NPC Newsstand with Out-of-Town Papers, Washington DC 1925

Mom and pop get squeezed again.

• Individual Investors Wade In as Stocks Soar (WSJ)

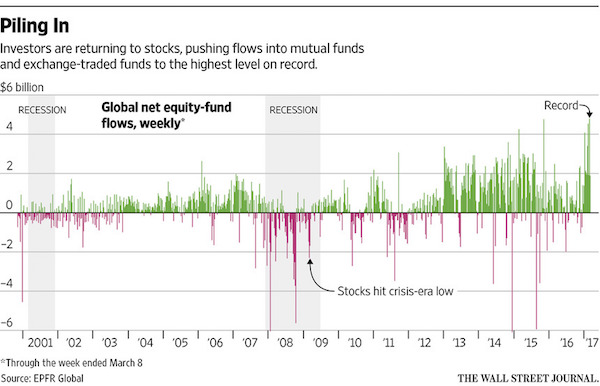

The stock-market rally presents a difficult choice for some individual investors: Miss out or risk getting in at the top. The scars of the financial crisis have left many wary, even as the second-longest bull run in S&P 500 history has added more than $14 trillion in value to the index since it bottomed in March 2009, according to S&P Dow Jones Indices. Yet there are signs that caution is dissipating. Investors have poured money into stocks through mutual funds and exchange-traded funds in 2017, with global equity funds posting record net inflows in the week ended March 1 based on data going back to 2000, according to fund tracker EPFR Global. Inflows continued the following week, even as the rally slowed. The S&P 500 shed 0.4% in the week ended Friday.

The investors’ positioning suggests burgeoning optimism, with TD Ameritrade clients increasing their net exposure to stocks in February, buying bank shares and popular stocks such as Amazon.com and sending the retail brokerage’s Investor Movement Index to a fresh high in data going back to 2010. The index tracks investors’ exposure to stocks and bonds to gauge their sentiment. “People went toe in the water, knee in the water and now many are probably above the waist for the first time,” said JJ Kinahan at TD Ameritrade. That brings individual investors increasingly in line with Wall Street professionals. A February survey of fund managers by Bank of America Merrill Lynch found optimism about the global economy improving while investors were holding above-average levels of cash, leaving room for them to drive stocks still higher.

Bullishness among Wall Street newsletter writers reached 63.1%—the highest level since 1987—a week ago in a survey by Investors Intelligence, before falling to 57.7% this past week. Overall investor sentiment is strong right now for the U.S. stock market, said Ann Gugle, principal at Alpha Financial Advisors. She pointed to a typical growth-and-income portfolio with 70% in stocks and 30% in bonds and alternatives. The 70% allocation to stocks, she said, would ordinarily be evenly split between U.S. and international stocks, but for the past three years it has shifted about 40% to U.S. stocks and 30% international.

“The Most Broadly Overvalued Moment in Market History”.

• Stock Market Valuations Are Totally Unprecedented (Felder)

Last week I updated the Warren Buffett yardstick, market cap-to-GNP. The only time it was ever higher than it is today was for a few months at the top of the dotcom mania.

NEW POST: Why Warren Buffett Is So Reluctant To Call Stocks A ‘Bubble’ https://t.co/HSqxmgC6ep pic.twitter.com/BPSOjaioMX

— Jesse Felder (@jessefelder) March 1, 2017

However, when you look under the surface of the market-cap-weighted indexes at median valuations they are currently far more extreme than they were back then. As my friend John Hussman puts it, this is now “the most broadly overvalued moment in market history.”

The Most Broadly Overvalued Moment in Market History https://t.co/XleMnXh3NZ by @hussmanjp pic.twitter.com/AjviMnPt6U

— Jesse Felder (@jessefelder) March 7, 2017

Another way to look at stock prices is in relation to monetary velocity and here, too, we see something totally unprecedented.

Nothing to see here. Move along pic.twitter.com/ELZojkcElM

— Eric Pomboy (@epomboy) March 3, 2017

Time for public transport investments, Donald.

