Giovanni Bellini The Feast of the Gods c1514 (completed by his disciple, Titian, 1529)

Strangest thing was the level of secrecy, blinded windows the whole flight, no phones; Trump felt really under threat.

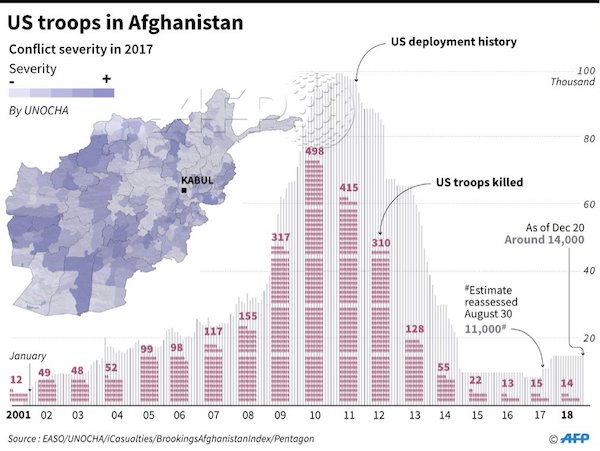

• Trump Declares End To US ‘Policeman’ Role In Surprise Iraq Visit (AFP)

President Donald Trump used a lightning visit to Iraq — his first with US troops in a conflict zone since being elected — to defend the withdrawal from Syria and to declare an end to America’s role as the global “policeman.” Trump landed at 7:16 pm local time at Al-Asad Air Base in western Iraq, accompanied by his wife Melania, following what he described as a stressful, secrecy shrouded flight on a “pitch black” Air Force One. The president spoke to a group of about 100 mostly special forces personnel and separately with military leaders before leaving a few hours later. A planned meeting with Iraqi Prime Minister Adel Abdel Mahdi was scrapped and replaced by a phone call, the premier’s office said.

White House video showed a smiling Trump shaking hands with camouflage-clad personnel, signing autographs and posing for photos at the base in Iraq. Morale-boosting presidential visits to US troops in war zones have been a longstanding tradition in the years following the September 11, 2001 terrorist attacks. Trump has taken considerable criticism for declining to visit in the first two years of his presidency. But speculation had been mounting that he would finally make the gesture following his controversial plan to slash troop levels in Afghanistan and his order to withdraw entirely from Syria. At the Iraqi military base, Trump sought to defend his “America First” policy of pulling back from multinational alliances, including what to many Americans seem like the endless wars of the Middle East.

“It’s not fair when the burden is all on us,” he said. “We don’t want to be taken advantage of any more by countries that use us and use our incredible military to protect them. They don’t pay for it and they’re going to have to.” “We are spread out all over the world. We are in countries most people haven’t even heard about. Frankly, it’s ridiculous,” he added. Trump told reporters he had overruled generals asking to extend the Syria deployment, where about 2,000 US forces, joined by other foreign troops, assist local fighters battling the Islamic State jihadist group. “You can’t have any more time. You’ve had enough time,” he said he told the top brass.

