Walker Evans Street Scene, Vicksburg, Mississippi 1936

“This could be the start of a worrying trend.” Huh? The start?

• The US Economy Is Signalling An Iceberg And We’re Out Of Lifeboats (Guardian)

As the economic news from the eurozone improves by a notch (although not in Greece, inevitably), US consumers are sending the opposite signal. Sluggish retail sales in the first quarter of the year were, we were told, caused by a cold snap. There would be a spring bounce, investors assumed, as supposedly confident Americans spent their windfalls from the lower oil price. Well, it didn’t happen in April: yesterday’s figures were flat, and the weather-related explanation is wearing thin. This could be the start of a worrying trend. Indeed, if Americans are preferring to use excess cash to pay down debt, it’s hard to see why they would change their minds now. The oil price has started to rise again and long-term bond yields are also on the up, reducing opportunities to remortgage at a cheaper rate.

Economists assume that this “soft patch” for the US economy is now so soggy that the US Federal Reserve will, again, postpone its attempt to raise interest rates. A hike next month is seen as a non-starter; it will come in September, at the earliest. But what if the run of weak numbers points to something more severe? On cue, HSBC economist Stephen King yesterday published a weighty analysis titled “the world economy’s titanic problem” that pointed out that it has been six years since the trough of the last US recession. “If history is any guide, we are probably now closer to the next one,” he said. Business cycles always turn, and after six years of growth, even at a pedestrian rate, the current recovery is old.

One could make the same point about the UK, where the economic weather tends to follow that of the US, with a lag. King’s point – which explains the Titanic reference – is that policymakers are out of lifeboats if a recession were to arrive. The US Fed has dealt with past recessions by cutting interest rates by at least five percentage points. That is obviously impossible today because rates are still on the floor. To change the metaphor, the arsenal is bare: “Whereas previous recoveries have enabled monetary and fiscal policymakers to replenish their ammunition, this recovery – both in the US and elsewhere – has been distinguished by a persistent ammunitions shortage,” says King. “This is a major problem.”

Read more …

Central banks should have stayed on the sidelines, but it’s too late now.

• Central Banks Are Running Low on Ammunition (Bloomberg)

“The world economy is like an ocean liner without lifeboats.” That’s the headline in HSBC Chief Economist Stephen King’s latest note. What he’s getting at is that with interest rates sitting at or near record lows in economies across the globe, central banks could be set for major struggles if the economy starts to sour.

If another recession hits, it could be a truly titanic struggle for policymakers. … Remarkably enough, it’s six years since the last recession, suggesting the next one may not be too far away, yet there is a total absence of traditional policy ammunition.

In past recoveries, policymakers on both the fiscal and monetary side have been able to raise rates and “replenish their ammunition,” as King puts it. This recovery has proved otherwise. King says this is a huge problem.

In all recessions since the 1970s, the US Fed funds rate has fallen by a minimum of 5 percentage points. That kind of traditional stimulus is now completely ruled out. Meanwhile, budget deficits are still uncomfortably large and debt levels uncomfortably high: while the US fiscal position has improved, it remains structurally weak.

Although the Federal Reserve is the most discussed, it’s not just the U.S. central bank that has embarked on this historical move. King notes that several other regions have similar narratives. The European Central Bank appears to be committed to quantitative easing until September 2016. The Bank of Japan is basically in the same boat. The Bank of England may not be increasing its balance, but it has yet to raise rates. Fiscal positions, meanwhile, are mostly poor, at least when compared with those pre-crisis. So what options do central banks actually have at this point?

Here’s what King’s report looks at:

• Reducing the risk of recession

• Reverting to quantitative easing

• Moving away from inflation targeting

• Using fiscal policy to replace monetary policy

• Using fiscal and monetary policy together in a bid to introduce so-called “helicopter money”

• Pushing interest rates higher through structural reforms designed to lower excess savings, most obviously via increases in retirement age.

Regarding his first point, how exactly can fiscal and monetary policy reduce the risk of the next recession? Well, it’s not easy. According to King, new safeguard regulations such as increasing bank capital might work in a narrow sense, but not every crisis is the same.

Read more …

And here’s the inevitable result of the Fed actions:

• America’s Future Got $7 Trillion Worse Since the Financial Crisis (Bloomberg)

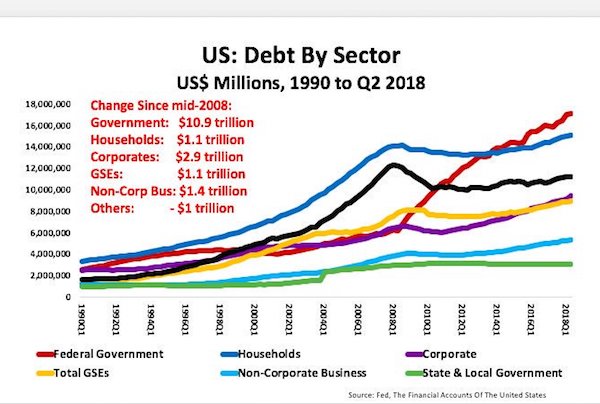

Still feeling uncomfortable about that tax bill you owed last month? Think about it this way: If you didn’t pay it, America’s fiscal future would look even worse than it does now, six years out from the financial crisis. Driven by higher interest costs, Social Security and Medicare for baby boomers, as well as tax cuts made permanent in 2012, the federal debt held by the public is expected to hit $40 trillion in 2035, according to calculations by the Committee for a Responsible Federal Budget based on Congressional Budget Office estimates. Back in 2009, soon after President Barack Obama took office, the forecast for the 2035 burden was at least $7 trillion lower.

In 2035, the debt will almost equal the size of the U.S. economy; four years later it will match the previous record, set in 1946, at 106% of gross domestic product, the CBO estimated last year. Compare that to the 2014 debt burden of $12.8 trillion, or 74% of GDP.

