Pablo Picasso Self portrait 1906

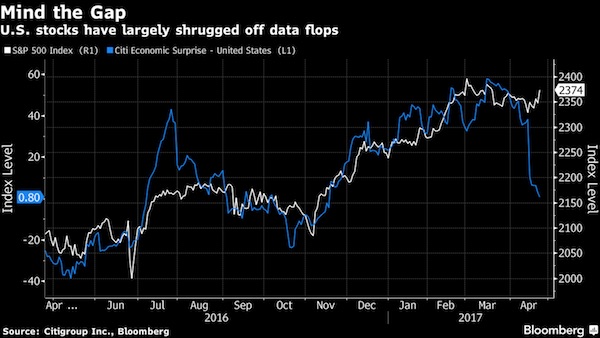

“The rates market is pricing in the death of tax reform and dimming 2018 economic prospects..”

• There’s a Huge Disagreement Between Bonds and Stocks (BBG)

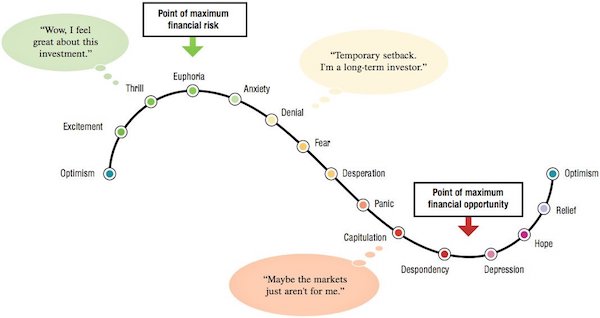

Markets are taking sides when it comes to the direction of the U.S. economy. In the green corner are stocks. The Standard & Poor’s 500 index is just 0.2% away from a record high reached in March on bets that Donald Trump’s administration will push through tax-code changes to spark growth. In the red corner sit U.S. government bonds, where benchmark 10-year Treasury yields have unwound almost half of their post-election increase, suggesting a far more pessimistic view the economy. “The increasing divergence between global equity market performance and bond markets has raised questions as to whom is right,” Jefferies Group analysts led by Sean Darby wrote in a note.

Figuring out which market will be on the right side of history is a pressing issue for analysts, investors and traders. If government bonds prove correct, risk appetite may soon vanish; if the optimism displayed by stocks and corporate bonds is vindicated, then interest-rate markets are likely to sell off in coming months, according to strategists. The issue is gaining added urgency as Trump nears his 100th day as president with plans to unveil Wednesday a proposal to lower the corporate rate to 15%. Optimism that the new U.S. administration would deliver tax cuts and boost corporate earnings may account for the resilience of bullish equity sentiment, according to strategists at Rabobank.

“The post-election jump in stocks could at least in part have been due to this mechanistic response rather than an optimistic view of the future,” strategists led by Richard Macguire wrote in a note. A cut in the corporate tax rate would automatically boost earnings per share, justifying an advance in stock prices, they argue. Still, interest-rate markets are flashing warning signals. Money markets such as the London interbank offered rate and interest rate swaps, for instance, show some alarm over growth prospects next year, according to Bank of America. “The rates market is pricing in the death of tax reform and dimming 2018 economic prospects,” strategists led by Shyam Rajan wrote in a note to clients.

Haven’t heard that term in a while: “He also has emphasized the need for a cheap dollar and low interest rates as the economy seeks escape velocity..”

• Trump May Pick Gary Cohn To Replace Janet Yellen At The Fed (CNBC)

Should President Donald Trump choose to replace Fed Chair Janet Yellen when her term expires next year, he could well turn to someone close by to fill the void. Speculation is building on Wall Street that a likely replacement to run the central bank would be Gary Cohn, director of the National Economic Council and Trump’s closest economic advisor. Cohn also is a former chief operating officer of Goldman Sachs. “The buzz among those who claim Cohn confides in them is that he would like to eventually replace” Yellen, assuming Trump decides to move in a different direction when the chair’s term ends in early February, Beacon Policy Advisors said in its daily report for clients Tuesday.