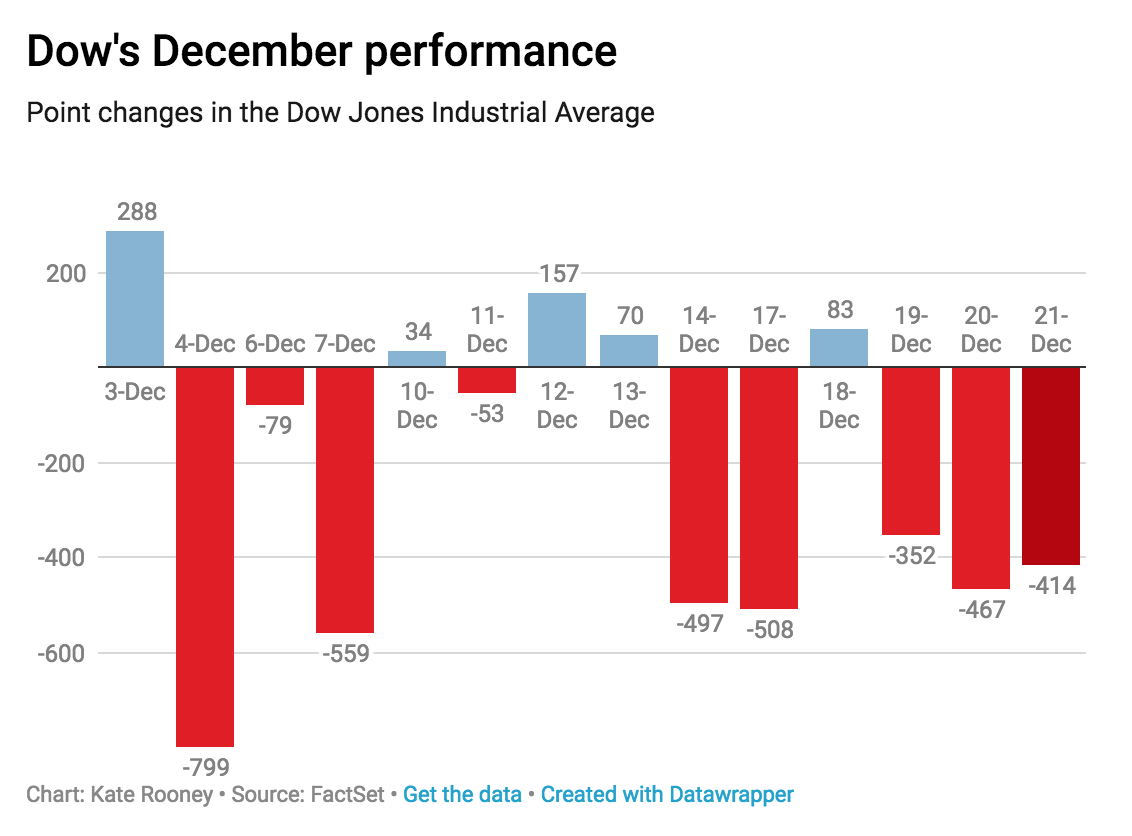

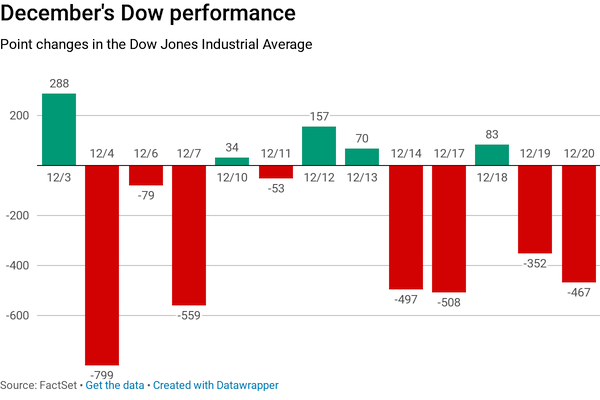

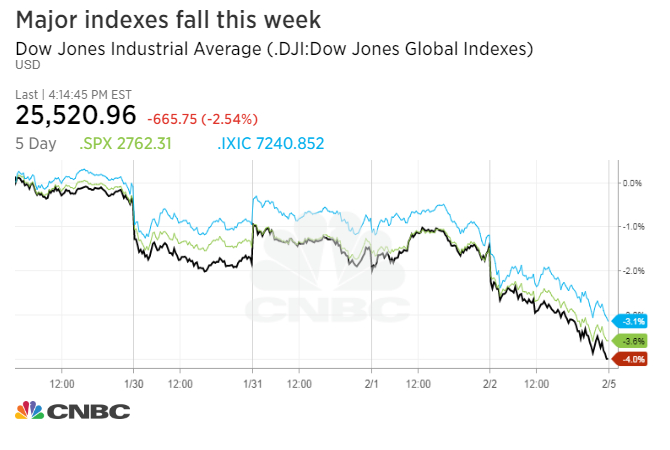

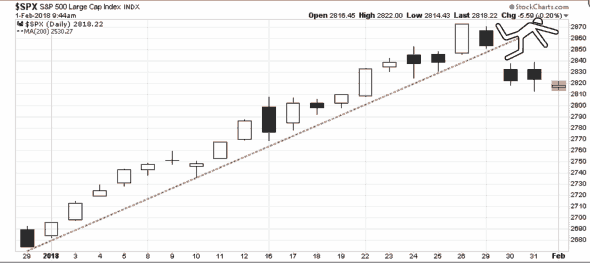

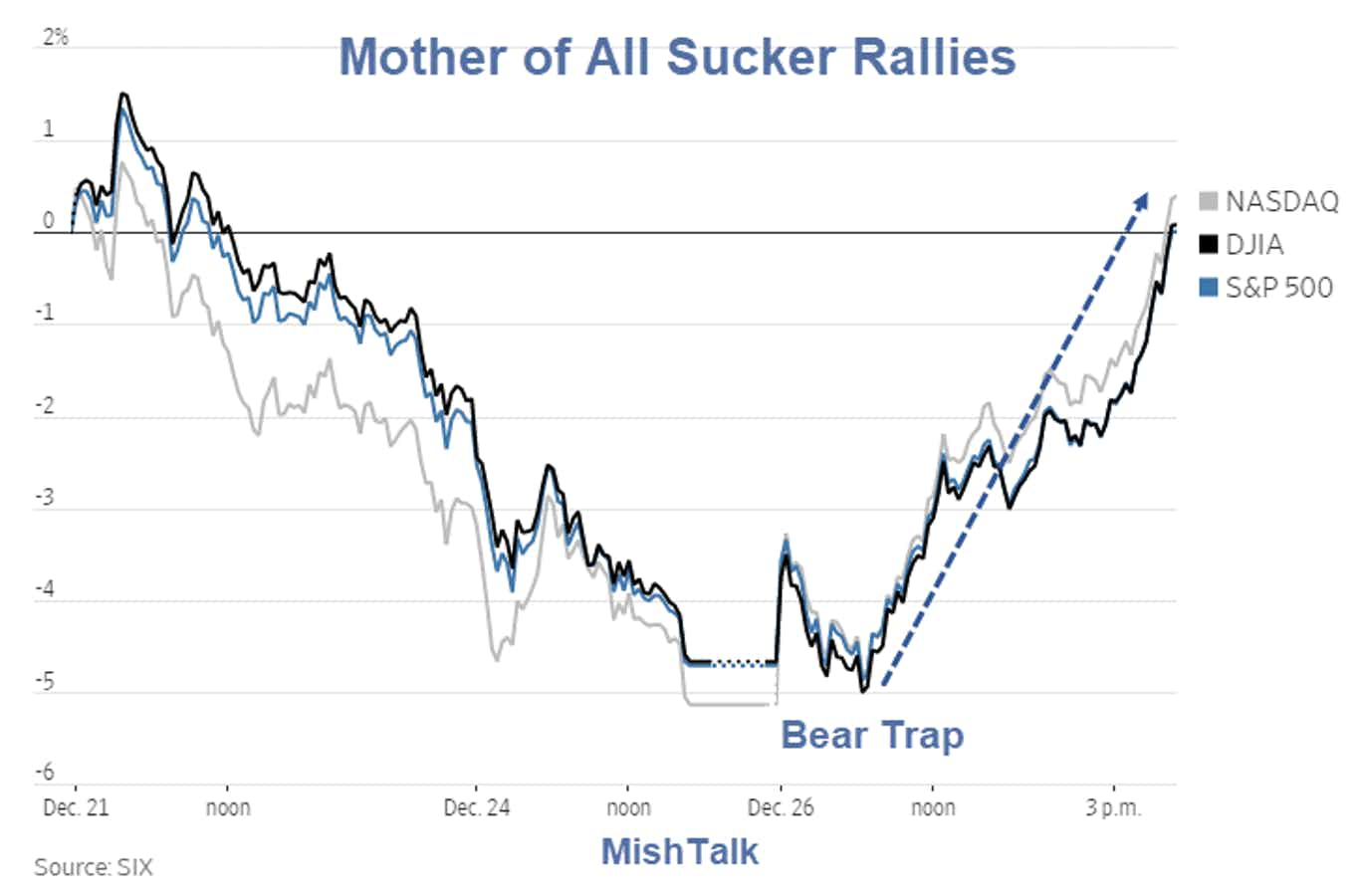

Precisely what you’d expect in a non-functional market, or a non-market, whatever the immeditate trigger.

Then again, Trump DID say to buy the dip. Made a lot of people a lot of money.

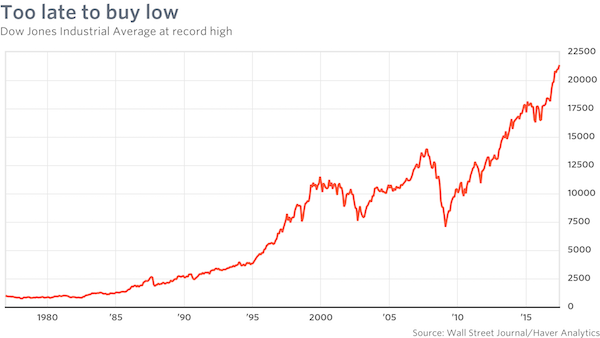

• Dow Rallies 1,000 Points, Biggest Single-Day Point Gain Ever (CNBC)

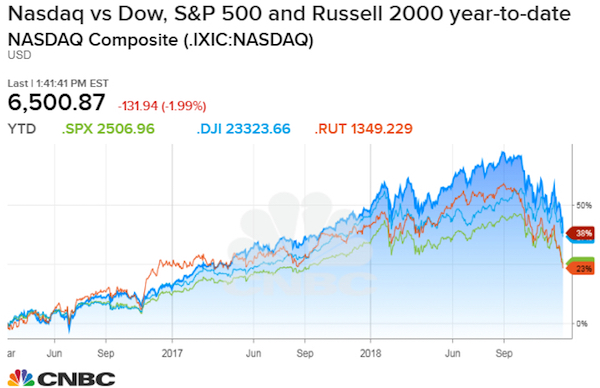

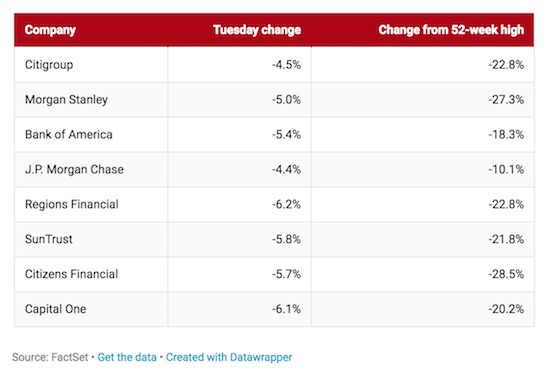

Stocks posted their best day in nearly a decade on Wednesday, with the Dow Jones Industrial Average notching its largest one-day point gain in history. Rallies in retail and energy shares led the gains, as Wall Street recovered the steep losses suffered in the previous session. The 30-stock Dow closed 1,086.25 points higher, or 4.98 percent, at 22,878.45. Wednesday’s gain also marked the biggest upside move on a percentage basis since March 23, 2009, when it rose 5.8 percentage points. The S&P 500 also catapulted 4.96 percent — its best day since March 2009 — to 2,467.70 as the consumer discretionary, energy and tech sectors all climbed more than 6 percent. The Nasdaq Composite also had its best day since March 23, 2009, surging 5.84 percent to 6,554.36. Wednesday also marked the biggest post-Christmas rally for U.S. stocks ever.

