Elliott Erwitt Crowd at Armistice Day Parade, Pittsburgh 1950

A huge number of people will not be able to rebuild, because they lack insurance. And in many cases, rebuilding on the same -flood prone- spot wouldn’t be a good idea to begin with. But where will the people go?

Time to stop talking about the damage to the economy, and focus on the people.

• The Economy Minus Houston (Slate)

Houston, America’s fourth-largest city, has a massive, diversified economy. Sure, New Orleans sits near the mouth of the mighty Mississippi River and is an important entrepôt and site for export of raw materials, agricultural commodities chemicals, and petroleum products. But Houston is a larger, busier, and far more important node in the networked economy. Economies derive their power and influence from their connections to other cities, countries, and markets. And Houston is one of the more connected. It is one of the global capitals of the energy and energy services industries. Yes, there’s a degree to which consumption and other economic activity that is forestalled or foregone during a flood is consumption and economic activity deferred. And cleanup efforts tend to be additive to local economies. But in today’s economy, a lot of value can easily be destroyed very quickly.

With only a small portion of the housing stock carrying flood insurance, billions of dollars in property will simply be destroyed and not immediately replaced. People who get paid by the hour, or who work for themselves, won’t be able to make up for the income they’re losing a few weeks from now. Hotel rooms and airplane seats are perishable goods—once canceled, they can’t simply be rescheduled. Refineries won’t be able to make up all the time offline—they can’t run more than 24 hours per day. And given that supply chains rely on a huge number of shipments making their connections with precision, the disruption to the region’s shipping, trucking, and rail infrastructure will have far-reaching effects. If you’re a business in Oklahoma or New Mexico, there’s a pretty good chance the goods you are importing or exporting pass through the Port of Houston.

Sorry, Naomi, but you can’t take individual events and blame them on cllmate change. The system is far too complex for that. We must stick to science, not lose ourselves in assumptions.

• Harvey Didn’t Come Out Of The Blue (Naomi Klein)

Now is exactly the time to talk about climate change, and all the other systemic injustices — from racial profiling to economic austerity — that turn disasters like Harvey into human catastrophes. Turn on the coverage of the Hurricane Harvey and the Houston flooding and you’ll hear lots of talk about how unprecedented this kind of rainfall is. How no one saw it coming, so no one could adequately prepare. What you will hear very little about is why these kind of unprecedented, record-breaking weather events are happening with such regularity that “record-breaking” has become a meteorological cliche. In other words, you won’t hear much, if any, talk about climate change.

This, we are told, is out of a desire not to “politicize” a still unfolding human tragedy, which is an understandable impulse. But here’s the thing: every time we act as if an unprecedented weather event is hitting us out of the blue, as some sort of Act of God that no one foresaw, reporters are making a highly political decision. It’s a decision to spare feelings and avoid controversy at the expense of telling the truth, however difficult. Because the truth is that these events have long been predicted by climate scientists. Warmer oceans throw up more powerful storms. Higher sea levels mean those storms surge into places they never reached before. Hotter weather leads to extremes of precipitation: long dry periods interrupted by massive snow or rain dumps, rather than the steadier predictable patterns most of us grew up with.

The records being broken year after year — whether for drought, storm surges, wildfires, or just heat — are happening because the planet is markedly warmer than it has been since record-keeping began. Covering events like Harvey while ignoring those facts, failing to provide a platform to climate scientists who can make them plain, all while never mentioning President Donald Trump’s decision to withdraw from the Paris climate accords, fails in the most basic duty of journalism: to provide important facts and relevant context. It leaves the public with the false impression that these are disasters without root causes, which also means that nothing could have been done to prevent them (and that nothing can be done now to prevent them from getting much worse in the future).

