Harris&Ewing Motorcycle postman, Washington, DC 1912

A big one. But not THE big one.

• Dow Plunges 531 Points In Global Selloff, Largest Weekly Drop Since 2008 (WSJ)

Stocks plummeted on global-growth fears for a second straight day Friday in a plunge that dragged the Dow industrials into correction territory. The global market rout pummeled stocks and commodities as fresh evidence emerged that China’s economy is slowing, spooking investors. The Dow industrials lost 530.94 points, or 3.1%, to close at 16459.75, putting it in correction territory, as defined by a 10% decline from a recent high. The S&P 500 dropped 64.84 points, or 3.2%, to close at 1970.89. The Nasdaq Composite fell 3.5%, or 171.45 points, to 4706.04. The Dow’s more than 1,000-point drop this week was the largest weekly drop since the week ended Oct. 10, 2008. U.S. oil prices also briefly dropped below $40 a barrel on Friday, a level not seen since the financial crisis.

Signs of a sharp slowdown in the world’s second-largest economy have unnerved investors since Beijing surprised markets last week by devaluing its currency. Shares in the U.S., Asia and Europe have tumbled, along with commodity prices as investors fretted about waning Chinese demand just as supplies are surging. The market turmoil has some traders exercising caution. “You have a situation that’s tough to play,” said Christopher Cady, a New York-based trader. He said he closed out bets toward the end of the week that U.S. stocks would fall. “Nimble…is the new black.” The pan-European Stoxx Europe 600 ended the session 3.3% lower, closing out its biggest week of losses since August 2011. The index has now lost nearly 13% since its April peak, entering correction territory.

Earlier, the Shanghai Composite Index tumbled 4.3%, hitting its lowest level since March, despite Beijing’s efforts to prop up the market in recent weeks. In Japan, the Nikkei fell 3% to a six-week low. An early gauge of China’s factory activity fell to a six-and-a-half year low in August, heaping further pressure on stocks and commodities after Thursday’s global selloff. “Now we’ve had some harder evidence that China is slowing relatively fast, people have chosen to get out,” said Kiran Ganesh at UBS Wealth Management.

“You have across-the-board competitive currency devaluations that will invoke the deflationary monster here in the U.S.”

• Stocks Post Worst Week In Years On China Fears (Reuters)

World stock markets tumbled on Friday and U.S. oil prices dove briefly below $40 a barrel sparked by fresh evidence of slowing growth in China, sending investors scurrying to the safety of bonds and gold. Stocks on Wall Street and in Europe fell more than 3% in a global rout spurred by a more than 4% fall in Shanghai stocks. Thomas Lee at Fundstrat Global Advisors in New York, said it was hard to say what was behind the sell-off in stocks but a market bottom may be close at hand. “There’s no shortage of things people can cite, from the movement in currencies, to the weakness in commodities and fears about China,” Lee said. “But at the end of the day if people are trying to take down risk, then it’s going to make sense for them to sell their exposure in equities as well.”

Crude posted its longest weekly losing streak in nearly 30 years and emerging market stocks, bonds and currencies all fell, with slowing Chinese growth withering demand for commodities from developing countries. China’s manufacturing sector shrank at its fastest rate in more than six years in August, according to a survey from private data vendor Caixin/Markit. World markets had already been on edge after China’s surprise devaluation of the yuan last week and a more than 30% fall in its stock markets since mid-year. The U.S. dollar fell too, dropping to a two-month low against the euro, as the Chinese data and falling commodity prices eroded expectations the Federal Reserve will raise U.S. interest rates next month.

“The Fed is in an extremely awkward situation right now,” said Robbert van Batenburg at Societe Generale. “You have across-the-board competitive currency devaluations that will invoke the deflationary monster here in the U.S.” The Dow industrials, Nasdaq and major European stock indices have now fallen more than 10% from their peak earlier this year. The pan-regional FTSEurofirst fell 3.4% to 1,427.13, its worst day since November 2011, as traders shrugged off upbeat euro zone manufacturing and services data in a third straight day of selling. MSCI’s emerging markets index was at its weakest in four years, off 2.16%, while the firm’s all-country world stock index fell 2.7%. The Dow Jones industrial average fell 530.94 points, or 3.12%, to 16,459.75. The S&P 500 slid 64.84 points, or 3.19%, to 1,970.89 and the Nasdaq Composite lost 171.45 points, or 3.52%, to 4,706.04.

Well, that’s definitely one I got right, when I said after the first devaluation move that capital flight could well out-do any positive effects Beijing was hoping for. I’m thinking Peking Duck. Meanwhile, Ambrose is jubilant about China one day, and morose the next.

