Claude Monet The Manneporte (Étretat) 1883

The crazy idea of ultra low risk will be found out.

• VIX – From Fear Index To Greed Index (Tchir)

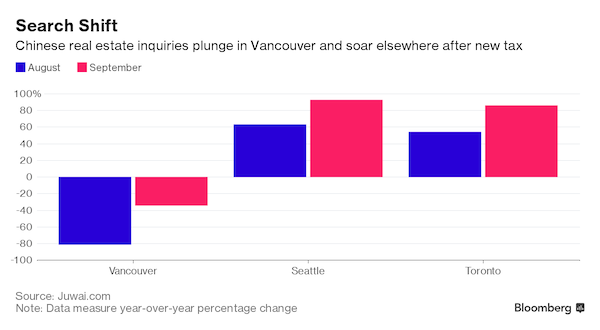

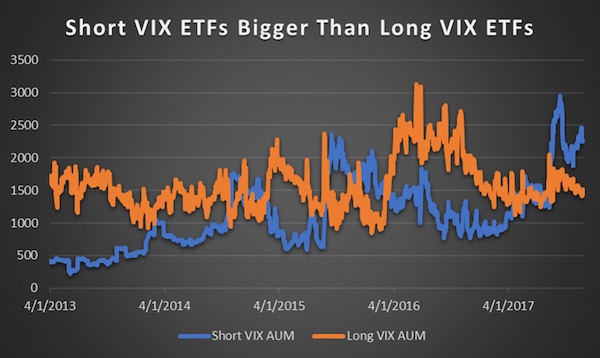

We have all heard the VIX or volatility index referred to as the Fear Index or Fear Gauge. Rising VIX was meant to signal fear in the markets. That is how most investors have historically thought about VIX and traded it (directly or through Exchange Traded Products). I have gone back in time and combined the total assets under management of XIV and SVXY (two short VIX products) and UVXY and VXX (the two largest long VIX products). There are others and it doesn’t account for the fact that UVXY incorporates leverage, but the point is the same. The funds that in theory helped investors ‘hedge’ their portfolios went from being the dominant species to those that enable investors to sell volatility.

Short VIX Funds are Larger than Long VIX Funds (source Bloomberg)

This has rarely been the case. Typically investors had more interest in hedging their portfolios despite the evidence that the long VIX ETFs and ETNs had to continually perform reverse splits as their share prices drifted lower (some would argue “raced” lower is a more accurate description). While the products looking to benefit on a volatility spike still attract inflows (otherwise their assets under management would be even lower), they have lost the competition to the VIX sellers. The only other gap of similar size and duration was in late August 2015 – AFTER the market sold off and volatility spiked. This time, it is occurring as stock markets are near all-time highs and VIX is still close to the all-time low it set just a few weeks ago (VIX is only calculated since 1990). [..] A spike in volatility could be far more problematic than the market is prepared for as even a small spike could turn into a larger problem with so many people positioned the other way.

“.. it has the potential to destabilize the entire financial system on its own.”

• When VIX Trade Finally Blows Up, It Could Get Ugly All Over (MW)

Bitcoin’s face-melting rally toward $10,000 is the talk of financial circles these days. But if the digital currency is, indeed, the dangerous bubble many believe it to be, its inevitable implosion will pale in comparison to the potential damage caused by the demise of one of the best trades the Wall Street has ever seen: Shorting the VIX. You’d have to be living under a rock — or maybe just a normal person who doesn’t fixate on the stock market — to not notice the incredible lack of volatility in this bull run. This persistent trend has lined the pocket of any investor who’s been savvy/lucky enough to bet against the VIX. Count Seth Golden, a former Target manager, among those fortunate to be on the right side of it. He told the Times this summer his net worth exploded from $500,000 to $12 million in about five years thanks to his VIX shorts. This chart shows insane it’s been:

But all good things come to an end, and when this historic trend finally reverses, the fallout could be devastating. In our call of the day, Kevin Muir of the Macro Tourist blog warns that these people face getting completely “wiped out” when volatility returns to this market. And it won’t end there. “A VIX spike is dangerous not only for everyone that is playing in the VIX square, but for all market participants,” he explained in a recent blog post. “Given the size of the VIX complex, it has the potential to destabilize the entire financial system on its own. If the move is abrupt and large enough, it will not only bankrupt many different parties, but will cause a ripple effect in other markets.”

