Times Square, New York 1954

But nary a soul still sees a payback ahead….

• The Payback Date For Today’s Economic Recovery Is Getting Closer (WEF/PS)

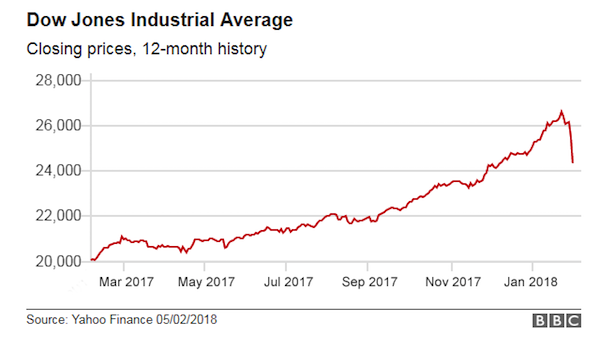

In recent days, the initial New Year optimism of many investors may have been jolted by fears of an economic slowdown resulting from interest-rate hikes. But no one should be surprised if the current sharp fall in equity prices is followed by a swift return to bullishness, at least in the short term. Despite the recent slide, the mood supporting stocks remains out of sync with the caution expressed by political leaders. Market participants could easily be forgiven for their early-year euphoria. After a solid 2017, key macroeconomic data – on unemployment, inflation, and consumer and business sentiment – as well as GDP forecasts all indicated that strong growth would continue in 2018. The result – in the United States and across most major economies – has been a rare moment of optimism in the context of the last decade.

For starters, the macro data are positively synchronized and inflation remains tame. Moreover, the IMF’s recent upward revision of global growth data came at precisely the point in the cycle when the economy should be showing signs of slowing. Moreover, stock markets’ record highs are no longer relying so much on loose monetary policy for support. Bullishness is underpinned by evidence of a notable uptick in capital investment. In the US, gross domestic private investment rose 5.1% year on year in the fourth quarter of 2017 and is nearly 90% higher than at the trough of the Great Recession, in the third quarter of 2009. This is emblematic of a deeper resurgence in corporate spending – as witnessed in durable goods orders. New orders for US manufactured durable goods beat expectations, climbing 2.9% month on month to December 2017 and 1.7% in November.

Other data tell a similar story. In 2017, the US Federal Reserve’s Industrial Production and Capacity Utilization index recorded its largest calendar year gain since 2010, increasing 3.6%. In addition, US President Donald Trump’s reiteration of his pledge to seek $1.5 trillion in spending on infrastructure and public capital programs will further bolster market sentiment. All of this bullishness will continue to stand in stark contrast to warnings by many world leaders. In just the last few weeks, German Chancellor Angela Merkel cautioned that the current international order is under threat. French President Emmanuel Macron noted that globalization is in the midst of a major crisis, and Canadian Prime Minister Justin Trudeau has stated that the unrest we see around the world is palpable and “isn’t going away.”

Ne’er a lesson learned: Collateralized Loan Obligations.

• Big Reset Looms for Corporate Credit Market (WS)

“Leveraged loans,” extended to junk-rated and highly leveraged companies, are too risky for banks to keep on their books. Banks sell them to loan mutual funds, or they slice-and-dice them into structured Collateralized Loan Obligations (CLOs) and sell them to institutional investors. This way, the banks get the rich fees but slough off the risk to investors, such as asset managers and pension funds. This has turned into a booming market. Issuance has soared. And given the pandemic chase for yield, the risk premium that investors are demanding to buy the highest rated “tranches” of these CLOs has dropped to the lowest since the Financial Crisis. Mass Mutual’s investment subsidiary, Barings, has packaged leveraged loans into a $517-million CLO that is sold in “tranches” of different risk levels.

[..] These floating-rate CLOs are attractive to asset managers in an environment of rising interest rates. If rates rise further, Libor rises in tandem, and investors would be protected against rising rates by the Libor-plus feature of the yields. Libor has surged in near-parallel with the US three-month Treasury yield and on Monday reached 1.83%. So the yield of Barings CLO was 2.82%. While the Libor-plus structure compensates investors for the risk of rising yields and inflation, it does not compensate investors for credit risk!