The economy just isn’t growing fast enough to keep pace with the costs of caring for the soaring ranks of the elderly, and the discrepancy between spending and revenue is estimated to widen in the next few decades. Republicans say their proposal passed by Congress last week will save $5 trillion and balance the budget within a decade. The Obama administration likes to tout how it’s reduced the budget deficit by three-fourths and is on track to narrow further.

Either way, the number of people paying Social Security taxes is expected to grow more slowly than the number of those receiving the entitlements. The number of taxed workers will increase 20% between now and 2045, while beneficiaries of Social Security’s Old-Age, Survivors and Disability Insurance (OASDI) funds will increase 57% over the same period, according to the Social Security Board of Trustees. As a result, there will be about two taxpayers per beneficiary in three decades, down from almost three now. For comparison, the same ratio was 3.4 to 1 in 2000.

Higher spending on debt servicing and entitlements means less money for other purposes, such as education or research. It also means some hard decisions at some point. In order to prevent debt from becoming an even bigger portion of GDP, the U.S. needs to increase taxes by 7.5% or cut spending by 7%, said Marc Goldwein, vice president and policy director of the Committee for a Responsible Federal Budget, a Washington advocacy group. To bring the ratio more in line with the historical level of 40%, taxes would have to go up 13.5%, according to Goldwein. The later any action is taken, the deeper the spending cuts or the higher the tax increases would have to be.

Read more …

Classic lowballing.

• The US Economy Has Left Behind 20 Million Americans (MarketWatch)

Last month, when Baltimore was burning after a young African-American man died in police custody (six officers were subsequently charged), I did a Google search to find what David Simon thought about it. Simon, a former reporter for the Baltimore Sun, was the creator and show runner of “The Wire,” which ran for five seasons on HBO and which Entertainment Weekly called the greatest television show ever. It was a brilliant narrative of the struggle for survival in a violent, drug-riddled Baltimore neighborhood much like the one that went up in flames. In my search, I came across an interview Simon did with Bill Moyers a few years ago in which he declared: “ ‘The Wire’ was not a story about America; it’s about the America that got left behind. … These really are the excess people in America. Our economy doesn’t need them — we don’t need 10% or 15% of our population.”

Have 10% to 15% of the U.S. population really been left behind? I contacted Simon at his website to ask where he got the number, but he didn’t get back to me. So I did my own calculations, and he’s actually not too far off. With a little help from the Labor Department’s Bureau of Labor Statistics, which produces the famous monthly jobs reports, I added up several categories of the unemployed, the underemployed and people on some form of public assistance. My conclusion: About 20 million Americans, roughly 10% of adults of working age, have at best marginal ties with the U.S. economy. I excluded the elderly, because most of them are retired and getting Social Security, and children, whose lives and futures are often collateral damage in the economic struggles of their parents.

Here’s how it adds up:

• 2.5 million are among the long-term unemployed, which the Labor Department defines as being out of work and actively seeking work for 27 weeks or more. That’s less than half what it was in 2009, but it’s still high.

• 6.6 million Americans are working part-time for economic reasons but would prefer to work full time.

• Another 2.1 million are marginally attached to the labor force, according to the Labor Department. That means they are “not in the labor force [but] want and are available for work, and … have looked for a job sometime in the prior 12 months.”

• Nearly 5 million adults from age 18-64 are collecting Supplemental Security Income (SSI) disability benefits, which go to people who can’t work because of various disabilities.

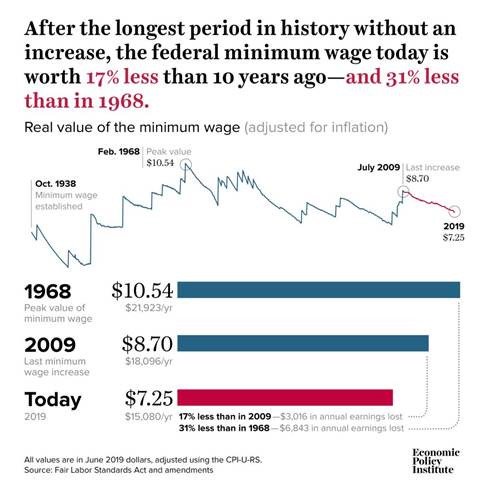

• Almost 1 million adults receive public assistance from Temporary Assistance to Needy Families (TANF) and General Assistance (GA), according to the U.S. Census Bureau. Those are temporary cash payments with some work requirements that replaced the old welfare system under welfare reform. • In 2013, 3.3 million Americans earned the federal minimum wage or less, according to the Pew Research Center. If you think they haven’t been left behind, try living on $7.25 an hour. Grand total: 20.4 million adults. Now, there is some overlap, and Labor Department figures are for people from 16 to 64, while the other stats cover those from 18 up. But those caveats aside, 20 million is a reasonable ballpark number — and a disturbing one.

Read more …

No, Ambrose, this is the sound of failure.

• Epic Global Bond Rout Is A QE Success Story – But It Won’t Last (AEP)

Occam’s Razor is the sharpest way to cut through tangled explanations for the epic rout in global bond markets. The simplest explanation is the best. “Frustra fit per plura quod potest fieri per pauciora.” Bond yields are soaring because the world’s central banks have demonstrably done enough for now to stop deflation taking hold. The short-term monetary cycle is turning. The reflation trade is on. The broad M3 money supply has been growing at a 7pc rate in the US over the past six months (annualized), and nearly 8pc in the eurozone. Fiscal austerity has run its course as well. Budget policy is no longer contractionary in either of the world’s two biggest economic blocs. Unless the normal mechanisms of monetary policy have broken down altogether – which is possible, but would you bet your pension on it? – the burgeoning M3 data point to a reflationary revival of some sort later this year.

