Harris&Ewing Buying Army surplus food sold at fish market 1919

Concerted effort to relieve the USD?

• Global Central Banks Dump US Debt At Record Pace (CNN)

Global central banks are unloading America’s debt. In the first six months of this year, foreign central banks sold a net $192 billion of U.S. Treasury bonds, more than double the pace in the same period last year, when they sold $83 billion. China, Japan, France, Brazil and Colombia led the pack of countries dumping U.S. debt. It’s the largest selloff of U.S. debt since at least 1978, according to Treasury Department data. “Net selling of U.S. notes and bonds year to date thru June is historic,” says Peter Boockvar, chief market analyst at the Lindsey Group, an investing firm in Virginia. U.S. Treasurys are considered one of the safest assets in the world. A lot of countries keep their cash holdings in U.S. government bonds.

Many countries have been selling their holdings of U.S. Treasuries so they can get cash to help prop up their currencies if they’re losing value. The selloff is a sign of pockets of weakness in the global economy. Low oil prices, China’s economic slowdown and currencies losing value are all weighing down global growth, which the IMF described as “fragile” earlier in the year. Despite all the selling by these countries, private demand for the bonds has sky rocketed. Demand is so high that the U.S. can afford to pay historically low interest rates. The 10-year U.S. Treasury hit a record low of 1.34% earlier this year, before bouncing back to about 1.58%, currently.

Nice try, but I’m not so sure a different way of accounting would make the hole itself any smaller.

• The $6 Trillion US Public Pension Sinkhole (MW)

U.S. state and local employee pension plans are in trouble — and much of it is because of flaws in the actuarial science used to manage their finances. Making it worse, standard actuarial practice masks the true extent of the problem by ignoring the best financial science — which shows the plans are even more underfunded than taxpayers and plan beneficiaries have been told. The bad news is we are facing a gap of $6 trillion in benefits already earned and not yet paid for, several times more than the official tally. Pension actuaries estimate the cost, accumulating liabilities and required funding for pension plans based on longevity and numerous other factors that will affect benefit payments owed decades into the future.

But today’s actuarial model for calculating what a pension plan owes its current and future pensioners is ignoring the long-term market risk of investments (such as stocks, junk bonds, hedge funds and private equity). Rather, it counts “expected” (hoped for) returns on risky assets before they are earned and before their risk has been borne. Since market risk has a price — one that investors must pay to avoid and are paid to accept — failure to include it means official public pension liabilities and costs are understated. The current approach calculates liabilities by discounting pension funds cash flows using expected returns on risky plan assets. But Finance 101 says that liability discounting should be based on the riskiness of the liabilities, not on the riskiness of the assets.

With pension promises intended to be paid in full, the science calls for discounting at default-free rates, such as those offered by Treasurys. Here’s the problem: 10-year and 30-year Treasurys now yield 1.5% and 2.25%, respectively. Pension funds on average assume a 7.5% return on their investments – and that’s not just for stocks. To do that, they have to take on a lot more risk – and risk falling short. Much debate focuses on whether 7.5% is too optimistic and should be replaced by a lower estimate of returns on risky assets, such as 6%. This amounts to arguing about how accurate is the measuring stick. But financial economists widely agree that the riskiness of most public pension plans liabilities requires a different measuring stick, and that is default-free rates.

“It’s happening to pension schemes but will feel like it’s happening to the whole company.”

If these companies cut dividends, investors will sell their shares. But they also will if and when true pensions deficits become public. Can’t win.

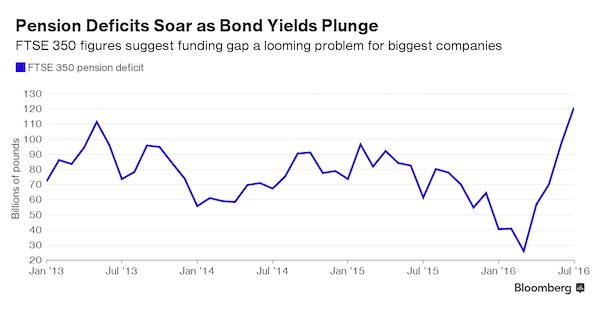

• UK Dividends at Risk as Pension Holes Deepen (BBG)

Workers have long fretted about funding gaps in U.K. companies’ retirement plans. Now investors are starting to join them. Since the U.K.’s June 23 vote to leave the European Union, pension deficits have swelled as record-low U.K. government bond yields have reduced returns on fund investments. That has added to pressure on companies facing gaps in their retirement funding, including telecommunications provider BT, grocer Tesco and military contractor BAE. With little prospect of higher returns after the Bank of England cut interest rates this month, companies may have to reduce dividend payments to raise pension contributions and close funding gaps. That means investors, who have been insulated from the U.K.’s pension crisis, could feel the effects.

