Arthur Rothstein Elm Street, Theater Row, Dallas Jan 1942

I don’t think it’s ever a good sign, no matter how funny it may look, when the US state Department makes one think of Monty Python. But it does. With a Silly Claims instead of Silly Walks department. Would these people really sit around a big table in the evening and brainstorm about what anti-Russia statement to feed to the press the next morning? What else could possibly be going on here? I mean, just look at this bit from the New York Times:

US Says Russia Tested Cruise Missile, Violating Treaty

The United States has concluded that Russia violated a landmark arms control treaty by testing a prohibited ground-launched cruise missile, according to senior American officials, a finding that was conveyed by President Obama to President Vladimir V. Putin of Russia in a letter on Monday. It is the most serious allegation of an arms control treaty violation that the Obama administration has leveled against Russia [..]

At the heart of the issue is the 1987 treaty that bans American and Russian ground-launched ballistic or cruise missiles capable of flying 300 to 3,400 miles. That accord, which was signed by President Ronald Reagan and Mikhail S. Gorbachev, the Soviet leader, helped seal the end of the Cold War and has been regarded as a cornerstone of American-Russian arms control efforts.

Russia first began testing the cruise missiles as early as 2008, according to American officials, and the Obama administration concluded by the end of 2011 that they were a compliance concern. In May 2013, Rose Gottemoeller, the State Department’s senior arms control official, first raised the possibility of a violation with Russian officials. The New York Times reported in January that American officials had informed the NATO allies that Russia had tested a ground-launched cruise missile [..]

If we are to believe the NYT, Russia started testing the system 6 years ago, it then took the US at least 3 years to ‘conclude’ it was ‘a compliance concern’, another 18 months or so to ‘raise the possibility of a violation with Russian officials’, 8 more months after that to inform NATO – and have the NYT write it up – and another half year on top of that for Obama to write a letter to ‘President Vladimir V. Putin of Russia’ (excellent choice of title, love the extra V.) and feed the press.

Whereas we can all agree that timing is everything, how many of you recognize that any and every single day over the past 6 years and change would have been better to go public with this than today? In all the papers, we can read that ‘Senior American officials’ stress that this is ‘a serious violation’.

Look, we know you’re trying to make Russia look bad. We get it. But we also know that if this would have been such a serious violation, you would have spoken out a long time ago. We therefore have no other choice but to file this under ‘whatever’. And wait with glee for what you come up with tomorrow.

By the way, while reading up on this, I happenstanced upon something else in the field of nuclear treaties. And since you guys insisted on putting us in Python mood, here goes. This is from the Santa Barbara Independent:

Feds Looks to Quash Nuclear Treaty Lawsuit

Federal attorneys have made their first big move to dismiss a lawsuit that alleges the United States, along with eight other countries, has violated a 46-year-old treaty to dismantle its nuclear arsenal. The lawsuit was filed in April — in U.S. Federal Court as well as in the International Court of Justice in The Hague – by the tiny Pacific nation of the Marshall Islands, which the U.S. bombarded with nuclear weapons tested between 1946 and 1958. Marshall Islands officials maintain that radioactive fallout from the tests sickened citizens and rendered some territories unlivable.

“Our people have suffered the catastrophic and irreparable damage of these weapons,” said Marshall Islands Foreign Minister Tony de Brum in May, “and we vow to fight so that no one else on Earth will ever again experience these atrocities.” The Treaty on the Non-Proliferation of Nuclear Weapons (NPT) was signed in 1968 and mandates that the United States, Russia, United Kingdom, France, China, Israel, India, Pakistan, and North Korea “pursue negotiations in good faith” to end the nuclear arms race “at an early date and to work toward worldwide nuclear disarmament.”

Attorneys for the Marshall Islands argue that the countries have instead increased and modernized their nukes over the decades. [..] In the fed’s Motion to Dismiss, the government claims the lawsuit should be thrown out because of procedural and jurisdictional issues. “The U.S.… does not argue that the U.S. is in compliance with its NPT disarmament obligations,” the NAPF explained in a prepared statement. “Instead, it argues in a variety of ways that its non-compliance with these obligations is, essentially, justifiable, and not subject to the court’s jurisdiction.”

That doesn’t exactly make that claim against Russia look better, does it? Anything else? Alright then, moving on. The Financial Times has a particularly spicy rendering of the Yukos lawsuit story in which Russia was ordered to pay $50 billion in damages:

‘Yukos Is Insignificant, There Is A War Coming In Europe’

Beleaguered shareholders of Yukos could scarcely have imagined when they launched arbitration in 2005 they would one day be awarded $50bn in damages – nor that the ruling would be released into the febrile atmosphere that exists between Russia and the west today.

Just six months ago, say legal experts, Russia still seemed interested in being part of international “clubs” like the Organisation for Economic Co-operation and Development, the group of mainly rich countries. As the Ukraine crisis worsens, protecting its international reputation no longer seems a priority. “If one were to be quite cynical, I think the reputational consequences for Russia [of not paying] will be very limited indeed, because they have already been through a lot of things,” said Loukas Mistelis, director of the School of International Arbitration at Queen Mary University of London. “I think they would be prepared to take quite a bit of risk.” [..]

… if Russian state businesses find themselves hit both by western sanctions and attempts to seize assets by Yukos shareholders, relations between the Kremlin and the west could sour further. One person close to Mr Putin said the Yukos ruling was insignificant in light of the bigger geopolitical stand-off over Ukraine.

