James Ensor The frightful musicians 1891

One of his people was brutally murdered this week

RED ALERT! High-level US Intel has warned me of a transnational operation targeting me for death. In the report below, I break down the nature of the threat. The agency intercepts show the highest threat level targeting a civilian ever recorded. I just received more information… pic.twitter.com/WmWOKDfhLz

— Alex Jones (@RealAlexJones) March 12, 2025

Inflation

CNN just aired Trump’s first inflation report—better than expected and reversing four straight months of rising inflation under Biden.

America is healing! pic.twitter.com/JyG74moYhG

— Libs of TikTok (@libsoftiktok) March 12, 2025

Maloney

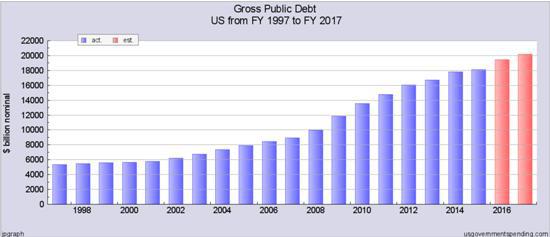

This is the story of USA's gold: there's only 0.04% left. pic.twitter.com/QJ5RUPEfYH

— Michael Maloney (@mike_maloney) March 12, 2025

THIS IS SUCH AN INSANE THING TO VISUALIZE pic.twitter.com/aJcPskSBWF

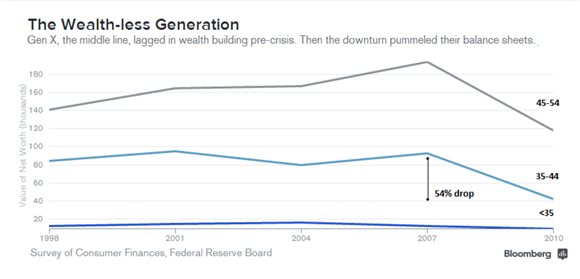

— Liz Wolfe (@LizWolfeReason) March 11, 2025

Lavrov and the US new media

“Trump is one of the most successful men in the world, but he’s a complete failure at being a dictator.”

• Trump Is the World’s Worst Dictator (Joecks)

Dictators crave power. President Donald Trump is using his power to give Americans more freedom. That’s a massive difference. Desperate to find an effective attack against Trump, some Democrats are recycling an old one. They claim he’s an authoritarian. Rep. Ayanna Pressley, D-Mass., invited laid-off federal workers to attend Trump’s recent speech to Congress. She said she was standing “shoulder to shoulder with people in defiance to a dictator.” That type of defiance led Democrats to callously withhold applause from a 13-year-old brain-cancer survivor simply because Trump introduced him. Shameful. Former Georgia gubernatorial candidate Stacey Abrams recently called Trump a “petty tyrant.” The Associated Press claimed that Trump “has embarked on a dizzying teardown of the federal government and attacks on long-standing institutions in an attempt to increase his own authority.”

These accusations aren’t new. Former President Joe Biden and Vice President Kamala Harris frequently labeled Trump a threat to democracy. Last year, historian Jon Meacham called Trump a “tyrant” who would cause the downfall of the American Republic. Trump has fed into this. After he attacked congestion pricing in Manhattan, the White House posted a picture of him wearing a crown. Trump said, “Long live the king.” While that was obviously not a serious claim to monarchical authority, it sent the propaganda press into a tizzy. Many Americans believe the worst about Trump as 41% of Americans say Trump is a dictator, according to a February YouGov poll. Those people aren’t just wrong–they have it backwards. Trump is doing the one thing dictators never do–reduce their own power.

It’d help to define some terms. Merriam-Webster says a dictator is “one holding complete autocratic control.” An autocracy is a “government in which one person possesses unlimited power.” Tyrant has a similar meaning–“an absolute ruler unrestrained by law or constitution.” Therefore, by definition, you can’t be a dictator while increasing freedom and shrinking the size and scope of government. It’s a contradiction. That’s what Trump is doing. He rolled back Biden’s target for electric vehicle sales. He’s unshackled the energy industry. He wants to undo Biden administration restrictions on dishwashers, shower heads and light bulbs. He’s ordered agencies to eliminate 10 previous regulations for every new one they put in place. He’s increasing freedom. He’s also pushing for a significant tax cut. Dictators aren’t known for wanting to let you keep more of your own money.

He’s laid off tens of thousands of federal workers. Another 75,000 federal workers took buyouts. The Department of Government Efficiency is attempting to reduce federal spending by more than $100 billion. He’s shrinking the government he runs. The Trump administration is even gearing up to eliminate the Department of Education. In early March, Education Secretary Linda McMahon laid out “our department’s final mission.” She wants “to send education back to the states and empower all parents to choose an excellent education for their children.” Indoctrinating a nation’s children is a powerful tool for any would-be dictator. Communist dictators wanted kids’ primary loyalty to be to the government. They sought to drive a wedge between children and their parents. Trump wants to give parents more control of their children’s education.

Now, Trump is governing aggressively. The executive orders have been fast and furious. He’s closed the border. He’s clearing out the deep state. He’s rooting out diversity, equity, and inclusion in the government. He’s recognized that men are not women. But an elected official changing government policy isn’t tyranny. That’s the point of having an election. It’d be tyrannical if an unelected, unaccountable bureaucracy could stop a democratically elected president from running the executive branch as he sees fit. Just look at the obstacles Trump faced in his first term. Trump is one of the most successful men in the world, but he’s a complete failure at being a dictator.

For now it’s just some statements, they haven’t been given the “plan” yet.

Rubio was doing fine so far, but here he leaves the impression that if Russia doesn’t respond to a “plan” they don’t even know, it means they don’t want peace. Confused comments galore.

• Moscow ‘Studying’ 30-day Truce Plan, Makes Steady Battlefield Gains (ZH)

The Kremlin says it is “studying” statements issued by the US and Ukrainian delegations following yesterday’s talks in Jeddah, and further describes Russian officials are waiting for a fuller briefing from the US on the proposal. The 30-day ceasefire plan calls for a halt to all the fighting on land, sea and in the air – which can be extended by mutual agreement, with a hoped-for path to a permanent truce based on negotiations in the interim. President Zelensky in a Tuesday X post said the ceasefire will apply to missile, drone and bomb attacks “not only in the Black Sea, but also along the entire front line” – though its as yet unclear what mechanism there will be to monitor this. The joint statement issued from Jeddah said the sides “will communicate to Russia that Russian reciprocity is the key to achieving peace.” Thus nothing will happen unless Moscow agrees.

Washington has agreed to lift the Trump ban on arms and intelligence for Kiev, while at the same Kiev and Washington agreed on inking a deal on Ukraine’s critical minerals “as soon as possible”. Russian state media is meanwhile reporting that President Putin is open to holding a telephone conversation with his US counterpart. On the potential for a new Trump call to discuss progress toward setting up negotiations and a truce, spokesman Dimitry Peskov said Wednesday, “We also do not rule out that the topic of a call at the highest level may arise. If such a need emerges, it will be organized very quickly. The existing channels of dialogue with the Americans make it possible to do this in a relatively short time.”

