Walker Evans Waterfront in New Orleans. French market sidewalk scene 1935

“Experience doesn’t count for much, and extreme confidence may be fatal.”

• Paul Singer: Market ‘Breakdown’ To Be ‘Sudden, Intense, And Large’ (CNBC)

In a bleak new letter to investors, Paul Singer’s Elliott Management warns that the bond market is “broken” and that when the central bank actions of recent years no longer ward off a market downturn, the subsequent loss of confidence could be severe. The fund’s recent investor letter, which covers the second quarter, notes that Elliott’s managers are currently seeing “what is in many ways the most peculiar period we have faced in 39 years.” Too much power has been ceded to central banks, the letter adds, the value of money has been debased, inflation is probably inevitable, and when it happens, it could be swift and impossible to tamp down.

Elliott is a $28 billion fund founded in 1977 by Singer, now its president. The fund is up more than 6% for the year through July, according to an investor. Given the persistence of low or negative yields on government and other bonds and the continued stampede to buy them nonetheless, today’s environment marks “the biggest bond bubble in world history,” and “the global bond market is broken,” the investor letter states. The letter discusses, at some length, the oddity of an investor mentality that flies to an asset class regarded as a “safe haven” even when there are low or nonexistent returns attached to it and no guarantee that current conditions will persist.

In one wry aside, the letter suggests a safety warning be attached to the $12 trillion government bond market now trading at negative yields: “Hold such instruments at your own risk; danger of serious injury or death to your capital!” Trading in this market is particularly difficult, it adds. “Everyone is in the dark,” Elliott notes. “Experience doesn’t count for much, and extreme confidence may be fatal.” Moreover, “the ultimate breakdown (or series of breakdowns) from this environment is likely to be surprising, sudden, intense, and large.”

Coming soon to a theater near you. Denmark, Holland, Australia, New Zealand, UK, the list is long.

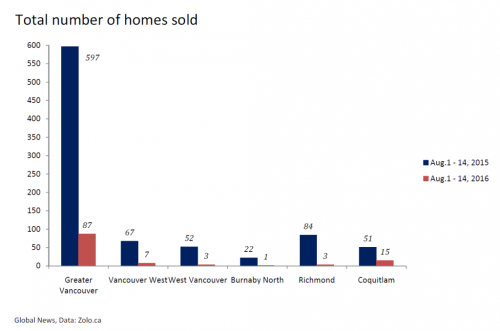

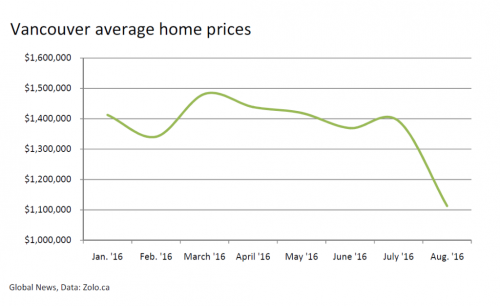

• Vancouver Housing Market Implodes: Average Price Plunges 20% In 1 Month (ZH)

It appears that the Vancouver housing market has slammed shut. Which is hardly a surprise: virtually everyone saw it coming, the only question was when. Eilers says he’s been warning of a real estate slow-down for at least a year due to the region’s unsustainable and unsupportable prices. West Vancouver, where he does a large part of his business, had a benchmark detached home price of almost $3.4 million in July according to the Real Estate Board of Greater Vancouver. “The market in West Van is up 450 per cent since 2001. So is everyone making 600 per cent more income than they were so they can pay their taxes and buy their houses? Of course not. So how is this inflation been financed? By off-shore money and record debt.”