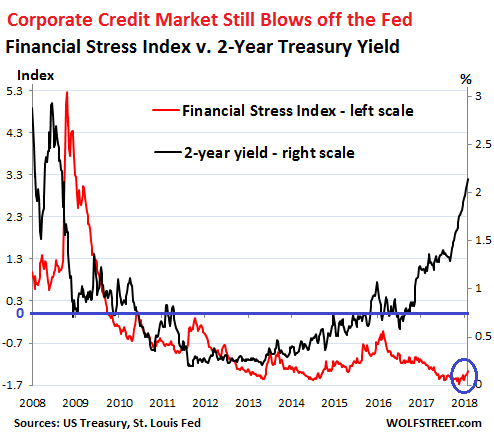

[..] One of the measures that track whether “financial conditions” are getting “easier” or tighter is the weekly St. Louis Fed Financial Stress Index. In this index, zero represents “normal.” A negative number indicates that financial conditions are easier than “normal”; a positive number indicates that they’re tighter than “normal.” The index, which is made up of 18 components – including six yield spreads, including one based on the 3-month Libor – had dropped to a historic low of -1.6 on November 3, 2017. Despite the Fed’s rate hikes and the accelerating QE Unwind, it has since ticked up only a smidgen and remains firmly in negative territory, at -1.35.

The Financial Stress Index and the two-year Treasury yield usually move roughly in parallel. But since July 2016, about the time the Fed stopped flip-flopping on rate hikes, the two-year yield began rising and more recently spiking, while the Financial Stress Index initially fell. The chart below shows this disconnect between the St. Louis Fed’s Financial Stress Index (red, left scale) and the two-year Treasury yield (black, right scale). Note the tiny rise of the red line over the past few weeks (circled in blue):

Volatility ain’t done with you yet.

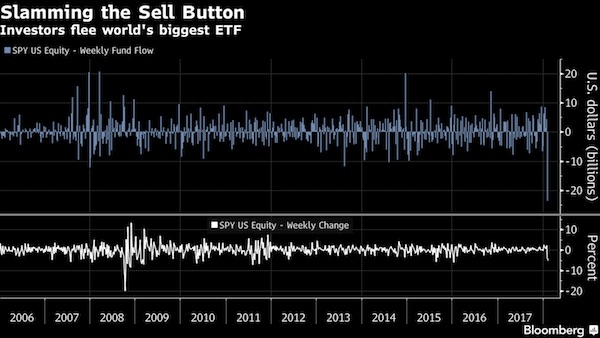

• Record $23 Billion Flees World’s Largest ETF (BBG)

Investors actively abandoned the world’s biggest passive fund during the onset of market mayhem. The SPDR S&P 500 exchange-traded fund (ticker SPY) suffered a record $23.6 billion in outflows last week amid the worst momentum swing in history for the underlying U.S. equity benchmark. Outflows amounted to 8% of the fund’s total assets at the start of the week, a rate of withdrawals not seen since August 2010. A blowup in volatility-linked products sent markets haywire, eliciting waves of risk aversion from jittery investors. Strategists at JPMorgan said the swiftness and severity of the positioning unwind is a sign that further selling from the likes of commodity trading advisors and risk parity funds “should be limited from here.”

“The picture we are getting in the U.S. equity ETF space is one of advanced rather than early state de-risking,” they added. The five-session stampede for the exits erased the previous nine weeks of inflows into the fund, which is issued by State Street. The combination of price declines and withdrawals erased $38.6 billion in SPY’s assets. That’s nearly double the second-worst showing of $19.4 billion in asset shrinkage during the week ending Aug. 21, 2015, when China’s surprise devaluation of the yuan roiled markets. Prior to this recent market tumult, extreme enthusiasm for U.S. equities had propelled the fund’s total assets above $300 billion.

What you say? Volatility?

