Louise Rosskam General store in Lincoln, Vermont 1940

How to gut a society.

• US on Road to Third World (Paul Craig Roberts)

On January 6, 2004, Senator Charles Schumer and I challenged the erroneous idea that jobs offshoring was free trade in a New York Times op-ed. Our article so astounded economists that within a few days Schumer and I were summoned to a Brookings Institution conference in Washington, DC, to explain our heresy. In the nationally televised conference, I declared that the consequence of jobs offshoring would be that the US would be a Third World country in 20 years. That was 11 years ago, and the US is on course to descend to Third World status before the remaining nine years of my prediction have expired. The evidence is everywhere. In September the US Bureau of the Census released its report on US household income by quintile. Every quintile, as well as the top 5%, has experienced a decline in real household income since their peaks.

[..] Only the top One Percent or less (mainly the 0.1%) has experienced growth in income and wealth. The Census Bureau uses official measures of inflation to arrive at real income. These measures are understated. If more accurate measures of inflation are used (such as those available from shadowstats.com), the declines in real household income are larger and have been declining for a longer period. Some measures show real median annual household income below levels of the late 1960s and early 1970s. Note that these declines have occurred during an alleged six-year economic recovery from 2009 to the current time, and during a period when the labor force was shrinking due to a sustained decline in the labor force participation rate. On April 3, 2015 the US Bureau of Labor Statistics announced that 93,175,000 Americans of working age are not in the work force, a historical record.

Normally, an economic recovery is marked by a rise in the labor force participation rate. John Williams reports that when discouraged workers are included among the measure of the unemployed, the US unemployment rate is currently 23%, not the 5.2% reported figure. In a recently released report, the Social Security Administration provides annual income data on an individual basis. Are you ready for this? In 2014 38% of all American workers made less than $20,000; 51% made less than $30,000; 63% made less than $40,000; and 72% made less than $50,000. The scarcity of jobs and the low pay are direct consequences of jobs offshoring. Under pressure from “shareholder advocates” (Wall Street) and large retailers, US manufacturing companies moved their manufacturing abroad to countries where the rock bottom price of labor results in a rise in corporate profits, executive “performance bonuses,” and stock prices.

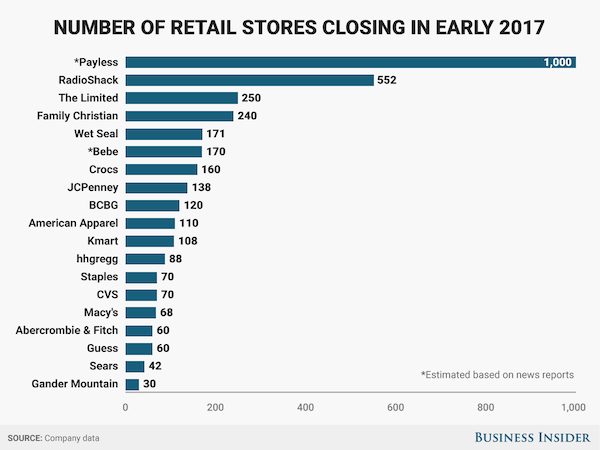

The departure of well-paid US manufacturing jobs was soon followed by the departure of software engineering, IT, and other professional service jobs. Incompetent economic studies by careless economists, such as Michael Porter at Harvard and Matthew Slaughter at Dartmouth, concluded that the gift of vast numbers of US high productivity, high value-added jobs to foreign countries was a great benefit to the US economy. In articles and books I challenged this absurd conclusion, and all of the economic evidence proves that I am correct. The promised better jobs that the “New Economy” would create to replace the jobs gifted to foreigners have never appeared. Instead, the economy creates lowly-paid part-time jobs, such as waitresses, bartenders, retail clerks, and ambulatory health care services, while full-time jobs with benefits continue to shrink as a percentage of total jobs.

These part-time jobs do not provide enough income to form a household. Consequently, as a Federal Reserve study reports, “Nationally, nearly half of 25-year-olds lived with their parents in 2012-2013, up from just over 25% in 1999.” When half of 25-year olds cannot form households, the market for houses and home furnishings collapses.

Read more …

Damned if you do and doomed if you don’t. The loss of credibility will finish the job for Yellen no matter what the Fed does.

• Janet Yellen Just Got Some Pretty Bad News (CNBC)

Two days after the Federal Reserve released what was allegedly its most hawkish statement in months came a reminder that the path toward a rate hike won’t be an easy one. One of the main economic factors for Fed officials when it comes to assessing the right time to start hiking rates is wage growth, tied with the consumer spending that is supposed to follow. There was bad news on both fronts in economic data released Friday morning. The big releases of the day were on personal income, which increased just 0.1% in September, missing even the meager consensus estimate of 0.2%, and the University of Michigan consumer confidence survey, which, at 90, whiffed as well with its second-lowest reading of the year.

