John M. Fox WCBS studios, 49 East 52nd Street, NYC 1948

“..of the 30 components of the Dow Jones Industrial Average, 20 reported “adjusted” earnings, with 18 of them reporting adjusted earnings that were higher than their earnings under GAAP”

• Stocks: Consensual Hallucination (WS)

The simple fact is that corporate earnings data is out there for everyone to see, but no one wants to see it. Instead, everyone wants to see and believe the sweet fairy tale that Wall Street and Corporate America spin with such skill just for us, because if everyone believes that everyone believes in this fairy tale, even knowing that it is a fairy tale, it will somehow lead to ever higher stock prices. This is part of a phenomenon we’ve come to call “Consensual Hallucination.” But that fairy tale got spun to new fanciful extremes in 2015. Revenues of the S&P 500 companies fell 4.0% in the fourth quarter and 3.6% for the year, according to FactSet, with most of the companies having by now reported their earnings. And these earnings declined 3.4% in Q4, dragging earnings “growth” for the entire year into the negative, so a decline in earnings of 1.1%.

While companies can play with revenues to some extent, it’s more complicated and not nearly as rewarding as “adjusting” their profits. That’s the easiest thing to do in the world. A few keystrokes will do. There are no rules or laws against it, so long as it’s called something like “adjusted earnings.” The rewards are huge, in terms of share prices, stock options, bonuses, and for Wall Street, fees. The ultimate target of the magic is earnings per share. EPS is the most crucial term in the canon of the markets. Turns out, the 2015 “growth” in earnings, and particularly the “growth” in EPS – so a decline – as reported by FactSet and others is a figment of the vivid imagination of Wall Street and Corporate America, called “adjusted earnings,” where everything bad has been “adjusted” out of it.

The reason every developed economy uses standardized accounting rules is to give investors a modicum of insight into what is going on in a company, compare these numbers to those of other companies, and make at least not totally ignorant investment decisions. In the US, these are the generally accepted accounting principles, or GAAP, the most despised acronym of Wall Street and Corporate America. Yet even these principles offer plenty of flexibility for financial statement beautification. We get that. Yet they’re way too harsh for Wall Street. So companies file the required financial statements under GAAP for everyone to look at, but then they hype their “adjusted” earnings in their communications with investors. And the gap between the two in 2015 was a doozie.

For example, of the 30 components of the Dow Jones Industrial Average, 20 reported “adjusted” earnings, with 18 of them reporting adjusted earnings that were higher than their earnings under GAAP, according to FactSet. That 18-to-2 relationship alone shows the clear bias of these adjustments: They’re used to inflate earnings, not to lower them to some more realistic level. These adjusted EPS were on average 31% higher in 2015 than EPS under GAAP. That’s way up from 2014 when 19 of the Dow components reported adjusted earnings that were on average 12% higher than under GAAP. And yet, despite the soaring portion of fiction, these adjusted EPS of the companies in the DOW still declined 4.8%. That’s bad enough. But under GAAP, beautified as it might have been, EPS plunged 12.3%.

It’s beginning.

• Mineworkers’ Protests Shake Chinese Leaders (CW)

Thousands of coal miners in the far northeast of China have been on strike for six days, demanding that China’s rulers – the so-called Communist Party dictatorship (CCP) – “give us back our money!” The protests, captured in dramatic video footage that is banned inside China, have shaken the Chinese regime during the very week when its ceremonial National People’s Congress (NPC) has been meeting in Beijing. A key discussion at the NPC has been about how the regime will cut the workforce in state-owned industries, with widely cited reports of 5-6 million redundancies, equivalent to one in six state sector jobs. The striking mineworkers of Heilongjiang province, a region already devastated by closures and layoffs, have given a courageous and resounding answer to these plans.

The mineworkers’ protests began on Wednesday 9 March in the city of Shuangyashan. Longmay Group, the largest state-owned coal producer in Heilongjiang and the whole of northeastern China, operates 10 mines in Shuangyashan and over 40 across the province as a whole. Last September, Longmay announced 100,000 job cuts – 40% of its entire workforce. The company owes a total of 800 million yuan (US$123 million) in unpaid wages dating from 2014. There have been earlier protests to demand payment of wage arrears by Longmay workers in different cities around Heilongjiang. The strike in Shuangyashan did not materialise from nowhere in other words, but is akin to a match being dropped into a large pool of gasoline.

