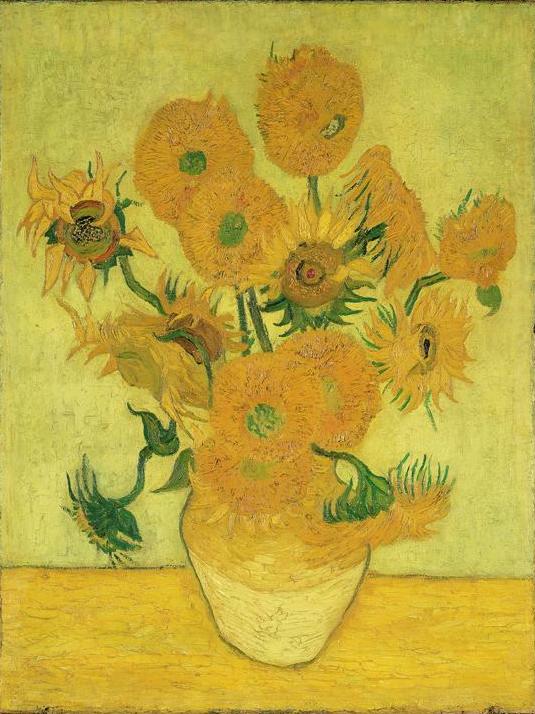

Vincent van Gogh Autumn landscape with four trees 1885

Tucker on Harris

Tucker on Harris: watching her during that debate, I realized she has no limits at all. She clearly thinks God doesn’t exist and she thinks that she is God.

As usual as he nails it with his perceptive analysis because anybody who can lie in the vicious and malignant way that she… pic.twitter.com/rwE8mieknO

— Insurrection Barbie (@DefiyantlyFree) September 14, 2024

RFK Tulsi

https://twitter.com/i/status/1835279419100819529

Walz wife

I can report that Tim Walz’ wife is now confirmed 1000x worse than Hillary Clinton

I’m sorry you have to watch this. pic.twitter.com/pOHAIWejmH

— Benny Johnson (@bennyjohnson) September 15, 2024

Vivek managerial class

WATCH: Vivek Ramaswamy Delivers The Greatest Breakdown of the 2024 Election in Under Three Minutes — 'We Are Running to Dismantle a System' | @VivekGRamaswamy

This is mastery. The perfect articulation of what is currently transpiring in America.

Vivek Ramaswamy just delivered… pic.twitter.com/LsPHttvnZM

— Overton (@overton_news) September 14, 2024

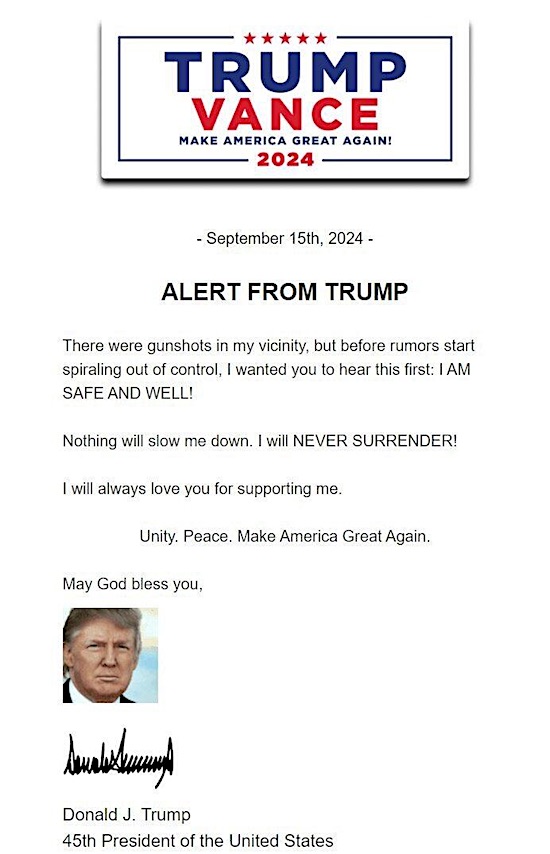

Trump is still not properly protected. No perimeter monitoring, because he’s not the president. The guy had an AK-47, right next to the golf track. They swept one hole ahead of where he was playing, and happened to see the gun barrel.

Trump got very lucky, again. But there are still people who want him dead. This is not over.

• New ‘Assassination Attempt’ Against Trump (RT)

The FBI is treating a shooting incident at Trump International Golf Club in Florida as an assassination attempt against former US President and Republican nominee Donald Trump. Federal agents are investigating “what appears to be an attempted assassination of former President Trump,” the FBI confirmed on Sunday. The incident occurred shortly before 2pm local time, when a Secret Service agent spotted a rifle barrel sticking through a fence surrounding the resort. The agent “engaged” with the threat, firing four to six rounds, according to West Palm Beach Sheriff Ric Bradshaw. The suspect fled the scene, but was later arrested.

Senior advisor to Donald Trump’s campaign Dan Scavino Jr. has posted a comment from the Republican presidential candidate on X, thanking the public for their “concern and well wishes.” “It was certainly an interesting day!” he added. Trump thanked the Secret Service, Sheriff Ric Bradshaw and his office for the “incredible job done.” [..] Trump’s running mate, J.D. Vance, has said he is relieved Trump was not injured. “I’m glad President Trump is safe. I spoke to him before the news was public and he was, amazingly, in good spirits. Still much we don’t know, but I’ll be hugging my kids extra tight tonight and saying a prayer of gratitude,” Vance wrote on X. [..] Tech mogul Elon Musk has reacted to the news of yet another attempt on Donald Trump’s life by wondering why “no one is even trying to assassinate Biden/Kamala,” in a post on his social media X.

