Marjory Collins 3rd shift defense workers, midnight, Baltimore April 1943

Debt deflation.

• Equities On Course For Worst Quarter Since 2011 (FT)

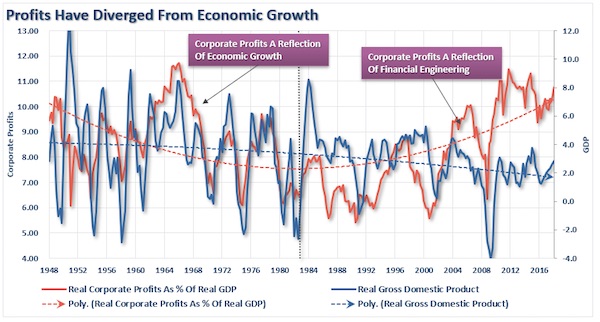

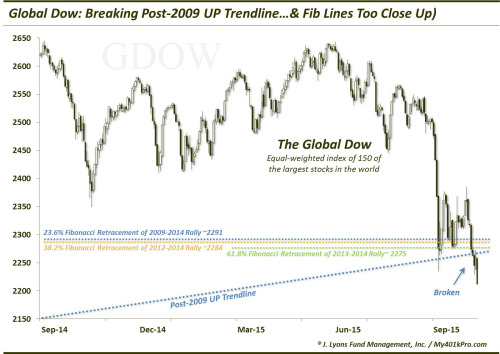

US and global equities are heading for their worst quarterly performance since 2011, with investors rattled by China’s economic slowdown, uncertainty over Federal Reserve policy and growing pessimism about corporate earnings. Adding to investors unease, the IMF on Tuesday warned that corporate failures were likely to jump in the developing world, after a borrowing binge in the past decade. With an array of sectors slumping since the start of July, beyond those directly influenced by the rout in commodity prices, the global equity bull run of recent years is now facing a major challenge. The S&P 500 has fallen 8.5%, the biggest decline since the third quarter of 2011. Previously high-flying sectors that led the market earlier this year, notably biotech and healthcare stocks, have fallen appreciably in recent weeks.

“The question now is are investors ready for the first down year since 2011…and the worst year since the “bad days of 2008”, said Howard Silverblatt, analyst at S&P Dow Jones Indices. In turn, global stock markets are poised for their worst quarterly showing since 2011, shedding more than $10tn in value. The FTSE Emerging Index has tumbled more than 21% this quarter, its worst showing since 2011, and the fifth-worst quarter this millennium. Investors have become increasingly unsettled by signs of weakening global growth and are now questioning the earnings outlook for US companies as the world’s largest economy is preparing to raise rates for the first time in nearly a decade. The US earnings season, which starts in two weeks, is shaping up as pivotal driver of sentiment, Mr Silverblatt said.

Analysts expect quarterly earnings will decline 4.6% year over year in the third quarter, and revenue to decline 3.3%, the third straight quarter of declines for top-line growth, according to the data provider, FactSet. US and global companies have sold record amounts of debt against the backdrop of a blockbuster year for mergers and acquisitions. M&A, equity capital markets, debt capital markets and syndicated lending produced fees of $16.5bn in the third quarter, the lowest total since banks billed $16.3bn in the final three months of 2011 when markets were gripped by the eurozone debt crisis. Under pressure from rising defaults linked to the energy sector, corporate bond prices are signalling broader weakness that reflects the downgrading of global growth prospects, notably for emerging markets.

Read more …

Oh well…

• September 30 Is Historically Worst Day Of The Year For Investors (MarketWatch)

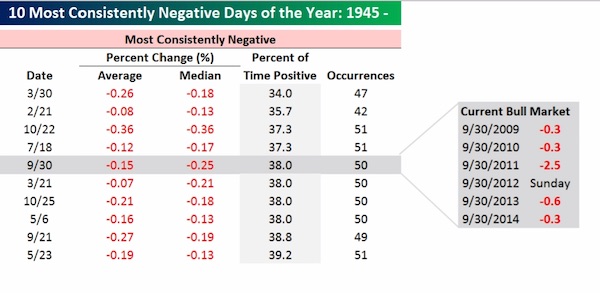

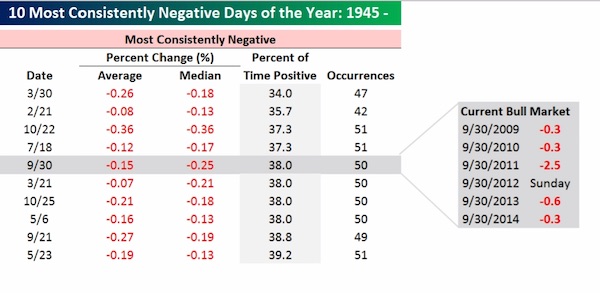

September has been tough for stock investors. But if history is any guide, the last day of September may deliver one more blow to already battered markets, according to the financial blog Bespoke. Looking at data as far as 1945, the S&P 500 has posted positive returns just 38% on the last day of September, making it one of the worst trading days of the year, according to Bespoke (as the included table illustrates). Earlier this month, financial blogger Ryan Detrick pointed out that the 38th, 39th and the 40th weeks of the calendar—which fall in September—tend to be the weakest of the year dating back to 1950.

September has marked a particularly rough stretch for the S&P 500 with only the week of Sept. 11 closing higher as China’s slowdown, global economic uncertainties, and lack of clarity on the timing of the Federal Reserve’s expected interest-rate hike have shaken investor confidence. According to FactSet, weekly performance in 2015 for the S&P 500 was among the worst in September. For the week, the benchmark stock-market index is off 2.3% so far, putting it on track for the second-worst week of the year after Aug. 21 when the benchmark tumbled 5.8%. If tomorrow’s trading action follows the historical trend, things could get worse for investors before they get better.

