Otto Dix Ice drift 1940

Here’s what this is about:

“Since the completion of the bridge over the Kerch strait, Moscow has demanded that Ukrainian ships not only give notice of their intention to transit the strait but request permission, a change that Kiev has rejected. According to western diplomats, the dispatch of the three ships was intended to assert freedom of navigation..”

Russia came close to losing its only warm water ports in early 2014. They won’t let that happen again.

• Putin ‘Seriously Concerned’ After Ukraine Votes To Impose Martial Law (G.)

Russian president Vladimir Putin has expressed “serious concern” over Ukraine’s decision to impose martial law, the Kremlin said on Tuesday, as the simmering confrontation between Moscow and Kiev sparked a new global crisis. In a phone conversation with Chancellor Angela Merkel, Putin also said he hoped the German leader could intervene to rein in Kiev. Putin “expressed a serious concern over Kiev’s decision to put its armed forces on alert and to introduce martial law,” the Kremlin said in a statement following the call. He also said he hoped “Berlin could influence the Ukrainian authorities to dissuade them from further reckless acts,” it added.

The political efforts came after Russia fired on and seized three Ukrainian vessels and their crews in the Kerch strait separating Crimea from the Russian mainland. Ukrainian MPs responded by voting to impose martial law. Six Ukrainians were reported to be injured, one of them critically, in the clash at the mouth of the Sea of Azov, where Russia has been building up its naval presence and seeking to restrict Ukrainian access since completing a bridge across the strait in May. The Ukrainian government released video footage of one of its ships being rammed by a Russian vessel. The incident sparked an emergency debate at the UN security council, where the Russian and Ukrainian ambassadors accused each other’s governments of seeking to trigger a conflict to deflect from their own domestic unpopularity.

The Ukrainian ambassador to the UN, Volodymyr Yelchenko, said the Russian naval authorities had been notified that the three Ukrainian vessels – two cutters and a tugboat – wished to pass through the strait, and had been waiting to hear confirmation on Sunday morning when the vessels were attacked. [..] Since the completion of the bridge over the Kerch strait, Moscow has demanded that Ukrainian ships not only give notice of their intention to transit the strait but request permission, a change that Kiev has rejected. According to western diplomats, the dispatch of the three ships was intended to assert freedom of navigation and also to reinforce a very small Ukrainian naval presence in the Sea of Azov.

“..Considering the current single-digit popularity rating of Poroshenko and the fact that he has no chance in hell to be re-elected ..”

• The Latest Ukronazi Provocation In The Kerch Strait (Saker)

Second, let me give you the single most important element to understand what is (and what is not) taking place: the Sea of Azov and the Black Sea are, in military terms, “Russian lakes”. That means that Russia has the means to destroy any and all ships (or aircraft) over these two seas: on the Black Sea the life expectancy of any intruder would be measured in minutes, on the Sea of Azov in seconds. Let me repeat here that any and all ships deployed in the Black Sea and the Sea of Azov are detected and tracked by Russia and they can all easily be destroyed. The Russians know that, the Ukrainians know that and, of course, the Empire knows that. Again, keep that in mind when trying to make sense of what happened.

Third, whether the waters in which the incident happened belong to Russia or not is entirely irrelevant. Everybody knows that Russia considers these waters are belonging to her and those disagreeing with this have plenty of options to express their disagreement and challenge the legality of the Russian position. Trying to break through waters Russia considers her own with several armed military vessels is simply irresponsible and, frankly, plain stupid (especially considering point #2 above). That is simply not how civilized nations behave (and there are plenty of contested waters on our planet).

Fourth, one should not be too quick in dismissing Poroshenko’s latest plan to introduce martial law for the next 60 days. Albeit Poroshenko himself declared that this mobilization does not mean that the Ukronazi regime wants war with Russia, the fact is that the first-line reserves will be mobilized. This is important because the situation resulting from the introduction to martial law could be used to covertly increase the number of soldiers available for an attack on Novorussia or, God forbid, Russia herself. In fact, Poroshenko also officially appealed to the veterans of the war against Novorussia to be ready for deployment.

[..] Considering the current single-digit popularity rating of Poroshenko and the fact that he has no chance in hell to be re-elected it is pretty darn obvious of why the Ukronazi regime in Kiev decided to trigger yet another crisis and then blame Russia for it. The very last thing Russia needs is yet another crisis, especially not before a possible Putin-Trump meeting at the G20 Buenos Aires summit later this month. In fact, Ukrainian bloggers immediately saw this latest provocation as an attempt to scrap upcoming elections.