“There is a war coming in Europe,” he said. “Do you really think this matters?”

I don’t know. I catch myself thinking at times that there’s already a war going on in Europe. It could certainly expand and accelerate a lot further, but the sanctions the US and EU intend to slam on Russia sure look like economic warfare to me. As do the innuendo, the lack of evidence, the constant stream of smear stories leaked through fuzzy channels, it all fits the picture.

The Yukos case is already causing people to wake up from various stages of slumber. BP reported ‘great’ profits today, largely from their interest in Russian oil giant Rosneft (got to love the irony), but it also said the sanctions that are being prepared could hurt its shares, because it has a 19% stake in Rosneft.

What it didn’t say out loud, but what is certainly an added threat, is that the parties who won the case can now go sue BP to get their $50 billion. Because of the same 19% stake. And given that many of the stakeholders of the other 81% will be hard to go after, BP could face a bit of a problem.

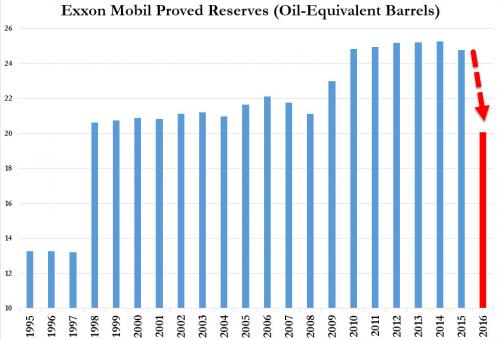

But something tells me that’s still not Beyond Petroleum’s biggest worry: the deals with Rosneft gave it the prospect of actual recognized fossil fuel reserves, something BP, like all western oil behemoths, has far too little of. Exxon, too, has Rosneft deals, as does Norway’s Statoil, both for Arctic drilling projects. Shell, though Sakhalin developement(s), may well be the largest foreign investor in Russia.

At some point Big Oil will need to write down reserves; at some point their shares will fall for real. That sanctions originating in western anti-Putin sentiments may accelerate the process is something that, I’m not even sorry to say it, amuses me.

To get some perspective on the whole story, here are a few principle ideas it is based on. The west – US and EU – tries to squeeze Russia, and Rosneft. The west also – so far – seems to think this would surprise Putin and hurt his plans. Many people for instance claim that he will lose popularity at home if his economy takes a southbound turn.

Me, I’m not so sure. I think Putin must have seen all of this coming from a long time and a long distance away. The US keeps trying to pull him into proxy wars, but he’s not biting (which is why they turn to unsubstantiated claims).

Russian speaking Ukrainians are getting killed by the dozen with western support, and he must detest that. But sending in his troops would be just what the west wants, and it would lead to far more bloodshed. As long as he and his people officially stay on sovereign Russian soil, he’s OK.

As for economic sanctions, Russia is not that vulnerable. While the US tries to break the bond between Russia and Europe, Russia can try the same for the bond between US and EU. What’s more, Putin knows the ‘leadership’ in Brussels is not overly competent, and dreams away in grand visions of power, of an equal partnership with their American friends. Vladimir V. knows the US has no intention of granting Brussels any such power.

The sanctions will eventually lead to either a break between US and EU -because European business interests get hurt too much -, or – more likely for now – it will lead to $200 a barrel oil, huge increases in EU heating costs and a sharp dip in the euro that will make that $200 a lot more still.

Putin’s fine either way. Sell 50% less to Europe at 100% higher prices, why not? Let’s see EU member Slovakia send Russian gas back to Ukraine – or however that reverse flow is supposed to work -. Putin can simply cut overall gas delivery to Europe by 25%, and 50% if they try it again. There’s no love lost between Putin and Europe in the aftermath of the crash and the things that have been said about him.

And I think Vladimir must know how the US feels about this. Washington sees the advantages of making Europe their bitch, pardon my French. With half of the old world in the cold come winter, the US can greatly enhance its influence there. The Americans think that with their domestic shale wealth – they’re wrong, but they think it -, $200 a barrel oil in international markets would suit them just fine for a while.

As I said last week, we have entered the next phase in the energy equals power battle, and we entered it for good. This should be evident from looking at the sanctions and the Yukos case, and the fall-out this will have on western oil companies. You can be a big wig in Brussels and feel nice about yourself negotiating punishments for Vladimir V. Putin, but that doesn’t mean you’re ready to play with the big boys. And from here on in, it’s a big boys game only.

Note: Holland announced today that 195 of the 298 people who died in the MH17 crash had the Dutch nationality; some had dual citizenship. The one person they added to the list was a 2-year old girl. Isn’t that just the saddest thing on the planet? And then the US and EU have the audacity to play a propaganda war over that, blaming people for killing that little girl without any proof? Also, finally, 12 days after the crash, the Dutch government is calling on Ukraine to stop the fighting on the crash site and let forensic experts do their job. President Poroshenko has promised for while that they would. But nothing changed. There are still dozens of bodies and body parts decomposing in the fields. Best remember who your friends are. Same question again: who’s commanding that army?

But hey, stock markets are up … What more can we ask for?

