Wassily Kandinsky Painting with Houses 1909 (click for background)

New York Fed chief John Williams said the US economy can handle more rate hikes..

• Don’t Blame Trump The Tariff Man, The Fed Crashed The Market Today (F.)

Don’t believe the hype: today’s reversal in equity markets has little, if anything, to do with this weekend’s trade war ceasefire. Tuesday’s drop in U.S. and European stock markets are largely thanks to the Federal Reserve. Treasury Secretary Steve Mnuchin came out immediately on Monday saying that details of the trade truce in terms of products China intended to import more of, and a new timeline for talks, would not be available to the public. The market new that immediately, but everyone still believed, and still believes today, that a trade truce is a market positive. Mnuchin told CNBC yesterday that China made trade commitments worth around $1.2 trillion, but stressed that the details still need to be negotiated and that he was taking Xi Jinping at his word. All positives.

The Hang Seng and every index on the Shanghai Stock Exchange settled higher again today. The Chinese yuan moved through its 50 and 100 day moving average to settle even stronger against the dollar today at 6.83. The blame for Tuesday’s slide in the U.S. can be laid upon New York Fed chief John Williams. He said today that the U.S. economy can handle more rate hikes. This comes just after Jerome Powell spoke at The Economic Club in New York last week saying the Fed funds rate was close to neutral. For once, a Powell speech sent the markets higher. No one really knows precisely what the neutral rate is, though it is perceived to be somewhere between 3% and 3.5%.

Unhinged?!

• Dow Plunges Nearly 800 Points On Rising Fears Of An Economic Slowdown (CNBC)

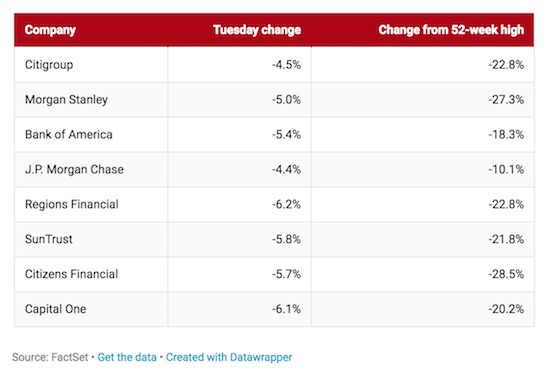

Stocks fell sharply on Tuesday in the biggest decline since the October rout as investors worried about a bond-market phenomenon signaling a possible economic slowdown. Lingering worries around U.S.-China trade also added to jitters on Wall Street. The Dow Jones Industrial Average fell 799.36 points, or 3.1%, to close at 25,027.07 and posted its worst day since Oct. 10. At its low of the day, the Dow had fallen more than 800 points. The S&P 500 declined 3.2% to close at 2,700.06. The benchmark fell below its 200-day moving average, which triggered more selling from algorithmic funds. Financials were the worst performers in the S&P 500, plunging 4.4%.

[..] The yield on the three-year Treasury note surpassed its five-year counterpart on Monday. When a so-called yield curve inversion happens — short-term yields trading above longer-term rates — a recession could follow, though it is often years away after the signal triggers. Still, many traders believe the inversion won’t be official until the 2-year yield rises above the 10-year yield, which has not happened yet. Stocks began falling to their lows of the day after Jeffrey Gundlach, CEO of Doubleline Capital, told Reuters this inversion signals that the economy “is poised to weaken.” The flattening yield curve caused investors to bail on bank stocks on concern the phenomenon may hurt their lending margins. [..] Shares of J.P. Morgan Chase, Citigroup and Bank of America all declined more than 4%. Citigroup and Morgan Stanley both reached 52-week lows ..

Are there people left who think they will regain these losses?

• FAANG Stocks Shed $140 Billion In Tuesday’s Market Rout (CNBC)

Tech stocks are back in correction territory after a painful day for public exchanges. The tech-heavy Nasdaq Composite index fell nearly 4%, with tech stocks like Apple, Amazon, Alphabet and Facebook weighing most heavily. In total, the so-called FAANG stocks — Facebook, Amazon, Apple, Netflix and Alphabet-owned Google — shed more than $140 billion in market value by the end of the trading Tuesday. The losses extend pain periods for Apple, which has seen downturn in recent weeks, and Facebook, which is suffering a down year on the heels of several scandals. Amazon and Netflix, though, are each up more than 40% year-to-date despite getting caught in the rout. With Tuesday’s losses, Alphabet is hanging onto modest year-to-date gains, up just 0.8% in 2018.