“What the Shuangyashan incident has exposed is just a tip of the iceberg. It has been pretty endemic (workers not getting paid),” a rights activist from Heilongjiang told the Voice of America website. The trigger for the strike was a statement made by Heilongjiang’s governor Lu Hao during the NPC. At a televised meeting on 6 March, Lu claimed there were no wage arrears among Longmay workers and held the company up as an example of successful restructuring. He also stated that annual payrolls of Longmay are 10 billion yuan, equivalent to one-third of the provincial government’s entire budget, implying that the Longmay workforce are a burden on the province. “Their income hasn’t fallen a penny,” said Lu, in comments that made the workers’ anger spill over.

Initially breaking out in the Dongrong district of the city where Longmay runs three mines, the protests quickly spread across the whole of Shuangyashan. According to local sources eight out of the ten pits in Shuangyashan are only partially working, with mineworkers facing months of wage arrears. Whereas underground workers could earn 6,000 yuan a month in the past, most receive just half this level now – when they get paid. For other workers, monthly salaries have been cut to just 800 yuan (US$120)..

Wolf Richter summarizes China perfectly: “As exports of money from China is flourishing at a stunning pace, exports of goods are deteriorating at an equally stunning pace. “

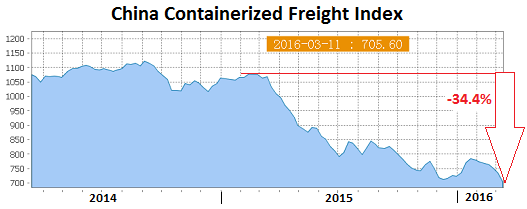

• China Ocean Freight Indices Plunge to Record Lows (WS)

Money is leaving China in myriad ways, chasing after overseas assets in near-panic mode. So Anbang Insurance Group, after having already acquired the Waldorf Astoria in Manhattan a year ago for a record $1.95 billion from Hilton Worldwide Holdings, at the time majority-owned by Blackstone, and after having acquired office buildings in New York and Canada, has struck out again. It agreed to acquire Strategic Hotels & Resorts from Blackstone for a $6.5 billion. The trick? According to Bloomberg’s “people with knowledge of the matter,” Anbang paid $450 million more than Blackstone had paid for it three months ago! Other Chinese companies have pursued targets in the US, Canada, Europe, and elsewhere with similar disregard for price, after seven years of central-bank driven asset price inflation. As exports of money from China is flourishing at a stunning pace, exports of goods are deteriorating at an equally stunning pace.

February’s 25% plunge in exports was the 11th month of year-over-year declines in 12 months, as global demand for Chinese goods is waning. And ocean freight rates – the amount it costs to ship containers from China to ports around the world – have plunged to historic lows. The China Containerized Freight Index (CCFI), published weekly, tracks contractual and spot-market rates for shipping containers from major ports in China to 14 regions around the world. Unlike most Chinese government data, this index reflects the unvarnished reality of the shipping industry in a languishing global economy. For the latest reporting week, the index dropped 4.1% to 705.6, its lowest level ever. It has plunged 34.4% from the already low levels in February last year and nearly 30% since its inception in 1998 when it was set at 1,000. This is what the ongoing collapse in shipping rates looks like:

What state control gets you.

• Yuan Loses Its Luster In Global Trade (WSJ)

The yuan is losing its luster as a means of settling cross-border transactions, a development that trading companies blame in part on the Chinese government’s reluctance to loosen its grip on the currency. Bureaucratic issues and a lack of yuan-denominated assets in which to invest have discouraged non-Chinese companies from using the currency in trade with their Chinese partners. Beijing’s recent heavy-handed market interventions have further reduced the currency’s appeal for foreigners, according to Chinese importers and exporters. The yuan’s popularity outside China slipped 0.2% last year, according to an index of metrics such as deposits and foreign-exchange turnover compiled by Standard Chartered since late 2010.

That was the index’s first ever annual decline, although it ticked up in the first month of 2016. Payments using the yuan fell to 21% of China’s total trade last October, before recovering to 30% in January, still well below the 37% peak recorded in August, according to central-bank data. “Given the yuan’s volatility and the authorities’ murky policy intentions, it’s hard to see interest in using the currency among our customers,” said Zhou Lin, finance director of Ningbo United Group Import & Export, a trading firm from China’s east coast that exports steel products and garments and imports coal and wood. “Demand for [yuan trade settlement] will only shrink further,” Mr. Zhou predicted.