“On paper, Cohn likely meets Trump’s expected top two requirements for a Fed chair candidate,” the Beacon analysis said, specifically citing Cohn’s advocacy for deregulation and his likelihood to keep interest rates low as Trump seeks to implement his pro-growth economic policies. Trump has had an awkward relationship with Yellen. During the campaign in 2016, he openly chided the central bank chief, accusing her of keeping interest rates low and using monetary stimulus to prop up the economy under former President Barack Obama. However, he’s been relatively mum about Yellen since taking office in January. He also has emphasized the need for a cheap dollar and low interest rates as the economy seeks escape velocity from an extended period of low growth.

“If Trump wants rates to be as low as possible, (Yellen’s) still the best choice,” said Greg Valliere, chief global strategist at Horizon Investments and a widely followed expert on the Wall Street-Washington connection. “In my career, I’ve never seen a president who favored higher interest rates. That’s pretty unusual.” Cohn, though, also would be more likely to endorse monetary policy that would fit the Trump agenda. [..] “He’s the leading contender,” said Christopher Whalen, an insider in the banking world and currently head of Whalen Global Advisors. “Every Fed chairman in recent memory going back even to (Paul) Volcker went through the White House in one way or the other. … It would certainly make sense.” A White House spokeswoman said the chatter was “entirely speculation” and called the Beacon report and any others “inaccurate.”

Softwood lumber is a forever problem.

• Trudeau’s Reward for Courting Trump Is a Trade War on Lumber (BBG)

Justin Trudeau has always played nice with Donald Trump. The refugee-hugging liberal bit his tongue, flooded Washington with envoys, feted Ivanka Trump on Broadway and relentlessly talked up Canada-U.S. ties. It hasn’t worked. On Monday, Trump teed off a fresh trade war by slapping tariffs of up to 24% on Canadian softwood lumber as battles brew over the North American Free Trade Agreement and the dairy industry. After winning praise for his Trump strategy, with Angela Merkel and others pressing the Canadian prime minister for advice, Trudeau finds himself a target – or an example. “Think of this as the violin Trump gets to play and set the mood of the place,” said Eric Miller, a former Canadian diplomat who is now with the Rideau Potomac Strategy Group.

“It’s a great way to underline America First to the Europeans, Japanese and others, if you actually take a hard line with Canada.” Canada is hardly a poster-child trade offender for Trump. It’s the number-one buyer of U.S. goods with a largely balanced trade relationship (totaling $635 billion in 2016, according to U.S. census data), a peaceful next-door neighbor and among the closest U.S. allies. Trudeau moderated his message, re-calibrated his domestic agenda to court Trump and even helped him dial back G-20 commitments on trade. Trump himself pledged only a “tweaking” of ties before turning on Canada this month.

[..] Canada looks set to stick to its play-nice strategy, and Trudeau had fair warnings on all this. His father, former prime minister Pierre Trudeau, famously described Canada-U.S. relations as “sleeping with an elephant,” with Canada “affected by every twitch and grunt.” This elephant is now wide awake, but Trump’s commerce chief says the softwood dispute is strictly business. Describing Canada as “generally a good neighbor,” Ross distanced Trump from the softwood decision during a White House briefing Tuesday. “I don’t think it has anything to do with the personal relationship between Mr. Trudeau and the president,” he said.