Muir went on to warn the real worry here is not just that those who have made enormous sums on shorting the VIX are about to give it all back. No, he believes they, as well as many others, stand to lose a whole lot more. “Shorting VIX, at these low levels, in the size they are doing, is not only dumb, but crazily dangerous, not only to the parties trading it, but also to the stability of the entire financial system,” he said.

How can the VIX remain low in the face of this?

• DB’s “2018 Credit Outlook” – Bearish Not Benign Conclusion (ZH)

Heading into 2018, Reid characterises risk assets as a tightrope walker who’s successfully negotiated a hire wire since the 2008 crisis. However, the confidence of our risk asset funambulist was always fortified by the knowledge that there was a huge safety net direct beneath him in the shape of the central bank put. In Reid’s own words. “The best analogy for our view on 2018 is that risk assets are like a highly skilled but still relatively inexperienced tightrope walker. Our tightrope walker started his career immediately after the GFC and earned his apprenticeship in very difficult conditions with lots of crosswinds but with the knowledge that a huge safety net existed beneath him. This allowed him to walk across the narrow line with slow but ever-increasing confidence, skill and aplomb. In our analogy the safety net is the central bank put that has continued to help financial markets’ confidence over the last several years in spite of very challenging conditions.”

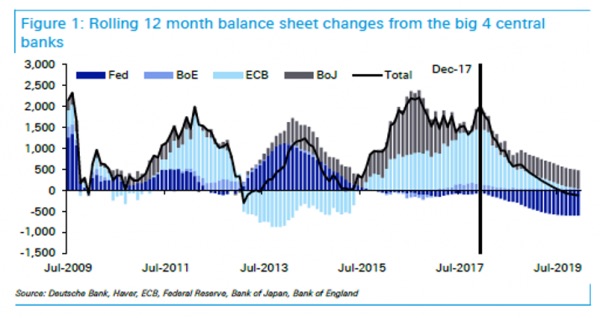

As the tightrope walker steps from December 2017 into January 2018, he’s going to notice a disconcerting change in his safety net. “However in 2018 our tightrope walker will have to move onto the next phase of his career where the structural support of the safety net will likely be slowly weakened. Every time he looks down he’ll figuratively see a central banker loosen or take away a supporting rope. As such his skills and confidence are likely to be tested more than in recent years.” Reid is specifically referring to the growth in the size of the big four DM central bank balance sheets, i.e. the Federal Reserve, ECB, Bank of Japan and the Bank of England. At the end of 2017, the combined size of the big four’s balance sheets is estimated to reach about $14.9 trillion, an increase of about $1.8 trillion on the end of 2016. That’s about to change radically, as he notes. “Assuming fairly neutral and consensus assumptions, central bank balance sheet growth will fall sharply over the next 12-24 months from the near peak levels currently seen.”

The chart below shows that on a rolling twelve-month basis, growth will fall sharply, beginning in 2Q 2018. By the end of 2018, DM estimates that the rolling twelve-month growth will have declined about 75% from its 2017 level to about $450 billion. By August 2019, growth will have declined to zero according to DB’s estimate.

Hope the GOP reads these missives.

• The GOP Tax Bill: Fuggedaboutit! (Stockman)

The GOP has become so politically desperate that they might as well enact a two-word statute and be done with it. It would simply read: Tax Bill! Actually, that’s not far from where they are in the great scheme of things. The Senate Finance Committee’s bill is a dog’s breakfast of K-Street/Wall Street pleasing tax cuts, narrowly focused revenue raisers that will be subject to withering attack on the Senate floor, nonsensical vote-driven compromises and outrageous fiscal gimmicks – the most blatant of which is the sun-setting of every single individual tax provision after 2025. This latter trick is designed to shoe-horn the revenue loss into the $1.5 trillion 10-year allowance in the budget reconciliation instruction and also comply with the Senate’s “Byrd Rule” which allows a point of order to strike down a reconciliation bill that increases the deficit after year 10.