“..36 purchases of U.S. companies valued at $39 billion, eclipsing 2015’s full-year record of $17 billion..”

• Chinese Investors Increase Buying in the US (WSJ)

Chinese companies are continuing their U.S. shopping spree. On Monday, the focus was on real estate. A group led by China’s Anbang Insurance came in with a $12.8 billion takeover offer for Starwood Hotels & Resorts Worldwide. The buyout offer threatens to upend Starwood’s tie-up with Marriott International. Anbang is also near a deal to buy Strategic Hotels & Resorts from a Blackstone-managed real-estate fund, people familiar with the situation said. Chinese companies have announced 36 purchases of U.S. companies valued at $39 billion, eclipsing 2015’s full-year record of $17 billion through 114 deals. And 2015 broke the record set in 2014, when Chinese buyers spent $14 billion on U.S. acquisitions. The tally for each year includes transactions where Chinese firms took big stakes in U.S. firms, such as the 5.6% stake that Alibaba took in Groupon in February.

Globally outbound Chinese M&A activity is closing in on its full-year high. Chinese companies have spent $102 billion to buy companies outside of its borders, just shy of its full-year record set in 2015 of $106 billion. The $43 billion acquisition of Swiss pesticide and seed company Syngenta by government-owned China National Chemical Corp. accounts for a large portion of that volume. Beyond real estate, Chinese companies have aggressively pursued deals for U.S. chip makers. In mid-February, U.S. technology distributor Ingram Microid said it had agreed to be acquired for about $6 billion by a unit of Chinese conglomerate HNA Group. Chinese buyers also have sought break up a number of existing deals for U.S. semiconductor companies with offers of their own.

Late last year, a group including China Resources Microelectronics and Hua Capital Management made an unsolicited bid for Fairchild Semiconductor International, which already had a deal with U.S. chip maker ON Semiconductor. Prior to that deal, the Chinese chip maker Montage Technology sought to break up Diodes planned purchased of Pericom Semiconductor. Both Fairchild and Pericom rejected the proposals from the Chinese firms, citing concerns that they would fail to pass muster with U.S. authorities on national-security grounds. U.S. regulators -specifically the U.S. Committee on Foreign Investment- have pushed back on Chinese purchases. In January, the committee blocked Royal Philips planned $2.8 billion sale of most of its lighting components and automotive-lighting unit to a Chinese investor on national-security grounds. The aggressive push into the U.S. comes amid slowing growth in China.

Smells desperate.

• China Drafts Rules for Tobin Tax on Currency Transactions (BBG)

China’s central bank has drafted rules for a tax on foreign-exchange transactions that would help curb currency speculation, according to people with knowledge of the matter. The initial rate of the so-called Tobin tax may be kept at zero to allow authorities time to refine the rules, said the people, who asked not to be identified as the discussions are private. The tax is not designed to disrupt hedging and other foreign-exchange transactions undertaken by companies, they said. Imposing a levy on foreign-exchange trading would be the most extreme step yet by policy makers to prevent speculative bets against the Chinese currency, after state-run banks repeatedly intervened to support the yuan and the government intensified a crackdown on capital outflows.

A Tobin tax would complicate plans by China to create an international reserve currency and could undermine the leadership’s pledge to increase the role of market forces in the world’s second-largest economy. “These measures can’t guarantee volatility in the market will come down since it’s difficult to identify if currency trading is down to speculation or the genuine need of companies hedging their foreign-exchange exposure,” said Tommy Ong, managing director for treasury and markets at DBS Hong Kong Ltd. “There haven’t been many successful experiences of this happening anywhere else in the world.” The rules still need central government approval and it’s not clear how quickly they can be implemented, the people said. PBOC Deputy Governor Yi Gang raised the possibility of implementing the punitive measure late last year in an article written for China Finance magazine.

Deflation misunderstood.

• Bank of Japan Holds Fire on Stimulus, Negative Rate Unchanged (BBG)

The Bank of Japan refrained from bolstering its record monetary stimulus as policy makers gauge the impact of the negative interest-rate strategy they adopted in January. Governor Haruhiko Kuroda and his board kept the target for increasing the monetary base unchanged, and left their benchmark rate at minus 0.1%, the BOJ said in a statement on Tuesday. The decision was forecast by 35 of 40 economists surveyed by Bloomberg. The central bank reiterated that it will add easing if necessary. With the BOJ far from its 2% inflation goal and economic growth stalling, most analysts have seen additional stimulus as just a matter of time.