• US Subprime Auto Loan Losses At Highest Level Since The Financial Crisis (BBG)

U.S. subprime auto lenders are losing money on car loans at the highest rate since the aftermath of the 2008 financial crisis as more borrowers fall behind on payments, according to S&P Global Ratings. Losses for the loans, annualized, were 9.1% in January from 8.5% in December and 7.9% in the first month of last year, S&P data released on Thursday show, based on car loans bundled into bonds. The rate is the worst since January 2010 and is largely driven by worsening recoveries after borrowers default, S&P said. Those losses are rising in part because when lenders repossess cars from defaulted borrowers and sell them, they are getting back less money. A flood of used cars has hit the market after manufacturers offered generous lease terms.

Recoveries on subprime loans fell to 34.8% in January, the worst since early 2010, S&P data show. With losses increasing, investors in bonds backed by car loans are demanding higher returns, as reflected by yields, on their securities. That increases borrowing costs for finance companies, with those that depend on asset-backed securities the most getting hit hardest. American Credit Acceptance, one of nearly two dozen subprime lenders to securitize their loans in recent years, had one of the highest cost of funds last year with yields on its securitizations as high as 4.6%, even as the two-year swap rate benchmark hovered around 1%, according to a report from Wells Fargo. The company relies heavily on asset-backed securities for funding.

2nd article in a row that ends with “Since The Financial Crisis”.

• US Government Revenues Suffer Biggest Drop Since The Financial Crisis (ZH)

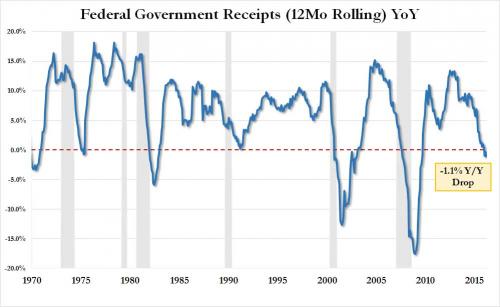

[..] something more concerning emerges when looking at the annual change in the rolling 12 month total. It is here that we find that, like last month, in the LTM period ended Feb 28, total federal revenues, tracked as government receipts on the Treasury’s statement, were $3.275 trillion. This amount was 1.1% lower than the $3.31 trillion reported one year ago, and is the third consecutive month of annual receipt declines. This was the biggest drop since the summer of 2008. At the same time, government spending rose 3.8%. Why is this important? Because as the chart below shows, every time since at least 1970 when government receipts have turned negative on an annual basis, the US was on the cusp of, or already in, a recession. Indicatively, the last time government receipts turned negative was in July of 2008.

One potential mitigating factor this time is that much of the collapse in receipts is due to a double digit % plunge in corporate income tax, which begs the question what are real corporate earnings? While we hear that EPS are rising, at least for IRS purposes, corporate America is in a recession. How about that far more important indicator of overall US economic health, and biggest contributor to government revenue, individual income taxes? As of February, the YTD number was $611bn fractionally higher than the same period a year ago, and declining. Finally should Trump proceed to cut tax rates without offsetting sources of government revenue, a recession – at least based on this indicator – is assured.

Why did he refuse?

• Trump Fires US Attorney Preet Bharara After He Refuses To Quit (ZH)

The speculation over whether Trump would or would not fire the US attorney for the Southern District of New York, Preet Bharara, who earlier reportedly said he would not resign on his own, came to a close a 2:29pm ET when Preet Bharara, tweeting from his private Twitter account, announced he had been fired. “I did not resign. Moments ago I was fired. Being the US Attorney in SDNY will forever be the greatest honor of my professional life.” Bharara’s dismissal ended an “extraordinary” showdown in which a political appointee who was named by Mr. Trump’s predecessor, President Barack Obama, declined an order to submit a resignation. “I did not resign. Moments ago I was fired. Being the US Attorney in SDNY will forever be the greatest honor of my professional life,” Mr. Bharara wrote on his personal Twitter feed, which he set up in the last two weeks.

Bharara was among 46 holdover Obama appointees who were called by the acting deputy attorney general on Friday and told to immediately submit resignations and plan to clear out of their offices. But Bharara, who was called to Trump Tower for a meeting with the incoming president in late November 2016, declined to do so. As reported previously, Bharara said he was asked by Trump to remain in his current post at the meeting. Bharara met with Trump at Trump Tower, and then addressed reporters afterward. Before the firing, one of New York’s top elected Republicans voiced support for Bharara on Saturday.

