Berthe Morisot After luncheon1881

Catchy, but A Christmas Carol might be a better example. ‘Investors’ believe the ghosts are real, just like they believe markets are real. Read yesterday’s 2019: Zombie Markets Before The Fall to understand why that is nonsense.

• Investors Are Speechless: “It’s Like Watching Pulp Fiction” (ZH)

With market action becoming increasingly surreal and the panicked, vertigo-inducing bear market rallies (spawned by a record $64 billion pension fund reallocation into stocks in a historically illiquid market) reminiscent of the chaos observed at the depths of the financial crisis, it is only appropriate that some of the quotes Bloomberg picked for its daily wrap piece which commemorated the biggest intraday reversal since 2010, be just as surreal. “Investors are becoming desensitized,” Bryce Doty, SVP at Sit Investment Associates, told Bloomberg, then continued the verbal poetry: “It’s like watching ‘Pulp Fiction.’ Halfway through, the violence doesn’t even bother you anymore.”

He’s right, although whereas the market “violence” in past weeks was one directional, this week it has developed a twist to trap both the bulls and bears, and while the latest Dow swing (of nearly 1000 points) was only slightly bigger than the average up-and-down move last week, back then equities were merely tumbling, now it tends to drop early in the day then soar in afternoon trading. So fast forwarding to the post-Christmas chaos – which this website explicitly warned about when last Friday we said to “Brace For Seismic Volatility” – strategists are starting to ask: if days like these are now normal, is there a context in which the whole three-month rout starts to feel routine?

There are the optimists like Jim Kelleher, director of research at Argus Research, who said market turmoil that happens when the economy is holding up reminds him of past stock declines that ended gently. Unless evidence emerges of deep global growth erosion, what’s going on now “will prove to be shorter and more shallow than the declines experienced in ‘classic’ bear markets.” Others are not so sure: “Investors are wondering if this will be a crash,” said Dave Campbell, a principal at San Francisco’s BOS, who nonetheless still managed to put a favorable spin on events.

“The risks are there, but they’re always there. They’re more heightened but it’s not the most likely outcome. The economy continues to grow – maybe a little more slowly – but next year markets will have hit their lows and we’ll be on the rebound.” Then there are those who echo what we asked yesterday, namely if this is only a bear market rally, although granted a very furious one: as Bloomberg writes in its second end of day wrap, “on the surface, the rally is good news for investors searching for a bottom after a three-month sell-off sent the S&P 500 to the brink of a bear market. But days like this are rarely good omens.”

What’s happening is much more profound than bear markets.

• Investors Fear Historic Market Rebound Was Just A ‘Wicked Bear Trap’ (MW)

It’s been a rough three months, and a particularly difficult December, for stocks, however. The Nasdaq is in a bear market while the Dow and S&P 500 are solidly in correction territory and nursing hefty December losses and year-to-date declines. Some market watchers find big bounces in such an environment less than convincing. Russ Mould, investment director at AJ Bell, offered up the table below in a Thursday note. It takes a look back at the 20 biggest one-day percentage gains for the S&P 500 going back to 1970, a stretch that includes nearly 12,800 trading days.

[..] Bulls can take encouragement from the fact that three of the 17 other days that saw an advance of 5% or more came immediately in the aftermath of the October 1987 crash, “when buying did prove a good plan,” while two more came in March 2009, when the S&P 500 hit bottom and began its current bull run. But here’s the rub: Eight of those gains of 5% or more came during the 2007-09 bear market and three more occurred during the downturn of 2000-03, “to suggest there is still a risk that this year’s Boxing Day bonanza could be no more than a wicked bear trap set to lure investors into more trouble,” Mould wrote ahead of Thursday’s open, saying that traders and investors “will be looking out for a couple of further definitive signals before they decide it really is time to buy on the dips following this year’s Christmas selloff.”

Indeed, market veterans warn that massive, one-day rallies are often more characteristic of downturns, occurring as selloffs lead to significantly oversold technical conditions that leave markets ripe for short covering only to give way to renewed selling once the frenzy of forced buying is exhausted. Investors who short a stock are essentially betting that its price will fall by first borrowing the shares, but those traders can be forced to buy shares back if prices suddenly swing higher, which, in turn, can amplify price swings.