If it happens this would mark the second call since Trump’s inauguration, after the prior February 12 call. Theoretically this could lead to an in-person meeting between the two leaders if all goes well. Secretary of State Marco Rubio is traveling back from the meeting in Saudi Arabia, and gave some remarks to a press conference in Ireland:

• Deterrence against future attacks on Ukraine will be a crucial element of future negotiations.

• The US-Ukraine minerals deal benefits both nations and deepens Washington’s interest in Ukraine, but “I would not couch it as a security guarantee”.

• European sanctions against Russia will be part of the negotiations, making Europe’s involvement in the process essential.

• Any truce could be effectively monitored, but “one of the things we’ll have to determine is who both sides trust on the ground” to oversee it.Ukraine continues to hold little to no leverage, given Russia is fast taking back its territory in Kursk as of mid-week. Over a dozen settlements have been liberated, and by all accounts Ukraine forces are in retreat there, also as Russian troops are currently in the center of Sudzha town. One regional source says that the Russian advance has been swift especially after one particularly daring operation: “Reports over the weekend claimed that 800 Russian special forces had crawled for 15 kilometers through an unused section of pipeline, which once carried Russian gas to Europe via Ukraine, in order to carry out a sneak attack on Ukrainian forces in Sudzha,” writes Moscow Times. These developments mean that Putin is even less likely to agree to any temporary pause in fighting. In January statements he had warned the Kremlin will not sign off on any temporary truces – given Ukraine could just use it to rearm, resupply, and regroup. Moscow has less incentive to sign onto a deal unless territorial concessions are part of it, given that at this rate it can just keep advancing in territory, particularly in the Donbass.

“Steve Witkoff, the president’s special envoy, is making his way to Moscow this week again..”

• Trump Envoy Witkoff To Present Ceasefire Deal To Russia This Week – White House (RT)

US President Donald Trump’s special envoy Steve Witkoff will be traveling to Moscow later this week to deliver the US ceasefire proposal for the Ukraine conflict, White House Press Secretary Karoline Leavitt said on Wednesday. US Secretary of State Marco Rubio and National Security Advisor Mike Waltz met with representatives from Kiev in Jeddah on Tuesday to discuss a diplomatic end to the Ukraine conflict. In a joint statement afterward, Ukraine agreed to a 30-day ceasefire, while the US resumed all military aid and intelligence sharing with Ukraine. Waltz held a phone conversation with his “Russian counterpart” on Wednesday to discuss the proceedings, Leavitt told journalists in a media stakeout at the White House. Trump’s envoy will be traveling to Russia in person, she added. “Steve Witkoff, the president’s special envoy, is making his way to Moscow this week again to urge the Russians to sign on to this negotiation,” Leavitt told Fox News on Wednesday.

Russia and the US will hold a “big meeting” on Thursday, Trump told reporters in the Oval Office. When asked about potential US leverage on Moscow to accept the ceasefire deal, the US president warned of “devastating” financial measures he could impose. Moscow is “carefully studying the statements that were made as a result” of the US-Ukraine talks, Kremlin spokesman Dmitry Peskov has said. He cautioned against making rushed statements, and stressed that Russia first needs to receive “detailed information” on the proposed ceasefire teased by Waltz on Tuesday. Moscow has previously opposed any temporary truce in the Ukraine conflict, saying that it would simply be a repeat of the ill-fated 2014-2015 Minsk agreements, which it claims were used by Kiev’s Western backers to rearm them.

How can you “drag your feet” on a “deal” plan you’re not part of or party to?

• Kremlin Drags Its Feet On Ceasefire Deal As Armies Steamroll Ukraine (JTN)

Kremlin spokesman Dmitry Peskov on Wednesday indicated that Moscow was in no rush to reply to the American-Ukrainian plan for a 30-day ceasefire, an announcement that came as Russian armies drove battered Ukrainian troops out of a salient in its own Kursk Oblast and appear poised to advance along the front. On Tuesday, Ukrainian diplomats reached an agreement with American officials to restore military aid and intelligence sharing to Kyiv in exchange for agreeing to an immediate, 30-day ceasefire deal that they would present to the Russians. That exchange followed a public squabble at the Oval Office between Ukrainian President Volodymyr Zelensky and President Donald Trump in which Zelensky was removed from the White House. Zelensky had been in Washington to sign a mineral resources deal that was not executed. Ukraine recommitted to the deal as part of the Wednesday deal.

“Look, you are getting a little ahead of yourself, we don’t want to do that,” Peskov told reporters about the ceasefire, according to Russian outlet RIA Novosti. “Yesterday, when talking to the press, both [Secretary of State Marco] Rubio and [National Security Advisor Mike] Waltz said that they would pass on to us detailed information about the essence of the conversations that took place in Jeddah through various diplomatic channels. First, we need to get that information.” A ceasefire proposal appears to be unpopular with some members of the Russian government, with high-profile politicians condemning the idea. State Duma Deputy Viktor Sobolev, a member of the Duma’s defense committee and notably, an opponent of the pro-Putin coalition, called a temporary ceasefire “absolutely unacceptable,” saying it would allow Ukraine to “regroup and rearm” and “play into the hands of” Kyiv.

Russian troops are currently advancing along the front and posting substantial gains against the Ukrainian military at the moment and a ceasefire would potentially bring that momentum to a halt. Ukrainian forces last year invaded Russia directly, carving out a large swath of territory in the border “oblast,” or region, of Kursk, centered on the city of Sudzha. That location became a cauldron for the Ukrainians as Russia stiffened its defense, and the region became decidedly unstable in recent weeks after the recapture by Russian forces of Sverdlikovo, exposing the Ukrainian flank. A daring operation by Russian special forces, moreover, saw personnel travel through a drained pipeline to attack the Ukrainian rear, which triggered a rout and led to the Russian recapture of Sudzha on Tuesday. Geolocation-based territorial maps show varying degrees of Russian control in the city.

Complicating matters for both sides is their history of dubious and short-lived ceasefires since the outbreak of the Donbas War in 2014. The Minsk I and II Accords both followed a decisive Ukrainian defeat on the battlefields of Ilovaisk and Debaltsevo, respectively. In those battles, Ukraine fought Russian-backed separatists and not the official Russian military. Both sides blame the other for violating both agreements. Explicitly pro-Ukrainian analyst Julian Ropcke, senior editor for security policy at Bild-Zeitung, a German-owned tabloid, highlighted that history and implied a ceasefire deal would lead to a repeat of those incidents. “Amazed to see people thinking a ceasefire deal would stop Russia’s war in Ukraine,” he wrote on X. “After signing Minsk 1 in September 2014, Russia pumped in more troops and kept advancing, capturing Donetsk airport and 20 more towns and villages. After signing Minsk 2 in February 2015, Russia further advanced and captured Debalsteve and five more villages.”