Here’s how it shook out:

• Facebook fell 2.2%, losing $7.6 billion in implied market value

• Amazon fell 5.9%, losing $50.8 billion in implied market value

• Apple fell 4.4%, losing $38.5 billion in implied market value

• Netflix fell 5.2%, losing $6.5 billion in implied market value

• Alphabet fell 4.8%, losing $37.5 billion in implied market value

Long term makes sense. h/t Tyler.

• The Art of Defaulting (Jensen)

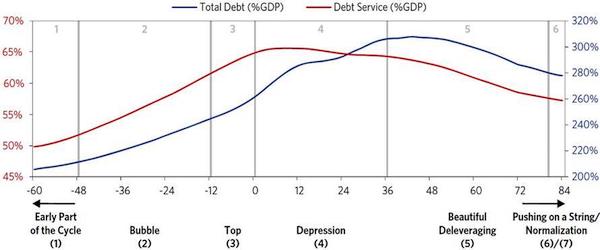

I always distinguish between short-term debt cycles and debt super-cycles. Short-term debt cycles move more or less in parallel with the underlying economic cycles and last on average 7-8 years – in line with the average length of economic cycles. Debt super-cycles are a different kettle of fish. They typically last 50-75 years and have (unbeknown to many) existed for thousands of years. According to Ray [Dalio], they even get a mention in the Old Testament, which described the need to wipe out debt every 50 years or so. It is referred to as the Year of Jubilee in the old book. Debt super-cycles always end with a big bang. The previous debt super-cycle ended with the breakout of World War II, and a new debt super-cycle commenced its life when the canons fell silent in 1945. We are now almost 75 years into the current super-cycle; i.e. it will go down in history as one of the longer ones.

What do debt crises have in common? To begin with, I should point out that the 41 major debt crises that Ray has identified since 1980 are part of an even bigger number of debt crises that he discusses in his new book, starting with the hyperinflationary debt crisis in Germany between 1918 and 1925. I should also point out that every crisis he brings up is a mid to late stage super-cycle crisis. Not one crisis is from the 1950s, 1960s or 1970s. The logic is quite simple. In the early stages of a debt super-cycle, adding debt is actually a good thing and spurs economic growth; i.e. debt crises rarely occur in the earlier stages of debt super-cycles and almost never cause a major slump in GDP. Only later in the super-cycle does more debt actually become a problem.

Back to my question – what do all these crises have in common? All debt cycles start with a period of healthy borrowings, which is good for GDP growth (stage 1 in Exhibit 1 below). It is also worth noticing that, in the early stages of a typical debt super-cycle, a dollar of added debt leads to approx. a dollar of GDP growth. The two grow more or less in line, but that changes dramatically later in the super-cycle – more on that below. Healthy borrowing eventually turns into what Ray calls the bubble stage (stage 2). At this stage, excesses are creeping in; borrowers assume that the good times will continue forever, so they continue to borrow, even if they cannot always afford it. Three conditions are typically prevalent during the bubble stage: 1. Debt grows faster than income. 2. Equity markets rally. 3. The yield curve flattens. All three conditions have been prevalent in recent years.

They simply don’t like Macron.

• Anarchists, Butchers And Finance Workers In Court Over Paris Riots (AFP)

What started out as protests against the introduction of new fuel taxes has spiralled into a broad opposition front to Macron and his pro-business economic reforms since he took power in May 2017. Stephane, a 45-year-old butcher from the Hautes Alpes area of eastern France, said it was the first time he had joined a demonstration like the one on the Champs-Elysees on Saturday. He was accused of charging head-first into a line of riot police, known as CRS. “I would have liked the CRS to come and shake us by the hand, to put themselves on the people’s side,” he told the court. Jeremy Onselaer, a 22-year-old from the Parisian suburbs, defied any stereotyping: the master’s student earns 2,500 euros a month working part-time in the finance department of the national postal service.