• ‘Yukos Is Insignificant, There Is A War Coming In Europe’ (FT)

Beleaguered shareholders of Yukos could scarcely have imagined when they launched arbitration in 2005 they would one day be awarded $50bn in damages – nor that the ruling would be released into the febrile atmosphere that exists between Russia and the west today. The award is a landmark not just for its size – 20 times the previous record for an arbitration ruling. The tribunal also found definitively that Russia’s pursuit of Yukos and its independently-minded main shareholder, Mikhail Khodorkovsky, a decade ago was politically motivated. Through inflated tax claims, the ruling said, senior officials set out to destroy Russia’s then biggest oil company, transfer its assets to a state-controlled competitor – Rosneft – and put Mr Khodorkovsky in jail. “The tribunal confirmed what the [Yukos shareholders] have been saying all along,” said Tim Osborne, director of GML, the Yukos holding company. [..]

Just six months ago, say legal experts, Russia still seemed interested in being part of international “clubs” like the Organisation for Economic Co-operation and Development, the group of mainly rich countries. As the Ukraine crisis worsens, protecting its international reputation no longer seems a priority. “If one were to be quite cynical, I think the reputational consequences for Russia [of not paying] will be very limited indeed, because they have already been through a lot of things,” said Loukas Mistelis, director of the School of International Arbitration at Queen Mary University of London. “I think they would be prepared to take quite a bit of risk.” [..]

Emmanuel Gaillard of Shearman & Sterling, which represented the Yukos claimants, said he was confident of eventually “piercing the veil” around assets of Russian state companies such as Rosneft, the oil company, and the natural gas monopoly, Gazprom. He added that the principle that state-controlled businesses could be a kind of proxy for the state was already inherent in sanctions over Ukraine against companies such as Rosneft – which has been targeted by the US. But if Russian state businesses find themselves hit both by western sanctions and attempts to seize assets by Yukos shareholders, relations between the Kremlin and the west could sour further. One person close to Mr Putin said the Yukos ruling was insignificant in light of the bigger geopolitical stand-off over Ukraine. “There is a war coming in Europe,” he said. “Do you really think this matters?”

Read more …

• BP: Russia Still Key As Production Set To Dip (CNBC)

BP, the U.K. oil giant, announced a 34% rise in profits Tuesday – but its results highlighted concerns over its important Russian joint venture. The company’s 19.75% stake in Rosneft is regularly cited as one of the most lucrative deals which could be threatened if sanctions imposed against Russia in the light of the Ukrainian crisis escalate. The company confirmed these concerns in the statement accompanying its second-quarter results: “If further international sanctions are imposed on Rosneft or new sanctions are imposed on Russia or other Russian individuals or entities, this could have a material adverse impact on our relationship with and investment in Rosneft, our business and strategic objectives in Russia and our financial position and results of operations.”

BP also warned that third-quarter production would be lower than the second quarter, blaming seasonal slowing. Output from the Gulf of Mexico helped push overall underlying production of oil and gas, excluding Russia, up by over 3% compared to a year earlier. The company also hiked its provision for litigation related to the Gulf of Mexico oil by $260 million, bringing the total potential bill for the accident to $43 billion.

Read more …

• BP Warns On Russia Sanctions Despite Rosneft Profits (Guardian)

BP has earned bumper profits from its stake in the Kremlin-controlled oil company Rosneft since the start of the year, but warned investors that it could be hurt by western sanctions against Russia. The FTSE 100 company, which owns one fifth of Russia’s largest oil company, made $1.6bn (£950m) from Rosneft in the first six months of 2014, an 80% increase on last year. On top of this BP was paid a $700m dividend from Rosneft in July. But with the European Union poised to announce tougher sanctions against Russia, BP acknowledged that its reputation was at stake over its ties with the Russian state oil giant. “Further economic sanctions could adversely impact our business and strategic objectives in Russia, the level of our income, production and reserves, our investment in Rosneft and our reputation,” the company said. Earlier this month the United States added Rosneft to its sanctions list and EU is expected to approve a ban on the export of advanced technology that could be used to drill for oil in Russia.

Igor Sechin, the chairman of Rosneft and a close friend of President Vladimir Putin, has been on the US sanctions list since April. As EU leaders have struggled to keep a united front amid the conflict in eastern Ukraine, BP has stuck to a business-as-usual policy with Russia. In May BP and Rosneft struck a deal to exploit shale reserves in the Urals at a ceremony attended by Putin at the St Petersburg Economic Forum, a Russian Davos that was shunned by many other western business leaders. BP’s exposure to Russia was highlighted on Monday when a tribunal in the Hague ruled that Rosneft had been the prime beneficiary from a “devious and calculated expropriation” by the Russian government against Yukos, once Russia’s largest private oil company, broken up by the Russian government after its boss fell foul of Putin. Rosneft went on to acquire Yukos’s prime assets at rock-bottom prices. Shareholders have vowed to pursue Rosneft for a $50bn damages claim and indicated they may also pursue BP.

Read more …

Ambrose gets a lot wrong here.

• BP’s Faustian Pact With Russia Goes Horribly Wrong With Yukos Verdict (AEP)

The Permanent Court of Arbitration in The Hague has thrown the book at the Russian state, or more specifically at Vladimir Putin and his Soliviki circle from the security services. The $51.5bn ruling against the Kremlin unveiled this morning has no precedent in international law. The damages are 20 times larger than any previous verdict. Lawyers for the Yukos-MGL-Khodorkovsky team tell me that they cannot pursue the foreign bond holdings of the Russian central bank if the Kremlin refuses to pay up when the deadline expires on January 15, as seems likely. Moscow has already dismissed the case as “politically motivated”. Nor can they go after embassies and other sovereign assets that enjoy diplomatic immunity, though they are eyeing a list of Russian state targets that slipped through the net. What they can certainly do – and have every intention of doing – is attacking the assets of state-owned companies that act as instruments of the Russian government.