The stakes are rising for Kuroda, with household and corporate sentiment waning and investors questioning whether monetary policy is reaching its limits. The governor holds a press briefing later today. “You can see from the statement the agony for the BOJ in the gap between their hopes and the realities in the economy and prices,” said Kyohei Morita, an economist at Barclays. “Japanese inflation is at a level where even the BOJ has to admit its weakness. It is leaning toward additional stimulus and I expect it to be in July.”

Mortgages for free.

• ECB Rate Cuts Help Spanish Home-Buyers, Hurt Banks (WSJ)

Sheila Guerrero loves Mario Draghi. Her Spanish bank probably doesn’t. Ms. Guerrero’s mortgage payments have fallen by about 40% since she and her husband took out a loan in 2006 to buy their two-bedroom home on the southern outskirts of Madrid. The current payments of €485 a month, or about $541, she says, are “less than some people pay in rent.” Mortgage borrowers in Spain, and their banks, are acutely affected by the rate cuts that ECB President Mr. Draghi, rolled out on Thursday. That is because 96% of mortgages in Spain, a far higher percentage than in other European countries, are variable-rate loans that fluctuate with the rise and fall of the euro interbank offered rate. The 12-month Euribor, as the rate is known, plummeted from 2.2% in mid-2011 into negative territory last month. It is now around -0.03%.

The nosedive is a boon to millions of Spanish homeowners, whose mortgage payments are typically repriced each year based on changes in the rate. It has been a bust for the balance sheets of Spanish banks, helping to drive down their stock prices in recent months. The ECB’s announcement Thursday brought some relief for lenders because it included an offer of cheaper funding through new long-term loans to eurozone banks. Investors welcomed the news, and shares of major Spanish banks surged on Friday. Still, negative rates remain a drag on the banks’ profitability. Each drop of 10 basis points in the 12-month Euribor rate triggers around a 2% decline in a profit metric for Spanish banks known as net interest income, Daragh Quinn, an analyst at Keefe, Bruyette & Woods, wrote in a research report Tuesday.

One basis point is equal to one one-hundredth of a percentage point. Net interest income is the difference between what lenders pay clients for deposits and charge for loans. Spanish banks are trying to compensate for the hit to net interest income by shifting away from mortgages, which have accounted for about half their lending, to business loans that carry higher interest rates. But the shift is happening en masse, driving down the rate on business loans too. Ms. Guerrero and her husband, a mechanic, began paying €800 a month when they took out the 50-year loan a decade ago, when they were in their 20s. Their current mortgage will be repriced in April based on February’s negative Euribor rate, which she expects will reduce it by €15, to €470. “Every extra bit you can get is welcome,” said Ms. Guerrero. Mortgages issued by Spanish banks yielded an average of 1.51% in January, one of the lowest rates in all of Europe, ECB data show. That figure compares with 2.58% in Italy and 3.27% in Germany.

Deutsche derivatives start cracking. Uncleared, single-name, oh boy! How many pennies do they get on the buck?

• JPMorgan, Goldman Discuss Buying Deutsche Bank Derivatives (BBG)

Deutsche Bank, the lender exiting some trading operations, is in talks with JPMorgan Goldman Sachs and Citigroup to sell the last batches of about 1 trillion euros ($1.1 trillion) in complex financial instruments, people with knowledge of the matter said. Deutsche Bank, based in Frankfurt, has sold about two-thirds of the portfolio of uncleared, mostly single-name credit default swaps since last year and wants to sell the rest within the next few months, according to the people, who asked not to be identified as the talks are private. The three U.S. banks have already purchased some of the instruments, the people said.

Deutsche Bank is withdrawing from countries, dumping unprofitable clients and pulling out of businesses as co-CEO John Cryan, 55, tries to boost profit and meet tougher capital rules after starting in July. He inherited a plan by his predecessor, Anshu Jain, to stop trading most credit default swaps tied to individual companies after new banking regulations made them costlier. “It’s all about capital and leverage,” said Chris Wheeler at Atlantic Equities. “Cryan clearly feels it’s not a profitable business, given the need to provide more capital under new regulations.” JPMorgan was among banks in talks to purchase more than $250 billion of the swaps, while Citigroup had already bought almost $250 billion, Bloomberg News reported in October. Deutsche Bank’s portfolio of swaps had a gross notional value of about 1 trillion euros when it began sales last year, the people said. That measure includes long and short bets and doesn’t account for offsetting contracts.

