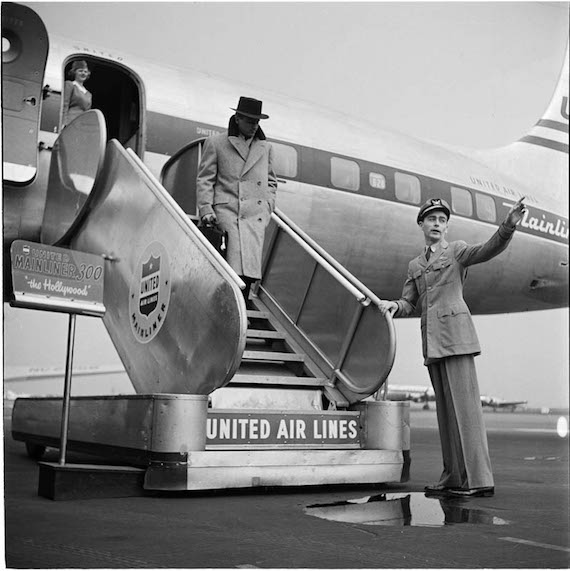

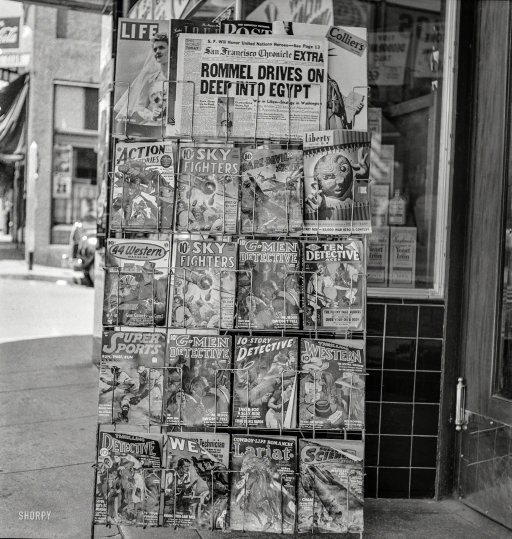

Russell Lee “Yreka, California. Magazine stand” 1942

” If the remaining $1.5 trillion is indeed on the balance sheets of financial institutions, that would represent about 1.5% of the total assets of all the world’s publicly traded banks. [..] U.S. subprime mortgages represented less than 1% of listed banks’ assets at the end of 2007.

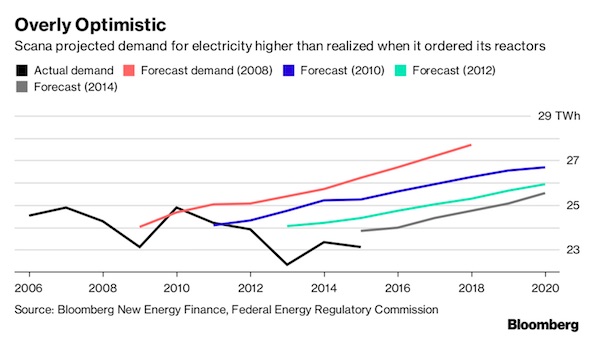

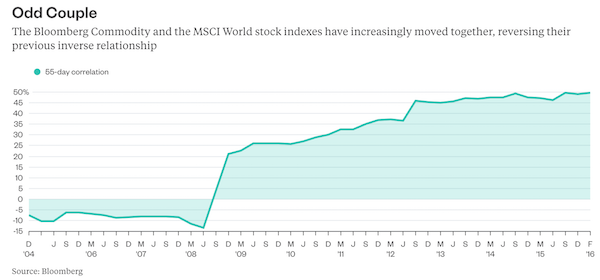

• Commodities’ $3.6 Trillion Black Hole (BBG)

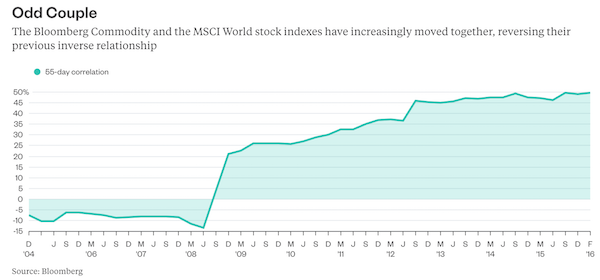

Markets rallied this week after it became clear that some of the world’s biggest oil producers were going to curb production to stop prices from dropping any further. The news also buoyed other commodities, from coal to iron ore. Then everything dropped on Thursday with oil. Before the global financial crisis, a rise in raw-materials prices used to be bad news for the economy and stocks in general. Since central bank easy-money policies took off, that’s become a thing of the past:

One possible explanation is the level of exposure that banks and investors have to the industry. The 5,000 biggest publicly traded companies tracked by Bloomberg in the iron and steel, metals and mining, and energy sectors have a combined $3.6 trillion in debt, according to their most recent financial reports, double what they had at the end of 2008. Much of the increase is due to money that was borrowed to dig mines and wells whose output, at previous prices, would have easily repaid most maturing bonds and loans. But as commodity prices have tumbled, so has the ability of companies to meet their obligations. The Bloomberg Commodity Index is still only 3.9% higher than a 25-year low hit on Jan. 20. Five years ago, those companies tracked by Bloomberg had more operating income than debt, on average. Now, it would take them more than eight years’ worth of current earnings, without provisioning for interest, taxes, depreciation or amortization, to clear their combined net obligations.