It’s also worth noting that the Harvey coverage has been highly political since well before the storm made landfall. There has been endless talk about whether Trump was taking the storm seriously enough, endless speculation about whether this hurricane will be his “Katrina moment” and a great deal of (fair) point-scoring about how many Republicans voted against Sandy relief but have their hands out for Texas now. That’s politics being made out of a disaster — it’s just the kind of partisan politics that is fully inside the comfort zone of conventional media, politics that conveniently skirts the reality that placing the interests of fossil fuel companies ahead of the need for decisive pollution control has been a deeply bipartisan affair.

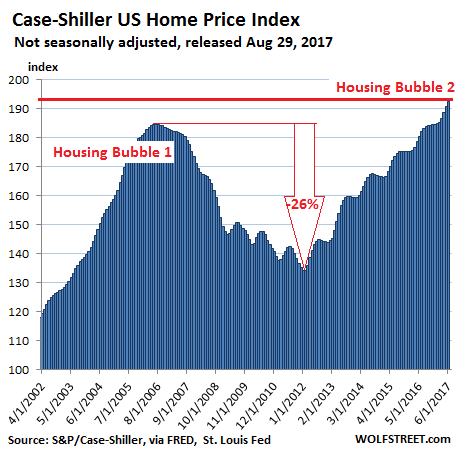

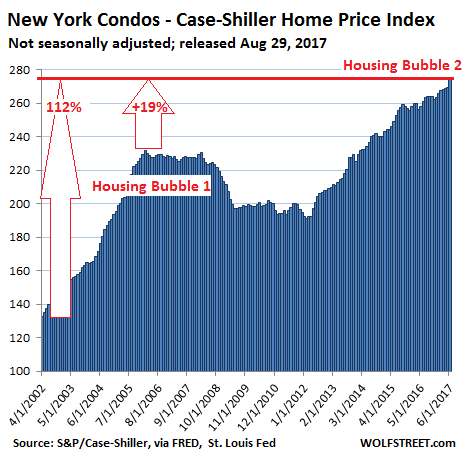

Wolf Richter with a whole series of US cities, all with record new highs. How people can keep saying there is no bubble in the US, I don’t know.

• The US Cities with the Biggest Housing Bubbles (WS)

For the good folks who hope fervently that the Fed doesn’t have reasons to raise rates or unwind QE because there isn’t enough inflation, here is an update on one aspect of inflation – asset price inflation, and particularly house price inflation – where the value of your hard-earned dollars has collapsed over a given number of years to where it takes a whole lot more dollars to pay for the same house. So here are some visuals of amazing house price bubbles, city by city. Bubbles really aren’t hard to recognize, if you want to recognize them. What’s hard to predict accurately is when they will burst. Normally the Fed doesn’t want to acknowledge them. But now it has its eyes focused on them.

The S&P CoreLogic Case-Shiller National Home Price Index for June was released today. It jumped 5.8% year-over-year, not seasonally adjusted, once again outpacing growth in household incomes, as it has done for years. At 192.6, the index has surpassed by 5% the peak in May 2006 of crazy Housing Bubble 1, which everyone called “housing bubble” after it imploded (data via FRED, St. Louis Fed). The Case-Shiller Index is based on a rolling-three month average; today’s release was for April, May, and June data. Instead of median prices, it uses “home price sales pairs,” for example, a house sold in 2011 and then again in 2017. Algorithms adjust this price movement and add other factors. The index was set at 100 for January 2000. An index value of 200 means prices have doubled in the past 17 years, which is what most of the metros in this series have accomplished, or are close to accomplishing.

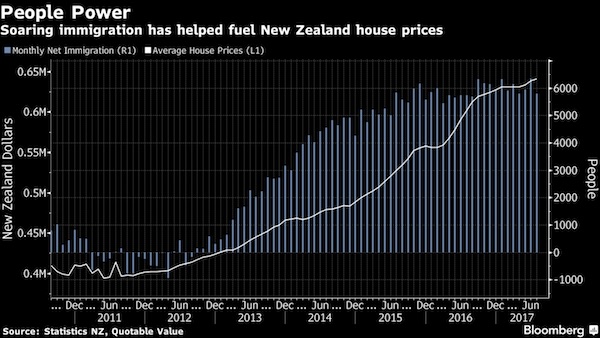

There is no easy way out for New Zealand.