“There is no doubt that shareholders of companies with major pension deficits will be concerned,” said Raj Mody, who heads PricewaterhouseCoopers’ pension consulting group. “It’s happening to pension schemes but will feel like it’s happening to the whole company.” Companies in the FTSE 100 paid around five times as much in dividends as they provided in contributions to defined-benefit pension plans last year, a report published Tuesday by consultant Lane Clark & Peacock showed. Through July 31 the FTSE 100 companies’ combined pension deficits – the amount by which liabilities outstrip assets – increased to £46 billion ($59.7 billion) from £25 billion a year earlier, Lane Clark said. Total pension liabilities of the 350 largest U.K. companies as a percentage of market capitalization rose to 40% in June, the highest level in the last 10 years except during the global financial crisis, according to Citigroup.

Like what? QE?

• Japan Official Threatens Action If Yen Rises Too Sharply (WSJ)

Japan’s top currency bureaucrat issued a fresh warning Wednesday over the soaring yen, saying the government would have to act should it rise too sharply. “If there are excessively sharp movements, we will have to take action,” Vice Finance Minister for International Affairs Masatsugu Asakawa told reporters at the ministry’s headquarters. The comment was likely a veiled threat of direct intervention in the currency market to force lower the yen — a step increasingly seen as undesirable manipulation among wealthy economies. The remark followed the yen’s surge Tuesday beyond the 100 mark against the dollar. A higher yen reduces Japanese manufacturers’ repatriated profits and undermines a positive growth cycle sought by Prime Minister Shinzo Abe. The dollar rose against the yen following Asakawa’s remark. Japan last intervened to undercut the yen in 2011.

Abe and Kuroda are a success story.

• Bank Of Japan Buying Sends Nikkei 225 To Highest In 18 Years (ZH)

Having noted the farcical share ownership of The Bank of Japan (biggest shareholder in 55 companies) as Kuroda's ETF-buying goes to '11', we thought it interesting that the distortion caused by these "pick a winner" purchases has sent Japan's Nikkei 225 to its richest relative to Japan's Topix index in 17 years. As Bloomberg notes, Japan’s two major equity benchmarks have moved mostly together over the years. That changed this month following the latest meeting by the Bank of Japan, which boosted its purchases of exchange-traded funds as part of its easing program.

The BOJ’s heavier allocation to ETFs tracking the Nikkei 225 has helped push the gauge to its highest level versus the Topix index in 18 years.

Which – as we noted previously – leaves one big question… just how will the BOJ ever unwind its unprecedented holdings of not only bonds, which are now roughly 100% of Japan's GDP, but also of stocks, without crashing both the bond and the stock market. And then we remember, that the BOJ will simply never unwind any of its "emergency" opertions just because nobody actually thought that far, plus the whole point of the exercise is hyperinflation or bust, as the sheer lunacy of Japan's authorities is exposed for the entire world to see, leading to the terminal collapse of faith in the local currency. With every passing day, we get that much closer to said terminal moment.

Time for a hole new approach to housing. It should be a basic right, not some financial bet.

• The “Housing Crisis” in San Francisco Strangles Demand (WS)

Here’s the other side of central-bank engineered asset price inflation, or “healing the housing market,” as it’s called in a more politically correct manner: San Francisco Unified school district, which employs about 3,300 teachers, has been hobbled by a teacher shortage. Despite intense efforts this year – including a signing bonus – to bring in 619 new teachers to fill the gaps left behind by those who’d retired or resigned, the district is short 38 teachers as of Monday, when the school year started. Others school districts in the Bay Area have similar problems. For teachers, the math doesn’t work out. Average teacher pay for the 2014-15 school year was $65,000. And less after taxes. But the median annual rent was $42,000 for something close to a one-bedroom apartment.

After taxes and utilities, there’s hardly any money left for anything else. A teacher who has lived in the same rent-controlled apartment for umpteen years may still be OK. But teachers who need to find a place, such as new teachers or those who’ve been subject of a no-fault eviction, are having trouble finding anything they can afford in the city. So they pack up and leave in the middle of the school year, leaving classes without teachers. It has gotten so bad that the Board of Supervisors decided in April to ban no-fault evictions of teachers during the school year. Yet renting, as expensive as it is in San Francisco, is the cheaper option. Teachers trying to buy a home in San Francisco are in even more trouble at current prices. And it’s not just teachers!

