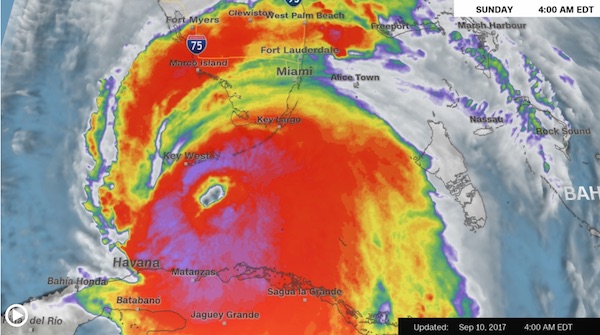

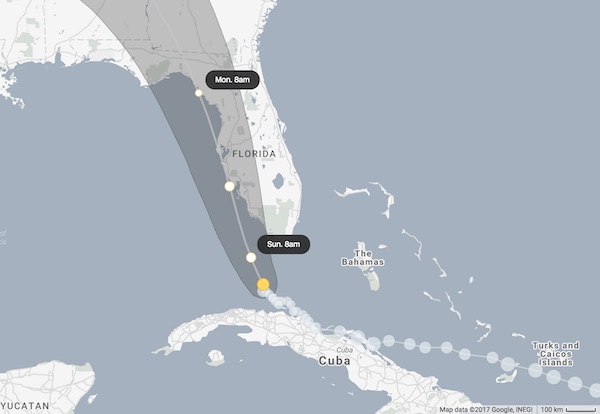

Irma gets closer

But it looks like things could have been much worse. Still, do spare a prayer.

• ‘The Most Catastrophic Storm Florida Has Ever Seen’ (G.)

Florida faces the “most catastrophic” storm in its history as Hurricane Irma prepares to unleash devastating force on the state, including 120mph winds, life-threatening sea surges that could submerge buildings and an advance battery of tornadoes. “You need to leave – not tonight, not in an hour, right now,” Governor Rick Scott commanded in a press conference, 12 hours before the cyclone was expected to make landfall on Sunday morning. “This is the most catastrophic storm the state has ever seen.” The US national hurricane centre said in its 8pm Saturday update on Irma that “heavy squalls with embedded tornadoes” were already sweeping across south Florida. The US National Weather Service later said the first hurricane-force wind gust had been recorded in the Florida Keys, a low-lying island chain off the state’s southern coast.

Irma dropped to a category three hurricane but could regain its category four intensity as the bathtub-warm seawater of nearly 32C (90F) will enable the storm to build strength. It was forecast to hit the Keys first, then again near Cape Coral or Fort Myers, and then a third time near Tampa Bay on its path up Florida’s west coast. Weather stations in Marathon, a city in the Keys, reported sustained winds of 51mph (81kmh) with a gust to 71mph (115kmh) on Saturday night. In Florida’s south-west, officials expected sea surges as high as 15ft (4.5 metres), which can rapidly rise and fall. “Fifteen feet is devastating and will cover your house,” Scott said. “Do not think the storm is over when the wind slows down. The storm surge will rush in and it could kill you.” He said at least 76,000 people were without power as the 350 miles (560km) wide storm unleashes winds and rain on the state. Officials said the window for people in evacuation zones was shutting, with gas stations closing and bridges blocked off.

Eerie.

• Bahamians Freak Out As Hurricane Irma ‘Sucks Away’ Miles Of Ocean (RT)

Footage from the Irma-hit Bahamas freaked out social media users on Saturday as it emerged that seawater was missing from a bay as far as the eye could see. The scene turned out to be a rare natural occurrence tied to the outgoing hurricane. “I am in disbelief right now… This is Long Island, Bahamas and the ocean water is missing!!! That’s as far as they see,” @Kaydi_K wrote on Twitter. The eerie scene was shared over 50,000 times in one day and it spooked web users, many of whom suggested it resembled the sucking away of water before a tsunami. However, weather experts analyzing the scene put the blame on Hurricane Irma, which had just left a trail of destruction in the Caribbean and was about to land in Florida. The ominous-looking occurrence was in fact caused by a combination of low tide, low pressure and strong winds in the right direction, which literally pushed the water away from the long narrow bay. The phenomenon has been dubbed “reverse storm surge” by some of those explaining it online.