• Record Capital Flight From China As Industrial Slump Drags On (AEP)

Capital outflows from China have surged to $190bn over the last seven weeks, forcing the authorities to intervene on an unprecedented scale to defend the Chinese currency. The exodus of funds is draining liquidity from interbank markets and has pushed up overnight Shibor rates by 30 basis points in the last ten trading days, a sign of market stress. Yang Zhao from Nomura said $90bn left the country in July. The pace has accelerated since the central bank (PBOC) shocked the markets by ditching its currency peg to the US dollar. Capital flight for the first three weeks of August is already close to $100bn, despite draconian use of anti-terrorism and money-laundering laws to curb illicit flows. Mr Zhao said the PBOC had intervened “very aggressively” to stabilise the currency and prevent the devaluation getting out of hand, but this automatically tightens monetary policy.

The central bank will almost certainly have to cut the reserve requirement ratio (RRR) for banks to offset the loss of liquidity, with some analysts expecting action as soon as this weekend. The PBOC’s latest report calls for “monetary easing”, dropping the usual caveat that measures should be targeted. It is a sign that Beijing is preparing blanket stimulus, despite worries that this could lead to a repeat of the credit excesses that have haunted China since the post-Lehman boom. The PBOC has already injected $160bn into the China Development Bank for projects. Hopes that China is at last shaking off a recession in the first half of the year – caused by a combined monetary and fiscal crunch – have once again been dashed by grim manufacturing data.

The Caixin PMI survey slumped to 47.1, far below the boom-bust line of 50 and the lowest since March 2009. New export orders slid further to 46.0 while inventories are rising, a nasty cocktail. Caixin Insight said the bad figures reflect the tail-end of a downturn that has largely run its course as stimulus kicks in. “The economy could be in the process of bottoming out and may start to rebound within the next few months,” it said. The ructions in China come at a moment when markets are already bracing for the first interest rate rise by the US Federal Reserve in eight years, a move that threatens to tighten the noose further on over-stretched emerging markets (EM) and the commodity nexus. Danske Bank said the latest rout is worse than the “taper tantrum” in 2013 when the Fed first hinted at tightening, and is quickly turning into a “perfect storm” as the Turkish lira, Brazilian real, Malaysian ringgit, and Russian rouble all go into free-fall.

“In fact, like many of us, sometimes they don’t have a clue.”

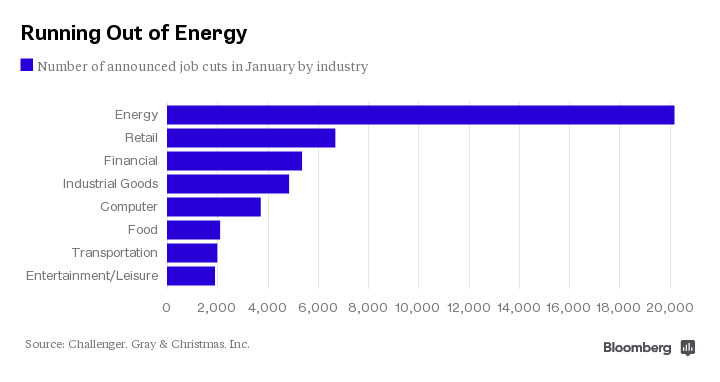

• Chanos on China: “Whatever You Might Think, It’s Worse” (CNBC)

Lingering concerns about China have helped drive stock selling, but investors may still underestimate how much the world’s second-largest economy has slowed, short seller Jim Chanos said Friday. “It’s worse than you think. Whatever you might think, it’s worse,” he said. Chanos appeared on CNBC’s “Fast Money: Halftime Report” on Friday amid the fourth straight day of losses for major U.S. averages. The Dow Jones industrial average, S&P 500 and Nasdaq were setting up for their worst weeks since 2011. He did not classify the drop as a correction or a bear market. But he noted that the yearslong runup in U.S. stocks shows “we’ve gotten a little complacent.” China’s slowdown, among other macroeconomic concerns, has spooked global investors.

Beijing’s handling of a stock market spike, “panic responses” from investors and recent currency devaluation has “given investors pause,” Chanos added. “People are beginning to realize the Chinese government is not omnipotent and omniscient,” he said. “In fact, like many of us, sometimes they don’t have a clue.” He added that investors should forget about the performance of the Shanghai composite, but instead focus on how declining GDP growth and the Chinese consumer could affect American companies with exposure to the country. Concerns about demand in China, one of the world’s largest energy consumers, has added pressure to already sagging commodities. Crude oil fell again on Friday, with West Texas Intermediate breaking below $40 per barrel for the first time since 2009.

