Arthur Rothstein Grain elevators, Great Falls, Montana 1939

93 million not in the labor force.

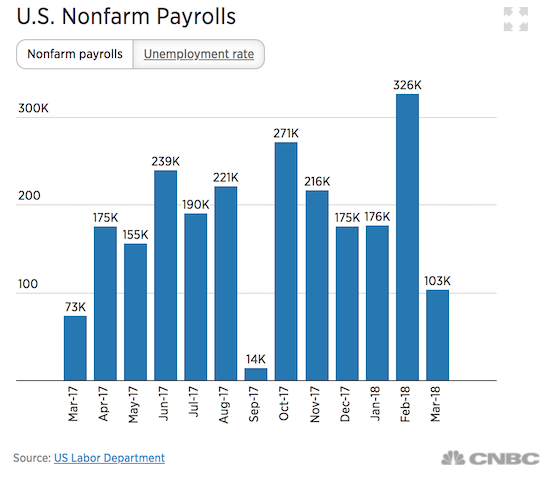

• US Jobs: One Big Miss (CNBC)

Nonfarm payrolls rose 103,000 in March while the unemployment rate was 4.1%, falling well short of Wall Street expectations during a month where weather caused havoc on the jobs market, according to a Bureau of Labor Statistics report Friday. Economists had been expecting a payrolls gain of 193,000 and the unemployment rate to decline one-tenth of a point to 4%. The monthly reading was a huge slip from the 326,000 reported in February. A broader measure of unemployment that includes discouraged workers and those holding part-time positions for economic reasons — the underemployed — fell two-tenths of a point to 8%, its lowest reading in 11 years.

“If one were to only focus on this single month, the March employment report is on the disappointing side,” said Mark Hamrick, senior economic analyst at Bankrate.com. “Broader context is appropriate, however. The job market is widely regarded to be close to full employment. So, hiring gains should be slowing at this point in the expansion.” In addition to the payrolls news, the closely watched average hourly earnings figure rose 0.3%, against estimates of 0.2%. The number equates to a healthy but not worrisome 2.7% rate on an annualized basis. The average work week was unchanged at 34.5 hours.

Stock market reaction to the report was muted, with major indexes lower largely on renewed worries over a U.S. trade war with China. “Wage growth continues to inch higher but not enough to worry markets at this point,” said Quincy Krosby, chief market strategist at Prudential Financial. “As we move closer and closer towards full employment expectations are that headline employment should slow. This number reflects a continued reversion to the mean.” Professional and business services led with 33,000 new jobs while manufacturing and health care added 22,000 new jobs apiece. Mining rose 9,000 while construction lost 15,000 positions and retail fell 4,000.

Never again…

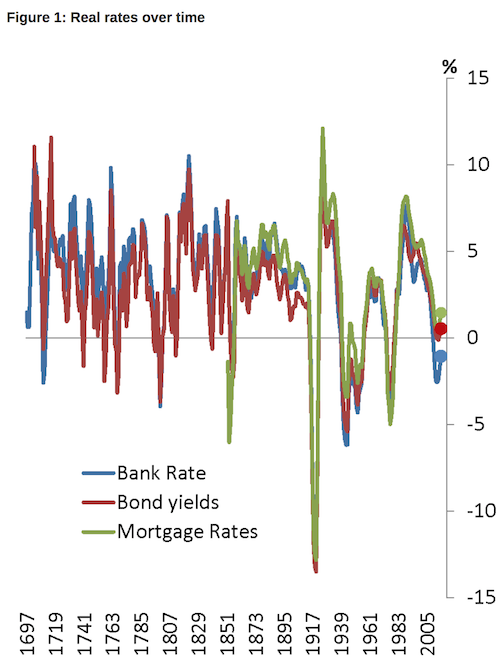

• Everything Has Changed In Macroeconomics, But.. (Murphy)