Precisely what we said at the start of the year when we first heard horror stories about Chinese buyers paying cash, sight unseen, for any and every local luxury, and not so luxury home. It appears that it is not just the 15% luxury tax implemented on on July 25 that has burst the bubble: according to Eilers sales were dropping even before the tax. According to the data, July was another slow month in West Vancouver with only 44 sales, down from 80 in 2015. June saw 74 sales, also down from 102 the year before. The pattern has left the market “devastated”, Eilers adds. While it may be too early to make a definitive conclusion, after all while earlier this month, the REBGV released its statistics for the month of July, saying the data showed the market had slowed down to “normal levels”, there was still no official August data available, and thus no actual indication of the slowdown.

Fortunately for buyers, real-time data proves otherwise. Zolo, a Canadian real estate brokerage, keeps track of MLS home sales in real-time and reports prices as an average rather than the “benchmark price” used by the REBGV. It currently shows a major correction underway in most Metro Vancouver markets. According to the website, the City of Vancouver currently has an average home price of $1.1 million, down 20.7% over the last 28 days and down 24.5% over the last three months. The average detached home is $2.6 million, down 7% compared to three months ago.

What a bubble looks like. This is going to be painful. Re: Vancouver.

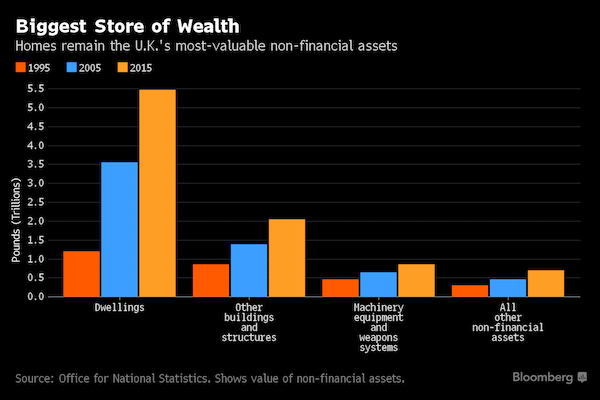

• UK’s £8.8 Trillion Wealth Owes Much to Housing (BBG)

The total net worth of the U.K. at the end of 2015 was £8.8 trillion ($11.6 trillion), the Office for National Statistics said in London on Thursday. Much of the £493 billion jump from a year earlier came from the £355 billion increase in the value dwellings. The data also showed the U.K. was ahead of other G-7 countries in terms of growth of non-financial assets in 2014.

More housing shock, more pain to come. “The strong price appreciation of residential real estate has been driving an increase in household debt to a record high..”

• Moody’s Lowers Outlook On Australia Banks To Negative (R.)

Moody’s has lowered its outlook on Australia’s banks to negative from stable, warning of sluggish profit growth due to slow wage increases, record-low interest rates, strong lending competition and rising household debt. The agency said the banks, whose credit ratings are among the highest in the world, could be hurt by an increase in problem loans among mining companies and households in mining-dependent states. Moody’s action came after S&P in July also placed major Australian banks’ AA- ratings on negative outlook, in a signal that a downgrade was possible. Both agencies rate the banks one rung below the highest, triple-A, investment grade. A downgrade would make financing more expensive for banks at a time when regulators want them to put aside more cash to weather any repeat of the global financial crisis.

Australia’s highly profitable “Big Four” banks – National Australia Bank, ANZ Banking Group, Westpac and Commonwealth Bank – emerged from the financial crisis relatively unscathed but are facing questions over their capital levels, slowing earnings growth and rising bad debts. “The outlook change reflects Moody’s expectation of a more challenging operating environment for banks in Australia for the remainder of 2016 and beyond,” Frank Mirenzi, a vice president and senior analyst at Moody’s, said in a statement. He noted that profit growth could slow and asset quality decline, and make banks and consumers more vulnerable to economic shocks. “The strong price appreciation of residential real estate has been driving an increase in household debt to a record high,” Mirenzi noted.