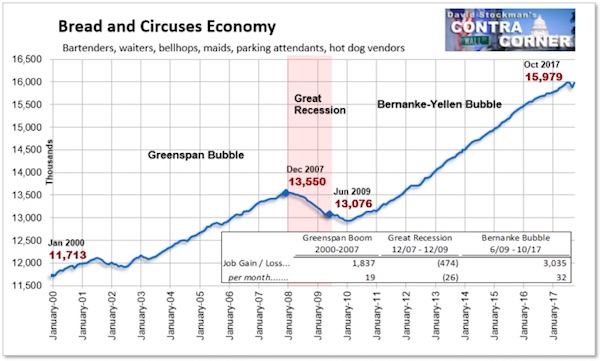

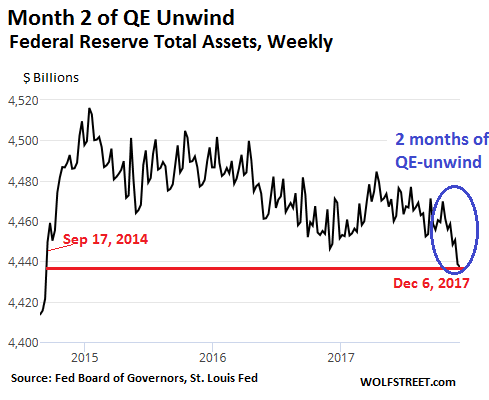

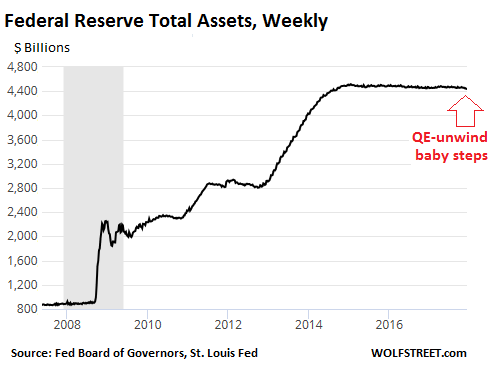

When is all this cheap money going to bail out?

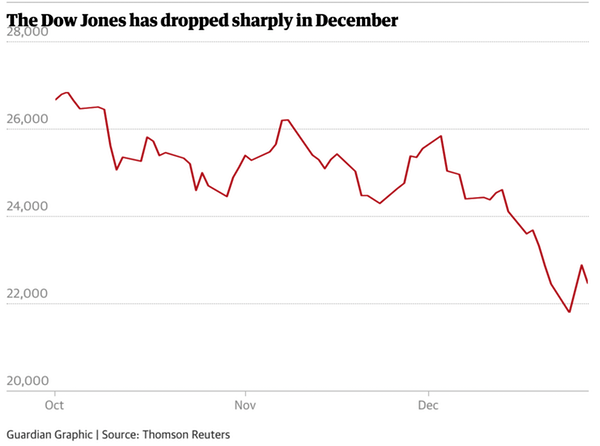

• US Stocks Follow Record-Breaking Rise With Day Of Wild Swings (G.)

US stock markets seesawed again on Thursday as a record-breaking day of gains gave way to selling once again before rising again in late trading. By lunchtime all the major US markets were in the red, with the Dow Jones Industrial Average down 1.4%, the S&P 500 losing 1.5% and the Nasdaq off 1.9%. But most US markets ended the day in the black with the Dow up 1.13%, the S&P adding 0.85% and the Nasdaq 0.38%. After a series of often wild swings the US stock markets are still on course to end the year in bear market territory – triggered when markets fall 20% from their most recent high. A bear market would be the first in close to a decade.

Michael Antonelli, managing director, institutional sales trading at Robert W Baird in Milwaukee, said he expected more dramatic days aheads. “There’s only two more sessions left before the end of the year. I would expect volatility to reign. It’s dug in like a tick,” he said. Stocks had fallen for four consecutive days through Monday. Wednesday’s rally – with the Dow adding close to 5% and a record 1,080 points – could have signaled a turning point. Markets closed up in Japan and Australia but European markets sank again on Thursday, with the FTSE closing down 1.5% in London, sinking to it’s lowest level since July 2016 (a month after the Brexit vote). Germany’s DAX closed down 2.3% and France’s CAC fell 0.6%

Stock markets have become increasingly volatile in recent months and recorded both record losses and record gains this week. The Dow Jones plummeted 653 points on Monday, capping its worst week in a decade and marking its “worst day of Christmas Eve trading ever”.