“..homes may also be occupied by alligators, rodents and snakes due to the floods.”

• Houston Residents Confront Officials Over Decision To Flood Neighborhoods (R.)

Angry Houston residents shouted at city officials on Saturday over decisions to intentionally flood certain neighborhoods during Hurricane Harvey, as they returned to homes that may have been contaminated by overflowing sewers. A town hall grew heated after City Council member Greg Travis, who represents parts of western Houston, told about 250 people that an Army Corps of Engineers official told him that certain gauges measuring water levels at the Buffalo Bayou – the city’s main waterway – failed due to a decision to release water from two municipal reservoirs to avoid an overflow. Travis’ words inflamed tensions at the town hall, held at the Westin Houston hotel, as the region struggled to recover from Hurricane Harvey, which dropped as much as 50 inches (127 cm) of rain in some areas along Texas’ Gulf Coast, triggering historic floods.

More than 450,000 people either still do not have safe drinking water or need to boil their water first. On Aug. 28, the Army Corps and the Harris County Flood Control District opened the Addicks and Barker reservoirs in western Houston to keep them from overflowing. They warned it would flood neighborhoods, some of which remained closed off two weeks later. Travis said the Army Corps official said they kept releasing water without knowing the extent of the flooding. “They didn’t understand that the bathtub effect was occurring,” he said. Residents attempting to return to flooded homes may have to contend with contaminated water and air because the city’s sewer systems overflowed during the floods. Fire chief Samuel Pena said people returning home should wear breathing masks and consider getting tetanus shots.

“We couldn’t survive the Corps – why should we rebuild?” Debora Kumbalek, who lives in Travis’ district in Houston, shouted during the town hall. Scattered heaps of discarded appliances, wallboard and mattresses can be still seen throughout the city of 2.7 million people, the nation’s fourth-largest. There were no representatives from the Army Corps at the town hall. The Corps released water at an intended maximum rate of 13,000 cubic feet (370 cubic meters) per second to keep those reservoirs from overflowing. However, preliminary data from the U.S. Geological Survey suggests that on at least two days, the average release rate exceeded that 13,000 level.

Many residents face lengthy rebuilding processes, and the majority do not have flood insurance. The Federal Emergency Management Administration will contribute a maximum of $33,000 per home in assistance to cover damages, a FEMA official said at the town hall, though for heavily flooded homes, damages will likely exceed that amount. Fire chief Pena said homes may also be occupied by alligators, rodents and snakes due to the floods.

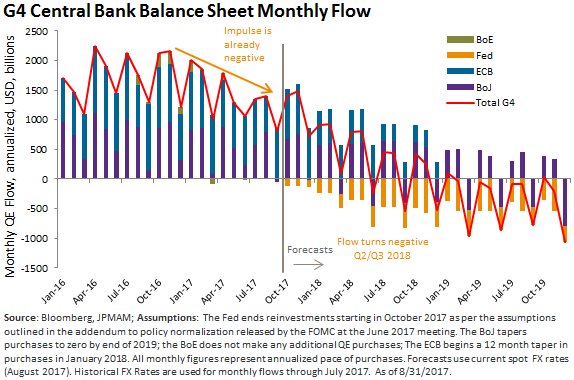

From JPMorgan. Central banks set prices for everything. But the impulse has turned negative.

• Stock, Flow or Impulse? (JPMi)

Notwithstanding all the discussion of balance sheet reduction and tapering, the developed market central banks in aggregate are still very much in expansionary mode, with the G4 balance sheets still growing by more than $1 trillion per year on an annualized pace (see Chart). The strength of asset prices in the face of fundamental challenges serves as an enduring reminder for me of the importance of this positive QE flow. The link between QE flow and asset prices makes intuitive sense. The world’s stock of savings is held in two places: cash and everything else (“financial assets”). QE, by its nature, increases the supply of cash in the world, and simultaneously decreases the supply of non-cash financial assets, by removing government bonds, corporates, and in some cases equities from circulation.