Read more …

Banks rule the world.

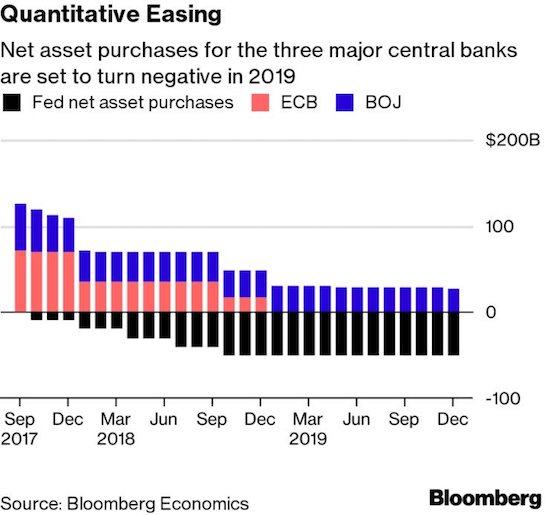

• ‘Cold Fusion’ Is Citi’s Answer to Fading Central Bank Firepower (Bloomberg)

If the world economy enters a downdraft, Steven Englander, global head of G-10 FX strategy at Citigroup, proposes a more revolutionary response, akin to the “helicopter money” once advocated by Milton Friedman. In what he calls “cold fusion,” politicians would cut taxes and boost spending. Central banks would then cover the resulting increase in borrowing by purchasing more bonds as part of a commitment to permanently expand their balance sheets. The easier fiscal policy would be covered by QE Infinity. “Politically it is difficult for central banks to outright endorse monetization of government debt, but faced with another slump and armed with ineffective policy tools, we expect that central banks will quickly give the wink and nod to fiscal measures,” Englander said in a report to clients last week.

The upshot would be greater purchasing power would be injected straight into the economy, increasing activity and inflation. Long-term bond yields would rise, yet short-term yields adjusted for inflation would turn negative. “Increasingly the absence of fiscal policy is viewed as one of the reasons for a less than satisfactory recovery,” said Englander. “With rates at zero, fiscal policy will be needed to offset any negative shock that hits global economies.” Michala Marcussen, head of global economics at Societe Generale SA in London, agrees. “In a risk scenario, we believe policy makers, faced with the abyss, would take the next step into unorthodox policy, namely fiscal expansion,” she said. “Clearly not the risk that bond markets have in mind.”

Read more …

“..relatively slow growth and over-reliance on cheap credit to cope with that funk has “zombified” global economies for years to come..”

• Loss Of Traction Puts Central Bank Mandates Under Scrutiny (Reuters)

Growing anxiety that the world’s top central banks have lost control of their mission has intensified scrutiny of their mandates and independence from both political and investment circles. Far from soothing already nervy financial markets, the Fed’s decision not to raise interest rates in September raised more questions than it answered. The turbulent response of equity, commodity and emerging markets marks this as a rare, if not singular instance in recent years of markets reacting so negatively to an ostensibly dovish policy signal from the Fed. Chief among the questions is whether the world’s most influential central bank, along with many of its peers, is trapped at near zero interest rates as the economic cycle crests and inflation flatlines, due to a rapid cooling of China and other emerging economies and a commodity price slump.

The uncomfortable prospect of heading into another economic slowdown with no interest rate ammunition to fight the downturn is at the root of much that investment angst. “The relative paucity of the monetary policy toolkit increases the fragility of the expansion, with risks that an adverse shock could lead businesses and consumers to retrench and thereby transform a mid-cycle slowdown into something significantly worse,” wrote Citi chief economist Willem Buiter. Yet by subsequently insisting a rate rise was still on the cards this year, the Fed simultaneously removed any low-rates balm and confused many as to its ‘reaction function’. Just which of the global pressures that stayed its hand only two weeks ago – weakening China, emerging markets and commodity prices – will disappear again by year end?

And if the rise of the dollar is at least partly behind both those pressures and the below-target U.S. inflation rate, then surely every future push to raise rates will simply strengthen the currency again and re-ignite the same chain reaction. “You can’t run a independent, domestically-focused monetary policy in this environment,” said Salman Ahmed, chief strategist at asset managers Lombard Odier, adding that a major complication is the huge uncertainty internally at the Fed about just how the world’s second biggest economy, China, is actually performing. “What has happened is that central banks have lost control to calibrate monetary policy to only domestic economic data.” The Fed may be in the hot seat, but the Bank of England has a similar dilemma.

The Bank of Japan and ECB differ only in that there’s no domestic pressure yet to tighten policy. But their attempts to avoid deep deflation and reach explicit inflation targets seem to be similarly sideswiped by global rather than domestic developments. And that’s not changing any time soon. In a world that’s wound down very little of its overall indebtedness some seven years after the credit crash was supposed to launch a wave of ‘deleveraging’, relatively slow growth and over-reliance on cheap credit to cope with that funk has “zombified” global economies for years to come, Ahmed added. And in such a low growth world, political pressure to bring central banks into a more centrally-directed policy framework will only increase.

Read more …

“..the failure will have serious consequences on China’s financial stability..”