Yield-hungry bond investors sucked up a lot of the debt that was issued and now hold about $2.1 trillion of outstanding notes. They’ll be first to feel the pain considering Standard & Poor’s has already downgraded securities equivalent to 47% of that amount and made some 400 negative-ratings moves in the basic materials and energy sectors over the past 12 months alone. Such scale and depth is reminiscent of the way banks were slaughtered by ratings companies during the 2008 financial crisis. It’s unclear where the other portion of the $3.6 trillion in liabilities lies but probably, most of it is owed to banks. If the remaining $1.5 trillion is indeed on the balance sheets of financial institutions, that would represent about 1.5% of the total assets of all the world’s publicly traded banks. That doesn’t seem very significant, or any cause for concern. But to put it in some context, U.S. subprime mortgages represented less than 1% of listed banks’ assets at the end of 2007.

Read more …

“You have every major economic zone in the world in big, big trouble including the US and that is why I say this crisis has the potential of becoming much, much worse than the last one.” (h/t Stockman)

• ‘It’s Going To Be Much Worse Than 2008’ (FS)

Bert Dohmen, founder of Dohmen Capital Research, is uber-bearish and believes that it is time for investors to panic (before everyone else does) given a potential collapse of the stock market greater than what we saw in 2008. Here’s what he had to say on Thursday’s podcast: “Over a year ago we said that we are now in a transition year from a bull market to a bear market and from a growing economy to a recession—and this could be a very deep recession… now we see that we are finally there and more and more people are starting to realize it. But I raise the question here, ‘Is it too late to panic?’ Because…the advice given by so many analysts is ‘Don’t panic, don’t sell, don’t panic.’ And I say, ‘Yes, panic!’ And it’s not too late to panic. Panicking at the right time can save you a lot of money…

I predict in this bear market you will see the majority of stocks—majority meaning over 50% of the stocks—selling at $5 or less. Okay, just put that into your portfolio and see if you should be selling some stocks… We here other analysts say, ‘Oh, this is nothing like 2008’ and I agree with that, but I say that because I think it’s going to be much worse. 2008 was really a crisis triggered by the subprime mortgage market and the confetti that the Wall Street firms distributed around the world. They took those subprime mortgages, put them into pools, they sold participations in these pools, in these CDOs…they got a triple-AAA rating on all this garbage and sold it around the world and then they started defaulting. That caused ripples throughout the financial system and a global financial crisis, okay; but it was basically a mortgage crisis—that’s how it started.

Now, look at what we have currently. We have every major economic zone in the world in financial trouble. You have Japan with a debt-to-GDP ratio of 280%. You have China at 300% debt-to-GDP. China has over $34 trillion of debt and the banking system is flooded with bad loans. The best estimate—and this was two years ago I wrote a book called The Coming China Crisis—and I said the best estimate is that they have $11 trillion of bad loans in the banking system. $11 trillion is the annual GDP of China—this is huge! You have Europe, you have Latin America in trouble, you have Russia in big trouble, you have Saudi Arabia even thinking about doing an IPO on their big oil company in order to make up for the shortfall of oil revenues. You have every major economic zone in the world in big, big trouble including the US and that is why I say this crisis has the potential of becoming much, much worse than the last one.”

Read more …

“..it can’t be done in a non-messy way.”

• Has The Market Crash Only Just Begun? (ZH)

Having successfully called the market’s retreat in the fall of 2015, Universa’s Mark Spitznagel is not taking a victory lap as he warns Bloomberg TV that “the crash has only just begun.” Investors are facing the most binary “let’s make a deal” market in history in Spitznagel’s view: choose Door #1 to bet on Keynesianism, central planners, and monetary interventionism; or Door #2 to bet on free markets and natural price discovery. “There is massive cognitive dissonance here,” Spitznagel explains as history teaches us that door #2 is the right choice… but it’s not possible to do that today as investors have been coerced to choose door #1, but when door #1 is slammed open “we will see that dreaded black swan monster.” That is what is going on right now:

“Investors want to go with The Fed when it’s working – like David Zervos… the problem is, when do you know that it is not working?” “At some point this stops working…” “the market is going through a resolution process, transitioning from the cognitive dissonance of Door #1 to the harsh reality of Door #2… if everyone were to change doors at the same time, that is a market crash… it can’t be done in a non-messy way.”