• “Crazy” House Prices Are Firing Up New Zealand’s Voters (BBG)

As ownership falls to the lowest since 1951, housing affordability is firing up voters ahead of New Zealand’s general election on Sept. 23. The government is under attack for failing to respond to price surges that have forced many to ditch their property dreams. New Labour leader Jacinda Ardern has made housing a key issue, helping restore the main opposition party in opinion polls and leaving the election too close to call. “The government’s response has been too slow and inadequate for many because they’ve seen house prices rising very fast,” said Raymond Miller, professor of politics at Auckland University. “Some voters might well have a feeling of being let down by what they see as indifference to their plight. It’s the government’s Achilles’ heel.” Prices across New Zealand have risen 34% the past three years, fanned by record immigration, historically low interest rates and a supply shortage.

That’s seen the portion of owner-occupied properties slump to 63% of the nation’s 1.8 million homes in the second quarter, down from a peak of 74% in the early 1990s. In response, the ruling National Party has made more land available for development and increased deposit grants to first-home buyers. But it’s done little to curb immigration that’s added 201,000 to the population the past three years, while a policy of taxing profits on investment properties sold within two years of purchase has been criticized as too mild. Labour is pledging a more aggressive solution. It’s promising to ban property sales to non-resident foreigners who it says have fanned price pressures, and will extend the period in which investors will be subject to tax to five years. It wants to curb immigration, and plans to build 100,000 homes over 10 years and sell them at affordable prices.

“We’re going to get the government back into the business of building large numbers of affordable homes for first-home buyers like governments used to in this country,” Labour’s housing spokesman Phil Twyford said in a Television New Zealand interview. “The government has had nine years and they’ve just tinkered around the edges.” Many New Zealanders are motivated to save for a home where they can bring up a family just as their parents and grandparents did. National will be wary that disillusioned home-buyers may turn their back on the party, thwarting its efforts to win a rare fourth term. No party has won an outright majority since the South Pacific nation introduced proportional representation in 1996. National had 44% support in a poll published Aug. 17. Labour had 37% but could get across the line with the additional support of ally the Green Party, which had 4%, and New Zealand First, which got 10%.

I think the estimates are still low.

• China’s $2 Trillion of Shadow Lending Throws Focus on Rust Belt (BBG)

Regional banks in China’s rust-belt provinces are driving the rapid expansion of shadow banking in the country, fueling a web of informal lending that poses wider risks to the financial system, according to a study by UBS. Smaller rust-belt banks like Bank of Tangshan Co. and Baoshang Bank have been using products such as trust beneficiary rights and directional asset-management plans to hide the true state of their bad loans and circumvent lending restrictions, the study by analyst Jason Bedford said. Others have been using the shadow loan instruments to diversify away from lending in their struggling home provinces, exposing themselves to a much wider spectrum of Chinese corporate risk in the event of a default, according to the report. By analyzing 237 Chinese banks, many of them small and unlisted regional lenders, Bedford casts a new spotlight on underground financing and the risks it poses to the nation’s $35 trillion banking industry.

Shadow loans grew almost 15% to 14.1 trillion yuan ($2.3 trillion) by December from a year earlier, equal to about 19% of economic output, he estimates. “This is a sleeper issue,” Bedford wrote. “The remarkable level of concentration in regional banks in rust-belt region banks, combined with evidence that these assets are increasingly being used to roll over loans to existing borrowers as well as being swapped between banks without a clear transfer of risk are alarming.” Accounting for this financing, Chinese banks’ nonperforming loans could be three times higher than the official published level, he said. By recording such lending under “investment receivables” rather than “loans” on their financial statements, banks were able to disguise what is in effect lending, to get around regulatory lending curbs or heavy reliance on wholesale funding.