Save for these gimmicks, the actual 10-year cost of the Senate bill would be $2.2 trillion including interest on the added deficits. Nevertheless, this and other sunset gimmicks also underscore how threadbare the whole undertaking has become. To wit, the bill provides interim, deficit-financed tax relief of $1.38 trillion during 2018-2025 before these budget gimmicks kick-in, which is not a big number in the scheme of things: it amounts to just 4.2% of current law revenue collections during the eight year period, and only 0.8% of GDP. Since the bill doesn’t even really cut marginal rates during this interim period (the top bracket drops from 39.6% to 38.5%), its hard to see how a mere 0.8% “stimulus” to GDP is going to incite a tsunami of growth and jobs.

As we have frequently pointed out, the Reagan tax cut of 1981 – which had no measureable effect on the trend rate of economic growth – slashed marginal rates from 70% to 50% and as a total package paled the current Senate Plan into insignificance: It reduced the Federal revenue base by 26%, not 4.2%; and it amounted to 6.2% of GDP, not 0.8%, when fully effective in the later 1980s. Moreover, the “fully effective” part is especially salient because the Senate bill’s impact does not widen with time, as do most permanent tax cuts which require phase-in periods, but, instead, shrinks into virtual insignificance. Thus, the bill’s net tax cut amounts to $225 billion or 1.1% of GDP in 2019, but by 2022 the net cut shrinks to $199 billion and 0.9% of GDP – and then to just $145 billion or 0.6% of GDP in 2025 when the sunset gimmick kicks in.

Changing the landscape.

• Number Of US Store Closings Triples From Last Year (Snyder)

Did you know that the number of retail store closings in 2017 has already tripled the number from all of 2016? Last year, a total of 2,056 store locations were closed down, but this year more than 6,700 stores have been shut down so far. That absolutely shatters the all-time record for store closings in a single year, and yet nobody seems that concerned about it. In 2008, an all-time record 6,163 retail stores were shuttered, and we have already surpassed that mark by a very wide margin. We are facing an unprecedented retail apocalypse, and as you will see below, the number of retail store closings is actually supposed to be much higher next year. Whenever the mainstream media reports on the retail apocalypse, they always try to put a positive spin on the story by blaming the growth of Amazon and other online retailers.

And without a doubt that has had an impact, but at this point online shopping still accounts for less than 10% of total U.S. retail sales. Look, Amazon didn’t just show up to the party. They have been around for many, many years and while it is true that they are growing, they still only account for a very small sliver of the overall retail pie. So those that would like to explain away this retail apocalypse need to come up with a better explanation. [..] Of course the truth is that the economy is not doing well. The U.S. economy has not grown by at least 3% in a single year since the middle of the Bush administration, and it isn’t going to happen this year either. Overall, the U.S. economy has grown by an average of just 1.33% over the last 10 years, and meanwhile U.S. stock prices are up about 250% since the end of the last recession.

The stock market has become completely and utterly disconnected from economic reality, and yet many Americans still believe that it is an accurate barometer for the health of the economy. [..] So far this year, more than 300 retailers have filed for bankruptcy, and we are currently on pace to lose over 147 million square feet of retail space by the end of 2017. Those are absolutely catastrophic numbers. And some analysts are already predicting that as many as 9,000 stores could be shut down in the United States in 2018.

Deregulation.

• Trump Deserves Some Credit for the Rally in Stocks (A. Gary Shilling)

Reducing government regulation is tough. It’s resisted by all those who benefit, including government employees who administer the many programs. Every president since Jimmy Carter has attempted to lower the cost of regulation. At best, any cuts have been tiny and mostly centered on trimming paperwork. But less regulation is one campaign promise made by Donald Trump that is coming true. With tax and health-care reform problematic and given the president’s protectionist leanings, deregulation is probably a major driver of the stock market rally. The size and scope of the federal government give the president immense powers. In relation to gross domestic product, federal spending rose from 16% in 1946 to 22% in the 2017 fiscal year. Executive orders give the chief executive, in effect, legislative powers.