I spend a lot of time writing about the Global Financial Crisis. Not much of it is published yet: academia is desperately slow. The crash of 2008 and its aftermath is, however, an ever-present reality both in my work life, and to be candid, the world beyond it. But I still do not think we appreciate how much everything has changed. A blog from John Lewis who works for the Bank of England gave some hint of the scale of this change this week. Lewis looked at real interest rates for three centuries i.e. those adjusted for inflation. When considering real bank rate, mortgage rates, and 10-year government bond yields over time this is what he found. As he notes: ‘the lines show the five-year moving averages of the ex-post real interest rate. The dots show the values over the years 2012 to 2016’:

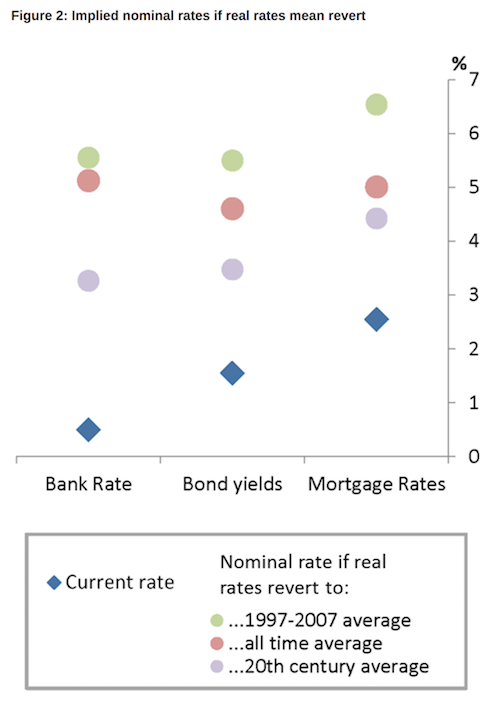

As he notes: “The 5-year average of real bank rate rarely goes below zero – previous instances were mainly during the 1970s inflation and around world wars. The decline in real bond yields since the 1980s leaves them about 300bps below their all time average.” Now there may be good reason for that: broader markets, real reduced risk because of better information, and so on. The absence of world war helps too. But it also means that if we were to return to ‘normal’ or the mean then the change in rates would be massive:

The most useful contrast is with 1997 – 2007, of course. We’re talking adjustments of 4% or more. That is not going to happen. There are good reasons. Most mortgage holders would fail to make their payments. Most banks would then collapse. and government debt costs would increase and may politicians would panic at that whether appropriately or not. I will be blunt. Everything has changed. Those rates are history. This though has massive implications. If this is the case then monetary policy as a mechanism for controlling inflation and economic activity has died: rates that let it work cannot be recreated. And yet almost the whole of macroeconomic thinking is premised on its use, as is the role of central banks in our economies.

The reality is that everything has changed. And yet there is, so far, almost no reaction. Fiscal policy – spend and tax – is the only tool left to the government now and yet no one is saying so. No wonder I spend half my time wondering why we feel so out of control. We are.

We’ll get you into the casino yet.

• Income From UK Savings Accounts Dropped 16% In A Year (Ind.)

UK savers’ income from bank accounts fell 16 per cent in a year, according to new research, due to low interest rates from banks and building societies. According to easyMoney, the investment platform launched by easyJet founder Stelios Haji-Ioannou, the drop in savings income is worse in real terms due to rising inflation. The decline in income is based on numbers from the 2015/2016 financial year (the latest available data from HMRC) when savers made £5.7bn compared with £6.8bn in 2014/2015. At the end of the 2014/2015 fiscal year, inflation was -0.1 per cent; by January this year it had risen to 3 per cent.

With savers seeing less benefit from stashing their money in bank accounts and cash ISAs, easyMoney said, people are increasingly turning towards alternatives, with many inclined to “take on a sensible increase in risk”. Andrew de Candole, CEO of easyMoney, said: “Savers are increasingly fed up with seeing their money just sitting doing nothing in bank accounts. “It’s easy to see why: these figures show that savings accounts’ and cash ISAs’ performance has been getting worse. With inflation eating away at values, the reality is there’s very little incentive to save through these traditional routes. “For many people the time has come to take action. Investors need products that offer real returns, and many are prepared to accept a sensible, calculated increase in risk in order to achieve this.”

So act.