A slowdown in consumption has fueled additional concern about what many observers have already called an oversupplied market. “Now that demand is flagging a little bit, the oversupply situation has just swamped the real demand,” he noted. Chanos is “betting against a number of the big guys” in the energy sector, he added. He dislikes Shell and Chevron, in particular.

“In 1929, the market declined 50.6%. So that was a warning that there was something more serious in the market breakdown.”

• Chinese Market Mirroring 1929 Crash: Analyst (CNBC)

Chinese stocks are set to fall another 9% in the next four or five days and are in danger of replicating the hefty losses seen in the U.S. exchanges in the Wall Street crash of 1929, an analyst has told CNBC. Thomas DeMark, founder and CEO of DeMark Analytics, told CNBC Friday that the current turmoil on the Shanghai Composite index is already on course to echo the crash of 1987 and 2001, but could still fall even lower. “That’s what could happen,” DeMark said, detailing the technical analysis that his company use to predict stock market declines. “In 1929, the market declined 50.6%. So that was a warning that there was something more serious in the market breakdown.”

DeMark added that his company turned bearish on China on June 12, just as the market reached a top and has – more or less – correctly predicted the downturn of 38% that has occurred since. He now sees the blue-chip index – which closed 4.3% lower Friday at 3,509.98 points – dropping to 3,282 points, or even 3,200 points. At this juncture, his technical models state there could be a 40% rally, which would mirror similar moves in 1987 and 2001. However, he added that a further fall was still possible which would echo world stock markets in the time of the Great Depression. “We can’t determine that right now. We think there’s going to be great rally, meaningful rally off the 3200 (points), or even worse case 3282, and we’ll see a retracement of 40% of the decline. And at that time we can reassess what the outlook is,” he said.

DeMark spoke of a “preordained” move in the Chinese stock markets. Authorities in Beijing have curbed short selling and several publicly listed firms have been able to suspend the trading of their shares over the last few weeks. Economists have highlighted that the Chinese officials might be trying to force a bottom in the Chinese markets or “shake out” foreign investors from speculating on its indexes. This sort of “interference” creates a vacuum in the market, according to DeMark, who said it adds to a growing sense of pessimism. DeMark is no stranger of making bold market predictions. In early 2014, he told CNBC that U.S. stocks had reached an “inflection point” that resembled the period prior to the 1929 stock-market crash. He did stress that certain caveats and preconditions would need to be met before “turning all-out bearish” but the market turmoil in U.S. stocks failed to materialize.

“The “end of excess liquidity and the end of excess profits has caused an end of excess returns in 2015..”

• Fed Suffers Interest-Rate ‘Impotency’ as China Withers Markets (The Street)

Years of holding interest rates near zero have left the Federal Reserve suffering from “central bank policy impotence,” a Bank of America report says, and there’s no pill to provide a quick fix. Pushing interest rates up now, even though the benefits of low rates are fizzling, risks spooking the markets just when they’re getting hammered by China’s slump. The S&P 500 plummeted 3.2% for the day and has fallen 7.5% since its May high, near the 10% decline which would constitute a correction. The Dow Jones Industrial Average dropped 3.1% or 539 points. The “end of excess liquidity and the end of excess profits has caused an end of excess returns in 2015,” Michael Hartnett of the bank’s Merrill Lynch Global Research unit wrote in the report this week.

“The summer mood of investors appears to have darkened considerably as the declines in commodities and emerging markets have induced widespread losses in equities in recent weeks.” Worldwide, stocks have dropped 2.6% in the past month, he noted. The excess returns Hartnett’s team acknowledged were largely due to the Fed’s policy of keeping interest rates near zero for the past seven years. Unfortunately, the effectiveness of that policy has waned in what Bank of America characterized as “central bank policy impotence.” Year-to-date returns across asset classes have been underwhelming compared with those in the market run-up from 2009 to 2014, Hartnett’s team noted. By his measure, the total return on stocks so far this year has been 2.3%, while bonds decreased 2.5%.

Still, Bank of America advises that tactical traders – those who take short to medium-term positions in their trades – may want to add some riskier, potentially higher-yielding, assets to their portfolio. The recommendation comes with two big caveats, however: China devaluation and, of course, Fed policy. Last week, China devalued its currency by 2%. While the amount is small, it can pose significant consequences to U.S. manufacturing and export businesses. Bank of America already sees U.S. inventories outpacing sales, which could lead to a supply glut. If the demand for U.S. goods overseas is further decreased by the comparably higher cost relative to Chinese goods, profits could take a hit.