President Barack Obama issued many in his waning days, especially affecting power plants and oil pipelines. The Competitive Enterprise Institute last year found regulation cost American businesses $1.9 trillion, dwarfing the $344 billion in corporate taxes. About 56% of CEOs see overregulation as a major threat to their organization, more than cybersecurity (50%), rising taxes (41%) or even protectionism (27%). Whenever a new regulation is made or changed, it must be chronicled in the Federal Register. In the last years of the Obama administration, regulatory activity went parabolic, hitting almost 97,000 pages in a year. The annualized pace under Trump through July 31 was 61,330 pages, the fewest since the 1970s.

This year through June, the federal government had made 1,731 preliminary, proposed or final rules, the least since 2000 and down 40% from the 2011 peak under Obama. Many actions taken under Trump are reversals of earlier rules made under Obama. Of 66 completed actions at the Environmental Protection Agency, a third were rule withdrawals. Shares of banks have benefited, as those with more than $50 billion in assets are now able to merge without increased scrutiny. Scaling back the Volcker Rule would allow big banks to resume proprietary lending. The delay and likely alterations of the fiduciary requirement would aid brokers and insurers. The House has already approved a widespread rewrite of Dodd-Frank.

I think he meant it.

• Fed Chair Nominee Jerome Powell Says Too Big To Fail Is Over (BI)

Jerome Powell, Donald Trump’s nominee to replace Janet Yellen as Federal Reserve Chair, just made a frightening statement that suggests he is far too sanguine about risks in the US and global financial systems. During his confirmation hearing at the Senate on Tuesday, when pressed on the issue of whether any US banks are still considered too big to fail, Powell said simply: “No.” It’s the kind of blind optimism that could come back to haunt him during his tenure, which begins in February. Too big to fail, of course, is the financial crisis-era term for banks that the US government would be forced to bail out in a crisis because they might take the entire system down with them. Think of Citigroup, JPMorgan Chase, and Goldman Sachs. They underpin too much of our financial network to be allowed to falter.

“Dodd-Frank did a lot of things, but ending Too Big To Fail can’t be listed among its accomplishments,” Isaac Boltansky, director of policy research at Compass Point, told Business Insider. “The system is far safer given the capital and liquidity rules, and new mandates such as living wills and orderly liquidation authority should blunt panic in a crisis, but I doubt anyone in Washington or on Wall Street truly believes the federal government would stand idly by in the event of another systemic banking crisis,” he said. Democratic Senator Elizabeth Warren also took issue with Powell’s opening statement, which talked about “easing the burden” of regulation for banks.

“I’m troubled that you believe the biggest problem with bank regulations is that they are too tough,” Warren said during the hearing, arguing that it was that kind of mindset that led to the financial crisis of 2007-2008. At that time, many large investment banks were rescued by the Treasury and the Federal Reserve after their investments in housing soured quickly as a historic boom turned to bust. Treating the banks as victims of burdensome rules — rather than perpetrators of a historic crisis in need of deeper and more constant supervision — could lay the groundwork for a repeat. When it comes, Powell is going to regret that he didn’t have more to say about this.

The pound surged on this news, but without solving the Irish border issue, none of it is worth a thing.

• Britain Close To Deal On Brexit Bill With EU (R.)

Britain has offered to pay much of what the European Union was demanding to settle a Brexit “divorce bill”, bringing the two sides close to agreement on a key obstacle to opening talks on a future free trade pact, EU sources said on Tuesday. The offer, which British newspapers valued at around 50 billion euros, reflected the bulk of outstanding EU demands that include London paying a share of post-Brexit EU spending on commitments made before Britain leaves in March 2019 as well as funding of EU staff pensions for decades to come. A British government official said they “do not recognize” this account of the talks going on ahead of a visit by Prime Minister Theresa May to Brussels this coming Monday.

EU officials close to the negotiations stressed that work was still continuing ahead of May’s talks with European Commission President Jean-Claude Juncker and his chief Brexit negotiator Michel Barnier. But EU diplomats briefed on progress said the British offer was promising and that, on the financial settlement, the two sides were, as one said, “close to a deal”. Nonetheless, others cautioned that Britain had yet to make a fully committed offer and that essential agreement from the other 27 member states could not yet be taken for granted. The EU set the condition of “significant progress” on three key elements of a withdrawal treaty before it would accede to London’s request for negotiations on a free trade pact that could keep business flowing after Brexit in 16 months.

