John M. Fox WCBS studios, 49 East 52nd Street, NYC 1948

Brilliant.

• Truth to Power: This Man Will Never Be Invited Back On CNBC (Zero Hedge)

And now for something completely unexpected: 2 minutes of pure truth (courtesy of Mizuho’s Steve Ricchiuto) on CNBC… 148 seconds of awkward uncomfortable truthiness…

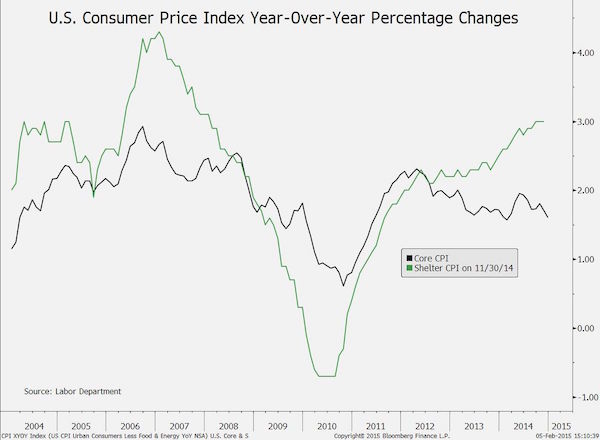

While Steve had a number of hard to hear quotes for the CNBC anchors – such as: “There is no acceleration in underlying economic activity,” and “There’s this wrong concept that I keep on hearing about in the financial press about the acceleration in economic growth… It’s not happening!” A stunned Simon Hobbs rebuffs, “That’s a long list of non-ideal situations we find ourselves in,” to which Ricchiuto snaps back “and we can keep on going!”

“After a string of dismal data on durable goods, retail spending, and inventories, we get a good jobs number and everyone saying the economy’s good – it’s not good! It was Sara Eisen that had the quote of the brief clip… (which has unbelievably been edited out since we posted it seems at around the 1:40 mark) when faced Steve’s barrage of facts about the real economy, replied: “but the key is that’s not what The Fed is telling us.” Summing up the unbelievable ‘faith’ (misplaced beyond all reputational loss) that so many have in the central planners of the world.

Very lucid explanation of one of Steve’s longtime big themes and squabbles with Krugman: the role of banks in debt creation.

• Nobody Understands Debt – Including Paul Krugman (Steve Keen)

Paul Krugman has published a trio of blog posts on the issue of debt in the last week: “Debt Is Money We Owe To Ourselves” (February 6th at 7.30am), “Debt: A Thought Experiment” (same day at 5.30pm), and finally “Nobody Understands Debt” (February 9th in an Op Ed). There is one truly remarkable thing about all three articles: not one of them contains the word “Bank”. Now you may think it’s ridiculous that an economist could discuss the macroeconomics of debt, not once but three times, and never even consider the role of banks. But Krugman would tell you why you don’t need to consider banks when talking about debt, and call you a “Banking Mystic” if you persisted. Well Krugman would be wrong, and you would be right.

This is one of the many times where “experts” in economics have it all wrong, and the general public’s gut feelings about banks, debt and money are closer to the truth. Bank lending is fundamentally important to the performance of the economy, and it is also fundamentally different to lending between individuals. But mainstream economics has convinced itself of the opposite propositions—that lending (most of the time) has trivial macroeconomic implications (the exception being during a “liquidity trap”), and that bank lending to individuals is really no different to lending between individuals. Bunkum—and it’s easy to show why using that boring but vital tool of the accountant, double-entry bookkeeping.

Imagine that you want to buy a new iPhone 6, but you don’t have the $299 Apple wants for it. There are two ways you can get the money: you can borrow from a friend—who transfers money from her bank account to yours—which we can call “Peer to Peer” lending. Or you can add to your credit card debt with your bank—which obviously is “Bank Lending”. Are the two operations macroeconomically equivalent? Or if they are not, are there rules that constrain bank lending so that it’s effectively just the same as “peer to peer” lending? I’ll consider the first point in this article and tackle the second in a later post.

If you borrow from a friend—let’s call you “Impatient” and your friend “Patient” to borrow Krugman’s terminology—then from the situation, as seen from the bank’s point of view, is as shown in Table 1. When you borrow the money, Patient’s deposit account falls by $299, while yours rises by $299. Then when you buy the iPhone, your account falls by $299, and Apple’s rises by $299. Apple gets an extra $299 in income, but since Patient’s bank account has fallen by that much, she is likely to spend less over time, which will reduce someone else’s income by about as much as Apple’s income rose.

“Nothing is going to go worse, every day is the worst day.”

• Cornered Greeks Brace For Confrontation (BBC)

Everyone in Greece has been watching closely as the rhetoric hardens, because they all have something at stake. At a union office in a northern suburb of Athens, a radio programme was going on air. Former employees of the former state broadcaster, ERT, who were abruptly fired in 2013, are still working without pay, determined to talk to the nation. Their makeshift studio is just across the road from their old headquarters, and Syriza has promised to rehire them and reopen ERT. “If we’re building a new country,” argued radio host Andreas Papastamatiou, “we have to [give people] the proper information.” “But we must [also] find a way to live together as European countries. Not as the emperor and his subjects.”

Opinion polls suggest that a growing number of people like the fact that Greece is trying to stand up for itself, and is taking its argument to the rest of the Europe. But they know they will not get everything they want. Now as eurozone finance ministers prepare to meet for what could be a stormy emergency session, the Greek government is floating proposals it clearly sees as a compromise. “What we are proposing,” the Minister for International Economic Affairs, Euclid Tsakalotos, told me, “is that we are given some room for manoeuvre.” “We are presenting a fair case – you cannot reform when people are frightened and uncertain. You need a certain amount of stability first.” [..]