Such financial engineering also enabled some lenders to overstate their capital adequacy ratios, understate nonperforming loans and reduce provision charges. [..] Bank of Tangshan is an unlisted lender in the struggling northeast city of the same name, which produces more steel than any other city around the world. The firm’s shadow loans grew 86% last year to a size equal to 308% of its formal book, the highest of any bank in China, according to Bedford’s report. Still, the bank reported a bad-loan ratio of just 0.05% last year, the lowest of any bank in UBS’ analysis, exemplifying the “distortion” shadow loan books create in assessing asset quality, Bedford said.

How is this NOT criminal intent? Where are the indictments?

• Homeowner’s Lawsuit Says Wells Fargo Charged Improper Mortgage Fees (R.)

A homeowner has filed a lawsuit accusing Wells Fargo of improperly charging thousands of customers nationwide to lock in interest rates when their mortgage applications were delayed. Filed on Monday in San Francisco federal court, the lawsuit said Wells Fargo managers pressured employees to blame homeowners for the delays, sometimes by falsely stating that paperwork was missing, so homeowners could be stuck with extra fees. Wells Fargo Spokesman Tom Goyda said the bank is reviewing past practices on rate lock extensions and will take steps for customers as appropriate. The lawsuit, which will request the court grant class action status, comes as Wells Fargo is trying to recover from a scandal last year when the bank was fined for opening accounts for customers without their authorization in order to boost sales figures.

Last month, a new lawsuit accused it of charging several hundred thousand borrowers for auto insurance they did not request. Monday’s lawsuit accuses the bank of violating state and federal consumer protection laws, including the U.S. Real Estate Settlement Procedures Act and the U.S. Truth in Lending Act. Earlier this month, Wells Fargo disclosed that the Consumer Financial Protection Bureau was investigating the fees the company charged to lock in interest rates for delayed mortgage loans. In a securities filing, the bank said it was working with regulators to see if customers had been harmed by the fees. Interest rate locks are guarantees by a lender to lock in a set interest rate, usually for several weeks, while a loan is processed. If the rate lock expires before a loan closes, lenders often cover the cost of extending the lock if the delay was their fault.

Modi taking people’s incomes away. Reforms. Here’s thinking India is nowhere near ready for this.

• The Battle for India’s $45 Billion Gold Industry Has Begun (BBG)

India’s past and future are colliding in Anand Ghugre’s family jewelry shop in Mumbai. “We still operate the way my father did for 50 years,” said Ghugre, 52, explaining that transactions were typically in cash and were not always recorded. “For small jewelers and the unorganized sector, most of our sales happen through personal connections. Sometimes they don’t want bills, but the jewelers can’t say no to them.” That way of doing business is under threat as the world’s second-largest gold market faces Prime Minister Narendra Modi’s campaign to bring India’s informal economy to book. About three quarters of the estimated $45 billion of the precious metal that is traded in the country each year makes its way through thousands of family-run jewelry shops that have catered for centuries to the nation’s love of gold.

Modi’s financial reforms, including demonetization and a new goods and services tax, combined with a younger generation that shops online, may usher in a wave of takeovers and mergers by big state-wide and national chains as small shops are swallowed up or close. “The one story that we hear is that the business is becoming problematic for smaller jewelers,” said Chirag Sheth at London-based precious metals consultancy Metals Focus. “The bigger jewelers have deeper pockets, they have larger shops, better designs and better margins. It is very difficult for a smaller guy to compete.” Modi in November banned higher denomination notes to bring unaccounted cash back into the system and introduced tougher proof of identity for purchases, capped the amount of cash used in transactions and topped it off with the uniform goods and services tax last month.

An overhaul of the fragmented industry is also on the cards with the government said to be planning a new policy on gold that will bolster confidence among consumers, where the gifting of gold at weddings and festivals or its purchase as a store of value are deeply held traditions. Fixing quality standards and allowing supply chains to be easily tracked are ways to enhance trust.