He was accused of building barricades in the street, attempting to harm police officers and possessing cannabis. His lawyer urged magistrates not to impose a restraining order that would have banned him from the capital, because he had studies to pursue at the Paris School of Business. The strain on police and the justice system caused by so many cases was also evident at the recently opened new Paris city court complex, designed by star Italian architect Renzo Piano. “The conditions for the defence are completely unacceptable,” one lawyer complained, adding that she had six clients and had spent only a few minutes with each of them. Many suspects opted to have their trials deferred to prepare their defence, with hearings set to resume next year.

In most cases, magistrates ordered the suspects to report to police regularly until their trials, starting on Saturday morning when another day of protests has been announced. There were also numerous cases of instant acquittals due to the flimsiness of evidence provided by police. A 50-year-old nurse from Nice walked free saying he had been randomly arrested while walking in the Bastille area of Paris. “Violence is not part of my thinking,” he said, adding that he was a regular practitioner of yoga and meditation.

“Even its elected representatives disagree with one another about the future of the movement.”

Eh, there are not elected representatives. That’s exactly what they don’t want. There may be a small group who pick some reps, but that’s not the same thing.

• French History Has Never Seen A Protest Like The Yellow Vest Movement (Qz)

France is a country that’s no stranger to protest movements—from the massive student demonstrations of 1968 to contemporary union-led strikes. But during the “yellow vest” protests that rocked the streets of Paris this weekend, protesters reached further back in their history, to the era of the French Revolution. Protesters marching along the Champs-Elysées on Saturday (Dec. 1) could be heard chanting slogans like “We are running the revolution” and “Macron to the Bastille.” The Arc de Triomphe bore a message in spray paint: “We have chopped off heads for less than this,” a reference to the death by guillotine of king Louis XVI and his wife, Marie-Antoinette.

Are the yellow vests modern Jacobins fighting contemporary tyranny—or are they something entirely different? Quartz spoke with Danielle Tartakowsky, a history professor at Paris 8 university who recently published a book about the French state, about how to contextualize the yellow vests within France’s history of protest movements. According to Tartakowsky, the current demonstrations are unlike any other, marking an important shift in France’s political landscape. Unlike in previous large-scale protest movements in France, the yellow vests began as an organic, grassroots movement, born of the frustration of a small group of individuals who organized the protests entirely on Facebook. Tartakowsky says that’s one way in which these protests are unique.

Typically, French protests on the left have been organized or supported by major labor unions, and protests on the right (such as the marches against the legalization of gay marriage in 2012) were typically organized by Catholic groups. The lack of institutional framework is one of the things that sets the yellow vests apart from previous political movements and give them independence from any particular party, politician, or political leaning. That is one of their strengths, says Tartakowsky, since it gives the movement broader appeal (link in French). But it is also a major weakness, since the movement suffers from a lack of coherent message and leadership. Even its elected representatives disagree with one another about the future of the movement.

No Brexit or no Deal. Anything in between is crumbling.

• Theresa May Suffers Worst Day In Her Career … Until Next Week (Ind. )

The door of the flat above 10 Downing Street flat clicks shut. In the kitchen, Philip May stops rotating the tin opener around the rim of the baked bean tin and turns his head toward the hallway. “Hello darling. How was your day?” An exhalation is heard, followed by the sound of breaking glass. In the living room, the cat quietly turns to stone. “Well I lost more votes than Gordon Brown managed in three years. My own government became the first in history to be found in contempt of parliament, which means that in the morning I’ve got to publish the legal advice on just how terrible my own Attorney General reckons Brexit will be. Yes, Philip, yes, the same chap who I got to introduce me at party conference.

Yes, yes I know he said Brexit was “an eagle mewing her mighty youth” and yes, now it turns out he’d rather be imprisoned in the Tower of London than admit in public to how bad he has said it will be in private. “The TV debate where I wanted to show the people just how useless Jeremy Corbyn is isn’t happening and everyone is already saying it’s because I’m too useless to do it. My oldest friends voted against me. The EU has decided Article 50 can be revoked unilaterally, which means Brexit could be stopped altogether. No, Philip, that’s not a good thing. What do you mean why? I can’t remember why. Oh, and I’ve just opened a five day debate on my Brexit deal that’s going to end with my last two years work being chucked out, and barring a miracle that isn’t going to happen, me being chucked out after.”