An hour’s drive west of Athens tugboats pull large cargo ships along a narrow channel between the sheer limestone walls of the Corinth Canal. There is no room for manoeuvre – a familiar story for the Greek economy. But it is not hard to find out why Syriza is determined to negotiate some wiggle room. In a cafe overlooking the entrance to the canal, locals described the economy as a disaster, and their own prospects as bleak. The cafe owner, Vassiliki Kourtaki, said she was well aware of the increasingly bitter dispute between Greece and some of its Eurozone partners. But the sense of looming confrontation no longer scared her. “Scary is what we have now,” Vassiliki said. “Nothing is going to go worse, every day is the worst day.”

“The government has to do something now, because we need a lot of help. “And when you are down, the only way is up.” That is where Syriza believes its mandate comes from. And the tone of the prime minister’s speech suggests that he is willing to take his country right to the brink if necessary. The recent history of the European Union suggests that compromise is still on the cards. But if there is no deal by the end of the month the money will run out. And there is a clear and present danger of failure, with consequences impossible to predict.

“There is no way back,” he said. “As long as we have the people by our side, we cannot be blackmailed by anyone.”

• Greek PM Tsipras Wins Confidence Vote Before Talks With Creditors (NY Times)

With Greece preparing for tough talks with creditors in Brussels, Prime Minister Alexis Tsipras’s government easily won a confidence vote in Parliament early Wednesday with assurances that it would reverse an economic program that has slashed living standards. Speaking to Parliament before the vote, Mr. Tsipras said his government would seek a short-term “bridge” agreement to a new deal and a “necessary” reduction of Greek debt. He appealed for “space and time,” instead of an extension of the current loan program, saying the country could not “return to an age of bailouts and suppression.” Mr. Tsipras told lawmakers, “This is our red line” – a short-term bridge agreement without further austerity.

In the vote, his government, which came to power last month, secured the support of all 162 coalition lawmakers in the 300-seat House. But winning over international creditors – the EC, ECB and IMF, which have extended Greece more than $270 billion in bailout loans since 2010 – will be much more difficult. Mr. Tsipras said he was optimistic about a “mutually acceptable agreement” with creditors. But earlier in the day, Wolfgang Schäuble, the finance minister of Germany, which has championed austerity in economically troubled eurozone states, appeared to dismiss the prospect of a new plan for Greece. “We are not negotiating a new program,” Mr. Schäuble said amid a flurry of diplomacy aimed at laying the groundwork for a compromise.

Greece’s finance minister, Yanis Varoufakis, is expected to present his compromise plan at a summit meeting Wednesday in Brussels. The proposal anticipates a bridge financing program through the end of August and a change in the mix of economic measures imposed by creditors, a Greek official said Monday. Mr. Tsipras did not give details on the proposal but indicated that Greece would press its case. “There is no way back,” he said. “As long as we have the people by our side, we cannot be blackmailed by anyone.” Polls indicated that seven in 10 Greeks backed the tough stance toward the country’s creditors. The same proportion said they wanted Greece to remain in the eurozone “at all costs” amid renewed speculation about the Greece’s defaulting on its huge debt, which stands at 175% of GDP, and about its leaving the single-currency union.

“Greece is in a sense escalating its demands. It now wants to repeal the Troika Memorandum, and raise its T-bill issuance limit by a further €8bn, AND secure loans as well. Good luck.”

• Greece’s Last Minute Offer To Brussels Changes Absolutely Nothing (AEP)

The art of Game Theory brinkmanship is to convince opponents that you are utterly defiant, almost insane, and willing to bring the temple crashing down on everybody’s heads. Then you smile and talk turkey. Greece’s Syriza radicals are proving good at this, at least in demonstrating, or feigning, madness. Finance minister Yanis Varoufakis – by all reports the new heart-throb for the thinking German woman – is a theorist on the subject. He wrote a book, “Game Theory: A Critical Text” in 1995. Now he is putting it into practice with great relish. His latest letter to European Commission chief Jean-Claude Juncker is a sudden switch in tone. You can almost hear the sighs of relief in Brussels. The Eurogroup may not have to hit the pre-GREXIT button this week after all. The crunch can be put off for a bit longer. Greek newspaper Ekathimerini calls it a plan with four pillars:

1) Keep 70pc of the “good” EU-IMF Troika reforms. This means scrapping the other 30pc of course, as yet unnamed. These will be replaced ten new reforms in cooperation with the OECD that in principle go deeper and tackle the cartel/oligarchy system of the old dynasties. Abolish the Troika. Europe could live with this.

2) Cut the target for the primary budget surplus to 1.5pc of GDP over the next two years, instead of 3pc in 2015 and 4.5pc in 2016 as demanded by the Troika. This will stabilize fiscal policy, and open the way for durable recovery. Europe will scream, fretting that fiscal discipline will collapse across Club Med. The Spanish will scream because it will embolden Podemos. But the Americans and Chinese will scream at Europe. The G2 superpowers matter.

3) A debt swap to replace €195bn of loans from EMU governments and rescue funds. These will be GDP-linkers based on Keynes’s Bisque Bonds. No growth, no interest payments. Creditors put their money where their mouth is. The €27bn owed to ECB will be turned into “perpetual bonds”, parked on ECB balance sheet, more or less for ever. This averts a debt write-off – and therefore spares Chancellor Angela Merkel the unpleasant task of explaining to the Bundestag and Bild Zeitung why German taxpayers have just lost a great deal of money – but it amounts to the same thing by the back door. It is further debt relief. Lazard in Paris said today -seemingly on behalf of Athens – that Greece wants a €100bn cut in the ultimate debt stock. They are pitching their opening bid very high.

Europe will scream. Italy and Spain will scream loudest, since they pay too. If they accept this, it would amount to capitulation by Brussels. Furthermore, Mr Varoufakis is extending the plan until September 1. He wants to bite deep into the next Troika loan payment – something Syriza said before that it would never do – in order to pay off ECB loans. This means Europe will have to hand over fresh money. Greece is in a sense escalating its demands. It now wants to repeal the Troika Memorandum, and raise its T-bill issuance limit by a further €8bn, AND secure loans as well. Good luck. The country has funding needs of €17bn by the end of August. Some of this can be covered from a plethora of extraordinary items if EMU wants to play ball, but not all.