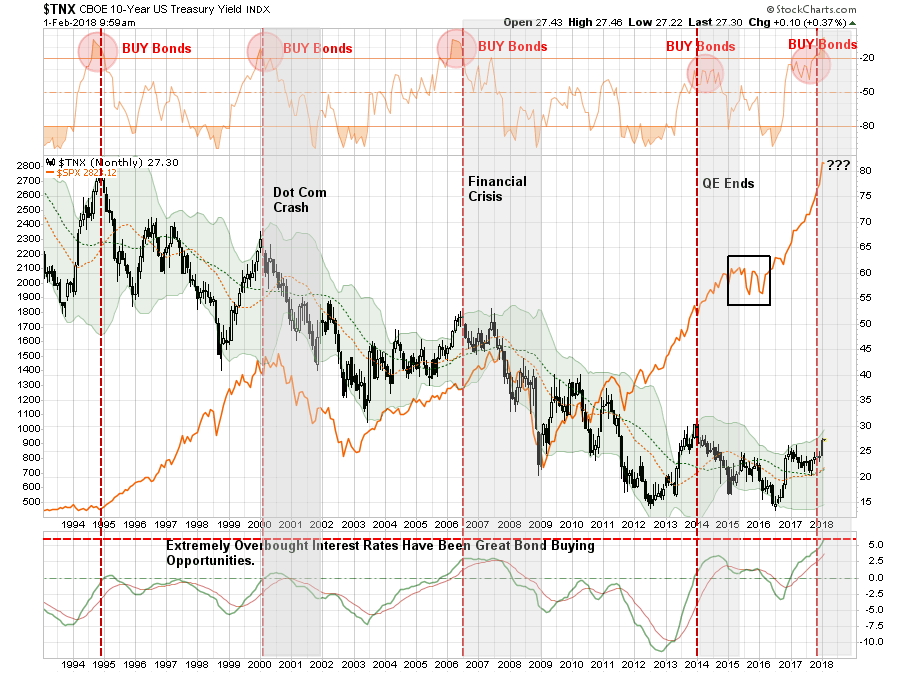

Losses on bonds are so big they have to move into the stocks that lost 20% or so lately?!

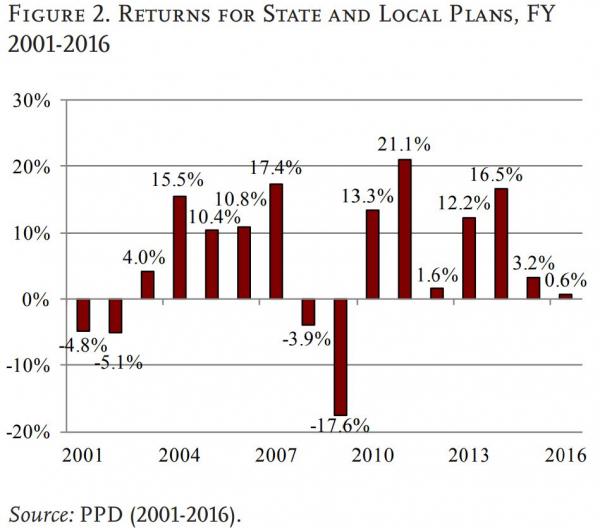

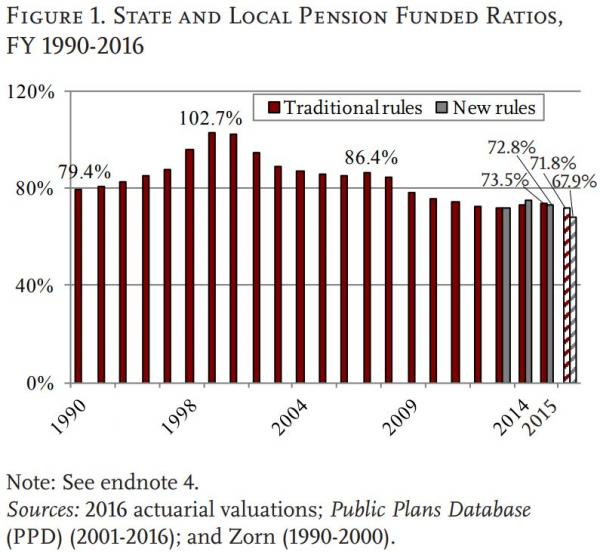

• Why Stocks Soared: US Pension Funds Rebalance With $64 Billion Buy Order (ZH)