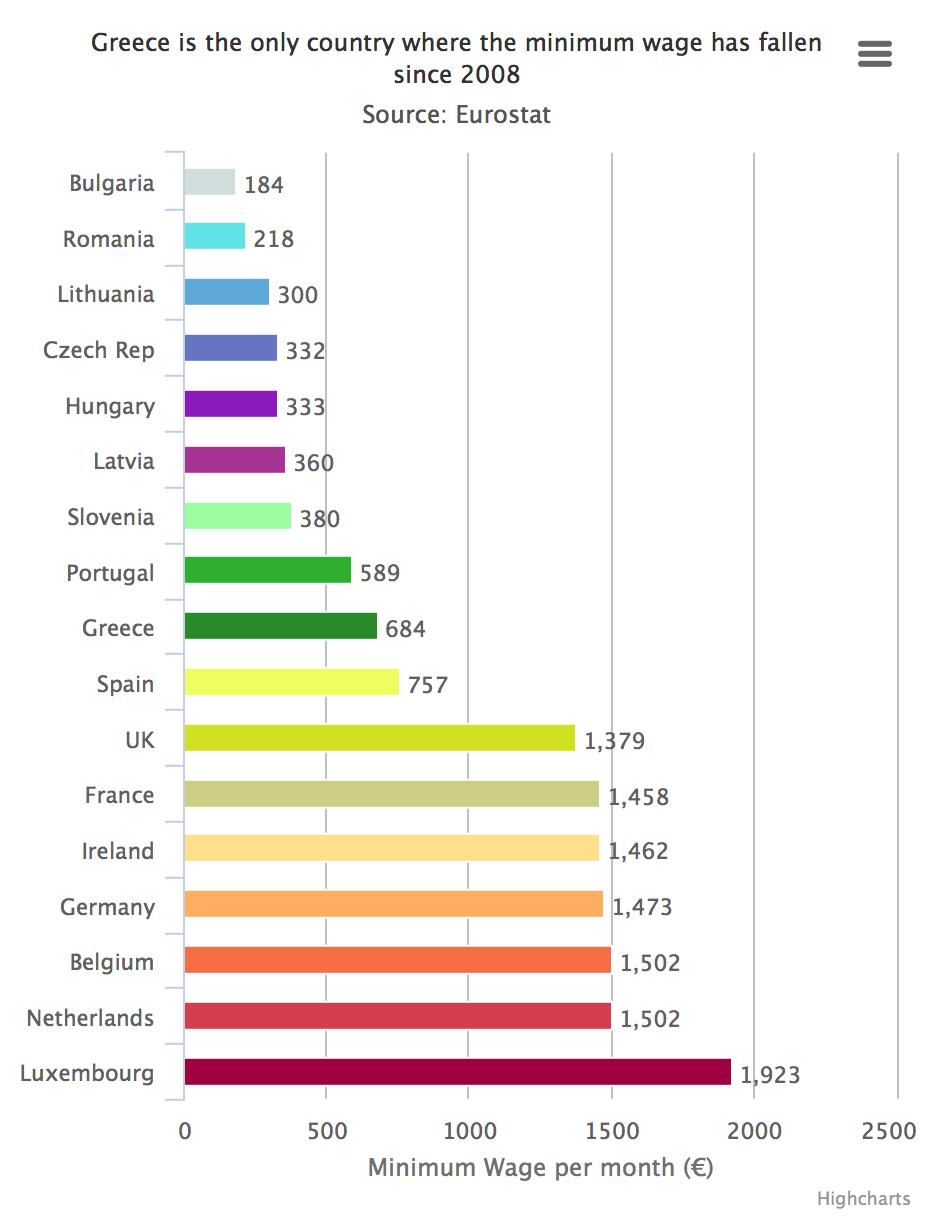

It’ll be interesting elections. If Greec, in its predicament, did not have these heated discussions, it wouldn’t be a functioning democracy.

• Tsipras Hits Back After SYRIZA Rebels Form Own Group (Kathimerini)

Prime Minister Alexis Tsipras chaired a meeting of SYRIZA’s political secretariat on Friday to discuss strategy ahead of snap elections as former Energy Minister Panayiotis Lafazanis announced his new breakaway party, Popular Unity, which is to campaign on an anti-austerity platform. The party, comprising Lafazanis and another 24 SYRIZA hardliners, will aim to cancel Greece’s bailouts and write down the country’s debt, Lafazanis told a press conference in Parliament. The goals are virtually the same as those championed by Tsipras ahead of the January elections that brought SYRIZA to power. But Lafazanis, who has lobbied for Greece to return to the drachma, also indicated that his party would “follow the course of exiting the euro” if necessary, insisting that any exit would be “orderly.”