John Williams, the once dovish head of the San Francisco Fed, told Yahoo! Finance on Tuesday that the US economy is “running a little bit hot”. Rightly or wrongly, he chose to dismiss the economic relapse in the first quarter as a weather-blip. The world’s monetary superpower is chomping at the bit. Hedge funds were asking for trouble by driving yields on 10-year German Bunds to a historic low of 0.07pc in mid-April. Trouble is what they got. Three weeks later, Bunds are trading at 0.65pc. The paper losses across the spectrum of global bond markets is roughly half a trillion dollars. Put another way, Bank of America says the €2.8 trillion of eurozone debt trading at negative yields has just shrunk to €2 trillion. It calls this a “positioning purge”.

The mistake was to bet on an acute shortage of sovereign bonds once the European Central Bank launched its €60bn monthly blitz of quantitative easing. Bunds were thought to have a special “scarcity premium” since they are dying out. The German government is running a fiscal surplus of 0.5pc of GDP this year. Markets ignored known evidence that bond yields rose by 80-120 basis points during the various bouts of QE in America, which is what one would expect as recovery builds and the risk of deflation abates. Contrary to mythology, QE does not work by lowering bond rates. It works through a different mechanism: by causing banks to “create” money.

ECB president Mario Draghi has accomplished his first goal, even if he might silently be cursing the newfound strength of the euro. The eurozone is clawing its way out of depression. The growth rate of nominal GDP growth has risen from 1.1pc at the start of the year to 1.5pc, subtly altering long-term debt dynamics for the crisis states of southern Europe. They are no longer quite so close to a debt-deflation trap. The one-year “inflation swap rate” – measuring expectations – has jumped by almost 100 basis points since October in the eurozone. The five-year contracts are starting to catch up. This is a short-term cyclical upswing. It does not in itself narrow Europe’s North-South rift in competitiveness, and does not magically turn EMU into an optimal currency area. It does buy time.

Read more …

We accept monopoly money.

• Foreign Money Pours Into US Real Estate, and It’s Not Just Houses (Bloomberg)

Blockbuster real estate deals are back and breaking records as cash from around the globe pours into U.S. office buildings, apartment complexes and other investment properties. Commercial real estate transactions jumped 45% by dollar volume in the first quarter, an increase driven by sales of multiple buildings or entire companies, according to research firm Real Capital. Since then, GE. agreed to sell real estate assets to Blackstone and Wells Fargo in a deal valued at about $23 billion, the largest property purchase since the financial crisis. As the pot of money set aside for U.S. commercial real estate grows, competition for the best properties is pushing investors to buy in bulk.

Based on the pipeline, which includes the GE deal, the second quarter may be one of the biggest on record for property transactions, according to Real Capital. “It’s so hard to get things on a single-asset basis,” said Janice Stanton, an executive managing director at commercial brokerage Cushman & Wakefield. “You’re starting to see larger and larger transactions.” Real estate deals surged to $129 billion during the three months through March, marking the most active start to a year since 2007, according to Real Capital. The largest was Blackstone’s $8.1 billion sale of IndCor Properties, an owner of industrial buildings, to GIC Pte, Singapore’s sovereign-wealth fund. Demand for property from warehouses to skyscrapers is booming, helped by more than six years of Federal Reserve efforts to stimulate economic growth by keeping interest rates low, and stockpiles of cash from overseas investors seeking a haven.

About $24 billion in foreign capital flowed to U.S. properties in the first quarter, more than half the total for all of 2014, according to Cushman. That number is poised to grow further because the majority of sovereign wealth funds – investors such as GIC – have yet to hit their target allocations for real estate, according to Preqin Ltd., an alternative-assets research firm. Total property allocations for such funds now top $6.3 trillion, more than double the amount in 2008, London-based Preqin said in a report this month. Surging prices for the best buildings in big cities such as New York and San Francisco are driving the real estate recovery. Centrally located office towers are fetching prices 33% above records set in 2008, according to an index from Real Capital and Moody’s.

Read more …

“In the face of an extraordinary event, you would also witness some extraordinary support” for Greece..”

• Greece Will Stay In Euro Even If It Defaults, Renzi Adviser Says (Bloomberg)

Greece will remain in the euro even if it fails to meet a debt payment, according to Italian Prime Minister Matteo Renzi’s economic adviser. Filippo Taddei, a key aide to Renzi during his overhaul of the euro region’s third biggest economy, said that “nobody knows” whether Greece can meet its debt obligations from one day to the next. As a result, “plans are being set” at European level to mitigate the effect of a Greek default, he said in an interview in Rome on Tuesday. “It’s an intellectual and analytical mistake to think that a default on Greek debt would automatically bring Greece out of the euro,” Taddei said. “The euro is not just an economic project but has a strong political project, and it is very hard to envisage a united currency without Greece.”

Taddei’s comments are the strongest public indication yet that Greece’s euro-area creditors are preparing a plan in case Prime Minister Alexis Tsipras’s government is unable to meet a payment on its outstanding debt. The Greek economy returned to recession in the first quarter, European Union statistics showed on Wednesday, two days after Finance Minister Yanis Varoufakis said that Greece will run out of cash within a couple of weeks unless it gets help. Italy, which saw 10-year bond yields soar to more than 7% in November 2011 at the height of the debt crisis, would again suffer “additional volatility,” if Greece got into more difficulty, Taddei said. Similar Italian debt yielded about 1.82% [today]. “In the face of an extraordinary event, you would also witness some extraordinary support” for Greece, Taddei said.