4) An emergency humanitarian plan worth €1.86bn. Food stamps. Free power for 300,000 homes below poverty threshold. Free health and transport for the poor. A pension boost for lowest cohort. Europe can live with this. So there we have it. Syriza has not backed down (though I note that the rise in the minimum wage is not on this very provisional list). Its core demands remain. Panagiotis Lafazanis, head of Syriza’s powerful Left Platform, reiterated in the Greek parliament that there will be no fundamental concession. “Greece is not a protectorate. If the EU’s ruling elites think they can blackmail us, they are very wrong,” he said.

What has changed is that Mr Varoufakis will go to Brussels on Wednesday with a package that will most likely throw enough sand in everybody’s eyes – and exploit mounting alarm in EMU circles that this showdown is becoming dangerous – to force a delay. EMU lives on. Yet nothing of substance has changed. The eurozone still faces its Morton’s Fork: either it finds a way to surrender to the Greek mutineers on austerity and debt (calling it victory), or it persists in holding Syriza to the letter of a discredited and destructive Troika deal agreed by a previous government, and in doing so risks blowing up the European Project. Either way, we are already in an entirely different Europe.

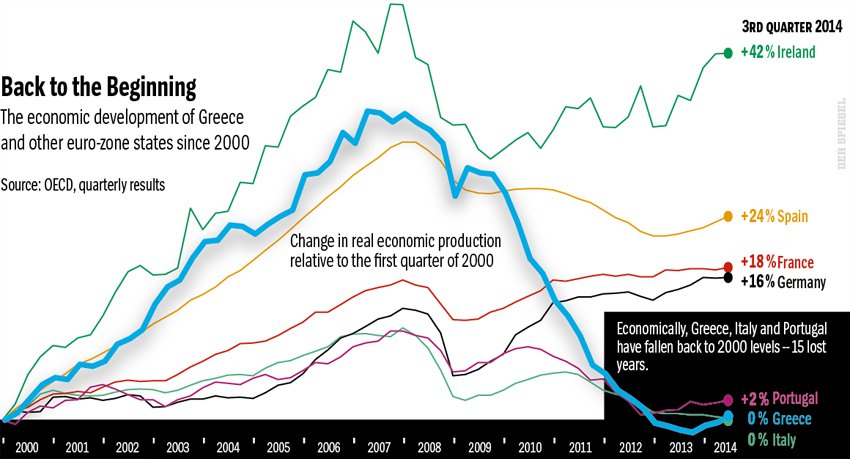

“The real nightmare for Merkel’s government is that the next two largest countries in the capital key are on a fast track toward their own fiscal demise.”

• Europe’s Greek Showdown: The Sum Of All Statist Errors (David Stockman)

The politicians of Europe are plunging into a form of ideological fratricide as they battle over Greece. And “fratricide” is precisely the right descriptor because in this battle there are no white hats or black hits – just statists. Accordingly, all the combatants—the German, Greek and other national politicians and the apparatchiks of Brussels and Frankfurt – are fundamentally on the wrong path, albeit for different reasons. Yet by collectively indulging in the sum of all statist errors they may ultimately do a service. Namely, discredit and destroy the whole bailout state and central bank driven financialization model that threatens political democracy and capitalist prosperity in Europe – and the rest of the world, too. The most difficult case is that of the German fiscal disciplinarians.

Praise be to Angela Merkel and her resolute opposition to Keynesian fiscal profligacy and her stiff-lipped resistance to the relentless demands for “more stimulus” from the likes Summers, Geithner, Lew, the IMF and the pundits of the FT, among countless others. At least the Germans recognize that if the EU nations are going to devote 49% of GDP to state spending, including nearly a quarter of national income to social transfers, as was the case in 2014, then they bloody well can’t borrow it. Notwithstanding the alleged German led austerity regime, however, that’s exactly what they are doing. Germany has managed to swim against the surging tide of EU public debt, lowering its leverage ratio from 80% to 76% of GDP in the last four years.

Indeed, Germany’s frustration with the rest of the European fiscal sleepwalkers is more than understandable, as is its fanatical resolve not to give an inch of ground to the Greeks. Or as Merkel’s deputy parliamentary leader, Michael Fuchs told Bloomberg, “There is no way out” for Greece from its treaty obligations….. conditions set for Greece by The Troika (EU, ECB, IMF) for bailout funds “have to be fulfilled…. That’s it, very simple.” This isn’t just teutonic rigidity. It’s actually all about the so-called capital contribution key—-the share of the EU bailout fund that must be covered by each member country in the event of a default.

At dead center of Greece’s $350 billion of debt is $210 billion owed to the Eurozone bailout mechanism. Germany’s share of that is 27% or roughly $57 billion. Yet the prospect of tapping the German taxpayers for some substantial part of that liability in the event of a Greek default is not the main problem—-even as it would mightily catalyze Germany’s incipient anti-EU party. The real nightmare for Merkel’s government is that the next two largest countries in the capital key are on a fast track toward their own fiscal demise. So what puts a stiff spine into its insistence that Greece fulfill the letter of its MOU obligations is that if either France or Italy is called upon to cover losses, the whole bailout scheme will go up in smoke.

“As part of a wider appeal to Europe for solidarity, Greece’s new finance minister has suggested a parallel between his country and the rise of Nazism in a bankrupt Germany in the 1930s..”

• Germany Rejects Greek Claim For World War II Reparations (Reuters)

– Germany said on Monday there was “zero” chance of it paying World War Two reparations to Athens, following a renewed demand from Greece’s new leftist Prime Minister Alexis Tsipras. Tsipras, in his first major speech to parliament on Sunday, laid out plans to dismantle Greece’s austerity program, ruled out any extension of its €240 billion international bailout and vowed to seek war reparations from Berlin. The demand for compensation, revived by a previous Greek government in 2013 but not pursued, was rejected outright by Sigmar Gabriel, Germany’s vice chancellor and economy minister. “The probability is zero,” said Gabriel, when asked if Germany would make such payments to Greece, adding a treaty signed 25 years ago had wrapped up all such claims.