Must watch reality check behind the smoke and mirrors we call markets… (we note Mark’s excellent analogy starting at around 3:10)

Read more …

Amen Paul Craig Roberts.

• The US Economy Has Not Recovered and Will Not Recover (PCR)

The US economy died when middle class jobs were offshored and when the financial system was deregulated. Jobs offshoring benefitted Wall Street, corporate executives, and shareholders, because lower labor and compliance costs resulted in higher profits. These profits flowed through to shareholders in the form of capital gains and to executives in the form of “performance bonuses.” Wall Street benefitted from the bull market generated by higher profits. However, jobs offshoring also offshored US GDP and consumer purchasing power. Despite promises of a “New Economy” and better jobs, the replacement jobs have been increasingly part-time, lowly-paid jobs in domestic services, such as retail clerks, waitresses and bartenders.

The offshoring of US manufacturing and professional service jobs to Asia stopped the growth of consumer demand in the US, decimated the middle class, and left insufficient employment for college graduates to be able to service their student loans. The ladders of upward mobility that had made the United States an “opportunity society” were taken down in the interest of higher short-term profits. Without growth in consumer incomes to drive the economy, the Federal Reserve under Alan Greenspan substituted the growth in consumer debt to take the place of the missing growth in consumer income. Under the Greenspan regime, Americans’ stagnant and declining incomes were augmented with the ability to spend on credit. One source of this credit was the rise in housing prices that the Federal Reserves low interest rate policy made possible.

Consumers could refinance their now higher-valued home at lower interest rates and take out the “equity” and spend it. The debt expansion, tied heavily to housing mortgages, came to a halt when the fraud perpetrated by a deregulated financial system crashed the real estate and stock markets. The bailout of the guilty imposed further costs on the very people that the guilty had victimized. Under Fed chairman Bernanke the economy was kept going with Quantitative Easing, a massive increase in the money supply in order to bail out the “banks too big to fail.” Liquidity supplied by the Federal Reserve found its way into stock and bond prices and made those invested in these financial instruments richer.

Corporate executives helped to boost the stock market by using the companies’ profits and by taking out loans in order to buy back the companies’ stocks, thus further expanding debt. Those few benefitting from inflated financial asset prices produced by Quantitative Easing and buy-backs are a much smaller%age of the population than was affected by the Greenspan consumer credit expansion. A relatively few rich people are an insufficient number to drive the economy. The Federal Reserve’s zero interest rate policy was designed to support the balance sheets of the mega-banks and denied Americans interest income on their savings. This policy decreased the incomes of retirees and forced the elderly to reduce their consumption and/or draw down their savings more rapidly, leaving no safety net for heirs.

Read more …

As trade plummets, so does M&A. So how are they going to pump up stock prices now? All buybacks all the time?

• Worldwide M&A Activity Falls 23% (Reuters)

Worldwide mergers and acquisitions deals have fallen 23% to $336 billion so far this year compared with last year, but cross-border activity by amount targeting U.S.-based companies reached a record high, Thomson Reuters data shows. After hitting a record high by deals value in 2015, worldwide M&A activity has been hurt this year by falling oil prices, worries about slowing growth in China and the health of the financial sector. A trio of deals for U.S. companies topped the list of M&A announced this week, including Chinese company Tianjin Tianhai’s $6.3 billion offer for U.S.-based Ingram Micro, bringing year-to-date China outbound M&A targeting the U.S. to $23.3 billion. China, Ireland and Canada account for 88% of cross-border acquirers in the U.S. so far this year. European M&A activity, which lagged the U.S. in 2015, has hit $92 billion so far this year, up 4% compared with a year ago, after state-owned ChemChina announced it would buy Swiss seeds and pesticides group Syngenta for $43 billion in February.

Read more …

$9.8 billion for the year. With hedges disappearing.

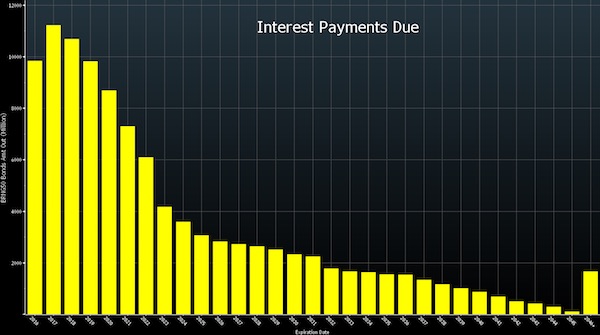

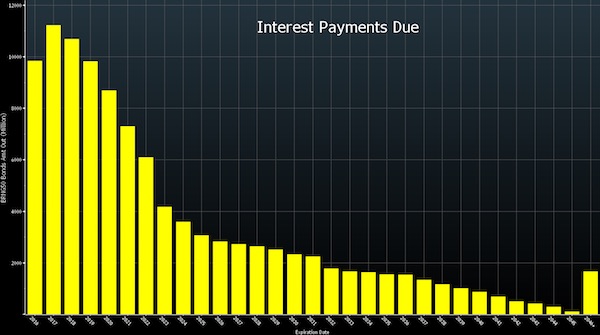

• US Shale Faces March Madness With $1.2 Billion in Interest Due (BBG)