Those securities are replaced in the financial system by cash of equivalent value. So, QE increases the ratio of cash to financial assets worldwide, and that ratio reflects the relative abundance or scarcity of cash available to purchase each unit of assets. QE’s influence on that ratio drives up the price of financial assets, all else equal. This rationale suggests that it is the flow of QE, i.e. the speed with which cash is injected and financial assets are removed, that influences the change in asset prices. Flow is positive, asset prices go up; flow is negative, asset prices go down. However, despite this simplicity (or maybe because of it) the relationship between balance sheets and asset prices is still a matter of intense debate.

Some clever analysis yields a compelling case that the impulse, rather than the flow, of global central bank balance sheets is likely to be the primary driver of asset prices. Whereas the “flow” of QE is the speed of balance sheet increase, the “impulse,” is its acceleration. If the speed of balance sheet growth is slowing down, impulse is negative. A carefully constructed dataset shows a remarkably good fit between QE impulse and change in spreads and stock prices. Unfortunately the fit is so good historically that it almost looks like data mining, and recently, there has been a material breakdown: global central bank QE impulse has already turned negative, most demonstrably back in Q2 of this year, and asset prices have continued to remain buoyant.

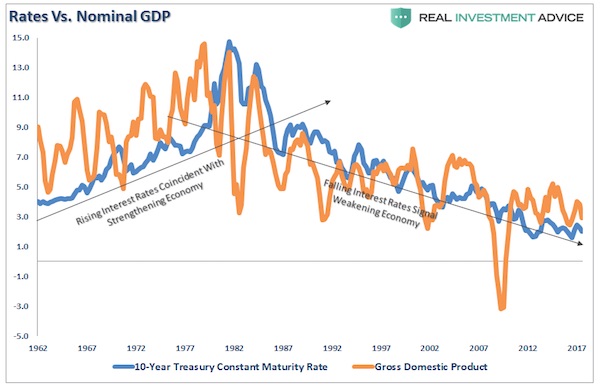

Do low rates kill growth?

• Signs, Signs, Everywhere A Sign (Roberts)

You don’t have to look very hard to see a rising number of signs that suggest the “Trump Trade” has come to its inevitable conclusion. Following the election, this past November the financial markets rallied sharply on the hopes of major policy reforms and legislative agenda coming out of Washington. Eleven months later, the markets are still waiting as the Administration has remained primarily embroiled in Washington politics with a divisive, Republican controlled, House and Senate. While there are still “hopes” the Administration will pass through tax reform, the failure to “rally the troops” to repeal the Affordable Care Act leaves permanent tax cuts an unlikely outcome. That hopeful outcome was further exacerbated with the deal cut between President Trump and leading Democrats to lift the debt ceiling and fund the Government through December.

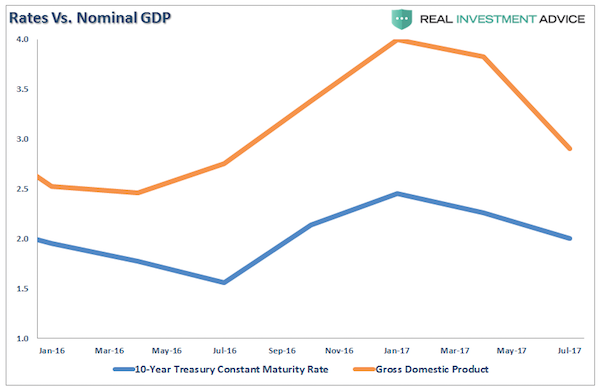

That “deal” has effectively nullified any leverage the Republicans had to strong-arm a deal on taxes later this year. The markets are figuring it out as well. If you want to know where the economy is headed over the next few months, you don’t have to look much further than interest rates. Since interest rates are ultimately driven by the demand for credit, and that demand is driven by economic growth, their historical correlation is no surprise.

But like I said, if you want to know where GDP is going to be in the months ahead, keep a close watch on rates. I suspect, before year-end, we will see rates below 2.0%. As a reminder, this is why we have remained rampant bond bulls since 2013 despite the continuing calls for the end of the “bond bull market.” The 3-D’s (Demographics, Deflation & Debt) ensure that rates will remain low, and go lower, in the years to come. Think Japan.

China’s too late.