• Two Very Disturbing Forecasts By A Former Chinese Central Banker (Zero Hedge)

Earlier today, Yu Yongding – currently a senior fellow at the Chinese Academy of Social Sciences in Beijing but most notably a member of the PBOC’s Monetary Policy Committee from 2004 to 2006 as well as a member of China’s central planning bureau itself, the Advisory Committee of National Planning – gave a speech before the Peterson Institute, together with a slideshow. Since the topic was China’s debt, economic growth, corporate profitability, and since, inexplicably, it wasn’t pre-cleared by the Chinese department of truth, it was not cheerful. In fact it was downright scary. Among other things, the speech discussed:

• Capital efficiency – low and falling (capital-output ratio rising)

• Corporate profitability – has been falling steadily

• Share of finance via capital market – Very low

• Interest rate on loans – High

• Inflation rate – producer price Index is falling

A key observation was the troubling surge in China’s capital coefficient, first noted here two weeks ago in a presentation by Daiwa which also had a downright apocalyptic outlook on China, and wasn’t ashamed to admit that it expects a China-driven global meltdown, one which “would more than likely send the world economy into a tailspin. Its impact could be the worst the world has ever seen.” The former central banker also discussed the bursting of China’s market bubble. This, he said was created deliberately for two government purposes: 1) To enable debt-ridden corporates to get funds from the equity market, 2) To boost share prices to stimulate demand via wealth effect He admits this shortsighted approach failed and “to save the city, we bombed the city” adding that it brings “authorities’ ability of crisis managing into question.”

He also observes that the devaluation that took place on August 11 was the government’s explicit admission that its attempt to reflate an equity bubble has failed, and it was forced to find an alternative method of stimulating the economy. Of the CNY devaluaton Yu says quite clearly that it was simply to boost the economy: “In the first quarter of 2015 China’s capital account deficit is larger that than that of current account surplus” which is due to i) The Unwinding of Carry trade; ii) The diversification of financial assets by households; iii) Outbound foreign investment; and iv) Capital flight. And now that China has officially unleashed devaluation (which Yu believes should be taken to its logical end and the RMB should float) there are very material risks: “the implication of episode can be more serious than the stock market fiasco, with much large international consequences” and that “the failure will have serious consequences on China’s financial stability”

Read more …

“If you do dumb economic things, whether you’re capitalist, communist, or some hybrid, you ultimately pay the price.”

• Jim Chanos on China: The Emperor is In His Underwear (Lynn Parramore)

[..] China is the only industrialized country that knows its annual GDP on Jan. 1 of that year. Because it’s planned. You can truly manufacture your growth. Now, you may end up with lots of white elephants and a banking system with lots of bad loans, and that’s the problem, whether you’re a closed system or an open system or somewhere in between (which is what I believe): a closed system with lots of leakage. At the end of the day, other countries have tried this model and it doesn’t really work that well. The Soviet Union and Japan, to some extent, in the late 80s, followed this model. If you do dumb economic things, whether you’re capitalist, communist, or some hybrid, you ultimately pay the price.

[..] We’re getting inexorably to a tipping point in China. What has made 2015 much different from 2010, other than magnitude (almost everything I saw in 2009-2010 is twice as big today: the banking system, the economy, debt to GDP), is that the veneer of technocratic excellence has been wiped away. Now the West sees that the problems. That was not the case in 2010. I was considered a crank, someone who had never been there, never spoken Mandarin. They said, you don’t know, these people are geniuses! Now I think we’ve begun to see that, no, they make the same policy mistakes that we make. They don’t always get it right.

The other thing that’s changed dramatically, and I think more ominously, is the rise of Xi Jinping, who is a much different leader than the previous two groups of party leaders. Under Hu Jintao and Jiang Zemin, China was open for business. As long as you don’t rock the political boat, you can go to Macau, buy your three Ferraris, have fun, make money. This is the new China. Then Xi comes in, and his first speech is a fiery speech in Guangdong Province, where he absolutely rips into the Soviet Union for being soft on Perestroika. He says, what were you guys thinking about? Why didn’t you put the troops on the street the first chance you got? That was his first speech.

One of the next things he did was – I know this sounds silly, but to me it was very telling — he told the auto show models to cover up. Think about that for a second. He truly said, they’re showing too much skin and this is an embarrassment to China. Cover up! He told the kids, go to bed earlier! I began to see that this guy is different. This guy really sees himself as father of China. Some might say that now he sees himself as an emperor. Sure enough, the cult of personality stuff started. He made the PLA (People’s Liberation Army) senior officers take an oath of personal loyalty to him. That’s very important. His nationalism, which was unmistakable and you couldn’t miss it by 2013-14, has also taken on a very anti-Western tone. Now, if there’s a problem with the stock market, it’s Western speculators. If there’s something going on, it’s the West’s fault.

Read more …

Weidmann wants everyone to be Germany. But that is no longer such a glorious prospect.

• Bundesbank Chief Warns Of Risks From Cheap Money (Reuters)

The dip in oil prices will save German companies and individuals €25 billion this year, the head of the Bundesbank said on Tuesday, as he warned of the perils of keeping the cost of money too low. “The expansionary monetary policy should not go on for longer than is absolutely necessary,” Jens Weidmann told an audience near Frankfurt, saying the economic recovery in the 19-member euro zone was holding steady. The remarks from Weidmann illustrate the continued scepticism in Germany about the need to extend the ECB’s €1 trillion-plus money printing program.

While such opposition cannot prevent extra money printing, it can delay any such move. Weidmann, who also sits on the ECB’s policy-setting Governing Council, argued that cheap money, with borrowing rates at record low in the euro zone, risked that financial markets would ‘overdo it’. He also pointed to the threat that permanently low borrowing costs would keep ‘zombie’ companies afloat that should be out of business. Weidmann also criticized the negative impact of low interest rates on German savers, who he said earned a fraction of a percentage point of interest on their deposits.