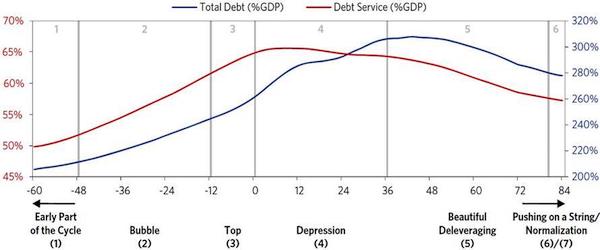

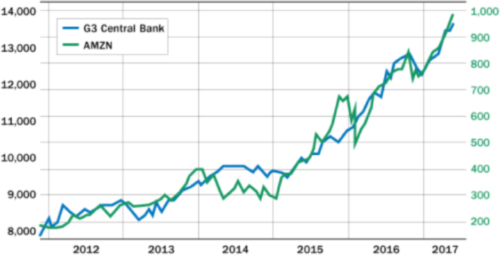

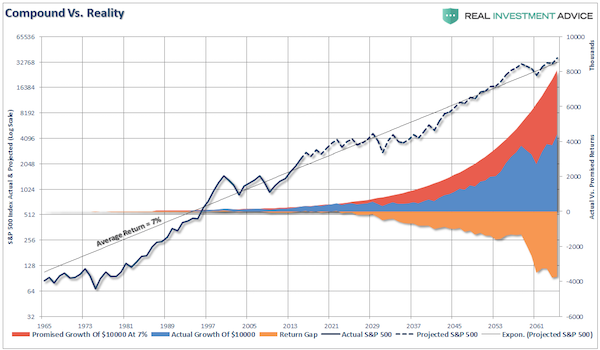

Last Friday, when stocks were tumbling, we reported “some good news for the bulls” which was lost in the overall chaos over the latest mutual fund liquidation discussed earlier. And no, we did not anticipate that President Trump would activate the Plunge Protection Team over the weekend: the good news in question was that as Wells Fargo calculated U.S. defined-benefit pensions fund would need to implement a “giant rebalancing out of bonds and into stocks” – in fact the biggest in history – with the bank estimating roughly $64 billion in equity purchases in the last trading days of the quarter and year, prompting the banks to ask if traders are about to make pension rebalancing “great” again.

Judging by today’s market action, the answer is a resounding yes, even though as Wells warned investors and traders looking for a desperately needed respite from market gyrations “may have to deal with yet one more seismic bout of volatility before Dec 31 finally pops up on their calendar dials.” For those who missed our Friday post on the topic, Wells explained where this massive rebalancing comes from: the huge, end-of-quarter buy order was precipitated by the jarring divergence between equity and bond performances both in Q4 and the month of December. The stocks in the bank’s pro forma pension asset blend had suffered a 14% loss this quarter, including about an 8.5% drop in December. Contrast this with a roughly +1.6% quarterly total return for the domestic aggregate bond index.

The gap between equity and bond performance in pension portfolios would have been even larger had IG credit OAS not widened nearly 40 bps in Q4. As a result of this need for massive quarter-end rebalancing, corporate pensions would need to boost their equity portfolios by as much as $64 billion into year-end. Getting a bit more granular, Wells analyst Boris Rjavinski wrote that domestic stocks – both large cap and small cap – may need disproportionately large boosts of $35 billion and $21 billion, respectively, compared to “only” $9 billion for global developed equities. This is driven by large performance gaps within equity markets: U.S. stocks have trailed global and EM equities in Q4 and December after outperforming the ROW for quarters on end.

A bit of both.

• Plunge Protection And/Or Deeply Underwater Public Sector Pension Funds (CI)

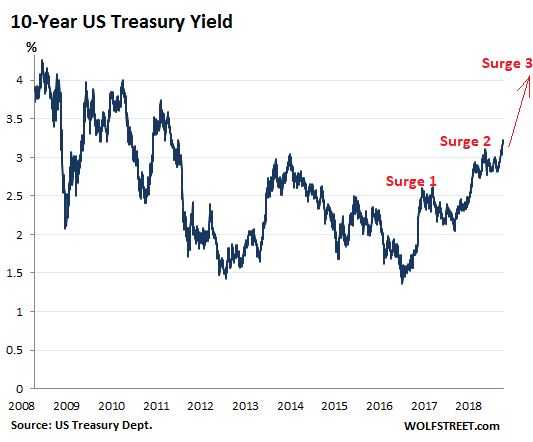

The Dow rose over 1,000 points (almost 5%) after President Trump’s adviser Kevin Hassett assured skittish markets that Fed Chair Jerome Powell is 100% safe. Talk about plunge protection. After numerous jawboning by Fed board members, the Trump administration did its own plunge protection. Of course, an alternative explanation is a rotational shift of public sector pension funds from fixed-income in equities. OR did we just experience the first leg down in the eventual deflation of the massive asset bubble with the bubble deflation taking months … or years. Welcome to the financial circus!

That means they expect Jay Powell to reverse course.