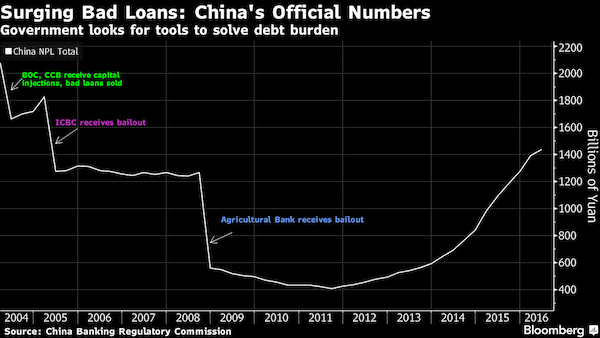

China would collapse if not for the shadow banks. It’s fully addicted.

• China’s Secret Lists of Zombie Borrowers Leave Banks in the Dark (BBG)

There’s a list Ni Baixiang, head of Industrial & Commercial Bank of China’s Jiangxi branch, would love to get his hands on. Commonly referred to as the “zombie list,” it’s compiled by Jiangxi regional authorities and holds the names of the most deadbeat of borrowers: state-owned companies deemed too weak to survive and destined to be wound down. In short, the kind of enterprises banks already weighed down by rising bad loans want to steer well clear of. Only, neither Ni nor his competitors in Jiangxi are allowed to know who they are. “They won’t tell us because if we know, we’ll lose confidence,” Ni, whose bank is China’s largest, told reporters after a press briefing in Beijing earlier this month.

Ni’s dilemma underscores the challenge China faces as it tries to stem a tide of bad loans while carrying out an orderly restructuring of a state corporate sector burdened by overcapacity and bloated bureaucracies. Several provincial governments are withholding information on zombie borrowers from banks for fear that they’ll cut off financing immediately, according to officials who asked not to be identified. In several provinces, government-compiled lists of zombie companies are also kept secret from local banking regulators, the people said, asking not to be named discussing sensitive information. Knowing which state-owned companies get the “zombie” designation can be crucial for bankers because authorities ultimately decide whether they’ll fail, and local officials often meddle in banks’ lending decisions.

An economy growing at the slowest pace in a quarter century is adding urgency to President Xi Jinping’s push to steer China away from the investment-led model it’s relied on in the past. A key part of that is restructuring industries saddled with overcapacity, such as steel, cement and coal. McKinsey estimates that shedding surplus industrial capacity could add $5.6 trillion to the economy between now and 2030.

China’s making up the numbers it goes along, but here’s how we find out how it’s really doing.

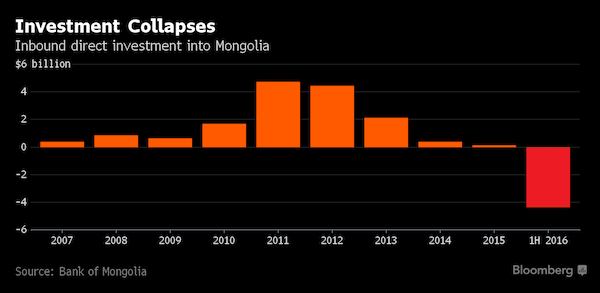

• As China Shrinks, Mongolia Has an Epic Economic Meltdown (BBG)

Back in 2008, Mongolia honored its revered national hero Genghis Khan with an enormous, stainless steel statue on the bank of the Tuul River about a half-hour’s drive outside of the capital of Ulaanbaatar. The 13th century conqueror’s name graces the capital’s international airport and his image is also plastered on the tugrik, the local currency. Right now, Khans aren’t getting much respect. The government, having burned through much of its foreign currency reserves, faces a crushing debt burden and is having trouble meeting its civil service payroll. On Thursday, the central bank hiked its benchmark interest rate by a remarkable 4.5 percentage points to 15% to prop up the tugrik, the world’s worst performing currency in August.

Mongolia, a mineral-rich and landlocked $12 billion economy bordering Russia and China, is staring at a full-blown balance of payments crisis. It’s caused barely a ripple in global financial markets, but the nation’s economic meltdown offers instructive lessons to far bigger resource-reliant economies like Brazil, Venezuela, Russia and Saudi Arabia. This is an economy that gives new meaning to what economists call the resource curse. An overabundance of natural resources can result in lopsided economic growth, government waste and boom-bust cycles that can leave a country’s finances in tatters. “Mongolia should be much richer than it is,” said Lutz Roehmeyer, a money manager at Landesbank Berlin Investment. “There is nowhere else in the world where it is so easy to dig up resources without any problems and sell the commodities to China with such low transportation costs.”