• Wednesday Could Be a Huge Day for the VIX (BBG)

Tomorrow’s VIX options expiration could prove extra volatile for the gauge. The Cboe Volatility Index tends to have bigger swings on days its contracts mature, with intraday moves of 13% on average on the past 12 monthly expirations. That compares with a mean daily fluctuation of 10% in the year through January. Of course, that was before this month, when a record VIX surge on Feb. 5 sent its average intraday move for February to almost 60%. What’s more, the recent market turmoil has led to a surge in the number of VIX contracts, and put open interest almost tripled to a record since the Jan. 17 expiration. Counting puts and calls, there are 15.4 million VIX options outstanding, and 40% of them mature tomorrow. While most stock-index options expire on the third Friday of every month, monthly VIX contracts expire two days earlier, on the Wednesday.

Wait for rates to rise.

• Europe Has a $1 Trillion Bad-Loan Problem (BBG)

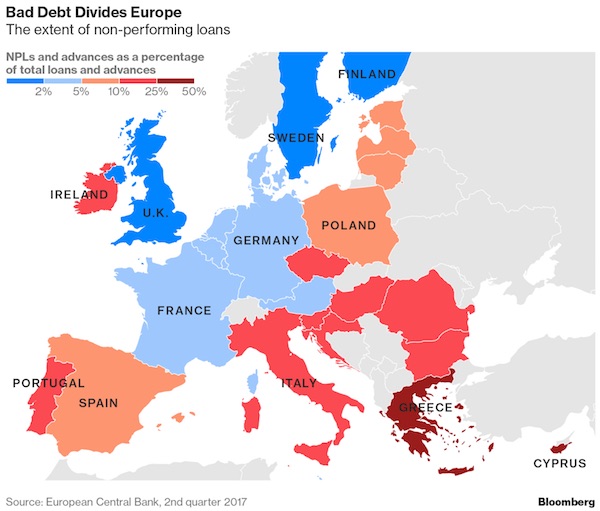

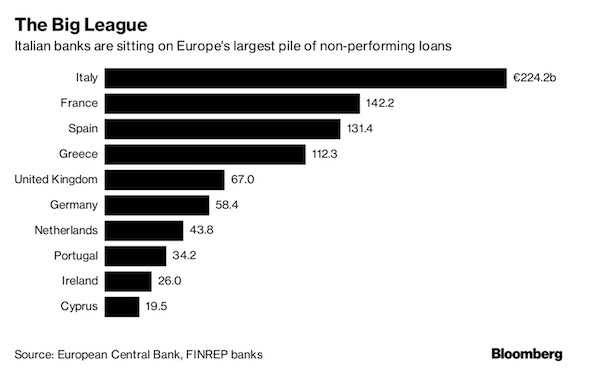

For European banks, it’s a headache that just won’t go away: the €944 billion ($1.17 trillion) of non-performing loans that’s weighing down their balance sheets. Economists say the pile of past-due and delinquent debt makes it harder for banks to lend more money, hurting their earnings. European authorities are prodding lenders to sell or wind down non-performing credit, but they’re split on how to tackle the issue, and some investors are disappointed by the pace of progress.

The problem is particularly acute in the countries that were hit hardest by the sovereign debt crisis. Greece, which has yet to exit its bailout program, tops the list of non-performing loans as a share of total credit, while Italy has the biggest pile of bad debt in absolute terms.

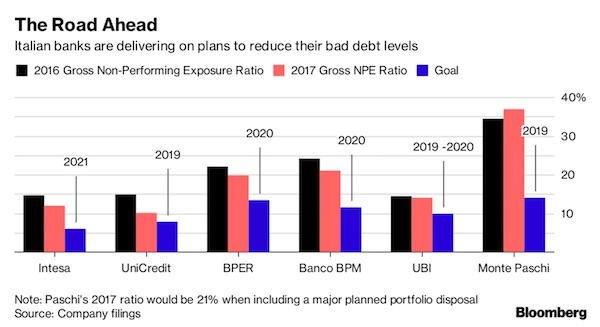

Italian banks have fixed goals for shrinking their bad credit levels by selling portfolios or winding down loans. Intesa Sanpaolo, the country’s biggest bank by market value, got a head start on its rivals two years ago and plans to accelerate the reduction of non-performing loans, Chief Executive Officer Carlo Messina said last month. He says other Italian banks “are doing the right job” and should make further progress this year.

Trumped.