The Russians themselves previously ruled out a ceasefire, with Russian President Vladimir Putin stating last year that he would not accept a temporary agreement and would only allow a ceasefire after a lasting accord had been reached. Minister of Foreign Affairs of the Russian Federation Sergei Lavrov, meanwhile, downplayed the seriousness of a ceasefire proposal ahead of the Ukrainian meeting with the Americans on Tuesday. “Zelensky is saying publicly that he doesn’t want any ceasefire until Americans give him any guarantees that they will destroy Russia with nuclear weapons. It’s not serious,” Lavrov told reporters on a Russia Today webcast. In an interview with bloggers Mario Nawfal, Larry C. Johnson, and Andrew Napolitano published Wednesday, moreover, Lavrov insisted that Trump had no desire to provide Ukraine with security guarantees while Zelensky remained in power.

“He has his own view of the situation, which he bluntly presents every now and then that this war should have never started. That the pulling Ukraine into NATO, is a violation of its constitution, a violation of the declaration of independence of 1991,” Lavrov said. “On the basis of which we recognized Ukraine as a sovereign state for several reasons, including that this declaration was saying no NATO.” The terms of the deal itself remain unclear and the joint statement from the State Department and Ukrainian government did not offer much detail other than a proposal for an immediate 30-day ceasefire, during which they hope to hold negotiations with Moscow. At present, Russia maintains a swath of Ukrainian territory from the Khariv to Kherson Oblasts, providing a land bridge to Crimea, which it annexed in 2014. Russia formally annexed four more regions amid the war but does not fully control any of them. Secretary of State Marco Rubio suggested that the Ukrainians would likely have to give up some territory in a peace deal.

“The most important thing that we have to leave here with is a strong sense that Ukraine is prepared to do difficult things, like the Russians are going to have to do difficult things to end this conflict or at least pause it in some way, shape or form,” Rubio told reporters Tuesday. “I think both sides need to come to an understanding that there’s no military solution to this situation.” The state of the Russian economy has also appeared as a contributing factor. Trump previously threatened the Russians with additional sanctions if they refused to come to the table, though the scope of those sanctions and their potential impact remains unclear. “Based on the fact that Russia is absolutely ‘pounding’ Ukraine on the battlefield right now, I am strongly considering large scale Banking Sanctions, Sanctions, and Tariffs on Russia until a Cease Fire and FINAL SETTLEMENT AGREEMENT ON PEACE IS REACHED,” Trump wrote on Truth Social last week.

Conversely, some analysts believe Putin may use the ceasefire offer to drag out negotiations and demand greater concessions for a pause. Bloomberg News, citing an unnamed person “close to the Kremlin,” reported that he may demand an end to arms shipments to Ukraine. “Putin won’t give a hard ‘yes’ or a hard ‘no,’” Carnegie Russia Eurasia Center Senior Fellow Tatiana Stanovaya told the outlet. “Even in a fantastic situation where Putin makes some gestures toward a truce, it would still be a temporary one and with very harsh conditions.”

“Moscow has repeatedly stated that the status of these regions is non-negotiable.”

• US Discussed Territorial Concessions With Ukraine – Rubio (RT)

American and Ukrainian delegations discussed the issue of territorial concessions during their meeting in Saudi Arabia, US Secretary of State Marco Rubio confirmed on Wednesday. Representatives from Washington and Kiev met in Jeddah on Tuesday to discuss a path toward a peaceful resolution of the Ukraine conflict. Kiev claims sovereignty over Crimea, the Donetsk and Lugansk People’s Republics, and the Kherson and Zaporozhye regions. These territories officially became a part of Russia after each of them held referendums in 2014 and 2022. Moscow has repeatedly stated that the status of these regions is non-negotiable. After a nearly 9.5-hour meeting, the two sides released a joint statement in which Kiev agreed to a 30-day ceasefire while the US announced the resumption of military aid and intelligence sharing with Ukraine.

Speaking to journalists on Wednesday, Rubio, who took part in the meeting, was asked to disclose more details about what had been discussed and whether the issue of territorial concessions had been brought up. The secretary stated that “we had conversations” on the issue but declined to disclose specifics. He emphasized that the key point was figuring out what the negotiation process would look like and what issues would be on the agenda. Rubio called it obvious that the Ukraine conflict cannot be resolved militarily, and that “neither side can militarily achieve their maximalist goals” and that the only way to stop the fighting is through negotiations.

On Monday, ahead of the Jeddah talks, Rubio also indicated that Ukraine would inevitably have to relinquish the goal of regaining all the territory it claims in order to facilitate peace negotiations with Russia. “Obviously, it’ll be very difficult for Ukraine in any reasonable time period to sort of force the Russians back all the way to where they were in 2014,” the secretary told the New York Times. Moscow has not yet commented on the statement released by the US and Ukraine following the talks in Saudi Arabia, nor has it yet reacted to the proposed 30-day ceasefire. Kremlin spokesman Dmitry Peskov has stated that Moscow first expects to receive the details from the US, which should be sent in the coming days.

“..it wants the big questions addressed front and centre. These include Ukraine’s aspiration to join NATO, the status of the four oblasts annexed by Russia since the start of the war and the protection of the Russian language in Ukraine.”

• All The Pressure Is Now On Zelensky After Ceasefire Offer (Proud)

I assess that Russia will agree with the U.S. on a proposed ceasefire in Ukraine. This would put the ball back in Zelensky’s court to sign a peace deal that could destroy him politically and may give President Putin the security assurances he has sought for over seventeen years. In a quite remarkable turn of events, the BBC announced that Britain had helped the U.S. and Ukraine agree on the need for a 30-day ceasefire. This is spin of the most disingenuous kind. The UK has done everything in its power to prevent the possibility of ‘forcing’ Ukraine into negotiations on ending the three-year war. Indeed, just last week, a prominent UK broadsheet reinforced this point in a searing editorial. The British narrative for three years has been that, with sufficient support and strategic patience, Ukraine could impose a defeat on Russia. To use a British military phrase, that plan ‘didn’t survive contact with the enemy’.

Ukraine’s sudden collapse in Kursk, after Russian troops crawled ten kilometres through a gas pipeline that President Zelensky had, with much fanfare, shut down in January, was an astonishing defeat. It was astonishing because it revealed what many western commentators had said since August 2024, that seizing a small patch of land in Russia would turn out to be a strategic blunder for Ukraine. Since the Kursk offensive was launched, Russia has occupied large tracts of land in southern Donetsk, including several important mines and one of Ukraine’s largest power stations. The basic maths show a significant net loss to Zelensky over the past six months. The bigger picture proves that the overall direction of the war has been moving in Russia’s direction since the failed Ukrainian counter-offensive in the summer of 2023. In Ukraine itself, the vultures are already circling in the sky as the body of Zelensky’s now six-year presidential term approaches its final breath.