Germany and Greece share a complex history that has complicated the debt debate. Greece was occupied by German troops in World War Two, an issue that has resurfaced since it has been forced to endure tough reforms in return for a financial bailout partly funded by euro zone partners. Many Greeks have blamed euro zone heavyweight Germany for the austerity, leading to the revival of a dormant claim against Berlin for billions of euros of war reparations. As part of a wider appeal to Europe for solidarity, Greece’s new finance minister has suggested a parallel between his country and the rise of Nazism in a bankrupt Germany in the 1930s, referring to Greece’s far-right Golden Dawn party.

Gabriel referred to the “Treaty on the Final Settlement with respect to Germany”, also known as the “Two plus Four Treaty” signed in September 1990, by the former West and East Germanys and the four World War Two allies just before German reunification. Under its terms, the four powers renounced all rights they formerly held in Germany. For Berlin, the document, also approved by Greece among other states, effectively drew a line under possible future claims for war reparations. Germany thus denies owing anything more to Greece for World War Two after the 115 million deutsche marks it paid in 1960, one of 12 war compensation deals it signed with Western nations. But Athens has said it always considered that money as only an initial payment, with the rest of its claims to be discussed after German reunification, which eventually came in 1990.

“Greece is in a situation of financial distress, it knows a humanitarian crisis like Europe has not known since World War II..”

• Lazard Sees $113 Billion Greek Debt Cut as ‘Reasonable’ (Bloomberg)

Canceling €100 billion of Greece’s debt would enable the country to cut the load in line with targets set by the international authorities that bailed out the nation, the country’s debt adviser, Lazard Ltd.’s Matthieu Pigasse, said in a radio interview Tuesday. A debt-to-gross-domestic-product ratio of 120% in 2020 is “a target that looks reasonable to me and that effectively allows bringing Greece into a sustainable pattern,” Pigasse, who leads Lazard’s sovereign advisory team, said on France Inter radio. “An effort is absolutely necessary” and negotiations are ongoing, he said, speaking in French.

European leaders on Monday urged Greek Prime Minister Alexis Tsipras to pare back his ambitions for easing the financial pressure on his people, saying they would go against the conditions attached to the country’s bailout. Greece’s public debt currently stands at more than €320 billion, or about 175% of GDP, making it Europe’s most-indebted state when measured against output. “It’s a negotiator’s position,” said Michel Martinez, an economist at SocGen in Paris. “A debt cut of this magnitude politically is very difficult, or even unacceptable. One should explain to German and French taxpayers that have lent to Greece that there will be losses,” Martinez said.

Canceling the debt isn’t the only option to reduce Greece’s debt-to-GDP ratio, and interest rate cuts and longer maturities are also possible, he said. Debt can be canceled, or reduced, in several ways, Lazard’s Pigasse said, without elaborating. “Greece is in a situation of financial distress, it knows a humanitarian crisis like Europe has not known since World War II,” Pigasse said. “The austerity cure that was imposed to Greece by what’s called the troika, which is the IMF, the ECB and European states has led to a true disaster.”

Find the common thread.

• Wednesday is Going to be Huge for Europe (Bloomberg)

[Today] sees two big meetings in Europe, the success or failure of which could have major repercussions for markets, and the European political landscape. In Minsk, Belarus, the leaders of Germany, France, Ukraine and Russia are due to meet to try to hammer out a peace agreement. Failure to reach an agreement will lead to further EU economic sanctions against Russia, which were delayed at yesterday’s EU foreign minister’s meeting meeting to allow time for the diplomatic offensive tomorrow. Failure would also make it easier for The United States to step up its plans to send lethal aid to Ukraine – plans that US president Barack Obama has not yet committed to. If the prospect of all out war on its eastern border is not enough for Europe to worry about, there is also the real prospect of a major sovereign debt blow-up on its southern border.

Tomorrow evening the finance ministers of the euro area meet to see if a new deal can be done for Greece. Greece is pushing for a €10 billion bridging loan to allow it avoid a funding crunch, while also giving the new Greek government time to come up with a new plan for the sustainability of Greek finances. So far Greek plans have met with very little support from other euro area finance ministers, with German’s Schaeuble saying that Greece must agree to a full plan, rather than a bridging loan, or commit to the existing bailout program. There are hints this morning that there may be some room to compromise on both sides ahead of the meeting tomorrow, but with both the Greeks and the other euro area finance minsters still seeming so far apart on the details, chances of failure are still high.

“Visually, he’s someone you could imagine starring in a film like ‘Die Hard 6’..”

• Germans Swoon Over Greek God, Yanis (Irish Ind.)

Greek Finance Minister Yanis Varoufakis has become an improbable heartthrob in Germany, where his charm and appearance have not gone unnoticed. ZDF television has even lampooned its own news anchor for enthusiastically comparing the minister with Hollywood tough guy Bruce Willis, while ‘Stern’ magazine published a gushing article on Varoufakis’s “classical masculinity”. “Varoufakis is without doubt a man full of charisma,” ZDF anchor Marietta Slomka said on air. “Visually, he’s someone you could imagine starring in a film like ‘Die Hard 6’ – he’s an interesting character.” Varoufakis’s casual appearance – and the fact that he does not tuck his shirts in and leaves their tops unbuttoned – was an unlikely focus of news reports in Germany. “What makes Yanis Varoufakis a sex icon” was a headline in the conservative newspaper ‘Die Welt’ while ‘Stern’ magazine wrote that Varoufakis’s appearance reminded Germans of a Greek hero in marble, even though media elsewhere in Europe say he looks more like a bouncer.

Bluster.

• Schaeuble Says ‘Over’ for Greece Unless Aid Program Accepted (Bloomberg)

German Finance Minister Wolfgang Schaeuble doused expectations of a positive outcome for Greece at an emergency meeting with its official creditors tomorrow, saying there are no plans to give the country more time. Speaking to reporters in Istanbul after a two-day meeting of finance chiefs from the Group of 20, Schaeuble said “it’s over” if Greece doesn’t want the final tranche of the current aid program. Greece’s creditors also “can’t negotiate about something new,” Schaeuble said. Greek government bonds had risen today for the first time in five days on optimism there might be room to move toward an agreement that will help ensure the nation isn’t left short of funds. That had come after Greece had offered compromises in a bid to push for a bridge plan to stave off a funding crunch and to buy time for negotiations to ease austerity demands.