Lafazanis, whose party is now the third largest in Parliament and as such has the right to seek to form a government, said Popular Unity would seek alliances with all “progressive” parties except those that have backed austerity. Lafazanis is to take over the exploratory mandate on Monday from New Democracy leader Vangelis Meimarakis, who assumed it yesterday. Tsipras meanwhile convened his political secretariat. Before discussing pre-election strategy, the three members of the secretariat who are now aligned with Lafazanis resigned. They blamed Tsipras and SYRIZA’s leadership for the breakup of the party. Tsipras also took a jab at the SYRIZA rebels. “It is not revolutionary to choose to escape from reality or create a virtual reality,” he was quoted as saying. “It is revolutionary to open roads where there aren’t any.”

As for SYRIZA, he said it “has a chance to develop a new relationship with the society that supports it and to acquire a clear ideological and political identity of a contemporary, radical left, purged of reactionary remnants and self-delusion.” The party’s central committee is expected to meet in the week. It remains unclear when the elections will take place. The proposal was for September 20 but if the procedures involving the exploratory mandates are delayed, that date could be put back to September 27. Parliament Speaker Zoe Constantopoulou, another SYRIZA rebel who has used her power to delay and obstruct proceedings in the House, raised objections yesterday to the procedure followed by President Prokopis Pavlopoulos in handing a mandate to Meimarakis.

She accused Pavlopoulos of an “institutional faux pas,” saying that she had not been informed in advance as, she said, the Constitution dictates. Sources in the president’s office retorted that he had “honored the Constitution to the letter.” The intervention was not expected to delay the process though the outlook for Constantopoulou’s relationship with SYRIZA remained unclear. The response from Greece’s creditors to looming elections appeared relatively upbeat, with several officials indicating that they had been expecting the move and saying the polls could help Tsipras broaden his majority and boost implementation of the new bailout program.

“The ‘no’ of the referendum will not be an ‘orphan’ in these elections..”

• Lafazanis Declares New Party’s Goals To Cancel Bailout, Write Down Debt (Kath.)

Addressing his new breakaway party Popular Unity, Panayiotis Lafazanis on Friday declared that the new movement would offer a “realistic, alternative to the memorandum,” and said its key goals would be to cancel the memorandums and write down Greece’s debt, adding that any euro exit would be “orderly.” “We will become a major and decisive political force,” he said, adding that the grouping of 25 MPs “will try to express the spirit and substance of the 62% who voted no to austerity,” referring to last month’s referendum on austerity measures proposed by Greece’s creditors.

“The ‘no’ of the referendum will not be an ‘orphan’ in these elections,” Lafazanis told MPs and reporters in Parliament. He said the decision by Prime Minister Alexis Tsipras to call snap elections in the summer “does not portend good things” and suggested that the premier had tried to catch Greeks off guard. “If it is necessary for us to cancel the memorandum, we will follow the course of exiting the euro,” Lafazanis said, adding that any exit would be “orderly.”

Not sure they would get what they want. Don’t think Tsipras is done yet.

• In a Twist, Europe May Find Itself Relying on Success of Alexis Tsipras (NY Times)

Europe spent months trying to crush Alexis Tsipras. But now that Greece’s leftist prime minister has called a snap election and is seeking a mandate for the tough new bailout program he negotiated with his country’s creditors, Europe, oddly enough, may find itself invested in his success. Greece never fails to surprise, and Mr. Tsipras’s turbulent eight-month tenure has proved he is rarely predictable. But the man many European leaders once regarded as a populist wrecking ball is now presenting himself as a figure who can deliver pragmatism and stability — and carry out the sort of austerity program he once inveighed angrily against.

“I’m sure that he has talked to European leaders, and they are O.K. with what he is doing now,” said Harry Papasotiriou, a professor at Panteion University in Athens, adding that Mr. Tsipras was staking his political life on a bailout deal that includes the kind of taxes and pension cuts he once opposed. “He’s taking ownership of it.” The latest twist by Mr. Tsipras was met with cautious optimism on Friday by some European commentators even as his surprise move again tossed Greece into political turmoil. On Friday, a faction of hard-line leftists split from Mr. Tsipras’s Syriza party and formed a new party, vowing to resist austerity and possibly even lead Greece out of the eurozone.

At the same time, analysts cautioned that the new election, and the continuing political maneuverings in Athens, could further complicate and slow implementation of the 86 billion euro bailout program, worth about $98 billion at Friday’s exchange rate, signed by Mr. Tsipras in July. An initial progress review by creditors, scheduled for October, may be delayed, which would delay discussions between Greece and its lenders over possible restructuring of the country’s crippling sovereign debt. Some economists also warned that the uncertainty surrounding the elections, including the possibility that the proposed Sept. 20 election could be pushed back, could revive the sort of public anxiety that earlier this year destabilized the broader economy and spurred a run on Greek banks. “That element I find to be much more risky,” said Marcel Fratzscher, president of the German Institute of Economic Research in Berlin. “It creates much more uncertainty.”