See you in court.

• Former New Zealand PM John Key Lied About Mass Surveillance Program (NZH)

Sir John Key’s story of how and why he canned a “mass surveillance” programme are at odds with official papers detailing development of the “Speargun” project. The issue blew up in the final days of the 2014 election with Key claiming the programme was long-dead and had been replaced by a benign cyber-security system called Cortex. Key always claimed the Speargun project to tap New Zealand’s internet cable was stopped in March 2013. But new documents show development of Speargun continued after the time he had said he ordered a halt – apparently because the scheme was “too broad”. Instead, they show Speargun wasn’t actually stopped until after Key was told in a secret briefing that details were likely to become public because they could be in the trove of secrets taken by NSA whistleblower Edward Snowden.

With days to go until voting in 2014, Key found himself accused by some of the world’s most high-profile and outspoken surveillance critics of secretly developing a mass surveillance system with the United States’ National Security Agency. It was high stakes for Key, also Minister of the GCSB, as he had previously promised the public he would resign as Prime Minister if there was ever mass surveillance of New Zealanders At the Kim Dotcom-organised “Moment of Truth” event, journalist Glenn Greenwald and Snowden claimed our Government Communications Security Bureau spy agency had developed the “Speargun” project to tap New Zealand’s internet cable and suck out masses of data.

Key denied it, saying Speargun had been canned in March 2013 because it was too intrusive. He said: “We made the call as government and I made the call as the Minister and as Prime Minister, that actually it was set too broadly. “What we ultimately did, when it comes to Speargun, in my opinion, I said it’s set too far. I don’t even want to see the business case.” The NZ Herald has found – after three years of refusals and information going missing – that the former Prime Minister’s version of events doesn’t match that of documents created at the time.

As if MbS is any different.

• Senior Saudi Prince Freed In $1 Billion Settlement Agreement (R.)

Senior Saudi Prince Miteb bin Abdullah, once seen as a leading contender to the throne, was freed after reaching an “acceptable settlement agreement” with authorities paying more than $1 billion, a Saudi official said on Wednesday. Miteb, 65, son of the late King Abdullah and former head of the elite National Guard, was among dozens of royal family members, ministers and senior officials who were rounded up in a graft inquiry partly aimed at strengthening the power of Crown Prince Mohammed bin Salman. The official, who is involved in the anti-corruption campaign, said Miteb was released on Tuesday after reaching “an acceptable settlement agreement”. The amount of the settlement was not disclosed but the official said it is believed to be the equivalent of more than $1 billion.

“It is understood that the settlement included admitting corruption involving known cases,” the official said. According to a Saudi official, Prince Miteb was accused of embezzlement, hiring ghost employees and awarding contracts to his own firms including a $10 billion deal for walkie talkies and bulletproof military gear worth billions of Saudi riyals. The allegations against the others included kickbacks, inflating government contracts, extortion and bribery.

Easy: let the banks take the losses, not the people.

• Europe Needs a Way to Prevent the Next Greek-Style Debt Crisis (BBG)

If there was ever a textbook example of how not to handle a sovereign debt crisis, it was Greece. Nearly a decade since Athens first asked for help from its euro zone partners and the IMF, the Greek economy is still struggling to recover. Even after a steep restructuring, sovereign debt remains unsustainable. If Greece is not to be crippled by its debt load, European governments will have to accept further debt-reducing measures, on top of the maturity extensions and the cut in interest rates they have already agreed to. So it’s no surprise that one of the key debates on the future of the euro zone relates to how sovereign debt restructuring should be made easier. There is little doubt that forcing losses on creditors at an earlier stage, as some propose, would increase the chance that a program of financial assistance is successful.

However, the euro zone should be wary of automatic triggers; they risk bringing on the very crisis they are designed to avert. The debate on the future of debt restructuring in the euro zone largely involves two positions. The first, which is widely shared in Germany, sees an orderly debt restructuring mechanism as an essential next step for the currency union. When a country applies for financial help from the European Stability Mechanism (ESM), creditors should face some form of debt restructuring immediately. This would ensure a better distribution of risks between debt-holders and the ESM. The threat of a haircut will make investors more discerning in their lending, contributing to fiscal discipline within the euro zone.