[..] Federal agents are conducting a search of a North Carolina residence linked to the detained suspect, named by Ryan Routh in media reports, but still not officially identified by authorities. [..] Vice President Kamala Harris has issued a longer statement condemning political violence and praising the Secret Service agents who thwarted the attempted assassination of her rival. “I am deeply disturbed by the possible assassination attempt of former President Trump today. As we gather the facts, I will be clear: I condemn political violence. We all must do our part to ensure that this incident does not lead to more violence,” she said. “I am thankful that former President Trump is safe. I commend the US Secret Service and law enforcement partners for their vigilance. As President Biden said, our Administration will ensure the Secret Service has every resource, capability, and protective measure necessary to carry out its critical mission,” she added.

[..] Donald Trump has praised the Secret Service and other law enforcement agents for doing an “absolutely outstanding” job in keeping him safe. “It was certainly an interesting day! Most importantly, I want to thank the US Secret Service, Sheriff Ric Bradshaw and his Office of brave and dedicated Patriots, and, all of Law Enforcement, for the incredible job done today at Trump International in keeping me, as the 45th President of the United States, and the Republican Nominee in the upcoming Presidential Election, SAFE,” he wrote in a new post on Truth Social. “I would like to thank everyone for your concern and well wishes,” he added, stating that he feels “very proud to be an American.”

[..] The suspect remained silent when he was detained by law enforcement, according to State Attorney for Palm Beach County, Florida, David Aronberg. The state attorney said the suspect had a “rap sheet,” but did not confirm his identity. “He knew enough to stay silent,” Aronberg told CNN. “He did not apparently speak to officers, he was calm. So, it looked like a person who has done this before, not necessarily this crime, but someone who has had repeated interactions with law enforcement.”

Eric Prince

BREAKING: Blackwater CEO & Ex-Navy SEAL Erik Prince is calling on Governor Ron DeSantis and other local authorities to TAKEOVER the investigation into the 2nd attempt on Trump's life from the FBI before they scrub everything

"I would not even turn that guy over to the Feds until… pic.twitter.com/w7uBRXH4Y8

— George (@BehizyTweets) September 15, 2024

Sheriff

JUST IN: The Trump assas*ination suspect was hiding in the bushes with an AK-47 with a scope, two backpacks, and a GoPro.

The Secret Service agents were one hole ahead of Trump, scoping out the area when they noticed the suspect.

The FBI is now investigating the incident as an… pic.twitter.com/Makr1NLupZ

— Collin Rugg (@CollinRugg) September 15, 2024

https://twitter.com/i/status/1835428406026232159

And yes, they knew him…

“..with the alleged Trump shooter’s personal and public participation in military activity in Ukraine, it is hard to imagine this White House’s agencies can claim zero contact – ’clean hands.’”

• Would-Be Trump Assassin ‘Obsessed’ With Ukraine (RT)

The man behind a botched assassination attempt against Donald Trump at his Florida golf club has been identified as Ryan Wesley Routh by multiple media reports citing anonymous law enforcement sources. Authorities have yet to officially confirm the suspect’s identity. The incident occurred on Sunday afternoon while the former US President and Republican nominee was playing golf at Trump International Golf Club in West Palm Beach. A Secret Service agent apparently spotted a rifle barrel sticking through the resort’s fence and fired several rounds at the threat. The suspect fled the scene, leaving behind an AK-style rifle with a scope and a GoPro camera, but was later arrested. ”He was not displaying a lot of emotions. He never asked, ‘What is this about?’” Martin County Sheriff William Snyder told a press conference.

The suspect was reportedly “relatively calm” when the authorities detained him. Fox News has obtained a photo of the suspect moments after his arrest, while New York Post columnist Karol Markowicz has shared another photo of him being pulled out of his vehicle. While the man’s identity and motive have not yet been officially confirmed by authorities, law enforcement sources told AP, CNN, and Fox News that the detained man’s name was Ryan Wesley Routh. A man by that name appeared to be a staunch supporter of Ukraine in its conflict with Moscow, according to US media and internet users who analyzed his social media accounts before they were deleted. Routh’s social media profiles were filled with posts highlighting his “self-proclaimed involvement” in the Ukraine conflict and attempts to recruit soldiers to fight against Russia, according to CNN chief law enforcement and intelligence analyst John Miller.

Routh repeatedly voiced staunch support for Kiev in dozens of often nonsensical posts in 2022, saying he was willing to fight and die for Ukraine and that “we need to burn the Kremlin to the ground,” according to CNN. “I would like to buy a rocket from you,” he wrote in a message to Elon Musk, according to NYPost. “I wish to load it with a warhead for Putin’s Black Sea mansion bunker to end him.” Routh spent several months in Kiev in 2022 and told the New York Times about his efforts to recruit former Afghan soldiers to fight in Ukraine. He also spoke with Newsweek about his attempts to enlist volunteers for the International Legion Defense of Ukraine. According to the New York Post, Routh frequently criticized politicians, including Trump and current President Joe Biden, and “touted his do-gooder credentials while championing left-wing causes.”

Republican Congresswoman Marjorie Taylor Greene stated that if the suspect’s identity is confirmed, it is clear he is “obsessed with the Ukraine war, which is funded by the US.” NSA whistleblower Edward Snowden has questioned whether US intelligence agencies had any “contact” with the attempted shooter, pointing to his alleged connections to Ukraine and vocal support for Kiev. ”We know little so far, but with the alleged Trump shooter’s personal and public participation in military activity in Ukraine, it is hard to imagine this White House’s agencies can claim zero contact – ’clean hands.’ Something of an Oswald vibe here. Congress should get answers,” Snowden wrote on X. Meanwhile, Trump’s son Donald Trump Jr. labeled the suspected would-be shooter a “psychopath” who probably “spends a lot of time watching leftwing propaganda.”

Poso

https://twitter.com/i/status/1835467674106912888

Kirk

President Trump's round of golf was NOT on any public schedule.

How did the suspect know Trump was golfing there today?

How did he get a semi-automatic rifle so close to the president? pic.twitter.com/FvWw5cdukv

— Charlie Kirk (@charliekirk11) September 15, 2024

“When the election is stolen, what will Americans do about it? Nothing. They will accept tyranny before they will fight.”