Below the Wall Street radar, though, came another report that doesn’t garner the headlines but is believed to be one watched closely by Fed Chair Janet Yellen and her fellow monetary policymakers: The employment cost index. The quarterly release from the Bureau of Labor Statistics showed that compensation costs for nongovernment workers rose just 0.6% in the three-month period – about what economists had expected but not much to move the inflation needle. On an annualized basis, compensation costs rose just 2%, which actually is a decline from the 2.2% increase realized for the same period a year ago. Benefit costs increased just 1.4%, despite a 3% jump in health-care packages. The news was slightly better for state and local government workers, who collectively saw a 2.3% annualized increase, compared with 1.8% in the year-ago period.

The pace of wage increases is critical to Fed thinking. Many on Wall Street took Wednesday’s statement, which referenced conditions for an interest rate increase by the end of the year, as indicating that central bank officials are close to hiking for the first time since taking their key policy rate to near-zero in late 2008. Federal Open Market Committee members are hoping to see demand-driven inflation, something hard to come by when wage increases are so anemic. The wage and confidence news comes just a day after the government reported gross domestic product growth of just 1.5% in the third quarter. With the slow wage growth, core inflation as measured through Yellen’s preferred indicator, the personal consumption expenditures index, is tracking at just 1.25%, according to Steve Blitz, chief economist at ITG.

“The FOMC, if true they are tied to trends, can only be disappointed by the trend in consumption and wage growth coming out of the third quarter,” Blitz said in a note. “Because [if] they really, really, really want to move 25 basis points in December they have to be, by their own rules, now focused on whether the individual data points for the economy in the next six weeks indicate a change in trends to the upside. In other words, the next two payroll numbers mean everything.”

Read more …

Channeling Groucho: “Those are my principles, and if you don’t like them… well, I have others..”

• Fed’s Updated Model of Economy Suggests It’s Time to Raise Rates (Bloomberg)

The Federal Reserve Board released an updated version of its large-scale model on the U.S. economy that may hold clues into why policy makers pivoted at their meeting earlier this week toward a December interest-rate increase. The revised inputs and calculations on Friday suggest the economy will use up resource slack by the first quarter of 2016, according to an analysis by Barclays Plc, and that also indicates Fed staff lowered their near-term estimate for how fast the economy can grow without producing inflation – a concept known as potential growth. “The output gap appears closed,” said Michael Gapen at Barclays in New York. “This means further progress would lead to resource scarcity and potential upward pressure on inflation in the medium term.”

Gapen said that may explain why U.S. central bankers signaled this week that they will consider the first interest-rate increase since 2006 at their next meeting, on Dec. 15-16. The model assumes that the Federal Open Market Committee raises the benchmark lending rate in late 2015. However, immediate liftoff has “been a feature” of the model since late 2014, Barclays noted. In the current model, “the long-run growth rate is two-tenths lower” at 2%, Barclays said. FOMC participants forecast the economy’s long-run growth rate at 2% in September. The unemployment rate stood at 5.1% in September, and the Fed model assumes little change from that level, dipping to a low of 4.8% in a forecast horizon that extends to 2020, according to Barclays.

FOMC officials estimated full employment – or the level of the unemployment rate consistent with stable prices – at 4.9% last month. “This view is quite different than ours,” said Gapen, who formerly worked at the Fed. “We forecast ongoing declines in the unemployment rate and see it reaching 4.3% by end-2016.” The model, known as FRB/US and updated periodically, is a series of calculations put together by Fed staff that sketch out how broad measures of the economy would change based on a set of defined parameters. The staff also constructs a bottom-up forecast for policy makers before each FOMC meeting. U.S. central bankers use the models and forecasts as reference points, not sole determinants of their decision-making.

Read more …

“By 2014, China’s production had reached 823 million tonnes. It was not just the world’s largest producer, it produced more than the rest of the world combined.”

• China Has Created A Steel Monster And Now Must Tame It (Reuters)

The British steel industry is in crisis. That statement may come as a surprise to non-UK readers, many of whom might well be forgiven for thinking the country’s steel mills had gone the way of other legacy industries such as coal mining and shipbuilding. But Britain produced 12.1 million tonnes of crude steel last year, making the country the fifth-largest producer in the EU. It won’t produce that much this year. The last couple of months have brought a string of closure announcements, including that of the Redcar plant in Teeside, a symbol of previous against-the-odds survival. British steel mills are struggling with UK-specific problems, particularly high energy costs that are significantly above the European average.