Because Bayer is a German chemical company with very deep roots in Berlin, and it’s buying Monsanto. Ironically, the only party that can stop that purchase is the EU… German media say Merkel was angry at the German representative for going it alone on Germany’s decision to support this stance. So let’s see her reverse it.

• Controversial Glyphosate Weedkiller Wins New 5-Year Lease In Europe (G.)

Glyphosate, the key ingredient in the world’s bestselling weedkiller, has won a new five-year lease in Europe, closing the most bitterly fought pesticide relicensing battle of recent times. The herbicide’s licence had been due to run out in less than three weeks, raising the prospect of Monsanto’s Roundup disappearing from store shelves and, potentially, a farmers’ revolt. Instead, an EU appeal committee voted on Monday to reauthorise the substance despite a petition by 1.3 million EU citizens last week calling for a ban. In 2015, the World Health Organisation’s cancer agency, the IARC, famously declared glyphosate “probably carcinogenic to humans,” although several international agencies, including Efsa, subsequently came to opposite conclusions. Monsanto insists glyphosate is safe.

The EU health commissioner Vytenis Andriukaitis said: “Today’s vote shows that when we all want to, we are able to share and accept our collective responsibility in decision making.” However, the approval falls far short of the 15-year licence the commission had originally sought and Conservative MEPs lashed out at what they called “an emotional, irrational but politically convenient fudge”. Ashley Fox, the Conservative party’s delegation leader in the European parliament, said that the vote “simply prolongs the uncertainty for our farmers, who are being badly let down. They cannot plan for the future without long term assurances about the availability of substances they rely on.”

A re-run of the struggle to reauthorise glyphosate will now begin again in two years’ time, with a new safety assessment by the European Food Safety Authority (Efsa). Greenpeace EU food policy director, Franziska Achterberg, commented: “The people who are supposed to protect us from dangerous pesticides have failed to do their jobs and betrayed the trust Europeans place in them.” The Green party called it “a dark day for consumers, farmers and the environment”.

[..] Traces of glyphosate are routinely found in tests of foodstuffs, water, topsoil, and human urine in amounts way above safe limits set by regulators. Ben & Jerry’s recently introduced a new line of organic ice cream, in a bid to sate public concern. Campaigners say Monsanto ghostwrote research papers for regulators, enlisted EPA officials to block a US government review of glyphosate and formed front groups to discredit critical scientists and journalists, citing documents revealed in a US lawsuit by non-Hodgkin’s lymphoma sufferers. More than 280 similar lawsuits are now pending against Monsanto, according to the US right to know campaign.

A tad scary?!

• New Zealand Fault Line Wakes Up: “We Must Think Japan 2011 Ruptures” (SHTF)

The devastating Kaikura earthquake in 2016 has resurrected the Hikurangi subduction zone where two tectonic plates clash and one is pushed down. Geologists are now warning that this trench could cause a massive earthquake on the ocean floor, and could trigger other 9.0 magnitude earthquakes and tsunamis that will reach the western coast of the islands in just seven minutes. The Australian plate is heading north while the Pacific plate is heading west, and the combination of these motions means that the Pacific plate, which includes much of the South Island, is moving relative to the Australian plate at a rate of about 40millimeters each year in a southwesterly direction. Ursula Cochran, from the science firm GNS, told The Marlborough Express: “We need to think Japan 2011 basically, because if our whole plate boundary ruptured it would be a magnitude-9 earthquake.”

The Great East Japan Earthquake and resulting tsunami smashed through the country’s north-eastern coast killing almost 16,000 people and destroying the lives of thousands more. It also triggered a major ongoing crisis at the Fukushima nuclear plant. “One of the biggest hazards of that kind of earthquake is the tsunami that is triggered by a fault rupture offshore.,” Cochran added. “We know from tsunami modeling from a hypothetical earthquake from the Hikurangi subduction zone that the travel times could be very short to the coast, so seven minutes for some of the south Wairarapa coast.” One year after it struck, scientists are also warning that the Kaikoura quake was not the “big one” for the Hikurangi subduction zone. The quake on the Hikurangi subduction zone was devastating. The magnitude 7.8 that destroyed houses, lifted the Kaikoura seabed by 2m, tore apart farmland, and wrecked kilometers of State Highway 1, may be minor compared to what could come, Cochran said.