• Pretty Much All Of Wall Street Thinks The Market Will Rally In 2019 (CNBC)

Wells Fargo strategist Christopher Harvey sharply reduced his expectations for the stock market in 2019, making him easily the least optimistic forecaster on Wall Street. Even with the sharp cut, though, pretty much every major house on the Street sees the market higher in the year ahead, despite the brutal correction and potential bear market that looms over investors as 2018 comes to a tumultuous close. Before the new year even begins, Harvey cut his price target for the S&P 500 from an original outlook of 3,079 to a much more muted 2,665. That’s a 13.4 percent reduction that the bank’s head of equity strategy attributed largely to fears of an over-aggressive Federal Reserve, which hiked its benchmark interest rate four times this year, most recently on Dec. 19.

The move “is due to our more comprehensive understanding of the Fed’s near-term philosophy and the belief that it will cause the growth deceleration to intensify,” Harvey said in a note to clients. Still, the new target represents a virtually exact 13.4 percent upside from Monday’s close. Harvey’s peers all agree that stocks are heading higher, from Morgan Stanley’s 2,750 price target all the way up to Deutsche Bank’s robust 3,250 for the large-cap index.

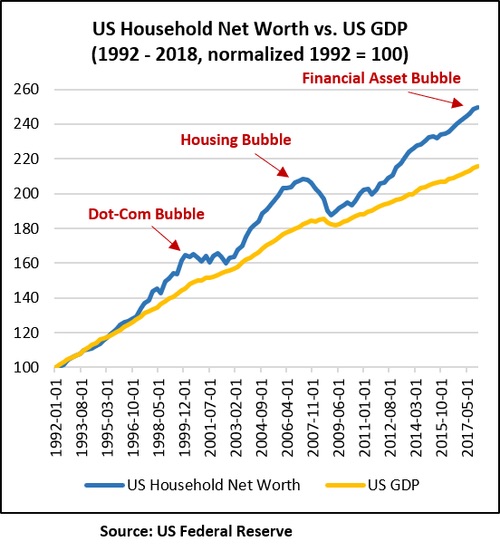

By far the biggest bubble. The economy runs on this bubble.

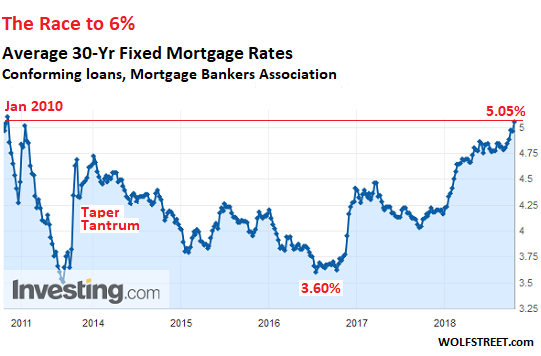

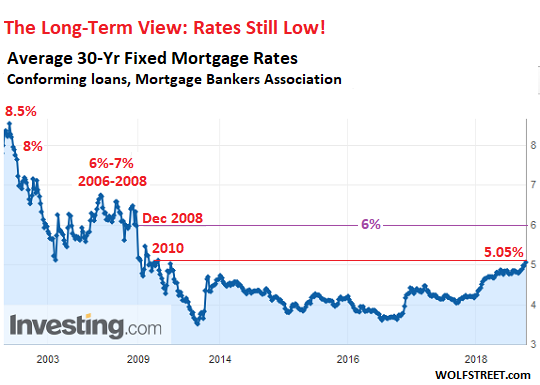

• The Most Splendid Housing Bubbles in America Decline (WS)

Seattle house prices drop 4.4% in four months, biggest drop since Housing Bust 1; Prices deflate in San Francisco Bay Area, San Diego, Denver, and Portland. Some of the markets in this select group of the most spending housing bubbles in America have turned the corner, according to the S&P CoreLogic Case-Shiller Home Price Index, released this morning for October, confirming other more immediate data. This includes the Seattle metro, the five-county San Francisco Bay Area, the San Diego metro, the Denver metro, and the Portland metro. In these metros, house prices have skidded the fastest, and in some cases for the first time, since the Housing Bust. In other markets, house prices have been flat for months. And in a few markets on this list, prices rose.