• Doom Is the West’s Future (Paul Craig Roberts)

Putin has been at war with NATO since the 2007 Munich Security Conference when Putin announced that a multi-polar world was replacing Washington’s uni-polar order. In other words, he threw down the gauntlet to the neoconservatives and their agenda of Washington’s hegemony. Putin possibly did not comprehend how determined neoconservatives are about hegemony, as a hegemonic agenda undoubtably seems unrealistic to Putin. He did not foresee that his challenge would lead directly to Washington’s overthrow of the Ukrainian government and move to make Ukraine a member of NATO. Once Washington had Ukraine, Washington began building a large Ukrainian army with which to embarrass Putin by suppressing the Donbas Russians. Putin was like a babe in the woods. For eight years while Washington built a Ukrainian army, Putin put his trust in the Minsk Agreement and remained unprepared for the easily predictable war on the horizon.

When Putin was finally forced to intervene, he did so in a foolish way that guaranteed increasing Western involvement, and by never enforcing any of his red lines now has his back to the wall and cannot ignore NATO/US missile strikes into Russia. Finally, he is forced to acknowledge the truth: “the United States and European countries are at war with Russia.” If Putin had been realistic instead of lost in liberal delusions, the war that seems ready to break loose could have been avoided. As the cautious Gilbert Doctorow wrote four days ago, “a Third World War fought at least initially with conventional weapons is now just days, at most weeks away.” And this is just the Ukraine scene. Another major war is brewing in the Middle East. Whether or not war is that close, Doctorow’s point is well taken. War can’t be far off when the US and UK governments are discussing firing missiles at Russia.

As I wrote two or three days ago, “as talk has been forbidden, war is now a certainty.” Unlike during the Cold War, the West no longer has independent foreign policy experts. With very few exceptions, such as Scott Ritter, Mearsheimer, Doctorow, and myself, the Western “foreign policy community” speaks with one voice: “US good, Russia bad.” That’s about it. Those few of us who are independent of think tanks and university faculties funded by the military/security complex and neoconservative foundations are labeled “Russian agents/dupes” and worse. We are gradually being criminalized. Scott Ritter on his way to a conference in Russia was taken off the flight by the Washington Gestapo. His passport was confiscated, and his home was invaded. Currently, charges are being made against Americans accused of cooperating with “Russian disinformation,” by which is meant reporting a fact or expressing an opinion that is inconsistent with the official narratives.

As one thoroughly experienced with the 20th century Cold War, I know that talk between Americans and Russians was the solution, not the problem. When talk is defined as the problem, as Washington defines it today, war is the result. And that is where we are headed. Even the cautious and understated Doctorow sees in Washington an “insane recklessness” that threatens life on earth. What is the point of it? Ukraine’s fraudulent borders while our own go undefended. Americans, Europeans, Russians, indeed the entire world need to understand that in the government in Washington there is not one ounce of intelligence or integrity. The American president is senile. The National Security Council is a collection of morons. Not a single one of them has achieved any distinction other than being a mouthpiece for the military/security complex. The military’s officer ranks have been purged to make room for sexual perverts, women, and “racial minorities.”

The notion among conservatives that the US military is going to save us is laughable. The military is tamed with fangs pulled and has been forced to accept zero promotions for white Americans until the military has achieved in the officer ranks “equity” for sexual perverts, women and “racial minorities.” The ruling establishment is determined to install their puppet Kamala in the White House. She has always prostituted herself to move ahead, and now is her big chance. Unless Democrats get a surprise from Trump winning in blue states, the 2024 election will be stolen in the swing states exactly as it was in 2020. Indeed, as local news reports have made clear, many of the theft mechanisms used in 2020 have been legalized. It is now legal in swing states for the Democrats to steal the election. When the election is stolen, what will Americans do about it? Nothing. They will accept tyranny before they will fight.

Fighting requires belief, but Americans’ beliefs have been destroyed by decades of liberal/left “education” that has undermined Western civilization by presenting it as a racist, misogynist scheme of exploitation of women and “minorities” by white supremacists. White kids go to taxpayer-financed schools funded by their parents to learn that they have been born into the wrong body and that they, their parents and grandparents are racists who owe reparations to “suppressed minorities.” They are being prepared to pay an additional round of taxes to those declared to be their victims. They are being sexualized at an early age and prepared for pedophiles. We must be honest. This is a correct portrayal of America and the entire West today. Every Western government is on the side of immigrant-invaders against the ethnic citizens who comprise the countries. Now, tell me, how can a social, political, belief system this weak go to war with real people such as Russians, Chinese, Iranians? They cannot. The only future the Western world has is Doom.

“The idea that you can’t achieve results without being part of the intelligence service has exposed them for what they are..”

• US Has Declared War On Free Speech – Russia (RT)

The US crackdown on Russian media amounts to a declaration of war on free speech, Foreign Ministry spokeswoman Maria Zakharova said on Sunday. She described the new sanctions against RT and other news outlets as “repressions unprecedented in scale.” US Secretary of State Antony Blinken announced new sanctions against RT on Friday, accusing it of engaging in “covert influence activities” and “functioning as a de facto arm of Russian intelligence.” Earlier in September, Washington imposed sanctions on RT Editor-in-Chief Margarita Simonyan and three other senior RT employees over alleged attempts to influence the 2024 US presidential election. “The US has declared war on freedom of speech throughout the world, turning to open threats and blackmail against other states in an effort to set them against the domestic media and establish sole control over the global information space,” Zakharova said, promising that the punitive measures Washington was using to target Russian media would not go unanswered.

She added that accusations of attempts to influence the elections are a mere “witch-hunt” and “spy-o-mania” introduced to manipulate public opinion and bar its citizens from any information that is inconvenient for the state. The head of the State Department’s Global Engagement Center (GEC), James Rubin, told reporters on Friday that the “broad scope and reach” of RT was one of the reasons many countries around the world did not support Ukraine. The GEC has funded propaganda games aimed at children and forced Twitter to censor pro-Russian content. Rubin admitted last year that he wanted to use the GEC to shut down Russian media outlets around the world.