Arestovich was quick to call for Zelensky to resign after the damaging shoot-out at the Oval Office. Poroshenko has come out to say Ukraine has no choice but to cut a deal. Even Zelensky’s former press spokeswoman has called for peace and implied that the Ukrainian government tries to limit free speech on the subject of a truce. Team Trump is apparently talking to the egregiously corrupt former Prime Minster Yulia Tymoshenko about the future, heaven help us. The domestic political space for Zelensky to keep holding out with meaningless slogans like ‘peace through strength’, and ‘forcing Russia to make peace’ is rapidly closing around him. That Ukraine has come to the negotiating table at all is a sign that it has been given no choice, since America paused the military and intelligence gravy train. There is nothing in the Jeddah meeting that suggests any change in the U.S. position towards Ukraine.

All that the ceasefire does, if Russia agrees to it, is pauses the fighting. Indeed, it goes further than the unworkable Franco-Ukrainian idea to pause the fighting only in the air and sea, allowing Ukraine to keep fighting on the ground. Ironically, the Jeddah formulation favours Russia, as a partial ceasefire would have provided succour to the Ukrainian army which does not enjoy strategic air superiority, despite its mass drone attack on Moscow and other parts of Russia. The joint U.S.-Ukraine statement calls for Ukraine and others to ‘immediately begin negotiations toward an enduring peace that provides for Ukraine’s long-term security’. If Russia agrees to a ceasefire, the clock will start on 30-days of intensive talks aimed at delivering a durable peace. Russia has said consistently that it will not agree to a ceasefire only; it wants the big questions addressed front and centre. These include Ukraine’s aspiration to join NATO, the status of the four oblasts annexed by Russia since the start of the war and the protection of the Russian language in Ukraine.

“Trump has spoken of substituting tariffs for the income tax. This is a brilliant thought. The income tax taxes labor and capital, factors of production. Thus income tax reduces GDP and living standards.”

• Free Trade: Ricardo’s Theory To Dispossess The British Aristocracy (PCR)

In their book, Global Trade and Conflicting National Interests published in 2000 by The MIT Press, Ralph E. Gomory and William J. Baumol proved that the free trade theory with which economists today are still indoctrinated is false. Economists have done their best not to notice that a part of their repertory is invalid. A number of years ago I presented Gomory and Baumol’s analysis to libertarian economists at the Mises Institute. They didn’t like it, but they couldn’t confute it. Over the years I have called attention to the defective theory that economists hold close to their breasts, but it is unpleasant information that they don’t want to hear. With Trump’s talk of tariffs, the invalid free trade theory is being used as a weapon against Trump. Those on Wall Street who are indoctrinated with free trade have been driving down the Dow with their panic.

As for Trump’s tariffs, at the present time it seems that often they are threats leveled at specific countries to get them to do what they should be doing or to get them to give their help to Trump’s agenda. For example, the initial tariffs Trump announced against Mexico and Canada were withdrawn once the two countries agreed to police their borders with the US to help halt the flow of immigrant-invaders into America. It remains to be seen whether a full blown tariff system is put in place. The American market is a large one, and although US consumer demand has been weakened by the offshoring of middle class manufacturing jobs, debt expansion has kept the American consumer market going, and the US remains a lucrative market for foreign produced goods.

It is possible that tariffs could recover their historic role in the financing of the US government. The US government was financed over most of its history by tariffs. It was not until 1918 that the income tax passed in 1913 affected the population, so the US government has been dependent on income taxation only for about a century. As I have explained, the introduction of an income tax resurrected a form of slavery as it gave government ownership rights in our labor. The definition of a free person is a person who owns his own labor. Today people subject to an income tax are in the same position as medieval serfs who owed part of their labor to feudal lords.

Trump has spoken of substituting tariffs for the income tax. This is a brilliant thought. The income tax taxes labor and capital, factors of production. Thus income tax reduces GDP and living standards. Classical economists, unlike the present day “junk economists” as Michael Hudson correctly calls them, said, correctly, that consumption, not factors of production, should be taxed. That is what a tariff does. If you don’t consume goods produced in other countries, you pay no taxation. Countries once understood that being dependent on imports of necessities, such as food, was a threat to national existence. A country could be subdued by the cutoff of food.

The British had the Corn Laws (corn was the term for all grains–wheat, barley, oats) that protected English farmers. The Corn Laws protected the incomes of the landed aristocracy, Britain’s leadership class during the years that Britain was the world power. As income is a basis of power, the rising British middle class wanted the power that was in aristocratic hands. David Ricardo, a bourgeois financier, attacked the incomes of the landed aristocracy with his concocted free trade theory. The repeal of the Corn laws shifted power from one class to another. The bourgeois gained and the aristocrats lost, and the British became dependent on food imports. The repeal was followed by Death Duties that appropriated the estates of the aristocrats, thus destroying the leadership class of Great Britain. Look at the post-aristocratic leadership of Britain. What do you see?

“What US President Donald Trump does not realize is that as soon as he gets rid of Zelensky… the Ukrainian political system will throw another clown at him..”

• Medvedchuk Cautions Trump On Dealing With Kiev (RT)

US President Donald Trump will not be able to reach any kind of agreement with Ukraine’s Vladimir Zelensky, nor with any other politician from his circle who may eventually replace him, exiled Ukrainian opposition leader Viktor Medvedchuk has cautioned. Zelensky’s presidential term officially expired in May 2024 as he has refused to hold a new election, citing martial law imposed during the conflict with Russia. Trump reportedly insisted earlier this week that the Ukrainian leader should hold elections and possibly step down. Writing in an article for the ‘Other Ukraine’ news outlet on Wednesday, Medvedchuk – who was ousted in 2022 – suggested that removing Zelensky might not help achieve peace, as the country’s political system could produce another leader with similarly obstructive tendencies.

“What US President Donald Trump does not realize is that as soon as he gets rid of Zelensky… the Ukrainian political system will throw another clown at him,” Medvedchuk claimed. Medvedchuk cited the recent talks between Zelensky and Trump in the Oval Office, which escalated into an unprecedented public confrontation, as proof that there is a pervasive culture among Kiev’s pro-Western political factions that prioritizes self-interest. Trump and Vice President J.D. Vance ended up accusing the Ukrainian leader of disrespectful behavior, a lack of gratitude, and an unwillingness to pursue peace. “America’s problem is that it’s not just Zelensky who doesn’t understand how he disrespected Trump, but most of his entourage doesn’t… Ukraine’s pro-Western politicians are not accustomed at all to considering the interests of others,” Medvedchuk argued.

He went on to claim that “Zelensky’s Ukraine is raising citizens to be spoiled, hysterical, illiterate, infantile and irresponsible; they believe that everyone owes them, and that they never owe anything to anybody in return.” Medvedchuk was leader of the Opposition Platform – For Life party, formerly the second-largest group in the Ukrainian parliament, until his arrest in April 2022. The party was subsequently banned, and Medvedchuk was sent to Russia in September of that year in exchange for several POWs. He founded the Other Ukraine movement in 2023 and acts as chairman of its council. In January, Zelensky imposed sanctions against him.