“..the plundering that has now begun unmasks the whole euro charade for what it really is — a war of conquest by money rather than by arms.”

• Germans Begin The Looting Of Greece (MarketWatch)

To the victor goes the spoils. The ink was not yet dry on the new European bailout accord for Greece before German companies started their plundering of Greek assets. Per provisions of the “agreement” imposed on Greece, the Athens government awarded the German company that runs the Frankfurt Airport, Fraport, a concession to operate 14 regional airports, mostly on the islands like Mykonos and Santorini favored by tourists, for up to 50 years in the first privatization of government-owned assets demanded by the creditors. The airport deal had been agreed upon last year by the previous Greek government and then suspended by Prime Minister Alexis Tsipras’s newly elected government this year as part of his pledge to prevent the fire sale of valuable public assets at bargain-basement prices.

The airport deal gives Fraport the right to run the facilities as its own for €1.2 billion over the 50 years and an annual rent of €23 million. The German company is also pledging to invest significantly in upgrades for the airports. Under the terms of the new bailout accord, which provides 86 billion euros of new debt to a government already vastly overindebted, the country must sequester €50 billion worth of public assets to sell off at distressed prices to mostly foreign bidders — with German companies first in line. In the end, Tsipras had no choice but to buckle under to the creditors’ demands if he wanted to fulfill his other pledge of keeping the country in the euro. But the plundering that has now begun unmasks the whole euro charade for what it really is — a war of conquest by money rather than by arms.

Privatization is a standard feature of the neoliberal policy mix seeking smaller government, less state intervention and more free-market competition. (Privatization, of course, leads just as often to crony capitalism, while some services, such as electricity and trains, are arguably more efficient as government-owned monopolies.) But privatization in the context of the bailout accord is tantamount to expropriation, like forcing a bankrupt to sell the family silver in order to pay off debts. After piling more and more unsustainable debt onto the Greek government in two previous bailouts — most of which went back to banks in France and Germany — the victorious Northern European governments are now inviting their companies to partake in the spoils.

“..workers will be sacked and their conditions made worse, while the elite of Europe profits.”

• After the Bailout: The Spoils of Greece Are Bound for Germany (Sputnik)

The ‘Asset Development Plan’ for Greece is out and it’s all go for the privatization of the country. Hellenic sea ports, air ports, motorways, petroleum companies, water and gas supply, real estate, holiday resorts – it’s all for sale. Debt laden Greece has been forced to sell the family silver in an all too familiar tale with ancient history repeating itself. The Hellenic Public Asset Development Fund has been published by German Green MEP Sven Giegold who said the Greek people “hardly know” what will be sold off and that they have “the right” to know. The selling of Greek assets to raise €50 billion was demanded by Greece’s creditors, the Troika. The document reveals that 66% of a gas distribution and processing firm will be sold to Azerbaijan; 35% of Greece’s first oil refinery firm will be sold off along with 17% of its electricity distributor and 65% of gas distributor Depa.

All rail and bus services will go under the hammer — along with the Greek telephone and postal service. Even before the bailout deal was completed and the money arrived safely in the Greek banks, the Germans had won their bid to take over 14 Greek airports for the next 40 years, paying $1.36 billion (€1.23bn) for the privilege. Of the $56 billion (€50bn) needed in asset stripping and bank shares, only $8.69 billion (€7.7bn) has been agreed so far. Nick Dearden, economic expert and campaigner, says it makes “no sense to sell off valuable assets in the middle of Europe’s worst depression in 70 years.” Writing in Global Justice Now, Dearden says: “The vast majority of the funds raised will go back to the creditors in debt repayments, and to the recapitalization of Greek banks.

“From German airport operators and phone companies to French railways — who are getting their hands on Greece’s economy. Not to mention the European investment banks and legal firms who are making a fast buck along the way. “The self-interest of European governments in forcing these policies on Greece leaves a particularly unpleasant flavour…workers will be sacked and their conditions made worse, while the elite of Europe profits.” Dearden continues to offer a scathing attack on the asset stripping of Greece. “Privatization in the context of the bailout accord is tantamount to expropriation, like forcing a bankrupt to sell the family silver in order to pay off debts…the victorious Northern European governments are now inviting their companies to partake in the spoils.”

Interesting take.