Plans are being drawn up in “the proper European” forums to prepare for a possible default. While Taddei declined to be drawn on specifics, he said that European institutions were now “a lot more attentive, a lot more ready to respond” to such volatility than during previous financial crises. “We all learned that European institutions in general were not very active and were not very quick at addressing the crisis, or the shock, or the consequences of the crisis. But I think that lesson has been learned and now there is increased awareness that you have to react quickly,” Taddei said. “We will be ready to act.” That includes taking part in any third rescue package for Greece. Italy, he said, “will always take part in any effort to safeguard the euro.”

Read more …

“I’m sorry to say that this huge cost for the economy is the basic negotiating weapon of the other side..”

• Greek Minister Sees ‘Only 10%’ Chance Of Failure In Creditor Talks (Bloomberg)

The chances of a breakdown between Greece and its creditors are small, as neither of the two sides is willing to risk the breakup of the euro area, Greece’s administrative reform minister said. “I estimate that the chances of rift are only 10%, as I have faith that reason will prevail,” George Katrougalos, 52, said in a telephone interview from Athens on Tuesday. “We are in a trajectory heading towards agreement for the simple reason that neither of the two sides wants a rift.” Europe’s most indebted state is locked in talks with its creditors over the terms attached to its €240 billion bailout. Uncertainty over the country’s future in the euro area has triggered a liquidity squeeze, which pulled the economy back into a double-dip recession.

“We have moved from Grexit to Grimbo, as Greece is in limbo,” said Katrougalos, who is also a professor of public law. “This liquidity crunch, which is caused by the European Central Bank not adhering to its responsibilities, doesn’t allow the Greek economy to grow.”Without access to capital markets, Greek lenders are bleeding deposits and relying on €80 billion of Emergency Liquidity Assistance, extended by the country’s central bank, to stay afloat. The European Central Bank, which can block the ELA provision, has so far resisted the Greek government’s demands to allow Greek lenders to buy more treasury bills, as the use of central bank funds to finance the state would go against EU treaties.

Sorbonne-educated Katrougalos said the ECB’s stance and the refusal of euro-area member states to disburse bailout funds are tactics creditors are using to force the Greek government to capitulate to their demands.“I’m sorry to say that this huge cost for the economy is the basic negotiating weapon of the other side,” the minister said. “They bring time limits to reach a deal to the brink, as a negotiating tactic. This is not proper behavior among partners.”Despite the lengthy negotiations, the minister believes a compromise will be reached. “Only if the logic in the back of the minds of some of our peers – which says that a government of the left shouldn’t be allowed to succeed – only then we will not reach an agreement,” he said.

Read more …

‘Emergency’ meetings are a daily event.

• Greek Government Mulls Reforms With Eye On Deal As Some Resist (Kathimerini)

The government’s strategy in negotiations with creditors and a raft of possible measures, including tax reforms, that could form the basis of an agreement, dominated a marathon cabinet meeting on Wednesday chaired by Prime Minister Alexis Tsipras. The meeting, which ran late into the night, was aimed at examining a wide range of changes to the tax system as well as possible privatizations ahead of technical-level talks that are due to resume in Brussels on Thursday. Officials also discussed the possible timing for drafting some of these changes into legislation in a bid to show good will and convince the European Central Bank to relax liquidity restrictions on Greece.

Comments by cabinet members earlier in the day gave a mixed picture of the government’s intentions with some insisting that it remained focused on reaching a deal while others suggested there should be no compromise with the demands of Greece’s creditors, despite the increasingly tight liquidity situation. Speaking in Parliament, Energy Minister Panayiotis Lafazanis, who heads SYRIZA’s radical Left Platform, said, “This government will not surrender,” noting that “those who believe we will step back from our red lines are deluding themselves.” He was referring to SYRIZA’s pre-election pledges to protect pensions and the rights of workers.

Another senior member of the Left Platform was widely quoted in the media as saying that Greece will be unable to reach a deal with creditors this month as the latter “keep yanking our chain” and that Greece might be forced to “go it alone.” Interior Minister Nikos Voutsis appeared more conciliatory. “We are working toward an honorable compromise,” he told Mega TV. “Immediate recourse to a referendum or elections is not in our plans right now.” Finance Minister Yanis Varoufakis caused a stir earlier in the day when he said he could not guarantee that the government would be in power next January. He said his comments, which were in response to a question from one of hundreds of ministry cleaning staff who were rehired by the new administration, had been blown out of proportion.

Read more …

Without a restructuring blueprint, smaller parties will always get creamed.

• The Greek Bailout Crisis Didn’t Have to Happen (Slate)

Everyone knows that bailouts have become overly politicized. The U.S. bailout during the financial crisis, which cemented “too big to fail” in the public consciousness, triggered hostility that helped spur a Republican landslide in the 2010 midterms. Now imagine if every one of the 900,000 or so commercial and consumer bankruptcy filings in the U.S. last year triggered bailouts. Creditors would eventually elbow each other for repayments; mayhem would ensue. In Greece the bailout has been marked by malfeasance, infighting, and decision-fumbling. A 2013 IMF report claimed that the fund underestimated the problems austerity might cause to the Greek economy and that Greece did not qualify on three of its four criteria before receiving the initial three-year, €30 billion loan.

The report also noted that the stimulus prioritized the health of Europe’s banking system over the Greek economy. For example, an early debt write-off was delayed for political reasons because of countries whose banks held Greek bonds. Debt restructuring, or an effort to renegotiate the terms and provisions of a debt, could be a valuable alternative to bailouts, or transfers of finances by a governmental body to rescue an entity that is not meeting its financial obligations. That’s because creditors aren’t impartial. Take the European Central Bank. It’s an invested stakeholder in the current standoff, with a €104 billion exposure that roughly equals 65% of Greek’s GDP.