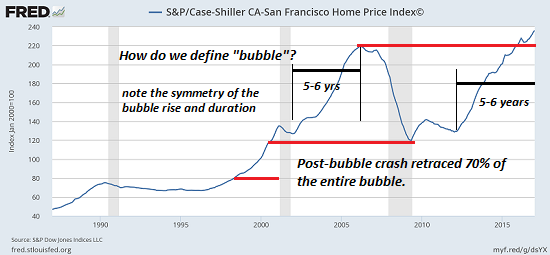

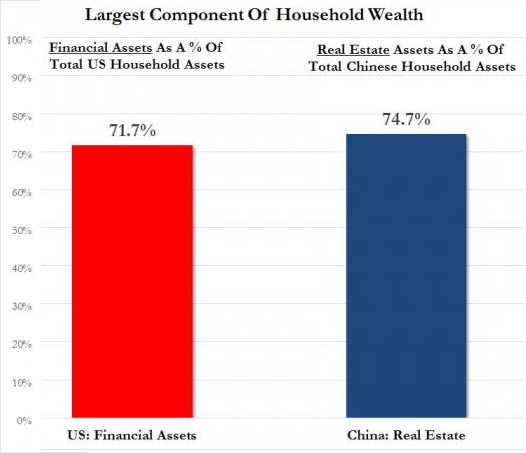

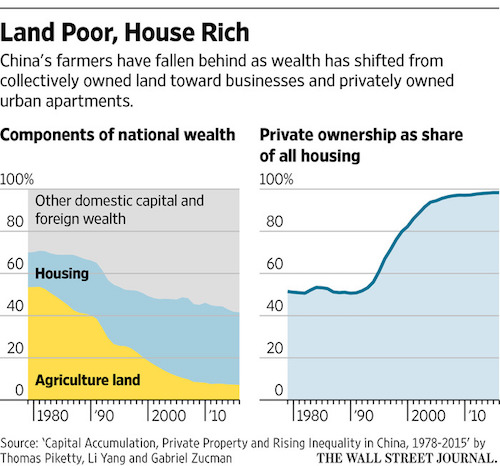

A story full of craziness: “Over the past decade, housing prices have increased as much as 700% in cities like Beijing and Shanghai.”

• Apartheid Without the Racism’: How China Keeps Rural Folks Down (WSJ)

An epic property boom restricted to city dwellers has opened a wealth gap that continues to widen in China, setting back a state campaign to ease poverty and shunting rural dwellers from the middle-class dream. China’s system of hukou, or household registration, a decades-old legacy of the planned economy, binds most Chinese to their place of birth, and denies those outside China’s booming megacities the right to buy property inside them. That has largely shut them out of one of history’s biggest wealth transfers: 98% of Chinese housing is now in private hands from virtually none a generation ago. Over the past decade, housing prices have increased as much as 700% in cities like Beijing and Shanghai. Property now accounts for 70% of personal wealth in the country.

“Housing is everything in China,” said Li Gan, a professor at Southwestern University of Finance and Economics. Unless the Communist Party privatizes land, which is unlikely, farmers will continue to lose ground, he said. Meanwhile, home prices keep rising at a faster pace, with March the quickest in the past five months. China has recently stepped up efforts to fight poverty, including extending medical insurance to the poor and resettling them from areas prone to landslides and other geological threats. It also said it is building a new megacity two hours from Beijing, bringing whirlwind growth to a dusty backwater. Both initiatives suggest leaders’ awareness of the deep inequities along rural-urban lines.

In 1978, when China embarked on economic overhauls, city dwellers earned about twice as much as rural residents; they now earn about 3.5 times as much, according to a study released in April by Paris School of Economics professor Thomas Piketty and World Bank consultant Li Yang. Studies by the Asian Development Bank and the University of Michigan suggest China’s rich-poor gap is even higher once property and hukou status are taken into account. “The urban-rural wealth divide is much greater than the income divide,” Southwestern University’s Mr. Gan said.

Never left.

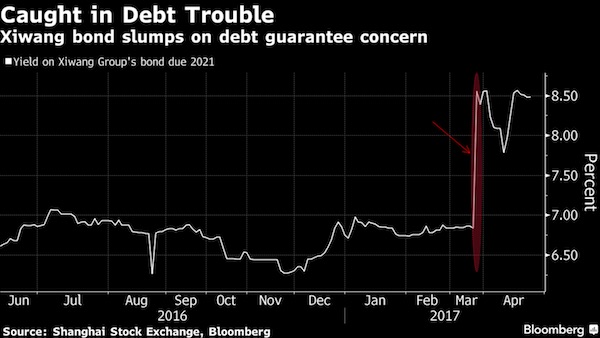

• Chinese Stock Market Roller Coaster Looks To Be Back In Full Force (CNBC)