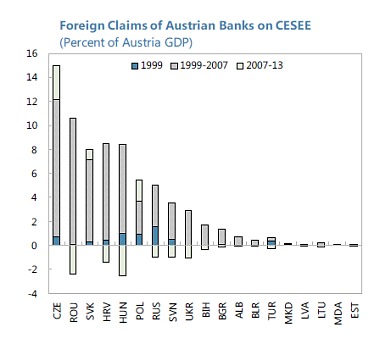

• German Wage Repression: Getting to the Roots of the Eurozone Crisis (Miller)

Beggar Thy Neighborhood

Germany’s transformation into an export powerhouse came at the expense of the southern eurozone economies. Despite posting productivity gains that were equal or almost equal to Germany’s, Greece, Portugal, Spain, and Italy saw their labor costs per unit of output—and in turn prices rise— considerably faster than Germany’s. Wage growth in these countries exceeded productivity growth, and the resulting higher unit labor costs pushed prices up by more than the eurozone’s low 2% annual inflation target (though by only a small margin). The widening gap in unit labor costs gave Germany a tremendous competitive advantage and left the southern eurozone economies at a tremendous disadvantage.

Germany amassed its ever-larger current account surplus, while the southern eurozone economies were saddled with worsening deficits. Later in the decade, the Greek, Portuguese, and Spanish current account deficits approached or even reached alarming double-digit levels, relative to the sizes of their economies. In this way, German wage repression is an essential component of the euro crisis. Heiner Flassbeck, the German economist and longtime critic of wage repression, and Costas Lapavistas, the Greek economist best known for his work on financialization, put it best in their recent book Against the Troika: Crisis and Austerity in the Eurozone: “Germany has operated a policy of ‘beggar-thy-neighbor’ but only after ‘beggaring its own people’ by essentially freezing wages. This is the secret of German success during the last fifteen years.”

While Germany’s huge exports across Europe and elsewhere created German jobs and lowered the country’s unemployment rate, the German economy never grew robustly. Wage repression subsidized exports, but it sapped domestic spending. And, held back by this chronic lack of domestic demand, Germany’s economic growth was far from impressive, before or after the Great Recession. From 2002 to 2008, the German economy grew more slowly than the eurozone average, and over the last five years has failed to match even the sluggish growth rates posted by the U.S. economic recovery.

With low wage growth, consumption stagnated. German corporations hoarded their profits and private investment relative to GDP fell almost continuously from 2000 on. The same was true for German public investment, held back by the eurozone budgetary constraints. At the same time, Germany spread instability. Germany’s reliance on foreign demand for its exports drained spending from elsewhere in the eurozone and slowed growth in those countries. That, in turn, made it less likely that German banks and elites would recover their loans and investments in southern Europe.

Infrastructure.

Rand Paul said something funny the other day. No, really — although of course it wasn’t intentional. On his Twitter account he decried the irresponsibility of American fiscal policy, declaring, “The last time the United States was debt free was 1835.” Wags quickly noted that the U.S. economy has, on the whole, done pretty well these past 180 years, suggesting that having the government owe the private sector money might not be all that bad a thing. The British government, by the way, has been in debt for more than three centuries, an era spanning the Industrial Revolution, victory over Napoleon, and more. But is the point simply that public debt isn’t as bad as legend has it? Or can government debt actually be a good thing?

Believe it or not, many economists argue that the economy needs a sufficient amount of public debt out there to function well. And how much is sufficient? Maybe more than we currently have. That is, there’s a reasonable argument to be made that part of what ails the world economy right now is that governments aren’t deep enough in debt. I know that may sound crazy. After all, we’ve spent much of the past five or six years in a state of fiscal panic, with all the Very Serious People declaring that we must slash deficits and reduce debt now now now or we’ll turn into Greece, Greece I tell you.

But the power of the deficit scolds was always a triumph of ideology over evidence, and a growing number of genuinely serious people — most recently Narayana Kocherlakota, the departing president of the Minneapolis Fed — are making the case that we need more, not less, government debt. Why? One answer is that issuing debt is a way to pay for useful things, and we should do more of that when the price is right. The United States suffers from obvious deficiencies in roads, rails, water systems and more; meanwhile, the federal government can borrow at historically low interest rates. So this is a very good time to be borrowing and investing in the future, and a very bad time for what has actually happened: an unprecedented decline in public construction spending adjusted for population growth and inflation.

“..more than a foot in just eight months..”

• The Drought Is Sinking California (Bloomberg)

Land in California’s central valley agricultural region sank more than a foot in just eight months in some places as residents and farmers pump more and more groundwater amid a record drought. The ground near Corcoran, 173 miles (278 kilometers) north of Los Angeles, dropped about 1.6 inches every 30 days. One area in the Sacramento Valley was descending about half-an-inch per month, faster than previous measurements, according to a report released Wednesday by the Department of Water Resources. NASA completed the study by comparing satellite images of Earth’s surface over time.