The U.S. shale industry must come up with $1.2 billion in interest payments by the end of March as $30-a-barrel oil makes it harder for companies to scrape up the cash needed to stay current on their debts. Almost half of the interest is owed by companies with junk-rated credit, according to data compiled by Bloomberg on 61 companies in the Bloomberg Intelligence index of North American independent oil and gas producers. Energy XXI said in a filing Tuesday that it missed an $8.8 million interest payment. The following day, SandRidge announced that it didn’t make a $21.7 million interest payment. “You’ve seen two of these happen in two days, and I wouldn’t be surprised to see more in the next month as these payments come due,” said Jason Wangler at Wunderlich in Houston.

Energy XXI may not be able to meet its commitments in the next 12 months, raising “substantial doubt regarding the Company’s ability to continue as a going concern,” according to a company filing with the U.S. Securities and Exchange Commission. A company representative didn’t return a phone call and e-mail seeking comment. SandRidge “has sufficient liquidity to make these interest payments, but has elected to use the 30-day grace period in connection with its ongoing discussions with stakeholders,” the company said in a statement released Wednesday. “Today’s actions will preserve liquidity and flexibility as we continue to engage in constructive dialogue with our stakeholders,” James Bennett, SandRidge president and chief executive officer, said in the statement.

Oil has tumbled about 70% since a June 2014 peak of $107 a barrel. While prices were high, many drillers spent more money than they earned, plugging the shortfall with debt. That debt has become increasingly burdensome as prices collapse. Since the start of 2015, 48 North American oil and gas producers have declared bankruptcy, owing more than $17 billion, according to law firm Haynes & Boone. Deloitte said this week that bankruptcies in the oil and gas industry could surpass levels seen in the Great Recession.

Read more …

And with hedges gone, borrowing gets much more expensive at the same time.

• Moody’s Tallies 28 Downgrades In The Energy Sector Since December (MW)

Moody’s Investors Service said Friday it has downgraded a total of 28 energy companies since December, as it continues a global review of the troubled sector. The agency surprised investors in January when it placed the credit ratings of 120 energy companies and 55 mining companies from around the world on review for a possible downgrade. The move came after a deep slump in the price of oil and other commodities, hurt by oversupply and the slowdown in China, a major consumer of natural resources. Today’s tally includes issuers that had already been placed on review in December and surprised some in the market. “Moody’s drops another hammer,” is how analysts at credit research firm CreditSights described the move Friday.

“Over the past several weeks, it has become increasingly clear in our discussions with clients and in hearing from company managements that the agency was taking a very Draconian view of the sector,” they wrote in a note. Moody’s said it downgraded two energy companies by five notches each, sending them deep into speculative-grade, or “junk” territory. Denbury Resources was cut to Caa2 from Ba3, and Whiting Petroleum was cut to Caa1 from Ba2. The agency downgraded seven energy companies by four notches, nine companies by three notches and five companies by two notches. The agency affirmed ratings on another nine companies. It continues to review a total of 137 global issuers for a possible downgrade.

Read more …

Oil is everywhere in society. And lots of places rely on mostly high, but certainly somewhat stable, prices.

• Why Oil Rout Is Hurting The Global Economy Instead Of Helping (MW)

Saudi Arabia saw Standard & Poor’s cut its credit rating cut two notches this week to A-minus—an unsurprising move that nevertheless helps illustrate why collapsing oil prices haven’t seemed to be the economic boon many had anticipated. In a Thursday note, Carl Weinberg, chief economist at High Frequency Economics, used the downgrade—along with cuts in ratings for Bahrain, Oman and Kazakhstan—to remind clients of his explanation of how falling commodity prices can weigh on global growth. Weinberg has calculated that a $100 drop in the price of a barrel of crude would reduce global income from extraction alone by $3.2 trillion, or about 4.5% of world gross domestic product. That’s to say nothing of the impact on global economic activity from oil sales, transportation and exploration.

The U.S. benchmark settled below $31 a barrel on Thursday, or about $76 below its mid-2014 high after settling as low as $26.21 earlier this month. Brent crude, the global benchmark, ended Thursday at $34.28. It traded around $115 a barrel in mid-2014. It isn’t wrong to assume that those losses would rebound to the benefit of oil consumers, Weinberg says. But the rub lies in the fact that consumers in oil-importing countries may be more likely to stash those savings away while workers in oil-exporting countries would have been more likely to spend that lost income. That means it can take “years or decades” before that savings is translated into spending. He writes:

If purchasing power is transferred from one country to another, and if the countries receiving the windfall have a higher marginal propensity to save than the countries that are paying the transfer, then world GDP will be reduced. So if oil-importing countries tend to have higher incomes and higher savings rates, then world GDP will be reduced. In other words, halving the weekly income of an oil field worker in Nigeria earning near-subsistence wages will likely affect his or her consumption more than reducing the monthly auto fuel bill of a dentist in Belgium by the equivalent amount.