• China Targets A $3 Trillion Shadow Banking Industry (R.)

As a flood of unregulated cash swirls through the Chinese economy, Beijing has been taking aim at the trust companies whose unrestrained lending practices are worrying regulators. The trusts, at the heart of a vast shadow banking industry, are being pressured to step up compliance and background checks, and are being pushed towards greater transparency. But the fast-growing 20 trillion yuan ($3 trillion) industry, whose lending operations are cloaked behind opaque structures, will be tough to rein in, according to employees at some trusts. A regulatory sanction against one trust, Shanghai International Trust, and a legal case against another, National Trust, offer rare insights into the industry, and reveals just how hard it will be to police it. Shanghai Trust was fined 200,000 yuan for selling a product that violated leverage rules, according to a regulator’s notice in January.

Under these rules, property developers are only allowed to borrow up to three times their existing net assets. According to two people with direct knowledge of the case, an unknown sum was loaned by China Construction Bank through Shanghai Trust to Cinda Asset Management Company. Cinda then invested the cash. One of the sources said Cinda used the cash to acquire land, a sector rife with speculation that regulators have singled out as a “risky” destination for trust company loans. [..] The case against National Trust, which had revenue of 655 million yuan in 2016, involves wealth management products linked to the steel industry. The trust was sued in June this year by eight investors who allege it misrepresented the risks involved in products it sold them and failed to adequately assess the guarantor’s creditworthiness.

The trust skirted restrictions on loans to the steel industry by using the products to raise money to lend to a subsidiary of Bohai Steel Group, according to Tang Chunlin, a lawyer at Yingke Law Firm, who is representing the investors. The plaintiffs invested different sums in the wealth management products, which National Trust promised would deliver an annual return of over 9 percent. National Trust lent the money collected to a Bohai subsidiary, Tianjin Iron and Steel Group. National Trust has now defaulted on the product, according to Tang and Gongyu Zhou, one of the eight investors, because Tianjin Iron and Steel is unable to pay back its loan.The products were also illegally sold via third-party non-financial institutions, Tang and Zhou said.

Let me guess. When lithium prices go to the moon?

• China Studying When To Ban Sales Of Traditional Fuel Cars (R.)

China has begun studying when to ban the production and sale of cars using traditional fuels, the official Xinhua news agency reported, citing comments by the vice industry minister, who predicted “turbulent times” for automakers forced to adapt. Xin Guobin did not give details on when China, the world’s largest auto market, would implement such a ban. The UK and France have said they will ban new petrol and diesel cars from 2040. “Some countries have made a timeline for when to stop the production and sales of traditional fuel cars,” Xin, vice minister of the Ministry of Industry and Information Technology, was quoted as saying at an auto industry event in the city of Tianjin on Saturday. “The ministry has also started relevant research and will make such a timeline with relevant departments. Those measures will certainly bring profound changes for our car industry’s development,” he said.

To combat air pollution and close a competitive gap between its newer domestic automakers and their global rivals, China has set goals for electric and plug-in hybrid cars to make up at least a fifth of Chinese auto sales by 2025. Xin said the domestic auto industry faced “turbulent times” over the years to 2025 to make the switch towards new energy vehicles, and called on the country’s car makers to adapt to the challenge and adjust their strategies accordingly. Banning the sale of petrol- and diesel-powered cars would have a significant impact on oil demand in China, the world’s second-largest oil consumer. Last month, state oil major China National Petroleum Corp (CNPC) said China’s energy demand will peak by 2040, later than the previous forecast of 2035, as transportation fuel consumption rises through the middle of the century.

As Hillary’s starting a book tour attacking Bernie, he’s gathering Democrats around him.

• How Democrats Learned To Stop Worrying And Love ‘Medicare For All’ (CNN)

First, consider this: It’s the summer of 2019 and a dozen Democratic presidential candidates are gathered onstage for a debate somewhere in the Midwest. The network moderator concludes her introductions and tees up the opening question. “Who here tonight supports moving the United States toward a single-payer, or ‘Medicare for all,’ taxpayer-funded health care system?” Pause it there and rewind to January 2016 in Iowa. The caucuses are days away, and Hillary Clinton is fending off an unexpected challenge from Sen. Bernie Sanders. The discussion turns to single-payer, and Clinton balks. “People who have health emergencies can’t wait for us to have a theoretical debate about some better idea that will never, ever come to pass,” she tells voters in Des Moines, explaining her campaign’s focus on preserving and expanding Obamacare, while dismissing the progressive insurgent’s more ambitious pitch.