“Groundwater levels are reaching record lows — up to 100 feet lower than previous records,” Mark Cowin, the department’s director, said in a statement. “As extensive groundwater pumping continues, the land is sinking more rapidly and this puts nearby infrastructure at greater risk of costly damage.” Areas along the California Aqueduct — a system of canals and tunnels that ships water from the north to the south — sank as much as 12.5 inches, with eight inches of that occurring in just four months of 2014, researchers found.

The warnings come as a four-year, record-setting drought squeezed California’s $43 billion agriculture industry and led to mandatory, statewide water restrictions for the first time. The sinking could damage aqueducts, bridges, roads and dams, NASA said. As it occurs over time, sinking land has already destroyed thousands of public and private groundwater well casings in central California, the agency found. A state law enacted in September requires local governments to form agencies to regulate pumping to better manage groundwater supplies.

Countries must leave EU to deal with this.

• Macedonia Migrants: Hundreds Rush Border (BBC)

Hundreds of migrants have rushed at Macedonian border forces in an attempt to enter the country from Greece. The security forces beat back the migrants with truncheons and riot shields. A number of people were injured. On Thursday, Macedonia declared a state of emergency to cope with migrants – many from the Middle East – who are trying to reach northern EU states. The UN urged both Greece and Macedonia to tackle a “deteriorating situation”. Some 44,000 people have reportedly travelled through Macedonia in the past two months, meeting little border resistance, but razor wire has now been rolled across the frontier to prevent people from entering. Medecins Sans Frontieres said it had treated 10 people with wounds from stun grenades fired by Macedonian troops, near the Greek border village of Edomeni.

Amnesty International deputy Europe director Gauri van Gulik said: “Macedonian authorities are responding as if they were dealing with rioters rather than refugees who have fled conflict and persecution.” Macedonian Foreign Minister Nikola Poposki told the BBC that his government had been forced to act because the numbers trying to enter Macedonia had recently soared to more than 3,000 a day. He said a small country such as his could not cope with such an influx. Police have issued temporary transit documents to 181 migrants in the past 24 hours. Spokesman Ivo Kotevski told Reuters: “We are allowing entry to a number that matches our capacity to transport them or to give them appropriate medical care and treatment.”

The BBC’s James Reynolds, who was at the scene, says that later on Friday he saw some families being allowed to cross – they smiled with relief as they walked to a train station so they could head north to Serbia, Hungary and the rest of Europe. The UN refugee agency, the UNHCR, on Friday expressed concern for “thousands of vulnerable refugees and migrants, especially women and children, now massed on the Greek side of the border amid deteriorating conditions”. It urged Macedonia to “establish an orderly and protection-sensitive management of its borders” while appealing to Greece to “enhance registration and reception arrangements” on its side of the border. The UNHCR also said it had been assured by Macedonia the border “will not be closed in the future”, but did not elaborate.

Back to the future.

• Are Jellyfish Going To Take Over The Oceans? (Guardian)

Another British summer, another set of fear-mongering headlines about swarms of “deadly” jellyfish set to ruin your holiday. But news that jellyfish numbers may be rising carries implications far beyond the interrupted pastimes of the sunburnt masses. Like a karmic device come to punish our planetary transgressions, jellyfish thrive on the chaos humans create. Overfishing wipes out their competitors and predators; warmer water from climate change encourages the spread of some jellies; pollution from fertilisers causes the ocean to lose its oxygen, a deprivation to which jellyfish are uniquely tolerant; coastal developments provide convenient, safe habitat for their polyps to hide. In addition, the great mixing of species transported across the world in the ballasts of ships opens up new, vulnerable ecosystems to these super-adaptors.

“They’ve got this unique life cycle where they can tolerate harsh conditions and then rapidly thrive when conditions are favourable. So when a stressor like climate change or overfishing opens up a niche for them they can really take advantage of that and rapidly proliferate,” said Lucas Brotz, a researcher at the University of British Columbia. Not all species of jelly benefit, rather there tends to be a reduction in the diversity of species and vast, homogenous masses emerge. “They can make millions and millions of copies of themselves and clone asexually. That’s when you get these massive blooms. I think that’s the secret to the success of jellyfish, the reason they’ve been around for hundreds of millions of years.”[..]

The links between human activity and local jellyfish blooms are strong. In the Black Sea, invasive comb jellies dumped from the ballast of tankers have spawned deliriously and destroyed the region’s fishing industry. In the Sea of Japan, fertiliser run-off has left an oxygen-depleted sea where little other than jellies can thrive. But aside from these regional observations, Mark Gibbons, a zoologist at the University of the Western Cape, said the evidence to support a global trend was still patchy. “Whether there is strong evidence of a global increase in jellyfish populations [now] is difficult to answer. Certainly in some coastal systems there have been increases but in others there have not – or at least the background data with which to measure change are absent or scant, so it is hard to say,” he said.