Needless to say, the oil market carnage has translated into real fiscal problems for oil-producing nations. It feeds into ideas that this week’s talk of a production freeze that would include OPEC members and Russia—seemingly shot down by Saudi Arabia after Iran refused to comply—was a sign of desperation. While freezing output at record levels wasn’t seen as likely to do much to alleviate a global glut, oil futures have rallied on the idea that producers are at least talking to each other is an important step. Helima Croft, global head of commodities at RBC Capital Markets, said this week’s talks were “one of the first clear acknowledgments by the oil heavyweights that all isn’t entirely well in the current price environment.”

It might even lay the groundwork for a “more proactive” approach later in the year after OPEC has had a chance to gauge the impact of Iran’s post-sanctions return to the global oil market as well as the trajectory of non-OPEC production, Croft said in a Tuesday note. ”Recently, some leading Saudi experts have suggested that by the June meeting, those variables will be known, and with the supply-and-demand balance expected to be tighter by then, it will be easier for cartel to pull additional barrels if needed in order to accelerate a price recovery,” she wrote.

Read more …

“Beijing has also instructed bank branches in Hong Kong to limit their lending of renminbi to make it harder for traders and investors to place bets against the Chinese currency in financial markets.”

• China’s Foreign Exchange Reserves Dwindling Rapidly (NY Times)

During China’s biggest boom years, its currency could have risen in value as huge sums in dollars, euros and yen flowed into the country. Instead, Beijing tightly controlled the value of the renminbi, buying up much of the inflows and putting them into its reserves instead. That brought angry accusations from the United States and Europe that it was manipulating its currency to help keep Chinese exports inexpensive and competitive in foreign countries. Now that the renminbi faces pressure to fall, China is spending its reserves in an effort to prop up the currency. But many American lawmakers and presidential candidates still accuse China of keeping its currency artificially weak. The reserves are still considerable, more than double Japan’s, which has the world’s second-largest amount.

The central bank chief, Mr. Zhou, and others have questioned whether the reserves are too big and the money could be better invested if left in the private sector. Mr. Zhou led a move over the last two years to make it easier for Chinese companies and families to invest their own money overseas, only to find in recent months that the outflows have been disconcertingly fast at times. China has taken steps to stem further flows out of the country. This winter the Chinese authorities arrested the leaders of underground banks that were converting billions of renminbi into dollars and euros. They also made it harder for Chinese citizens to use their renminbi to buy insurance policies in dollars. More quietly, Beijing bank regulators have halted sales within China of investment funds known as wealth management products that are denominated in dollars.

Beijing has also instructed bank branches in Hong Kong to limit their lending of renminbi to make it harder for traders and investors to place bets against the Chinese currency in financial markets. “We did receive notice from Beijing in the earlier part of January to be more stringent in approving renminbi-denominated loans,” said a Hong Kong-based China bank executive, who insisted on anonymity for fear of employer retaliation. “It is no fun being caught in the middle, with marketing officers wanting to do more business and the higher-ups telling you to be tougher when reviewing credit proposals.” The erosion of reserves is also politically awkward, given public perception, and Beijing has taken steps aimed directly at shoring them up.

Read more …

Big deal. He offered to step down last month. Beijing should understand that heavy-handedness does not boost confidence. What does this say about how Chinese securities have been regulated until today? Not much good.

• China ‘Removes’ Top Securities Regulator (Reuters)

China has removed the head of its securities regulator following a turbulent period in the country’s stock markets, appointing a top state banking executive as his replacement, as leaders move to restore confidence in the economy. The announcement on the official Xinhua news agency on Saturday follows a string of assurances from senior leaders following the Lunar New Year holiday that China will underpin its slowing economy and steady its wobbly currency. Xinhua said Xiao Gang, chairman of the China Securities Regulatory Commission (CSRC) since 2013, had been succeeded by Liu Shiyu, chairman of the Agricultural Bank of China Ltd. (AgBank) and a former deputy governor of the central bank. “Xiao’s departure is not a surprise following the recent stock disaster. This is a role vulnerable to public criticism because most Chinese retail investors are destined to lose money in such a market,” said Zhang Kaihua, a fund manager of Nanjing-based hedge fund Huyang Investment.

Xiao and the CSRC came under fire as China’s Shanghai and Shenzhen stock markets slumped as much as 40% in just a few months last summer. In a further blow, a stock index “circuit breaker” introduced in January to limit stock market losses was deactivated after four days of use because it was blamed for exacerbating a sharp selloff. Online media nicknamed Xiao “Mr. Circuit Breaker.” Reuters reported in January that Xiao, 57, had offered to resign following the “circuit-breaker” failure. The CSRC said at the time the information did not conform to the facts. The gyrations in China’s stock markets, an unexpected devaluation of the yuan in August and sharp falls in currency reserves rattled global markets, raising concerns about the health of the economy and Beijing’s ability to steer the country through both a protracted slowdown in growth and a shift away from manufacturing towards services.