Above all, they intend to pursue Rosneft, the venture built from the expropriated assets of Yukos. That means they also intend to pursue BP (indirectly), since BP owns a fifth of Rosneft shares as a legacy from the TNK-BP debacle. Rosneft is the world’s biggest traded oil company with production of 4m barrels a day. It is run by Mr Putin’s close friend Igor Sechin, a former KGB operative in Africa, a loyalist in Mr Putin’s political machine in St Petersburg, and the architect of Russia’s energy strategy for the last decade. The Court’s ruling made it clear that Rosneft is not a commercial company with a (passive) state shareholder. It said the Rosneft was “the vehicle” used to expropriate Yukos and has acted as an instrument of the state. Mr Putin himself said at the time that the purpose was to reverse the giveaway privatisation of Russia’s natural resources and sovereign heirlooms in the bandit era of the 1990s. “The State, resorting to absolutely legal market mechanisms, is looking after its own interest,” he said.

Read more …

• US Says Russia Tested Cruise Missile, Violating Treaty (NY Times)

The United States has concluded that Russia violated a landmark arms control treaty by testing a prohibited ground-launched cruise missile, according to senior American officials, a finding that was conveyed by President Obama to President Vladimir V. Putin of Russia in a letter on Monday. It is the most serious allegation of an arms control treaty violation that the Obama administration has leveled against Russia and adds another dispute to a relationship already burdened by tensions over the Kremlin’s support for separatists in Ukraine and its decision to grant asylum to Edward J. Snowden, the former National Security Agency contractor. At the heart of the issue is the 1987 treaty that bans American and Russian ground-launched ballistic or cruise missiles capable of flying 300 to 3,400 miles. That accord, which was signed by President Ronald Reagan and Mikhail S. Gorbachev, the Soviet leader, helped seal the end of the Cold War and has been regarded as a cornerstone of American-Russian arms control efforts.

Russia first began testing the cruise missiles as early as 2008, according to American officials, and the Obama administration concluded by the end of 2011 that they were a compliance concern. In May 2013, Rose Gottemoeller, the State Department’s senior arms control official, first raised the possibility of a violation with Russian officials. The New York Times reported in January that American officials had informed the NATO allies that Russia had tested a ground-launched cruise missile, raising serious concerns about Russia’s compliance with the Intermediate-range Nuclear Forces Treaty, or I.N.F. Treaty as it is commonly called. The State Department said at the time that the issue was under review and that the Obama administration was not yet ready to formally declare it to be a treaty violation.

In recent months, however, the issue has been taken up by top-level officials, including a meeting early this month of the Principals’ Committee, a cabinet-level body that includes Mr. Obama’s national security adviser, the defense secretary, the chairman of the Joint Chiefs of Staff, the secretary of state and the director of the Central Intelligence Agency. Senior officials said the president’s most senior advisers unanimously agreed that the test was a serious violation, and the allegation will be made public soon in the State Department’s annual report on international compliance with arms control agreements. “The United States has determined that the Russian Federation is in violation of its obligations under the I.N.F. treaty not to possess, produce or flight test a ground-launched cruise missile (GLCM) with a range capability of 500 kilometers to 5,500 kilometers or to possess or produce launchers of such missiles,” that report will say.

Read more …

• US Looks to Quash Nuclear Treaty Lawsuit (Santa Barbara Independent)

Federal attorneys have made their first big move to dismiss a lawsuit that alleges the United States, along with eight other countries, has violated a 46-year-old treaty to dismantle its nuclear arsenal. The lawsuit was filed in April — in U.S. Federal Court as well as in the International Court of Justice in The Hague, Netherlands — by the the tiny Pacific nation of the Marshall Islands, which the U.S. bombarded with nuclear weapons tested between 1946 and 1958. Marshall Islands officials maintain that radioactive fallout from the tests sickened citizens and rendered some territories unlivable.

“Our people have suffered the catastrophic and irreparable damage of these weapons,” said Marshall Islands Foreign Minister Tony de Brum in May, “and we vow to fight so that no one else on Earth will ever again experience these atrocities.” The Treaty on the Non-Proliferation of Nuclear Weapons (NPT) was signed in 1968 and mandates that the United States, Russia, United Kingdom, France, China, Israel, India, Pakistan, and North Korea “pursue negotiations in good faith” to end the nuclear arms race “at an early date and to work toward worldwide nuclear disarmament.”

Attorneys for the Marshall Islands – and with the law firm Keller Rohrback LLP, which has an office in Santa Barbara and specializes in constitutional and treaty law – argue that the countries have instead increased and modernized their nukes over the decades. Santa Barbara’s Nuclear Age Peace Foundation (NAPF) is a consultant to the Marshall Islands on the legal and moral issues involved in the case, which has received attention all over the globe and the support of Nobel Prize winners. In the fed’s Motion to Dismiss, the government claims the lawsuit should be thrown out because of procedural and jurisdictional issues. “The U.S.… does not argue that the U.S. is in compliance with its NPT disarmament obligations,” the NAPF explained in a prepared statement. “Instead, it argues in a variety of ways that its non-compliance with these obligations is, essentially, justifiable, and not subject to the court’s jurisdiction.”