Remind me, what did it cost to keep GM alive?

• Trump Says He Isn’t Happy With GM Decision To Shed 14,700 Jobs (G.)

General Motors has announced it will halt production at five North American facilities and cut 14,700 jobs as it deals with slowing sedan sales and the impact of Donald Trump’s tariffs. More than 6,000 blue-collar jobs will be hit by GM plans to stop production at a car plant in Canada and two more in Ohio and Michigan. Two transmission plants in the US will also be mothballed, putting the future of those plants in doubt. The cuts will also include 15% of GM’s 54,000 white-collar workforce, about 8,100 people, and come as 18,000 GM workers have been asked to accept voluntary redundancy. Trump, who won over voters in many of the states affected by GM’s decision by promising to save their jobs, told reporters he was not happy with the decision.

“We don’t like it,” he told reporters. “This country has done a lot for General Motors. They better get back to Ohio, and soon.” Mary Barra, GM’s chief executive, was due to meet with top White House economic adviser Larry Kudlow later on Monday. “We are taking this action now while the company and the economy are strong to keep ahead of changing market conditions,” Barra said in a conference call. GM’s share price rose 5.5% on the news. The car plants – Lordstown Assembly in Ohio, Detroit-Hamtramck Assembly and Oshawa Assembly – all build slow-selling cars. Trump held a rally close to the Lordstown plant in July and told workers not to sell their homes because “jobs are coming back”.

Fiat/Chrysler increased sales (but its CEO died recently), Ford and GM lost big.

• GM Cuts 14,700 Jobs As Auto Bubble Begins To Burst (Colombo)

On Monday, General Motors announced that it will cut 14,700 jobs or 15% of its North American workforce in addition to closing three assembly plants and two other facilities: While GM’s CEO Mary Barra is spinning this move as a positive, I am highly suspicious because it is taking place at the same time that global auto sales are plunging (see chart below). Ford also said recently that it will cut more than 20,000 jobs across the globe as part of an $11 billion restructuring.

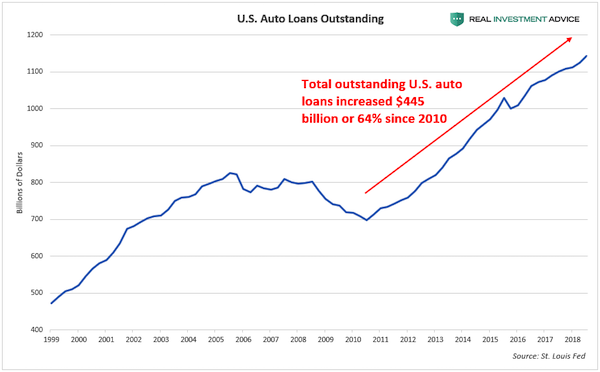

The reason why I criticized President Trump’s excitement about Ford’s decision was because I’ve been warning (then and now) that the U.S. automobile sales boom was driven by a debt bubble that would end very badly. Since 2010, total outstanding U.S. auto loans increased by $445 billion or 64% to over $1.1 trillion as Americans took advantage of record low interest rates to finance automobile purchases.

U.S. Auto Loans

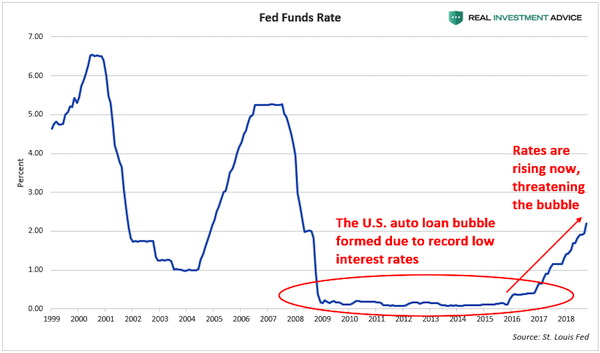

After the Great Recession in 2008 and 2009, the U.S. Federal Reserve cut interest rates to record low levels and held them there for a record length of time, making it much cheaper to take out loans of all kinds. Notice how the total outstanding U.S. auto loans in the chart above start to soar shortly after interest rates were cut to record lows (based on the chart below)? That is certainly no coincidence. Low interest rates lead to borrowing booms that end when interest rates go back up, which is what has been happening over the last few years. Rising interest rates are threatening the U.S. automobile sales and loan bubble and will eventually cause its popping.