• Social Media Users Treated As ‘Experimental Rats’ – EU Watchdog (CNBC)

Facebook needs to make sure the new tools it has introduced to help safeguard user data in the wake of the Cambridge Analytica scandal is done in “practice and not only on paper,” the European Union’s top data watchdog told CNBC. The social network has unveiled a raft of new tools since news of the fiasco broke, with the aim of helping users understand and control how their data are used. Giovanni Buttarelli, the European Data Protection Supervisor (EDPS), said Facebook CEO Mark Zuckerberg needs to ensure these changes are done in practice. “I take note of what Zuckerberg has said recently, he said that he takes care of the privacy right. The question is they should do it in practice and not only on paper,” Buttarelli told CNBC in a phone interview on Thursday.

[..] Buttarelli criticized social media firms’ data collection practices. “There are days when you have the impression people are treated as battery animals or experimental rats. We are treated as a farm for data. We are in within a walled garden and every single action is monitored,” Buttarelli said. The EDPS is in charge of making sure that data are being handled correctly within EU institutions like the Commission. But it is also part of a working group made up of the data protection authorities from various member states.

[..] Buttarelli said there are likely to be far-reaching consequences which could include punishments for companies. “I’m expecting far-reaching consequences on the broader scale. There is a need of a change of culture,” he told CNBC. Last month, European Parliament President Antonio Tajani invited Zuckerberg to testify in front of lawmakers and give reassurances that EU citizens’ data were not used to “manipulate democracy.” Buttarelli said it would be “wise” for Zuckerberg to honor the invitation from Tajani.

If you ask me, the highest tree ain’t high enough. But that’s just me. And it’s not those that do it, it’s those that let them.

• Facebook Users Have To Pay To Opt Out Of Their Data Being Used (CNBC)

Facebook users could have to pay to completely opt out of their data being used to target them with advertising, the company’s Chief Operating Officer Sheryl Sandberg told NBC News on Thursday. NBC asked if Facebook could come up with a tool to let people have a button that allows them to restrict the social network from using their profile data to stop targeted ads. Sandberg said that the company has “different forms of opt out” but not one button for everything. “We don’t have an opt-out at the highest level. That would be a paid product,” Sandberg told NBC. The comments come in the wake of the scandal in which 87 million Facebook profiles were scraped with the data being sent to political consultancy Cambridge Analytica.

Facebook CEO Mark Zuckerberg has apologized for the company’s role in the data scandal and is now set to testify in front of Congress on April 11. Zuckerberg has also been summoned to appear in front of lawmakers in the U.K. and European Union. The data issue arose from a quiz app that collected data of Facebook users and their friends. This data was then passed on to Cambridge Analytica. Facebook banned the app in 2015, and said it got “assurances” from Cambridge Analytica and the app maker that the data was deleted. However, reports suggested this wasn’t the case. Facebook has been criticized for not checking the data had been erased, a mistake that Sandberg acknowledged.

Even Musk makes sense once in a blue moon.

• AI: An ‘Immortal Dictator From Which We Can Never Escape’ (CNBC)

Superintelligence — a form of artificial intelligence (AI) smarter than humans — could create an “immortal dictator,” billionaire entrepreneur Elon Musk warned. In a documentary by American filmmaker Chris Paine, Musk said that the development of superintelligence by a company or other organization of people could result in a form of AI that governs the world. “The least scary future I can think of is one where we have at least democratized AI because if one company or small group of people manages to develop godlike digital superintelligence, they could take over the world,” Musk said. “At least when there’s an evil dictator, that human is going to die. But for an AI, there would be no death. It would live forever. And then you’d have an immortal dictator from which we can never escape.”

The documentary by Paine examines a number of examples of AI, including autonomous weapons, Wall Street technology and algorithms driving fake news. It also draws from cultural examples of AI, such as the 1999 film “The Matrix” and 2016 film “Ex Machina.” [..] “If AI has a goal and humanity just happens to be in the way, it will destroy humanity as a matter of course without even thinking about it. No hard feelings,” Musk said. “It’s just like, if we’re building a road and an anthill just happens to be in the way, we don’t hate ants, we’re just building a road, and so, goodbye anthill.”

Lowballing.