Read more …

Very good point.

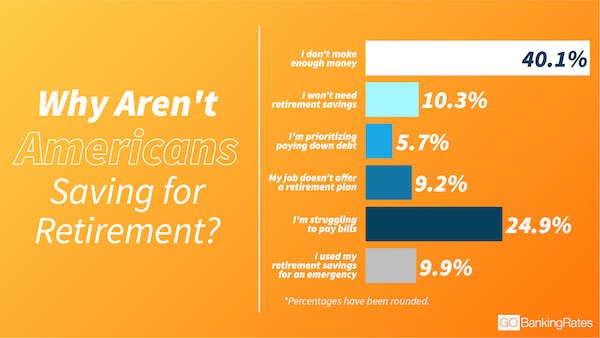

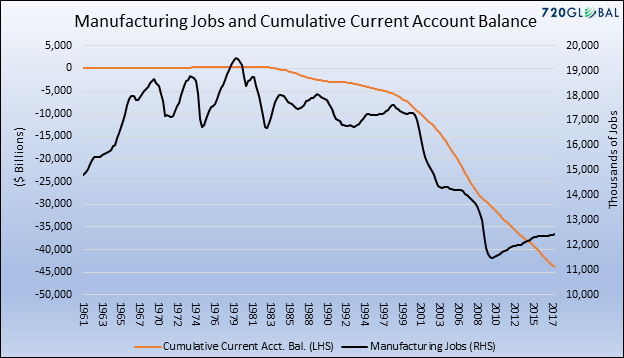

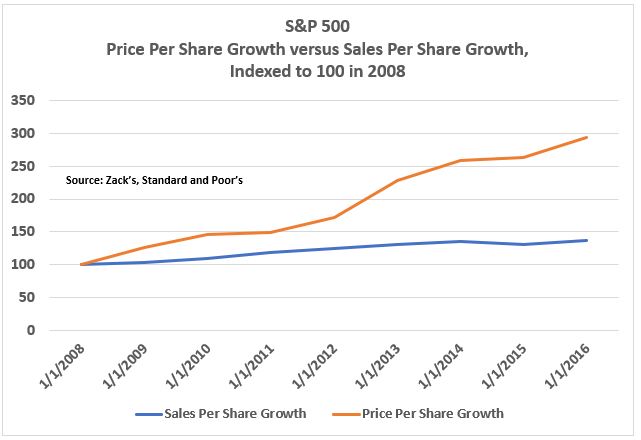

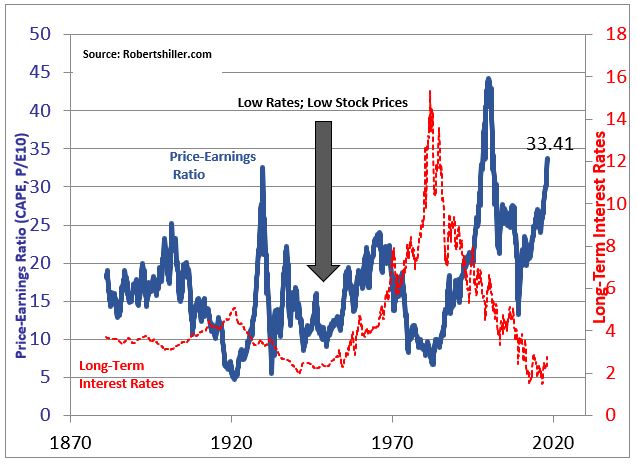

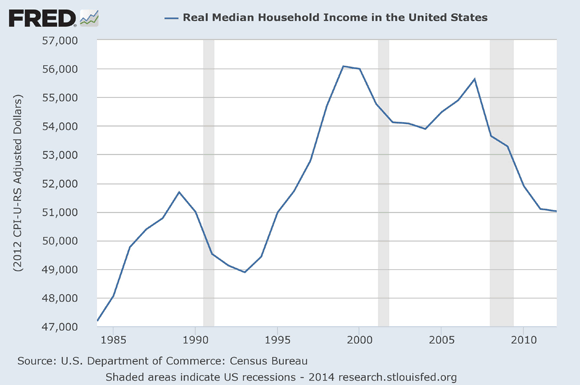

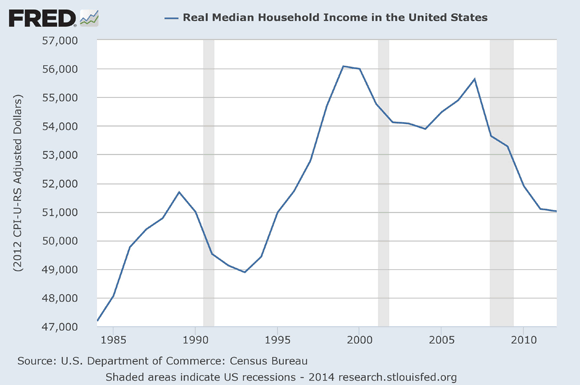

• Fed Creates Asset Bubbles To Paper Over Decline In Quality Of Life (Phoenix)