It’s way too late to save the euro.

• Stiglitz: The Euro Is On Course To Fail (Economist)

Those in search of an antidote to the anxieties that arise from Britain’s vote to leave the European Union should avoid the latest book from Joseph Stiglitz. Its subject is the euro, which has hitherto been the main font of fears for Europe and (his analysis suggests) will soon be once again. It is a meaty subject, suited to a big-name economist. Mr Stiglitz has won a Nobel prize, served as a feather-ruffling chief economist for the World Bank and written several books with a fair claim to prescience, notably, “Globalisation and Its Discontents”, published in 2002. The main argument of his new book is that, on its current course, the euro is certain to fail—and indeed, that it was fatally flawed from birth.

It entails a fixed exchange rate and a single interest rate for its members, which means countries must forgo the option to devalue in times of economic weakness. To make up for that loss, the euro’s architects should have created institutions, such as jointly issued bonds, mutual backing of bank deposits and a common fund for unemployment insurance, so the costs of righting each economy are shared. Instead the burden falls on individual countries through austerity policies, such as tax rises and wage cuts. The results have been ugliest in Greece, where national income has shrunk by a quarter since 2007 and where the unemployment rate is 24%. There is still time to put in place better policies, thinks Mr Stiglitz. But an amicable divorce would be preferable to the current situation, which puts the considerable achievement of European integration at risk.

A good chunk of the book is taken up with a critique of policymakers’ efforts to address the euro crisis. Mr Stiglitz rightly takes issue with the blame-the-victim analysis of the euro’s failings that is commonly heard in Germany. The persistent trade surpluses of Germany and the vast deficits of boomtime Spain, Portugal and Greece are two sides of the same coin. Indeed, in a world short of aggregate demand, German thrift is the bigger failing, argues Mr Stiglitz. He favours the remedy, first proposed by John Maynard Keynes, of forcing creditor countries to adjust by taxing their trade surpluses.

“In any protocol, everyone has to act the same. But in a blockchain like Ethereum, everyone has to think the same.”

• The Subtle Tyranny of Blockchain (Thomas)

The past months have become a new chapter in the evolution of blockchain technology. Ethereum’s fork in the wake of the DAO hacks. Bitcoin’s almost-fork in the wake of the (still unresolved) block size debate. All of this is leading to the growing frustration and even disillusionment of key figures in the crypto-currency community. I left the Bitcoin community in 2012 for very similar reasons. In 2011, I was part of the group that helped Gavin Andresen design the Pay-to-Script-Hash (P2SH) feature. The design wasn’t very complex, it was backwards-compatible and provided crucial building blocks for improving Bitcoin’s security and performance. Unfortunately, getting it deployed turned out to be very political.

It was easy to extrapolate from this change to more advanced functionality still on the roadmap and get depressed about our chances to make important progress in the future. As the Bitcoin price rose, the number of stakeholders expanded and the amount of money at stake increasingly dominated the technical discussion. With this context in mind, the recent situation with Ethereum is not surprising in the slightest. As a blockchain grows, the larger and highly vested userbase becomes more and more difficult to shepard. When combined with time pressure (i.e. the 27-day DAO split creation period), something had to give. There wasn’t enough time to get the sort of buy-in and preparation needed to safely hardfork a system like Ethereum.

At the root of the difficulty in updating blockchains is the need to maintain shared state. In any protocol, everyone has to act the same. But in a blockchain like Ethereum, everyone has to think the same. Everyone’s memory (also known as “state” in computer science terms) has to be exactly the same and evolve according to the same rules. Shared state adds tremendous complexity and that has a big impact on developers: Blockchains are a pain to work with. Everyone who has done it knows what I’m talking about. The fact that blockchain has been largely ignored by major tech companies and embraced by the financial industry is partly because that industry has a relatively high tolerance for arcane and complex systems.