This aspect of Ben Bernanke’s and now Janet Yellen’s asset price inflation – and consumer price inflation for those who have to pay for housing – is what everyone here calls “The Housing Crisis.” As if to drive home the point, so to speak, the California Association of Realtors just released its Housing Affordability Index (HAI) for the second quarter. It is based on the median house price (only houses, not condos), prevailing mortgage interest rate, household income, and a 20% down payment. In San Francisco, the median house price – half sell for more, half sell for less – is $1.37 million. According to Paragon Real Estate, if condos were included, the median price would drop to $1.2 million.

Wonder what Trump thinks about this.

• Chinese Investors Are Largest International Buyers Of US Real Estate (Forbes)

Over the past five years, Chinese buyers spent about $17 billion on U.S. commercial real estate while spending roughly $93 billion on homes in the U.S. over the same period. Last year they paid about $832,000 per U.S. home in high profile cities like New York, Chicago, Miami, Los Angeles, Las Vegas and San Francisco. The Society indicated that Chinese purchase of residential property is primarily motivated by a desire for second homes; primary residences for those moving to the U.S. on EB-5 investor visas or as rental or resale investments. Concerns about the stability of the renminbi exchange rate have accelerated the pace of Chinese commercial investment abroad since the middle of 2015.

Motivations aside, China’s interest in investing in the U.S. has legs that carry implications for our enterprises and communities alike. When coupled with the 100 million mainland Chinese travelers expected to visit the U.S. annually by 2020 it’s clear the U.S. travel and hospitality industry and business community at large need to prepare for a changing landscape. For the travel and hospitality industry, it won’t be long before we see mainland Chinese hoteliers exporting their national lodging brands to the U.S. and other countries to complement the high-profile global brands in which they’ve invested. As their countrymen increasingly travel the world, just like generations of Americans and Europeans before them, they will want to stay in hotels with which they’re familiar back home.

Soon, it will be commonplace to find hotel brands developed by hoteliers like Jinling Hotels & Resorts or Jin Jiang International Holdings sitting side by side U.S. brands like Hilton, Sheraton, Hyatt or Marriott in cities throughout the U.S. Across the country, already more than 100,000 Americans get their weekly paychecks from a company based in China. That number will grow exponentially in coming years. As mainland Chinese investors continue to buy U.S. companies and brands and establish their own enterprises here, they will be eager to become members and leaders of the local chamber of commerce, to join the neighborhood PTA, represent their companies on area social and charitable boards and so on—just as our nationals who work and live abroad do in the countries in which they reside.

And so is the author of this piece. Stunning. The heading is mine.

• Australia Central Bank Governor In Complete Bubble Denial (BI)

The surge in property prices, especially in Sydney and Melbourne has made home owners extremely wealthy but cruelled the prospect of home ownership for many who aren’t already in the market. That’s especially true for younger Australians. That is causing some intergenerational issues in housing, which is a bigger question than “is there a housing bubble or not” according to RBA governor Glenn Stevens in the full transcript of his interview with the Australian and Wall Street Journal. Stevens acknowledged “it’s always been hard to be that cohort that’s trying to enter the market. There’s always been a hurdle. It may be getting worse, though part of this is – I mean, there’s a lot of things happening here”.

One of things that’s happening, Stevens believes, is that a chunk of the wealth home owners think they are sitting on in their house will prove ephemeral. That’s because if they want their children to own a home then they are going to have to give them some of that cash to do so. Here’s Stevens: “I think that a lot of people of my generation are actually going to find themselves, if they haven’t already, helping their children into the housing market because that may be almost the only way that their children can enter the Sydney market, anyway, and be not too far from mum and dad. And I suspect that will happen a lot, and that, of course, means that for people of my age, that the wealth we think we have in our house, actually, we don’t have quite as much as we thought because we’re going to have to give some of it to the next generation.”

He acknowledged that for renters locked out of the property market this could mean the issue perpetuates into the next generation. But his point about the shared wealth of families is also an important one for the future. It suggests for many children of those with property, who feel locked out of the market, the problem of home ownership can be self-curing. That’s because, as Stevens notes, older Australians can share their wealth now. [..] With the nuclear family shrinking, and the number of children and grandchildren on average reduced from a generation or two ago, there is likely to be a large number of younger Australians coming into some serious wealth when their parents or grandparents pass on. It could take a decade or two, but ultimately younger Australians could end up the longest living and richest generation in the nation’s history.