Stung into belated action, the government is scrambling to assemble a rescue plan, albeit with one hand tied behind its back by EU state subsidy rules. But there is a much, much bigger problem roiling steel production, not just in Britain, but across the globe. China. China exported 11.25 million tonnes of steel last month. It was an all-time high and, expressed in annualized terms, was equivalent to 80% of the entire steel output of the 28-member EU last year. This wave of Chinese steel is creating a global steel-making crisis, of which Britain is only a minor sub-plot. But the biggest crisis of all may yet turn out to be in China itself. With exquisitely bad political timing, Britain’s steel woes erupted just before the long-planned visit to the country by Chinese President Xi Jinpeng.

Xi said China was committed to eliminating surplus steel capacity with 77.8 million tonnes already shuttered and more closures planned. Overcapacity, he added, was a global problem, not just a Chinese problem. Which is true. Steel-making has been dogged for decades by structural overcapacity, a tendency to overproduction and resulting weak pricing. But this time is different, because there has never been a steel giant like China before. China’s crude steel production tripled between 1980 and 2000 to 128.5 million tonnes and then went supernova in the following decade with annual growth rates of up to 30%. By 2014, China’s production had reached 823 million tonnes. It was not just the world’s largest producer, it produced more than the rest of the world combined.

Underpinning that breakneck pace of growth was the country’s massive investment in urban infrastructure. From new cities to new roads to new airports, it all needed massive amounts of steel, and of course the iron ore used to make the steel, generating secondary booms in key suppliers such as Australia. But now the boom is over and the world is paying the price.

Read more …

All on red. Expansion plans for a shrinking market. Time to ditch shares?!

• VW Sticks to $24.2 Billion China Spending Plan Amid Cost Cuts (Bloomberg)

Volkswagen will shield its five-year, €22 billion expansion plan in China from cost cuts, underscoring the importance of its largest market to stem the fallout of the diesel-emissions manipulation scandal. This year and next, VW is pushing to update about 70% of the vehicles it sells in China and introduce more than 30 models to the market. The company is aiming to boost its production capacity in China from last year’s 3 million cars to at least 5 million vehicles. The carmaker needs growth in China to at least partly offset the towering cost of recalling as many as 11 million diesel cars worldwide. Volkswagen set aside €6.7 billion for the recalls in the third quarter, acknowledging this won’t be enough.

Analysts’ estimates for the total price tag, including fines and legal costs, range from about €20 billion to as much as €78 billion. “We continue to be committed to our investment plans in China, including our capacity goal,” Larissa Braun, a spokeswoman for VW’s Chinese business, said Friday in an e-mailed response to questions. The Wolfsburg-based manufacturer will make the investments together with joint venture partners SAIC Motor and FAW Car. The expansion comes even as the Chinese economy slows and many cities consider restricting car purchases to fight traffic jams and pollution. The market is such a priority that VW’s new Chief Executive Officer Matthias Mueller made the country his first major trip destination as CEO, joining German chancellor Angela Merkel on a trade mission this week.

Read more …

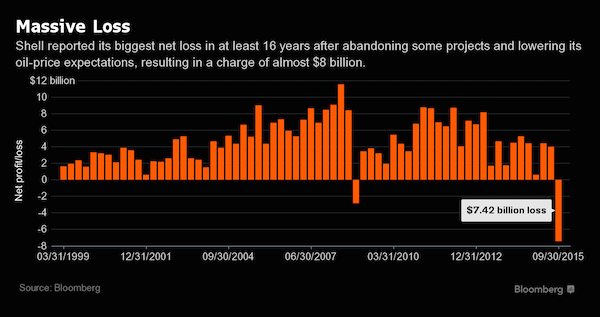

All oil majors are in far deeper doodoo then they let on. All big producing nations too.

• Chevron to Cut Up to 7,000 Jobs (WSJ)

Chevron on Friday said it could cut 6,000 to 7,000 jobs and pare its capital spending by 25% next year, as profit tumbled in its third quarter. Still, results for the quarter fell less than Wall Street had expected. Shares of Chevron, down 20% this year, added 1% in premarket trading. Chevron didnt detail when the job cuts could occur. As of December 2014, Chevron had about 64,700 employees, according to a securities filing. The second-biggest U.S. oil company said it expects capital spending of $25 billion to $28 billion in 2016, down 25% from this year’s budget. The company said it expects to cut spending further in 2017 and 2018, to around $20 billion to $24 billion. For the quarter ended Sept. 30, Chevron reported earnings of $2.04 billion, or $1.09 a share, down from $5.6 billion, or $2.95 a share, a year earlier. Revenue fell 37% to $34.32 billion.