The roller coaster that is the Chinese stock market seems to be back in full force. Stocks in Shanghai had been in a period of relative calm so far this year, but a relatively precipitous drop of 2.7% this month has refocused attention on the markets. This year, investors have been buoyed by stronger economic data — first quarter GDP growth came in at 6.9%, which was better than expected. Specific sectors like property and construction also got a boost after Beijing announced the creation of a new special economic zone, dubbed Xiongan New Area, in Hebei province. But, as the saying goes, what goes up must come down. Since late last week, Shanghai stocks have been on a bit of a losing streak. Monday’s drop of more than 1% was the worst thus far this year, and Tuesday saw an uptick that left numbers little changed.

The Shanghai Composite was up about 0.3% by 11 a.m. SIN/HK. This recent volatility complicates government efforts to keep calm in the markets ahead of a major leadership change this fall. Only about 10 days ago, Liu Shiyu, the chairman of the China Securities Regulatory Commission, delivered a speech at the Shenzhen exchange, making an explicit call to maintain market stability, connecting the financial markets to politics directly. Consultancy Eurasia Group pointed out that Liu said, “today there is no finance without politics, and no politics that does not closely watch finance,” noting sensitivities around the coming change in top Communist Party brass and protecting the 100 million investors in China.

” The costs of failure are borne by the victims.”

Very few people foresaw its failure when it was imminent, even purported experts. The small group who said Soviet communism wouldn’t work because it couldn’t work were disparaged right up until it didn’t work. However, the deck is always stacked in favor of those predicting this or that government will fail. Ultimately they all do because they all come to rest on a foundation of coercion and fraud, which doesn’t work because it can’t work. There is both a quantitative and qualitative calculus for individuals subject to a government: what the government takes versus what individuals get back. Government is a protection racket: turn over your money and it promises physical security from invasion and crime, and adjudication and restitution in the event of civil or criminal wrongs. The quantitative calculus: am I getting more back than I put in? The qualitative calculus: what activities and people does the government help or hinder?

Protection rackets are often indistinguishable from extortion rackets, the “protector” a bigger threat to the “protected” than the threats against which they’re supposedly protected. Such is the case with the US government, as it was with the former Soviet government. Blessed with naturally defensive geographies and huge nuclear arsenals, the chances of the US being attacked are (or were, in the case of the former Soviet Union) remote. The cost for actual protection provided by those governments has been a tiny fraction of what’s been extracted by force or fraud from their citizenries, the very definition of an extortion racket. Freedom militates against stupidity; coercion compounds it. Competitive markets and a wide-open intellectual climate either kill the worst ideas or impel their improvement.

Power corrupts so completely because those who hold it rarely face negative feedback or consequences. Critics are mocked, stifled, imprisoned, or murdered. The costs of failure are borne by the victims. The perpetrators blame those failures on lack of funding or authority and receive more of the same. Nothing succeeds like failure in coercive systems. Just look at the US governments “wars” on poverty, drugs, and terrorism. For rational people in free, competitive systems an ever-expanding gap between shining intentions and dismal reality prompts psychological turmoil. The powerful salve outbreaks of cognitive dissonance with arrogance, which expands apace with their failing programs. Just look at Obamacare, which its progenitor hails as his greatest accomplishment.

Bit of a problem?