“We have 500 million people in Europe and they’re very upset that 330 million people across the ocean will not help 40 million people fighting 140 million people in Russia…”

• Why Won’t Europe Step Up and Help Ukraine? (Victor Davis Hanson)

Europe is greeting Ukrainian President Volodymyr Zelenskyy as if he’s a rock hero and giving us all sorts of dramatic, melodramatic, psychodramatic pronouncements that they are going their own way because of the Trump isolationism, and sometimes it’s Trump Jacksonianism. They can’t count on us. And Ukraine was the catalyst. But let’s look at that issue for a moment. We have 500 million people in Europe and they’re very upset that 330 million people across the ocean will not help 40 million people fighting 140 million people in Russia. In other words, of all the players in this drama, it’s Europe who should be in the driver’s seat. They have 500 million people. And yet, when we look at their expenditures, nine countries out of the 32, 11 years later, have not increased their NATO contributions to 2%. What should they be doing? They should be meeting with the Trump administration and telling the American people why countries in Europe still won’t meet their military responsibilities.

They’re also running a $200-plus billion trade surplus with the United States. They need to tell us—instead of just saying, “We don’t want to get in a tariff war; Trump is a protectionist”—just explain to us why we in Europe believe that we deserve a $200 billion surplus each year with the United States. And maybe you could explain why your tariffs are not symmetrical with ours. We just need to know. We need to know that very quickly, in fact. Another thing we need to know from Europe that we’re not getting, besides their surplus and the inability for all the NATO nations to meet their responsibilities and their promises of 11 years ago, is what is the strategy for Ukraine? They’re very angry that President Donald Trump temporarily cut off some aid to Ukraine to urge Mr. Zelenskyy to consider a truce so he can negotiate a more lasting peace and stop the Stalingrad slaughter between Ukraine and Russia.

I don’t even mean between Ukraine and Russia. It’s basically caused by Russia’s invasion of Ukraine and they’re on the defensive, but Ukraine has not been able, strategically, to show a pathway to strategic resolution and victory. Again, my interest and your interest is, what’s the alternative position by Europe? Is it we have 500 million people, we’re going to rearm, we’re going to divide up tasks? Finns have great artillery. They will supply the artillery to Ukraine. The Swedes and the French have good air forces. They will supply the air cover. The Germans have a tradition of great tank-making. They’re not very productive in tank production today. But perhaps they’ll promise to send 500 tanks. And then outline a position or a trajectory or a pathway where they can force, apparently, Russian President Vladimir Putin all the way back to where he was either in February 2022 or maybe even 2014.

But we don’t get any of that. We don’t get anything but rah-rah talk that we’re all Europeans. We’re not Donald Trump. We’re going to stick together. We’re going to put boots on the ground. We have what? Logistical capacity, armor, air force. Why can’t they just get together and get an exact, detailed plan of military wherewithal, coupled with a strategy, coupled with a renewed commitment to meet their NATO promises, coupled with an explanation to the American people why they feel that $200-plus billion trade surplus is essential to Europe’s survival and it is not a result of asymmetrical and unfair trade practices? That’s all we’re asking for.

“They want a peace guarantee that’s backed by American blood..”

• EU Accuses Trump of ‘Blackmailing’ Zelensky! (Pinsker)

Yesterday’s pacifists are today’s Rambos, it seems: 442 lawmakers in the 720-seat European Parliament just agreed to a joint declaration that “strongly deplores any attempts at blackmailing Ukraine’s leadership into surrender to the Russian aggressor for the sole purpose of announcing a so-called ‘peace deal.’” It passed via landslide: 61%. Not all EU politicians supported the measure: Melonian Nicola Procaccini, co-chair of the Conservatives (ECR), had tried to delay the vote arguing that a strong stance by the chamber would risk undermining the delicate ongoing discussion between the United States and Russia on the conditions of the ceasefire that were agreed yesterday in Jeddah — on which the Kremlin has yet to officially comment — casting a negative light on the efforts of the star-studded administration.

But the parliament rejected his request, and thus the joint resolution submitted by EPP, S&D, ECR, Renew and Greens (which followed a debate last February) passed with 442 votes in favor, 98 against and 126 abstentions. Which means, less than 14% of our “friends” in the EU had the testicular fortitude to oppose this brazenly anti-American statement. Thanks, guys. But perhaps we’re being unfair. Perhaps the EU genuinely, sincerely opposes browbeating a democratic nation — especially one that was just invaded and attacked! — into accepting a permanent, immediate, and unconditional ceasefire. Perhaps this isn’t another example of our European “friends” acting selfishly and cowardly, but a heartfelt moral position. Nah: Fun Fact: Just one year ago, this is the same European Parliament that demanded Israel commit to a ceasefire in Gaza!

Hypocrisy, thy name is EU: The European Parliament was able to call for a permanent, immediate, and unconditional ceasefire in Gaza only last month, on February 28, over 140 days after the genocidal war began. On that day, at the initiative of the Left, the European Parliament’s plenary in Strasbourg amended the 67th article of the 2023 Report on the ‘Human Rights and Democracy in the World and the European Union’s policy on the matter’ to include the call for an “immediate and permanent ceasefire in Gaza, allowing uninterrupted access to food and water for its inhabitants.” [emphasis added] It raises the very obvious question: Israel was attacked by invaders, too. Why is it moral and just to impose a ceasefire on Israel, but “blackmail” to do so to Ukraine? As Politico reported today:

“The European Parliament on Wednesday accused the Trump administration of “blackmailing” Ukraine’s leadership into capitulating to Russia with a forced ceasefire, and denounced Washington’s decision to leave the European Union out of negotiations.” It’s unclear why the European Parliament insisted on using the word “blackmailing.” We’re not threatening to disclose harmful information about Zelensky. Besides, how do you blackmail a guy who’s already been videotaped [playing piano with his dick]: Usually, the “victim” of blackmail is the one who lost his money. Not here: The EU is claiming that Zelensky was blackmailed because Trump DIDN’T pay him. It doesn’t make much sense.The Politico article continued: “The statement also condemned as “counterproductive and dangerous” the current attempts by the Trump administration “to negotiate a ceasefire and peace agreement with Russia over the heads of Ukraine and other European states.”

Russian President Vladimir Putin, they added, was being “rewarded” for Moscow’s ongoing three-year invasion of Ukraine. Even after all these years, Europe’s level of entitlement never ceases to astonish. What Ukraine and the EU really want is an American war guarantee. When you strip away the diplomatic niceties and coded language, Zelensky’s tantrum and EU’s fury can all be boiled down to this: They want a peace guarantee that’s backed by American blood. And because Trump doesn’t believe a Ukrainian war guarantee would “Make America Great Again,” he’s trying to find an off-ramp that averts World War III. He’s trying to stop a war between a nuclear superpower and a near-west ally that’s already cost 1.5 million lives.