Interest Rates

It’s entirely possible that GM is aware of the risk of a more serious auto sales downturn ahead as higher interest rates start to bite, which is why they decided to cut jobs and close the plants before it’s too late. If that’s the case, it’s a smart move on CEO Mary Barra’s part.

70% may seem a lot, but the remaining 30% consisted of just 211 cars. Non-story.

• Tesla China Sales Plunge 70% In October (R.)

Tesla Inc’s vehicle sales in China sank 70 percent last month from a year ago, the country’s passenger car association told Reuters on Tuesday, underscoring how the Sino-U.S. trade war is hurting the U.S. electric carmaker. An official from China Passenger Car Association said data from the industry body showed Tesla sold just 211 cars in the world’s largest auto market in October. The electric carmaker, which imports all the cars it sells in China, said in October that tariff hikes on auto imports were hammering its sales there. In July, Beijing raised tariffs on imports of U.S. autos to 40 percent amid a worsening trade standoff with the United States. While so-called new-energy vehicle sales have continued to climb in China, wider auto sales have slowed sharply since the middle of the year, taking the market to the brink of its first annual sales contraction in almost three decades.

First vote is December 11, the second around Christmas time.

• May’s Brexit Deal Sounds Like A ‘Great Deal For The EU’ – Trump (G.)

Donald Trump has delivered a weighty blow to Theresa May’s hopes of steering her Brexit deal through parliament, saying it sounded like a “great deal for the EU” that would stop the UK trading with the US. Trump was speaking to reporters outside the White House when he was asked about the deal May struck with the EU’s other 27 heads of state and government on Sunday. “Sounds like a great deal for the EU,” the president said. “I think we have to take a look at, seriously, whether or not the UK is allowed to trade. Because, you know, right now, if you look at the deal, they may not be able to trade with us … I don’t think that the prime minister meant that. And, hopefully, she’ll be able to do something about that.”

Trump’s intervention caught Downing Street off-guard and is likely to weaken May’s hand at a time when she is seeking to get the deal approved by parliament, where she faces determined resistance from 89 Tory backbenchers who argue the deal does not secure sufficient freedom of action for the UK. A vote is due on 11 December after a five-day debate. A No 10 spokesman argued that Trump’s take on Brexit was wrong: “The political declaration we have agreed with the EU is very clear we will have an independent trade policy so that the UK can sign trade deals with countries around the world – including with the US.”

Insert any number you can think of. And then realize that people actually get paid to issue these fully hollow reports.

• Theresa May’s Brexit Deal Could Cost UK £100bn Over A Decade (G.)

Theresa May’s Brexit deal is expected to cost the UK economy as much as £100bn over the next decade compared with remaining in the EU, according to one of the country’s leading economic thinktanks. An analysis of the prime minister’s EU withdrawal agreement from the National Institute of Economic and Social Research suggested that by 2030, Britain would lose GDP growth equivalent to the annual economic output of Wales. The study, commissioned by the People’s Vote campaign for a second referendum, found GDP over the long term was forecast to be about 4% less than it would have been had the UK stayed in the EU.

It comes as the government prepares to publish its own analysis of the impact of the deal this week, possibly on Wednesday, to help inform MPs before they vote on whether to back it in parliament. NIESR said the cost to the economy of the prime minister’s deal would be the equivalent of losing about £1,000 a year for every person in the UK. Garry Young, the director of macroeconomic modelling and forecasting at NIESR, said: “Leaving the EU will make it more costly for the UK to trade with a large market on our doorstep and inevitably will have economic costs.” The NIESR report found May’s deal would not be as damaging for the economy as Britain leaving the EU without an agreement, which would cost the economy about £140bn over the next 10 years.

The emptiness of the rumors that drive this stuff is deafening. These are not markets.

• Shares Rally As Italy Edges Away From Brussels Budget Clash (G.)