Any accord, however, would require an easing of Germany’s stance in the standoff between Greece and its creditors over conditions attached to its €240 billion lifeline. An impasse risks leaving Greece without funding as of the end of this month, when its current bailout expires, and may put Europe’s most-indebted state’s euro membership in danger. Schaeuble damped expectations, saying euro region finance ministers meeting in Brussels tomorrow won’t negotiate a new program for the cash-strapped country as a program is already in place and was arrived at after “arduous” negotiations. He also said media reports that the European Commission will give Greece six more months to reach an aid deal “has to be wrong” because he’s not aware of such a plan and the commission isn’t in charge of making such decisions. Schaeuble said he had discussed the rules of the aid programs at a meeting with his Greek counterpart Yanis Varoufakis in Berlin last week.

Not a good tone to start a debate with: “A senior European official described the situation as “berserk” and said, “there is no plan.”

• EU-Greek Relations Soured by Leaks; Sides Further Apart (MNI)

The carefully orchestrated dance between the new Greek government and its European creditors appeared to crack Tuesday, with top Brussels officials infuriated by what they see as wildly misleading claims coming from Athens. Apparent claims from Athens officials to other governments and media suggesting that the U.S. Treasury supports a plan by the Syriza-led government to alleviate Greece’s debt, and that the European Commission president Jean-Claude Juncker either backed the plan or had an alternative himself, have enraged senior economic officials in Brussels. A senior European official, who spoke on condition of anonymity, described the situation as “berserk” and said, “there is no plan.” He added that the European Commission and U.S. Treasury were both perturbed at the way they had apparently been represented externally by Greek officials.

A team from the U.S. Treasury led by Daleep Singh, deputy assistant secretary for Europe & Eurasia, was in Athens late last week. “The Greeks are digging their own graves,” the EU official said. At the G-20 meeting in Istanbul Tuesday, the U.S. Treasury secretary Jack Lew said that Greece and its international creditors must find a pragmatic solution to that country’s debt crisis, adding that US officials would like to see rhetoric on the issue toned down. “I don’t think that there should be casual talk about the kind of resolution that would end up leaving Greece in a place that is unstable or the EU in a place that is unstable,” Lew said. Early Tuesday, Greece floated its latest funding plan via press leaks, including to the Kathimerini newspaper, proposing a bridge financing programme that would lead to a “new deal” with creditors from September onwards.

There were reportedly four parts to the new deal: 30% of the existing memorandum with the Troika will be cancelled and replaced with 10 new reforms agreed with the OECD; Greece’s primary surplus target would be cut from 3% of GDP this year to 1.49%; Greek debt would be reduced via an already announced swap plan; and the “humanitarian crisis” would be alleviated via policies announced by Prime Minister Alexis Tsipras Sunday. Putting aside frustrations about communications from Athens, initial reactions from Eurozone capitals to the ideas in the draft plan have not been positive.The first official described the plan as “hopeless” and added, “how can you have a plan when you make no payment obligation till the autumn and then you probably scrap that.”

Boy, would they be welcome: “German Finance Minister Wolfgang Schaeuble said he repeated his offer to send 500 German tax officials to Greece to tackle the problem..”

• Getting Rich Greeks to Pay Taxes Is Tsipras Biggest Test at Home (Bloomberg)

As Greek Prime Minister Alexis Tsipras goes into a Battle of the Titans with German Chancellor Angela Merkel, he may find he has as big a fight closer to home: taking on rich tax-evaders. People like Angeliki Katsarolia, a waitress at the Julia café lounge bar in the rundown neighborhood of Omonia in Athens, want to see him cast his net wide. Gesturing to a receipt for coffee curled up in a small glass on a recent afternoon, one of the few signs of success in five years of attempts to get Greeks to pay taxes, she said she’s doing her bit. “I pay my taxes straight from my wages,” said Katsarolia, 38, who gave up working in luxury hotels where her employers avoided paying her. “I can’t accept that big employers aren’t taxed. They have to pay their taxes too.”

The age-old problem of getting more Greeks to pay their taxes adds pressure on Tsipras, who’s trying to convince Merkel and other euro-area partners he can put his fiscal house in order while raising wages and reinstating government workers. He wants his official creditors to ease the austerity demands that have helped wipe out a quarter of gross domestic product since the start of the crisis. His election pledge to snag Greeks who under-pay or don’t pay their taxes is key both to his rise to power and to his staying there. Germany, the largest holder of Greek debt among euro-area countries and vital to any compromise that will keep Greece in the euro, remains skeptical. German Finance Minister Wolfgang Schaeuble, meeting his Greek counterpart Yanis Varoufakis in Berlin last week, said he repeated his offer to send 500 German tax officials to Greece to tackle the problem, an offer that has not yet been taken up.

“We can well understand and support it that the wealthy in Greece must also contribute, that the tax base gets broadened and the efficiency of tax administration is improved, that corruption is fought energetically,” Schaeuble said. Greek wage-earners and pensioners have suffered punishing taxes to plug a yawning budget deficit revealed in 2009 in five years of an overhaul of Greek taxes that the International Monetary Fund, one of Greece’s lenders, said could have been more fairly distributed. Just a day after Tsipras’s election on Jan. 25, figures from the finance ministry showed that revenue for the government last year amounted to €51.4 billion, lower than a €55.3 billion target, in part due to a €1.4 billion shortfall in tax revenue. “The great struggle is the struggle against tax evasion, which is the real reason our country reached the brink,” Tsipras said in parliament on Feb. 8. “The new government guarantees that in this country justice will be served.”

“..a law allowing SDOE to rubber-stamp the imposition of tax rather than having to pass it over to tax offices, which often lack the resources to follow up..”