Read more …

“Companies from developing countries quadrupled their borrowing to well over $18 trillion last year from around $4 trillion in 2004..”

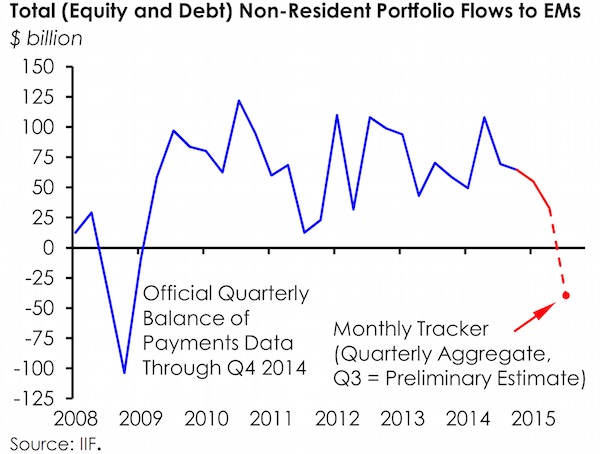

• Investors Pull $40 Billion From Emerging Markets in Current Quarter (WSJ)

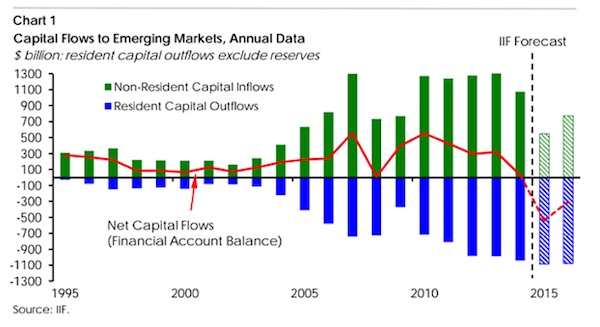

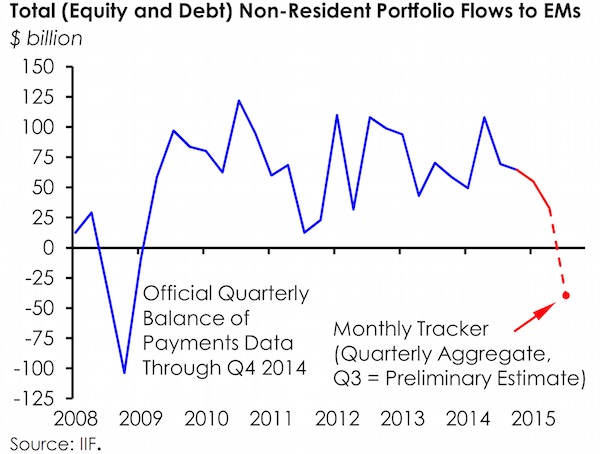

Foreign capital is gushing out of emerging markets. Global investors are estimated to have yanked $40 billion from emerging-market stocks and bonds during the current quarter, the most for a quarter since the depths of the 2008 global financial crisis, according to the latest data from the Institute of International Finance. The retrenchment reflected growing tensions in some of the world’s once-highflying emerging economies, which are struggling with slower growth, substantial debt and plunging prices for commodities, which many of these economies rely on. In a report published on Tuesday, the IMF warned that emerging markets could brace for a rise in corporate failures as debt-laden firms find it harder to repay their loans and bonds as a result of sputtering growth and weakening currencies.

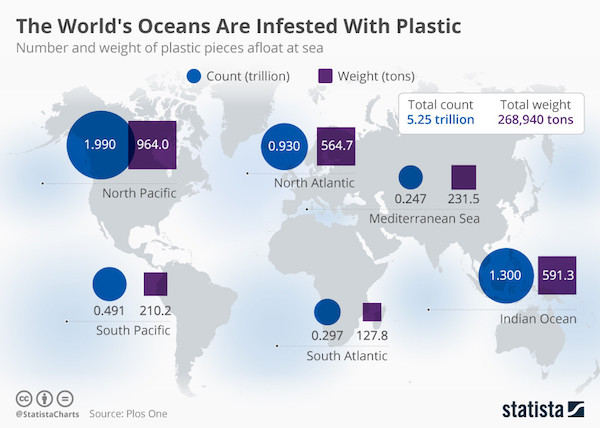

Companies from developing countries quadrupled their borrowing to well over $18 trillion last year from around $4 trillion in 2004, with Chinese firms accounting for a major share, according to the bank. Thanks to low interest rates in developed countries, many of the borrowings were conducted in hard currencies, such as the dollar and euro. Investor confidence in emerging markets was further shaken in the quarter by an epic stock-market crash in China, as well as Beijing’s botched efforts to prop up share prices. The selloff in emerging markets accelerated and rattled global financial markets after the Chinese central bank’s move to let its currency devalue in August fueled suspicions that China’s underlying economy might be faring worse than expected.

These concerns had a knock-on effect on commodities, driving prices down to levels not seen in six years. As the biggest buyer of many commodities from countries including Brazil, South Africa and Malaysia, China’s woes hurt these countries’ currencies. “Emerging markets are going to be a very difficult place to invest in for the next 12 to 24 months,” said David Spika, global investment strategist at GuideStone Capital, which oversees $10.7 billion in assets. Falling commodity prices hurt many emerging countries’ growth, leading to capital outflows and weakening their currencies, he said.