[..] Deutsche Bank’s swaps are uncleared, meaning that investors trade them directly with each other rather than through one of the clearinghouses that are mandatory for many trades after the crash. Europe’s biggest banks will need billions of dollars to meet new rules for collateral that they must set aside when trading uncleared swaps, regulators said this week. The swaps are mostly “single-name,” meaning that they’re tied to individual companies’ creditworthiness, as opposed to an index of securities, one of the people said. Deutsche Bank stopped trading these instruments in late 2014, the lender said then. The total size of the credit derivatives market has dropped by almost two-thirds from $33 trillion in 2008, according to the Depository Trust & Clearing Corp.

Those are old worries, FT.

• Fears Rise Over US Car Loan Delinquencies (FT)

HDelinquencies on poor-quality US car loans have climbed to their highest level in almost two decades, according to Fitch Ratings, reinforcing concerns over the rapidly growing market. The rate of “subprime” auto loans overdue by more than 60 days rose to 5.16% in February. This surpassed the post-financial crisis peak and was the highest since the 5.96% reading in October 1996, according to the rating agency. Subprime auto loans have long been a concern for analysts, some of whom feared that rapid issuance since the crisis and weakening lending standards would cause problems in the market for securitised auto loans. There, banks repackage loans into asset-backed securities and sell them on to investors, much like they did with subprime mortgages in the 2000s.

“Sharp origination growth, increased competition and weaker underwriting standards over the past three years have all contributed to the weaker performance of the past year,” Fitch Ratings said in its report. The overall US auto finance market passed $1tn in 2015, powered by strong car sales. Issuance of US auto loan-backed ABS climbed 17% to $82.5bn last year, according to data provider Dealogic, the strongest year for such sales since 2005. Fitch tracks the performance of almost $100bn of auto loans that have been securitised into so-called asset-backed bonds, of which just over a third is considered subprime. The delinquency rate on prime US auto ABS stood at just 0.46% in February, up slightly month-on-month but flat compared to the same month in 2015.

Subprime typically means borrowers with scores below 620 from FICO, the biggest credit risk scorer, which rates consumers from 300 to 850. Fitch expects both prime and subprime auto loan ABS performance to improve this spring thanks to tax refunds, but that the seasonal benefits will be more muted given the weakening of loan quality and the expected softening of the US wholesale car market. “Both the prime and subprime sectors have been buoyed by strong used vehicle values over the past five years, contributing to lower loss severity on defaults,” the report said. “However, with new vehicle sales and expected off-lease vehicle supply levels at historical highs entering 2016, Fitch anticipates weakness in the wholesale market.”

“Australia’s net foreign debt is now over a trillion dollars, and less than a quarter of that is public debt.”

• The Recession Australia Has To Have (ABC)

Earlier this week, Liberal Immigration Minister Peter Dutton warned that Labor’s proposed property investment tax changes would bring the economy to “a shuddering halt” and “crash” the stock market. His comments drew a swift rebuke from Labor’s shadow treasurer Chris Bowen, who described them as “reckless” and part of an “outlandish scare campaign”. But are they really so farfetched? Given the massive impact of Australia’s housing market on the economy as a whole, perhaps not. But that’s precisely why something needs to be done now, so that the possibility of a recession doesn’t become the threat of a depression. If we look closely at Australia’s GDP figures, we can get a sense of how out of kilter our housing market has become – and what might happen if the rug was pulled out from beneath it.

Over the past year, residential construction and renovations grew by around 10%, according to the ABS national accounts. The residential building sector alone thus directly added around half a percentage point to the nation’s 3% GDP growth. Obviously, if the sector stopped expanding, other things being equal, GDP growth would slow to 2.5%. If the industry shrank by an equivalent amount, it would have directly pulled GDP growth back closer to 2%. However, that’s only the beginning. As the home is by far the biggest asset for most of the roughly two-thirds of households who own one (outright or mortgaged), the “wealth effect” of rising property prices is a major driver of household consumption. Unlike residential building which makes up about 5.3% of spending in the economy, household consumption makes up nearly 56%.