The low VIX shows you how out of touch the financial world is. There can be only one reason for it: the Fed.

• VIX Is About To Do Something It Hasn’t Done Since 2011 (MW)

It shouldn’t come as a surprise to anyone paying attention that stock-market volatility is on the rise. But here’s a statistic that underlines the phenomenon. The Cboe Volatility Index, commonly known as the VIX and often, if not sometimes derisively, referred to as Wall Street’s fear gauge, was on track Thursday to close above 30 for the fourth day in a row. The index, an options-based measure of expected volatility over the coming 30-day period, traded at 32.92 in recent action, up 2.51 points. According to data compiled by Dow Jones Market Data, that would be the longest streak since a 14-day run that ended in November 2011, surpassing a three-day period seen in August 2015. The index has a long-term average near 20.

It’s certainly been a week of whipsaw trading for investors. The S&P 500, Dow Jones Industrial Average and Nasdaq Composite all falling more than 2% in Monday’s holiday-abbreviated session to post the worst Christmas Eve performance in Wall Street history, only to roar back on Wednesday to more than reverse those declines as the S&P and Dow jumped 5% each and the Nasdaq gained 5.8%. On Thursday, stocks were back under pressure, with the Dow giving up more than half of the previous day’s 1,086-point gain.

Robert Fisk is done. Comparing Putin to Hitler on the brink of 2019 is all we need to know. BTW, Mattis DID consider running.

• Watch Out When Men Of War Come To The Rescue (Fisk)

When a general popularly known as James “Mad Dog” Mattis abandons a really mad American president, you know something has fallen off the edge in Washington. Since the Roman empire, formerly loyal military chiefs have fled crackpot leaders, and Mattis’s retreat from the White House might have the smell of de Gaulle and Petain about it. De Gaulle was confronted by an immensely powerful hero of the people – the Lion of Verdun – who was, in his dotage, about to shrug off the sacred alliance with Britain for Nazi collaboration (for which, I suppose, read Putin’s Russia). The decision was made to have nothing to do with Petain, or what Mattis now refers to as “malign actors”. De Gaulle would lead Free France instead.

Mattis has no such ambitions – not yet, at any rate – although there are plenty of Lavals and Weygands waiting to see if Trump chooses one of them for his next secretary of defence. Besides, history should not grant Trump and Mattis such an epic panorama. After all, no Trump tweet could compare with Petain’s 1916 “We’ll get them!” (“on les aura”) slogan, and the dignified, cold and fastidious de Gaulle would never have lent himself to the rant Mattis embarked upon in San Diego in 2005: “You go into Afghanistan, you got guys who slap women around for five years because they didn’t wear a veil. You know, guys like that ain’t got no manhood left anyway. So it’s a hell of a lot of fun to shoot them. Actually, it’s a lot of fun to fight. You know, it’s a hell of a hoot. It’s fun to shoot some people. I’ll be right upfront with you, I like brawling.”

If investigations like this are not held, the US risks becoming a very volatile place.

• Giuliani: Mueller Must Be Investigated For Destruction Of FBI Evidence (Hill)