Many emerging countries rely on outside capital to finance their budget deficits, and the continuous outflow is already forcing some of these countries to devalue their currencies or dip into their foreign-currency reserves to defend their exchange rates. This quarter’s exodus was about evenly divided between equities and bonds, losing $19 billion and $21 billion, respectively, according to the IIF. The $40 billion outflow would rank the current quarter the worst quarter since the fourth quarter of 2008 when emerging markets saw outflows of about $105 billion.

Read more …

“It’s the trifecta of slowing investment growth, declining commodity prices and the strong dollar.”

• Traders Flee Emerging Markets at Fastest Pace Since 2008 (Bloomberg)

Investors have pulled $40 billion out of developing economies in the third quarter, fleeing emerging markets at the fastest pace since the height of the global financial crisis. The quarterly outflow was the first since 2009 and the biggest since the final three months of 2008, when traders sold $105 billion of assets, according to the Institute of International Finance. The retreat came as data signaled faltering Chinese economic growth, commodity prices slumped and the Federal Reserve moved closer to an increase in the near-zero U.S. interest rates that have supported demand for riskier assets in developing nations. About $19 billion of the selloff was equities, with the remaining $21 billion in debt, the IIF said in a report Tuesday. There were outflows in all three months this quarter.

The MSCI Emerging Markets stocks benchmark has declined 20% in the past three months, on track for the biggest retreat in four years. Local-currency developing-nation bonds have lost 6.6% in dollar terms in the third quarter, according to Bank of America Corp. indexes, the biggest retreat on a quarterly basis since 2011. Currencies from Brazil to South Africa have tumbled, sending a gauge of 20 foreign-exchange rates to a record low. “The reaction we’re seeing is quite severe, but a lot of the damage has already probably taken place,” Brendan Ahern, managing director of Krane Fund Advisors LLC in New York, said by phone. “It’s the trifecta of slowing investment growth, declining commodity prices and the strong dollar.”

Read more …

Speaking in forked tongues.

• IMF Warns Of New Financial Crisis If Interest Rates Rise (Guardian)

Rising global interest rates could prompt a new credit crunch in emerging markets, as businesses that have ridden the wave of cheap money to load up on debt are pushed into crisis, the International Monetary Fund has said. The debts of non-financial firms in emerging market economies quadrupled, from $4tn in 2004 to well over $18tn in 2014, according to the IMF’s twice-yearly Global Financial Stability Report. This borrowing binge has taken business debt as a share of economic output from less than half, in 2004, to almost 75%. China’s firms have led the spree, but businesses in other countries, including Turkey, Chile and Brazil, have also ramped up their debts — and could prove vulnerable as interest rates rise.

With the US Federal Reserve expected to raise interest rates in the coming months, the IMF warns that emerging market governments should ready themselves for an increase in corporate failures, as firms struggle to meet sharply higher borrowing costs. That could create distress among the local banks who have bought much of this new debt, causing them in turn to rein in lending, in a “vicious cycle” reminiscent of the credit crisis of 2008-09. “Shocks to the corporate sector could quickly spill over to the financial sector and generate a vicious cycle as banks curtail lending. Decreased loan supply would then lower aggregate demand and collateral values, further reducing access to finance and thereby economic activity, and in turn, increasing losses to the financial sector,” the IMF warns.

Its economists find that the sharp increase in borrowing has been driven largely by international factors, including the historically low interest rates and quantitative easing unleashed by central banks in the US, Japan and Europe, as they have sought to rekindle growth in the wake of the sub-prime crisis. “Monetary policy has been exceptionally accommodative across major advanced economies. Firms in emerging markets have faced greater incentives and opportunities to increase leverage as a result of the ensuing unusually favourable global financial conditions,” the IMF says.

Read more …

A deep dark hole lies right ahead.

• World Set For Emerging Market Mass Default, Warns IMF (Telegraph)

The IMF has issued a double warning over higher US interest rates, which it said could trigger a wave of emerging market corporate defaults and panic in financial markets as liquidity evaporates. The IMF said corporate debts in emerging markets ballooned to $18 trillion last year, from $4 trillion in 2004 as companies gorged themselves on cheap debt. It said the quadrupling in debt had been accompanied by weaker balance sheets, making companies more vulnerable to US rate rises. “As advanced economies normalise monetary policy, emerging markets should prepare for an increase in corporate failures,” the IMF said in a pre-released chapter of its latest Financial Stability Report.

It warned that this could create a credit crunch as risks “spill over to the financial sector and generate a vicious cycle as banks curtail lending”. In a double warning, the IMF said market liquidity, or the ease with which investors can quickly buy or sell securities without shifting their price, was “prone to sudden evaporation”, particularly in bond markets, when the Federal Reserve started to raise interest rates. It said a steady growth environment and “extraordinarily accommodative monetary policies” around the world had helped to maintain a “high level” of liquidity. However, it warned that this was not the same as “resilient” liquidity that could support markets in time of stress.

Gaston Gelos, head of the IMF’s global financial stability division, said these factors were “masking liquidity risks” that could trigger violent market swings. “Liquidity is like the oil in an engine, when there’s too little of it, the machine starts stuttering,” he said. The IMF said an “illusion” of abundant liquidity may have encouraged “excessive risk taking” by some investors that could cause market ructions if many investors suddenly rushed to the exit. “Even seemingly plentiful market liquidity can suddenly evaporate and lead to systemic financial disruptions,” the IMF said. “When liquidity drops sharply, prices become less informative and less aligned with fundamentals, and tend to overreact, leading to increased volatility. In extreme conditions, markets can freeze altogether, with systemic repercussions.”