Analysts polled by Thomson Reuters expected Chevron to post 76 cents a share in earnings on $29.76 billion in revenue for the third quarter. A 15% reduction in capital spending to $7.97 billion helped prop up earnings in the period. Foreign currency effects also added $394 million to profit in the quarter, up from $366 million a year earlier. The company eked out a $59 million profit in its exploration and production segment, down from a profit of $4.65 billion a year earlier. Its U.S. segment swung to a loss of $603 million from a profit of $929 million a year earlier. The company’s average price for a barrel of crude oil and natural gas liquids was $42 in the quarter, down from $87 a year ago. The average price for natural gas was $1.96 per thousand cubic feet, down from $3.46 in the prior year.

Read more …

A deflating fairy tale of riches.

• Saudi Arabia Credit Rating Cut by S&P After Oil Prices Sink (Bloomberg)

Saudi Arabia’s credit rating was cut by Standard & Poor’s , which said the decline in oil prices will increase the budget deficit in a country that relies on energy exports for 80% of its revenue. S&P cut the sovereign rating one level to A+, the fifth-highest classification, as it said the biggest OPEC producer’s deficit will increase to 16% of GDP this year. The nation’s credit outlook is negative as the decline in oil prices makes it difficult to reverse the fiscal deterioration, S&P said in a statement. “Credit metrics for oil producers like Saudi Arabia are coming under pressure,” said Steve Hooker, a money manager at Newfleet in Hartford, Connecticut, who helps oversee $12.5 billion of debt. “It’s not likely to reverse until the oil prices go up.”

The widening deficit and a high reliance on energy revenue “point to vulnerabilities in Saudi Arabia’s public finances,” the ratings company said. Brent crude has plunged 27% from this year’s high in May amid a persistent global supply glut. Still, public debt in Saudi Arabia is among the world’s lowest, with a gross debt-to-GDP ratio of less than 2% in 2014. “We could lower the ratings within the next two years if Saudi Arabia did not achieve a sizable and sustained reduction in the general government deficit, or its liquid fiscal financial assets fell below 100% of GDP,” Trevor Cullinan, a credit analyst at the rating company, said in the statement.

The Saudi Finance Ministry said it “strongly disagrees with S&P’s approach to ratings management in this particular instance.” The downgrade was “driven by fluid market factors rather than changes in the fundamentals of the sovereign,” which “remain strong,” the ministry said in a statement on the website of state-run Saudi Press Agency. The country is rated Aa3 by Moody’s Investors Service, the equivalent of one step higher than S&P’s new grade. S&P’s classification for Saudi Arabia is the same as Slovakia, Ireland, Bermuda and Israel.

Read more …

No mention of action other than freeing up $120 million that had been frozen.

• Swiss Probe Banks to Gauge Exposure to Petrobras Scandal (Bloomberg)

Switzerland’s finance regulator is investigating local banks to gauge their possible exposure to a widening scandal surrounding Brazilian oil producer Petrobras. The regulator, known as Finma, said it is looking into whether banks and securities trading firms met their due-diligence obligations in possible cases of money laundering, and whether any possible incidents were reported to authorities. Bern, Switzerland-based Finma didn’t identify the banks that it began talking to months ago as part of the ongoing investigation. Switzerland’s attorney-general in March released $120 million of $400 million in assets tied to suspicious Petrobras-related transactions that had previously been frozen. The Rio de Janeiro-based oil and gas producer is mired in a corruption scandal in which company executives allegedly directed hundreds of millions of dollars from overpriced contracts to politicians.

The worsening affair has sent investor confidence in Brazil tumbling, plunged Latin America’s largest country into recession and triggered calls for Brazilian President Dilma Rousseff to be impeached over her handling of the matter. Swiss prosecutors said in March they’d uncovered more than 300 accounts belonging to senior Petrobras executives and its suppliers at more than 30 banking institutions apparently used to “process bribery payments.” Valor reported on the Finma probe earlier. Swiss Attorney-General Michael Lauber and his Brazilian counterpart Rodrigo Janot have complimented each other on the speed and cooperation with which the two countries’ justice systems have worked together, at a time when Swiss justice has been criticized for moving too slowly.

Read more …

Makes no difference when you’re TBTF.

• Largest US Banks Face $120 Billion Shortfall Under New Rule (Reuters)

Six big U.S. banks need to raise an additional $120 billion, most likely in long-term debt, under a rule proposed on Friday by the Federal Reserve. The requirements are aimed at ensuring that some of the biggest and most interconnected banks, which include Goldman Sachs, JPMorgan and Wells Fargo, can better withstand another crisis by turning some of their debt, particularly debt issued by their holding companies, into equity without disrupting markets or requiring a government bailout. The banks are expected to meet the $120 billion shortfall by issuing debt, which is usually more cost-effective than issuing equity, according to Federal Reserve officials speaking at a background press briefing Friday.