Well, we can’t have that, can we?

• US Defense Boost May Unravel Into a $65 Billion Cut (BBG)

U.S. national security funding may be slashed by about $65 billion in January as lawmakers forge ahead with a spending plan that collides with a budget ceiling under a six-year-old law. A $614 billion bill passed by the U.S. House in H.R. 3219 is caught in a political vise: President Donald Trump and most lawmakers want to see increases in Pentagon spending, yet that intention isn’t backed up by an agreement to undo the 2011 Budget Control Act. Without another budget agreement in place, the Defense Department faces automatic across-the-board cuts of 9% to 10% starting in mid-January, according to Chris Sherwood, a Pentagon spokesman. That’s about $65 billion, the Congressional Budget Office estimates.

Enforcement of the act’s caps are returning for the coming fiscal year that begins Oct. 1 after they were adjusted in fiscal 2016 and 2017 for discretionary domestic and national security spending. That was the third time since the act passed that the limits were adjusted, in those cases for both defense and domestic discretionary spending. Trump wants to cut domestic spending while adding to defense, a proposal opposed by Democrats and many Republicans. If the mandatory cuts go ahead, they would be leveled across thousands of Pentagon programs. The White House would have the option of exempting military personnel funds from the automatic cuts, known as sequestration. Such cuts are likely because all of the pending congressional defense bills so far propose busting the cap of $549 billion in national security spending for fiscal year 2018, or $522 billion for the Pentagon alone.

Cameron and Osborne and May have gutted the entire country.

• England’s Fire Services Suffer 25% Cut To Safety Officers Numbers (G.)

Fire services in England have lost more than a quarter of their specialist fire safety staff since 2011, a Guardian investigation has found. Fire safety officers carry out inspections of high-risk buildings to ensure they comply with safety legislation and take action against landlords where buildings are found to be unsafe. Figures released to the Guardian under the Freedom of Information Act showed the number of specialist staff in 26 fire services had fallen from 924 to 680, a loss of 244 officers between 2011 and 2017. Between 2011 and 2016, the government reduced its funding for fire services by between 26% and 39%, according to the National Audit Office, which in turn resulted in a 17% average real-terms reduction in spending power.

Warren Spencer, a fire safety lawyer, said the figures showed a “clear culture of complacency” about fire safety. “The government has tended to take the view that fewer people are dying in fires, fires occur less frequently, and therefore there’s no need to invest in fire prevention. So there’s been a total brain drain in fire safety knowledge and many experienced specialist officers have left the force,” he said. “But fire safety officers have been saying to me for years that one day, there would be a big fire in a multiple occupancy building, which would make everyone sit up and take notice of the lack of fire safety provision. Tragically, that’s what happened at Grenfell Tower.”

As dividends keep being paid out.

• UK’s Leading Companies’ Pension Deficit Rises To 70% Of Their Profits (G.)

The combined pension deficit of FTSE 350 companies has risen to £62bn, accounting for 70% of their profits. The deficit as a proportion of profits recorded for 2016 is higher than at any time since the financial crisis, following a £12bn rise since 2015. The 25% increase came in a second year of comparatively low profit for UK publicly listed companies. The deficit is the gap between the expected liabilities of pension commitments and the funds that companies hold to pay for pensions. While many have set aside billions in recent years, a trend towards rising life expectancy, combined with lower expectations for returns on investment, has put more pressure on pension schemes and seen the deficit grow. Actuaries have warned that even a slight fall in bond yields would see the pension deficit of the plcs outstrip their aggregate profits by 2019.