Read more …

Politicans and board members should draw their own consequences, not point to others. This guys is both.

• Volkswagen Board Member: Staff Acted Criminally (BBC)

Olaf Lies, a Volkswagen board member and economy minister of Lower Saxony has told Newsnight some staff acted criminally over emission cheat tests. He said the people who allowed the deception to happen or who installed the software that allowed certain models to give false emissions readings must take personal responsibility. He also said the board only found out about the problems at the last meeting. About 11 million diesel engine cars are affected by the problem. Mr Lies told the BBC: “Those people who allowed this to happen, or who made the decision to install this software – they acted criminally. They must take personal responsibility.” He said: “We only found out about the problems in the last board meeting, shortly before the media did. I want to be quite open. So we need to find out why the board wasn’t informed earlier about the problems when they were known about over a year ago in the United States.”

He said the company had no idea of the total bill to sort out the engines and cover any legal costs arising: “Huge damage has been done because millions of people have lost their faith in VW. We are surely going to have a lot of people suing for damages. We have to recall lots of cars and it has to happen really fast.” He added that the company was strong and that rebuilding trust – and ensuring the majority of the 600,000 workers at the car giant were not blamed, was its priority. He added his apology to those already made by senior company figures and said: “I’m ashamed that the people in America who bought cars with complete confidence are so disappointed.” VW is working out how to refit the software in the 11 million diesel engines involved in the emissions scandal. Seat is the latest VW brand to reveal it, too, used the emission cheat device.

Read more …

Be good to see how different legal systems have different approaches.

• Volkswagen Spain Faces Criminal Complaint Over Emissions Tests (Bloomberg)

Volkswagen AG’s three Spanish units and their chairmen are facing a criminal complaint stemming from its rigged emissions tests that accuses them of defrauding consumers and the tax authorities and damaging the environment. Manos Limpias, a public workers’ union that has pursued corruption allegations against high-profile figures in Spain including the king’s sister, filed the private suit with the National Court on Monday. The Spanish state could face a civil liability for failing to adequately supervise the automaker, according to a copy of the lawsuit seen by Bloomberg News. German prosecutors have already started a criminal probe of the car maker that will examine the role of former CEO Martin Winterkorn. Winterkorn resigned on Friday after a tumultuous week in which Europe’s biggest car manufacturer admitted to tampering with some diesel engines to cheat on U.S. emissions tests.

The complaint named Volkswagen Audi SA Chairman James Morys Muir, Volkswagen Navarra SA Chairman Ulbrich Thomas and Seat SA Chairman Francisco Javier Garcia Sanz. Volkswagen and its Seat unit have built more than 500,000 cars in Spain with the 1.6- and 2.0-liter diesel motors subject to the German investigation, Manos Limpias said in the lawsuit. Several models from Volkswagen’s other brands that are under investigation have also been sold to Spanish consumers. In addition, the German company has been claiming subsidies from the Spanish government since at least 2009 as an incentive to produce low emission cars. While Industry Ministry Jose Manuel Soria says Spain will ask Volkswagen to give back the subsidies, the government may also face a civil charges because it ordered Seat’s technical unit to conduct the emissions tests, Manos Limpias said in the document.

Read more …

“Volkswagen did not say how the planned refit would make cars with the “cheat” software comply with regulations..”

• Volkswagen To Refit Cars Affected By Emissions Scandal (Reuters)

Volkswagen said on Tuesday it will repair up to 11 million vehicles and overhaul its namesake brand following the scandal over its rigging of emissions tests. New CEO Matthias Mueller said the German carmaker would tell customers in the coming days they would need to have diesel vehicles with illegal software refitted, a move which some analysts have said could cost more than $6.5 billion. In Washington, U.S. lawmakers asked the automaker to turn over documents related to the scandal, including records concerning the development of a software program intended to defeat regulatory emissions tests. In separate letters, leading Republicans and Democrats on the House Energy and Commerce Committee requested information from both Volkswagen and the EPA as part of an investigation into the controversy.

Europe’s biggest carmaker has admitted cheating in diesel emissions tests in the US and Germany’s transport minister says it also manipulated them in Europe, where Volkswagen sells about 40% of its vehicles. The company is under huge pressure to address a crisis that has wiped more than a third off its market value, sent shock waves through the global car market and could harm Germany’s economy. “We are facing a long trudge and a lot of hard work,” Mueller told a closed-door gathering of about 1,000 top managers at Volkswagen’s Wolfsburg headquarters late on Monday. “We will only be able to make progress in steps and there will be setbacks,” he said. Volkswagen did not say how the planned refit would make cars with the “cheat” software comply with regulations, or how this might affect vehicles’ mileage or efficiency, which are important considerations for customers. It said it would submit the details to Germany’s KBA watchdog next month.

Read more …

Exactly what I was thinking listening to Obama. “We bring them democracy” has become a ridiculous line.

• Obama Re-Defines Democracy – A Country that Supports US Policy (Michael Hudson)

In his Orwellian September 28, 2015 speech to the United Nations, President Obama said that if democracy had existed in Syria, therenever would have been a revolt against Assad. By that, he meant ISIL. Wherethere is democracy, he said, there is no violence of revolution. This was his threat to promote revolution, coups and violence against any country not deemed a “democracy.” In making this hardly veiled threat, he redefined the word in the international political vocabulary. Democracy is the CIA’s overthrow of Mossedegh in Iran to install the Shah. Democracy is the overthrow of Afghanistan’s secular government by the Taliban against Russia. Democracy is the Ukrainian coup behind Yats and Poroshenko. Democracy is Pinochet. It is “our bastards,” as Lyndon Johnson said with regard to the Latin American dictators installed by U.S. foreign policy.