Go back even further now to the last contested Democratic primary before that, in 2008, and recall the lone and lonely voices in favor of single-payer care. They belonged to Ohio Rep. Dennis Kucinich and former Alaska Sen. Mike Gravel. The pair combined for a delegate haul of precisely nil. Back to the present – a decade on – and after a chaotic months-long push by Republicans to dismantle former President Barack Obama’s Affordable Care Act, the prospect of Sanders’ “Medicare-for-all” program has emerged as the hot-button centerpiece of the Democratic Party’s roiling public policy debate. After a summer that has seen so many of the party’s most ambitious officials and brightest prospects line up in vocal support of what was so recently a fringe cause, consider again how the single-payer question will be received on a Democratic debate stage. Here’s a hint: Expect to see a lot of hands.

[..] .. in mid-July, Sanders returned to Des Moines, Iowa, for the first time since the 2016 election to water the grassroots. “Our immediate test,” he said, was to defeat the Republican plan. “But as soon as we accomplish that, I will be introducing legislation which has gained more and more support all across this country, legislation for a Medicare for All, single-payer system.” Robert Becker, Sanders’ 2016 Iowa campaign director, was in the hall that day. Between cigarettes, and before his old boss arrived on the scene, Becker sat back and diagnosed the bubbling dynamic. “Every time Paul Ryan, or someone who is trying to dismantle the Affordable Care Act, steps to the podium and starts talking about insurance rates and premiums getting higher and higher and higher, they’re actually making an argument for a single-payer system,” he said. “You don’t hear people on Medicare and Medicaid complaining about their co-pays.”

But the feeding frenzy will continue.

• Laughing on the Way to Armageddon (PCR)

The United States shows the world such a ridiculous face that the world laughs at us. The latest spin on “Russia stole the election” is that Russia used Facebook to influence the election. The NPR women yesterday were breathless about it. We have been subjected to ten months of propaganda about Trump/Putin election interference and still not a scrap of evidence. It is past time to ask an unasked question: If there were evidence, what is the big deal? All sorts of interest groups try to influence election outcomes including foreign governments. Why is it OK for Israel to influence US elections but not for Russia to do so? Why do you think the armament industry, the energy industry, agribusiness, Wall Street and the banks, pharmaceutical companies, etc., etc., supply the huge sum of money to finance election campaigns if their intent is not to influence the election?

Why do editorial boards write editorials endorsing one candidate and damning another if they are not influencing the election? What is the difference between influencing the election and influencing the government? Washington is full of lobbyists of all descriptions, including lobbyists for foreign governments, working round the clock to influence the US government. It is safe to say that the least represented in the government are the citizens themselves who don’t have any lobbyists working for them. The orchestrated hysteria over “Russian influence” is even more absurd considering the reason Russia allegedly interfered in the election. Russia favored Trump because he was the peace candidate who promised to reduce the high tensions with Russia created by the Obama regime and its neocon nazis—Hillary Clinton, Victoria Nuland, Susan Rice, and Samantha Power.

What’s wrong with Russia preferring a peace candidate over a war candidate? The American people themselves preferred the peace candidate. So Russia agreed with the electorate. Those who don’t agree with the electorate are the warmongers—the military/security complex and the neocon nazis. These are democracy’s enemies who are trying to overturn the choice of the American people. It is not Russia that disrespects the choice of the American people; it is the utterly corrupt Democratic National Committee and its divisive Identity Politics, the military/security complex, and the presstitute media who are undermining democracy. I believe it is time to change the subject. The important question is who is it that is trying so hard to convince Americans that Russian influence prevails over us?