“We are going to be talking… in Latin America, Africa and Asia… to try to show all of those countries that right now broadcast – with no restrictions or control – RT and allow [RT] free access to their countries,” Rubin said, arguing that its presence has “had a deleterious effect on the views of the rest of the world about a war that should be an open and shut case.” Reacting to the new restrictions, Simonyan argued that Washington’s claims about RT collaborating with Russian intelligence are a “classic case of projection.” “The idea that you can’t achieve results without being part of the intelligence service has exposed them for what they are,” she said.

“It has dawned on some troglodytes in the US State Department that RT is not relying on mechanical typewriters and the telegraph but has a “cyber” capability!”

• Attacks on RT Reveal The Sad Truth About The West (Amar)

The US and its ever-loyal followers Canada and Great Britain have launched a fresh information war offensive. If “fresh” is the word: In a new season of the long-running, apparently never-ever ending Russia Rage show (aka “Russiagate”) that at least the American “elites” simply cannot get enough of, it is again – drum roll – RT that is the target. This time, it stands accused not “merely” of spreading “disinformation” (that is, any information Western governments do not like) but of intelligence work as well. And then some. Such as trying to influence the American elections (yaaawn) and somehow being linked to collecting volunteer contributions for Russia’s war effort in Ukraine – a form of outreach, by the way, which is exactly the same as what Ukrainian organizations do. There also is an even more terrifying revelation. It has dawned on some troglodytes in the US State Department that RT is not relying on mechanical typewriters and the telegraph but has a “cyber” capability!

Or something. That charge really seems to boil down to being internet-literate, a very special skill set that must appear fiendishly futuristic to some in the US administration. And who can blame them? Can you imagine its – official – leader, Joe “Kind-of-Still-President-When-he-Can-Remember” Biden handling even something as almost antediluvian as a laptop? That is better left, as we know, to his son Hunter “The-Naked-and-The-Paid” Biden. And even then, the consequences tend to be dire. Of course, the whole performance comes with more sanctions, too. Because sanctions are to American policy on Russia as popcorn is to a really bad B movie: indispensable yet also not making things any better.

Inevitably, this latest US initiative has attracted ridicule, with very good reason. In essence, it is yet another piece of self-owning, sad cringe from a regime struggling – and never making any progress – to come to terms with its steadily declining power, authority, and relevance. It is also easy to spot that, once again, these self-appointed guardians of the “rules-based order” and its “values” have dialed the hypocrisy up to eleven. Seriously? You want to talk about “disinformation”? While Western media, from American CNN, via British BBC, to German ZDF, have become complicit through silence, bias, and even the spreading of outright Israeli propaganda in the by now almost year-long genocide of the Palestinians in Gaza and increasingly the West Bank, too?

Of course, we could look back and name one example after another of Western flagrant lies with horrific, often mass lethal consequences. Indeed, so many that we can’t, actually, do that here. So, just recall two: the brutal campaign of government lying and media propaganda that the same powers used to “justify” their unjustifiable war of aggression against Iraq in 2003. By March 2023, the Costs of War project, based at the prestigious Brown University in the US, put the losses among Iraqi civilians alone at, as a very conservative minimum estimate, between almost 281,000 and over 315,000 “killed by direct violence since the US invasion.”

Note the word “direct.” If we add, as we realistically have to, those killed “indirectly,” that is by avoidable malnutrition, disease, infrastructure destruction etc., then the real death toll, so the Costs of War project, was “likely much higher” again. Keep in mind also that those who were killed are only the tip of a dark iceberg of the ruined, injured, amputated, displaced, physically and psychologically scarred for life and over generations. Those are the real, countable results of brazen Western lies. And now the US and its accomplices are here to preach about “disinformation.” What’s left to say? Except perhaps that Western “elites” are not only literally mass-murderous but absolutely shameless and tone deaf, too.

Donbass: “I love how extremely patriotic they are there,” he noted. “The flags [are] everywhere, the patriotism. It’s extremely heartwarming.”

• US Journalist on Ukraine, Western Lies, Roots of Russian Invincibility (Sp.)

On his arrival in Russia’s Donetsk People’s Republic (DPR), American journalist Tofurious Maximus Crane, together with other war correspondents, came under Ukrainian fire at a local cafe.”As we were sitting in a restaurant eating, we had mortars incoming, people took cover and then, when the mortars stopped, they just went back to eating lunch. Like, to me, it kind of blew my mind because I thought everybody would just be living in fear,” Crane told Sputnik. According to Crane, that incident showed him how resilient everybody was. He has travelled a lot around the Donetsk and Lugansk People’s Republics and other Russian regions, and what struck him the most was the high morale and patriotism of people living there. “I love how extremely patriotic they are there,” he noted. “The flags [are] everywhere, the patriotism. It’s extremely heartwarming. How would I compare the real situation with Western media? You know, Western media doesn’t report about any of this.”

The US corporate press still keeps on the hush facts about Ukrainian neo-Nazis, downplays or altogether ignores the significance of the Donbass referendums, and claims that the ongoing conflict was “unprovoked” and the Russians have no right to be there, according to the journalist. In the wake of the beginning of the special military operation, Russian media, including Sputnik and RT, were banned in the EU and labeled as “disinformation” on US social media. On September 4, the US stepped up sanctions against the Rossiya Segodnya media group. Crane says he has never seen any falsehoods come out of Russian media. In contrast, the Western press usually quotes anonymous sources that can’t be corroborated. “Western media is just about control and deception,” he said. While in Moscow, Crane attended the Russian Defense Ministry’s exhibition of NATO weapons and equipment captured from the Ukrainian Armed Forces in the special military operation at Poklonnaya Hill.