If household consumption fell, there is a good chance Australia could see its first recession in a quarter of a century. Last quarter, “final consumption expenditure” was by far the biggest contributor to Australia’s economic growth, adding 0.4 percentage points out of a 0.6% GDP increase. Its mammoth size relative to the total economy saw household expenditure contribute just over half of Australia’s 3% economic growth last year, even though household spending only grew a tepid 2.9%. If falling home prices halted growth in household consumption, that would take a further 1.6 percentage points off growth. Not only has Australian household debt-to-income roughly tripled since the late 1980s to a fresh record 184.6%, driven entirely by surging housing debt, but most of that money has been borrowed from offshore. Australia’s net foreign debt is now over a trillion dollars, and less than a quarter of that is public debt.

Canada wins?

• Obama To Kill Off Arctic Oil Drilling (Guardian)

The Obama administration is expected to put virtually all of the Arctic and much of the Atlantic off limits for oil and gas drilling until 2022 in a decision that could be announced as early as Tuesday. The decision reverses Barack Obama’s move just last year to open up a vast swathe of the Atlantic coast to drilling – and consolidates the president’s efforts to protect the Arctic and fight climate change during his final months in the White House. The five-year drilling plan, which will be formally announced by the interior department, was expected to block immediate prospects of hunting for oil in the Arctic, according to those familiar with the proposals. The move was widely anticipated after Obama and Justin Trudeau, the Canadian prime minister, declared last week they would follow “science-based standards” when it came to sanctioning new oil and gas drilling in the Arctic.

But the plan was also expected to seal off large areas of the Atlantic coast from future exploration, following protests from coastal communities in the Carolinas and Georgia – and that could cause reverberations in the presidential elections. Shell, ExxonMobil and Chevron have been pushing heavily to reopen drilling off the Atlantic coast, and Republicans and some state governors were also in favour. Obama had been inclined to agree. But after protests from dozens of coastal tourist towns, which feared a repeat of BP’s oil disaster in the Gulf of Mexico, and opposition to drilling from the Democratic presidential contenders Hillary Clinton and Bernie Sanders, Georgia and the Carolinas were expected to remain closed to future drilling, sources familiar with the plans said.

Why the EU doesn’t work, and never will. This time it’s all of Europe against tiny Cyprus.

Donald Tusk, the European Council president who has been attempting to broker a deal to stop the influx of refugees into the EU, has flown to Nicosia for a meeting this morning with Cypriot president Nicos Anastasiades. For a man who spent the week before the last EU migration summit travelling to seven different capitals in four days, the fact that Mr Tusk is making Cyprus his only stop ahead of the next two-day gathering beginning Thursday is telling: the small island nation may prove the most difficult needle to thread in Brussels’ nascent deal with Turkey to take back thousands of migrants now washing ashore in Greece. [UPDATE: Mr Tusk has tacked on an evening trip to Ankara at the last minute.]

Cyprus has long been one of the biggest complicating factors in EU-Turkey relations, so objections from Nicosia to the demands being made by Ankara– another €3bn in aid, a visa-free travel scheme, opening of new “chapters” in EU membership talks – may have been expected. But the small group of EU leaders who brokered last week’s deal, led by Germany’s Angela Merkel, seemed to have forgotten that Cypriot objections this time around are far more consequential: the country is in the middle of delicate talks that diplomats believe are the best (and perhaps last) chance to reunify an island divided since Turkey invaded and held its northern half in 1974.

For Mr Anastasiades, making concessions to Ankara now without any compensation would not only cost him politically at home, but could wreck reunification talks altogether since the Greek Cypriot community he leads would likely abandon him. Like all other 27 EU heads of state, Mr Anastasiades can, on his own, veto the Turkey deal. Officials involved in last week’s summit now admit they may have mishandled the Cyprus issue; at one point, Mr Anastasiades was put into a room with Ms Merkel and the leaders of four other countries, all of whom pressured him to give up the “freeze” Nicosia has on the five membership chapters. The freeze was imposed by Cyprus in 2009 because Ankara had not lived up to commitments made to the EU to recognise the Nicosia-based Greek Cypriot government, and Mr Anastasiades has repeatedly insisted he cannot simply give up on the position without something in return.

There’s enough being blamed on Greece as is.