The rule proposed Friday, largely in line with banks’ expectations, concerns the lenders’ total loss-absorbing capacity. It is one of a series of rules aimed at reducing risk in the banking system by determining how much debt and equity banks should use to fund themselves. In a procedural vote, the Fed’s governors approved a draft of the proposal, meaning it will be submitted for public comment. During a public meeting with Fed officials, one staffer who worked on the rule said banks should have an easy time complying, because many requirements overlapped with existing rules. Further, the bulk of the debt requirements can be fulfilled by refinancing existing debt, the staffer said.

Some requirements must be met by Jan. 1, 2019, while more-stringent requirements must be met by Jan. 1, 2022. The requirements are most stringent for JPMorgan, followed by Citigroup. After that come Bank of America, Goldman Sachs and Morgan Stanley, all of which have the same requirement. Wells Fargo’s requirement is the next highest, followed by State Street and finally Bank of New York Mellon. JPMorgan has more than $2 trillion in total assets, making it the largest U.S. bank by that measure.

Read more …

Portugal’s president is playing a murky role in this.

• Portugal Risks Becoming ‘Ungovernable’: President (Telegraph)

Portugal risks becoming “ungovernable” as Leftist forces prepare to topple the returning government of prime minister Pedro Passos Coelho after just 11 days, the country’s president has warned. Mr Passos Coelho – whose pro-bail-out coalition presided over four years of austerity policies – was sworn into office on Friday after his ruling coalition finished first in recent elections, but lost its parliamentary majority. The appointment was met with controversy after the country’s president vowed to block an alliance of Leftist, anti-EU parties from taking the reins of office. The coalition of Socialists, Communists and the radical Left have vowed to bring down the minority government when a parliamentary vote is held on November 10. A collapse would make it the shortest government in Portugal’s 40 years of post-war democracy.

Addressing the nation, president Anibal Cavaco Silva defended himself against accusations of constitutional over-reach. But the head of state struck a more conciliatory tone, calling for all the main parties to broker a compromise to stop Portugal from descending into political chaos. “Without political stability, Portugal will become an uncontrollable country. And, of course, no one trusts an ungovernable country,” said the president. “The government taking over today does not have majority in parliament so the effort of dialogue and compromise has to proceed with the other political forces to seek the necessary understanding.” Mr Cavaco Silva warned the anti-austerity Left against derailing four years of fiscal consolidation and poisoning relations with the EU.

Prime minister Passos Coelho said Portugal’s commitment to the eurozone was “imperative”. “Nobody should risk the well being of the Portuguese in the name of ideological agendas or personal or political ambition,” he said. Despite exiting its €78bn bail-out last year, Portugal has the highest combined debt levels in the eurozone and the second highest government deficit at -7.8pc. The pro-euro opposition Socialist party is presenting itself as the only stable government having agreed to work with the two more strident anti-EU forces on the left. Together they will command a majority of over 50pc in the 230-seat parliament. The Left-wing alliance has reportedly agreed to reverse many of the fiscal measures taken by the previous conservative government, providing relief to low-income pensioners and workers.

Read more …

A country ruled by money.

• Subprime Mortgages Make Surprise Comeback In The UK (Guardian)

Sub-prime mortgages, widely blamed for causing the 2007-08 financial crisis, are making a surprise comeback in the UK, with several new lenders launching home loans for people with poor credit histories. Lenders are targeting people who have faced serious financial problems including repossession and bankruptcy – as well as those with more minor blots on their records – for the mortgages, which come with interest rates as high as 8%. Bluestone Mortgages, a lender part-owned by Australia’s biggest investment bank, has just launched in the UK, following hard on the heels of another Australian-owned business, Pepper Homeloans, which similarly caters for those who have experienced a “credit event” such as missing payments on a previous mortgage. Another recent arrival is Foundation Home Loans, which offers buy-to-let mortgages to people who have had financial problems.

These three join a group of other players in a sector that argues it is offering a lifeline to the sizeable number of people who have suffered a financial “hiccup” and as a result are being rejected by the big name high street lenders. But the new wave of sub-prime mortgages on offer may prompt concern among those who fear a return to the lending practices of the past. And these mortgages come at a price: some borrowers taking out a two-year fixed-rate deal will be charged as much as 7%-8%, compared with current best-buy rates of as little as 1.54% on conventional loans. Peter Tutton, head of policy at StepChange debt charity, sounded a note of caution, pointing out that “last time around, before the crash, there were some really bad lending practices. Certain sub-prime lenders were lending to people who couldn’t afford it and were vulnerable and were being repossessed.”