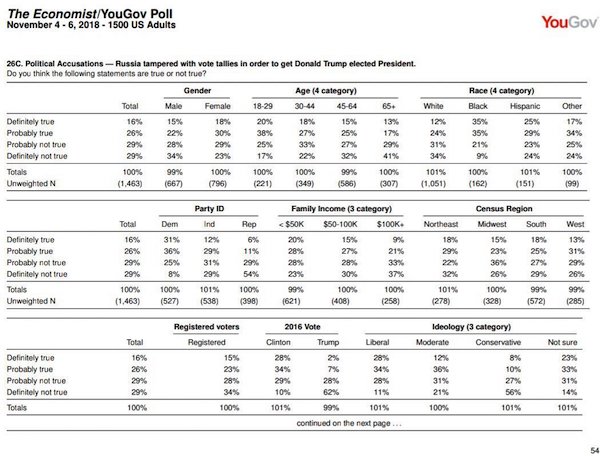

Rudy Giuliani has an unmistakable New Year’s message for special counsel Robert Mueller: It is time for the chief investigator in the Russia case to be investigated in 2019. In wide-ranging interviews with Hill.TV’s Buck Sexton and me on Wednesday and Thursday, President Trump’s defense lawyer pointedly accused Mueller’s office of destroying evidence by allowing text messages from now-fired FBI official Peter Strzok and his FBI lover, Lisa Page, to be erased in the Russia probe. “Mueller should be investigated for destruction of evidence for allowing those text messages from Strzok to be erased, messages that would show the state of mind and tactics of his lead anti-Trump FBI agent at the start of his probe,” Giuliani said.

The Justice Department inspector general (IG) reported this month that it found large gaps in the preservation of official government text messages between Strzok and Page, the two top FBI agents who helped to start the Russia probe in 2016, who were having an affair at the time, and who expressed disdain for Trump. The report said a technical glitch was to blame for the FBI’s failure to save those text messages, but the IG was able to recover more than 19,000 from the early part of the Russia probe before Mueller was named special prosecutor. However, the IG said it was unable to recover messages from the time Strzok and Page worked for Mueller’s office in spring and summer 2017 because the memories of both FBI officials’ government phones were wiped clean by technicians.

That erasure occurred after Strzok and Page left Mueller’s team over revelations they exchanged anti-Trump text messages, including one string in which they talked about stopping Trump from becoming president. “That should be investigated, damn it, that should be investigated fully. You want a special counsel, get one for that,” Giuliani said.

Really? The UN is going to pick sides? Against Trump and pro Big Tech?

• Donald Trump ‘Worst Perpetrator’ Of Fake News: UN Special Rapporteur (Pol.eu)

The President of the United States is the “worst” perpetrator of misinformation on the internet, the U.N. Special Rapporteur on Freedom of Expression and Opinion David Kaye said in an interview published today. “Governments are real offenders when it comes to disinformation,” said Kaye. “In my own country, the United States, the worst perpetrator of false information is the President of the United States.” The problem of fake news emanating from governments should be covered by journalists, the rapporteur said. Platforms such as Google, Facebook or Twitter can help the broader fight against disinformation — bots, foreign interference… — but should not remove content, Kaye said.

“The platforms, I think, can do things that are more technical as long as they are not evaluating content. There are things they can do. They can’t just zap it and say, “This is fake news, it’s off the platform.” According to Kaye, platforms should focus on reducing spam and bot accounts rather than on policing content. And even bots are “tricky, because there are good bots and bad bots.” Google, Facebook and Twitter are under intense pressure from the European Commission to tackle fake news ahead of the European election in May 2019.

When did the Yellow Vests become an insect species?

• Macron Lost Authority After Caving To Yellow Jackets – EU’s Oettinger (Pol.eu)

The EU will accept a French budget deficit above the EU’s 3 percent ceiling in 2018 “as a one-time exception,” Budget Commissioner Günther Oettinger said in an interview published Thursday. Oettinger told the Funke media group of German newspapers that French President Emmanuel Macron had “lost authority with his budget for 2019” by upping his spending in response to the Yellow Jackets protests, “but he remains a strong supporter of the European Union.” Brussels reviewed the French budget several weeks ago and won’t be revisiting it, Oettinger added. “It crucial now that Macron continues his reform agenda, especially in the labor market, and that France remains on its growth track.”