• Greek Asylum System Is Broken Cog In EU-Turkey Plan (EUO)

Much has been said on the merits of a draft EU-Turkey deal to return unwanted migrants from Greek islands. The plan hinges on designating Turkey as a “safe” country in order to send all “irregular migrants” packing. But Turkey’s patchy application of the Geneva Convention, Europe’s post-WWII human rights bible, and allegations of push-backs have cast a shadow over the draft accord. Big questions also remain on how Greece intends to implement EU asylum law under the new plan. Even if Ankara fulfills its side of the bargain, Greece can still expect a years-long backlog of asylum applications, appeals and meta-appeals that risk undermining the objective of speedy returns. Greece’s asylum system is dysfunctional. Some asylum seekers have waited up to 13 years to have their cases heard.

For rapid returns to work, Greece would need to overhaul its system and hire many more judges. The European Commission wants Greece to make it quick and efficient. “It’s up to the Hellenic authorities to organise this,” commission spokesman Margaritis Schinas said on Monday (14 March). The Greek deputy minister for citizens’ protection, Nikos Toskas, over the weekend said a return under its bilateral agreement with Turkey could take just 48 hours. But a glance at EU laws and at the Greek asylum process makes that prospect seem unlikely. EU law gives anyone, Syrian or otherwise, the right to defend their case before a Greek court after having transited through Turkey. “Asylum seekers won’t be denied the rights to be heard,” said Schinas.

It means all will have the right to claim Turkey is not safe enough for them to be returned to. If Greek authorities reject their initial claim, the asylum seeker can appeal. That appeal must heard before a Greek court. Past cases in Greece show that the system is cumbersome and already overstretched. The Greek Forum for Refugees, an Athens’ based migrants’ group, said in a blog post earlier this month that people who have had their appeal interviews “are now waiting for months, or even years, to receive a decision from the authorities”. As of September last year, Greece had 23,000 pending appeals for applications filed before June 2013. Nobody seems to know how many more cases were filed after June 2013 when the vast bulk of asylum seekers arrived in Greece.

The Greek administrative body that oversees them stopped digging into the cases last October after its mandate expired. “So currently there is a freeze in the examination of appeals. We don’t know how many are pending,” the Brussels-based European Council on Refugees and Exiles, a non-profit watchdog on EU policy, told EUobserver. Meanwhile, 35,000 more people became stuck in Greece in recent weeks after the EU slammed shut its Western Balkan borders About 2,000 more are arriving on Greek shores from Turkey each day. It is likely that many people who struggle across the Aegean will exploit their legal rights to prevent their immediate return. In an added complication, it is also unclear if the legal challenge would be handled in the zones where people are first screened, identified and registered or in separate courts in the Greek islands’ local capitals.

Another sorrowful episode. Should Greece let them in? Or should it protect its borders?

• FYROM Returned About 600 Migrants To Greece (Reuters)

The Former Yugoslav Republic of Macedonia (FYROM) has sent about 600 refugees who crossed the border on Monday back to Greece, a FYROM police official said on Tuesday. Most of the migrants were taken back to Greece on Monday or overnight on trucks, the official said. Hundreds of migrants marched out of a Greek transit camp, hiked for hours along muddy paths and forded a rain-swollen river on Monday to get around a border fence and cross into FYROM, where they were detained.

It’ll get completely out of hand way before.

• Greek Minister Sees Refugees Stuck For At Least Two Years (Kath.)

It may take up to two years for refugees and migrants trapped in Greece by closed borders at its north to be relocated to other countries of the EU or deported, Alternate Defense Minister and coordinator of the ministerial team managing the crisis Dimitris Vitsas, told the Financial Times on Sunday. “The thousands of migrants at the border are awaiting the outcome of the March 17 summit [of EU leaders] on refugees, hoping they will then be able to cross”, Vitsas said, referring to a summit later this week with Turkish officials to finalize a plan for migrant returns and relocations. “We have to persuade them this is not going to happen .. then the Idomeni camp will quickly empty, I think by the end of the week”, Vitsas told the FT.

His interview came a day before a spokesman for the UNHCR warned that conditions at the makeshift camp that is home to over 10,000 migrants on Greece’s border with the Former Yugoslav Republic of Macedonia (FYROM) are just unbelievable. Official estimates on Monday put the number of migrants trapped in Greece at over 44,000 as new arrivals kept landing on the country s eastern islands. Vitsas estimated that even if EU and Turkish leaders agree to speed up relocations, clearing the backlog in Greece may take up to two years. “We also have to recognize that some migrants will stay in Greece permanently. It’s going to happen”, Vitsas told the FT.