Italy has shown the first signs of backing away from a budget clash with Brussels, sparking a share rally in Rome. On a day when equities rose across the globe, tentative signs of progress in negotiations between the European commission and Italy’s populist leaders resulted in the key barometer of the Italian stock market rising by almost 3%. Bank shares – seen as particularly vulnerable in the event of a loss of confidence in Italian assets triggered by a prolonged confrontation – were up by 5% on Monday. Reports that Rome was willing to cut its budget deficit from 2.4% of national output to as low as 2% also led to a fall in the interest rate the Italian government pays to borrow on the world’s financial markets.

Italy’s main stock market index – the FTSE MIB – was the best performer of the leading European bourses on a day of across-the-board gains, closing 2.8% higher. Frankfurt’s Dax index rose by 1.45%, while the City’s FTSE 100 ended the day up by 1.2% at 7,036. After sharp falls last week, shares rallied on Wall Street and the Dow Jones industrial average ended Monday trading 1.5% higher amid signs of strong Black Friday spending by American consumers. Ever since it came to power in the spring, Italy’s coalition government has been on a collision course with the commission over its plans to stimulate growth by running a bigger budget deficit. The proposed move would violate the eurozone’s fiscal rules and in the past few weeks investors have become increasingly more nervous about Italy’s public finances.

The concessions hinted at by the Rome government would go nowhere near far enough to meet the demands made by Brussels, however. A proposed budget deficit of 2% of GDP would still leave open the possibility of Rome being fined by the commission’s excessive deficit procedure rules but even a partial climbdown was enough to trigger a fall in 10-year Italian bond yields – a key benchmark of official borrowing costs. The spread between the interest rate Italy pays and the much cheaper interest rates for Germany fell to its lowest in more than a month.

Nice try, but Bitcoin no longer is what it was 10 years ago at birth. So fluctuations aren’t either. Who’s going to put serious money into something that loses 81% in less than a year?

• Bitcoin Is Down More Than 80% From Last Year’s High (CNBC)

Bitcoin is only 10 years old, but the cryptocurrency has already seen its fair share of bear markets. The most recent one, which some are dubbing “crypto winter,” worsened over the weekend. The cryptocurrency slid below $3,500 for the first time in 14 months, then later recovered toward the $3,900 level by Monday, according to data from CoinDesk. That brings its decline from last year’s peak to more than 81 percent. That loss isn’t the worst bitcoin has suffered, but the world’s largest digital currency is getting close. Bitcoin’s current level is still well above the fraction of a penny price where it first began trading in 2010— and its early investors are mostly wealthier because of it. By June 2011, it had risen to a new all-time high of roughly $30. But by that November, the cryptocurrency was back below $2.50, tumbling more than 92 percent from their high.

That year, volume was still low and the dozens of now popular trading exchanges like Coinbase didn’t exist yet. Tokyo-based Mt. Gox was handling roughly 70 percent of all cryptocurrency transactions in the world. [..] Roughly $700 billion has been wiped off cryptocurrencies’ global market capitalization since the high, according to data from CoinMarketCap.com. The price of one bitcoin has dropped more than $15,000 since December. Bitcoin skyrocketed to current its all-time high of almost $20,000 in December 2017. Coinbase’s CEO said this summer that at the height of that boom, the exchange was opening up 50,000 new accounts a day, for mostly retail investors. The all-time high also came ahead of the availability of bitcoin futures. Those products have also fallen. On Monday, they dropped to their lowest levels since launching.

Not going to happen. Unless they find a vigilante prosecutor.

• Human Rights Watch Asks Argentina To Probe MbS Over Yemen, Khashoggi (R.)

Human Rights Watch has asked Argentina to use a war crimes clause in its constitution to investigate the role of Saudi Crown Prince Mohammed bin Salman in possible crimes against humanity in Yemen and the murder of journalist Jamal Khashoggi. Argentina’s constitution recognizes universal jurisdiction for war crimes and torture, meaning judicial authorities can investigate and prosecute those crimes no matter where they were committed. Human Rights Watch said its submission was sent to federal judge Ariel Lijo.

HRW’s Middle East and North Africa director Sarah Leah Whitson said the international rights group took the case to Argentina because Prince Mohammed, also known as MbS, will attend the opening of the G20 summit this week in Buenos Aires. “We submitted this info to Argentine prosecutors with the hopes they will investigate MbS’s complicity and responsibility for possible war crimes in Yemen, as well as the torture of civilians, including Jamal Khashoggi,” Whitson told Reuters. Argentine media cited judicial sources as saying it was extremely unlikely that the authorities would take up the case against the crown prince, Saudi Arabia’s de facto ruler.