Read more …

They do it on purpose. Set it up so poorly losses are inevitable, and meanwhile use it to keep housing prices propped up. The taxpayer can fork over the difference.

• Fannie Mae At Risk Of Needing A Bailout (FT)

Fannie Mae, the state-sponsored U.S. mortgage backer, is at risk of needing a government bailout that could shake confidence in the housing finance market, senior officials have warned. Fannie Mae’s chief executive and its regulator are sounding the alarm on a decline in the institution’s capital cushion, which is on course to vanish in 2018, when it would have to ask the US Treasury for emergency funds. Their warnings highlight Washington’s inaction on housing policy and its failure to reform the institution, which guarantees nearly $3 trillion of securities and enables 30-year fixed rate loans, following the last financial crisis. Since 2008 Fannie Mae has been in the post-crisis limbo of state-sponsored “conservatorship,” neither fully nationalized nor private, following several unsuccessful attempts by Congress to overhaul it.

Because the government does not let Fannie Mae retain profits, Tim Mayopoulos, its chief executive, told the Financial Times on Friday that its capital buffer, which has dwindled from $30 billion before the crisis to $1.2 billion today, was on track to disappear by January 2018. At that point it would be unable to weather quarterly losses and would need to draw on Treasury funds to avoid being placed into receivership. So far investors who own Fannie Mae’s mortgage-backed securities have not been spooked, Mr. Mayopoulos said, but he added: “We are a major source of liquidity to the mortgage markets and it would be better to avoid testing the market as to what the breaking point is well in advance of us getting to that point.” His comments came the day after Mel Watt, Fannie Mae’s top regulator, thrust the issue into the spotlight.

Addressing both Fannie Mae and its counterpart Freddie Mac, Mr Watt, director of the Federal Housing Finance Agency, said: “The most serious risk and the one that has the most potential for escalating in the future is the enterprises’ lack of capital.” “If investor confidence in enterprise securities went down and liquidity declined as a result, this could have real ramifications on the availability and cost of credit for borrowers,” he said in a speech. Fannie Mae’s inability to retain profits, which must instead be swept into government coffers, also makes it almost impossible for the institution to exit federal control.

Read more …

Refusing to kill the golden goose.

• Independent Modelling May Show Way Out Of Oz Housing Bubble (SMH)

Independent modelling has dented the Turnbull government’s attack on Labor’s negative gearing policy, finding it will generate billions for the Commonwealth with the vast bulk of revenue coming from just the top 10% of households who negatively gear their properties. The report’s author says the policy would likely slow the pace of house-price growth and boost new housing construction, making it “potentially the biggest housing affordability policy the country has seen.” Prime Minister Malcolm Turnbull launched a scathing attack on Labor’s negative gearing policy on Friday, saying home owners across the country would see the value of the family home “smashed” by the “very blunt, very crude” idea.

In a clear sign his government is preparing to launch a massive scare campaign in the lead-up to the 2016 election over Labor’s proposal, which is designed to save $32 billion over a decade, Mr Turnbull warned the policy was “calculated” to reduce the value of all homes. n”The Labor Party’s negative gearing policy and its wind-back on the capital gains discount – its increase in tax on capital gains – is a very dangerous one. It’s been very, very poorly thought out,” Mr Turnbull said on Friday. “The consequence of it will be a decline in property prices, every home owner in Australia has a lot to fear from Bill Shorten.”

But independent modelling shows there will be “significant” long-term savings from Labor’s proposal to quarantine negative gearing to new housing investments from July 2017, eventually raising between $3.5 to $3.9 billion a year. It also shows Labor’s proposal to cut the capital gains tax discount from 50% to 25% would raise about $2 billion a year in the long term. It shows the vast majority of savings would be at the expense of the top 10% of earners who negatively gear their properties. It also estimates that by restricting negative gearing to new housing, the policy would “increase the share of investment housing devoted to newly built housing” by 10 to 20%. It does not say house prices would drop. “Our modelling shows that negative gearing benefits high-income families with 52.6% of the benefit going to the top 20% of incomes,” the paper says.

Read more …

EU must turn into EMU. Which nobody wants outside of Brussels and EU capitals. Anyway, the coming economic downturn will turn the EMU into a crumbling ruin.

• Brexit!? France And Germany Can Not Wait (Gefira)

If London decides to leave the European Union nobody in Europe will even notice. Great Britain is an entirely separate country, isolated from the European Union and does not participate in the Euro or Schengen Agreement. The EU as a political platform is disintegrating and becoming more and more irrelevant and will be displaced by the European Monetary Union (EMU). The center of power in Europe has shifted from the EU to the EMU and London politicians are fully aware of it. A Brexit will accelerate the process of political integration of the EMU members and make the EU politically less significant.