In a way, it’s understandable that in early February, the ECB’s Governing Council removed a waiver that allowed Greece’s banks to post government debt as collateral for cash. But that led Greece to become reliant on emergency funds to stay afloat. Greek stocks then fell by as much as nearly 30% the following day, and depositors triggered a bank run. There have been many increases to the emergency ceiling, which is now €80 billion. The ECB has similarly strong-armed Ireland and Cyprus. It’s not that the ECB is wrong to pursue rules that benefit the eurozone; the terms of Greece’s bailout could still be changed midstream, but doing so would create legal headaches and other complications for the eurozone.

It’s that while bailouts may evoke a rescue operation of sorts for sovereign debtors, they can play out far differently. When countries like Greece risk going bankrupt, it can be an opportunity for bottom-feeding purchasers of distressed sovereign debt. Such private creditors, especially short-termers, might then either hock to another entity such as the ECB or IMF or hold on to assets and litigate until they recover those assets’ value. There ends up being not much of a rescue, but financial power plays that favor certain interests and assets over others. That has been one of the big criticisms of the Greek bailout. In March an IMF director reportedly told Greek’s Alpha TV that rescue funds were used for banks in France and Germany rather than to keep Greece afloat.

Read more …

Too big to touch. Break them down.

• The World’s Top Currency Dealers Are ‘Untouchable’ (MarketWatch)

The world’s five largest foreign-exchange brokers ceded a significant chunk of their market share over the past year as regulators pressured them to shrink their operations while investigations into exchange-rate manipulation heated up. But though these dealers have retreated slightly, regulators will find it difficult to break their hold on the market, which they’ve dominated for decades, said analysts at Greenwich Associates, a research firm that, among other things, tracks changes in the foreign-exchange market’s structure. Three of the top five banks (Citigroup, Barclays and J.P. Morgan) are expected to plead guilty to charges of foreign-exchange manipulation, according to The Wall Street Journal. A fourth, UBS, which was the first to cooperate with investigators, will likely reach a settlement.

Maybe one or two more banks will join the ranks of the Deutsche Banks and Citigroups of the world, said Kevin McPartland, head of research for market structure and technology at Greenwich Associates. But a more extreme redistribution of market share is unlikely because of the sheer scale of investment needed to be a player in the massive foreign-exchange market, where turnover is measured in the trillions. “There will probably be more competition than there was in the past, but it’s hard to compete with the scale,” said McPartland said.

Many of the top dealers have a huge advantage when it comes to infrastructure. The top banks developed their own proprietary electronic-trading platforms years ago. They also have branches all over the world, which large clients find reassuring. Many of their smaller rivals depend on multi-dealer e-trading platforms, which pool liquidity from a consortium of banks. The market share of the top five banks shrank to 51%, from 53% in the past year, compared with 45% in 2011. The next five banks’ market share increased from 22% to 24%, while the banks that round out the bottom 10 of the 20 largest dealers saw their share rise from 14% to 15%. The rest of the market is controlled by smaller players.

Read more …

There goes your pension plan.

• Five Reasons Chicago Is in Worse Shape Than Detroit (Bloomberg)

Forget all the nicknames attached to Chicago for generations – Windy City, City of Big Shoulders, the City that Works. This gleaming metropolis of 2.7 million people is now, along with Detroit, junk city. When Moody’s Investors Service downgraded Chicago’s debt on Tuesday to junk status, it deepened the city’s financial crisis and elevated comparisons to the industrial ruin 280 miles to the east. Chicago partisans, starting with Mayor Rahm Emanuel, argue vehemently that their city isn’t Detroit. They cite population growth, a diverse economy bolstered by an abundance of Fortune 500 companies, vibrant neighborhoods and a booming tourist trade. Yet here are five reasons, now more than ever, that suggest Chicago is akin to Detroit – or, by some measures, even worse. Or, as Illinois Republican Governor Bruce Rauner put it last month: “Chicago is in deep, deep yogurt.”

BIG, SCARY NUMBERS: Chicago’s unfunded liability from four pension funds is $20 billion and growing, hitting every city resident with an obligation of about $7,400. Detroit’s, whose population of about 689,000 is roughly a quarter of Chicago’s, had a retirement funding gap of $3.5 billion, meaning each resident was liable for $5,100. A January 2014 report from Morningstar Municipal Credit Research showed that among the 25 largest cities and Puerto Rico, Chicago had the highest per-capita pension liability.

HOSTILE COURT: When Detroit filed for Chapter 9 in July 2013, a federal bankruptcy judge exerted his considerable powers and decreed that everyone – taxpayers, employees, bondholders and creditors alike – would get a haircut to settle the crisis. When the Illinois Supreme Court ruled on May 8, it said the state couldn’t cut pension benefits as part of a solution to restructure the state retirement system. That decision sent a clear signal to Chicago, which was trying to follow the state’s benefit-cutting lead. Where the Detroit judge acted, the Illinois justices told elected officials to clean up the mess of their own making.

POLITICAL PARALYSIS: Just as Detroit slid into bankruptcy after decades of economic and actuarial warnings, Chicago politicians have watched the train wreck rumble toward them for more than a decade. During that time, they skipped pension payments and paid scant attention to the financial damage being done. In 10 years starting in 2002, the city increased its bonded debt by 84%, according to the Civic Federation, which tracks city finances. That added more than $1,300 to the tab of every Chicago resident. In Michigan, Governor Rick Snyder acted when the crisis in Detroit couldn’t be avoided. He invoked a state law giving an emergency manager what amounts to fiscal martial-law power. In Chicago’s case, there’s no political pressure to invoke a similar law.

NO BAILOUT: Detroit’s bankruptcy filing allowed it to restructure its debt, officially snuffing out $7 billion of it by cutting pensions and payments to creditors. In Illinois, the nation’s lowest-rated state with unfunded pension obligations of $111 billion, Rauner had a blunt message last week in an unprecedented address to Chicago’s City Council: The city will get no state bailout.