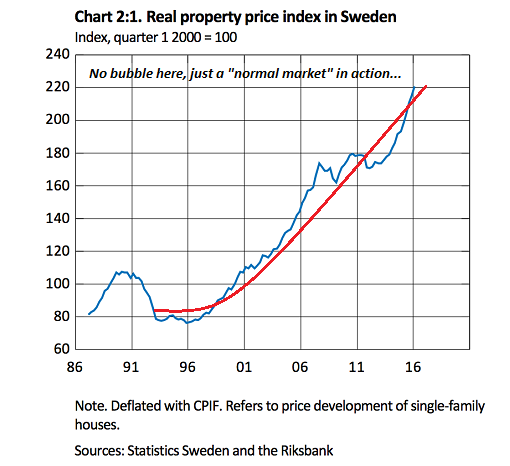

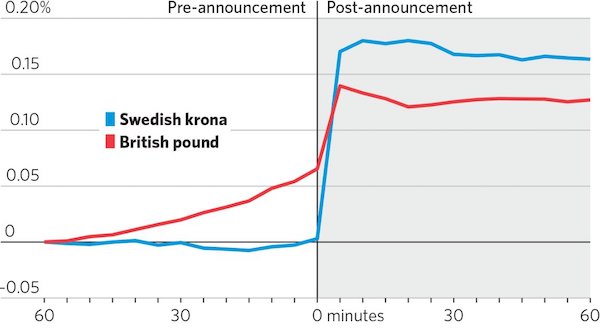

• Currency Markets Suggest Traders Get Early Glimpse at UK Government Data (WSJ)

A comparison of trading data for the Swedish krona and British pound may provide further evidence that some investors could be trading with knowledge of U.K. official statistics before they are published. Sweden and Britain, two European countries with widely traded currencies, have very different approaches when it comes to policy on who sees official economic data before it goes out. In Sweden, nobody outside the statistics office, not even the country’s prime minister, is allowed to see sensitive data before release, according to Statistics Sweden, the country’s official data provider. In Britain, over a hundred lawmakers, advisers and press officers get to see some numbers up to a day before it comes out.

The British pound often moves sharply in the hour before data is released, but the krona shows no signs of moving ahead of Swedish numbers, an analysis of trading data between January 2011 and March 2017 suggests. During the hour before unexpectedly strong or weak U.K. data is made public, the pound moved 0.065% versus the dollar on average in the same direction it subsequently did after those numbers came out, according to an analysis prepared for The Wall Street Journal by Alexander Kurov, associate professor of finance at West Virginia University. It showed that the average change in the pound’s value one hour before and after such economic data announcements is 0.127%, meaning around half the shift associated with the statistics came ahead of their official release.

The Swedish krona moved by an average of 0.163% versus the dollar over the same period before and after unexpectedly strong and weak data releases, according to the analysis. But in the hour ahead of public dissemination, the krona drifted only 0.003% in the direction it would end up going after publication. “The evidence of informed trading before U.K. macroeconomic news is very strong,” said Prof. Kurov. “The data offers no indication that informed trading is taking place before comparable Swedish announcements.” [..] Previous research by Prof. Kurov has also shown that traders in the U.S. aren’t anticipating government released statistics with the same precision as those in Britain appear to be. In the U.S., only the president and the chairman of the Council of Economic Advisers receive that data a day in advance.

So what if the stimulus stops?

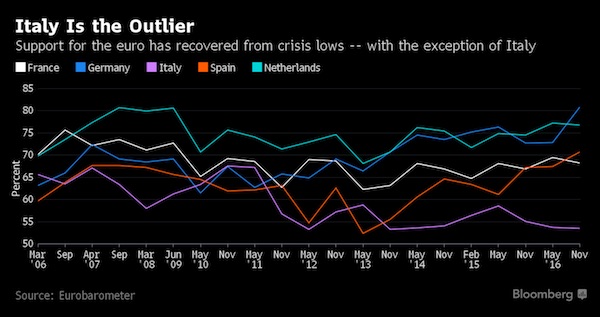

• Draghi’s Stimulus Could Blunt Populism (BBG)

Mario Draghi’s stimulus didn’t prevent the rise of populists who want to reject the euro, but it might be taking the edge off the economic pain that fueled their support. The European Central Bank president has pushed through measures that have led the currency bloc out of a double-dip recession and cut unemployment, a key source of discontent among voters, by 4 million people in the past four years. Satisfaction with the single currency has been rising in most nations over the same period. Yet as the French presidential election shows, politicians calling for an exit from the bloc are far from out of touch. The National Front’s Marine Le Pen made it past the first round and is on track for a 40% share of the vote in May’s runoff — not enough to win, but still a reminder that an ECB-inspired economic upturn won’t sway everyone.