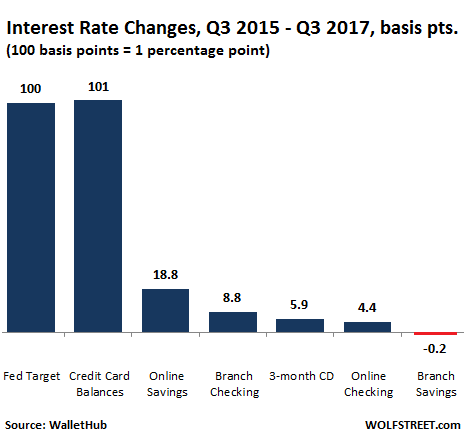

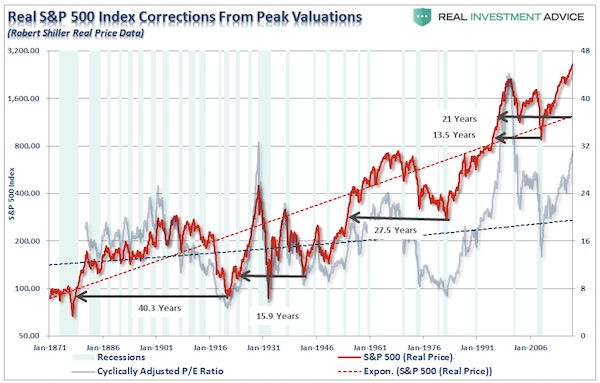

Many commentators have previously argued that the Fed is too dumb or too inept to identify of categorize asset bubbles. By focusing on the Fed’s mental acuity, these commentators are overlooking a key factor: the Fed WANTS asset bubbles. The reason for this? Asset bubbles, at least according to the Fed’s models, will paper over the steady decline in quality of life that began in the US roughly 50 years ago. This fact is staring everyone in the face, though few people make it explicit. Back in the 1950s, the average American family had one working parent and was able to get by just fine. Today, most families have two working parents, sometimes working more than two jobs and they’re still not able to live a stable life. Indeed, a 2012 study by NYU Professor Edward Wolff found that the median net worth of American households was at a 43-YEAR LOW. The average American in the 21st century was in worse shape than his 1970s counterpart. This process began to accelerate in the late ‘90s. Indeed, looking at real media household income, one can see clearly that things have generally been downhill for nearly 20 years now.

It is not coincidence that the Fed began blowing serial bubbles starting in the late ‘90s. The Fed is aware on some level that quality of life in the US has fallen. The Fed’s answer, rather than focus on items that it doesn’t understand (job growth, income growth, etc.) was to blow bubbles to paper over this decline. This is why we’ve had bubble after bubble after bubble in the last 15 years. The Fed doesn’t have a clue how to create jobs or boost incomes. Why would it? Most of the Fed’s Presidents are academics with no real world business experience. Instead, the Fed believes in the “wealth effect” or the theory that when housing prices or stock prices soar, people feel wealthier and so go out and spend more money. This theory is baloney. People spend based on their incomes, NOT the value of their homes or portfolios.

After all, both assets only convert into actual cash once the owner sells the asset. Anyone who goes out and spends more money because their home went up in value will only end up with credit card debt, which combined with their mortgage, puts an even greater strain on their financial resources. The Fed wants asset bubbles because they hide the rot within the US economy. If the Fed didn’t raise stock or housing prices, people might actually start to wonder… “hey, why is my life getting more and more difficult despite the fact that I’m working all the time?” The Fed wants bubbles. So we’re doomed to keep experiencing them and the subsequent crashes.

Read more …

Agree.

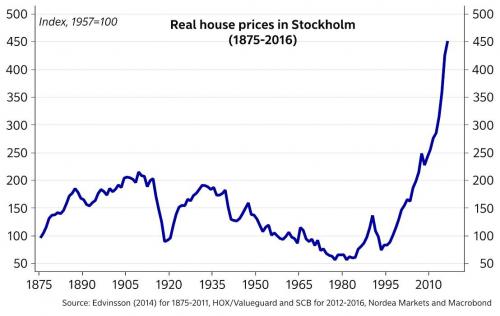

• Housing Bubble May Pop Entire U.K. Economy (Bloomberg)

You may not want to bring this up at any London dinner parties, but there are tentative signs that the bubble in U.K. housing prices that’s helped boost the economic recovery by underpinning consumer confidence may be running out of puff. Given the British obsession with home ownership, any evidence of real-estate deflation will complicate the Bank of England’s efforts to nudge borrowing costs higher. July marked the first month of no growth in London house prices since December 2012, according to figures last week from research company Hometrack Ltd. A different gauge showed the slowest pace of London gains in 15 months in June, according to the Royal Institution of Chartered Surveyors. And today, Lloyds Banking Group’s mortgage-lending unit reported that only five% of people say the coming year is a good time to buy a home, a 29-point drop in just three months.

With earnings still in the dumps – wages grew just 0.3% in May, while annual inflation was 1.5% – houses are becoming less and less affordable, hence the U.K. central bank’s imposition of new rules on mortgage lending in recent months. Some 71% of U.K. couples with at least one child own their own homes, rising to 80% for childless couples; U.S. home ownership is 65%, while in the euro region the rate is about 67%. Prices in the futures market suggest investors are currently less concerned about the Bank of England’s appetite for interest-rate increases than they were five weeks ago, when Mark Carney first raised the prospect of a shot across the bows of the monetary-policy landscape.

Read more …

How much longer till Nippon sinks into the ocean?