Gee, what a surprise. Downplaying the economic losses to communities caused by Airbnb, Uber and Amazon doesn’t help.

• The ‘Sharing Economy’ Has Been Seized By Big Money (G.)

[..] The year 2018 is to the sharing economy what 2006 was to user-generated content: it can only go downhill. Platforms won’t disappear; far from it. However, the initial lofty objectives that legitimised their activities will give way to the prosaic and occasionally violent imperative imposed by the iron law of competition: the quest for profitability. Uber may help some make ends meet through occasional driving gigs. The need to achieve profitability, however, means that it will have no qualms about ditching its drivers for fully automated vehicles; a company that lost $4.5 bn in 2017 alone would be silly to do otherwise.

Airbnb may have presented itself as an ally of the middle classes against entrenched economic interests. But the drive for profits already forces it to partner with the likes of Brookfield Property Partners, one of the world’s largest real-estate firms, to develop Airbnb-branded hotel-like residencies, often by purchasing and converting existing apartment blocks. Few entrenched interests – save, perhaps, for the tenants who see their apartment blocks become Airbnb-run hotels – get disrupted here. Given the huge sums involved, the most likely outcome of current battles in sectors such as ride-sharing will be more centralisation, with just one or two platforms controlling each region. Uber’s surrender – in China, India and Russia, as well as much of southeast Asia and Latin America – to local players, many of them also backed by Saudi money, suggests as much.

What ails the Automatic Earth: “Small blogs cannot exist without Facebook..”. But Facebook shut down access to our account, and thousands of ‘friends’, without one single word of explanation. So what now? Set up a new accoint, only for them do to it again? Are you beginning to see what’s wrong here?

• Who Will Fix Facebook? (Matt Taibbi)

James Reader tried to do everything right. No fake news, no sloppiness, no spam. The 54-year-old teamster and San Diego resident with a progressive bent had a history of activism, but itched to get more involved. So a few years ago he tinkered with a blog called the Everlasting GOP Stoppers, and it did well enough to persuade some friends and investors to take a bigger step. “We got together and became Reverb Press,” he recalls. “I didn’t start it for the money. I did it because I care about my country.”

[..] The site took off, especially during the 2015-16 election season. “We had 30 writers contributing, four full-time editors and an IT worker,” Reader says. “At our peak, we had 4 million to 5 million unique visitors a month.” Through Facebook and social media, Reader estimates, as many as 13 million people a week were seeing Reverb stories. Much of the content was aggregated or had titles like “36 Scariest Quotes From the 2015 GOP Presidential Debates.” But Reverb also did original reporting, like a first-person account of Catholic Church abuse in New Jersey that was picked up by mainstream outlets.

Like most independent publishers, he relied heavily on a Facebook page to drive traffic and used Facebook tools to help boost his readership. “We were pouring between $2,000 and $6,000 a month into Facebook, to grow the page,” Reader says. “We tried to do everything they suggested.” Publishers like Reader jumped to it every time Facebook sent hints about changes to its algorithm. When it emphasized video, he moved to develop video content. Reader viewed Facebook as an essential tool for independent media. “Small blogs cannot exist without Facebook,” he says. “At the same time, it was really small blogs that helped Facebook explode in the first place.”

The investors are not the answer to the problem. The links to secret services are.

• Investors Go After Zuckerberg After Facebook Plunges 40% In 4 Months (CNBC)

It’s been a brutal few months for Facebook investors. Shares of the social network have tumbled almost 40 percent since reaching a high on July 25, even after a modest rebound on Monday. The company has faced a barrage of attacks related to the numerous ways the platform has been manipulated to spread false information and for leadership’s insufficient and controversial response, which the New York Times detailed in a lengthy investigative report earlier this month. Some of the almost $200 billion of market value that’s been wiped out since the stock’s peak can be attributed to a broader sell-off in tech stocks, which have plummeted since August amid concern about a slowdown in global economic growth and President Trump’s threats of a trade war.

But Facebook’s slide started well before that and the stock has badly underperformed the Nasdaq and its big-tech peers this year. The problem for Facebook is in finding a way out. Facebook’s business model, which relies on a growing number of users to share more information and for advertisers to continue to pay up to reach them, starts to look shaky as trust in the network deteriorates. Yet at the top of the company, CEO Mark Zuckerberg, 34, has so much ownership and control that the board and shareholders have a very limited ability to exert any influence.