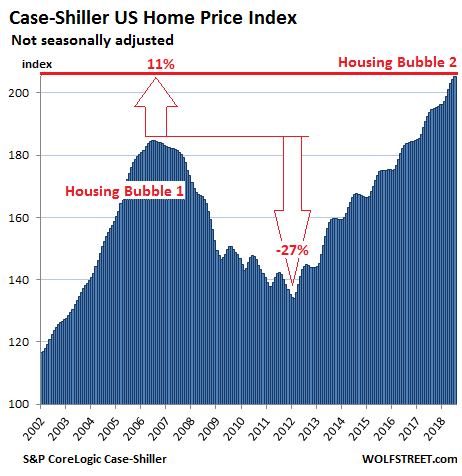

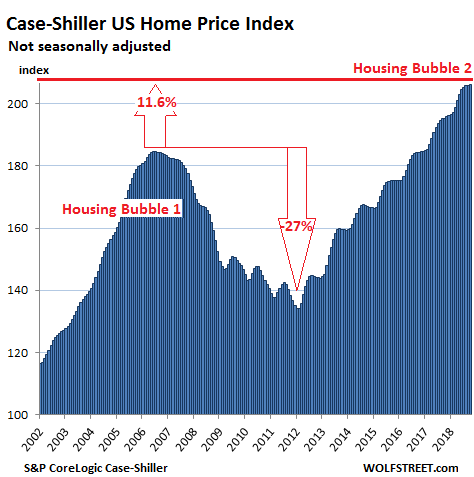

On a national basis, these dynamics get washed out. Single-family house prices in the US, according to the S&P CoreLogic Case-Shiller National Home Price Index, ticked up a smidgen on a month-to-month basis in October, and rose 5.5% compared to a year ago (not seasonally-adjusted). This year-over-year growth rate has been slowing from the 6%-plus range that reigned from September last year to July this year. The index is now 11.6% above the July 2006 peak of “Housing Bubble 1” (the first housing bubble in this millennium), which came to be called “bubble” and “unsustainable” only after it had begun to implode during “Housing Bust 1”:

“What am I going to do, stay until I’m 100 years old? No.”

• Kremlin Considers Changing Constitution To Extend Putin Presidency (ZH)

After last March’s not so shocking vote by China’s National People’s Congress to overwhelmingly pass a constitutional amendment to eliminate China’s presidential term limits, paving the way for President Xi Jinping to stay in power after his second term ends in 2023, it appears Russia is now inching toward the same scenario at a moment when, as one Moscow-based analyst put it, “The general sense is that there’s no one to replace Putin as the guarantor of the system.” Just prior to Russian President Vladimir Putin getting elected to his final possible term allowed under the constitution last March, Newsweek announced The End of The Putin Era is in Sight — looking ahead to the end of his term in 2024 — but even this could be in doubt, perhaps predictably, as this week Russian parliament raised the possibility of altering the constitution as rumors continue to circulate that the Kremlin is seeking ways to keep the popular 66-year old multi-term leader in power.

Currently the Russian constitution prohibits a president from being elected for more than two consecutive terms, but on Tuesday during a scripted meeting with Putin the speaker of Russia’s parliament, Vyacheslav Volodin, broached the issue, saying according to Bloomberg: “There are questions in society, esteemed Vladimir Vladimirovich,” Volodin said, addressing Putin in the respectful form, according to a Kremlin transcript. “This is the time when we could answer these questions, without in any way threatening the fundamental provisions” of the constitution, he added. “The law, even one like the Basic Law, isn’t dogma.”

Noting that the current constitution was drafted a quarter-century ago, Volodin continued, “That was a very difficult time. A time when the state stood on the edge of collapse, when social obligations weren’t fulfilled, when our citizens lost faith in the authorities.” [..] Perhaps the best quote on the issue came last Spring, however, when Putin was presented with a question of his prospects after 2024 just after his reelection to a second consecutive term. He said, “At present I don’t plan any constitutional reforms.” And when asked about seeking office in 2030, as allowed by current law, he quipped, “What am I going to do, stay until I’m 100 years old? No.”

And the US is nowhere near as extreme as Europe, Japan, China. Because: immigration.

• US Population Growth Hits 80-Year Low (ZH)

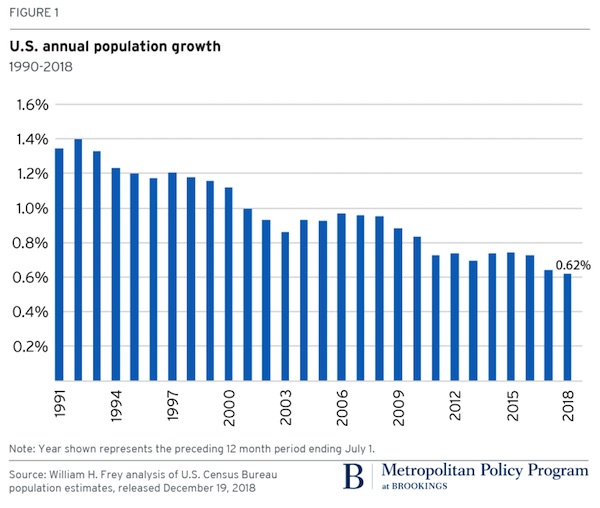

Last week, the Brookings Institution published a new report regarding population data from the US Census Bureau. The data showed population change estimates for the year ending in July 2018. Brookings said the national rate of population growth collapsed to its lowest level since 1937, “a result of declines in the number of births, gains in the number of deaths, and that the nation’s under age 18 population has declined since the 2010 census.” This new report comes after recent government data showed geographic mobility within the US is at historic lows. Some states —particularly in the Mountain West—are expanding at a quick rate, but approximately 20% of all states showed evidence of population losses over the last two years. The aging American population (i.e., those pesky baby boomers) is the broader cause for the downward shift in demographic trends that could cripple the nation in the years and decades ahead.