Read more …

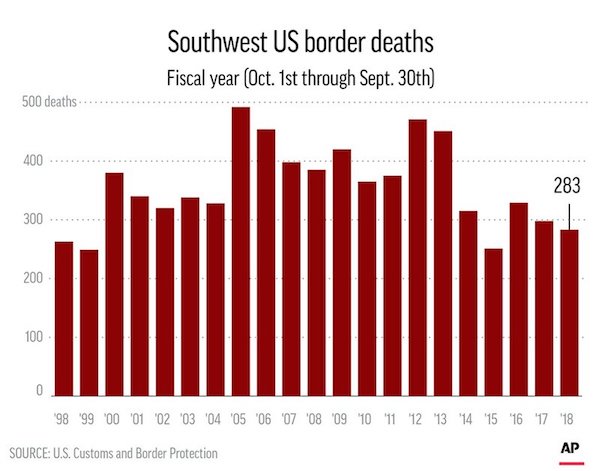

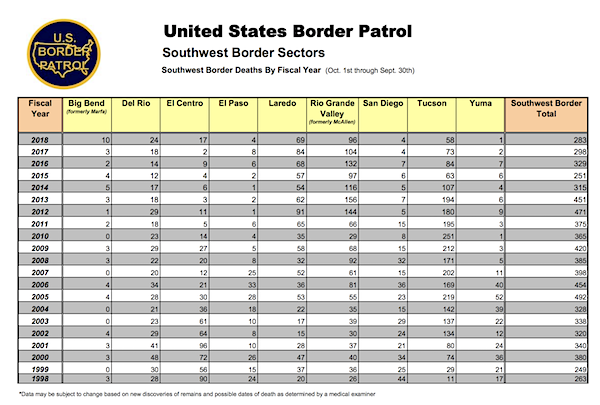

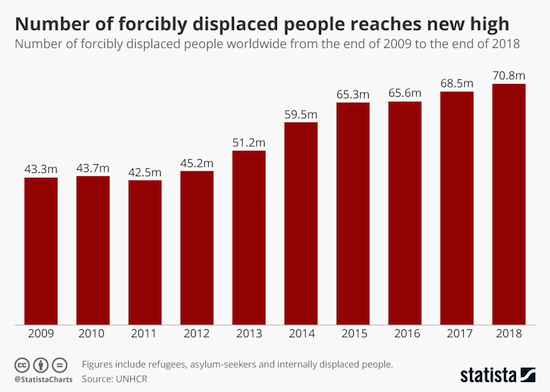

“Tsipras also said any suggestion that Greece was not effectively safeguarding the EU’s outermost borders – he referred to leaders of “certain European countries” – was borne of ignorance of international law dictating protection of the lives of people in distress at sea.”

• Greek PM Tsipras Says Shamed By Europe’s Handling Of Refugee Crisis (Reuters)

Greece’s prime minister said on Friday he was ashamed to be a member of a European Union that he said was sidestepping responsibilities over the migrant crisis and crying hypocritical tears for children who have drowned trying to reach its shores. In some of the hardest-hitting comments yet on a crisis resonating throughout Europe, Alexis Tsipras told parliament Greece didn’t want a “single euro” for saving lives as thousands of refugees continued to arrive daily on its shores, and the EU remained at odds on how to deal with the influx. At least 35 people drowned trying to cross the sea between Turkey and Greece this week. Authorities fear the death toll will rise as more people attempt the short but dangerous passage to Greece before the onset of winter.

“I feel ashamed as a member of this European leadership, both for the inability of Europe in dealing with this human drama, and for the level of debate at a senior level, where one is passing the buck to the other,” Tsipras told parliament. Impoverished Greece has been a transit point for more than 570,000 refugees and migrants fleeing conflict in the Middle East and beyond since January, triggering bickering among European nations. Speaking during prime ministers’ question time, Tsipras also said any suggestion that Greece was not effectively safeguarding the EU’s outermost borders – he referred to leaders of “certain European countries” – was borne of ignorance of international law dictating protection of the lives of people in distress at sea. “These are hypocritical, crocodile tears which are being shed for the dead children on the shores of the Aegean.”

“Dead children always incite sorrow. But what about the children that are alive who come in thousands and are stacked on the streets? Nobody likes them.” [..] Although his migration minister was quoted as saying earlier this week that EU financing was needed for a subsidized housing program to work, Tsipras said Greece did not expect to get paid for saving lives. “Greece is in crisis. We are a poor people, but we have retained our values and humanity, and we aren’t claiming a single euro to do our duty to people who are dying in our back yard,” Tsipras said, after an opposition lawmaker asked what Greece had received in return for agreeing to host refugees. His country, he said, couldn’t put a price on the human cost. “I’m not addressing you,” he told a lawmaker. “I’m addressing those European partners who are wagging their finger at Greece.

Read more …

The time for safe passage is long overdue.