The figures, in a report from the actuarial consultancy Barnett Waddingham, show the deficit has risen sharply as a proportion of profits in the past five years, from 25% of the £214bn pre-tax profits of the FTSE 350 in 2011. Even in the aftermath of the financial crisis in 2009, the deficit was lower at 60%. For 21 plcs, the pensions shortfall is more than 10% of their value, which Barnett Waddingham described as alarming. However, the actuaries said recent data suggesting years of austerity had seen gains in UK life expectancy grind to a halt could provide “welcome respite for companies”. It showed that after a century in which the rate of increase in life expectancy had accelerated, the average age of death was levelling off at 79 for men and 83 for women.

A discussion that must take place. But the political climate doesn’t lean towards nationalization. Besides, how do you nationalize companies that operate in many dozens of countries?

• We Need To Nationalise Google, Facebook and Amazon (G.)

At the heart of platform capitalism is a drive to extract more data in order to survive. One way is to get people to stay on your platform longer. Facebook is a master at using all sorts of behavioural techniques to foster addictions to its service: how many of us scroll absentmindedly through Facebook, barely aware of it? Another way is to expand the apparatus of extraction. This helps to explain why Google, ostensibly a search engine company, is moving into the consumer internet of things (Home/Nest), self-driving cars (Waymo), virtual reality (Daydream/Cardboard), and all sorts of other personal services. Each of these is another rich source of data for the company, and another point of leverage over their competitors.

Others have simply bought up smaller companies: Facebook has swallowed Instagram ($1bn), WhatsApp ($19bn), and Oculus ($2bn), while investing in drone-based internet, e-commerce and payment services. It has even developed a tool that warns when a start-up is becoming popular and a possible threat. Google itself is among the most prolific acquirers of new companies, at some stages purchasing a new venture every week. The picture that emerges is of increasingly sprawling empires designed to vacuum up as much data as possible. But here we get to the real endgame: artificial intelligence (or, less glamorously, machine learning). Some enjoy speculating about wild futures involving a Terminator-style Skynet, but the more realistic challenges of AI are far closer.

In the past few years, every major platform company has turned its focus to investing in this field. As the head of corporate development at Google recently said, “We’re definitely AI first.” All the dynamics of platforms are amplified once AI enters the equation: the insatiable appetite for data, and the winner-takes-all momentum of network effects. And there is a virtuous cycle here: more data means better machine learning, which means better services and more users, which means more data. Currently Google is using AI to improve its targeted advertising, and Amazon is using AI to improve its highly profitable cloud computing business. As one AI company takes a significant lead over competitors, these dynamics are likely to propel it to an increasingly powerful position.

What’s the answer? We’ve only begun to grasp the problem, but in the past, natural monopolies like utilities and railways that enjoy huge economies of scale and serve the common good have been prime candidates for public ownership. The solution to our newfangled monopoly problem lies in this sort of age-old fix, updated for our digital age. It would mean taking back control over the internet and our digital infrastructure, instead of allowing them to be run in the pursuit of profit and power. Tinkering with minor regulations while AI firms amass power won’t do. If we don’t take over today’s platform monopolies, we risk letting them own and control the basic infrastructure of 21st-century society.

Of course the headline said “populists”… Fixed that.

• As Poverty Surges in Italy, Five Star Propose a ‘Citizens’ Income’ (BBG)

“Poverty will be center stage in the campaign,” says Giorgio Freddi, professor emeritus of political science at the University of Bologna. The populist Five Star Movement “has imposed the issue on national politics. The mainstream parties are being forced to play catch-up.” Five Star is a fast-growing group fueled by anger at the old political class. Three years ago the movement rode economic concerns to power in Livorno, ending 70 years of rule by the Communists and other left-leaning parties. The new mayor, a former engineer named Filippo Nogarin, introduced a €500 ($590) monthly subsidy to the disadvantaged. That idea is a key plank in Five Star’s national platform, and the group’s leaders have promised to quickly implement such a program if they take power. Beppe Grillo, the former television comedian who co-founded the party, says fighting poverty should be a top priority.