• Greece To Collect €2.5 Billion From Tax Evaders ‘Straight Away’ (Kathimerini)

The strengthening of the Financial Crimes Squad (SDOE) will lead to Greece immediately collecting €2.5 billion from tax evaders, State Minister for Combating Corruption Panayiotis Nikoloudis said Tuesday. Nikoloudis, the former head of the anti-money laundering authority, said the government would pass a law allowing SDOE to rubber-stamp the imposition of tax rather than having to pass it over to tax offices, which often lack the resources to follow up. He said there are currently some 3,500 cases of tax evasion, totaling €7 billion, which have been unearthed by authorities but the state has yet to collect the taxes due. He said that €2.5 billion of this total could be retrieved straight away.

The view from Berlin.

• Greece Inches Closer to Renewal of Debt Crisis (Spiegel)

After new Greek Finance Minister Giannis Varoufakis had been repeatedly rebuffed on his introductory tour of European capitals, he opted for flattery and solicitation during his visit to Berlin last week. German Finance Minister Wolfgang Schäuble, Varoufakis said, had been an object of his admiration since way back in the 1980s for his dedication to Europe. He said that his host’s career, focused as it has always been on European unity, has been impressive. Varoufakis went on to say that Germans and Greeks are linked by their experiences of suffering. Just like the Germans, who were yoked with the burdensome Versailles Treaty after losing World War I, his country too has been humiliated by agreements forced onto it from the outside.

Both countries, he said, suffered from deflation and economic depression, the Germans in the 1930s and the Greeks today. “The Germans understand best how the Greeks are doing,” Varoufakis said. Schäuble’s sympathy for Varoufakis’ plight was limited. Indeed, the German finance minister sees Greek demands for an end to the troika and for a renegotiation of previous agreements as an affront. “We agreed to disagree,” is how Schäuble summed up their meeting, a tête-à-tête that took 45 minutes longer than the one hour that had been scheduled.

Just one day prior to his meeting with Schäuble last Thursday, Varoufakis had been given the cold shoulder at European Central Bank headquarters in Frankfurt. ECB head Mario Draghi rejected virtually all of Varoufakis’ requests, including his demand for more leniency on debt repayments. That evening, the ECB opted to stop accepting Greek government bonds as collateral, a move which will make it even more difficult for banks in Greece to access liquidity. The move came as a surprise to Varoufakis. Draghi had told him nothing about it during their meeting that morning.

“If Greece declines Germany’s offer of national humiliation, and the other EU governments follow through on Schaeuble’s threat, Greece will have no recourse but to default..”

• Meet Greece Halfway, Europe (Bloomberg Ed.)

Varoufakis wants a bridge loan while talks take place on the consolidation of Greece’s enormous external debts. So far, the rest of the euro area has said, “No way.” Greece’s initial position deserved a stone-faced response because it seemed to allow for no compromise: Greece’s debts would have to be partly written off, whether Europe liked it or not. But on his tour of EU capitals last week, Varoufakis climbed a long way down from that. He now says Greece wants not outright forgiveness but further debt restructuring, including a swap into debts with repayment linked to growth rates. Rather than refusing to have policy conditions tied to the new deal, he’s indicating that many of the reforms bundled into the existing bailout program will stay in place, together with some new ones.

These proposals aren’t as bad as the initial pitch would have led you to expect. Actually, they make a lot of sense. The existing bailout program is widely recognized to have failed: It imposed too much austerity, flattened the economy and, as a result, failed to get the ratio of debt to national income under control. Right or wrong, Greece’s modified position should be seen, at the very least, as a basis for negotiation. Yet some EU governments, and Germany’s especially, are refusing to budge. There’s nothing to talk about, they say. On Tuesday, German Finance Minister Wolfgang Schaeuble ominously pronounced that if Greece doesn’t want the final tranche of the bailout program, “it’s over.” Greece’s creditors “can’t negotiate about something new,” he added. Why on earth not?

Missed targets, failed programs and renegotiated agreements aren’t exactly unheard of in the EU: A cynic might call that sequence standard operating procedure. It seems perverse bordering on deranged to try to break this habit at the very moment when a sudden commitment to unwavering rigidity threatens the survival of the euro system. Taken at his word, Schaeuble is telling Greece that nothing short of unconditional surrender will do. What are Greek voters, rallying behind their new government, to make of that? If Greece declines Germany’s offer of national humiliation, and the other EU governments follow through on Schaeuble’s threat, Greece will have no recourse but to default and, in all likelihood, to impose capital controls as a prelude to exit from the euro system. EU creditors will be worse off than if they’d come to an accommodation – and possibly much worse off, if the collateral damage from a Greek exit can’t be contained.

Power struggle in the EU.

• EC President Juncker Poses Challenge To Merkel And Austerity Policies (Spiegel)

Jean-Claude Juncker deliberately chose to deliver his warning in German. “Commissioners are proposed by the member states, but they do not represent the interests of their member state,” the newly appointed president of the European Commission said as he introduced his team last September. In the event a commissioner confused “national and European policies,” he threatened, he would move that appointee to another portfolio. Germany’s Commissioner Günther Oettinger paid little heed to the warning. On Jan. 8, he met in Hamburg with German Chancellor Angela Merkel and Finance Minister Wolfgang Schäuble to warn them that Juncker was planning to loosen the rules of the Stability Pact for the common currency zone. The three quickly agreed at the meeting that the development would not be in Germany’s interest, and they agreed to thwart Juncker’s plans.

\

It had been clear for some time that Europe’s most powerful leader would eventually clash with the head of the European Commission, the EU’s executive, but it happened earlier than some might have expected. Juncker’s commission hasn’t even been in office for 100 days yet and conflicts between Berlin and Brussels are already surfacing. Policy differences are at the forefront, with Juncker feeling that Merkel has bound Europe to austerity policies for too long. But the conflict also touches on a more fundamental question: Who holds the power in Europe?Merkel’s ascendency to the most powerful woman in Europe is rooted to a large degree in the euro crisis, which shifted the balance of power from the European Commission to the European Council, the body representing the leaders of the 28 member states.As the crisis heated up, leaders gathered regularly to hold crisis summits under the auspices of the European Council in order to save the common currency from collapse. The decisions fell to the European Council because it was European leaders who had to make money available for the bailout packages. Given that Germany had the most money to offer, Merkel quickly became the most important player. Juncker now wants to level the playing field again. He’s the first Commission president to have campaigned as a leading candidate in European Parliament elections to head the commission, and he sees his rebellion against Merkel as an act of emancipation. He believes that the man backed by European Parliament should be at the European helm rather than the woman backed by money.