By any objective standard, that’s a laudable goal. (If this had been Obama doing the negotiating, the Nobel Prize committee would’ve called an emergency meeting and earmarked him the next 10 awards.)Yet the EU not only objected, they actually called it “blackmail!” Sigh. If only they were willing to stand up to Putin like they stand up to Trump. Because the EU will do everything they can to protect Ukraine… just as long as they don’t have to do any of the fighting themselves.

“..the EU will discuss proposals to exclude military spending from the limits imposed by the Stability and Growth Pact..”

• 800 Billion Euros of Delusional Promises (Dionísio)

Von der Leyen has accustomed us to her grandstanding nihilism and disconnection from reality. Listening to her, one might sometimes get the impression that she sees herself as a kind of a god of creation, capable of transforming everything into matter with the mere power of her words. But of course, this is not true! The Russian economy has not collapsed in “tatters”; in fact, it has shown remarkable resilience, with wages growing at their highest rate in 16 years (a 21.6% increase compared to March of last year, and an 11.3% real growth after inflation—a dream for any Portuguese citizen), with the average wage expected to reach $1,113 by 2025, while everything remains cheaper than in any EU country.

It is also not true that the Russians have been stripping semiconductors from washing machines, nor is it true that the G7 has blocked Russian oil exports with their oil caps. In fact, Russia has never exported as much oil as it does today. The broker Ursula von der Leyen was also wrong when she claimed that the U.S. had the cheapest LNG—why would Trump want to lower prices now?—urging European countries to buy more shale gas, in violation of the European corporate sustainability directive, which requires suppliers to comply with environmental sustainability rules. As is well known, shale gas is extracted through fracking, a method highly damaging to the environment and banned in the EU. It seems that for the unelected president of the European Commission, directives are applied according to her whims.

But the latest delusion from the European Commission president is the announcement of a “massive boost”—as she loves these Americanized propaganda slogans with supposed creative power—to European military spending, which has already been increasing over time, but now she proposes to raise it by an additional 840 billion euros. It’s worth noting that she was Germany’s Defense Minister, during the scandal involving the sale of Trident submarines to Portugal, a deal that led to the imprisonment of several intermediaries. During that time too, von der Leyen, when investigated about several businesses, said that she lost the cellphone which helped her avoid jail. Similarly, during her time at the European Commission, she was involved in the vaccine procurement scandal. Certain character traits never disappear, and it’s a pity that these are the traits that determine who gets chosen for such positions. To our detriment.

Of course, the European Commission president could have proposed, instead, a massive diplomatic effort, a vigorous and mobilizing movement for world peace, a series of proposals for disarmament and the reduction of military stockpiles. Would it have worked? Maybe not, but as a leader of a vast population and the guardian of the keys that unlock the doors to death, it was her duty, first and foremost, to make every effort to negotiate not just peace, but a relationship of unity and cooperation across Europe, promoting prosperity and improving the living conditions of its people. Wouldn’t this be expected of any leader who claims to be democratic, humanistic, and a lover of freedom? The first step should never be to deepen the war.

She could even blame Vladimir Putin, demonizing him to unimaginable levels, but always keeping her feet on the ground and acknowledging the enormous responsibility she claims to bear: the guardian of the free world. A “guardian of the free world” is expected to make every effort to preserve that freedom. Instead, von der Leyen has done everything to erode and erase it from the map. Instead of setting an example of elevating and exalting our civilizational values, the European Commission and all the actors parading around the European Council have chosen to adopt a rigid, backward, isolationist, and sectarian stance. “I won’t move from here,” “I won’t talk to them,” “I won’t even think about them!” The EU is the only bloc today that behaves this way, except for Israel with the Palestinians. This should give us much to think about.

But this isn’t even the biggest problem with von der Leyen’s proposal. I’m not even talking about the arbitrariness of a commission composed of unelected bureaucrats proposing draconian rearmament plans, which the Council approves almost unanimously, without criticism, except for Orban. It’s more than that. Von der Leyen doesn’t have the authority to approve such a thing, nor can she force member states to spend this money, or compel them to approve eurobonds that would allow such a magnitude of debt. I’ve mentioned in other articles that by 2026, with a military budget exceeding 600 billion euros, the EU and its member states will already be close to spending 3-4% of GDP on armaments, as Trump desires—the same Trump they claim not to align with. With this increase proposed by von der Leyen, 5% of GDP would be guaranteed.

The truth, however, is that when we look at the proposals, we see that what’s on the table is a line of credit, available to member states, worth 150 billion euros, with the remaining amount coming not from the “European Union,” but from the member states themselves. To facilitate this, the EU will discuss proposals to exclude military spending from the limits imposed by the Stability and Growth Pact, allowing increased investment in armaments to not count toward deficit or public debt limits. In other words, if it’s for weapons, states can borrow as much as they want.

“..the news of lower inflation..”

• This Is Literally The Worst News Democrats Could Get Right Now (Margolis)

The left’s desperate attempts to paint Donald Trump’s second term as an economic disaster are crumbling faster than Hunter Biden’s art career after his daddy left office. After spending four years gaslighting Americans about “Biden’s amazing economy” while families struggled to put food on the table, Democrats have suddenly discovered that inflation exists — and they’re trying to pin it on Trump. How convenient. House Minority Leader Hakeem Jeffries (D-N.Y.) recently embarrassed himself on ABC News when he claimed, “Donald Trump and Republicans consistently promised that they were going to lower the high cost of living, and they’ve done the exact opposite.” That’s not what the facts say at all. Remember when the left couldn’t stop squawking about egg prices? Well, those same Democrats are mysteriously quiet now that egg prices have plummeted.

After reaching an all-time high of $8.17 per dozen in early March, egg prices have plummeted to $5.51. Democrats will be sad to know that this is below the $7 average price when President Trump took office in January. But that’s not all — gas prices have dropped for three straight weeks. Funny how we’re not seeing wall-to-wall media coverage of these positive developments. The Democrats’ economic fearmongering hasn’t aged well. Their claims that Trump would cause runaway inflation have been proven laughably wrong. For Our VIPs: Sorry Dems, but the Trump Recovery Is Underway. The latest economic data shows inflation cooling to 2.8% year-over-year in February, with monthly inflation at just 0.2% — both numbers came in below expectations.

Even CNN had to swallow their pride and report on these positive developments. CNN’s Matt Egan had to concede that the latest economic report was “good news on the economy,” and he emphasized that inflation is “really the number one issue for many Americans.” He noted that both the annual and monthly increases were “a step in the right direction, and both were better than expected.” “This is definitely very encouraging to see,” Egan continued, adding that it is going to “relieve some fears that inflation was perhaps reaccelerating.” He pointed out that February’s report “actually breaks a streak of four straight months… where the inflation rate was going in the wrong direction, right? It was going higher and higher. Finally, we’re seeing it dip.”