• Japan’s Retail Sales Drop in Challenge to Abe Reflation (Bloomberg)

Japan’s retail sales fell more than forecast in June, capping a weak quarter that challenges Prime Minister Shinzo Abe’s bid to reflate the economy while heaping a heavier tax burden on consumers. Sales dropped 0.6% from a year earlier, the trade ministry said in Tokyo today, steeper than a median forecast for a 0.5% decline in a Bloomberg News survey. In the second quarter, sales slumped 7% from the previous three months. Prime Minister Shinzo Abe is counting on consumers to bear a higher sales levy even as the Bank of Japan drives the cost of living upward with record monetary easing. The risk is that spending fails to regain vigor, sapping strength from an economy lacking support from exports.

“The government and the BOJ say the economy is recovering from the slowdown after the sales-tax increase, but it’s too early to tell,” said Koya Miyamae, senior economist at SMBC Nikko Securities Inc. in Tokyo. “There’s a chance consumption will remain below year-earlier levels in the July-September quarter.” Abe’s effort to stoke a sustained recovery in domestic demand is running up against a failure of companies to pass along record cash holdings in the form of higher wages that could help households cope with rising prices and the heavier tax burden.

Read more …

• China Trade Numbers Still Don’t Add Up Post-Fake Exports (Bloomberg)

China’s trade numbers still don’t add up. A discrepancy between Hong Kong and Chinese figures for bilateral trade remains even after a crackdown last year on Chinese companies’ use of fake export-invoicing to evade limits on importing foreign currency. China recorded $1.31 of exports to Hong Kong in June for every $1 in imports Hong Kong tallied from China, for a $6.4 billion difference, based on government data compiled by Bloomberg News. Analysts offered at least three possible explanations for the gap, including differences in how China and Hong Kong record trade in goods that pass through the city, as well as a persistence in fraud at a lower level. Any discrepancies make it tougher to gauge the impact of global demand on a Chinese economy that’s projected for the slowest growth in 24 years. “Sporadic fake exports certainly still exist,” said Hu Yifan, chief economist at Haitong International Securities Co. in Hong Kong.

The longer the data gap remains at this level, the more likely it’s a permanent fixture: “If the ratio stays at 1.3 throughout the year, I think that’s consistent,” Hu said. Distortions in China’s trade data have abated since the State Administration of Foreign Exchange started a campaign in May 2013 to curb money flows disguised as trade payments. The initial crackdown may have failed to eliminate deception. SAFE said in December that it would boost scrutiny of trade financing and that banks should prevent companies from getting financing based on fabricated trade. The State Administration of Taxation said earlier this month that it found instances of fraudulent exports used to obtain tax rebates by some companies. “You can’t exclude the possibility that capital flows are being disguised as exports” in the China-Hong Kong figures, said Yao Wei, China economist at Societe Generale SA in Paris. “As the capital account becomes more open, the flows will show up in the places they should.”

Read more …

Mind you: ‘Unexpectedly’.

• Pending Sales of U.S. Existing Homes Unexpectedly Decrease (Bloomberg)

Fewer Americans than forecast signed contracts to buy previously owned homes in June, a sign residential real estate is struggling to strengthen. The index of pending home sales declined 1.1% from the month before after rising 6% in May, figures from the National Association of Realtors showed today in Washington. The median forecast of 39 economists surveyed by Bloomberg projected sales would rise 0.5%. Limited availability of credit and sluggish wage growth are making it harder for prospective buyers to take the plunge, threatening to throttle the pace of the housing recovery.

Continued gains in employment and a bigger supply of available homes will be needed to help accelerate the industry’s progress, which Federal Reserve Chair Janet Yellen has said is lackluster. “Unfortunately, I don’t see much of an acceleration in housing demand going forward until we get a significant improvement in the labor market and the income part of it in particular,” said Yelena Shulyatyeva, a U.S. economist at BNP Paribas in New York, who forecast a 1% decrease in pending sales. “An uneven recovery in the housing market is really one of the biggest concerns of the Fed.”

Read more …

Short on moral values. Not uncommon among the rich.

• Qatar World Cup Migrant Workers Not Paid For A Year (Guardian)

Migrant workers who built luxury offices used by Qatar’s 2022 football World Cup organisers have told the Guardian they have not been paid for more than a year and are now working illegally from cockroach-infested lodgings. Officials in Qatar’s Supreme Committee for Delivery and Legacy have been using offices on the 38th and 39th floors of Doha’s landmark al-Bidda skyscraper – known as the Tower of Football – which were fitted out by men from Nepal, Sri Lanka and India who say they have not been paid for up to 13 months’ work. The project, a Guardian investigation shows, was directly commissioned by the Qatar government and the workers’ plight is set to raise fresh doubts over the autocratic emirate’s commitment to labour rights as construction starts this year on five new stadiums for the World Cup.

The offices, which cost £2.5m to fit, feature expensive etched glass, handmade Italian furniture, and even a heated executive toilet, project sources said. Yet some of the workers have not been paid, despite complaining to the Qatari authorities months ago and being owed wages as modest as £6 a day. By the end of this year, several hundred thousand extra migrant workers from some of the world’s poorest countries are scheduled to have travelled to Qatar to build World Cup facilities and infrastructure. The acceleration in the building programme comes amid international concern over a rising death toll among migrant workers and the use of forced labour.