“Insofar as the SNB decision was dictated by concern about the risk of losses from continued expansion of its balance sheet, it highlights the limit to central bank actions.”

• This Single Currency Move Pressures The Entire Eurozone (Das)

A more serious problem will be externally induced deflationary forces, which will affect the Swiss economy through the stronger currency. It will accelerate deflationary pressures, expected to reach as much as negative 2% to 3%. This will create problems for both asset prices and the increased levels of debt. The Swiss are already being forced to contemplate measures such as capital inflow controls to minimize further pressure on the currency. But the biggest ramifications of the abandonment of the ceiling will be felt outside Switzerland. First, the move opens a new front in the currency wars. There will be pressure on other currencies. Following the Swiss decision, the Danish central bank has cut interest rates three times in a few weeks to a record low, from minus 0.05% to minus 0.75%.

This was designed to discourage capital inflows and due to speculation that Denmark would be forced to discontinue its peg to the euro. It also increases speculation on the sustainability of the euro itself. The Swiss decision will drive reductions in interest rates and currency devaluations as nations seek to preserve competitiveness and limit unstable capital movements. The Swiss National Bank set an interest rate on sight deposit accounts of minus 0.75%, well below the minus 0.25% previously assumed to be the effective lower-bound on interest rates. Other countries may be forced to follow, sending global interest rates even lower. This may exacerbate asset price bubbles, increasing the risk of future financial system problems.

Second, the Swiss now have drawn attention to the ability of central banks to intervene in and control market prices. Given assurances from the Swiss National Bank (SNB) in late 2014 about the continuation of the ceiling, the change in policy reduces trust in central banks’ forward guidance. Insofar as the SNB decision was dictated by concern about the risk of losses from continued expansion of its balance sheet, it highlights the limit to central bank actions. Central banks can operate without conventional capital, creating reserves and printing money. However, a large loss may affect a bank’s credibility and ability to perform its functions and implement policies. It may also affect market acceptance of the currency. This means that it would require recapitalization by governments, which would draw political attention to the issue.

Where commodities go to die. Grow your own!

• US Farmers Watch $100 Billion-a-Year Profit Fade Away (Bloomberg)

The squeeze on U.S. farmers is getting worse as low crop prices and rising costs erode incomes that not long ago were the highest ever. Illinois grower Jason Lay said he will buy 30% less fertilizer for his 2,500 acres of corn and soybeans, and 7% fewer seeds for spring planting. After his most profitable year ever in 2012, Lay said he upgraded his combine, tractor, sprayer and planter. With crop futures now near five-year lows, he has no plans to buy any new equipment. “You spend when times are prosperous so you don’t need to when they’re not,” Lay, 41, said by telephone from outside Bloomington, Illinois. “That’s how you make it through.” He estimates his profit is down by a quarter from its peak. Farm income in the U.S., the world’s top agricultural producer and exporter, is poised to drop for a third straight year in 2015.

While raising livestock remains profitable, as tight meat supplies keep prices high, growers of corn, soybeans and wheat saw crop and land values fall faster than many of their costs. That’s pinching sales for equipment maker Deere and seed and chemical producers including DuPont. “The budget picture for corn and soybeans is as negative as we’ve seen in a long time,” said Brent Gloy at Purdue University in Indiana. “You will see some farmers not able to cover their production costs.” The U.S. Department of Agriculture, in a report today at 11 a.m. in Washington, probably will forecast 2015 net-cash income from all farm activity at below $100 billion, which would be the lowest since 2010, Gloy said.

Last year, cash income dropped 17.5% to $108.2 billion, as expenses jumped to a record $370 billion and crop receipts tumbled 11.5%, USDA data show. Even a 14% increase in livestock receipts, which topped crop revenue for the first time in eight years, wasn’t enough to prevent a 2014 decline in overall farm profit. The agriculture industry has boomed over the past decade as record land and crop prices boosted sales of seed and farm equipment. Net net-cash income touched a record $137.1 billion in 2012. Land values have kept rising, up 8.1% last year to an all-time high of $2,950 an acre, while beef and pork prices were the highest ever.

Duh!

• Moody’s: Lower Oil Prices Won’t Boost Global Growth In Next 2 Years (MW)

Amid a death spiral for oil prices, a comfort in some corners has been the belief that lower energy prices will be a boon for global growth. Wrong, according to Moody’s Investors Service, which said Wednesday the pain of lower oil prices won’t result in any boost to global growth over the next two years, due to headwinds from the euro area, China, Japan and Russia. The only beneficiaries? The U.S. and India. Backing what plenty of economists have been saying, Moody’s said indeed, lower oil prices will give a lift to U.S. consumer and corporate spending over the next two years. The ratings service lifted its U.S. forecast for 2015 growth in GDP to 3.2%, from 3% in its last quarterly report. For 2016, it should stay strong at 2.8%, said Moody’s.

But for the Group of 20 countries as a whole, Moody’s expects growth of just under 3% for 2015 and 2016, mostly unchanged from 2014. That’s based on the assumption that Brent crude prices will average $55 a barrel this year, and rise to $65 in 2016. Moody’s expects oil prices will stick to current levels in 2015, because demand and supply issues won’t dramatically change in the near term. Where oil isn’t going to help much is in the eurozone. Moody’s is forecasting its GDP to increase just under 1% in 2015 — not much change from 2014 — and 1.3% in 2016.

You betcha.