Over the past decade we saw:

• Countries can enter the European Union;

• The very core values of the European Union can be set aside as we saw happening in Turkey just before the European Commission announced to restart Turkey’s accession negotiations;

• Trade relations with Great Britain can be suspended without any upheaval, as we saw it concerning non-EU member Russia;

• Borders can be opened and closed as is the case in south-east Europe due to the refugee crisis;

• The Dublin Regulation can be dissolved overnight in the face of the fact that more than a million refugees have entered Europe since the summer of 2015;

All these events hardly changed the life of the Europeans. Being a member of the European Monetary Union is of another magnitude. The Greek euro crisis changed the lives of millions of Greeks. During the tense days in July 2015, when the future of Greece, the EMU and indirect the future of Europe was at stake, Chancellor Merkel and President Hollande held 24 hours emergency meetings as did the Eurogroup. Great Britain and the European Parliament did not play any role whatsoever in these decisive moments for the future of Europe. Cameron was not even invited to share his opinion.

The European Monetary Union is doomed for further political integration; the euro members have no other option but to create a fiscal union and a banking union. Without these two pillars, the whole Euro will fall apart dragging with it the complete Western financial system. A fiscal and banking union means that these countries have to integrate far beyond the European Union framework. Prime Minister Cameron is an annoyance for the already struggling EMU. The European Monetary Union faces extreme difficulties, as on one hand further integration of the Euro countries is inevitable and on the other hand, the widespread support for this integration is eroding. In 2011, French President Sarkozy told Cameron:”We’re sick of you criticizing us and telling us what to do. You say you hate the euro, you didn’t want to join, and now you want to interfere in our meetings”.

The EMU countries face a big political problem that is to be solved. Germany and France will never let countries outside the EMU have a say in their affairs as Cameron proposed. The diplomatic words from French Prime Minister Manuel Valls make it all clear to London as he said; “a Brexit is a shock for Europe but still members can not pick and choose rules that suit them”. The UK leaving the EU will make life easier for Paris and Berlin as Figaro writes: “Brexit? An opportunity for Europe, for France and for Paris”. When the UK is outside the EU Frankfurt and Paris will have more opportunities to crush London as a financial center. London could not miss Merkel’s warning against gains for British banks under ‘Brexit’. If the UK decides to leave, Berlin and Paris will do definitely more than prevent London banks from making any gain; they will do everything to establish Paris or Frankfurt as the financial center of the EMU at London’s expense.

Read more …

Expect refugee numbers to soar over next 2 weeks.

• Tsipras, Merkel, Hollande Agree On Open Borders Until March 6 Summit (Kath.)

Greek Prime Minister Alexis Tsipras met with German Chancellor Angela Merkel and French President Francois Hollande on the sidelines of a European Union summit in Brussels on Friday. At the meeting, which reportedly lasted for an hour, the three leaders discussed the refugee crisis and the Greek bailout. According to a close Tsipras aide, the Greek premier reiterated that Greece would not accept any action against its interests. The three leaders agreed that the key with regard to decreasing the migration flow was Turkey and that NATO’s involvement was a positive development. Tsipras reportedly received assurances from Germany and France that assistance would be provided if necessary.

A pivotal point in the discussion was that the three leaders stressed that there would be no change in the European borders’ status quo until March 6, when a new summit on the refugee crisis is scheduled to take place, after Turkish PM Ahmet Davutoglu canceled his trip to Brussels following a bomb attack in Ankara which claimed the lives of 28 people on Wednesday. The leaders also agreed that representatives of the institutions should return to Athens as soon as possible in order to complete the review.

Read more …

Because Brexit allows convenient alternate story line. Much more important than human misery.

• EU Summit On Refugee Crisis Ends In Disarray (FT)

Chancellor Angela Merkel hoped this week’s EU summit on migration would provide at least a show of European unity in the refugee crisis. Instead, it ended in disarray. An Austrian plan to cap the entry of asylum-seekers at just 80 a day left the German leader isolated, Greece threatening to scupper any deal on Brexit in response, and leaders more divided than ever over the EU’s biggest challenge in decades. European leaders, from Berlin to Vienna to Athens, are now improvising and pursuing often contradictory policies. Ms Merkel took even her own officials by surprise when she demanded another summit on the refugee crisis on March 6, just before three key German regional elections on March 13 and before the onset of spring boosts the numbers crossing the Aegean.

Refugee arrivals have picked up, with more than 4,800 arriving in Greece from Turkey on Thursday a rate not far off the autumn peak, when an average of 7,000 people a day were arriving. A backlog is building up along the western Balkans route, where fractious states have had to pull together to cope with the arrival of more than 1m people since the start of 2015. In private, previously optimistic officials are starting to despair, with worries shifting to a potential humanitarian disaster on the bloc s south eastern border. An EU leader said: “It’s a serious situation”. Ms Merkel is still banking on a deal with Ankara to secure the vulnerable Greek-Turkish frontier. As the chancellor said in the early hours on Friday: “It is an absolute given that we must urgently move faster”.