“When I visited the exhibition, it was ironic, because that hill there is where Napoleon was waiting for the keys to the city,” Crane said. “For me, it was double comical. You know, it was like the last time, I guess you could say, the West tried to take Russia – we saw what happened. And then right below the hill, there’s these vehicles from the West. So it was kind of like a 2.0. And that’s what we’re seeing.” The West has not learned the lessons of the French and Nazi German invasions of Russia in 1812 and 1941, respectively, according to Crane. The French and Nazis also thought that they were invincible and could take on Russia, he said. History is repeating itself, and now NATO-trained Ukrainian troops and Western mercenaries are being obliterated in the special military operation. Vaunted US-made Abrams tanks, destroyed by the Russian military and put on display at Poklonnaya Hill, are a symbol of the West’s arrogance and enormous waste of money, the journalist pointed out.

“I was just laughing. I could hardly even keep a straight face, because in America, they believe that the Abrams is the most powerful tank in the world, and they cannot be destroyed,” the journalist noted. “It was like the greatest troll Russia could have ever done by bringing those vehicles here for all of us just to kind of point and laugh at.” The ongoing conflict hasn’t made the Russian people callous, and they treat Ukrainian prisoners of war (PoW) humanely, Crane said, referring to interviews with Ukrainian captives. The Russians are eager to forgive if one really repents of the malicious things one has done, per the journalist. According to Crane, that attitude stems from the traditional Orthodox Christian values shared by many Russians.

“Russia is the largest country still embracing traditional values. The traditional values work,” he said. “And in the US and Europe – they’ve rejected traditional values. And look at their economies right now, look at their people. Look at the amount of homeless people on the streets, look at the amount of drug addicts, etc. They’re rejecting moral values right now in the West. And now we see a massive decline in Western societies.”

It’s too f**ked up to straighten out.

• PA Supreme Court Rules to Disqualify Undated, Misdated Mail-In Ballots (ET)

The Pennsylvania Supreme Court issued a decision on Sept. 13 that upholds a requirement in the key battleground state that voters must include accurate dates on the exterior envelopes of their mail-in ballots for the votes to be counted. The split 4–3 ruling vacates a previous Commonwealth Court decision that had halted enforcement of the legal requirement under Pennsylvania law that disqualified mail-in ballots if they were undated or featured incorrect dates. The Commonwealth Court found that the date requirement was unconstitutional when enforced against voters who submit their ballots by deadline. The Pennsylvania Supreme Court found that the Commonwealth Court did not have the authority to review that case because the plaintiffs did not include all 67 county election boards as defendants. Even though they included Al Schmidt, the secretary of the Commonwealth, as a defendant, that alone wasn’t enough to give the Commonwealth Court authority to decide the case.

The high court also declined a request by the plaintiffs to use extraordinary jurisdiction powers (under 42 Pa.C.S. § 726) that allow the Pennsylvania Supreme Court to take over cases from lower courts when there is a significant public interest or an urgent issue needing immediate resolution. In a dissenting statement, Justice David Wecht argued that the court should have ruled on the constitutional question presented in the appeal rather than vacate the lower court’s decision on technical grounds. “A prompt and definitive ruling on the constitutional question presented in this appeal is of paramount public importance inasmuch as it will affect the counting of ballots in the upcoming general election. Therefore, I would exercise this Court’s King Bench authority over the instant dispute and order that the matter be submitted on the briefs,” wrote Wecht in dissent, with Chief Justice Debra Todd and Justice Christine Donohue joining.

King’s Bench authority is a broader and more powerful tool than the plaintiffs’ extraordinary jurisdiction request. It allows the Pennsylvania Supreme Court to step in and rule on urgent matters of public importance at any stage of a case, even if procedural hurdles exist. Wecht and the other dissenting justices also argued that the case should have been decided based on the written legal documents already filed rather than on the basis of potentially newly scheduled oral arguments, highlighting their view that it is important to settle the constitutional question of whether Pennsylvania’s mail-ballot date requirement violates the Free and Equal Elections Clause of the Pennsylvania Constitution, ahead of the fast-approaching Nov. 5 presidential election.

The case was brought by a coalition of nine advocacy groups, including the Black Political Empowerment Project, League of Women Voters of Pennsylvania, and Pittsburgh United, with co-counsel from the American Civil Liberties Union (ACLU) of Pennsylvania. The groups challenged the legality of enforcing the date requirement for mail-in ballots, arguing that it violated the Pennsylvania Constitution’s provision for “free and equal” elections. The Commonwealth Court initially ruled in favor of the plaintiffs, suspending enforcement of the dating rule in two key counties—Philadelphia and Allegheny. The Pennsylvania Supreme Court’s decision to reverse this ruling allows enforcement of the rule that mail-in ballots with date errors can be invalidated. The decision could affect thousands of votes in what is expected to be a highly competitive presidential election in Pennsylvania, a key swing state.

“I ask for justice in this violent world, Gonzalo expressed his political views without violence, never threatening, nor advocating violence. Gonzalo Lira Sr.”

• Blinken Brags Over Gershkovich, Pretends Gonzalo Lira Didn’t Exist (Cosgrove)

While speaking to “journalists” during a Friday press conference, US Secretary of State Antony Blinken patted himself on the back for securing the release of the Wall Street Journal’s Evan Gershkovich – telling them “Maybe the most striking part of spending time with Evan, is simply how wonderful it feels to see him free. Home where he belongs.” “Evan’s freedom is also a reminder of all Americans who are still held hostage or wrongfully detained,” Blinken continued. “We will not forget you, and we will not rest until we get you home.” It’s hard to overstate what an egregious display of sanctimonious hypocrisy this is when Blinken’s department wittingly neglected Gonzalo Lira — the California-born writer for mainstream financial outlets like Business Insider, Seeking Alpha, and even ZeroHedge — as he was tortured in a Ukrainian dungeon for eight months until his eventual death at the start of this year. State Spox Matthew Miller was aware of Lira being tortured for at least five of those months.