A century ago the word “democracy” referred to a nation whose policies were formed by elected representatives. Ever since ancient Athens, democracy was contrasted to oligarchy and aristocracy. But since the Cold War and its aftermath, that is not how U.S. politicians have used the term. When an American president uses the word “democracy,” he means a pro-American country following U.S. neoliberal policies. No matter if a country is a military dictatorship or the government was brought in by a coup (euphemized as a Color Revolution) as in Georgia or Ukraine. A “democratic” government has been re-defined simply as one supporting the Washington Consensus, NATO and the IMF. It is a government that shifts policy-making out of the hands of elected representatives to an “independent” central bank, whose policies are dictated by the oligarchy centered in Wall Street, the City of London and Frankfurt.

Given this American re-definition of the political vocabulary, when President Obama says that such countries will not suffer coups, violent revolution or terrorism, he means that countries safely within the U.S. diplomatic orbit will be free of destabilization sponsored by the U.S. State Department, Defense Department and Treasury. Countries whose voters democratically elect a government or regime that acts independently (or even that simply seeks the power to act independently of U.S. directives) will be destabilized, Syria style, Ukraine style or Chile style under General Pinochet. As Henry Kissinger said, just because a country votes in communists doesn’t mean that we have to accept it. It is the style of “color revolutions” sponsored by the National Endowment for Democracy.

In his United Nations reply, Russian President Putin warned against the “export of democratic revolution,” meaning by the United States in support of its local factotums. ISIL is armed with U.S. weapons and its soldiers were trained by U.S. armed forces. In case there was any doubt, President Obama reiterated before the United Nations that until Syrian President Assad was removed in favor of one more submissive to U.S. oil and military policy, Assad was the major enemy, not ISIL. “It is impossible to tolerate the present situation any longer,” President Putin responded. Likewise in Ukraine. “What I believe is absolutely unacceptable,” he said in his CBS interview on 60 Minutes, “is the resolution of internal political issues in the former USSR Republics, through “color revolutions,” through coup d’états, through unconstitutional removal of power. That is totally unacceptable.”

Read more …

Greece had an excellent education system for a very long time. Now that is gone too.

• Greek Crisis a Tragedy For Education System (BBC)

When considering the effects of the debt crisis on Greece, most people probably think of long queues outside banks and protests in the streets. A less visible but perhaps further reaching outcome is that Greece’s education system has become one of the most unequal in the developed world. Although education in Greece is free, public schools are suffering from spending cuts imposed as a condition of the bailout agreements. In practice, over the last 30 years it has become increasingly necessary for students to pay for expensive private tuition to pass the famously difficult Panhellenic exams required to get to university. But with unemployment rising and salaries falling, many poor and middle-class families are struggling to pay for this extra tuition.

A World Economic Forum report this month ranked Greece last of 30 advanced economies for education because of the close relationship between students’ performance and their parents’ income. And a professor of law and economics at the University of Athens warns that losing talented students from poor backgrounds is a “national catastrophe” which could hinder Greece’s long-term economic recovery. Greece’s education system was designed around the principle of equality. Article 16 of the constitution guarantees free education at all levels and university admission is decided solely by performance in the nationwide Panhellenic exams. But the low quality of some public education in Greece, and the difficulty of the Panhellenic exams, has led to a parallel education system being set up.

The majority of students in Greece attend private classes called “frontistiria” or one-to-one tuition in evenings and weekends. In 2008, the year before the crisis, families with children in upper secondary education spent more than €950m on these lessons, which represented nearly 20% of these households’ expenditure – more than any other European country. “If a student does not attend frontistirio, he is a dead man for the exams,” said Dimitra Kakampoura, a 22-year-old student who took the Panhellenic exams in 2011.

Read more …

“Banks lend to oil exploration companies based on the value of their reserves. But they only audit the value of those reserves every October. Given how much oil prices have tumbled in the past year, many analysts expect banks to greatly reduce in the next month..”

• Frackers Could Soon Face Mass Extinction (Fortune)

An analyst says one-third of the companies could be bankrupt by the end of next year. Doomsday may finally be coming to the fracking industry. Despite the big drop in oil prices in the past year, there have been relatively few bankruptcies in the energy industry. That may be about to change. James West, an energy industry analyst at ISI Evercore, says months of low activity have left many of the companies in the hydraulic-fracturing business either insolvent or close to it. He says as many as a third of the fracking companies could go bust by the end of next year. “This holiday will not be a time of cheer in the oil patch,” says West. So far oil and gas exploration companies, while cutting back somewhat, have continued to spend based on budgets set a year ago when oil prices were much higher.

But now West says the price of oil is catching up to them, and they may soon have to drastically cut back their spending on services. The catalyst is the banks. Banks lend to oil exploration companies based on the value of their reserves. But they only audit the value of those reserves every October. Given how much oil prices have tumbled in the past year, many analysts expect banks to greatly reduce in the next month how much they are willing to lend to oil and gas companies. Regulators, worried banks may face losses, have recently been pressuring banks to cut back their lending to oil and gas companies. On Friday, credit ratings firm Standard & Poors reported that its distressed ratio, which measures the%age of corporate borrowers that investors appear nervous may not be able to pay back their debt, had reached the highest level since 2011. The oil and gas sector accounted for the largest number of the distressed borrowers, 95 out of 270.

Read more …

Clueless Kiwis.