Americans may finally be seeing some relief from Bidenomics. Remember how Democrats were lamenting the recent stock market woes? The market has rallied in the wake of the news of lower inflation. This is exactly why Americans are turning their backs on the Democrats’ economic policies. While Biden and his cronies were telling us to lower our expectations and accept sky-high prices as the “new normal,” Trump has been delivering actual results. The stark difference between Democrat rhetoric and reality couldn’t be clearer. Maybe it’s time for Democrats to admit what the rest of us have known all along: their economic policies failed miserably, and Trump’s America First approach delivers results for working families. But don’t hold your breath waiting for that admission — they’re too busy planning their next round of failed talking points.

Smells like lawfare.

• Shutdown Schumer, the Shifty Democrats And a Government Standstill (Thorne)

D.C. Democrats have always ruled the shutdown game. When they are in charge of Congress, they are positively allergic to passing a budget, let alone a balanced one. They prefer to clobber Republicans over the head with shutdown showmanship, ultimately getting their spendthrift way while reaping the fringe benefit of demolished approval ratings for their rival party. Here’s how it works: Democrats sit on their hands and do nothing about spending until the budget deadline looms. Once they are operating in a time-crisis setting, Democrats put forth a grotesque, bloated, and usually immoral omnibus spending bill rife with grift for their friends and economic incontinence. Republicans naturally recoil at this abomination and refuse to vote for it. Democrats and their media allies then bray that Republicans are obstructionists.

If the deadline passes without an agreement, the blame is uniformly heaped upon the Republicans. It is always they, never the blameless Democrats, who shut down the government by refusing to pass the perfectly good spending resolution the Democrats produced. If there is a Democrat president, he does his part by making the shutdown as absurdly public and painful as possible. Who can forget Barack Obama somehow finding employees who were magically exempt from furlough to put up fences around open-air monuments and parks? And to enforce closure of 1,100 square miles of open ocean off the coast of Florida? The compounded applied pressure — generally combined with a greasy offering of pork — is intense enough to shake loose just enough persuadable Republicans to pass everything the Democrats want.

In fact, Republicans were savaged and rolled with this technique enough times that after a while, all the Democrats had to do was threaten to shut down the government to get enough GOP senators to capitulate. But things are different now. Democrats aren’t in power in Congress or the White House, and their media arm has finally lied itself out of relevance. On Tuesday, the Republicans in control of the U.S. House passed a continuing resolution that would keep the government running until this summer — without profligate spending increases — and passed it along to their colleagues in the Senate. Senate Minority Leader Chuck Schumer took to the floor Wednesday, still trying to play the Democrats’ game of blaming the Republicans for his party’s obstructionism. “Funding the government should be a bipartisan effort,” droned Schumer dolorously.

But alas, those dastardly Republicans “chose a partisan path, drafting their continuing resolution without any input — any input! — from congressional Democrats. Because of that, Republicans do not have the votes in the Senate to invoke cloture on the house CR.” Republicans brought this shutdown upon themselves, you see. Meanwhile, said Schumer, the virtuous Democrats were “unified on a clean April 11 CR that will keep the government open and give Congress time to negotiate bipartisan legislation that can pass.” Finally, he expressed his fervent hope that “our Republican colleagues will join us to avoid a shutdown on Friday.” But somehow, the blame does not seem to be falling on the Republicans this time. “With Schumer saying that Democrats are not ready to proceed, the Democrats hold the cards,” explains ABC News Delaware affiliate 6ABC. “If they do not furnish the votes to clear this procedural hurdle and get on to the bill, things could be at a stand still, and a shut down could be on the horizon.”

Meanwhile, House Democrats are urging their Senate colleagues to vote no on the funding bill they almost unanimously opposed when it passed through the House on Tuesday evening. “House Democrats are very clear. We’re asking Senate Democrats to vote ‘no’ on this continuing resolution, which is not clean, and it makes cuts across the board,” said Vice Chair Ted Lieu, flanked by five other members of House leadership at a press conference at the Issues Conference at the Lansdowne Resort. Lieu’s comments came before Schumer pushed for a 30-day clean stopgap bill. House Minority Leader Hakeem Jeffries said that conversations are “continuing” with Schumer all the way down to rank-and-file Democratic members about keeping the Democratic caucus united against the bill. “The House Democratic position is crystal clear as evidenced by the strong vote of opposition that we took yesterday on the House floor opposing the Trump-Musk-Johnson reckless Republican spending bill,” Jeffries said.

Was anything not fake?

• Old Joe’s Fake Oval Office – and Its Fake News Apologists – Exposed (Victoria Taft)

Joe Biden’s stage set is to the Oval Office what Dylan Mulvaney is to women: completely fake. We know that now, but there was a time when the media said all claims that Joe Biden was working from a virtual or fake Oval Office were considered to be “fake news.” Now, with Trump White House adviser Alina Habba personally finding the fake Oval Office set and showing it to the public in a video, people are discovering the story all over again. From January through September 2021, Joe Biden’s water carriers in the media went out of their way to “debunk” the claims that he was doing appearances from a phony Oval Office, a Hollywood-like set. Here’s a Reuters “fact check” that gives you an idea of how completely in-the-bag the White House media were for the man who ran for president from a set in his basement.

“Social media users have shared photos of President Joe Biden in the Oval Office, claiming they provide proof that the office is fake or a film set. The “evidence” includes a supposed change in wallpaper, allegedly darkened windows and claims that former President Trump is walking in the background outside the office. Reuters has examined each of these photos and found none of the claims to be true.” Reuters’ “debunking” went on to link Facebook posts that are no longer available, probably because Mark Zuckerberg’s social media platform instituted censorship on all posts that were from “right wing” sources that took a verbal shot at the man “saving democracy:”

“As so-called evidence, the post includes a series of photos [it] says show that Trump can be seen in the window behind Biden; the color of the rug has changed from Trump’s Oval Office; there is a tank outside the window; the background in the windows behind Biden does not match that of Trump’s Oval Office (here, here); the windows are darkened; the wallpaper is not the same as Trump’s Oval Office; and the post also includes photos of Oval Office movie sets”. When Politifact was at the center of the censorship industrial complex, it, too, “fact checked” the claim in its usual way; it took the claim, changed it, fact-checked the change, and pronounced the whole thing to be false. Here’s Politifact: “Since President Joe Biden was inaugurated in January 2021, false claims that his presidency is staged have proliferated online. We’ve debunked social media posts that a White House event was filmed at Tyler Perry Studios in Atlanta, and that his administration created a fake set for him to get a booster shot.”

Neither was true. Remember: the original claim was that Biden had a fake Oval Office. Charlie Kirk of Turning Point USA took a victory lap when he saw the Biden Administration optics as Joe got a COVID shot on a set: Here’s another Politfact fact check from September 2021 listing a Facebook meme as false. The headline reads, “No, White House didn’t create fake set just for Joe Biden’s booster shot.” The supposed fact-checking outfit was looking into a meme featuring a photo of Joe getting a COVID shot on the Hollywood-style set that said, “[The White House] created a fake set for (President Joe) Biden to get his booster shot. The entire Biden presidency is one giant charade.” You can see what they did there. The claim was that the Oval Office with the COVID shot was fake.