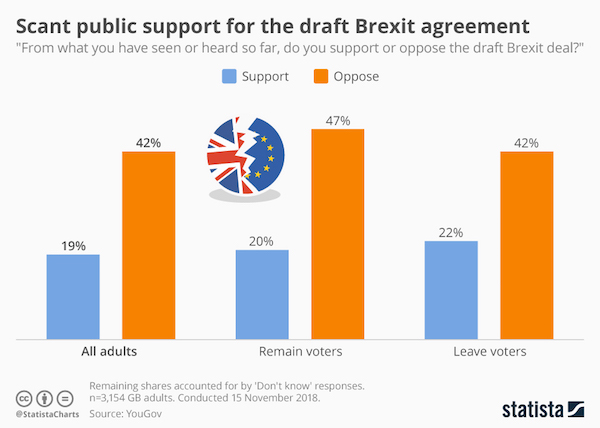

“Under this condition, we will tolerate a national debt higher than 3 percent as a one-time exception. However, it must not continue beyond 2019.” Oettinger also told the Funke media group that there’s still a chance Britain’s parliament will vote in favor of Prime Minister Theresa May’s Brexit deal in January and that “there is certainly no majority for a disorderly Brexit or for a new referendum.” If the U.K. leaves the bloc without a Brexit deal, it will become “a third country like Morocco or Azerbaijan,” Oettinger said. He added that if Britain withholds its divorce payment in 2019, Germany would be left footing the bill “in the mid-three-digit range” of hundreds of millions of euros.

The sudden urgency is too late.

• Corbyn Wants May To Recall MPs Early Over Critical Brexit Vote (Ind.)

Jeremy Corbyn has challenged Theresa May to cut short the Christmas recess and recall parliament early in the new year in order to bring forward a critical vote on the Brexit deal. In an interview with The Independent, the Labour leader said he believed the prime minister and her allies were engaged in a “cynical manoeuvre” to run down the clock and offer MPs the “choice of the devil or the deep blue sea”. His remarks come as the Commons prepares to vote on the UK-EU deal in the week beginning 14 January – in what is being billed as the most significant moment in parliament for a generation.

With just 91 days remaining until Britain formally leaves the European Union, Mr Corbyn also reiterated it is a matter of “when, not if” Labour attempts to force a general election by tabling a motion of no confidence in the government, which he signalled will come in the aftermath of Ms May’s deal failing to receive MPs’ backing. But he refused to be drawn on whether a Labour government would seek to extend Article 50, given that just weeks would remain for any renegotiation of Britain’s exit from the bloc, and claimed: “Lots of things are possible, the EU has longform on reopening and extending negotiations, but let’s not jump too many hoops when we haven’t arrived at them.”

Speaking in his constituency office in Islington, north London, ahead of Christmas Day, he poured scorn on the prime minister’s decision earlier this month to pull a vote on the deal in the face of near-certain defeat and instead begin a last-ditch attempt to seek assurances from the EU to assuage Brexiteers’ concerns over the contentious issue of the Irish backstop. Pressed on whether he believed Ms May should now recall parliament a week early, on 2 January, the Labour leader replied: “Well it is in her hands to recall parliament. I want us to have a vote as soon as possible, that’s what I’ve been saying for the past two weeks, and if that means recalling parliament to have the vote let’s have it.

“But it looks to me the government has once again reneged on that and tried to put it back another week. We need to have that vote so a decision of parliament can be made. What I suspect is that it’s a completely cynical manoeuvre to run down the clock and offer MPs the choice of the devil or the deep blue sea.”

For some, perhaps.

• Brexit’s Aura Of Inevitability Is Vanishing (Kaletsky)

In times of political turmoil, events can move from impossible to inevitable without even passing through improbable. In early 2016, the idea of Britain leaving the European Union seemed almost as absurd as the next American president being the six-time bankrupt and serial sex pest Donald Trump. A few months later, Brexit and the Trump presidency were universally acknowledged as the inevitable consequence of an anti-elitist, anti-globalization backlash that was predictable decades ago. This sense of inevitability, far more than genuine anti-European conviction, is what has discouraged Britain from changing its mind about a pointless and self-destructive policy that few voters cared about until 2016.

The message from post-Brexit polling and focus groups has been: “We all know that Brexit has to happen, so why don’t the politicians just get on with it?” But with the Brexit process now moving toward its climax, another outcome is moving from impossible to inevitable: Britain could soon change its mind and decide to stay in the EU. This reversal of fortune could begin next month, when Prime Minister Theresa May is expected to lose the decisive parliamentary vote on her Brexit deal. If and when this defeat happens, May will face two unpalatable options. She could preside over a “No Deal” rupture with Europe — tantamount to a declaration of economic war against the EU — and risk a 2008-level economic crisis accompanied by a border upheaval in Ireland that could reignite the “Troubles.”