The Southern District of New York, which Bharara has overseen since 2009, encompasses Manhattan, Trump’s home before he was elected president, as well as the Bronx, Westchester, and other counties north of New York City. Last weekend, Trump accused Barack Obama of wiretapping Trump Tower in Manhattan, an allegation which various Congressmen have said they will launch a probe into. And now the speculation will begin in earnest why just three months after Bharara, who at the time was conducting a corruption investigation into NYC Mayor Bill de Blasio as well as into aides of NY Gov. Andrew Cuomo, told the press that Trump had asked him to “stay on” he is being fired and whether this may indicate that the NYSD has perhaps opened a probe into Trump himself as some have speculated.

Don’t look at me, I didn’t write the book.

• A Generation of Sociopaths: How the Boomers Betrayed America (MW)

Millennials have a reputation for being entitled, self-absorbed and lazy, but a new book argues that their parents are actually a bigger danger to society. In “A Generation of Sociopaths: How the Boomers Betrayed America,” Bruce Cannon Gibney traces many of our nation’s most pressing issues, including climate change and the rising cost of education, back to baby boomers’ idiosyncrasies and enormous political power. Raised in an era of seemingly unending economic prosperity with relatively permissive parents, and the first generation to grow up with a television, baby boomers developed an appetite for consumption and a lack of empathy for future generations that has resulted in unfortunate policy decisions, argues Gibney, who is in his early 40s. (That makes him Generation X.) “These things conditioned the boomers into some pretty unhelpful behaviors and the behaviors as a whole seem sociopathic,” he said.

The book comes as Americans of all ages are sorting through a new political reality, which Gibney argues that boomers delivered to us through years of grooming candidates to focus on their political priorities such as, preferential tax treatment and entitlement programs, and then voting for them in overwhelming numbers. Though these circumstances are new, making the argument that a generation – particularly boomers – are to blame for society’s ills is part of a storied tradition, said Jennifer Deal, the senior research scientist at the Center for Creative Leadership. “There are a lot of people who like to blame the baby boomers for stuff and this has been going on for as far as I can tell since the late 60s,” Deal said. Indeed, a 1969 article in Fortune magazine warned that the group of then-20-somethings taking over the workplace were prone to job-hopping and having their egos bruised.

If that sounds familiar, it’s probably because it is. There’s no shortage of articles describing millennials similarly. Both are indicative of a natural human tendency to want to explain the world and other people through the lens of group mentalities, said Deal. “Everybody can think of someone older or someone younger who has done something annoying,” she said. “Everybody likes a good scapegoat.” Still, Gibney, a venture capitalist, argues there is something inherently different about the boomers from the generations that preceded them and those that followed: a sense of entitlement that comes from growing up in a time of economic prosperity.

Rotterdam was absolutely flattened by Nazi bombers.

• Netherlands Bars Turkish Ministers As Rally Dispute Escalates (R.)

Turkey told the Netherlands on Sunday that it would retaliate in the “harshest ways” after Turkish ministers were barred from speaking in Rotterdam in a row over Ankara’s political campaigning among Turkish emigres. President Tayyip Erdogan had branded its fellow NATO member a “Nazi remnant” and the dispute escalated into a diplomatic incident on Saturday evening, when Turkey’s family minister was prevented by police from entering the Turkish consulate in Rotterdam. Hundreds of protesters waving Turkish flags gathered outside, demanding to see the minister. Dutch police used dogs and water cannon early on Sunday to disperse the crowd, which threw bottles and stones. Several demonstrators were beaten by police with batons, a Reuters witness said. They carried out charges on horseback, while officers advanced on foot with shields and armored vans.

Less than a day after Dutch authorities prevented Foreign Minister Mevlut Cavusoglu from flying to Rotterdam, Turkey’s family minister, Fatma Betul Sayan Kaya, said on Twitter she was being escorted back to Germany. “The world must take a stance in the name of democracy against this fascist act! This behavior against a female minister can never be accepted,” she said. The Rotterdam mayor confirmed she was being escorted by police to the German border. Kaya later boarded a private plane from the German town of Cologne to return to Istanbul, mass-circulating newspaper Hurriyet said on Sunday. The Dutch government, which stands to lose heavily to the anti-Islam party of Geert Wilders in elections next week, said it considered the visits undesirable and “the Netherlands could not cooperate in the public political campaigning of Turkish ministers in the Netherlands.”