• 960,000 Households In Australia Will Face ‘Mortgage Stress’ (IBT)

The number of Australian households facing “mortgage stress” will likely reach 960,000, according to a new data. Slow wage growth is blamed for the trend as it does not keep up with the rising cost of living. Digital Finance Analytics (DFA) has recently released data which suggests that the number of households facing mortgage stress will likely reach about one million. Mortgage stress is a term used to refer to households spending 30% or above of its pre-tax income on home loan repayments. Households are defined as “stressed” when cash flow does not cover ongoing costs.

As for access to other available assets, that is something that they may or may not have. Some households have paid ahead, but those in mild stress have little leeway in their net income while those in severe stress could not meet repayments from current income. The new data also shows that the figure was a climb of 30,000 in the last month, encapsulating low and high-income-earning households, according to 9 News. For DFA spokesperson Martin North, it was an indication of how dire the country’s housing situation is getting.

“Things will get more severe, especially as household debt continues to climb to new record levels, mortgage lending is still growing at two to three times income,” Daily Mail Australia reported him as saying. North added that those numbers were not sustainable. It was estimated that over 55,000 households risk 30-day default in the next 12 months. Bank portfolio losses were expected to be about 2.8 basis points. Aside from flat wages growth and rising costs of living, higher real mortgage rates are perceived to be a burden. Mortgage lending continues to grow at two to three times income. The latest household debt to income ratio is currently at a record 188.6.

Pot and sanctuary.

• Another Mighty Conundrum (Kunstler)

The sanctuary city movement seems to me the most mendacious element of the story, a nakedly emotional appeal against the rule of law. The attorney general of California, Xavier Becerra, lately threatened to fine corporations there that share employee information with federal agents. There has not been such arrant flouting of federal law by state officials since Governor George Wallace stood in the doorway of the University of Alabama crying “segregation now, segregation tomorrow, segregation forever” in June, 1963 — and we all know how that ended. I’m among those who would like to see the immigration laws honestly enforced. In fact, I would also like to see the 1965 immigration law reformed to admit far fewer people from any land into this country. We have economic and cultural interests to protect, and they would seem to be self-evident.

So why has there been no move by the federal authorities to impose sovereign federal law over figures like Mr. Becerra, or Oakland Mayor Libby Schaaf, who went through the barrio there Paul Revere style warning that the ICE agents were coming? Well, one big reason is the marijuana situation. Nine states have legalized cannabis for recreational use (i.e. for getting high), and 29 have legalized it for medical purposes. This includes all of the states on the “Left Coast.” All of them are flouting federal law in doing that. But imagine the political uproar if the feds tried to step in at this point and quash the cannabis trade. In the early adapters, like Colorado, California, and Washington State, the trade has blossomed into multi-million dollar corporate enterprise, with significant tax revenue.

So, much as I object to the dishonest practices around immigration, I don’t see how the federal government can take principled action against them without first addressing its attitude to the marijuana situation. Of course, that could be easily disposed of by congress adopting a simple law to the effect that the cultivation and sale of cannabis shall be regulated by the states. The craven members of congress apparently don’t even dare to raise the issue of resolving this conundrum, and the thought may have never even entered the mighty golden brain-pan of our president — not to mention The New York Times, The Washington Post, CNN, Fox-News, or any of the other media organs of public debate. Well, maybe the time has come for that discussion.

An absolutely fantastic story by Dmitry. Don’t miss this.

First, I will present just the facts. Next, I will indicate some huge, gaping holes in the plot which we must, perforce, fill using our imaginations (for lack of detailed factual information), but relying on real world knowledge as much as possible to build a plausible scenario (or two). In the end, the most plausible scenario wins. On February 22, 2018, the Argentine newspaper El Clarin has reported that a major shipment of drugs from Buenos Aires to Moscow—389 kg of pure cocaine, valued at over 60 million USD, and bearing the markings of the Sinaloa drug cartel of Northern Mexico—was prevented from taking place thanks to the efforts of Russia’s FSB and the Argentine authorities. Several people, including a member of the Argentine police and someone involved in charity work, have been detained.