“..oil priced at over $75 a barrel in today’s dollars tends to crush economies, and oil priced under $75 a barrel in today’s dollars tends to crush oil companies.”

• “Racketeering Is Ruining Us” (Kunstler)

The disorders in politics that we’re seeing now are really expressions of the larger disorders in our economic life and our financial life. That just happens to be the avenue that the expression is coming out of. Another point I’d like to make is that the reason that people are against Hillary or dumping on Hillary or don’t like her, is because she’s a poster child for racketeering. I encourage people who are talking about our circumstances and people who are interested in the news and election, to use the word racketeering to describe what’s going on in this country. You really need the right vocabulary to understand exactly what’s going on.

Racketeering is just pervasive in all of our activities. Not just in politics but in things even like medicine and education. Obviously the college loan scheme is an example of racketeering. Anybody who has to go to an emergency room with a child whose broken their finger or something, is going to end up with a bill for $20,000. You know why? Because of medical racketeering. And so, these are really efforts to money-grub by any means necessary, often in ways that are unethical and probably illegal. Let’s use that word racketeering to describe our national situation. And let’s remember by the way, the activities of the central banks is just another form of racketeering. Using debt issuance and attempting to control interest rates in order to conceal our inability to generate the kind of real wealth that we need to continue as a techno-industrial society.

Societies have a really hard time understanding what they’re doing, articulating the problems that they face and coming up with a coherent consensus about what’s happening, and coming up with a coherent consensus about what to do about it. Combine that with another quandary, the relationships between energy and the dead racket for concealing real capital formation. I like to reduce it to one particular formula that is pretty easy for people to understand. It’s a classic quandary: that oil priced at over $75 a barrel in today’s dollars tends to crush economies, and oil priced under $75 a barrel in today’s dollars tends to crush oil companies. There is no real sweet spot between those two places. We’re ratcheting between them and each one of them entails a lot of destruction. That’s a terrible quandary that we’re in and it’s being expressed in banking and finance…and the people in charge of those things don’t really know what else to do except continue the deformation of institutions and instruments.

Strong.

• Iceland Prepares To End Currency Controls (Tel.)

Iceland plans to significantly ease capital controls for individuals and companies, marking the end of a regime that was described as the crutch for the Icelandic economy following the 2008 crisis. The Finance Ministry plans to put forward legislation on Wednesday to pave the way for the removal of capital controls for Icelanders who have been living with the restriction for eight years. The recommendations will mean that outward foreign direct investment will be unrestricted, but still subject to confirmation by the central bank.

Investment in foreign currency financial instruments will also be allowed and individuals will be authorised to buy one piece of property abroad each calendar year, irrespective of purchase price. Requirements, under penalty of law, to repatriate any foreign currency obtained abroad will also be eased and individual households will be given authorisation to buy foreign currency for travel. Iceland’s finance ministry said that next January the current ceiling on foreign investments will be raised. It is estimated that the changes in the bill will lead to a reduction of about 50-65pc in the number of requests for exemptions from the Foreign Exchange Act, which will speed up the processing time.

The flipside of Soros.

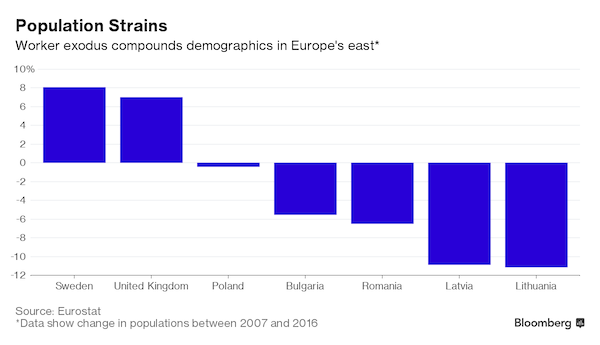

• ‘I Want You Back,’ Cries East Europe as Emigrant Tide Erodes GDP (BBG)

Eastern Europe is borrowing a line from the Jackson 5 as it bids to turn a tide of emigration that’s eroding its economic prospects and compounding an already-gloomy demographic outlook. “I want you back” is the slogan Latvia has chosen to lure home citizens who’ve upped sticks to Europe’s west in search of more job opportunities and higher salaries. Poland’s Return program offers tips on jobs, housing and health care, while Romania is teaming up with private business, offering scholarships and hosting employment fairs to tempt back talented citizens. The campaigns have gained fresh impetus after the Brexit vote threw into doubt the future status of foreign workers in the U.K.