The government said it saw the potential to import divisions into its own Turkish minority, which has both pro- and anti-Erdogan camps. Dutch politicians across the spectrum said they supported Prime Minister Mark Rutte’s decision to ban the visits. In a statement issued early on Sunday, Prime Minister Binali Yildirim said Turkey had told Dutch authorities it would retaliate in the “harshest ways” and “respond in kind to this unacceptable behavior”. Turkey’s foreign ministry said it did not want the Dutch ambassador to Ankara to return from leave “for some time”. Turkish authorities sealed off the Dutch embassy in Ankara and consulate in Istanbul in apparent retaliation and hundreds gathered there for protests at the Dutch action.

The curious story of Mr. Flynn.

• Flynn Attended Intel Briefings While Taking Money To Lobby for Turkey (NBC)

Former National Security Advisor Michael Flynn was attending secret intelligence briefings with then-candidate Donald Trump while he was being paid more than half a million dollars to lobby on behalf of the Turkish government, federal records show. Flynn stopped lobbying after he became national security advisor, but he then played a role in formulating policy toward Turkey, working for a president who has promised to curb the role of lobbyists in Washington. White House spokesman Sean Spicer on Friday defended the Trump administration’s handling of the matter, even as he acknowledged to reporters that the White House was aware of the potential that Flynn might need to register as a foreign agent.

When his firm was hired by a Turkish businessman last year, Flynn did not register as a foreign lobbyist, and only did so a few days ago under pressure from the Justice Department, the businessman told The Associated Press this week. [..] Flynn was fired last month after it was determined he misled Vice President Mike Pence about Flynn’s conversations with the Russian ambassador to the United States. His security clearance was suspended. When NBC News spoke to Alptekin in November, he said he had no affiliation with the Turkish government and that his hiring of Flynn’s company, the Flynn Intel Group, had nothing to do with the Turkish government. But documents filed this week by Flynn with the Department of Justice paint a different picture. The documents say Alptekin “introduced officials of the Republic of Turkey to Flynn Intel Group officials at a meeting on September 19, 2016, in New York.”

In the documents, the Flynn Intel Group asserts that it changed its filings to register as a foreign lobbyist “to eliminate any potential doubt.” “Although the Flynn Intel Group was engaged by a private firm, Inovo BV, and not by a foreign government, because of the subject matter of the engagement, Flynn Intel Group’s work for Inovo could be construed to have principally benefited the Republic of Turkey,” the filing said. The firm was paid a total of $530,000 as part of a $600,000 contract that ended the day after the election, when Flynn stepped away from his private work, the documents say. During the summer and fall, Flynn, the former director of the Defense Intelligence Agency, was sitting in on classified intelligence briefings given to Trump.

Funniest movie review in a while.

• Turkish Diaspora In Germany Divided On Powers For Erdogan (G.)

Only 38 people turned up at screen 7 of Berlin s Alhambra cinema on Thursday night to watch a powerful Turkish president make a pitch for why he deserves even more power. But those who came were impressed. Reis (the Turkish word for chief), a biopic in which Recep Tayyip Erdogan is played by soap opera star Reha Beyoglu, premiered in Istanbul last month. It is now touring cinemas among Europe s Turkish diaspora communities in the run-up to the constitutional referendum on 16 April, a vote that could boost Erdogan’s powers and allow him to remain president until 2029. The film shows the co-founder of Turkey s ruling Justice and Development party (AKP) growing up in Istanbul’s working class Kasimpasa neighbourhood to become a man of prodigal talent and saintly self-denial, scoring the last-minute winner in a five-a-side football match with an overhead kick and getting up in the middle of the night to rescue a puppy that has fallen down a well.

His supporters are willing to use blunter means to defend their chief against Turkey s cosmopolitan elite. In the film s final scene, showing one of Erdogan’s guards punching an assailant in the face, the Berlin audience watching the film with German subtitles broke into spontaneous applause. The dialogue was widely understood to be a reference to last July s averted coup: Who are you? asks the assailant. The people, the guard replies. Smoking cigarettes on the pavement outside the cinema, a group of four Turkish-Germans in their late teens said Reis had only affirmed their decision to vote yes in the referendum. A strong Erdogan is good for a strong Turkey, said Ahmet, 19.