• Greece Says 22 Refugees Drown Off Aegean Islands, 144 Rescued (Reuters)

Greece rescued 144 refugees and recovered the bodies of 22, including four infants and nine children, after their boats sank in two separate incidents in the Aegean sea, the coastguard said on Friday. The death toll from drownings at sea has mounted recently as weather in the Aegean has taken a turn for the worse, turning wind-whipped sea corridors into deadly passages for thousands of refugees crossing from Turkey to Greece. The coast guard said 138 migrants were rescued and 19 drowned after their wooden boat capsized off the island of Kalymnos late on Thursday. In a second incident off the island of Rhodes, three people, including a child and an infant, drowned and four were missing. Six people were rescued at sea, the coastguard said.

Some 16 people, including two infants and eight children, were confirmed dead and 274 people were rescued when a wooden boat they were on literally fell apart in rough seas off the Greek island of Lesbos late on Wednesday. Greece has been a transit point for more than 570,000 refugees and migrants fleeing conflict in the Middle East and beyond this year, triggering bickering among European nations at odds on how to deal with one of the biggest humanitarian crises in decades. Refugees have reported smugglers offering ‘discounts’ of up to 50% on tickets costing between 1,100 to 1,400 euros to make the journey on inflatable rafts in bad weather, UN refugee agency UNHCR said on Thursday. Perceptibly sturdier wooden boats cost more, at between €1,800 and €2,500 €per passenger.

Read more …

“The waves of the Aegean are not just washing up dead refugees, dead children, but (also) the very civilization of Europe..”

• Tsipras: Aegean Waves Wash Up Dead Children, And Europe’s Very Civilization (AP)

Drowned babies and toddlers washed onto Greece’s famed Aegean Sea beaches, and a grim-faced diver pulled a drowned mother and child from a half-sunk boat that was decrepit long before it sailed. On shore, bereaved women wailed and stunned-looking fathers cradled their children. At least 27 people, more than half of them children, died in waters off Greece Friday trying to fulfill their dream of a better life in Europe. The tragedy came two days after a boat crammed with 300 people sank off Lesbos in one of the worst accidents of its kind, leaving 29 dead. It won’t be the last. As autumn storms threaten to make the crossing from Turkey even riskier and conditions in Middle Eastern refugee camps deteriorate, ever more refugees – mostly Syrians, Afghans and Iraqis – are joining the rush to reach Europe.

More than 60 people, half of them children, have died in the past three days alone, compared with just over a hundred a few weeks earlier. Highlighting political friction in the 28-nation European Union, Greece’s left-wing prime minister, Alexis Tsipras, cited the horror of the new drownings to accuse the block of ineptitude and hypocrisy in handling the crisis. [..] Speaking in Athens, Tsipras accused Europe of an “inability to defend its (humanitarian) values” by providing a safe alternative to the sea journeys. “The waves of the Aegean are not just washing up dead refugees, dead children, but (also) the very civilization of Europe,” he said, dismissing Western shock at the children’s deaths as “crocodile tears.” “What about the tens of thousands of living children, who are cramming the roads of migration?” he said.

“I feel ashamed of Europe’s inability to effectively address this human drama, and of the level of debate … where everyone tries to shift responsibility to someone else.” Tsipras’ government has appealed for more assistance from its EU partners. It argues that those trying to reach Europe should be registered in camps in Turkey, then flown directly to host countries under the EU’s relocation program, to spare them the sea voyage. But it has resisted calls to demolish its own border fence with Turkey, which would also obviate the need to pay smugglers for a trip in a leaky boat. “My opinion is that at this stage — for purely practical reasons — … the opening of the border fence is not possible,” Greek Migration Minister Yiannis Mouzalas said.

“When talking about receiving refugees, it’s not under our control — they are coming,” he told state ERT TV. “So it’s a question of how we address this problem. … We will not put them in jail or try to drown them. They will have all the rights that they are allowed under (international) agreements and Greek law.” Greece’s Merchant Marine Ministry said 19 people died and 138 were rescued near the eastern island of Kalymnos early Friday, when a battered wooden pleasure boat capsized. Eleven of the victims were children, including three babies. At least three more people — a woman, a child and a baby — died when another boat sank off the nearby island of Rhodes, while an adult drowned off Lesbos.

Read more …

Curious: the version of the AP piece above, as posted by HuffPo, was quoted by Zero Hedge as containing the bolded lines in this piece below. But when I looked at the link, these lines had been edited out. An NBC version also misses the reference to western military action. The New York Post version still carries them.