Has the west ever ended slavery?

• Libya “Chose” Freedom, Now It Has Slavery (CP)

NATO’s military intervention in Libya in 2011 has justifiably earned its place in history as an indictment of Western foreign policy and a military alliance which since the collapse of the Soviet Union has been deployed as the sword of this foreign policy. The destruction of Libya will forever be an indelible stain on the reputations of those countries and leaders responsible. But now, with the revelation that people are being sold as slaves in Libya (yes, you read that right. In 2017 the slave trade is alive and kicking Libya), the cataclysmic disaster to befall the country has been compounded to the point where it is hard to conceive of it ever being able to recover – and certainly not anywhere near its former status as a high development country, as the UN labelled Libya 2010 a year prior to the ‘revolution’.

Back in 2011 it was simply inconceivable that the UK, the US and France would ignore the lessons of Iraq, just nine years previously in 2003. Yet ignore them they did, highlighting their rapacious obsession with maintaining hegemony over a region that sits atop an ocean of oil, despite the human cost and legacy of disaster and chaos which this particular obsession has wrought. When former UK Prime Minister David Cameron descended on Benghazi in eastern Libya in the summer of 2011, basking in the glory of the country’s victorious ‘revolution’ in the company of his French counterpart Nicolas Sarkozy, he did so imbued with the belief he had succeeded in establishing his legacy as a leader on the global stage. Like Blair before him, he’d won his war and now was intent on partaking of its political and geopolitical spoils.

Cameron told the crowd, “Your city was an inspiration to the world, as you threw off a dictator and chose freedom.” The destruction of Libya by NATO at the behest of the UK, the US and France was a crime, one dripping in the cant and hypocrisy of Western ideologues for whom the world with all its complexities is reduced to a giant chessboard upon which countries such as Libya have long been mere pieces to be moved around and changed at their pleasure and in their interests – interests which are inimical to the people of the countries they deem ripe for regime change.

Europe’s politicians care only about their careers.

• The EU Created Libya’s Migrant Abuses, Now It Must Address Them (CP)

Revelations into Libya’s awful migrant detention centres showed the humanitarian emergency that occurs within them. The international community – particularly the European Union, has not only failed to address this problem, but is responsible for causing it. After Libya descended into chaos following long-time leader Muammar Gaddafi’s fall in 2011, the nation became a major hub of slavery and migrant-trafficking. For the hundreds of thousands of those fleeing war-torn areas in Sub-Saharan Africa, Libya serves as a strategic point to reach the safe havens of Europe. However, those who fail to reach Europe face equally dire circumstances to their homeland after being detained by Libyan authorities, as part of an EU-deal with the Libyan Government of National Accord (GNA) penned in February.

This deal entails the Libyan coastguard stopping migrant vessels leaving Libya. It was quite rightly slammed as ‘inhumane’ by the UN recently. Due to lack of protections for migrants from in this deal, migrants are either brutally tortured, abused and even sexually assaulted by Libyan authorities in camps, or are sold into slavery by unscrupulous smugglers. A CNN investigation showed the true horrors of human-trafficking. Migrants are treated like cattle, sold for as little as four hundred dollars, and sometimes moved from one slave master to another. Others on the scene report migrants in camps showing signs of torture, burns, lashings, and other abuses. An Italian doctor Pietro Bartolo slammed them as ‘concentration camps’. “You must realise that in Libya, black people are not considered human beings, they’re seen as inferior, you can do whatever you want to them,” Bartolo told Euro News.

Observers foresaw the humanitarian consequences soon after the deal with Libya was agreed. German foreign minister Sigmar Gabriel warned in April that thousands of men, women and children would face “catastrophic conditions”. It turns out Gabriel and other’s predictions were correct. The EU must therefore accept the blame for creating this crisis, for backing these unregulated, barbaric camps with the Libyan authorities. However, Europe has a clear geopolitical aim: to contain migrants, rather than help them – even if their suffering is enhanced. In doing so it uses Libya – a frail nation itself, as a dumping ground, to rid itself of the migrant issue. It has no regard for the human rights of those in detention centres.