Lira’s father has accused Biden administration of greenlighting the arrest of his son, pointing to a video published to Lira’s YouTube days before his arrest in which he was uncharacteristically critical of Biden and Kamala. The video, interestingly enough, is titled “Joe Biden Will Be Removed—Kamala Will Be President.” That such a greenlight was given is not far-fetched considering Ukraine’s massive incentive to curry favor with the American government that had approved more than $100 billion already by this point (now at $175 billion). Would the Ukrainians risk the political backlash of arresting a U.S. citizen unless first given the go-ahead? Regardless, the State Department’s Miller acknowledged to me that he was aware of Lira’s arrest in May of 2023. Three months later, Miller then — after being made aware of allegations that Lira’s prison guards had tortured him with severe beating and having his cornea scraped with a toothpick — said he wanted to investigate the torture claims.

Yet, despite near-constant email correspondence between Lira’s father and State Dept officials, nothing was done and Lira died of pneumonia, an infection commonly treatable with antibiotics. A story that slid under the radar this July: Natsya Umka, a Kyiv-based fashion blogger with 600k followers, made an Instagram post, saying “people want peace” and that Ukraine does not need “the border of 1991” (which would include Crimea). For doing so, she was promptly called in to the offices of the Ukrainian Security Services (SBU) for “talk”. Umka posted videos before and after the meeting, appearing noticeably shaken up in the latter video where she claims to have been unable to eat for three days. Most notably… in the video after her “meeting” with the SBU, Umka suddenly supports the war effort: “Everything is fine and we will definitely win.”

Is this the liberal democracy we are risking nuclear war to maintain? Hundreds of billions of dollars and the possibility to destroy life on Earth so we can pay the pensions of these thugs who intimidate mothers into silence, who imprison and torture Americans to death? From an email Lira’s father sent Friday morning, coincidentally a few hours before the Blinken presser: “I ask for justice in this violent world, Gonzalo expressed his political views without violence, never threatening, nor advocating violence. Gonzalo Lira Sr.”

“The tyranny that has been created in the West is worse than the tyrannies imagined by writers of dystopian novels.”

• The Transition from Democracy to Unaccountable Tyranny (Paul Craig Roberts)

Former British Ambassador Craig Murray reports that in Britain honest news reporting of Israel’s destruction of Palestine is a felony for which journalists are arrested and face long prison sentences. In the US universities are gearing up to prevent any student protests of Israel’s destruction of Palestine. It is becoming ever more impossible to acknowledge reality. Official narratives have taken reality’s place. Manifestations of moral conscience are to be prohibited. In America the Biden regime has characterized RT’s new reporting as “Russian disinformation” and amounts to espionage. For reporting news that the US presstitutes carefully keep from the people, sanctions designed to shut down RT have been imposed. A September 13 report from a NY Times presstitute, “U.S. Accuses Russian TV Network of Conducting Covert Intelligence Acts,” establishes Washington’s false narrative. Honest information is “Kremlin-friendly content.”

I have long reported that truth was being criminalized throughout the Western world. The process has now been completed. It seems that analysts and commentators of foreign policy developments will have to terminate interviews with Russian journalists. As I previously warned, stopping communication between nuclear powers and limiting the narrative to one side’s version enhances the acceptance and likelihood of nuclear war. Neither truth nor freedom can exist without free speech, and free speech is being everywhere suppressed in the Western world. The “free” media itself has abandoned it. The tyranny that has been created in the West is worse than the tyrannies imagined by writers of dystopian novels. It will take time for the full impact to be felt, but it is on its way. With the US and Russia at the point of war, why is Washington stirring the pot with aggressive steps toward Russian media? The charge that RT and Sputnik are committing espionage by reporting differently from the official US narrative is unsupportable.

Such atrocious judgment by Washington seems to indicate a death wish for humanity. At this critical time we need maximum communication, not a cut-off of communication. It is difficult to avoid the conclusion that Washington is intentionally driving the world to war. As a “free American” I cannot read the Russian Foreign Ministry’s statement on the actions Washington has taken against RT and Sputnik published in Telegram because “this channel can’t be displayed because it violated local laws.” So, we seemed to have reached the point where official statements of the Russian government violate local laws. What is meant by “local laws?” There is certainly no such law in my town or state. Censorship and controlled narratives are tools tyrannies use to protect lies from truth. That Washington uses these tools so extravagantly indicates that Washington’s agenda requires suppression of the truth.

A useless idea that was promptly denied.

• Ukraine Ready For Ceasefire In Certain Areas – Bild (RT)

Ukraine could be ready to freeze hostilities with Russia on certain parts of the frontline, the German tabloid newspaper Bild has reported, citing what it claims to be Vladimir Zelensky’s revised strategy. The Ukrainian leader’s plan for the conflict also reportedly hinges on Western backers allowing Kiev to use the long-range missiles they have provided, to hit targets deep inside Russia. Back in July, Russian President Vladimir Putin made it clear that Moscow was not interested in a “ceasefire or some kind of pause that the Kiev regime could use to recover losses, regroup, and rearm.” “Russia is in favor of a complete and final end of the conflict,” Putin said at the time. A month earlier, the Russian head of state proposed an immediate ceasefire on the condition that Ukraine give legally binding guarantees that it will not seek to join NATO, and withdraw its troops from all territories claimed by Russia.

Kiev and its Western backers were quick to dismiss the roadmap. sIn an article on Saturday, Bild claimed that Zelensky plans to travel to the US in the coming weeks and present his revised strategy to President Joe Biden as well as Democratic nominee Kamala Harris and her Republican rival, Donald Trump. According to the German media outlet, the main points include a “demand to be allowed to deploy Western long-range weapons deep inside Russia, as well as Ukraine’s readiness to accept local ceasefires along certain portions of the front, and thus a provisional freezing of the situation.” Last month, Zelensky revealed his intention to present his “victory plan” to the US head of state in September. He suggested that the plan likely involved asking the US for more funds and weapons, saying that victory would depend on whether Washington gives Kiev “what is in this plan.”