Might as well give up on people ever understanding that climate change is not an economic problem, and can therefore not be solved by economics.

Whoever links the demise of the planet to solutions offered by the same money that is causing it, is blind.

• Fighting Climate Change Can Be America’s New New Deal (R.)

Fighting climate change can be America’s new New Deal. The effects of global warming on virtually all aspects of U.S. society could be devastating, according to a government report released on Friday. Rather than seize on its findings as a way to boost American innovation, economic output and jobs, President Donald Trump’s administration snuck the report out late on Friday after Thanksgiving – and then played down its devastating findings. That’s a big missed opportunity Unchecked, climate change could lop as much as a tenth off the nation’s GDP by the end of the century, according to the authors of Volume II of the Fourth National Climate Assessment.

That overall figure doubtless underestimates regional variances. The overall cost of the wildfires that hit California in 2017, for example, amounted to 6.5 percent of the Golden State’s economic output, estimated AccuWeather. Factor in everything from water scarcity to pollution to energy production to human health, and in some parts of the country the economic impact could be far worse. The cost in financial and human terms drops by up to 70 percent if greenhouse-gas emissions peak before the middle of the century and then drop, the report says. It requires investment, of course – which some Republicans like Senator Mike Lee deride as being harmful to the economy.

That’s clearly a ruse. Fully decarbonizing by 2050 the world’s cement, steel, plastics, trucking, shipping and aviation sectors could require investing some 0.5 percent of global GDP a year using mostly existing technology, according to the Energy Transitions Commission. But it would bring efficiencies, employment and advances in technology that could more than offset the costs. Similarly, modernizing aging infrastructure has multiple benefits. Investing the $800 billion or so needed to upgrade America’s water systems could generate an almost 300 percent return, according to the U.S. Water Alliance – and generate 1.3 million jobs.

Stefania Maurizi gained access to Assange recently. The cat is gone. So sorry for Julian. Maurizi makes a point that everyone should make: the role of the UK press. I wrote earlier this year about a series of smear pieces the Guardian published. Nothing has changed. These are the same folk that shout out about freedom of the press when Trump is concerned. They’re at the very least no better than he is.

• The Detention and Isolation from the World of Julian Assange (Stefania Maurizi)

They are destroying him slowly. They are doing it through an indefinite detention which has been going on for the last eight years with no end in sight. Julian Assange has become one of the most widely known icons of freedom of the press and the struggle against state secrecy. [..] After eight months of failed attempts, la Repubblica was finally able to visit the WikiLeaks founder in the Ecuadorian embassy in London, after the current Ecuadorian president, Lenin Moreno had cut him off from all contacts last March with the exception of his lawyers.

[..] The friendly atmosphere we had always experienced during our visits over the last six years is now gone. The Ecuadorian diplomat who had always supported the WikiLeaks founder, Fidel Narvaez, has been removed. Not even the cat is there anymore. With its funny striped tie and ambushes on the ornaments of the Christmas tree at the embassy’s entrance, the cat had helped defuse tension inside the building for years. But Assange has preferred to spare the cat an isolation which has become unbearable and allow it a healthier life.

The news that surfaced last week, revealing the existence of criminal charges against Julian Assange by the US authorities, charges which were supposed to remain under seal until it was impossible for Assange to evade arrest, vindicates what Assange has feared for years. He is now waiting for the charges to be unsealed, but in the meantime he is silent: the risk that he could suddenly lose Ecuador’s protection due to some public statement is not improbable these days. Two years ago, the UN Working Group on Arbitrary Detention (UNWGAD) established that the UK (at that time Sweden as well) is responsible for detaining Assange arbitrarily: it should free him and compensate him. London did not welcome this decision: they tried to appeal it, but lost the appeal and since then have simply ignored it.

The British media has never called on the UK authorities to comply with the UN body’s decision, quite the opposite: some even lashed out against the UN body. If Julian Assange ends up in the hands of the UK authorities in the upcoming months and the US asks for his extradition, where will the British medial stand? Never before has the life of the WikiLeaks founder been so crucially in the hands of public opinion and in the hands of one of the few powers whose mission it is to reign in the worst instincts of our governments: the press.