• Tsipras Blames Migrant Flows On Western Military Action In Middle East (AP)

Greek Prime Minister Alexis Tsipras accused Europe of an “inability to defend its (humanitarian) values” by providing a safe alternative to the dangerous sea journeys. “I want to express … my endless grief at the dozens of deaths and the human tragedy playing out in our seas,” he told parliament. “The waves of the Aegean are not just washing up dead refugees, dead children, but (also) the very civilization of Europe.” Tsipras accused western countries of shedding “crocodile tears” over children dying in the Aegean but doing little for those who make it across. “What about the tens of thousands of living children, who are cramming the roads of migration?” he said.

Tsipras blamed the migrant flows on western military interventions in the Middle East, which he said furthered geopolitical interests rather than democracy. “And now, those who sowed winds are reaping whirlwinds, but these mainly afflict reception countries,” he added. “I feel ashamed of Europe’s inability to effectively address this human drama, and of the level of debate … where everyone tries to shift responsibility to someone else,” Tsipras said.

Read more …

“Many Afghans dream of a better life in Europe. About 80,000 applied for asylum in Europe in the first half of 2015 alone, with most of them going to Germany.”

• The Next Wave: Afghans Flee To Europe in Droves (Spiegel)

Redwan Eharai’s journey ends where it began: in Afghanistan, in the city of Herat. Eharai, a 15-year-old boy, is carrying the heavy body of his mother Sima up the hill to the cemetery, together with neighbors and relatives. He and his mother had set out from Afghanistan together, headed for Germany. Now he is standing at her grave. She died at the border between Iran and Turkey, struck in the head by a bullet fired by an Iranian police officer. Hundreds of people have now come to say their goodbyes. When she was still alive and urgently needed help, no one was there for her, says Eharai, as he looks into his mother’s grave. Despite his stubble, which makes him look almost like a grown man, he currently seems more like a child.

His family is poor – Eharai’s father died of a brain tumor five years ago, and Sima, his 43-year-old mother, suffered from depression. She had trouble sleeping and cried a lot. In Afghanistan, being a widow without an income, and with three children, is like being buried alive, says Eharai – you have no rights at all. Instead, Sima Eharai decided to leave Afghanistan and go to Germany with three of her children, Adnan, Erfan and Redwan. Sanaz, her eldest daughter, was already living in Frankfurt. Her mother, determined that she would have a better life, had arranged for her to marry a German of Afghan descent. “I can’t continue living like this,” Sima Eharai said when she called her daughter the last time. “Either I make it to you or I’ll follow my husband into death.”

Many Afghans dream of a better life in Europe. About 80,000 applied for asylum in Europe in the first half of 2015 alone, with most of them going to Germany. They are the second-largest group of refugees and migrants in Germany after Syrians. At the moment, people are flooding into Herat Province from all over Afghanistan. From there, they drive across the border to Iran or travel farther south to cross into Iran along a less well-guarded section of the border. About 3,000 Afghans are now coming into Iran every day illegally. From there, they continue to Turkey, where they board boats to the Greek islands of Lesbos or Kos and then cross the Balkans to Northern Europe.

Read more …

That just moves the problems somewhere else.

• Refugee Crisis: Germans Restrict Entry Points From Austria (BBC)

Germany is to restrict the number of entry points for migrants arriving via Austria, in a bid to control the flow as thousands cross into Bavaria daily. It says it has reached agreement with Austria on five crossing points on the 800km (500-mile) border. Authorities in Bavaria have complained a lack of co-ordination with Austria is hampering efforts to aid new arrivals. Many others continue to make their way via Greece, in freezing temperatures, hoping to get asylum in Germany. Meanwhile, more than 20 migrants – many of them children – have drowned in more boat sinkings in Greek waters while they were trying to reach EU countries via Turkey. Greek officials said 19 people had died and 138 were rescued near the island of Kalymnos.

Three others died off Rhodes and three were missing. Six were rescued there. And the Spanish coastguard called off the search for 35 migrants missing at sea the day after their boat was shipwrecked en route from Morocco. Fifteen migrants were rescued alive from the vessel and the bodies of four others were found. A spokeswoman for Germany’s interior ministry told AFP news agency that the new rules on entry points would go into effect immediately. “We would like to have a more orderly procedure,” she said. A senior Bavarian politician said that under the agreement, 50 migrants an hour could cross into the state at the five agreed points.

Earlier this week, German Interior Minister Thomas de Maziere accused Austria of transporting refugees to the German frontier at night, leaving them there unannounced. Federal police spokesman Heinrich Onstein has said everything was being done to prevent the migrants from having to sleep outdoors. He said the problem had been that “we do not know how many people will arrive, and at which border post”. However an Austrian police spokesman dismissed such accusations as a “joke”, given that Austria was receiving 11,000 people a day just at the Spielfeld crossing from Slovenia. Germany expects at least 800,000 asylum seekers this year – some estimates put it as high as 1.5 million. That is at least four times the number who arrived last year.

Read more …