Nothing is real with these people, it’s all smoke and mirrors. But we’re supposed to entrust them with all of our personal health decisions? pic.twitter.com/9N5FPYm7pI

— Charlie Kirk (@charliekirk11) September 29, 2021

Politifact conflated that claim with the poster’s opinion that the “entire Biden presidency is one giant charade” and then denounced the whole thing as false. (Later, when proven wrong, Politifact went back and changed its fact check to include a revised version of the story it got wrong in a highlighted box with an “If your time is short” prompt to keep eyes off its incorrect story). Have I ever told you about Politi”fact”, as I call it, fact-checking a claim I made on the radio and my website about bike lanes in Portland? I provided photos and everything. The Politi”fact” reporter checked my claim and pronounced me a liar. When I called her out, the fake fact checker admitted that she checked when it was dark so she couldn’t see properly to verify my claim. She never removed her fake “fact check.”

And then, in October 2021, Newsweek tried to paper over Fourth Estate’s fake news about the Hollywood set in a clean-up piece entitled, “Why the White House Built a Fake Oval Office for Joe Biden.” There, the reporter pacified, “But there is a logical explanation as to why the White House has decided to construct a set version of the Oval Office.” This is the back story that Alina Habba referred to when she sent this video from the fake Oval Office this week. The fake Oval Office production set is in the Eisenhower Executive Office Building, which is part of the White House complex.

This map is from the White House tour office. Note how close the West Wing is to the Eisenhower Executive Office Building.

I cracked the case! DISGRATZ! pic.twitter.com/1hpRBObEb6

— Alina Habba (@AlinaHabba) March 11, 2025

Since it’s so close to the Oval Office (and probably accessible via tunnel or shortcut, but that’s classified), I propose liberating the rooms used by White House Correspondents in the West Wing and relocating the media to the auditorium in the Eisenhower Executive Office Building, where the fake Oval Office is. Move them all, offices and press room — the whole shebang. The West Wing is crammed full as it is, so why not move the fake news to the fake Oval Office?

“Made in China 2025” is a plan from 2015.

• Made in China 2025 – Revisited (Pepe Escobar)

Now let’s focus on China’s extremely complex domestic equation. At the opening of the Two Sessions, Premier Li Qiang came up with a rallying call for the whole nation to rise up to a series of “very challenging” goals, including growth of 5% in 2025 (it was 4.9% last year). Essentially, to revitalize the economy, Beijing will issue 1.3 trillion yuan (around US$182 billion) in ultra-long special treasury bonds. The deficit-to-GDP ratio was set at around 4%. The official policy of “opening up” will reach the internet, telecoms, healthcare and education industries – meaning more opportunities for foreign investors and possible partnerships up and down the industrial supply chain. All those moving parts of the ambitious Made in China 2025 tech project will be on overdrive: AI, smart terminals, the Internet of things, 5G, plus a new mechanism set up for “future industries” to support hi-tech domains,including biomaterials manufacturing, quantum technology, embodied intelligence and 6G.

Premier Li enthusiastically praised the role of regional growth drivers such as the Greater Bay Area – the super high-tech cluster in Guangdong province linked to Hong Kong. Predictably, he extolled the “one country, two systems” model and the further economic integration of both Hong Kong and Macau. Arguably this is the best analysis anywhere not only of why Hong Kong-based CK Hutchinson had to get rid of its port operations in the Panama Canal, but also because it offers a crisp Chinese evaluation of the “three powers” behind Trump 2.0: Wall Street, heavy industrial capital (energy, steel, mining) and Silicon Valley. CK Hutchison Holdings, founded in Hong Kong by notorious tycoon Li Ka-shing, essentially had to sell 80% of Hutchison Port Group, a subsidiary that owns 43 container ports in 23 countries, including a 90% stake in the Balboa and Cristobal docks at either end of the Panama Canal, because of hardcore geopolitics. Hutchison will continue to control its ports in China, including Hong Kong.

President Trump made a huge fuss about the BlackRock-led deal. The view in Hong Kong is more pragmatic. Hutchinson was not eager to engage in a furious court battle in US courts – not to mention potential sanctions. So they chose to opt for a “strategic exit”. Premier Li noted how consumption in China now is “sluggish” and, somewhat euphemistically, how there were “pressures on job creation and income growth”. Enter a promised “vigorous boost” to household demand, plus the creation of 12 million new urban jobs, with help focusing on fresh university graduates and migrant workers. In parallel, Beijing will expand its military budget by only 7.2% in 2025, reaching roughly 1.78 trillion yuan (US$ 245 billion). That’s not much compared to the Pentagon budget.

It’s quite enlightening to observe the proposals of the Two Sessions – and the tone-setting by Wang Yi – in relation to the analysis by a certified Asian star such as former Singaporean ambassador to the UN Kishore Mahbubani.

Kishore once again resorts to Sun Tzu, explaining how Chinese rulers always privilege the best way to win as not fighting kinetic wars. What matters is to coordinate expansion – epistemologically, educationally, economically, industrially, techno-scientifically, financially, diplomatically, militarily – under the aegis of deterrence. The bottom line is that Beijing will not be trapped by any possible, bombastic provocation coming from Trump 2.0. Once again, it’s all about “coordinated expansion”.Example. The Australian Strategic Policy Institute, partly funded by the Australian military, and frankly Sinophobic – and Russophobic – at least did something useful by developing a Critical Technology Tracker of 64 current, critical technologies. This is their latest report, from August 2024. It shows that between 2003 and 2007, the US led in 60 of 64 technologies. China led in only 3. Cue to between 2019 and 2023: the US led in only 7, whereas China led in 57 – including semiconductor chipmaking, gravitational sensors, high-performance computing, quantum sensors, and space launch technology.

All that is inextricably linked to the successful planning – and achieved targets – of Made in China 2025. Talk about two five-year plans back to back (Made in China was conceived in 2015). So this is what China 2025 will be all about: serious investments coupled with lots of partnerships with the whole Global South. Once again, in a sort of Sun Tzu framework tweaked by Bruce Lee, China is bound to use Trump 2.0 and the coming mix of confrontation, competition and periodic negotiation as a trampoline to expand its global reach even further. That might be one of the unstated meanings of what Xi Jinping told Putin in Moscow nearly two years ago: “Changes unseen in a century.” Beijing will be sure to find shelter from the storm – any storm. And without having to fight a single kinetic war.

Mother and son

Mother: This is the last time I show you how to go down..

Son: pic.twitter.com/ifOxnLOGYf

— Nature is Amazing ☘️ (@AMAZlNGNATURE) March 12, 2025

Humming rain

https://twitter.com/Rainmaker1973/status/1899897177243312326

Puli

https://twitter.com/gunsnrosesgirl3/status/1899758633291759933

https://twitter.com/buitengebieden/status/1899746630837887170

Book of Enoch

https://twitter.com/JasperUnleashed/status/1899676260550545736

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.