The recovery “will take away some fuel from populist parties but it is not sufficient to make them disappear,” said Joerg Kraemer, chief economist at Commerzbank in Frankfurt. “It would be wrong to follow a strategy saying: we only have to stimulate the economy enough, to create growth, to solve the problem.” Draghi, who will hold a press conference on Thursday after the Governing Council sets monetary policy, has previously called the ECB’s policies “socially progressive” because they boost consumption, investment and jobs. That addresses one of the key attractions of populism. Le Pen was bolstered by people out of work, winning nine of the 10 mainland French departments that have the highest jobless rates by anywhere from one-quarter to one-third of Sunday’s vote.

The country has barely managed to bring down unemployment since the financial crisis. While polls predict her defeat in the May 7 run-off, Le Pen’s chances of becoming president might hinge on how much voter disaffection reduces turnout, according to analysts who sifted through first-round results. Despite France’s woes, support for the euro there has been recovering. In Italy, where unemployment actually rose last year, it continues to languish and the anti-establishment Five Star Movement has a realistic chance of power.

While his underlings demand a lot more of it.

• Juncker Against ‘Major Cuts’ To Greek Pensions (K.)

European Commission President Jean-Claude Juncker has voiced skepticism over plans to impose further pension cuts in Greece while addressing the need to outline possible measures on debt relief next month. “No major cuts in the pension sector should be pursued by the institutions,” Juncker said in an interview with euro2day.gr financial website on the sidelines of the IMF spring meetings in Washington, adding that “the poor part of the Greek society – the pensioners and the retirees – are suffering.” “We have to acknowledge that Greece is making a huge progress and it will be a bad development if we insist on major cuts in pensions,” Juncker said.

Asked about the reaction of Christine Lagarde, the IMF’s managing director, Juncker said: “I did not get the impression that she was in total opposition to what I was telling her.” The head of the Commission also said EU governments should take steps toward securing a Greek debt relief. “I think that as far as debt relief is concerned, we don’t need other poems… Debt relief measures – reasonable ones – are heavily needed, Juncker said. “I don’t think that this can be done in May. But the eurogroup in May must give a design for future possible debt relief measures,” he said.

Tsipras says no measures unless debt relief. Want to bet he’ll capitulate on that too?

• As Bailout Negotiations Resume, Tsipras Tries To Sweeten Pill (K.)

As Finance Minister Euclid Tsakalotos resumed bailout negotiations in Athens with representatives of the country’s creditors, Prime Minister Alexis Tsipras declared on Tuesday that his government will legislate new tough measures in mid-May but will not enforce them if Greece does not get debt relief. “We entered a negotiation that does not relate strictly to the program itself but also has to do with the debt,” Tsipras told ANT1 channel. He said his government would approve a new raft of measures in Parliament in good faith, anticipating that creditors will follow suit by honoring pledges to offer medium-term debt relief, but will change course if those promises are not met. “A sovereign government can take back something it has voted if an agreement is not honored,” he said, noting that the only reason coalition MPs will approve a new agreement is to secure debt relief.

Tsipras defended his government’s performance in negotiations despite vehement criticism by the opposition, which, he insisted, has offered no viable alternative. “We won some things, we lost some things, but overall the negotiation ended with a positive score as the government secured the countermeasures and labor rights,” he said, referring to reforms that Athens has said will lighten the load of austerity. Noting that a “political agreement” is already in place, Tsipras said he was sure the technical details of the detail will be hammered out by a May 22 Eurogroup summit. He insisted that the new package of measures would be a “ticket out of the program,” referring to the austerity measures underpinning Greece’s bailout. Greek officials gave little detail about negotiations in Athens on Tuesday apart from saying they were “on a good course.”

The premier admitted to having “delusions” when his leftist SYRIZA was in opposition, hoping that a major change in Europe could be brought about by an uprising of the Greek people. “I didn’t hesitate to say that I had illusions,” he said. “We hit a wall,” he said, noting however, that “this battle was not in vain.” As for his one-time battle cry, “Go back Madame Merkel,” Tsipras said he still believed that German Chancellor Angela Merkel should not have championed such tough austerity across Europe but remarked that she showed herself to be a responsible politician in her response to the refugee crisis.

Will he understand the importance of a stable Greece in the region? Don’t count on it.