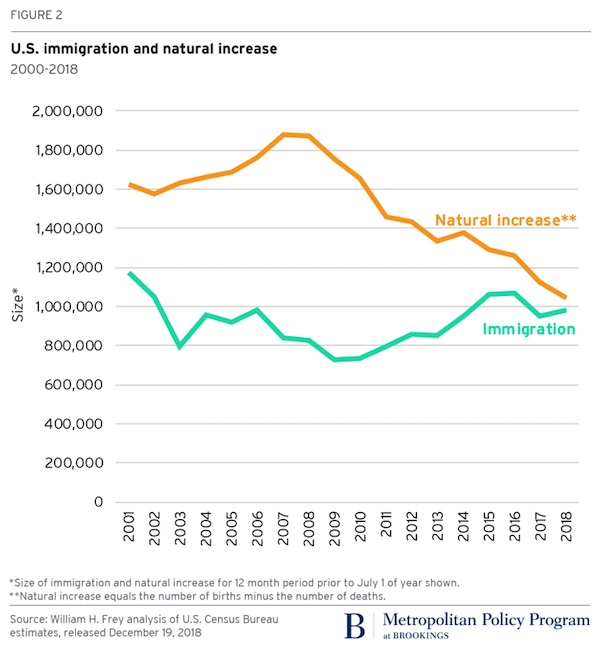

The population growth rate of 0.62% for 2017-2018 is the lowest registered since the end of the Great Depression. While the nation’s growth rate has fluctuated through wars, economic upheavals, baby booms, and baby busts, the current rate reflects a further fall that has also registered below the Great Recession low in 2007-2009. “These downward growth trends initially reflected declines in immigration as well as lower natural increase (the excess of births over deaths) because the economy was down. But over the past few years, as immigration gained slight momentum, reduced natural increase was more responsible for the overall decline in population growth—as it dropped from 1.6 million in 2000-2001 to just above 1 million in 2017-2018. There were fewer births than in recent decades and more deaths than in earlier years,” said Brookings.

A development that’s clearest perhaps in Japan, but will spread all over.

• Japan Shrinks As Birthrate Falls To Lowest Level In History (G.)

Japan suffered its biggest population decline on record this year, according to new figures that underline the country’s losing battle to raise its birth rate. The number of births fell to its lowest since records began more than a century ago, the health and welfare ministry said, soon after parliament approved an immigration bill that will pave the way for the arrival of hundreds of thousands of blue-collar workers to address the worst labour shortage in decades. The ministry estimated 921,000 babies will have been born by the end of 2018 – 25,000 fewer than last year and the lowest number since comparable records began in 1899. It is also the third year in a row the number of births has been below one million.

Combined with the estimated number of deaths this year – a postwar high of 1.37 million – the natural decline of Japan’s population by 448,000 is the biggest ever. The data suggests the government will struggle to reach its goal of raising the birth rate – the average number of children a woman has during her lifetime – to 1.8 by April 2026. The current birth rate stands at 1.43, well below the 2.07 required to keep the population stable. The prime minister, Shinzo Abe, has described Japan’s demographics as a national crisis and promised to increase childcare places and introduce other measures to encourage couples to have more children.

But the number of children on waiting lists for state-funded daycare increased for the third year in a row last year, raising doubts over his plans to provide a place for every child by April 2020. Japanese people have an impressive life expectancy – 87.2 years for women and 81.01 years for men – which experts attribute to regular medical examinations, universal healthcare coverage and, among older generations, a preference for Japan’s traditional low-fat diet. But the growing population of older people is expected to place unprecedented strain on health and welfare services in the decades to come.

Look, you can be an expert on population change, if you want, but that doesn’t make you an expert on the influence of artificial intelligence on populations, or on population decline and economies. Those are completely different topics.

• Falling Total Fertility Rate Should Be Welcomed, Population Expert (G.)

Declining fertility rates around the world should be cause for celebration, not alarm, a leading expert has said, warning that the focus on boosting populations was outdated and potentially bad for women. Recent figures revealed that, globally, women now have on average 2.4 children in their lifetime a measure known as total fertility rate (TFR). But while in some countries that figure is far higher – in Niger it is more than seven – in almost half of countries, including the UK, Russia and Japan, it has fallen to below two. Such declines have been met with alarm, with some warning that the “baby bust” puts countries at risk of a depopulation disaster.

But Sarah Harper, former director of the Royal Institution and an expert on population change, working at the University of Oxford, said that far from igniting alarm and panic falling total fertility rates were to be embraced, and countries should not worry if their population is not growing. Harper pointed out that artificial intelligence, migration, and a healthier old age, meant countries no longer needed booming populations to hold their own. “This idea that you need lots and lots of people to defend your country and to grow your country economically, that is really old thinking,” she said.

Having fewer children is also undoubtedly positive from an environmental point of view; recent research has found that having one fewer child reduces a parent’s carbon footprint by 58 tonnes of CO2 a year. Capping our consumption, said Harper, was crucial, not least because countries in Africa and Asia, where the fastest population rises were occurring, would need a bigger share of resources if global inequality were to be curbed. “What we should be saying is no, [a declining total fertility rate] is actually really good because we were terrified 25 years ago that maximum world population was going to be 24bn,” said Harper, who has three children herself.