• Chinese Buyers Holding Back On ‘High-End’ New Zealand Property (NZ Herald)

While some Chinese buyers are holding back on buying “high-end” property in Auckland, there is still demand for houses in the medium and lower end of the market, a Chinese-based real estate website says. Juwai.com hasn’t yet finalised its numbers for the third quarter of this year but still expects to see growth. It also predicts a massive increase in overseas investment from Chinese buyers of international property over the next few years. The Auckland housing market is cooling slightly and the boss of the city’s biggest real estate company has said Chinese property investors are disappearing from the auction room. Peter Thompson, of Barfoot and Thompson, attributes the the drop off to financial instability in China. “There are a lot less Chinese in the auction room at the moment and at the open homes,” he told the Herald on Monday.

“The market has changed and some of that is the Chinese buyers. There are more requirements in getting money out of China now and that is having an impact.” Juwai.com’s chief executive Simon Henry said he’d noticed a slow-down at the expensive end of the market. “We have some high-end buyers holding back since China announced a tightening of enforcement on the export of capital. “We haven’t yet crunched the numbers on the third quarter, but we believe they will still show growth over the second quarter,” Mr Henry said. “Mid-market and lower priced properties, like those bought for students, are still in demand.” Changes in the way Chinese investors can export capital were predicted to lead to a huge swell in money flooding into New Zealand, which Mr Henry said was a “good thing”. “It will lead to more than $100 million of new investment in New Zealand property over the medium to long term, as well as new investment in local business and industry.”

Read more …

Flip flopping with people’s lives.

• Berlin To Curb Refugees As Merkel Faces Backlash (FT)

Berlin on Tuesday agreed measures aimed at curbing an unprecedented surge in migrants, including cuts to cash payments, as a backlash grew over the German government’s handling of the refugee crisis. The new laws are aimed at lifting some of the pressures on overworked local officials and reassuring voters that the government is in control of the migrant problem. Berlin wants the laws to take effect as soon as November. Chancellor Angela Merkel has come under mounting pressure, including from within her own CDU/CSU coalition, since she pledged to set “no upper limit” on the right to asylum and promised to accept all refugees from Syria. Officials expects 800,000 refugees this year, four times more than 2014.

In a surprise development, Joachim Gauck, German president, who is widely viewed as a liberal, on Sunday launched a thinly veiled attack on Ms Merkel’s handling of the crisis, saying: “Our reception capacity is limited even when it has not yet been worked out where these limits lie.” Cash handouts of €143 a month for a single person are seen as making Germany more desirable for migrants than other European states. Refugees will instead receive non-cash benefits, such as food vouchers. Cash payments for living expenses will largely be stopped for asylum-seekers living in official reception centres.

Berlin will also add Kosovo, Albania and Montenegro to a list of countries where would-be refugees can be safely returned in an attempt to staunch inflows of economic migrants from the western Balkans. Failed asylum-seekers will face more rapid removal procedures and big cuts in financial support. However, successful applicants will have quicker access to language courses to improve integration into society and the jobs market. Berlin pledged to double its refugee-linked support for regional and local authorities to 2 billion euros this year, rising to about €4 billion in 2016, assuming refugee inflows of 800,000 annually.

Read more …

There are good people everywhere. They’re just not in charge.

• Risking Arrest, Thousands Of Hungarians Offer Help To Refugees (NPR)

Driving in rural, southern Hungary, especially at night, you’re likely to see people emerging from dark forests along the side of the road. They trudge along the highway’s narrow shoulder and sometimes flag down passing cars, asking for help. They’re migrants and refugees who’ve entered Hungary by the tens of thousands in recent months, mostly en route to Germany and other northern European countries. But it’s illegal for civilians in Hungary to help them get there. Hungarian law prohibits offering rides — even for free — to people who’ve entered the country illegally and without a visa. Another law grants Hungarian police and military extraordinary powers to search private homes if they suspect someone of harboring illegal migrants.

The laws, passed in stages earlier this year, target human traffickers, and have led to a few high-profile arrests. Back in August, it was in Hungary that 71 Syrian refugees were loaded into a northbound truck. They were found suffocated to death in the same truck, on the side of a highway in Austria, on Aug. 28. Hungarian police arrested four alleged smugglers. But the laws are also making well-intentioned volunteers think twice about helping — because they, too, could be prosecuted, fined or jailed. At a Migration Aid warehouse in downtown Budapest, volunteers stockpile crates of fruit and sleeping bags for refugees. Dozens of Hungarians stop by to help, including Gyorgy Goldschmit, who offers up his own home. His wife and child are going out of town for a few weeks and he says he has room for another family, if needed.

“My family is not going to be there, and I will be there – so it’s obvious that someone could come,” Goldschmit says. But Migration Aid can’t arrange it. Its directors understand Hungarian law. “Maybe they cannot help like this because that would be considered as helping illegally or trafficking,” Goldschmit says. “But I don’t care so much.” Like many Hungarians, Goldschmit is not afraid of prosecution. Thousands are helping. But it’s unclear how many more are dissuaded by these laws. It’s also unclear how aggressively the laws are being enforced. The highest-profile case so far involved a Hungarian man arrested in April after using a local ride-share website, through which fuel costs are shared, to give lifts to refugees.

He was acquitted after a months-long legal battle, but his case served as a well-publicized warning to anyone thinking of transporting migrants. “Basically, if I drive you across [the country] and you don’t have a visa, then I’m liable criminally,” says Marta Pardavi, a human rights lawyer with the Budapest branch of the Helsinki Committee. “We have advised volunteers doing this that there is a risk involved — the risk of a criminal procedure, of having to go to interrogations — and I think that risk is very real.”

Read more …