• Draghi Faces Impossible Task To Weaken The Euro; He Might Not Even Try (CNBC)

Mario Draghi is facing yet another headache this year as a strong currency threatens to derail his quest to keep prices stable, with many analysts suggesting there’s no easy way out for the president of the ECB. Investors have been flocking to the single currency as the euro zone economy keeps growing and political risks dissipate. However, that could become a problem for the ECB as a stronger currency can mean that European-produced products become pricier and less attractive outside the region. The euro has risen nearly 3% against the U.S. dollar since the start of the year, at a time when the ECB has been assessing how to reduce its monetary stimulus – which aims to increase lending and stoke consumer prices. At the bank’s last press conference in January, Draghi admitted that recent volatility in the exchange rate was a “source of uncertainty.”

The ECB’s primary target has always been inflation and not the exchange rate and Draghi — like many central bankers around the world — has been cautious when speaking of his own currency. However, analysts believe that Draghi wouldn’t be able to talk down the euro, even if he wanted to. “I believe it will be difficult for the ECB to talk the euro down in a very significant manner as it has already pretty much exhausted its preferred expansionary monetary policy instruments which it could use to weaken the currency (rate hikes and QE),” Thu Lan Nguyen at Commerzbank told CNBC via email. “And as the G-20 nations have agreed that they will refrain from manipulating their exchange rates, interventions are not a viable option either. Or even directly talking the euro down for that matter, because other nations would see this as a violation of the agreement as well,” she said.

As everyone else’s yields rise (often from below zero), Greece is helpless.

• Greek Bond Yields Keep Increasing (K.)

Greek bond yields continued to rise Tuesday, increasing worries about the cost of borrowing the country will face once it has to cover all of its financing needs through the market. At the same time Finance Minister Euclid Tsakalotos is adamant that Greece will not need a precautionary credit line and is embarking on a series of contacts in an attempt to attract investor interest. Tsakalotos departed on Tuesday for Paris for meetings with representatives of investment companies, hoping to convince them about the prospects of the Greek economy. He will continue his mission in London on Thursday. He is due back to Athens on Friday. The Greek 10-year bond saw its yield climb further on Tuesday, reaching 4.38% from 4.29% on Monday, while the yield on five-year paper advanced from 3.64% to 3.77% in a day. The 7-year debt yield exceeded 4%, having been sold to investors with a 3.5% yield just last Thursday.

I shudder to imagine what Britain will look like in 5 years time.

• Britons Face Surge In Household Debts In Next Five Years (G.)

Britons will spend almost a third more on their mortgages and other household debts over the next five years, according to new data, sparking fears many may struggle to cope with mounting costs if interest rates rise as predicted. The projection, revealed by a freedom of information request to the Office for Budget Responsibility, found household debt servicing costs were set to climb 29% by 2023, the vast majority of which are likely to be mortgages. The rise may take homeowners by surprise, given that costs fell 9% over the previous five years and also declined as a share of household income by almost a quarter due to historically low interest rates.

The Bank of England has indicated that it plans to raise interest rates from as early as May. On Monday the Resolution Foundation warned it could hit millions of low-income families who have relied on cheap credit. The Bank’s governor, Mark Carney, has said he believes the growing economy, including GDP growth and rising average wages, warrants a rise in interest rates from their low of 0.5%. Labour’s analysis found that an average household would see an increase of £468 in annual debt costs, from £1,983 in 2018 to £2,451 by 2023. The shadow chancellor, John McDonnell, called the figures “eye-watering increases in the potential costs faced by working families at a time when incomes are being squeezed”.

Nice series of articles on UK housing. Nice because contradictory.