On Wednesday, the Wall Street Journal, citing unnamed European diplomats, reported that earlier in the day US Secretary of State Antony Blinken and British Foreign Secretary David Lammy had told Ukrainian officials behind closed doors that a “full Ukrainian victory would require the West to provide hundreds of billions of dollars worth of support, something neither Washington nor Europe can realistically do.” Kiev is allegedly being urged to “come up with a more realistic plan.” Since the start of the conflict in February 2022, Zelensky has publicly insisted on the restoration of Ukraine’s 1991 borders, which would include Crimea, either through military or diplomatic means. Moscow says that Kiev must accept the “reality on the ground,” and that the issue of Crimea is “not up for discussion.”

“Russia believes that arms supplies to Ukraine hinder the settlement, directly involve NATO countries in the conflict and are “playing with fire.”

• Russian Electronic Warfare Makes GPS Useless for Ukraine’s Guided Missiles (Sp.)

Electronic warfare (EW) used by the Russian army has made Ukraine’s attempts to use the GPS system to guide missiles useless, the Times reported on Sunday, citing a British military source. “You could absolutely fire it unilaterally, but it probably wouldn’t survive in the contested, electronically jammed environment that the Russians have,” the source told the newspaper. “Russian electronic warfare has rendered GPS useless. They jam it. So it has to use another type of data set instead, which is American owned.” Russia believes that arms supplies to Ukraine hinder the settlement, directly involve NATO countries in the conflict and are “playing with fire.”

Russian Foreign Minister Sergey Lavrov noted that any cargo containing weapons for Ukraine would be a legitimate target for Russia. According to Lavrov, the US and NATO are directly involved in the conflict, including not only by supplying weapons, but also by training personnel in the UK, Germany, Italy, and other countries. The Kremlin stated that pumping weapons into Ukraine by the West did not contribute to negotiations and would have a negative effect.

“..what Americans really need to heal what is probably the most traumatic experience they have had since Pearl Harbor: a second investigation.”

• 9/11: The American Illness Which Still Has No Cure (Jay)

We tend to think of America as a pretty whacky place. The internet is full of mad, stupid, weird and hilarious stunts that Americans carry out every day captured on film. What we haven’t seen though is anyone go to an abandoned steel frame building and flood its upper floors with gasoline and set it alight. If someone were to do that in the name of democracy how would CNN and Fox report that fire when, ultimately it would become apparent that the building was not going to fall down? Steel frame buildings don’t fall down due to fires. The level of heat generated by burning gasoline isn’t anywhere near enough to bend or break the vertical columns which hold them together. This is 3rd grade science class stuff. And despite planes being sent to the 13 graveyards – or ‘boneyards’ as they are called – in the U.S. every day, no one in America has yet to fly one of these planes into an empty steel framed skyscraper as part of an experiment – not the deep state, not private individuals. No one.

If either of these experiments were to be carried out, the American people who hunker down and refuse to be drawn into the conspiracy theory zone would have no choice but to face their most ghoulish demon. Planes did not bring down the Twin towers. Nor the fire which they created. The evidence to prove it is pretty over-whelming as there has never been a single steel framed building before 9/11 to burn down. And not one since. The most extraordinary aspect of 9/11 is the sheer extent of the cover-up. Those who carried it out made sure no genuine investigation could be carried out. Within days of Bush standing on the rubble and posing for photos with firemen, the steel beams which held the building together and which gave it is characteristic unique strength were removed from the site and sent to China on boats. It was critically important that investigators could not take them and examine them as part of an investigation.

The steel beams could not break at the low temperatures that aviation fuel burns at, particularly starved of oxygen. Those beams needs to burn at a much, much higher temperature of around 1300 degrees Celsius before they finally buckle and then break. To get to this temperature and to break the main vertical support beams, thermite is needed which was found on the site in abundance. There was literally tones of it in the dust. And as the hundreds of architects and engineers have all said, to achieve the ‘freefall’ of the building, a certain ‘zero resistance’ from each floor has to be mastered, which can only be done by a controlled demolition on each floor timed perfectly. This is not conspiracy theory. These are facts proven by history, supported by professionals all around the world.

But the mainstream media isn’t going to get anywhere close to acknowledging these points. Nor even for that matter the scores of accounts of firefighters who spoke of hearing explosions shortly before the towers came down. Most Americans believe otherwise and that suits the mainstream press and the elite which controls it. Americans believe in the collapsing pancake theory which is that one floor collapsed onto the other as the support beams buckled and could no longer hold them. And the compounded weight alone made them all fall in perfect succession.

And most Americans chose to believe that an act of terrorism so horrific couldn’t have had the fingerprints of George W Bush and his cronies on it, despite the fact that he secured a second term easily and the ambitions of his father were realized: get into Iraq and Afghanistan where you will loot and plunder everything. Iraq had a lot of oil. Afghanistan was ripe for a 5 trillion dollar gas pipeline deal which had been a blueprint of a Californian energy company which the Bush family was connected to. Who masterminded it though? The Israelis can’t be ruled out as they also stood to gain by using 9/11 as a way of fuelling western hatred against Muslims – something which has worked very well since the U.S. invasion of Iraq lead to the creation of ISIS which then spurned a number of terror attacks in western countries. Indeed, the Israeli genocide of today possibly could not have been carried out if it weren’t for the number of horrific killings in Europe by terrorists their seeking an allegiance to the group. Join up the dots.

But historical context is not on offer by western media on the 9/11 anniversary. Media knows that we are possibly decades away from even being close to exposing the tawdry truth about the twin towers attacks. And possibly even 50 years away from getting what Americans really need to heal what is probably the most traumatic experience they have had since Pearl Harbor: a second investigation.