To once again quote Michael Moore: You can’t declare war on a noun.

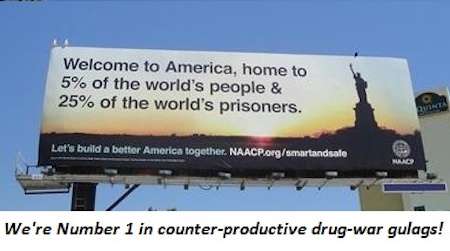

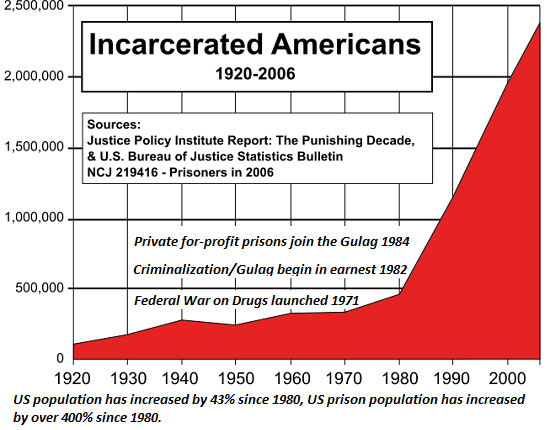

• It’s Time to Abolish the DEA and America’s “War on Drugs” Gulag (CHS)

It’s difficult to pick the most destructive of America’s many senseless, futile and tragically needless wars, but the “War on Drugs” is near the top of the list.Prohibition of mind-altering substances has not just failed–it has failed spectacularly, and generated extremely destructive and counterproductive consequences. What was the result of the Prohibition of alcohol in the 1920s? Prohibition instantly criminalized 40+% of the adult populace and created hugely profitable criminal organizations. What was the result of the “War on Drugs”? This modern-day Prohibition instantly criminalized large swaths of the adult populace and created hugely profitable criminal organizations. If you want to increase drug use, criminalize innocent citizens and spawn gargantuan criminal organizations, then by all means declare “war” via Prohibition.

The results of Prohibition/War on Drugs are so visibly perverse and so destructive that the entire enterprise is sickeningly Orwellian. The well-paid apologists for Prohibition/War on Drugs claim that imprisoning millions of people “helps” them avoid drugs. If you think being tossed in prison for a few years “helps” people, then step right up and accept a fiver (5-year sentence) in an American prison, which is essentially a factory that produces one product: people damaged by imprisonment, deprived of their full citizenship, hobbled by a felony conviction–ex-con beneficiaries of years of tutorials by hardened criminals. This is as Orwellian as the Vietnam War’s famous “It became necessary to destroy the town to save it.”

If you think throwing millions of people in prison “helps” them or society, you are either insane or you’re making a living in the gulag or our sick system of “justice”. If you don’t think America has a “War on Drugs” Gulag, please glance at this chart of Americans in jail and prison – many for drug-related offenses:

“..inside Yemen this is not perceived to be a Saudi bombing campaign, this is a US bombing campaign..”

• The US Is Promoting War Crimes In Yemen (G.)

Saudi Arabia resumed its appalling war in Yemen last week and has already killed dozens more civilians, destroyed a school full of children and leveled a hospital full of sick and injured people. The campaign of indiscriminate killing – though let’s call it what it is: a war crime – has now been going on for almost a year and a half. And the United States bears a large part of the responsibility. This US-backed war is not just a case of the Obama administration sitting idly by while its close ally goes on a destructive spree of historic proportions. The government is actively selling the Saudis billions of dollars of weaponry. They’re re-supplying planes engaged in the bombing runs and providing “intelligence” for the targets that Saudi Arabia is hitting.