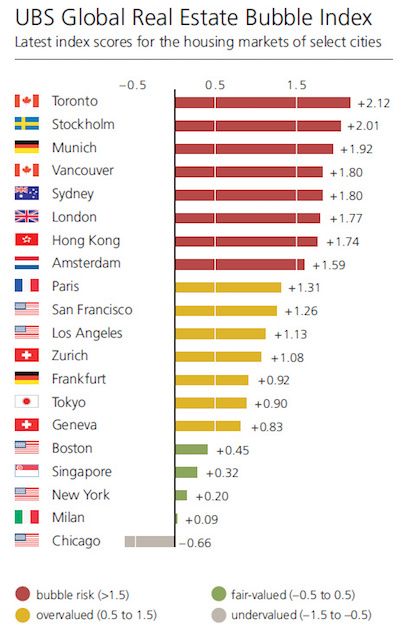

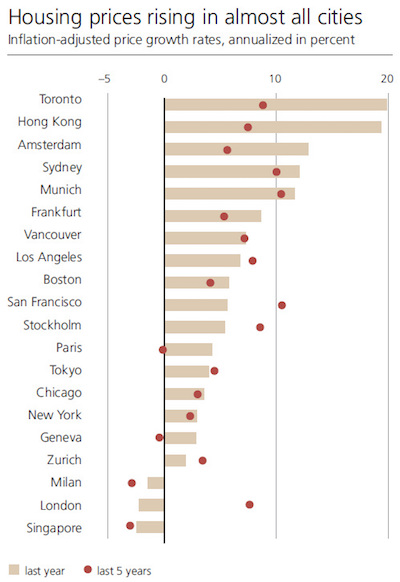

• The World’s Biggest Housing Bubbles According To UBS (VisualC)

If you had $1 billion to spend on safe real estate assets, where would you look to buy? For many funds, financial institutions, and wealthy individuals, the perception is that the world’s financial centers are the places to be. After all, world-class cities like New York, London, and Hong Kong will never go out of style, and their extremely robust and high-density city centers limit the supply of quality assets to buy. But what happens when too many people pile into a “safe” asset? According to UBS, certain cities have seen prices rise at rates that are potentially not sustainable – and eight of these financial centers are at risk of having real estate bubbles that could eventually deflate.

Every year, UBS publishes the Global Real Estate Bubble Index, and the most recent edition shows several key markets in bubble territory. The bank highlights Toronto as the biggest potential bubble risk, noting that real prices have doubled over 13 years, while real rents and real income have only increased 5% and 10% respectively. However, the largest city in Canada was certainly not the only global financial center with real estate appreciating at rapid rates in the last year. In Munich, Toronto, Amsterdam, Sydney and Hong Kong, prices rose more than 10% in the last year alone. Annual increases at a 10% clip would lead to the doubling of prices every seven years, something the bank says is unsustainable.

In the last year, there were three key markets where prices did not rise: London, Milan, and Singapore. London is particularly notable, since it holds more millionaires than any other city in the world and is rated as the #1 financial center globally.

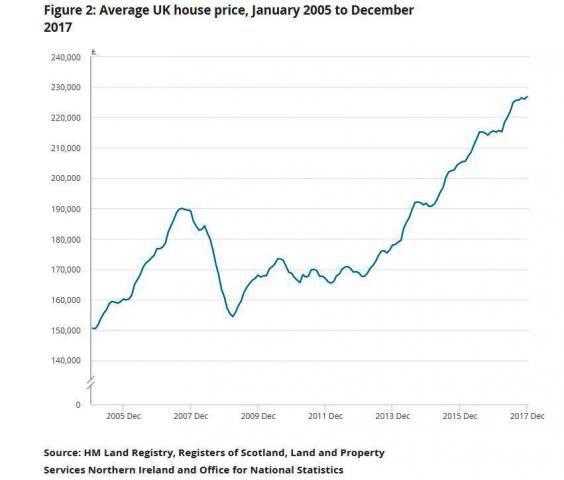

Article above: Prices did not rise in London. Article below: they did.

• UK House Price Growth Accelerates To 5.2% (Ind.)

UK house price growth accelerated to 5.2% in the year to December, new official data shows. That was a rise from 5% in the twelve months to November. The jump exceeds rises in average wages, prompting experts to warn of a further strain on affordability. The average UK house price hit £227,000 in December 2017, up £1,000 from the previous month and £12,000 higher than in December 2016. The house price index compiled by the Office for National Statistics and the Land Registry shows Scotland and the South-west experienced the highest annual house price growth, registering 7.7% and 7.5% respectively.