Do the idiots pushing this line realize how impotent this makes an alleged “superpower” look. How can we be the hegemonic power that the Zionist neocons say we are when Russia can decide who is the president of the United States? The US has a massive spy state that even intercepts the private cell phone conversations of the Chancellor of Germany, but his massive spy organization is unable to produce one scrap of evidence that the Russians conspired with Trump to steal the presidential election from Hillary. When will the imbeciles realize that when they make charges for which no evidence can be produced they make the United States look silly, foolish, incompetent, stupid beyond all belief?

The UK needs a national government. Or else.

• Scotland and Wales Deliver Brexit Ultimatum To Theresa May (Ind.)

Wales and Scotland will formally lay down a challenge to Theresa May’s Brexit plans this week, warning she risks a constitutional crisis if changes are not made. Governments in both nations are expected to officially submit documents confirming their intention to withhold consent for the Prime Minister’s approach to EU withdrawal unless it radically alters. Conservative ministers have admitted to The Independent that pushing on without their backing could hold up Brexit, while politicians outside England warn it will strain the UK at the seams. The devolved governments claim Ms May’s key piece of Brexit legislation will see London snatch authority over key policy areas and give Conservative ministers unacceptably-strong powers to meddle with other laws.

It comes as MPs are expected to approve the EU (Withdrawal) Bill at its first Commons hurdle on Monday, but the Prime Minister faces a rebellion later on because even Tories want changes to the same clauses that are angering leaders in Cardiff and Edinburgh. On Tuesday the Scottish and Welsh administrations will officially start their drive to force concessions, by submitting ‘legislative consent’ papers in their assemblies that set out how the bill must change. Welsh First Minister Carwyn Jones told The Independent Ms May’s bill will allow Whitehall to “hijack” powers during Brexit that should be passed to Cardiff. He said: “The UK Government is being rigid in its approach. It’s saying there is only one way. It’s acting as if it won a majority at the election in June. It didn’t.

It needs a national conscience too.

• British Arms Sales To Repressive Regimes Soar To £5 Billion Since Election (G.)

UK arms manufacturers have exported almost £5bn worth of weapons to countries that are judged to have repressive regimes in the 22 months since the Conservative party won the last election. The huge rise is largely down to a rise in orders from Saudi Arabia, but many other countries with controversial human rights records – including Azerbaijan, Kazakhstan, Venezuela and China – have also been major buyers. The revelation comes before the Defence and Security Equipment International arms fair at the Excel centre in east London, one of the largest shows of its kind in the world. Among countries invited to attend by the British government are Egypt, Qatar, Kenya, Bahrain and Saudi Arabia. Campaigners called on the government to end arms sales to the United Arab Emirates in light of its record on human rights.

They accused the government of negotiating trade deals to sell the Gulf state cyber surveillance technology which the UAE government uses to spy on its citizens, and weaponry which, they allege, has been used to commit war crimes in Yemen. The Saudis have historically been a major buyer of British-made weapons, but the rise in sales to other countries signals a shift in emphasis on the part of the government, which is keen to support the defence industry, which employs more than 55,000 people. Following the referendum on leaving the EU, the Defence & Security Organisation, the government body that promotes arms manufacturers to overseas buyers, was moved from UK Trade & Investment to the Department for International Trade. Shortly afterwards, it was announced that the international trade secretary, Liam Fox, would spearhead the push to promote the country’s military and security industries exports.

What’s going to happen to Tsipras when Greeks find out he can’t deliver?

• Greek PM Vows Bailout Exit In 2018, Help For Workers, Youth (R.)

Greece will exit successfully its bailout program in 2018 helped by strong growth, Prime Minister Alexis Tsipras said on Saturday, vowing to support workers, young Greeks and small businesses as the economy recovers. Addressing a Greek public worn out by austerity and skeptical after years of reform efforts have failed to fix the country’s woes, Tsipras said his leftist-led government would do whatever it takes to end lenders’ supervision next year. “The country, after eight whole years, will have exited bailouts and suffocating supervision. That’s our aim,” Tsipras said in his annual policy speech in the northern city of Thessaloniki. “We are determined to do everything we can.” Greece’s current international bailout, worth 86 billion euros, expires next year. Tsipras’ term ends a year later.