Read more …

• The Agricultural Holocaust Explained: GMOs (Natural News)

Here are the top 10 ways GMOs threaten us all:

#1) Every grain of GM corn contains poison

#2) GMOs have never been safety tested for human consumption

#3) GMOs transform farming freedom into farming servitude

#4) GMOs run the very real risk of runaway self-replicating genetic pollution and ecocide

#5) GMO agriculture is breeding a new generation of chemical-resistant superweeds

#6) GMOs may have long-term unintended consequences on the environment

#7) GMOs collapse biodiversity

#8) GMOs put control over the food supply into the hands of profit-driven corporations

#9) GMOs may be harming pollinators

#10) The kind of scientists who collaborate with biotech companies are the most dishonest, corrupt and unethical scientists in our world

Read more …

I’m shocked!

• UK Bee Research Funded By Pesticide Manufacturers (Guardian)

Criticial future research on the plight of bees risks being tainted by corporate funding, according to a report from MPs published on Monday. Pollinators play a vital role in fertilising three-quarters of all food crops but have declined due to loss of habitat, disease and pesticide use. New scientific research forms a key part of the government’s plan to boost pollinators but will be funded by pesticide manufacturers. UK environment ministers failed in their attempt in 2013 to block an EU-wide ban on some insecticides linked to serious harm in bees and the environmental audit select committee (EAC) report urges ministers to end their opposition, arguing there is now even more evidence of damage. Millions of member of the public have supported the ban.

“When it comes to research on pesticides, the Department of Environment, Food and Rural Affairs (Defra) is content to let the manufacturers fund the work,” said EAC chair Joan Walley. “This testifies to a loss of environmental protection capacity in the department responsible for it. If the research is to command public confidence, independent controls need to be maintained at every step. Unlike other research funded by pesticide companies, these studies also need to be peer-reviewed and published in full”. The EAC report found: “New studies have added weight to those that indicated a harmful link between pesticide use and pollinator populations.” Walley said: ”Defra should make clear that it now accepts the ban and will not seek to overturn it when the European commission conducts a review next year.” She added that ministers should make it clear that attempts to gain “emergency” exemptions, as pesticide-maker Syngenta did recently, will be turned down.

Read more …

No more hobbits.

• New Zealand Dramatic Ice Loss Causes Severe Decline Of Glaciers (Guardian)

New Zealand’s vast Southern Alps mountain range has lost a third of its permanent snow and ice over the past four decades, diminishing some of the country’s most spectacular glaciers, new research has found. A study of aerial surveys conducted by the National Institute of Water and Atmospheric Research (Niwa) discovered that the Southern Alps’ ice volume has shrunk by 34% since 1977. Researchers from the University of Auckland and University of Otago said this “dramatic” decrease has accelerated in the past 15 years and could lead to the severe decline of some of New Zealand’s mightiest glaciers. Glaciers, made up of ice that collects above the permanent snowline, have their size and shape altered by various conditions, such as temperature, wind and rainfall.

The Niwa data shows that New Zealand’s glaciers experienced three growth spurts during the 1970s and 1980s due to a change in the Pacific climate system that generated more wind. But since that wind circulation has returned to its previous state, rising global temperatures have caused the glaciers to retreat dramatically. About 40% of the recorded ice loss has been in the dozen largest New Zealand glaciers, including the Tasman, Murchison and Maud glaciers. These huge slabs of ice and snow, supported by rock, take many years to respond to changing temperatures but are now collapsing, according to researchers. “We are losing the bottom half of these large glaciers as they sink into lakes,” Trevor Chinn, a glaciologist at Niwa, told Guardian Australia. “We are also losing access to the upper glaciers. We used to be able to walk up them but it’s much harder now because the ridges are turning into gravel cliffs and they collapse.

Read more …

“With global carbon emissions already too high because of fossil-fuel use, he says, “why do we have to look for more?”

• For New Zealand Town, Oil Brings Debate Over Economy, Environment (WSJ)

A government push to lure oil companies to New Zealand offers the promise of diversifying the country’s economy, long dependent on wool and, more recently, Hobbit-inspired tourism. But in the university town of Dunedin, the oil push has also locked residents in a debate over how to balance economic gains with environmental consequences. Local business leaders welcome the boats that have been prospecting offshore over the past few years. “It would be a real boon to have an industry that would be able to employ a lot of people,” says Peter Brown, the head of Dunedin’s port. Business from exploration vessels is “massive for us,” says Nicky Gibbs, who runs a business supplying boats from a quay-side warehouse here. “Our income will at least double in any month that you have them here.”

But ecotourism entrepreneurs and environmental activists say looking for oil undermines New Zealand’s work to conserve land and reduce carbon emissions, especially because the country itself has scant demand for new oil and gas sources. “You’d have to have rocks in your head” to believe petroleum prospecting is good for Dunedin ecotourism, says Lisa King. For three generations, her family has brought tourists to see endangered yellow-eyed penguins that nest on their 1,500-sheep farm. Driving a 1980s-vintage bus atop a bluff where penguins nest in the scrub below, Ms. King’s brother Brian McGrouther says watching helicopters fly to exploration ships “right out there on the horizon” this year unsettled him. An oil spill off the coast could hurt the birds or the already-waning fish populations they depend on for food. “Our community has concerns around risk,” says Dunedin Mayor Dave Cull. With global carbon emissions already too high because of fossil-fuel use, he says, “why do we have to look for more?”

Read more …