Put simply, the US is quite literally funding a humanitarian catastrophe that, by some measures, is larger than the crisis in Syria. As the New York Times editorial board wrote this week: “Experts say the coalition would be grounded if Washington withheld its support.” Yet all we’ve heard is crickets. High-ranking Obama administration officials are hardly ever asked about the crisis. Cable television news has almost universally ignored it. Both the Clinton and Trump presidential campaigns have been totally silent on this issue despite their constant arguing over who would be better at “stopping terrorism”. Beyond the grotesque killing of civilians, it’s clear at this point that the Saudis’ bombing campaign has also boosted al-Qaida in the Arabian Peninsula (Aqap) to a level which Reuters described as “stronger and richer” than anytime in its 20-year history.

Jake Tapper commendably broke the television news blackout about Yemen on his CNN show on Wednesday. Senator Chris Murphy of Connecticut, one of the very few elected representatives talking about the crisis, told Tapper that “it’s wild to me” that the Congress isn’t debating the “unauthorized” war in Yemen. The Saudis “could not do it without the United States”, he said. “We have made the decision to go to war in Yemen” – against Saudi Arabia’s enemies, not ours – without any debate. “If you talk to Yemenis, they will tell you that inside Yemen this is not perceived to be a Saudi bombing campaign, this is a US bombing campaign,” Murphy continued. “What’s happening is we are helping to radicalize the the Yemeni population against the United States.”

Not from Turkey. Lybia is more likely.

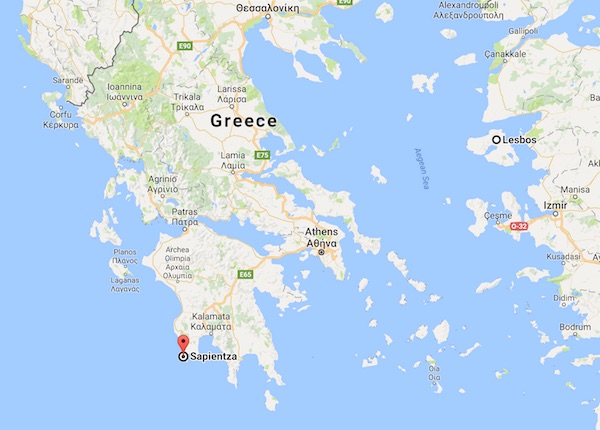

• Greek Coast Guard Rescues Dozens Of Migrants Stuck On Islet (AP)

Greece’s coast guard rescued dozens of migrants Friday whose boat ran aground on a deserted islet off the coast of southwestern Greece, hundreds of miles from the usual entry point of migrants into the European Union nation. The boat carrying about 70 people ran aground overnight on the tiny islet of Sapientza, off the southwestern tip of the Peloponnese, the coast guard said. The vast majority of migrants reach Greece’s eastern Aegean islands a few miles from the Turkish coast.

Coast guard vessels picked up the migrants Friday morning, ferrying them to the mainland where they were to be registered. It was not immediately clear what type of boat they had been on, where they had set sail from or where they had been sailing to. Separately, government figures showed 261 migrants or refugees arrived on Greek islands in the 24 hours from Thursday morning to Friday morning – a jump compared to recent figures, which had ranged from a few dozen to about 150 per day. Of those who arrived in the last 24 hours, the vast majority – 139 people – reached the eastern Aegean island of Lesvos. The rest arrived on Chios, Samos, Leros and Karpathos.

Endearing.

• The Fishermen of Lesbos (Hakai)

The Greek island of Lesbos is at the forefront of the refugee crisis as boatload after boatload of men, women, and children fleeing conflict in Syria, Iraq, Afghanistan, and elsewhere arrive on its shores. While citizen volunteers, NGOs, and governments claim much of the spotlight for rescue and recovery efforts, local people—especially those most experienced on the water—play a vital role, even at risk to their livelihoods and, perhaps, personal health. Greek video journalist Nikolia Apostolou introduces us to Lesbos fishermen on the front lines.