• Trump On Greece: “They Are In Such A Terrible Situation There” (NM)

Less than 24 hours after the International Monetary Fund closed its four-day meeting in Washington the president himself told Newsmax Monday night that he would soon reveal his policy toward the financial colossus. Although he offered no details, Mr. Trump nonetheless signaled — in announcing his IMF policy sooner rather than later — that he would most likely support keeping the current level of U.S. financial support for the IMF rather than ask Congress to rescind it. “We’ll have something on the IMF in a few days,” Trump said in response to a question from Newsmax, strongly hinting that he was aware of the questions about what the policy of the fund’s largest shareholder would be under its new president. The president spoke to us at a private meeting for conservative journalists in the West Wing of the White House.

Trump also made it clear he was sympathetic to the plight of Greece, now in its eighth year of grappling with a debt that is now at 323 billion euros. Along with the European Central Bank and Eurogroup (the 19 members of the Eurozone that exercise control over the Euro currency), the IMF is one of the members of the troika — the three creditors who provided loans to keep the Greek economy afloat since 2010. “Greece!” Trump exclaimed to us, “They are in such a terrible situation there. It’s awful. Are you Greek?” Trump’s statements came one month after he dealt a jolt to IMF supporters by naming David Malpass, a longtime critic of the fund, as the top U.S. Treasury official overseeing international finance. He subsequently named another IMF skeptic, former investment banker and American Enterprise Institute Visiting Scholar Adam Lerrick, as deputy to Malpass.

During the recent IMF/World Bank spring meeting in Washington, participants made it clear they had a nervous apprehension about how they would be treated by the Trump administration. “It is important that the IMF and the creditors reach an honorable compromise ensuring the sustainability of the Greek debt,” Greek Finance Minister Euclid Tsakalotos told me. “We are waiting to see what the new administration in the U.S. thinks. We don’t want this to drag on.”

This is a solvable problem.

• EU Auditors Say Refugee Centers In Greece, Italy Overwhelmed (AP)

European Union auditors say that centers set up in Greece and Italy to fast-track the registration of migrants are overwhelmed and urgently require more experts, particularly to help children. In a report released Tuesday, the auditors say that two more centers known as “hotspots” are needed to process migrants in Italy and that facilities on Greek islands where people arrive from Turkey must be improved. It says that in Greece “there are still more migrants arriving at the hotspots than leaving, and they are seriously overcrowded.” Some children have been held in “restrictive conditions” there for more than three months. The auditors say the hotspots in Greece and Italy are designed to process about 8,000 people but are routinely dealing with 15,000-16,000 migrants.

No, transfer them to northern Europe, not to other camps in Greece.

• Amnesty Calls For Shutdown Of Greece’s Elliniko Refugee Camp (K.)

Amnesty International has made an urgent appeal for the shutdown of the Elliniko migrant and refugee camp on Athens’s southern coast and is calling for the transfer of its 1,200 occupants to alternative shelters. The rights organization is decrying appalling living conditions at the facility and says that women and underage girls live in constant fear of sexual and verbal abuse. According to Amnesty, women at the camp feel that they might come under attack at any moment in their tents, toilets and showers. Many avoid leaving their tents altogether for fear of harassment. The camp at the site of Athens’s former airport is inhabited mainly by Afghans who have been living in squalor in tents for over a year, with an insufficient number of toilets and showers, and limited privacy.

The situation has reportedly led to increased rates of depression and anxiety, as well as suicide attempts. Meanwhile, European Union auditors said in a report released on Tuesday that the centers set up in Greece and Italy to fast-track the registration of migrants are in urgent need of more expert help – particularly with regard to children – as they are overcrowded. “There are still more migrants arriving at the hotspots than leaving, and they are seriously overcrowded,” the report said, adding that children are being held in “restrictive conditions” for more than three months. The auditors called for the improvement of facilities on the Greek islands and said two more hotspots are needed to process migrants in Italy. Hotspots in Greece and Italy, the report said, are designed to process some 8,000 people but routinely deal with 15,000-16,000 migrants.