Or she could break her extravagant promises to honor the “people’s instruction” from the 2016 referendum and allow a new popular vote that might cancel Brexit. To avoid this invidious choice, May could try one last time to push her proposals through Parliament after losing the vote scheduled for the week of January 14. But if this last-ditch effort fails, her choices will be reduced to a No Deal rupture with Europe and a new referendum.

Varoufakis is basically right, but I can’t see a three-year People’s Debate tackling 6 issues. Brits will think: we can’t even deal with one issue. And an extension of a transition period until 2022 is hard to see, too.

• Turning Brexit Into a Celebration of Democracy (Varoufakis)

With weeks left before the UK leaves the EU by default, none of the three main options on offer – a no-deal Brexit, Prime Minister Theresa May’s withdrawal agreement with the EU, and rescinding Article 50 in order to remain in the EU – commands a majority in Parliament or among the population. Each generates maximum discontent: The no-deal scenario strikes most as a dangerous plunge into the unknown. May’s deal appalls Remainers and is seen by most Leavers as the kind of document only a country defeated at war would sign. Lastly, a Brexit reversal would confirm Leavers’ belief that democracy is allowed only when it yields results favored by the London establishment.

The conventional wisdom in Britain is that this impasse is lamentable, and that it proves the failure of British democracy. I disagree on both counts. If any of the three immediately available options were endorsed, say, in a second referendum, discontent would increase and the larger questions plaguing the UK would remain unanswered. Britons’ reluctance to endorse any Brexit option at present is, from this perspective, a sign of collective wisdom and a rare opportunity to come to terms with the country’s great challenges while re-thinking the UK’s relationship with the EU. But to seize it, the UK must invest in a “People’s Debate,” leading, in time, to a “People’s Decision.”

The People’s Debate must address six issues: the British constitution, including the creation of an English parliament or multiple regional English assemblies; the electoral system and the role of referenda; the Irish question, including the possibility of joint UK-Irish sovereignty over Northern Ireland; migration and freedom of movement; Britain’s economic model, particularly the outsize role of finance and the need to boost green investment across the country; and of course the UK-EU relationship.

Proudly poisoning your food for 100 years.

• Crime and Punishment in an Age of the Jungle (Vallianatos)

[..] studies funded by EPA and others have been connecting farmers’ sprays to ecocide, disease and death. I traced the catastrophic decline of honeybees to the neurotoxic pesticides of the farmers. This brought me in touch with a caring beekeeper from Colorado named Tom Theobald. He was telling me his days as a beekeeper were coming to an end. In December 2018, he summarized 44 years of living with honeybees and the poisoners of honeybees. “Almost every problem we face,” he said, “can be traced to a Criminal Corporatism and an out of control Capitalism. If there is a profit to be made, there is little regard paid to the consequences. If challenged, we get denial, diversion, excuses and junk science. It simply doesn’t matter how many people are sickened or die, how many species are pushed to extinction or how seriously the planet is compromised.”

[..] We are fortunate we have a reliable history of that irresponsible age by Deborah Blum, director of the Knight Science Journalism Program at MIT. A prolific and outstanding writer, Blum is telling a story that illuminates both early twentieth century, but, perversely, our own times. Her timely book, The Poison Squad: One Chemist’s Single-Minded Crusade for Food Safety at the Turn of the Twentieth Century (Penguin Press, 2018) paints an unforgettable picture of an American table full of “adulterated” food. Milk and meat were routinely treated with formaldehyde, a carcinogen used for embalming of corpses. Wine drinkers drank a liquid that had nothing to do with grapes. Wine was made from “tannin and coal tar.”

The poisonous copper sulphate dressed canned vegetables. The cleaning chemical borax coated butter. Honey had nothing to do with real honey. It was rather a version of “thickened, colored corn syrup.” Coffee was usually “sawdust, or wheat, beans, peas and dandelion seeds, scorched black and ground to resemble the genuine article.” Bread was baked with alum or chalk, or “sawdust chopped up very fine or gypsum in powder… Terra alba just out of the mine.” There was no law against the poisonous adulteration of food and drink. However, the adulteration of food, Blum says, gave sickness and death, potentially to huge number of Americans. Tainted milk alone killed thousands of children in New York City every year.