But bad luck waylaid even this plan: Turkish prime minister Ahmet Davutoglu cancelled a planned trip to Brussels to discuss migration following a car-bomb attack in Ankara. After the stormy summit debate, a tired looking Ms Merkel put a brave face on events at the 2.30am press conference, pointing to the efforts made in recent weeks to engage with Turkish president Recep Tayyip Erdogan and boost Greece’s sea defences by deploying Nato ships. Meanwhile, Vienna has been accused of trampling on international law, including the Geneva Convention on refugees, throwing already barely enforced rules on asylum into further doubt. “Conventions are like fairies; if you stop believing in them, they die”, said Elizabeth Collett, a director at the Migration Policy Institute.

However, the Austrian public backs its chancellor Werner Faymann’s migrant cap, with Der Standard newspaper on Friday defending him, saying that Brussels had scored “an own goal” by criticising Vienna. Ms Merkel, who rarely criticises EU partners in public, said that she had been “surprised” by Mr Faymann. Privately, German officials are furious that an old ally has broken ranks. Brussels had desperately attempted to force member states to abide by the rules, with little success. Despite EU member states agreeing to share out 160,000 refugees from Italy and Greece among themselves, fewer than 600 have actually been moved. While some leaders such as Viktor Orban, Hungary’s prime minister, have noisily disagreed, others — such as Madrid and Paris — have simply dragged their feet.

Read more …

Here’s warning you once again, Brussels, you’re not going to survive this, somone will have your head on a platter for it, and it ain’t going to be silver. Even this UNHCR piece tries to blame the smugglers, but Europe could have provided safe passage all along.

• Two Children Drown Every Day On Average Trying To Reach Europe (UNHCR)

Two children have drowned every day on average since September 2015 trying to cross the eastern Mediterranean to find safety with their families in Europe, UNHCR, the UN Refugee Agency, said today. In a joint statement, issued in Geneva, UNHCR, UNICEF and the IOM warned that the number of child deaths was on the increase and called for more measures to increase safety for those escaping conflict and despair. Since last September, when the tragic death of toddler Aylan Kurdi captured the world’s attention, more than 340 children, many of them babies and toddlers, have drowned in the eastern Mediterranean. The total number of children who have died may be even greater, the sister organisations said, with their bodies lost at sea and never recovered.

One of those statistics was seven-year-old Houda from Afghanistan who went missing in a shipwreck off the Greek island of Kos at the end of January. Her mother, father, two sisters and one of her brothers had left Kabul for Istanbul earlier that month after her father, a middle-ranking police officer, received death threats. In Turkey, the family made a deal with a smuggler who promised them an “extra-safe trip in a spacious large boat” to Greece. To pay for the trip, Houda’s father had sold his house and borrowed money from family and friends. At night in a dark bay as they prepared to leave, they saw the boat was little more than a sailing coffin. It was small, old and massively overcrowded with around 80 passengers covering a few metres of deck. They tried to step back, but were forced by the smuggler to board the boat with no questions.

Smugglers allow no last-minute change of mind. Houda’s sister Aisha and her brother Aziz survived that deadly trip, along with 26 others, but her mother, father and an older sister perished. Their bodies were recovered. Houda’s was never found. Aisha and Aziz, 16 and 15 respectively, had learned to swim in school and that saved them. The stretch of the Aegean Sea between Turkey and Greece is now among the deadliest routes in the world for refugees and migrants. “These tragic deaths in the Mediterranean are unbearable and must stop,” said UN High Commissioner for Refugees Filippo Grandi. “Clearly, more efforts are needed to combat smuggling and trafficking. Also, as many of the children and adults who have died were trying to join relatives in Europe, organising ways for people to travel legally and safely, through resettlement and family reunion programmes for example, should be an absolute priority if we want to reduce the death toll,” he added.

With children now accounting for 36% of those on the move, the chance of them drowning on the Aegean Sea crossing from Turkey to Greece has grown proportionately. During the first six weeks of 2016, 410 people drowned out of the 80,000 people crossing the eastern Mediterranean. This amounts to a 35-fold increase year-on-year from 2015. Aisha and Aziz are now accommodated at a transit facility UNHCR runs with a national NGO offering specialized services to unaccompanied refugee children in Greece until they are assigned to a permanent facility. They wish to reunite as soon as possible with what remains of their family. They have a brother in Germany and hope one day to be able to join him there.

“These children expressed incredible dignity and courage throughout the many challenges they faced after the shipwreck. After already identifying the corpses of his own family members at the Coast Guard, Aziz insisted on seeing more pictures in order to recognize fellow travellers and help in their identification so that their families could also find out what had happened to them. They repeatedly expressed their gratitude towards me and other colleagues for the help we provided,” said Georgios Papadimitriou, a senior protection officer with UNHCR.

Read more …