“The diaspora living abroad represent a huge untapped potential for their countries of origin,” said Rokas Grajauskas, an economist at Danske Bank who’s based in the Lithuanian capital of Vilnius. Stints abroad can be beneficial, instilling new skills and ways of thinking, he said. The hunt for greener pastures isn’t new. The Soviet collapse prompted an unprecedented outflow of eastern Europeans to the wealthier west, with EU membership and the 2008 financial crisis triggering further waves. The Baltic region suffered most over the past decade, the latest Eurostat data show. Making matters worse, much of the continent is grappling with low birth rates and aging populations.

Losing workers to other countries has already cost 21 central and eastern Europe nations an average of about 7 percentage points of GDP, according to the IMF, which predicts a hit of as much as 9 percentage points over the next 14 years should current trends continue. It recommends the EU maintain funding to ease migration pressures, and that countries improve labor-market conditions and engage with their diaspora abroad. As governments belatedly heed that last piece of advice, they may well recall other lines from the Jackson 5’s 1969 hit song. “I was blind to let you go,” the group sang. “I need one more chance.”

Report due in 3 weeks.

• Tsipras Revives Greek Bid To Seek Wartime Reparations From Berlin (Kath.)

Greece’s leftwing Prime Minister Alexis Tsipras on Tuesday revived the country’s bid to seek war reparations over Nazi atrocities in Greece. “We will go all the way, first diplomatically and then legally, if necessary,” Tsipras said during events marking the World War II massacre in the village of Kommeno, in Arta, northwestern Greece. More than 300 people were executed on August 16, 1943 at the village which was then torched by German forces. The findings of an intra-party committee which was set up to look into Greek claims for German war reparations are expected to be submitted to Parliament in early September. The committee wrapped up its probe on July 27.

I bet you there are coup plotters among those 38,000.

• Turkey To Free 38,000 From Prisons To Make Space For Alleged Coup Plotters (AP)

Turkey has issued a decree paving the way for the conditional release of 38,000 prisoners in an apparent move to make jail space for thousands of people who have been arrested after last month’s failed coup. The decree allows the release of inmates who have two years or less to serve of their prison terms and makes convicts who have served half of their term eligible for parole. Some prisoners are excluded: people convicted of murder, domestic violence, sexual abuse or terrorism and other crimes against the state. The measures would not apply for crimes committed after 1 July.

The justice minister, Bekir Bozdag, said the move would lead to the release of 38,000 people, adding it was not a pardon or an amnesty but a conditional release of prisoners. The government says the coup attempt on 15 July, which led to at least 270 deaths, was carried out by followers of the movement led by the US-based Muslim cleric Fethullah Gülen who have infiltrated the military and other state institutions. Gülen has denied any prior knowledge or involvement in the coup but Turkey is demanding that the US extradite him.

Greece lives in fear. Because Merkel can’t give Turkey visa-free travel amid reports like this.

• German Officials Say Erdogan Supports Militants (DW)

Citing a classified document from the Interior Ministry to representatives of the Left party on Tuesday the German public broadcaster ARD reported, that members of the government consider Turkey’s regime a supporter of militant groups in the Middle East. German officials appear to have publicly acknowledged, if in a classified document, President Recep Tayyip Erdogan’s weapons support for militants fighting the regime of Bashar al-Assad in Syria, which Turkish journalists have reported in the past. “Especially since the year 2011 as a result of its incrementally Islamized internal and foreign policy, Turkey has become a central platform for action for Islamist groups in the Middle East,” the German officials said, according to ARD.

German security officials also said Erdogan had an “ideological affinity” with Egypt’s Muslim Brotherhood, ARD reported. Suppressed under Hosni Mubarak’s dictatorship, the movement went on to produce Egypt’s first democratically elected president, Mohammed Morsi. Despite the “affinity,” Erdogan has been publicly at odds with the Muslim Brotherhood in the past though he has since also criticized current Egyptian President Abdel-Fattah el-Sissi, who overthrew Morsi in a 2013 coup. Neither the United States nor the EU considers the Muslim Brotherhood a terror organization. The German officials also said Erdogan supported Hamas, the democratically elected governing party in the Gaza Strip.

Turkey’s president has said as much in the past, having told the US news host Charlie Rose, that “I don’t see Hamas as a terror organization.” Though the United States and EU do list Hamas as a prohibited group, nations such as Norway, Switzerland and Brazil do not. “It is a resistance movement trying to protect its country under occupation,” Erdogan added in the 2011 interview, referring to the Israeli state, with which Turkey also enjoys diplomatic ties.