-emancipation South. Mahone’s Readjuster Party, an independent coalition of black and white Republicans and white Democrats that was named for its policy of downwardly “readjusting” Virginia’s state debt, governed the state from 1879 to 1883.

During this period, a Readjuster governor occupied the statehouse, two Readjusters represented Virginia in the United States Senate, and Readjusters represented six of Virginia’s ten congressional districts. Under Mahone’s leadership, his coalition controlled the state legislature and the courts, and held and distributed the state’s many coveted federal offices. A black-majority party, the Readjusters legitimated and promoted African American citizenship and political power by supporting black suffrage, office-holding, and jury service. To a degree previously unseen in Virginia, and unmatched anywhere else in the nineteenth-century South, the Readjusters became an institutional force for the protection and advancement of black rights and interests.

At the state level, the Readjusters separated payment of the school tax from the suffrage, thereby enfranchising thousands of Virginia’s poorest voters. They restored and reinvigorated public education in the state, and they lowered real estate and personal property taxes. They banned the chain gang and the whipping post. At the municipal level, Readjuster governments paved streets, added sidewalks, and modernized water systems.

The Readjusters lost power in 1883 through a Democratic campaign of violence, electoral fraud, and appeals to white solidarity. While Democrats suppressed progressive politics in the state, other groups of elite white Virginians worked fast to eradicate the memory of Virginia’s experiment in interracial democracy. These were mutually reinforcing projects. Convinced that black enfranchisement was “the greatest curse that ever befell this country,” members of the Association for the Preservation of Virginia Antiquities (APVA), founded in 1889, equated the Readjuster’ rule with “mobocracy” and called for radical pruning of the electorate. After 1900, William Mahone was characterized by whites in Virginia as a demagogic race traitor with autocratic tendencies. This representation was so powerful that as late as the 1940s the worst charge that could be brought against an anti-Democratic opposition candidate was that he had been associated with Mahone and the Readjusters.

Monopolizing food should be fought for reasons much more profound than legal or economic ones.

• EU Opens Probe Into Bayer Takeover Of Monsanto (AFP)

The European Commission said Tuesday that it was opening an in-depth investigation into the proposed $66 billion (56-billion-euro) takeover of US seed and pesticide supplier Monsanto by Germany’s Bayer, citing concerns it could reduce competition in key products for farmers. “Seeds and pesticide products are essential for farmers and ultimately consumers,” said EU Competition Commissioner Margrethe Vestager. “We need to ensure effective competition so that farmers can have access to innovative products, better quality and also purchase products at competitive prices.” In its own statement, Leverkusen-based Bayer said it “believes that the proposed combination will be highly beneficial for farmers and consumers.” The firm “will continue to work closely and constructively with the European Commission” and still aims to receive approval for the deal by the end of the year, it added.

After a months-long pursuit in which it raised its offer price several times, Bayer won over Monsanto’s management in September for the deal, which would create the world’s largest integrated pesticides and seeds company. If the tie-up goes ahead, the new company would have some 140,000 employees around the world with combined annual revenues from agriculture alone of about €23 billion. But the deal has drawn criticism from environmental groups because of Monsanto’s long history of promoting genetically modified crops. “There’s not much to investigate. One monster corporation controlling our food is a bad idea for farmers and citizens everywhere,” said Nick Flynn of the Avaaz advocacy group. “Over a million people are hoping Commissioner Vestager comes back with a long-term rejection of Monsanto and Bayer’s marriage from hell.”

Trojan.

• Schaeuble Wants To Allow Eurozone Countries To Tap ESM For Investments (R.)

German Finance Minister Wolfgang Schaeuble is working on a proposal that would allow southern eurozone countries to tap into the single currency bloc’s bailout fund to boost investments during recessions, a newspaper said on Wednesday. If the unsourced report in the mass-selling German daily Bild is confirmed, the plan would mark a major change of policy for Schaeuble who had until recently always opposed transfers from richer eurozone countries to poorer members like Greece. Germany is the biggest contributer to the European Stability Mechanism, the eurozone’s bailout fund. Bild said Schaeuble intended to make the proposal after Germany’s Sept.24 election, which his conservatives led by Chancellor Angela Merkel are expected to win. In exchange for more flexible access to the ESM, Schaeuble wants the fund to have more say over national debt and budgets.

Bild added that the proposal was a goodwill gesture toward French President Emmanuel Macron who has vowed to work with Merkel on a roadmap for closer eurozone integration. Schaeuble said earlier this year that he shared Macron’s view that financial transfers from richer to poorer states are necessary within the eurozone. A joint eurozone budget and a common finance minister are among ideas for deeper European Union integration around the single currency after Britain leaves the EU in 2019. Completing a banking union has also been proposed. Schaeuble is loathed in many southern eurozone countries and especially in Greece, for insisting on tough austerity measures in exchange for bailout funds during the bloc’s debt crisis that started seven years ago.

Time for Greece to get scared again.

• Fears Of Tensions As Refugee Arrivals in Greece Rise Again (K.)

Authorities on the islands of the eastern Aegean were unnerved on Tuesday by the arrival of 397 undocumented migrants in just one day, though it remained unclear whether a recent spike in newcomers is the beginning of a new, stronger influx from neighboring Turkey. The 397 new arrivals – 225 on Chios, 61 on Samos, 93 on Leros and 18 on Kos – came on the heels of 643 who landed on the islands over the weekend. August has seen the people smugglers intensify their operations, with more than 2,400 migrants landing on Greek shores following journeys aboard smuggling vessels from Turkey. The renewed influx is putting further pressure on already overcrowded migrant reception facilities on the islands, with authorities acknowledging that a key problem is the slow rate at which hundreds of asylum applications are being processed.

“There has been a noticeable increase in refugee and migrant arrivals over the past few days, which underlines the need for asylum services to be boosted immediately so that the the process is completed more quickly and the islands can be decongested,” the regional governor for the northern Aegean, Christina Kalogirou, told Kathimerini. Most migrants who see their inital asylum claims rejected lodge appeals, which drags out the process even longer, Kalogirou said, adding that the presence of hundreds of migrants in crowded venues for months on end leads to “aggravated situations, tension and even outbreaks of violence.”