Average prices in England rose 5% in the year, to £244,000 while Wales saw house prices increase by 5.4% over the last 12 months to stand at £154,000. Growth in Northern Ireland was slightly more subdued, with the average price rising 4.3% to £130,000. Richard Snook, a senior economist at PwC, said the overall UK rise was above his projection made at the start of 2017. [..] “In terms of regional trends, London prices showed a slight recovery from the sharp fall in November so the picture is one of a market that has plateaued since the summer. London prices are just 2.5% above their level a year ago.

And first time buyers rise. That’s supposed to be a good thing.

• First-Time Buyers Hit 10-Year High As Buy-to-let Property Sales Fade (G.)

The number of first-time buyers hit the highest level for a decade in 2017 while lending for buy-to-let has gone into retreat, according to official figures. A total of 365,000 buyers took ownership of their first home last year, an increase of 7.4% on 2016 and the highest number since 2006, said UK Finance, the trade body for Britain’s banks. Its data showed that the average first-time buyer was 30 and had an income of £41,000. Property experts said the government’s help-to-buy programme plus lower deposit and cheap mortgage deals propelled first-time buyers in 2017. But in a sign that the boom may be waning, the figures for December show the number slipped compared with the same month last year. The slowdown comes despite the stamp duty cut in the November budget, which is expected to save four out of five first-time buyers up to £5,000.

The raft of tax measures on buy-to-let introduced last year has sent the sector swiftly into retreat. There were 5,300 new buy-to-let house purchase mortgages completed in December, 17.2% fewer than in the same month a year earlier. Paul Smee, of UK Finance, said: “2017 saw the number of first-time buyers reach its highest level in a decade, which is welcome news for those getting started on the housing ladder. “But although the market remains competitive there is no room for complacency, with weaker December figures consistent with our market forecast of subdued growth this year. [..] Separate figures from the Office for National Statistics revealed that house price inflation in 2017 was 5.2%, taking the price of a typical UK home to £226,760.

OK, we’ve had rising prices and falling prices. Flatlining is door no. 3.

• House Price Flatlining Is A Good Thing, Despite Estate Agents’ Gripes (G.)

Over the past year the rate of house price inflation has fallen while the number of first-time buyers has risen to its highest level since 2006. These two facts are connected: the reason young people have become renters rather than owner-occupiers is that property became expensive. Property has become so dear that the average first-time buyer is now 30 years old and has a salary of £41,000 a year. Owner-occupation rates have fallen from 70% to 63% over the past decade and it is not difficult to see why. Ultra-low interest rates mean that it has never been cheaper to service a mortgage, but that doesn’t matter all that much when the price of a home relative to incomes is so high.

For those who want to buy their own home, the good news is that house-price inflation will be modest in 2018. Earnings growth is still around 2.5%; the Bank of England is warning that interest rates are likely to go up faster and by more than previously expected; and tax changes that have helped cause a 17% annual drop in buy-to-let purchases in the year to December are going to become more stringent in April. House prices would already be falling were it not for the fact that interest rates and unemployment are low. It was the combination of 15% interest rates and a doubling of the jobless total that caused the property-price collapse of the early 1990s, and a repeat of that looks highly improbable because of a (welcome) lack of distressed sellers.

For his career.

• Boris Johnson: Stopping Brexit Would Be ‘Disastrous’ (Ind.)

Boris Johnson will say he fears people are becoming “even more determined” in their efforts to stop Britain’s withdrawal from the European Union (EU), as he sets out in a major speech what allies claim is a liberal vision of Brexit. The Foreign Secretary’s Valentine’s Day address – entitled the Road to Brexit – will be the first in a series of set pieces from Cabinet ministers and preludes Theresa May’s address in Germany this weekend. At a central London location, Mr Johnson will say he fears that some are becoming “even more determined” to stop Brexit and “frustrate the will of the people”.

“I believe that would be a disastrous mistake that would lead to permanent and ineradicable feelings of betrayal,” Mr Johnson will say. “We cannot and will not let it happen.” “But if we are to carry this project through to national success – as we must – then we must reach out to those who still have anxieties. “I want to try today to anatomise at least some of those fears and to show to the best of my ability that they are unfounded, and that the very opposite is usually true: that Brexit is not grounds for fear but hope.”