Tsipras said Athens would continue to outperform its fiscal targets and fight endemic tax evasion to create fiscal room for tax cuts that would alleviate the burden on businesses and households, long squeezed by the debt crisis. Greece has received about 260 billion euros in bailout aid from its eurozone partners and the International Monetary Fund since 2010 in return for draconian austerity which has wiped out a quarter of its output and cut tens of thousands of jobs. Unemployment stood at 21.2 percent in June, the euro zone’s highest, with young Greeks the hardest hit. Greece’s economy is expected to grow by about 2 percent in 2018, a sign that sacrifices are bearing fruit, Tsipras said outlining initiatives to boost employment and fight a brain drain.

A march of thousands of workers was largely peaceful outside the venue where he spoke. Tsipras said the state would give financial incentives to employers to hire more younger workers and spend 156 million euros to subsidize social security contributions of employers who will turn contractors into full-time staff. Unregistered work and contract jobs have increased during the debt crisis, as businesses are desperate to cut costs. The government will also pay 100 million euros to subsidize unpaid workers in struggling sectors and businesses, he said, promising to fight labor law violations.

In a country that has no jobs for its own people.

• Greek Government Aims To Integrate Up To 30,000 Migrants (K.)

Authorities are preparing measures to integrate between 25,000-30,000 asylum seekers who are not entitled to relocation under the existing European Union program, Migration Minister Yiannis Mouzalas has said. Speaking to Ta Nea newspaper over the weekend, Mouzalas said that a three-pronged scheme is under way to integrate newcomers, involving a new registration process and the issuing of tax identification and social security numbers; school enrolment for children; and access to the local labor market. Asked about Greece’s recent decision to take back a small number of asylum seekers in line with the EU’s so-called Dublin rules, Mouzalas said that Athens had only accepted returns “from countries who helped us by consenting to up to 17,000 relocations and 7,000 [family] reunions.”

The minister said that a new agreement is currently in the works because the Dublin system is “dead.” Meanwhile, more than 350 police officers took part in a pre-dawn operation on Saturday at the Moria camp on the Aegean island of Lesvos to transfer an unspecified number of migrants to the pre-deportation center. These individuals, who have all received a final rejection of their asylum application, will be returned to Turkey. Moria has been rocked by riots twice in recent weeks in protest at the slow pace of registration and asylum processing for certain nationalities, as well as crowded conditions.

Interesting mystery. No answers so far.

• Astronomers Find Stars That Appear Older Than The Universe (F.)

If you understand how stars work, you can observe the physical properties of one of them and extrapolate its age, and know when it had to have been born. Stars undergo a lot of changes as they age: their radius, luminosity, and temperature all evolve as they burn through their fuel. But a star’s lifespan, in general, is dependent on only two properties that it’s born with: its mass and its metallicity, which is the amount of elements heavier than hydrogen and helium present within. The oldest stars we’ve found in the Universe are nearly pristine, where almost 100% of what makes them up is the hydrogen and helium left over from the Big Bang. They come in at over 13 billion years old, with the oldest at 14.5 billion. And this is a big problem, because the Universe itself is only 13.8 billion years old.

You can’t very well have a star that’s older than the Universe itself; that would imply that the star existed before the Big Bang ever happened! Yet the Big Bang was the origin of the Universe as-we-know-it, where all the matter, energy, neutrinos, photons, antimatter, dark matter and even dark energy originated. Everything contained in our observable Universe came from that event, and everything we perceive today can be traced back to that origin in time. So the simplest explanation, that there are stars predating the Universe, must be ruled out. It’s also possible that we’ve got the age of the Universe wrong! The way we arrive at that figure is from precision measurements of the Universe on the largest scales.

By looking at a whole slew of features, including: • The density and temperature imperfections in the cosmic microwave background, left over from the Big Bang, • The clustering of stars and galaxies at present and going back billions of light years, • The Hubble expansion rate of the fabric of the Universe, • The history of star formation and galactic evolution, and many other sources, we’ve arrived at a very consistent picture of the Universe. It’s made up of 68% dark energy, 27% dark matter, 4.9% normal matter, about 0.1% neutrinos and 0.01% radiation, and is right around 13.8 billion years old. The uncertainty on the age figure is less than 100 million years, so even though it might be plausible that the Universe is slightly older-or-younger, it’s extraordinarily improbable to get up to 14.5 billion years.