DENIAL: After years of denial, Detroit officials finally, if grudgingly, agreed to major surgery. At least for now, Chicago’s Emanuel is sticking to his view that the Illinois Supreme Court’s rejection of a state pension reform law doesn’t apply to the city. “That reform is not affected by today’s ruling, as we believe our plan fully complies with the State constitution because it fundamentally preserves and protects worker pensions,” he said in a statement on Friday. Four days later, Moody’s begged to differ. “In our opinion,” it wrote, “the Illinois Supreme Court’s May 8 ruling raises the risk that the statute governing Chicago’s Municipal and Laborer pension plans will eventually be overturned.”

Read more …

“..the American public — crushed by stagnant wages, robbed of middle-class jobs by competition with low-wage countries, deprived of health care, burdened by student debt..”

• Many Americans Agree With Bernie Sanders’ Brand Of Socialism (MarketWatch)

John Nichols, a writer for The Nation, titled his 2011 book, “The ‘S’ Word: A Short History of an American Tradition…Socialism,” precisely because, he said, “it is the subject of daily derision, a derision that is at once more intense and more ignorant than at any point in the long history of the United States.” That is due in no small part to the sharp right turn taken by the Republican Party and the steady stream of right-wing blather on radio and television, where “socialist” is used as shorthand for big government, welfare, high taxes, and any other nefarious policy Rush Limbaugh and his cohorts care to attach to it. But it is also due to the residue of the long Cold War demonization of communism and the failure of centrally planned economies in the Soviet Union, Eastern Europe, Cuba, and China.

Of course, the Marxism-Leninism of those countries is only one strand of a progressive socialist tradition that also includes social democracy in its various forms, which is still a vital political force in most European countries — most prominently in Scandinavia. Comfortable in the conviction that the U.S. is the biggest, strongest economy in the world with the highest standard of living, Americans have for decades tended to sneer at these European countries as inferior, bogged down economically by anti-business policies. But it is slowly dawning on wide portions of the American public — crushed by stagnant wages, robbed of middle-class jobs by competition with low-wage countries, deprived of health care, burdened by student debt and the astronomical costs of a college education — that this supposed superiority of ours is no longer true, if it ever was.

And that’s just the middle class. The rapidly growing pool of families below the poverty line, forced to work two or three jobs at subsistence wages just to scrape by, is also waking up to the fact that the famous “American dream” is no longer theirs. George Stephanopoulos, the ABC anchor whose career began as an aide to Democratic presidential candidate Bill Clinton in the 1990s, did a little sneering of his own recently when he interviewed Sanders on “This Week.” “I can hear the Republican attack ad right now,” Stephanopoulos said after Sanders expounded on the benefits of universal health care, a living wage, free higher education, access to child care, guaranteed pensions and other benefits enjoyed in “socialist” countries. “He wants America to look more like Scandinavia.”

Sanders blinked away his astonishment and replied, “That’s right. That’s right. And what’s wrong with that? What’s wrong when you have more income and wealth equality? What’s wrong when they have a stronger middle class in many ways than we do, a higher minimum wage than we do, and they’re stronger on the environment?”

Read more …

“This vital truth, that the government exists for our benefit and operates at our behest, seems to have been lost in translation..”

• “We The People” Need To Circle The Wagons: The Government Is On The Warpath (ZH)

Despite what some special interest groups have suggested to the contrary, the problems we’re experiencing today did not arise because the Constitution has outlived its usefulness or become irrelevant, nor will they be solved by a convention of states or a ratification of the Constitution. No, as I document in my new book Battlefield America: The War on the American People, the problem goes far deeper. It can be traced back to the point at which “we the people” were overthrown as the center of the government. As a result, our supremacy has been undone, our authority undermined, and our experiment in democratic self-governance left in ruins. No longer are we the rulers of this land.

We have long since been deposed and dethroned, replaced by corporate figureheads with no regard for our sovereignty, no thought for our happiness, and no respect for our rights. In other words, without our say-so and lacking any mandate, the point of view of the Constitution has been shifted from “we the people” to “we the government.” Our taxpayer-funded employees—our appointed servants—have stopped looking upon us as their superiors and started viewing as their inferiors. Unfortunately, we’ve gotten so used to being dictated to by government agents, bureaucrats and militarized police alike that we’ve forgotten that WE are supposed to be the ones calling the shots and determining what is just, reasonable and necessary.

Then again, we’re not the only ones guilty of forgetting that the government was established to serve us as well as obey us. Every branch of government, from the Executive to the Judicial and Legislative, seems to be suffering this same form of amnesia. Certainly, when government programs are interpreted from the government’s point of view (i.e., the courts and legislatures), there is little the government CANNOT do in its quest for power and control. We’ve been so brainwashed and indoctrinated into believing that the government is actually looking out for our best interests, when in fact the only compelling interesting driving government programs is maintain power and control by taking away our money and control.

This vital truth, that the government exists for our benefit and operates at our behest, seems to have been lost in translation over two centuries dominated by government expansion, endless wars and centralized federal power. Have you ever wondered why the Constitution begins with those three words “we the people”? It was intended to be a powerful reminder that everything flows from the citizenry. We the people are the center of the government and the source of its power. That “we” is crucial because it reminds us that there is power and safety in numbers, provided we stand united. We can accomplish nothing alone.

Read more …

Joe’s late to the game, and has little to add. And if your claim to fame is your link to Bill Clinton, you may want to take a deep breath.