Tensions between the German and Turkish governments, triggered by the arrest of Die Welt s correspondent Deniz Yucel and culminating in Erdogan accusing Germany of Nazi practices over banned rallies in German cities, had merely strengthened his allegiance, said 20-year-old Mehmet. To be honest, when America, Germany and France tell me to vote no in the referendum, then I am going to vote yes. Both said no German party represented their interests: We are just foreigners to them. The heightened fervour of support for Erdogan even among younger members of Germany s population with Turkish roots, a community of about 3 million, of which roughly half are entitled to vote in April has scandalised the country’s public and media.

German politicians allege that the AKP is trying to influence the diaspora vote not just through public rallies but by covertly pressurising and threatening its opponents in Germany via religious and business networks. In January, Turkish-German footballer Hakan Calhanoglu was publicly criticised by his club Bayer Leverkusen for posting a video on social media in which he declared his allegiance with the evet (yes) camp. You are part of our country, Angela Merkel, the chancellor, appealed to the Turkish-speaking community on Thursday. We want to do everything to make sure that domestic Turkish conflicts aren’t brought into our coexistence. This is a matter of the heart for us.

“They will have to evict people from their homes and that won’t be easy. The people will react in unforeseeable ways.”

• Greek Activists Target Sales Of Homes Seized Over Bad Debts (G.)

The cavernous halls of Athens’ central civil court are usually silent and sombre. But every Wednesday, between 4pm and 5pm, they are anything but. For it is then that activists converge on the building, bent on stopping the auctions of properties seized by banks to settle bad debts. They do this with rowdy conviction, chanting “not a single home in the hands of a banker,” unfurling banners deploring “vulture crows”, and often physically preventing notaries and other court officials from sitting at the judge’s presiding bench. “Poor people can’t afford lawyers, rich people can,” says Ilias Papadopoulos, a 33-year-old tax accountant who feels so strongly that he has been turning up at the court to orchestrate the protests with his eye surgeon brother, Leonidas, for the past three years.

“We are here to protect the little man who has been hit by unemployment, hit by poverty and cannot keep up with mortgage payments. Banks have already been recapitalised. Now they want to suck the blood of the people.” The tall, bearded brothers were founding members of Den Plirono, an activist group that emerged in the early years of Greece’s economic crisis in opposition over road tolls. The organisation, which sees itself as a people’s movement, then moved into the power business – restoring the disconnected electricity supplies of more than 5,000 Greeks who could not afford to pay their bills. Auctions are their latest cause. “Solidarity is the only answer,” Papadopoulos insists. “Rich people have political influence. They can negotiate their loans and are never in danger of actually losing the roof over their heads.”

The protests have been highly effective. In law courts across Greece, similar scenes have ensured that auctions have been thwarted. Activists estimate that only a fraction of auctions of 800 homes and small business enterprises due to go under the hammer since January have actually taken place. Under pressure to strengthen the country’s fragile banking system, Athens’ leftist-led government has agreed to move ahead with around 25,000 auctions this year and next. In recent weeks they have more than doubled, testimony, activists say, to the relaxation of laws protecting defaulters. “There is not a Greek who does not owe to the banks, social security funds or tax office,” says Evangelia Haralambus, a lawyer representing several debtors.

“Do you know what it is like to wake up every morning knowing that you can’t make ends meet, that you might lose your home? It makes you sick.” [..] “We see our country as a country under occupation. It is inadmissible what has happened to Greece,” she splutters. “These vulture crows, homing in on the properties of the poor, are all part of the larger plan to control us.” [..] Fears are mounting that if the banks fail to recover losses, a Cypriot-style bail-in could follow and the government has announced that it will pushed ahead with electronic auctions. But the prospect of mass auctions at a click of a button has only incensed critics further. “It will create huge tensions and destabilise Greek society,” said Papadopoulos, claiming that laws protecting the poor had been increasingly whittled down. “They will have to evict people from their homes and that won’t be easy. The people will react in unforeseeable ways.”