A basic income can “give people back their dignity,” Grillo’s blog declared in April. “The current government is ignoring millions of families in difficulty.” The Five Star program echoes universal basic income schemes being considered around the world. Finland in January started an experiment in which 2,000 unemployed people receive a stipend of €560 per month. And the Canadian province of Ontario this summer began trials in three cities in which individuals can get almost C$17,000 ($13,600) per year. Five Star’s version would give Italians below the poverty line as much as €780 a month. Recipients must perform several hours of community service each week and actively seek work, and they’d be cut off after rejecting three job offers. Five Star says the plan would cost €17 billion a year, funded in part by spending cuts as well as tax hikes on banks, insurance companies, and gambling.

Opinion polls show Five Star neck and neck with the Democratic Party, led by ex-Premier Matteo Renzi, and a center-right bloc including Forza Italia, the party of former Premier Silvio Berlusconi. To keep Five Star from dominating the debate, Prime Minister Paolo Gentiloni, a Renzi ally, has approved a less ambitious plan he calls “the first universal tool against poverty.” The scheme, dubbed “inclusion income,” would give 1.7 million people as much as €485 a month as long as they’re actively seeking work, at a cost of about €2 billion a year. With industrial output down by about 25% from 2008 to 2013 in Italy’s worst postwar recession, either plan could be helpful, says Giuseppe Di Taranto, a professor of economic history at Rome’s Luiss University. “We lost lots of jobs, and poverty has risen so much that we’ve got to experiment.”

More of the same. But the anti-EU, anti-globalization mood is obvious: “77% of the people questioned in a recent poll could see no advantage to them at all from the country’s membership in the European Union.” While Macron and Merkel are planning a lot more EU. And claiming that the EU is doing fine.

• Why Every European Country Has A Trump Or Sanders Candidate (Drake)

As a result of the methods used to promote globalization, the consequences for the West have been tragic. Work is becoming increasingly uncertain and insecure, or it is in the process of disappearing altogether. It would take Veblen’s talents for social satire, which are unsurpassed in all of American literature, to depict with the essential exactitude of artistic synthesis how far the United States has fallen away from democratic grace, the country’s dramatically widening gap between the haves and the have-nots being what it is. Clearly, we are on the wrong course. What the robotics revolution, now at an incipient stage, will do to further diminish opportunities for Western peoples to work can be easily imagined, if the economic imperative of corporate capitalism is the rule to go by.

The same desolating trends can be seen in Europe, where people increasingly regard the European Union as a Trojan horse. The economic elites and their political front-men responsible for this image-challenged contraption lose public support with each new poll. The people by and large blame the European Union and the other accessories of globalization for their worsening standard of living. When informed by the establishment media that thanks to globalization Europe has never been more prosperous and peaceful, Europeans in historic numbers are reacting with disbelief. Their deepening sense of betrayal propels the surge of populism that defines the politics of Europe today. Arguments long-settled in favor of deregulation, liberalization, open borders, and other globalization watchwords have been reopened.

The constituency is growing for a politics that puts the well-being of Europeans first. Political measures calling for the protection of European jobs and cultures have gained a following unforeseen prior to 2008. In Italy, for example, 77% of the people questioned in a recent poll could see no advantage to them at all from the country’s membership in the European Union. 64% of them expressed hostility toward it. Eight Italian businesses out of 10 can find nothing positive to say about the European Union. It is seen to be a creature of the banks and the big financial houses. As public relations disasters go, this one has unfolded on an epic scale as the underlying populations, long left out of consideration by the economic elites, have begun to sense the fate their masters have in store for them.

Leaving underlying populations out of consideration was a special feature of the planning that went into globalization. They have been voiceless. In America, Trump gave them a voice, and they responded to him with their political support. It did not matter that he came before them without a plan for their deliverance. That he came to them at all mattered. He understood the depth of the anger and alienation in America against a status quo personified by his opponent, Hillary Clinton, whose repeated and munificently rewarded speeches before the captains of finance on Wall Street effectively branded her as the safe candidate for all who wanted to leave existing economic arrangements fundamentally undisturbed.