• The Secret Corporate Takeover Of Trade Agreements (Stiglitz)

When I chaired Bill Clinton’s council of economic advisers, when he was president, anti-environmentalists tried to enact a similar provision, called “regulatory takings”. They knew that once enacted, regulations would be brought to a halt, simply because government could not afford to pay the compensation. Fortunately, we succeeded in beating back the initiative, both in the courts and in the US Congress. But now the same groups are attempting an end run around democratic processes by inserting such provisions in trade bills, the contents of which are being kept largely secret from the public (but not from the corporations that are pushing for them). It is only from leaks, and from talking to government officials who seem more committed to democratic processes, that we know what is happening.

Fundamental to America’s system of government is an impartial public judiciary, with legal standards built up over the decades, based on principles of transparency, precedent, and the opportunity to appeal unfavourable decisions. All of this is being set aside, as the new agreements call for private, non-transparent, and very expensive arbitration. Moreover, this arrangement is often rife with conflicts of interest; for example, arbitrators may be a judge in one case and an advocate in a related case. The proceedings are so expensive that Uruguay has had to turn to Michael Bloomberg and other wealthy Americans committed to health to defend itself against Philip Morris. And, though corporations can bring suit, others cannot. If there is a violation of other commitments – on labour and environmental standards, for example – citizens, unions, and civil society groups have no recourse.

If there ever was a one-sided dispute-resolution mechanism that violates basic principles, this is it. That is why I joined leading US legal experts, including from Harvard, Yale, and Berkeley, in writing a letter to Barack Obama explaining how damaging to our system of justice these agreements are. American supporters of such agreements point out that the US has been sued only a few times so far, and has not lost a case. Corporations, however, are just learning how to use these agreements to their advantage. And high-priced corporate lawyers in the US, Europe, and Japan will likely outmatch the underpaid government lawyers attempting to defend the public interest. Worse still, corporations in advanced countries can create subsidiaries in member countries through which to invest back home, and then sue, giving them a new channel to bloc regulations.

Read more …

Damning.

• 2600 People Arrested Since 2012 Too Injured To Enter Baltimore Jail (CopBlock)

Over 2600 people arrested by Baltimore police since 2012 were too injured to enter the city’s detention center, jail records show. The Baltimore Sun reports that according to records, 123 of the detainees who weren’t admitted had visible head injuries, the third-most common ailment cited by officials while others had broken bones, facial trauma and lacerations. While the records do not indicate how the people were injured or whether they suffered their injuries at the hands of police, they do suggest that officers either ignored or did not notice the injuries. The report comes in the wake of the death of Freddie Gray last month, who died of a broken neck prosecutors say he suffered while riding in the back of a Baltimore police van. Six of the officers involved are facing criminal charges, including one charged with second-degree murder.

The incident sparked protests and rioting in the city, before Friday, when the U.S. Justice Department launched a civil-rights investigation into the department. Critics say the figures show that Baltimore police officers take little interest in detainees after they are arrested. This may result, law enforcement experts say, from officers not receiving adequate training to detect injuries or whether or not a detainee is faking being hurt in order to avoid jail. The United States Constitution guarantees health care to suspects before they are booked into jail. In the Gray case, prosecutors say the man requested medical care five times before his death. The Sun previously reported that dozens of Baltimore residents have accused the city’s police of inflicting injuries on them and disregarding their requests for medical help. The city has paid out almost $6 million in court judgments and settlements in response to over 100 lawsuits filed since 2011.

Read more …

Corporations have accumulated too much political power to allow for justice or common sense.

• Is The Only Purpose of a Corporation to Maximize Profit? (Bruce Bartlett)

Historically, corporations were expected to serve some public purpose as justification for the benefits and privileges they receive from the state. But since the 1970s, the view has become widespread that corporations exist solely to maximize profits and for no other purpose. While the shareholder-first doctrine was supposed to solve the agency problem, in fact it has gotten worse as corporate executives enrich themselves at the expense of shareholders. Moreover, the obsession with current share prices as the only measure of corporate success may be destroying long-term value as companies cut back on investment to raise short-term profits. Tax policies designed to raise after-tax profits have done nothing to reverse these trends.

To conservatives, the corporation is often treated as the pinnacle of capitalist development. This justifies their deferential treatment of corporations in terms of taxation and government regulation, which, they claim threaten to kill the goose that lays golden eggs. In reality, the corporation wouldn’t exist in a pure free market. It is and always has been a creature of the state. For many years, corporate status was only granted to businesses deemed to be in the public interest, such as companies that built turnpikes and canals. But as time has gone by, the idea that corporations exist at the pleasure of the state and in the public interest has been forgotten.

Today, it is widely believed that corporations exist for the sole purpose of making a profit. Corporate executives who believe corporations have a social responsibility are considered old fashioned. But the costs of this new view of the corporation have been very high in terms of lost jobs and investment, and minuscule wage growth for more than a generation. Shareholders, the owners of the corporation, haven’t even benefitted that much from the laser-like focus on profit above all else because much of it has been siphoned off by corporate executives, who have enriched themselves at the expense of shareholders, and financial institutions that have encouraged companies to become highly leveraged.

Read more …

Put the crazies in charge!

• McCain, Saakashvili Appointed To Ukraine Reform Advisory Team (RT)

Georgia’s fugitive ex-president Mikhail Saakashvili and hawkish US Senator John McCain have been approved as members of the newly-formed International Advisory Group that will help Ukraine’s president in “conducting reforms.” Saakashvili has been appointed as head of the new advisory group, says the statement on Ukraine’s presidential website. The list of members included in the advisory group mostly includes current and former European politicians. Among them are the German member of the European Parliament and the current Chairman of the European Parliament Committee on Foreign Affairs Elmar Brok, Sweden’s former Prime and Foreign Minister Carl Bildt, former Prime Minister of Slovakia Mikulas Dzurinda, and Lithuania’s former Prime Minister Andrius Kubilius.