On a less busy day, the Prime Minister might have had time to include the fact that the Governor of the Bank of England is now at open civil war with the previous Governor of the Bank of England. And he had to tell MPs on the Treasury Select Committee who had accused him of ratcheting up Project Fear by publishing his analysis of what might happen if the UK leaves the EU without a deal, that he had only published it because they themselves had asked him to.

Parliament should decide these things.

• UK Inches Closer To New Brexit Referendum As MPs Take Back Control (Ind.)

The push for a final say referendum has taken decisive steps forward in London and Brussels just a week before parliament is expected to reject Theresa May’s Brexit plan. On Tuesday MPs made the significant move of backing a plan to give the Commons more power to dictate what happens if the prime minister’s approach is ditched. A few hours earlier in Brussels the European Court of Justice also signalled it was set to rule that the UK could unilaterally revoke Article 50 – killing off Brexit – if it wanted to. The twin developments deliver both a means for MPs to secure a new referendum and legal clarity that they could halt the Brexit process if the public then decided to remain in the EU.

The government’s weakness was once again underlined as it lost three consecutive votes – including one unprecedented defeat which resulted in Ms May’s administration being held in “contempt of parliament” for refusing to publish legal advice on the proposed Brexit deal. At the start of the week campaigners delivered petitions carrying almost 1.5 million names to Downing Street, which demanded the British public have a Final Say on Brexit through a people’s vote. While Ms May remains adamant there will be no new referendum, MPs are already looking ahead to how parliament can impose its will if her deal is rejected in the commons vote on 11 December – something which now seems inevitable. Conservative, Labour and Liberal Democrat MPs tabled and won a vote on a motion significantly increasing the ability of parliament to steer the path of government if Ms May’s plan is defeated.

Flynn said he admitted a lie because he couldn’t afford his own defense. If he did anything truly wrong, it’s his deals with Turkey. But that’s not what this is about.

• Mueller Says Michael Flynn Gave Details Of Trump Team Russia Contacts (CNBC)

Former national security advisor Michael Flynn has given special counsel Robert Mueller “first-hand” details of contacts between President Donald Trump’s transition team and Russian government officials, a bombshell court document filed Tuesday says. Mueller in a sentencing memo said Flynn’s “substantial assistance” to his probe warrants a light criminal sentence — which could include no jail time for the retired Army lieutentant general. That assistance, which includes 19 interviews with Mueller’s team and Justice Department attorneys, related to a previsouly unknown “criminal investigation,” as well as to Mueller’s long-running probe of the Trump campaign’s and transition team’s links or coordination with the Russian government.

“The defendant provided firsthand information about the content and context of interactions between the transition team and Russian government officials,” the memo says. Mueller’s memo almost completely blacks out details of what Flynn might have said. Trump’s ex-national security advisor is due to be sentenced Dec. 18 in U.S. District Court in Washington. He pleaded guilty last December to a single count of lying to federal agents about his conversations with Russia’s ambassador to the United States during the presidential transition in late 2016. Flynn has cooperated with Mueller’s ongoing probe since pleading guilty. “Given the defendant’s substantial assistance and other considerations set forth below, a sentence at the low end of the guideline range — including a sentence that does not impose a term of incarceration — is appropriate and warranted,” Mueller’s office wrote in the memo filed Tuesday.

Stockman is no Trump fan.

• Hey, Mr. Trump! Tear Down That Deep State Wall (Stockman)

When the Donald promised to “drain the swamp” during the 2016 election campaign, it did sound vaguely like an attack on Big Government, and at least a directional desire to shrink the state and let free market capitalism breathe. After 22 months in office, however, the truth is patently obvious: The only Swamp that Donald Trump wants to drain is one filled with his political enemies and policy adversaries at any given moment in time. Even then, you have to consult his tweetstorm ledger to know exactly who the swamp creatures de jure actually are. Still, the Donald’s daily Twitter assaults on the Deep State are a wondrous thing. They surely do undermine public confidence in rogue institutions like the FBI, CIA and NSA, which profoundly threaten America’s constitutional liberties and fiscal solvency.