“..if allowed significant discovery, the case may shed light on the media reports of a scorched Earth strategy of the Biden team targeting critics and witnesses..”

• IRS Whistleblowers Sue Hunter Biden Lawyer Abbe Lowell for Defamation (Turley)

Last January, I received a letter threatening me with a defamation lawsuit if I continued my criticism of Hunter Biden, including allegations of criminal conduct. It all seemed part of a “Legion of Doom” defense hatched by Biden supporters reportedly to target critics and even potential witnesses. I proceeded to write three more columns repeating the claims, but did not hear again from the Biden team. Now, it is the Biden defense that is being targeted with defamation lawsuits. IRS investigators Gary Shapley and Joe Ziegler are suing attorney Abbe Lowell over public allegations of criminal conduct on their part. Lowell was hit with a $20 million defamation lawsuit that alleges “clear malice” in public allegations of criminally leaking grand jury material and other offenses. Due to their extensive public interviews, Shapley and Ziegler would be considered “public figures” for the purposes of defamation.

That will make the case challenging, particularly because Lowell will argue that he was zealously defending his client. The case will also trigger massive fights over attorney-client privilege and other defenses. However, if allowed significant discovery, the case may shed light on the media reports of a scorched Earth strategy of the Biden team targeting critics and witnesses. The whistleblowers claim, however, that Lowell “falsely and maliciously” accused them of “the illegal disclosure of grand jury materials and taxpayer return information — despite the fact that they never publicly discussed return information that was not already public.” Those constitute per se categories of common law defamation, which include allegations of criminal conduct. The alleged misconduct would constitute federal felonies.

One of the allegations is that Lowell or the team accused them of leaking information to the press revealing that an investigation was taking place, apparently in violation of federal law. However, months earlier, they allege, Hunter himself publicly disclosed that he was the subject of a criminal tax investigation. Lowell will likely argue that he was seeking congressional action on allegations to establish if his client was the subject of unlawful conduct by the government. He will argue that such defamation lawsuits chill communications with government. There is an obvious irony in that defense given the scorched Earth tactics of the Biden team to target those of us who have written on the corruption of the First Family. The suing of Lowell may offer another opportunity to review the standard for public figures, which I have previously questioned.

Who?

• Hillary Clinton Derides Palestinians, College Students in New Book (Miles)

Former US Senator and Secretary of State Hillary Clinton sparked controversy this week when leaked excerpts from her upcoming book criticized pro-Palestine campus protesters and Palestinian political leadership. Clinton described a Columbia University campus “tense with shock and grief” after Hamas’s October 7 attack on Israel last year. The former first lady has lectured on the Ivy League campus since January 2023 and described seeking advice from the university’s School of International and Public Affairs Dean Keren Yarhi-Milo, who grew up in Israel and served as an intelligence officer in the Israel Defense Forces (IDF). Clinton also described a tense environment during classes after the event, claiming she was “troubled” by a student who asked why Hamas is considered a terrorist organization but the IDF is not. The IDF has killed an estimated 41,118 Palestinians amid its military operation in Gaza and traces its roots to self-avowed Zionist terrorist groups such as Lehi, Irgun, and Haganah.

The former secretary of state also claimed campus protesters lacked an understanding of the history of the region, an attack she made earlier this year on liberal cable television channel MSNBC. “A lot of young people… don’t know very much at all about the history of the Middle East, or frankly about history, in many areas of the world, including in our own country,” Clinton chided in comments that provoked significant criticism on social media. A group of students walked out of Clinton’s class at Columbia in November to protest the school’s response to pro-Palestine activism on campus, while earlier this year demonstrators disrupted her appearance at her alma mater Wellesley College. Opinion surveys show a significant age divide on perceptions of the Palestine-Israel conflict in the United States, with younger Americans – increasingly including young Jews – more likely to express sympathy for the Palestinian cause.

Some 48% of people from 18 to 29 years old say Israel is intentionally killing civilians, while 55% oppose further US aid to Israel. There is broad support among the age group for a permanent ceasefire in Gaza. Clinton also took the opportunity in her new book to repeat a common line of attack against former Palestinian leader Yasser Arafat, whom she blames for the failure of peace talks organized by her husband former President Bill Clinton at Camp David in 2000. But Arafat had warned Clinton that “the two sides were not ready” before finally agreeing to take part in the discussions after the former president assured him he would not be blamed if talks failed. “Clinton put enormous pressure on Arafat to come [to the peace talks],” recalled international relations scholar John Mearsheimer of the discussions.

“Arafat said, ‘I’ll go to Camp David, but I want to be clear that I don’t think this is going to work out, and if it doesn’t work out, I don’t want you to blame me. In other words, I don’t want you to stab me in the back.’” “So they went to Camp David, they negotiated,” he continued. “It was a very dysfunctional negotiating process… And of course, the negotiations failed, right? Camp David broke up and, of course, Bill Clinton stabbed Arafat in the back. He blamed Arafat for the failure. And the story that Hillary is now telling is the story that Bill told after Camp David failed.”

First place

The look when she finally understood

pic.twitter.com/KoCAl6XXRv— Science girl (@gunsnrosesgirl3) September 15, 2024

Croc eye

https://twitter.com/i/status/1835286189735108939

Otter

https://twitter.com/i/status/1835230779355304308

Bees

Guard bees stopping ants accessing their hive

pic.twitter.com/z784TZ46zJ— Science girl (@gunsnrosesgirl3) September 15, 2024

Raise

Ok, this just made my day! pic.twitter.com/5PI6zlIswN

— Nature is Amazing ☘️ (@AMAZlNGNATURE) September 14, 2024

Baby goat

https://twitter.com/i/status/1835234818646302747

Rubber dog

I have seen everything pic.twitter.com/5owL7heq78

— Interesting As Fuck (@interesting_aIl) September 14, 2024

Lynx

Lynx and a hummingbird.. 😊 https://t.co/pzDpuVD9Vf

— Buitengebieden (@buitengebieden) September 16, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.