Back in February Saakashvili was appointed as a non-staff adviser to Poroshenko. The ex-Georgian president, who was in power from 2004 to 2013, faces numerous charges at home, including embezzlement of over $5 million, corruption and brutality against protesters during demonstrations in 2007. Georgia’s Chief Prosecutor’s Office launched proceedings to indict Saakashvili and place him on the international most wanted list, but Kiev refused to hand over the fugitive president, despite an existing extradition agreement between Ukraine and Georgia. Saakashvili is known for his strong anti-Russian stance, which garnered heavy US support. In August 2008 during his term in office Georgia launched an offensive against South Ossetia, killing dozens of civilians and Russian peacekeepers stationed in the republic.

Georgia’s shelling of Tskhinval prompted Russia to conduct a military operation to fend off the offensive. Despite Saakashvili’s claims that the conflict was “Russian aggression,” the 2010 EU Independent Fact Finding Mission Report ruled that Tbilisi was responsible for the attack. Meanwhile Senator John McCain, for years spearheading the anti-Russian and particularly anti-Putin crusade, said that while he “would love to do anything” to help Ukraine, he has not yet cleared his new appointment under the US Senate rules. “I was asked to do it both by Ukraine and Saakashvili and I said I would be inclined to do it but I said I needed to look at all the nuances of it, whether it’s legal under our ethics and all that kind of stuff,” McCain told BuzzFeed.

Read more …

Too late.

• Pope Francis to Congress: Capitalism Must Change (Bloomberg)

Pope Francis will denounce the inequalities of capitalism when he becomes the first pontiff to address Congress on his visit to the U.S. in September, according to his closest adviser. Cardinal Oscar Andres Rodriguez Maradiaga, a fellow Latin American whom the Argentine pope has appointed to advise him on governing the church, said in an interview in Rome that Francis will speak “not as an enemy of the system or of the culture” but “as a shepherd who wants to make the world better, especially for those who do not have a voice.” On his election as leader of 1.2 billion Catholics, Francis called for “a poor church for the poor,” setting a humbler tone for his papacy that began with his decision to live in a modest residence.

At the same time, he’s set out an ambitious political agenda, from lobbying for a global climate accord to decrying the widening gap between rich and poor. Francis will present the lawmakers with “the same way of thinking that he expressed” in Evangelii gaudium, his first 2013 encyclical, or major papal writing, according to Maradiaga. In that document, Francis attacked the “idolatry of money” and a financial system “of exclusion and inequality,” adding: “Such an economy kills.” Free-market laws aim to “to produce the biggest revenue possible and the lowest costs possible,” Maradiaga, 72, said on Wednesday. “Change is needed, making capitalism more human, otherwise inequalities will continue growing and inequalities produce violence, frustration, pain and especially insecurity in every sense.”

Maradiaga, the archbishop of Tegucigalpa, Honduras, expressed the hope that the Republican-dominated Congress will hear the pope “with open hearts.” Francis, 78, will travel to Cuba Sept. 19-22, and then to Washington, where he will meet with President Barack Obama at the White House, to New York, where he will address the United Nations General Assembly, and finally to Philadelphia. The White House said in a March statement that the discussion between Francis and Obama will include “caring for the marginalized and the poor” and “advancing economic opportunity for all.” As the Vatican’s spokesman on developing countries’ debt at the IMF and the World Bank, Maradiaga helped negotiate a writedown for his native Honduras in the 1990s.

Read more …

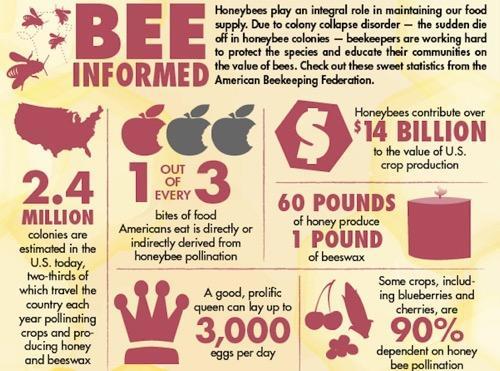

“For the first time since the survey began five years ago, the summer loss rates exceeded the winter loss rates..”

• Over 40% Of US Honeybee Colonies Died In The Past Year (WSJ)

More than 40% of U.S. honeybee colonies died in a 12-month period ending in April, extending a troubling trend that has scientists scrambling for a solution and professional beekeepers struggling to stay in business. The Agriculture Department said in its annual honeybee survey released Wednesday that beekeepers are starting to lose large numbers of bees during both the summer and winter—presenting scientists with a new wrinkle since die-offs had generally occurred during the cold winter months. “I think the situation is changing,” said Dennis vanEngelsdorp, an expert on honeybees at the University of Maryland. “It remains bad but I don’t know if we can assume the same thing is happening year to year.”

For the first time since the survey began five years ago, the summer loss rates exceeded the winter loss rates, suggesting bees are becoming vulnerable during a time of the year they were thought to be healthy and robust. The most recent summer loss rate reached 27%, up from 20%. While the precise cause of the honeybee crisis is unknown, scientists generally blame a combination of factors, including poor diets and stress. Some bees die from infestations of the Varroa mite, a bloodsucking parasite that weakens bees and introduces diseases to the hive. Environmental groups also point to a class of pesticides known as neonicotinoids.

In April, the Environmental Protection Agency said it would stop approving new outdoor uses for those types of chemicals until more studies on bee health are conducted. During the one-year period ending in April, beekeepers lost 42% of their colonies, according to the survey, marking the second-highest rate of loss since the Agriculture Department began tracking annual statistics in 2010. The loss rate was up from 34% during the previous 12-month period. Bee deaths present a considerable challenge to professional beekeepers, who spend substantial amounts of time and money to replenish their colonies. Many beekeepers, already in their 50s and 60s, are considering early retirement or are being forced out of the business due to the expense.

Read more …