Likewise, his frequently unhinged tweets also lather their congressional sponsors and beltway poo-bahs with well-deserved mud and opprobrium. And the Donald’s increasingly acrimonious public feuding with Deep State criminals like James Comey and John Brennan is just what the doctor ordered. The Deep State thrives and milks the public treasury so successfully in large part because the Imperial City’s corps of permanent policy apparatchiks like Comey and Brennan (and thousands more) pretend to be performing god’s work. So doing, they preen sanctimoniously to the adoration of their sycophants in the mainstream media, claiming to be above any governance or sanction from the unwashed electorate.

Attacking this rotten perversion of democracy, therefore, is the Donald’s real calling. While he lacks both the temperament and ideas to solve the nation’s metastasizing economic and social challenges and has no hope whatsoever to make MAGA, he is more than suited for his “Great Disrupter” mission. That is, the existing order needs to be discredited and brought down first, and on that score his primitive economic populism will more than do its part. As we have previously explained, Trump’s deadly combination of Fiscal Debauchery, Protectionism and Easy Money will eventually blow the nation’s debt and bubble-ridden economy sky-high.

Likewise, his crude rendition of America First is not a blueprint for rebooting America’s national security policy, but it is an existential threat to Empire First and the Deep State’s usurpation of constitutional government. And even as the Donald lurches to and fro on Russia, Korea, the Middle East, NATO, globalism and so-called allies, the main job is getting done. That is, the War Party’s self-appointed role as global policeman and the Indispensable Nation is getting thoroughly discredited.

“For all the deformities of the EU, France still maintains a general quality-of-life so far above what is found in the US these days that we look like some left-behind evolutionary dead end here in this wilderness of strip-malls and muffler shops…”

• The Ghost of Christmas Present (Kunstler)

It’s not hard to see why US life expectancy is going down, driven by the two new leading causes of death: opiate drugs and suicide — the former often in the service of the latter. The citizens of this land have exchanged just about everything that makes life worth living for the paltry rewards of “bargain shopping” and happy motoring. But the worst sacrifice is the loss of any sense of community, of face-to-face human transactions with people you know, people who have duties and obligations to one another that can be successfully enacted and fulfilled. Instead, you get to do all your business with robots, even including the robots fronting for companies that seek to ruin you. “Your call is important to us,” says the telephone robot at the hospital billing office dunning you to fork over $7,000 for the three stitches Little Skippy got when his best friend flew the drone into his forehead. “Please hold for the next available representative.” Who wouldn’t want to shoot themselves?

Interestingly, it’s the people of France who are going apeshit at this moment in history and not the much more beaten-down Americans. For all the deformities of the EU, France still maintains a general quality-of-life so far above what is found in the US these days that we look like some left-behind evolutionary dead end here in this wilderness of strip-malls and muffler shops. They live in towns and cities that are designed to bring people together in public. They support small business in spite of the diktats of Brussels. They maintain an interest in doing things well for its own sake. The French are rioting these days not simply over the cost of diesel fuel but because they’ve had enough impingements on their traditional ways of life and seek to arrest the losses.

The first in a long series of overborrowed nations.

• Australia’s Economy Slows, Debt-Laden Consumers A Deadweight (R.)

Australia’s economy slowed more than expected last quarter as consumers reacted to tepid wage growth by shutting their wallets, a disappointing outcome that sent the local dollar sliding as investors pushed out the chance of any rate hike. The news came as fears of a possible slowdown in the U.S. economy and the Sino-U.S. tariff slugged world shares and threatened future business investment. The gloomy report provides another blow to Australia’s center-right government, which is already lagging in polls ahead of a likely election in May. Wednesday’s report on GDP showed the economy expanded 0.3% in the third quarter, half of what economists had expected.

Second-quarter growth was unrevised at 0.9%. Annual GDP rose by a still-respectable 2.8% to A$1.8 trillion ($1.32 trillion), but confounded expectations in a Reuters poll for a 3.3% increase. The figures also imply growth in the year to June was 3%, rather than the originally report 3.4%. The data will not be welcomed by the Reserve Bank of Australia (RBA), which predicts growth of around 3-1/2% this year and next. “The RBA forecasts are now looking pretty optimistic,” said Tom Kennedy, senior economist at JPMorgan.