Victor Coronelli, Russia’s ambassador to Argentina, related how all the way back in 2016 the embassy received information that possessions belonging to some third party had been found in a storage space at a children’s school operated by the embassy and located several blocks away from it. Suspicions arose and a thorough examination had uncovered 12 colorful suitcases filled with 389 “keys” (1-kilo blocks) of cocaine bearing the little star that is the symbol of the Sinaloa cartel of Northern Mexico. Shortly after the cocaine was discovered, Russia’s FSB, working together with the Argentine police, hatched an ingenious plan for a sting operation, to find out who is behind this shipment. To this end, they carefully replaced the cocaine with flour and placed the 12 colorful suitcases back in storage.

And there they sat for over a year. What has been done with the cocaine that was extracted isn’t known. Apparently, it took a great deal of effort to get anyone to take possession of these suitcases. Eventually, two people were found who agreed to take delivery of them in Moscow: Vladimir Kalmykov and Ishtimir Hudzhamov. They are currently in pretrial detention in Russia. A third suspect, Andrei Kovalchuk, is under arrest in Germany, awaiting extradition to Russia, but his extradition is conditional on whether the Russian side can offer evidence of his complicity or guilt in organizing the shipment.

Kovalchuk used to work for Russia’s Foreign Ministry, but most recently he has used his old ministerial connections to arrange for some small-scale contraband to be shipped to Russia via diplomatic mail: cigars, coffee, cognac, etc. Such trade had been common during the 1990s, when Russian diplomats had fallen on hard times and did whatever they could to make ends meet, but it has become unnecessary in recent years, now that they are very well provided for once again. Still, cigars, coffee and cognac is what Kovalchuk—an apparent throwback to this earlier, meager era—maintains was in the suitcases he had stashed at the school in Buenos Aires: he has kept all of the receipts. He plans to travel to Russia of his own free will once he has gathered all the evidence he needs to exonerate himself.

Bloomberg editors are clueless, but the issue is real.

• Shipping Is a Big Part of the Climate Problem (BBG)

When almost all the world’s governments agreed in Paris more than two years ago to address climate change, they sidestepped an important issue: carbon emissions from international shipping. Next week in London, they have a chance to put this right. Shipping is by far the most energy-efficient mode of transport, and it moves some 80% of world trade by volume. However, the fuel it uses is hard on the environment and human health — and ships last a long time, so deploying cleaner fleets takes time. Already, international shipping accounts for about as much carbon dioxide each year as Germany’s whole economy. On current trends, its share of the total will rise quickly. It could account for roughly 15% of the global carbon budget set by the Paris accord for 2050.

Next week, the International Maritime Organization is expected to announce a strategy for reducing these emissions. The plan is unlikely to be bold. Countries including Argentina, Brazil, India, Panama and Saudi Arabia are resisting carbon dioxide targets for shipping. Unsurprisingly, the industry itself is also opposed. Despite this resistance, the IMO needs to be ambitious. Ultimately, the most cost-effective approach would be to put a tax on carbon, and let that guide investment and innovation. But devising and implementing an international carbon-price system won’t be done overnight. In the short run, the IMO ought to propose a variety of useful course corrections.

The problem in a nutshell: 1 year in jail (5 months with good conduct?!) for 5 rhinos. He’ll do it again as soon as he’s freed. $600,000. Another issue where the tallest tree isn’t high enough.

And we’re not even trying.

• Chinese Man Caught Smuggling Five Rhino Horns Is Jailed By Dutch Court (G.)

A Dutch court has sentenced a Chinese man to a year in jail for smuggling five rhino horns and four other horn objects worth about €500,000 ($613,000) in his luggage. The man was caught by customs officials at Schiphol airport in December as he traveled through Amsterdam on his way from South Africa to the Chinese city of Shanghai. It recalled that trading in endangered species is banned under the CITES convention prohibiting sales of protected animals and plants. South Africa is battling a scourge of rhino poaching fuelled by insatiable demand for their horn in Asia.

The country’s ministry of environmental affairs said earlier this year that 1,028 rhinos were slaughtered in 2017. In the last eight years alone, roughly a quarter of the world population of rhinos has been killed in South Africa, home to 80% of the remaining animals. Most of the demand comes from China and Vietnam, where the horn is coveted as a traditional medicine, an aphrodisiac or as a status symbol.