• World’s Biggest Oil Trader Warns Crude Prices Could Dive Again (Bloomberg)

The world’s biggest independent oil trader said crude could resume a slump that saw prices fall 61% between June and January, as unrelenting growth in U.S. output leads to a “dramatic” build in the nation’s stockpiles. The oil market seems slightly oversupplied and another downward move is possible in the first half of this year, Ian Taylor, chief executive officer of Vitol Group, said Tuesday. There are no signs of slowing U.S. output even as the country’s drillers idle rigs, he said. Oil inventories in industrialized nations may climb near a record 2.83 billion barrels by the middle of the year because supplies remain abundant, the International Energy Agency said in a report.

Brent crude, a global benchmark, has rallied 29% from its low point this year. It’s still down by half from last year’s peak as the U.S. pumps the most oil in three decades and OPEC responds by maintaining its own output to keep market share. While companies have pulled rigs off oil fields and cut billions of dollars of planned spending, it will be some time before there is an impact on production, according to the IEA. “The market looks a little bit long in the first half of the year,” Taylor said in an interview at a conference in London. “We think there are going to be quite dramatic builds in stock for the next few months” before the market moves into balance in the second half.

The IEA, a Paris-based adviser to 29 nations, cut its forecast for oil-supply growth from nations outside the Organization of Petroleum Exporting Countries for a second consecutive month Tuesday, citing cuts in company spending. Production will increase by 800,000 barrels a day this year, the slowest rate expansion since 2012 and down from an estimate of 1.3 million a day in December. “Extreme cuts in investment in output now could lead to an oil deficit by the fourth quarter,” Igor Sechin, chief executive of Russia’s largest oil producer OAO Rosneft, said in a speech at the London conference.

“For the Saudis, it’s market share at any cost. Saudi is the leader in this and the others have to follow the leader.”

• OPEC Producers Cut Oil Prices to Asia in Battle for Market Share (Bloomberg)

Iraq and Iran joined Saudi Arabia in cutting their March crude prices for Asia to the lowest level in more than a decade, signaling the battle for a share of OPEC’s largest market is intensifying. Iraq’s Basrah Light crude will sell at $4.10 a barrel below Middle East benchmarks, the lowest since at least August 2003, the Oil Marketing Co. said Tuesday. National Iranian Oil lowered its official selling price for March Light crude sales to a discount of $2.10 a barrel, the lowest since at least March 2000, according to a company official who asked not to be identified because of corporate policy.

The cuts come after Saudi Arabia, the largest crude exporter, reduced pricing to Asia last week to the lowest in at least 14 years. OPEC left its members’ output targets unchanged at a November meeting, choosing to compete for market share against U.S. shale producers rather than support prices. Iraq is the second-biggest producer in OPEC and Iran is fourth. “This is an effort by some producers to protect market share,” Sarah Emerson, managing principal of ESAI Energy Inc., a consulting company in Wakefield, Massachusetts, said by phone Tuesday. “It’s really straightforward; cutting prices is how you keep your foot in the door.”

Middle Eastern producers are increasingly competing with cargoes from Latin America, Africa and Russia for buyers in Asia. Oil prices have dropped about 45% in the past six months as production from the U.S. and OPEC surged. The International Energy Agency said Tuesday that the U.S. will contribute most to global growth in oil supplies through 2020 as OPEC’s attempts to defend its market share will hurt other suppliers including Russia more. “If they go out and sell at a higher price, they won’t sell much,” John Sfakianakis, Middle East director at Ashmore, a London-based investment manager, said in an interview in Dubai Tuesday. “For the Saudis, it’s market share at any cost. Saudi is the leader in this and the others have to follow the leader.”

“Kotsaba’s particular crime, according to prosecutors, was in describing the conflict as a civil war rather than a Russian “invasion.”

• Ukrainians Rage Against Military Draft: “We’re Sick Of This War” (Antiwar.com)

When Ukrainian army officers came to the Ukrainian village of Velikaya Znamenka to tell the men to prepare to be drafted, they weren’t prepared for what happened next. As the commanding officer was speaking, a woman seized the microphone and proceeded to tell him off: “We’re sick of this war! Our husbands and sons aren’t going anywhere!” She then launched into a passionate speech, denouncing the war, and the coup leaders in Kiev, to the cheers of the crowd. What she did is now a crime in Ukraine: the only reason she wasn’t arrested on the spot is that the villagers wouldn’t have permitted it. But in Ukrainian Transcarpathia, well-known journalist for Ukrainian Channel 112 Ruslan Kotsaba has been arrested and charged with “treason” and “espionage” for making a video in which he declared: “I would rather sit in jail for three to five years than go to the east to kill my Ukrainian brothers. This fear-mongering must be stopped.”

Kotsaba may sit in jail for twenty-three years, the prescribed term for the charges filed against him. Kotsaba’s arrest is part of a desperate effort by the Ukrainian government to intimidate the growing antiwar and anti-draft movement, which threatens to upend Kiev’s dreams of conquering the rebellious eastern provinces. Kotsaba’s particular crime, according to prosecutors, was in describing the conflict as a civil war rather than a Russian “invasion.” This is a point the authorities cannot tolerate: the same meme being relentlessly broadcast by the Western media – that an indigenous rebellion with substantial support is really a Russian plot to “subvert” Ukraine and reestablish the Warsaw Pact – now has the force of law in Ukraine. Anyone who contradicts it is subject to arrest.

Also subject to arrest, and worse: the thousands who are fleeing the country in order to avoid being conscripted into the military. In a Facebook post that was quickly deleted, Defense Minister Stepan Poltorak wrote: “According to unofficial sources, hostels and motels in border regions of neighboring Romania are completely filled with draft dodgers.” President Petro Poroshenko, the Chocolate Oligarch, is readying a decree imposing possible restrictions on foreign travel for those of draft age – which means anyone from age 25 to 60. Ukrainians may soon be prisoners in their own country – but they aren’t taking it lying down.

Draft resistance is at an all-time high: a mere 6% of those called up have reported voluntarily. This has forced the Kiev authorities to go knocking on doors – where they are met either with a mass of angry villagers, who refuse to let them take anyone, or else ghost towns where virtually everyone has fled.[..] The frantic Ukrainian regime is now contemplating conscripting women over 20.